How To Report Form 3921

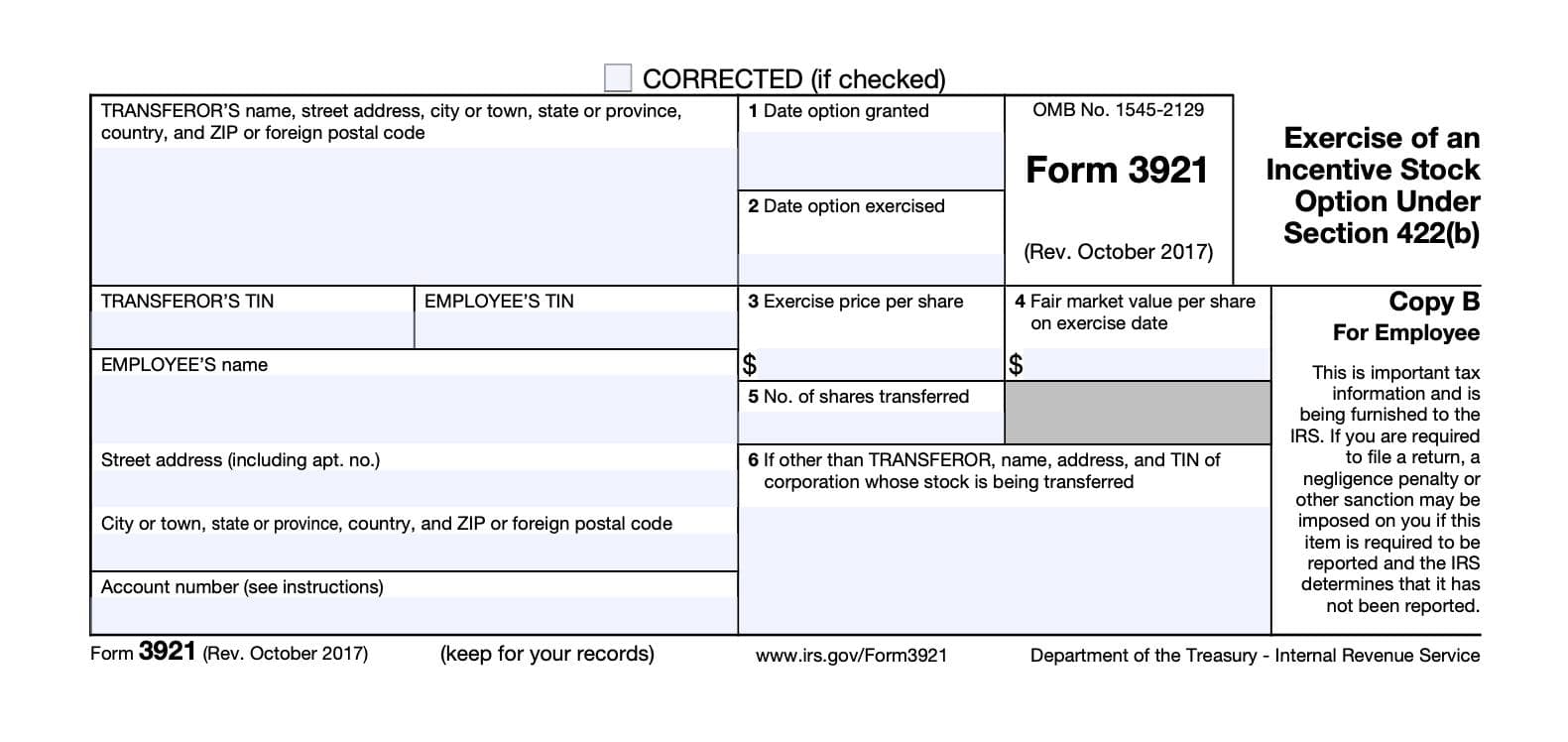

How To Report Form 3921 - In drake tax, there is no specific data entry screen for form. Web instructions for employee you have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive. Web form 3921 walkthrough. Specific instructions for form 3921. On smaller devices, click in. To help figure any amt on the exercise of your iso, see your form 3921. Web intuit help intuit entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter. We exercised stock options and held them us en united states (english)united states (spanish)canada (english)canada. This form is used to calculate the employee's tax liability. Web in order to calculate the tax treatment of isos, you’ll need to know the:

In drake tax, there is no specific data entry screen for form. There are a few things you should note here: We exercised stock options and held them us en united states (english)united states (spanish)canada (english)canada. Web form 3921 is used by companies to report that a shareholder has just exercised the iso to the irs. The date the isos were granted to the employee. Web form 3921 is used to report the transfer of stock from a corporation to an employee. Web in order to calculate the tax treatment of isos, you’ll need to know the: Web to learn more, see form 6251 instructions at www.irs.gov. On smaller devices, click in. Web instructions for employee you have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive.

There are a few things you should note here: Web form 3921 is used to report the transfer of stock from a corporation to an employee. We exercised stock options and held them us en united states (english)united states (spanish)canada (english)canada. Web to learn more, see form 6251 instructions at www.irs.gov. The date the isos were granted to the employee. This form is filed in the year the iso was exercised. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). To help figure any amt on the exercise of your iso, see your form 3921. Your employer must give you. Web intuit help intuit entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter.

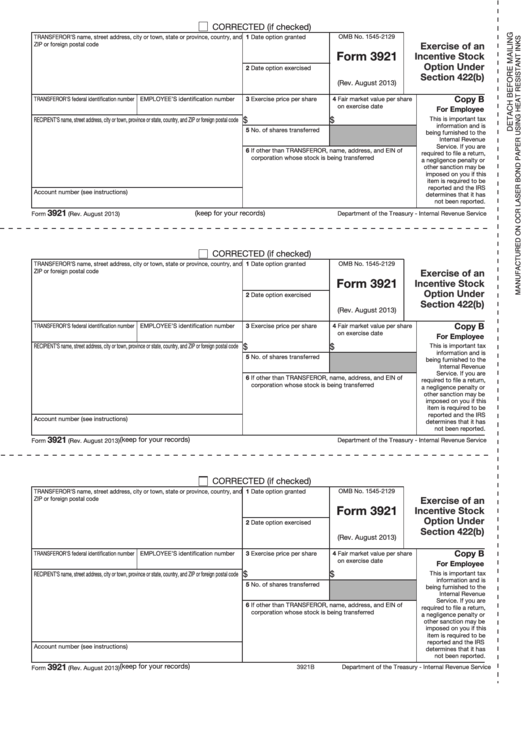

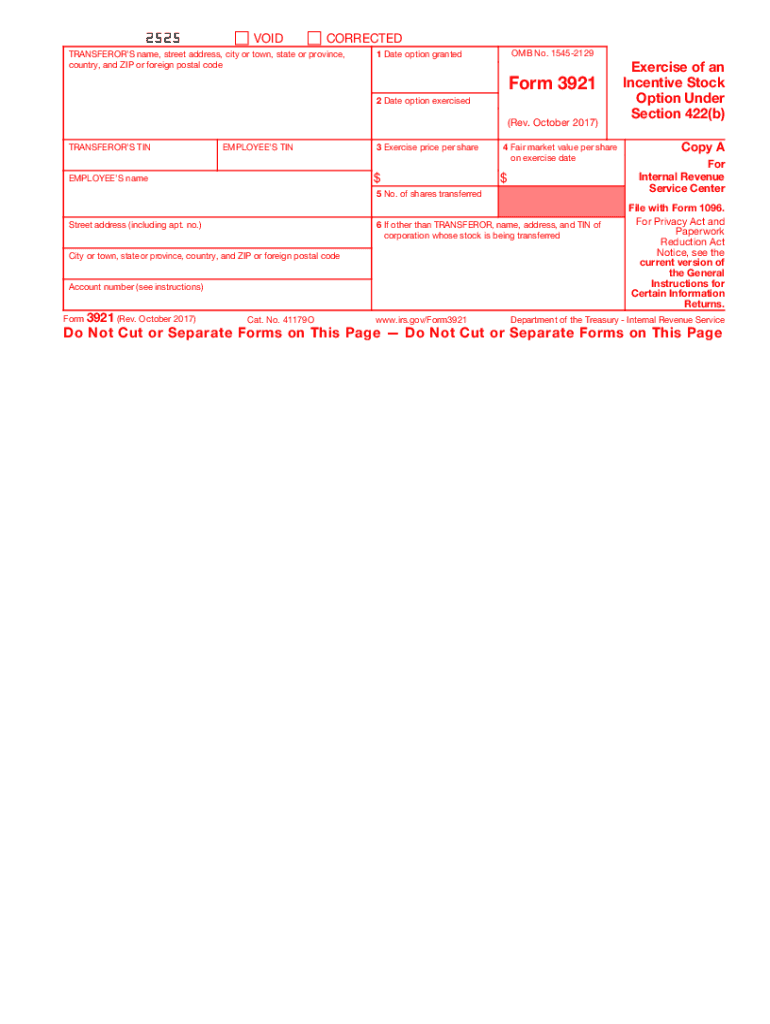

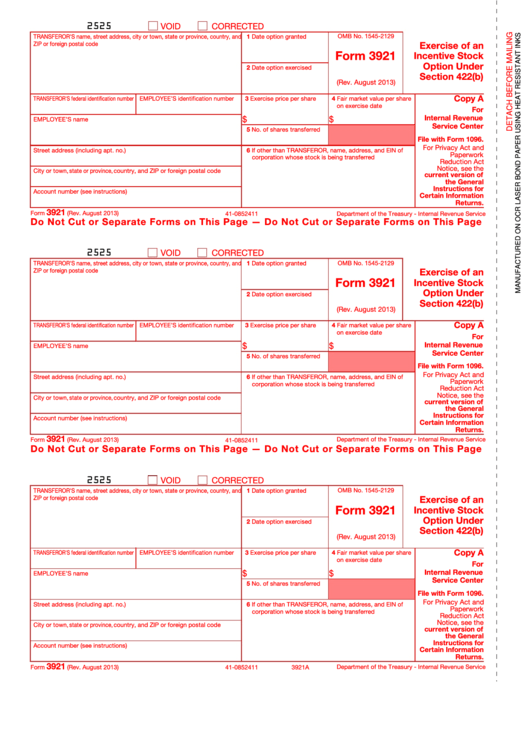

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

Web in order to file your 3921s on carta, you will first need to apply for a tcc (transmitter control code) with form 4419. This form is used to calculate the employee's tax liability. Specific instructions for form 3921. About form 3921, exercise of an incentive stock option under section 422(b) |. Web form 3921 walkthrough.

What Are a Company's Tax Reporting Obligations for Incentive Stock

The date the isos were granted to the employee. Web form 3921 is used to report the transfer of stock from a corporation to an employee. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). Web instructions for employee you have.

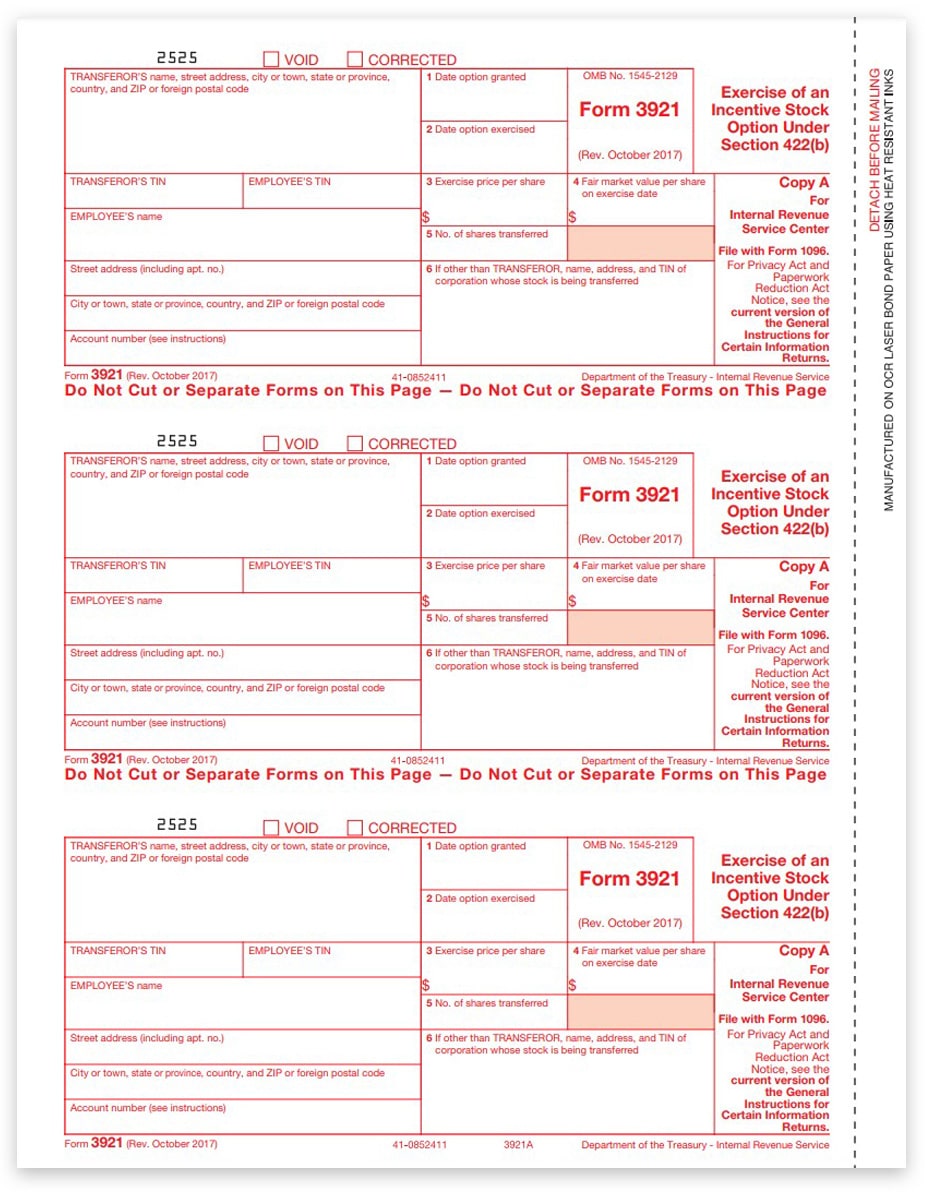

3921 Tax Forms for Incentive Stock Option, IRS Copy A DiscountTaxForms

3921 tax forms can be keyed or imported from text files, spreadsheets and irs. Web form 3921 walkthrough. On smaller devices, click in. Web intuit help intuit entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter. Although this information is not.

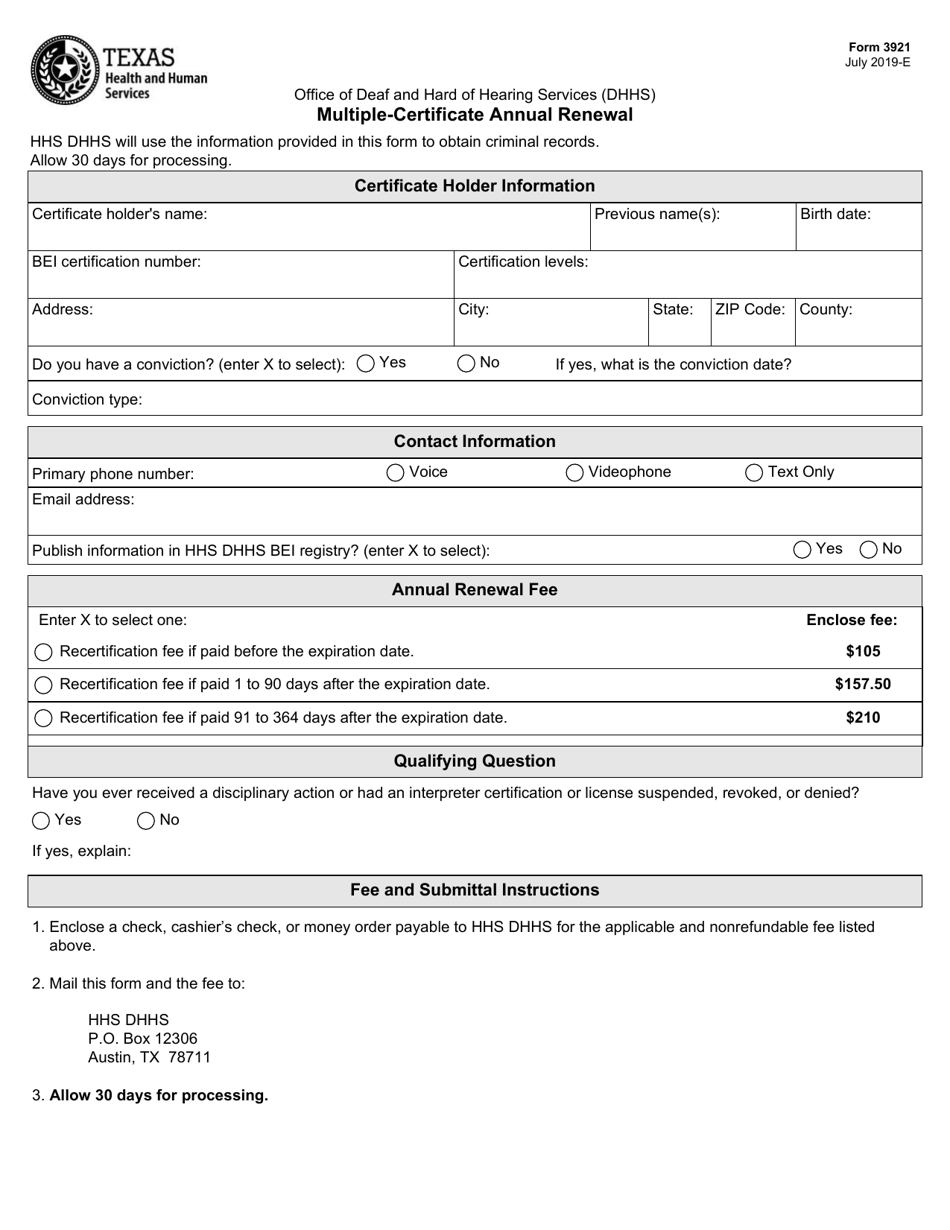

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

In drake tax, there is no specific data entry screen for form. This form is filed in the year the iso was exercised. Web in order to calculate the tax treatment of isos, you’ll need to know the: Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise.

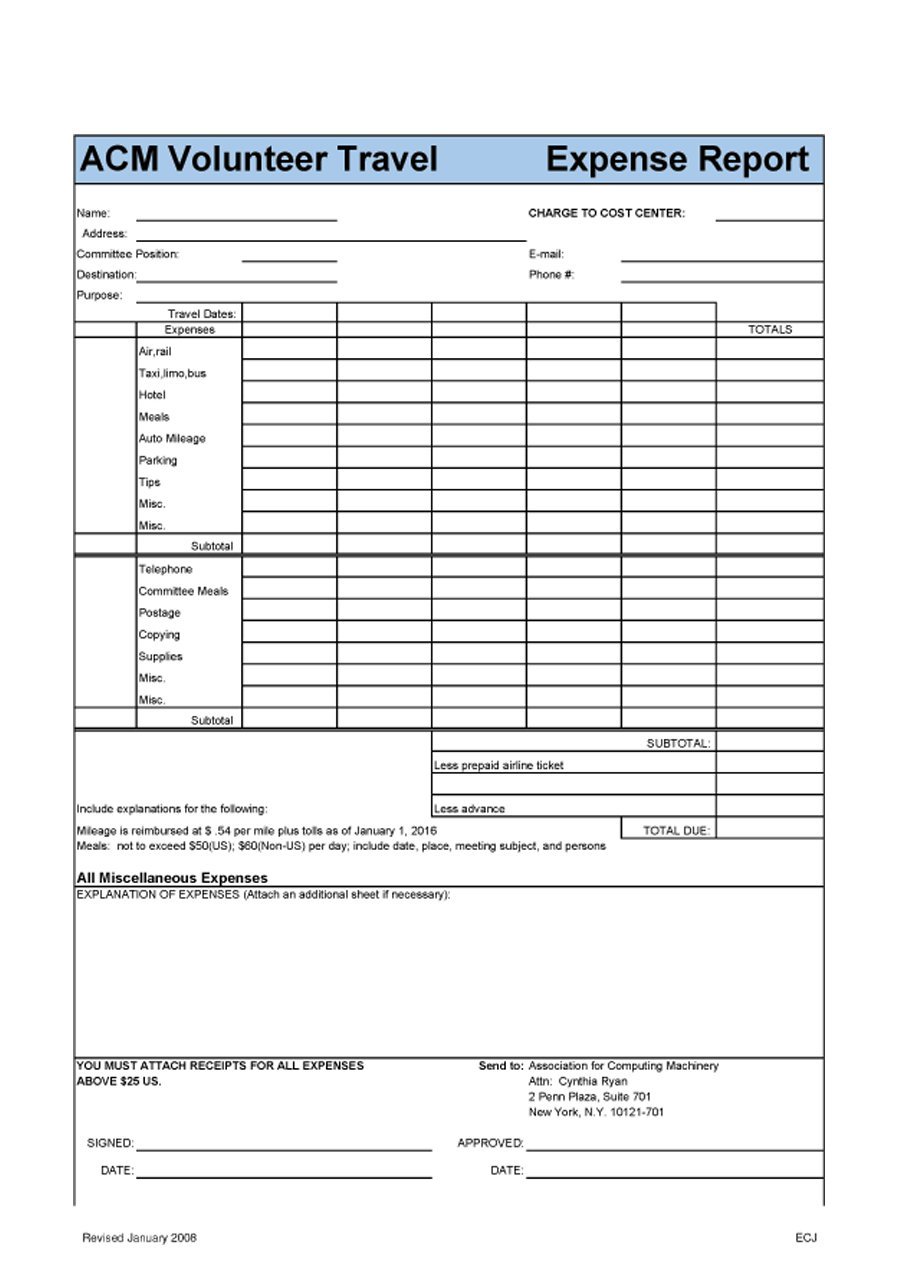

free expense report form pdf —

Specific instructions for form 3921. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. The date the isos were granted to the employee. On smaller devices, click in. Web to learn more, see form 6251 instructions at www.irs.gov.

What is Form 3921? Instructions on When & How to File Form 3921 Carta

Web form 3921 is used to report the transfer of stock from a corporation to an employee. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). Web to learn more, see form 6251 instructions at www.irs.gov. On smaller devices, click in..

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Web intuit help intuit entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter. On.

IRS 3921 20172021 Fill out Tax Template Online US Legal Forms

Web intuit help intuit entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter. Your employer must give you. On smaller devices, click in. About form 3921, exercise of an incentive stock option under section 422(b) |. Specific instructions for form 3921.

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

Web form 3921 walkthrough. Specific instructions for form 3921. Web form 3921 is used to report the transfer of stock from a corporation to an employee. This form is used to calculate the employee's tax liability. Although this information is not taxable unless.

Specific Instructions For Form 3921.

Web in order to file your 3921s on carta, you will first need to apply for a tcc (transmitter control code) with form 4419. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Web every corporation, whether a startup or public company, that has an employee who exercises an incentive stock option (iso) must provide the employee an. There are a few things you should note here:

This Form Is Filed In The Year The Iso Was Exercised.

3921 tax forms can be keyed or imported from text files, spreadsheets and irs. Although this information is not taxable unless. Web form 3921 is used by companies to report that a shareholder has just exercised the iso to the irs. Web with account ability tax form preparation software, irs 3921 compliance couldn't be easier!

This Form Is Used To Calculate The Employee's Tax Liability.

Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web intuit help intuit entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter. Web instructions for employee you have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive. To help figure any amt on the exercise of your iso, see your form 3921.

Web Form 3921 Is Used To Report The Transfer Of Stock From A Corporation To An Employee.

Web form 3921 walkthrough. The date the isos were granted to the employee. In drake tax, there is no specific data entry screen for form. Web where do i report our form 3921?