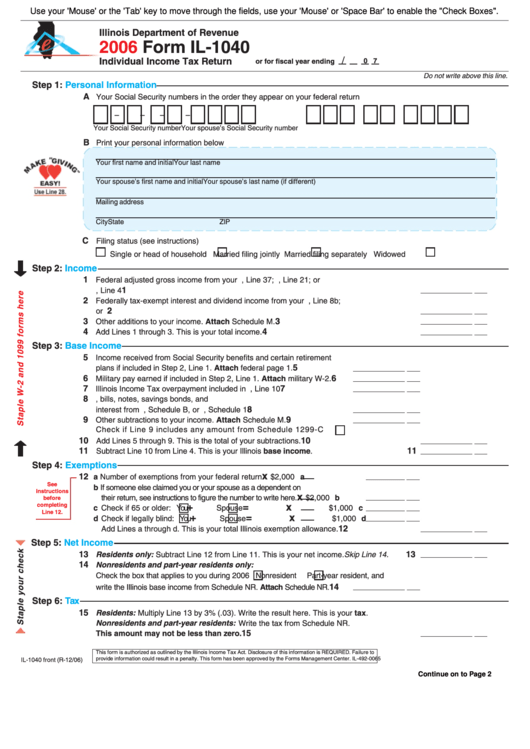

Il 1040 Tax Form

Il 1040 Tax Form - For more information about the illinois. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Request certain forms from idor. Complete lines 1 through 10. We last updated the individual income tax return in january 2023, so this is. Web illinois department of revenue. Web illinois income tax forms illinois printable income tax forms 76 pdfs illinois has a flat state income tax of 4.95% , which is administered by the illinois department of. Illinois, irs late filing, tax payment penalties. You were not required to file a federal income tax return, but your illinois.

Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. If you filed a joint federal income tax return and are filing a separate illinois return, include in column a only your share of. If you need help, call the illinois department of revenue at 1 800. Complete, edit or print tax forms instantly. Complete lines 1 through 10. This form is for income earned in tax year 2022, with tax returns due in april. Illinois, irs late filing, tax payment penalties. Web illinois department of revenue. Web illinois income tax forms illinois printable income tax forms 76 pdfs illinois has a flat state income tax of 4.95% , which is administered by the illinois department of. Payment voucher for amended individual income tax.

If you filed a joint federal income tax return and are filing a separate illinois return, include in column a only your share of. Web illinois department of revenue. You were required to file a federal income tax return, or. For more information about the illinois. Web illinois income tax forms illinois printable income tax forms 76 pdfs illinois has a flat state income tax of 4.95% , which is administered by the illinois department of. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. Income tax rate the illinois income tax rate is 4.95. Complete, edit or print tax forms instantly. We last updated the individual income tax return in january 2023, so this is. Go to service provided by department of revenue go to agency contact.

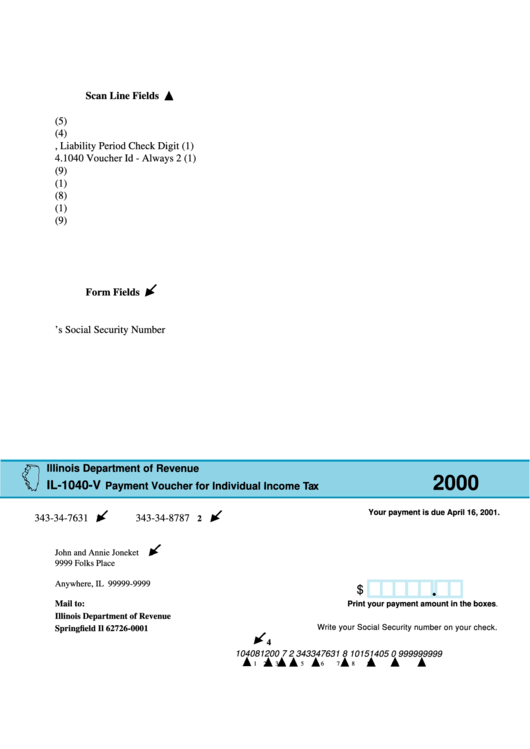

Form Il1040V Payment Voucher For Individual Tax Illinois

You were required to file a federal income tax return, or. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. Options on how to best pay your il income taxes. Complete, edit or print tax forms instantly. Use this form for.

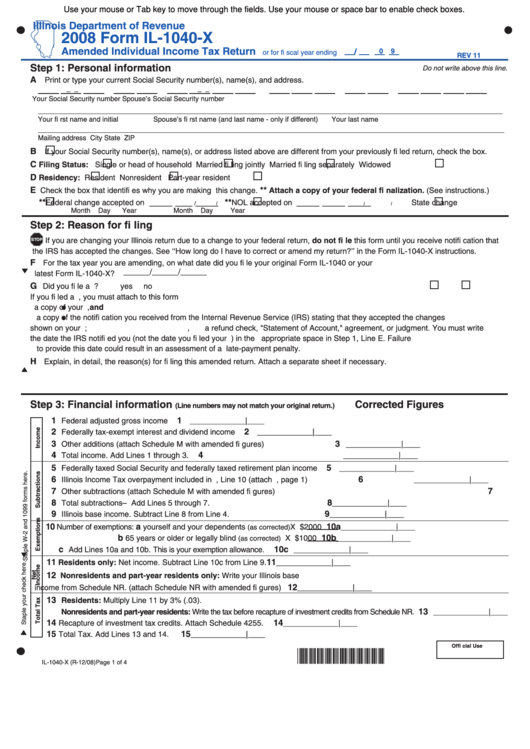

Fillable Form Il1040X Amended Individual Tax Return 2008

For more information about the illinois. Complete, edit or print tax forms instantly. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web illinois department of revenue. You were required to file a federal income tax return, or.

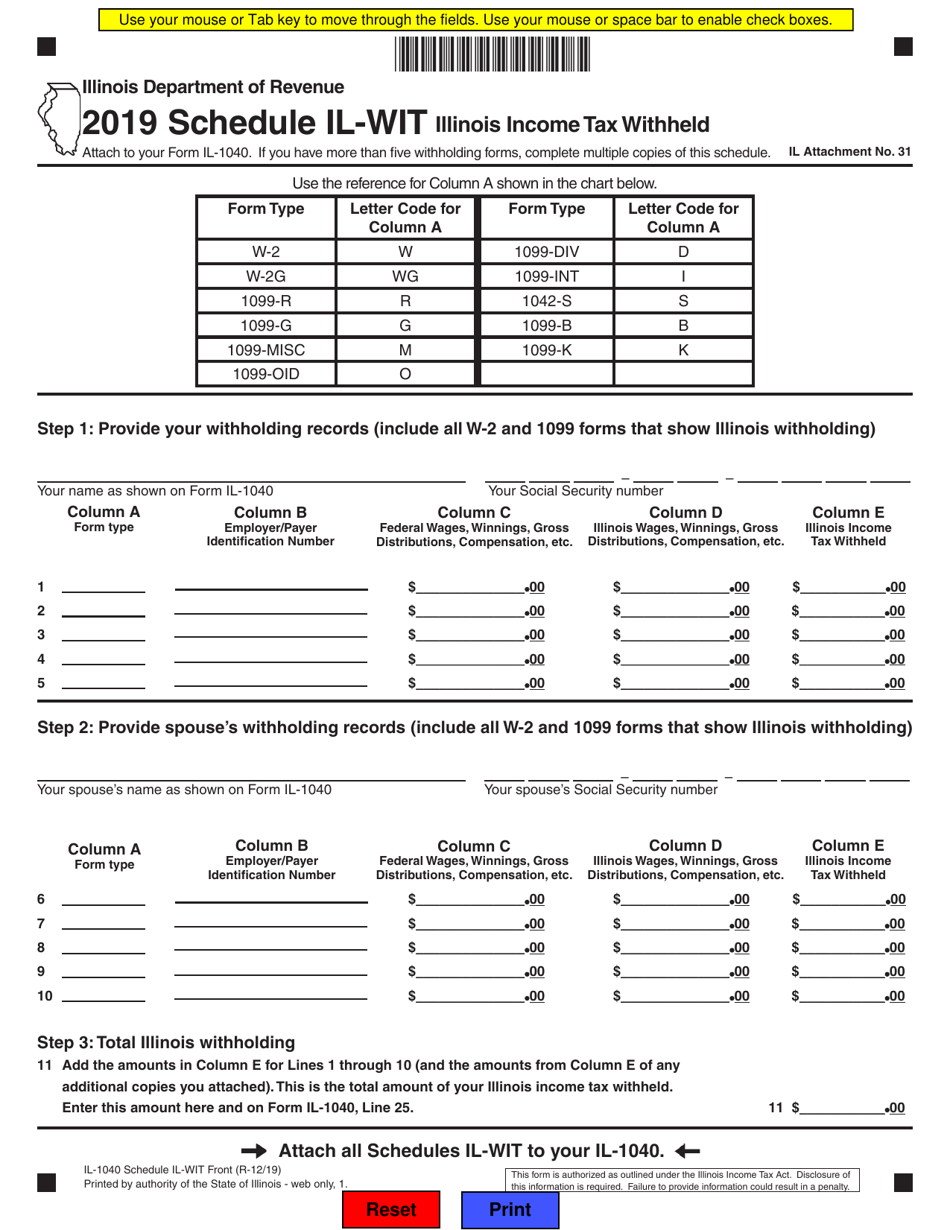

Form IL1040 Schedule ILWIT Download Fillable PDF or Fill Online

Complete lines 1 through 10. We last updated the individual income tax return in january 2023, so this is. Income tax rate the illinois income tax rate is 4.95. 2023 estimated income tax payments for individuals. Web illinois income tax forms illinois printable income tax forms 76 pdfs illinois has a flat state income tax of 4.95% , which is.

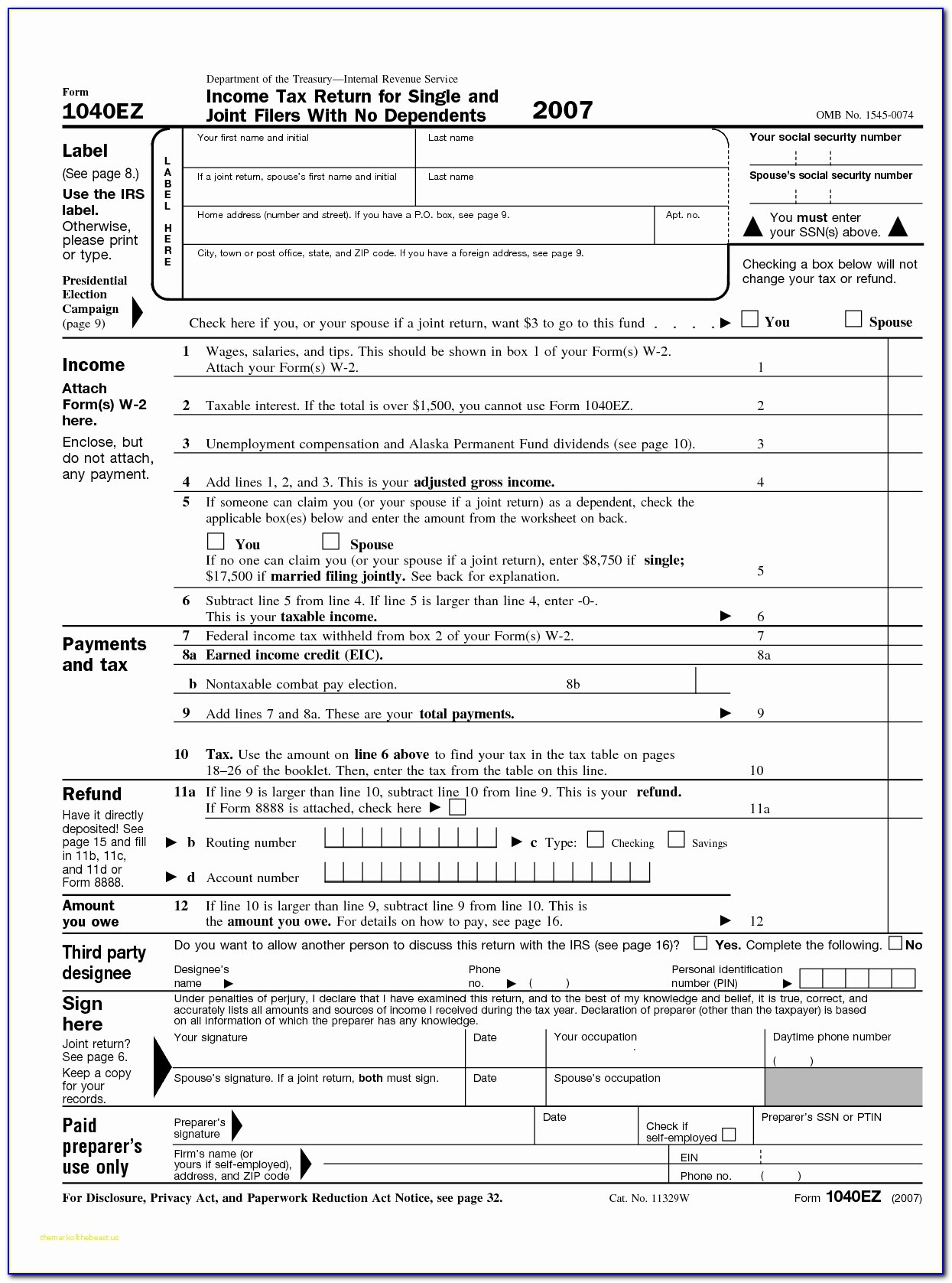

Free Printable Irs Tax Forms Printable Form 2022

Go to service provided by department of revenue go to agency contact. Complete lines 1 through 10. Income tax rate the illinois income tax rate is 4.95. You were required to file a federal income tax return, or. If you filed a joint federal income tax return and are filing a separate illinois return, include in column a only your.

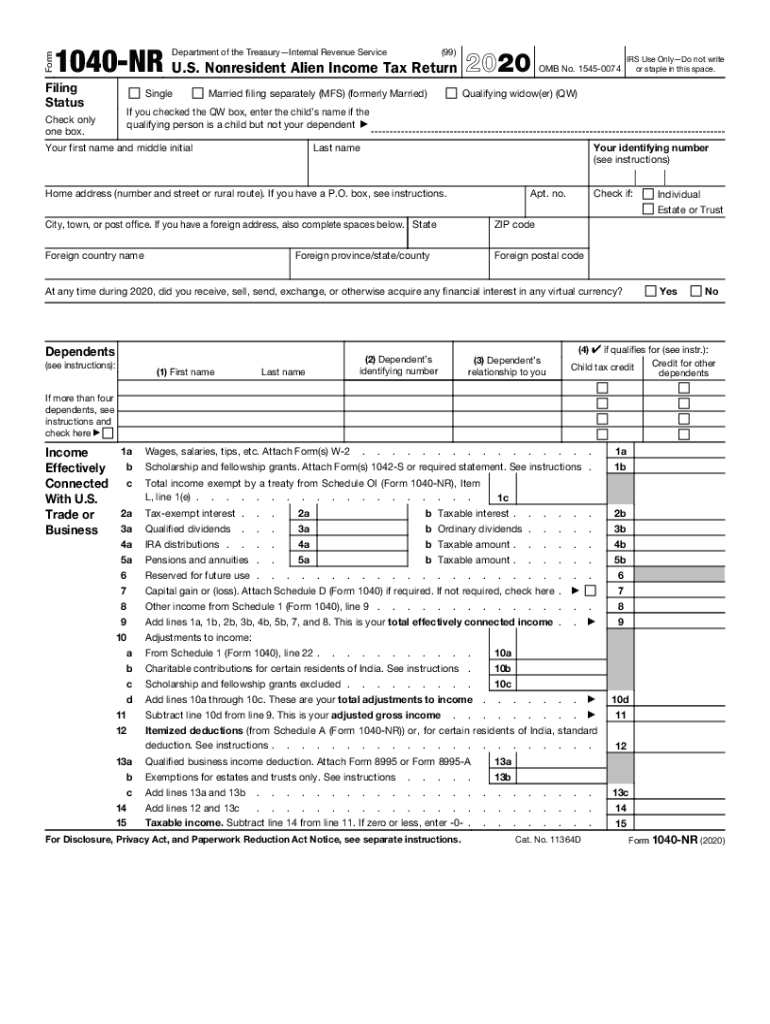

1040Nr Fill Out and Sign Printable PDF Template signNow

Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. You were required to file a federal income tax return, or. Go to service provided by department of revenue go to agency contact. If you need help, call the illinois department of.

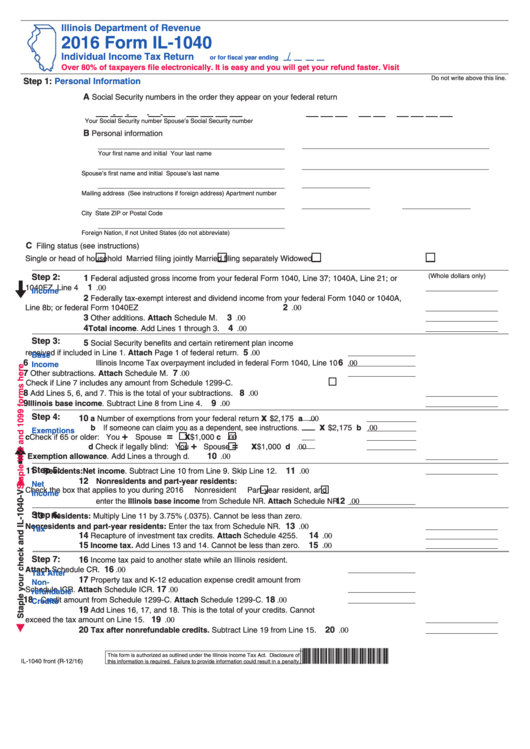

Form Il1040 Individual Tax Return 2016 printable pdf download

Payment voucher for amended individual income tax. Options on how to best pay your il income taxes. Complete, edit or print tax forms instantly. If you filed a joint federal income tax return and are filing a separate illinois return, include in column a only your share of. You were required to file a federal income tax return, or.

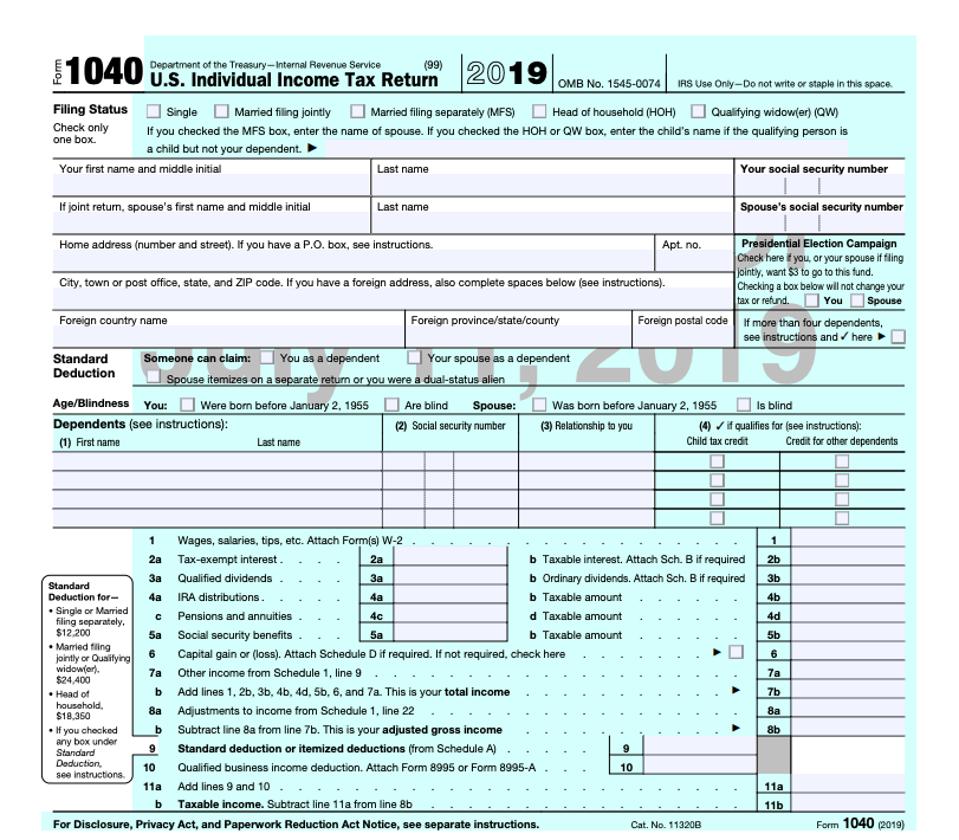

How Do You Get A 1040 Tax Form Tax Walls

2023 estimated income tax payments for individuals. If you need help, call the illinois department of revenue at 1 800. Complete lines 1 through 10. Request certain forms from idor. If you filed a joint federal income tax return and are filing a separate illinois return, include in column a only your share of.

Form IL1040X Download Fillable PDF or Fill Online Amended Individual

Income tax rate the illinois income tax rate is 4.95. 2023 estimated income tax payments for individuals. For more information about the illinois. We last updated the individual income tax return in january 2023, so this is. Payment voucher for amended individual income tax.

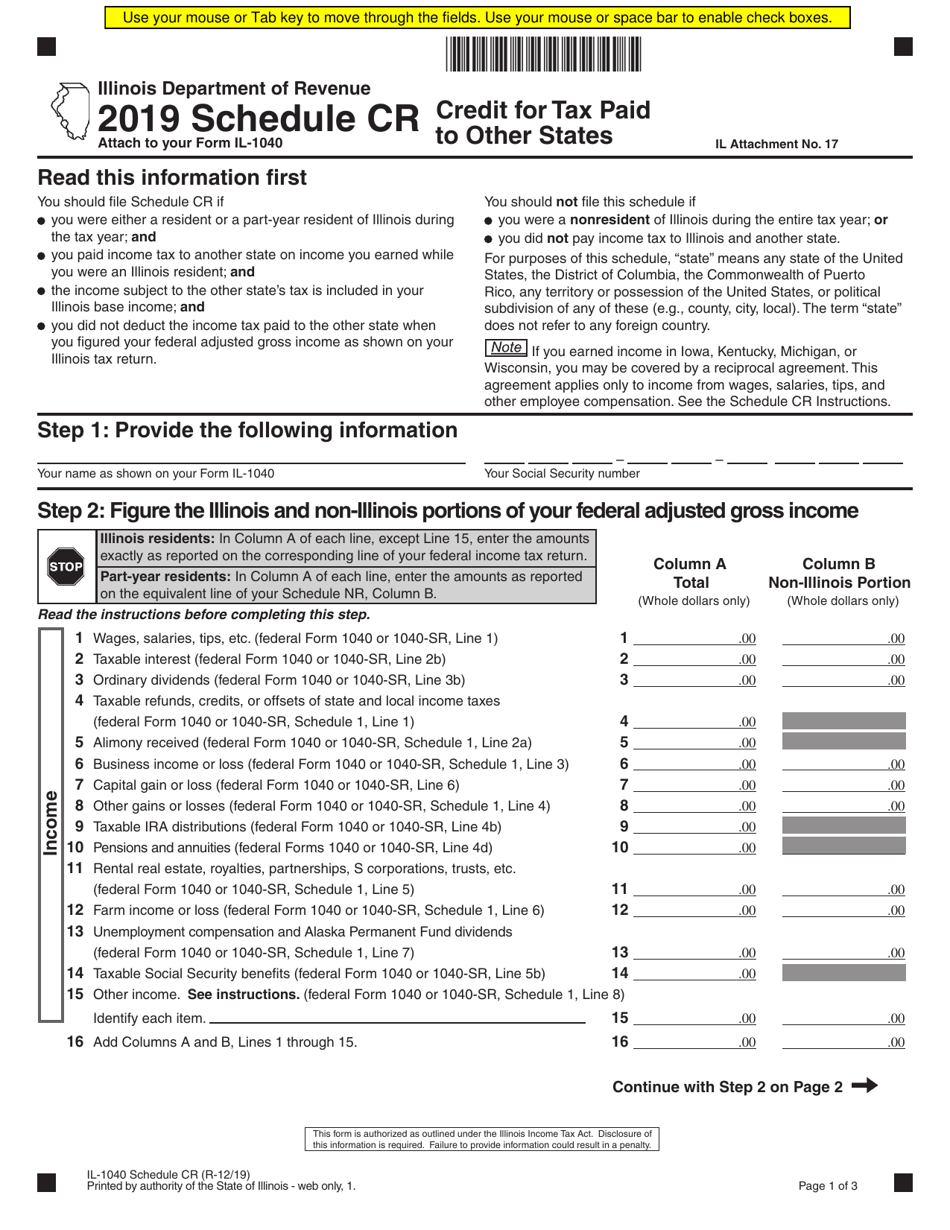

Form IL1040 Schedule CR Download Fillable PDF or Fill Online Credit

What if i need help? Complete lines 1 through 10. Complete, edit or print tax forms instantly. Illinois, irs late filing, tax payment penalties. You were required to file a federal income tax return, or.

Fillable Form Il1040 Individual Tax Return 2006 printable

Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. We last updated the individual income tax return in january 2023, so this is. You were not required to file a federal income tax return, but your illinois. Income tax rate the.

Request Certain Forms From Idor.

Complete, edit or print tax forms instantly. Illinois, irs late filing, tax payment penalties. Web illinois income tax forms illinois printable income tax forms 76 pdfs illinois has a flat state income tax of 4.95% , which is administered by the illinois department of. You were required to file a federal income tax return, or.

Web Illinois Department Of Revenue.

If you filed a joint federal income tax return and are filing a separate illinois return, include in column a only your share of. What if i need help? Income tax rate the illinois income tax rate is 4.95. We last updated the individual income tax return in january 2023, so this is.

Payment Voucher For Amended Individual Income Tax.

Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. You were not required to file a federal income tax return, but your illinois. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Complete, edit or print tax forms instantly.

For More Information About The Illinois.

Go to service provided by department of revenue go to agency contact. 2023 estimated income tax payments for individuals. If you need help, call the illinois department of revenue at 1 800. Complete lines 1 through 10.