How To Form A Nonprofit In Georgia

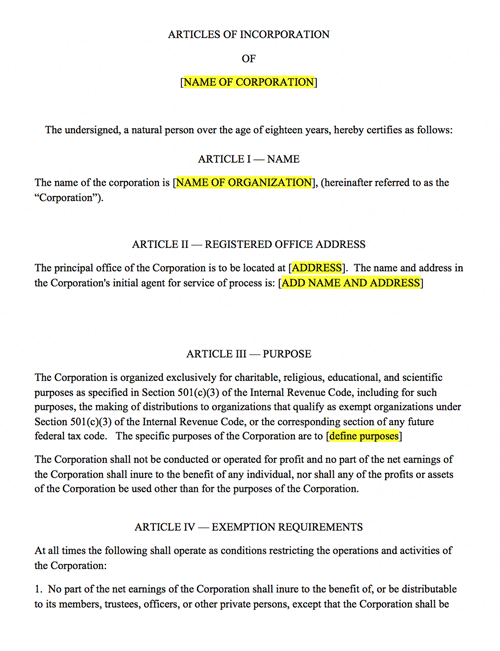

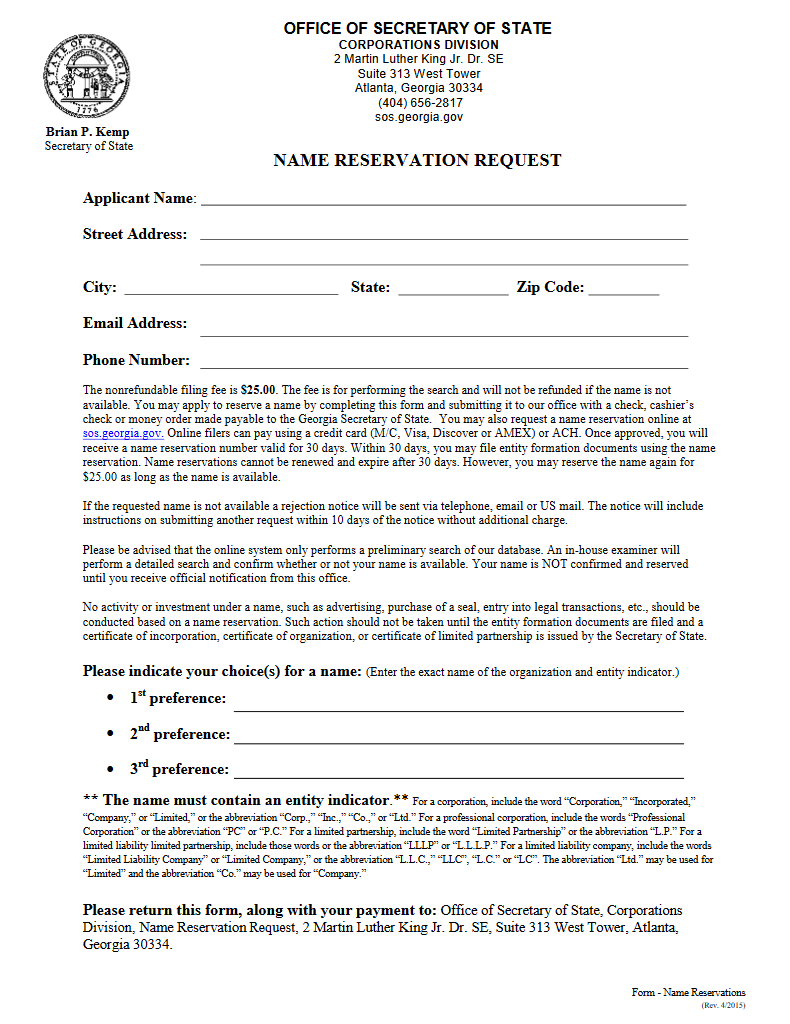

How To Form A Nonprofit In Georgia - Register your nonprofit & get access to grants reserved just for nonprofits. 501 (c) (3) organizations can qualify for tax. Web you are required to file a copy of the federal form 990, 990ez or 990pf with the georgia department of revenue. From completing & filing your state registration forms to guiding your diy efforts. Apply for exemption from state taxes a. Protect your business from liabilities. Web limited exemptions from the payment of georgia’s sales and use tax are available for qualifying nonprofit organizations including: Select your board members & officers step 4: Publish your intent to incorporate. Articles of incorporation for nonprofit corporations explains what to include in your.

Web file charities and nonprofits georgia georgia state charities regulation: Every day, ga businesses choose swyft filings® to securely form their nonprofit. Ga data transmittal form 227;. Choose your registered agent step 3: Select your board members & officers step 4: Web there are many types of nonprofits, but the most common type of nonprofit is the 501 (c) (3) charitable organization. Ad our charitable registration services are tailored to meet your specific needs. This holds for any state in the u.s. Come up with your organization’s name. Web welcome to the registration and compliance page for georgia nonprofit organizations.

File the articles of incorporation (+1 copy). Name your georgia nonprofit step 2: Protect your business from liabilities. Web up to 40% cash back below is an overview of the paperwork, cost, and time to start an georgia nonprofit. Web there are many types of nonprofits, but the most common type of nonprofit is the 501 (c) (3) charitable organization. To form a nonprofit, you'll need to learn how to name, appoint a registered agent, select board mem. Web initial filing requirements to become georgia nonprofit how to incorporate in georgia state: Web welcome to the registration and compliance page for georgia nonprofit organizations. Apply for exemption from state taxes a. We'll help set up your nonprofit so you can focus on giving back to your community.

nonprofit filing requirements GA Nonprofit Registration

In order to comply with. Register your nonprofit & get access to grants reserved just for nonprofits. Every day, ga businesses choose swyft filings® to securely form their nonprofit. Search the georgia secretary of state's securities and business regulations registered charitable. One of the fundamental steps in starting a nonprofit organization in georgia is.

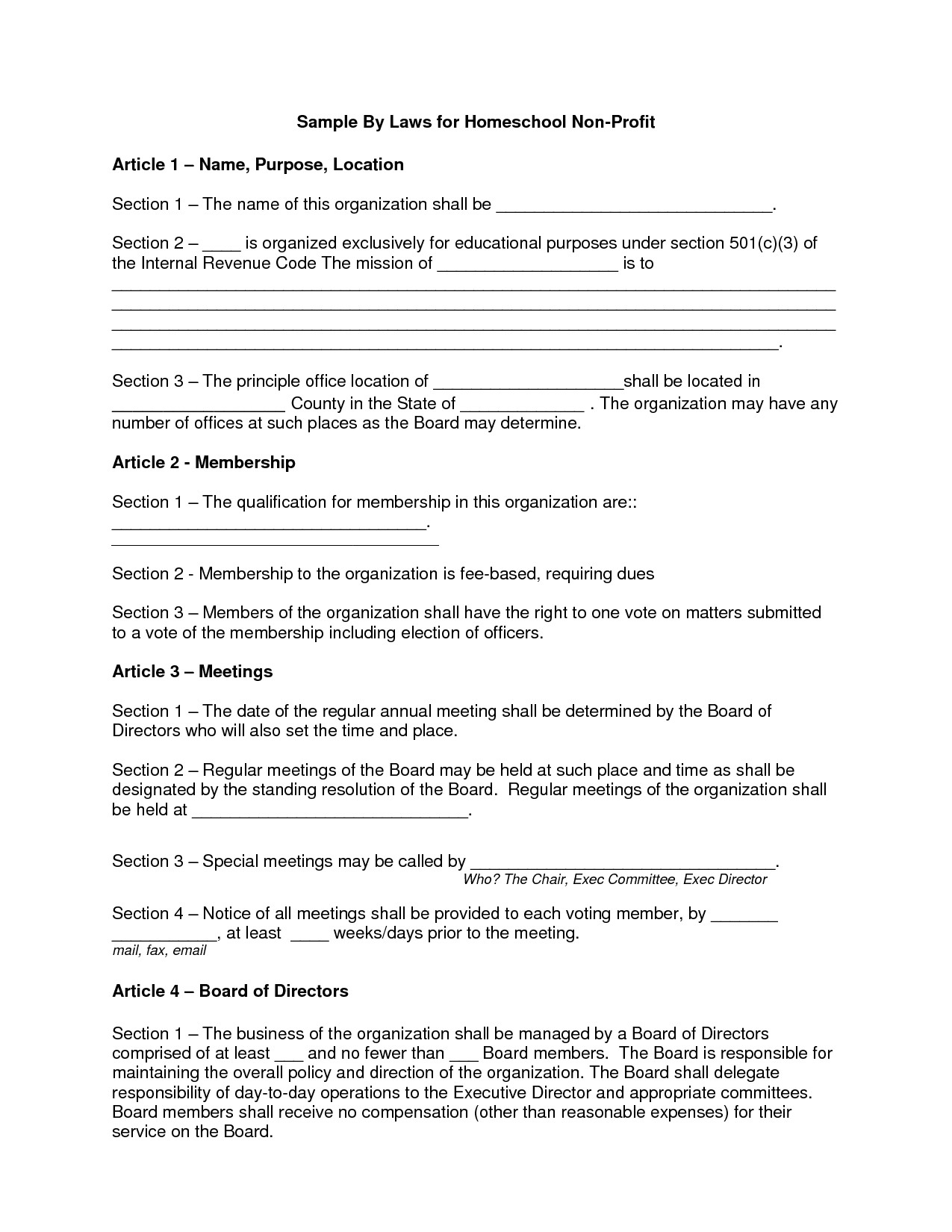

Sample Bylaws For Nonprofit Organizations With Members Sample Site a

Adopt bylaws & conflict of. Web initial filing requirements to become georgia nonprofit how to incorporate in georgia state: Web you are required to file a copy of the federal form 990, 990ez or 990pf with the georgia department of revenue. Search the georgia secretary of state's securities and business regulations registered charitable. Prepare and file articles of incorporation with.

How To Start a Nonprofit in A Complete StepbyStep Guide

Choose your registered agent step 3: Web file charities and nonprofits georgia georgia state charities regulation: In georgia, charities regulation responsibilities are shared by the attorney general and the. Select initial directors georgia law requires that you name one initial director, but if you want to apply for an irs tax exemption, it is a good idea to select at.

Annual Registration Form Pdf

Every day, ga businesses choose swyft filings® to securely form their nonprofit. Select a name for your organization. File the ga nonprofit articles of incorporation. Register your nonprofit & get access to grants reserved just for nonprofits. Now that you have decided to start a nonprofit, you need to determine the charitable mission and purpose for the business.

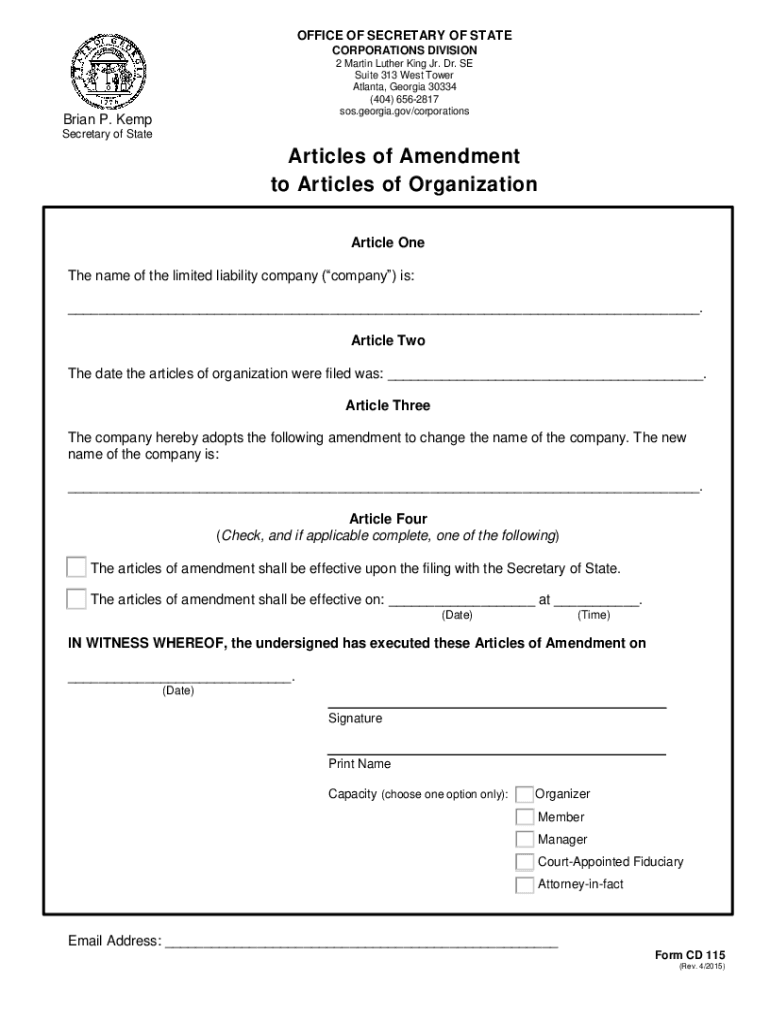

Articles Of Organization Fill Online, Printable, Fillable

Publish your intent to incorporate. File the articles of incorporation (+1 copy). Web how to start a nonprofit in georgia 1. Select your board members & officers step 4: From completing & filing your state registration forms to guiding your diy efforts.

Free Illinois Corporate Bylaws Template PDF Word eForms

Web welcome to the registration and compliance page for georgia nonprofit organizations. Protect your business from liabilities. Select a name for your organization. In georgia, charities regulation responsibilities are shared by the attorney general and the. Search the georgia secretary of state's securities and business regulations registered charitable.

Bylaws for Nonprofit organizations Template williamsonga.us

Adopt bylaws & conflict of. File the ga nonprofit articles of incorporation. Web there are many types of nonprofits, but the most common type of nonprofit is the 501 (c) (3) charitable organization. 501 (c) (3) organizations can qualify for tax. In georgia, charities regulation responsibilities are shared by the attorney general and the.

What You Need to Know About Starting a Nonprofit in Etherions

Now that you have decided to start a nonprofit, you need to determine the charitable mission and purpose for the business. Name your georgia nonprofit step 2: Choose your registered agent step 3: Web starting a georgia nonprofit guide: Web there are many types of nonprofits, but the most common type of nonprofit is the 501 (c) (3) charitable organization.

Nonprofit NOW, Spring 2017 by Center for Nonprofits Issuu

In order to comply with. Ad our charitable registration services are tailored to meet your specific needs. We do not have a form equivalent to the irs informational. Web up to 40% cash back below is an overview of the paperwork, cost, and time to start an georgia nonprofit. To form a nonprofit, you'll need to learn how to name,.

Articles of Incorporation Nonprofit

Web limited exemptions from the payment of georgia’s sales and use tax are available for qualifying nonprofit organizations including: Now that you have decided to start a nonprofit, you need to determine the charitable mission and purpose for the business. We'll help set up your nonprofit so you can focus on giving back to your community. Web starting a georgia.

Choose Your Ga Nonprofit Filing Option.

Web up to 40% cash back below is an overview of the paperwork, cost, and time to start an georgia nonprofit. Web there are many types of nonprofits, but the most common type of nonprofit is the 501 (c) (3) charitable organization. Every day, ga businesses choose swyft filings® to securely form their nonprofit. We'll help set up your nonprofit so you can focus on giving back to your community.

Below You Will Find Information On Initial Filings Required When Starting A Nonprofit.

This holds for any state in the u.s. Ad our business specialists help you incorporate your business. To form a nonprofit, you'll need to learn how to name, appoint a registered agent, select board mem. In georgia, charities regulation responsibilities are shared by the attorney general and the.

Ga Data Transmittal Form 227;.

Select your board members & officers step 4: We do not have a form equivalent to the irs informational. Select a name for your organization. File the ga nonprofit articles of incorporation.

File The Articles Of Incorporation (+1 Copy).

Web how to start a nonprofit in georgia 1. Select initial directors georgia law requires that you name one initial director, but if you want to apply for an irs tax exemption, it is a good idea to select at least three. Name your georgia nonprofit step 2: Web limited exemptions from the payment of georgia’s sales and use tax are available for qualifying nonprofit organizations including: