Indiana Durable Power Of Attorney Form

Indiana Durable Power Of Attorney Form - Assert any interest in and exercise any power over any trust, estate or property subject to fiduciary control; Web dor tax professionals power of attorney procedures and form power of attorney allows an individual to act as the authority for another person in specific instances. Identification numbers* indiana taxpayer identification number (tid) (10 digits) Web indiana durable (financial) power of attorney form. Web an indiana durable power of attorney form is a legal document that allows an individual (“the principal”) to designate another person (“the agent”) to make decisions on their behalf. Under indiana law, the agent is allowed to make primarily financial decisions during the principal’s lifetime and in case he or she becomes incapacitated. This authorization is used primarily for making financial decisions in the principal’s interest. Web a durable poa allows someone to help you with your financial matters if you ever become incapacitated—here's how to make one in indiana. Web to accept, receipt for, exercise, release, reject, renounce, assign, disclaim, demand, sue for, claim and recover any legacy, bequest, devise, gift or other property interest or payment due or payable to or for the principal; An indiana durable power of attorney form can be used to appoint a representative or “agent” to exercise control over a person’s finances.

Identification numbers* indiana taxpayer identification number (tid) (10 digits) Web indiana durable (financial) power of attorney form. If the field is not complete, this form will be returned to the sender. Durable (financial) power of attorney. Web a durable poa allows someone to help you with your financial matters if you ever become incapacitated—here's how to make one in indiana. Web an indiana durable power of attorney form is a legal document that allows an individual (“the principal”) to designate another person (“the agent”) to make decisions on their behalf. Web to accept, receipt for, exercise, release, reject, renounce, assign, disclaim, demand, sue for, claim and recover any legacy, bequest, devise, gift or other property interest or payment due or payable to or for the principal; Under indiana law, the agent is allowed to make primarily financial decisions during the principal’s lifetime and in case he or she becomes incapacitated. An indiana durable power of attorney form can be used to appoint a representative or “agent” to exercise control over a person’s finances. Prepare for your care advance health care directive.

Durable (financial) power of attorney. An indiana durable power of attorney form can be used to appoint a representative or “agent” to exercise control over a person’s finances. Web an indiana durable power of attorney form is a legal document that allows an individual (“the principal”) to designate another person (“the agent”) to make decisions on their behalf. By jennie lin , attorney if you want someone to be able to deposit your checks at your bank, file your taxes, or even sell or mortgage your home, you can create a handy document called a power of attorney. Prepare for your care advance health care directive. An indiana power of attorney legally allows an individual to select an agent to represent their affairs related to finances, health care, minor children, and any custom. Web indiana durable (financial) power of attorney form. If the field is not complete, this form will be returned to the sender. Web dor tax professionals power of attorney procedures and form power of attorney allows an individual to act as the authority for another person in specific instances. This authorization is used primarily for making financial decisions in the principal’s interest.

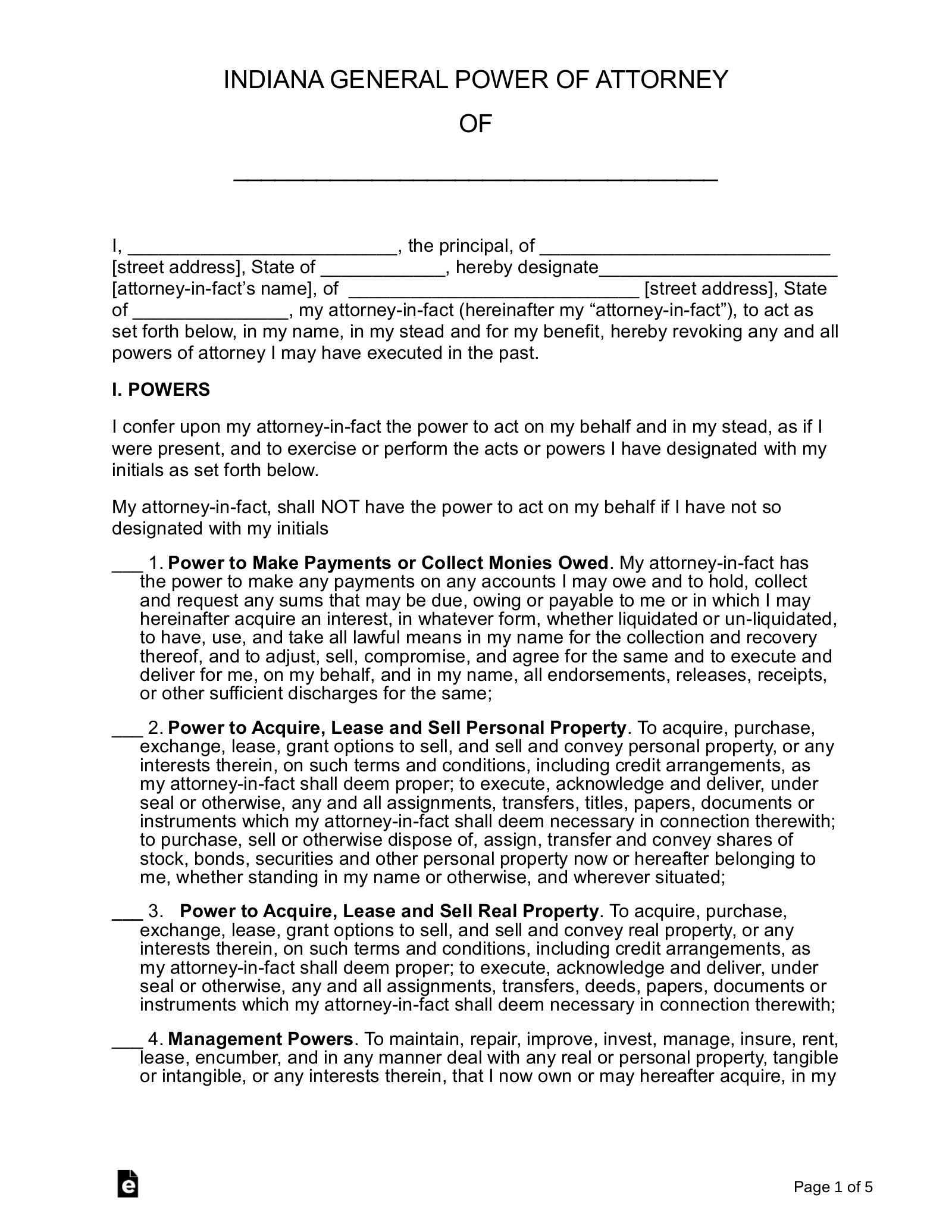

Free Indiana General Power of Attorney Form PDF Word eForms

An indiana power of attorney legally allows an individual to select an agent to represent their affairs related to finances, health care, minor children, and any custom. Durable (financial) power of attorney. This authorization is used primarily for making financial decisions in the principal’s interest. Web updated on may 5th, 2023. Web to accept, receipt for, exercise, release, reject, renounce,.

How To Form A 501c3 In Indiana Form Resume Examples lV8NQQv30o

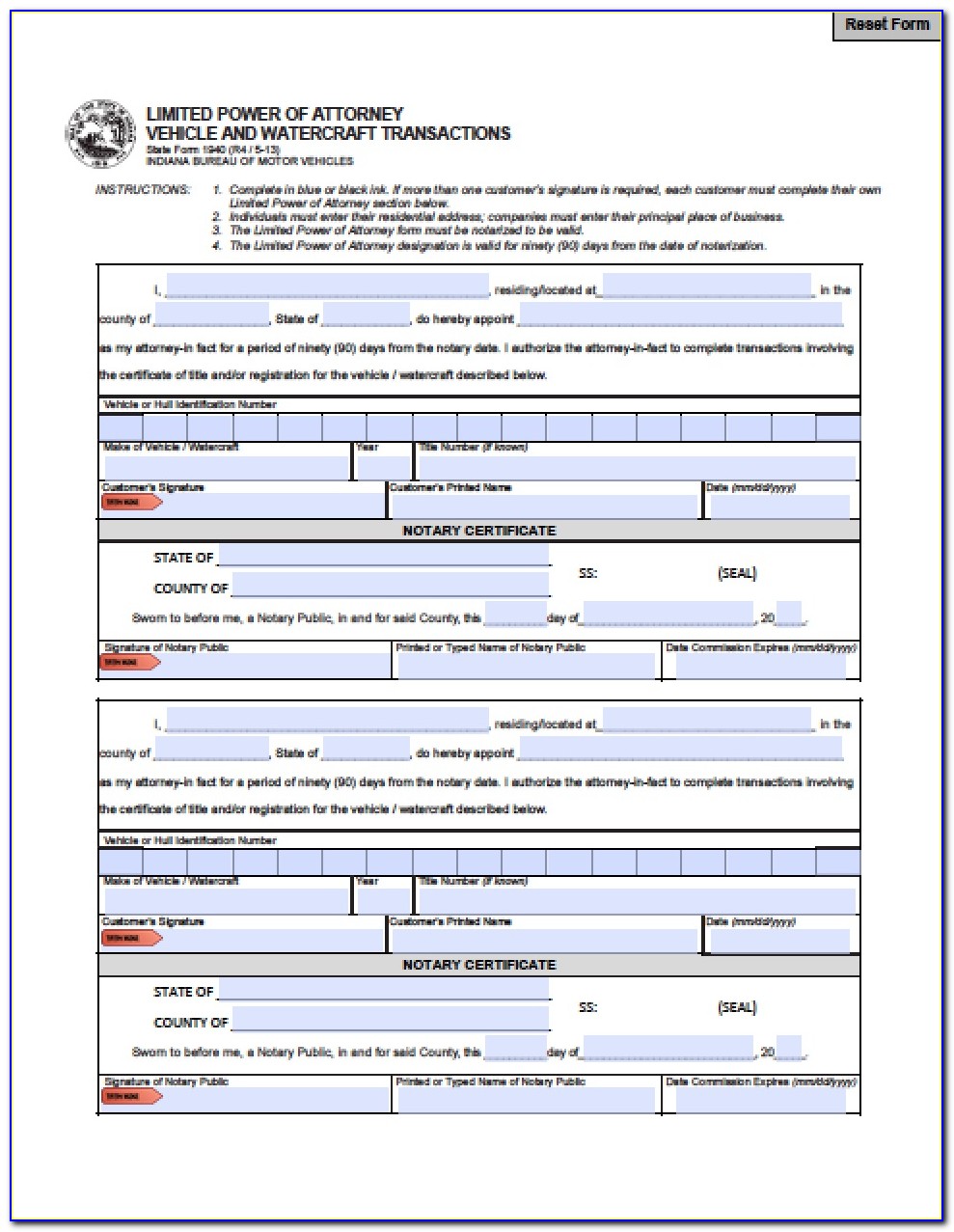

Web dor tax professionals power of attorney procedures and form power of attorney allows an individual to act as the authority for another person in specific instances. Prepare for your care advance health care directive. Identification numbers* indiana taxpayer identification number (tid) (10 digits) If the field is not complete, this form will be returned to the sender. An indiana.

Indiana Durable Power Of Attorney Form Pdf Luxury Power Attorney Form

Identification numbers* indiana taxpayer identification number (tid) (10 digits) Web to accept, receipt for, exercise, release, reject, renounce, assign, disclaim, demand, sue for, claim and recover any legacy, bequest, devise, gift or other property interest or payment due or payable to or for the principal; An indiana durable power of attorney form can be used to appoint a representative or.

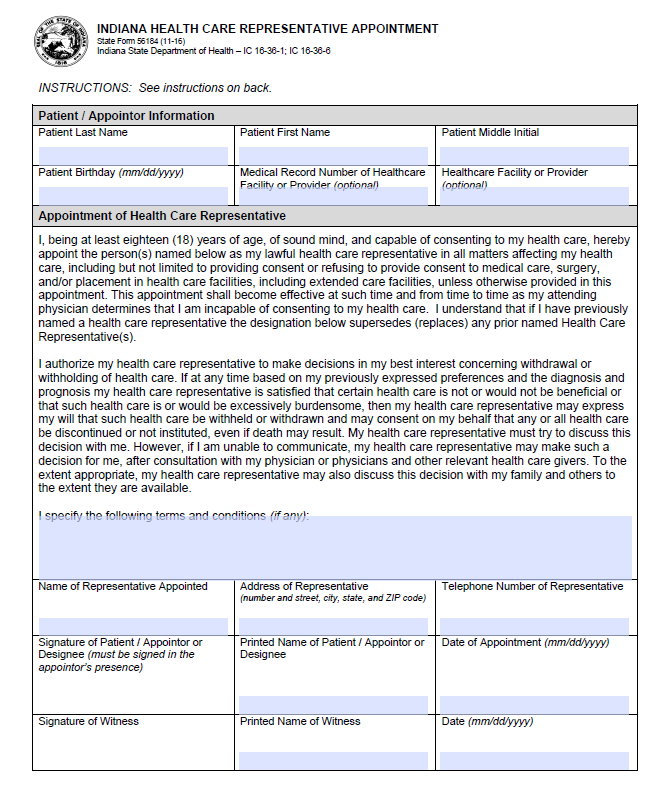

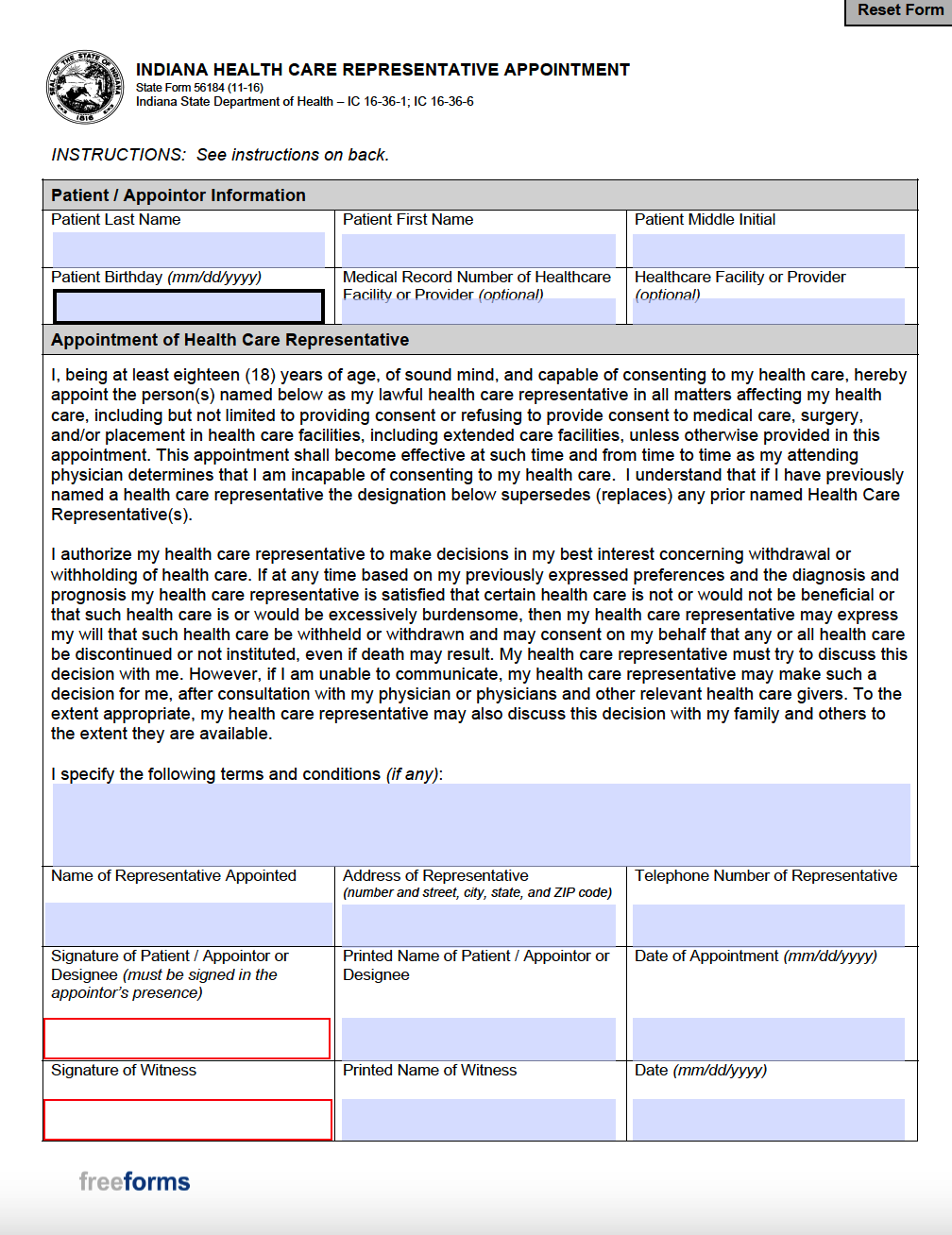

Indiana Medical Power of Attorney PDF Free Printable Legal Forms

Identification numbers* indiana taxpayer identification number (tid) (10 digits) Durable (financial) power of attorney. This authorization is used primarily for making financial decisions in the principal’s interest. Web to accept, receipt for, exercise, release, reject, renounce, assign, disclaim, demand, sue for, claim and recover any legacy, bequest, devise, gift or other property interest or payment due or payable to or.

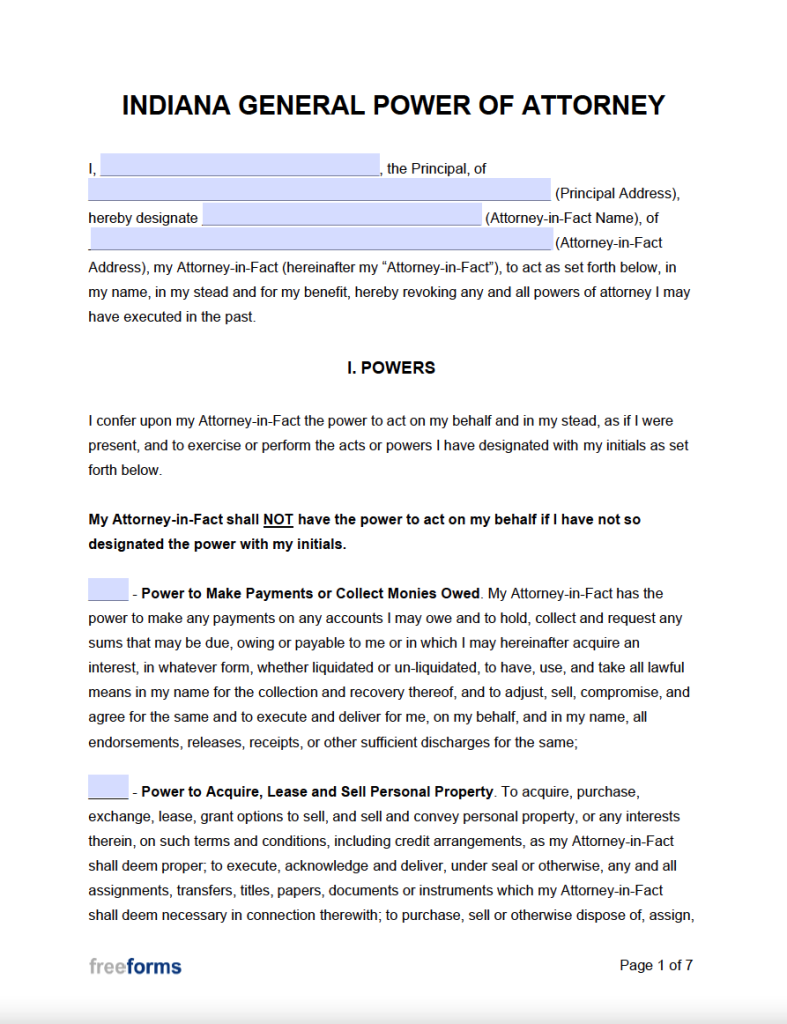

Free Indiana General (Financial) Power of Attorney Form PDF WORD

An indiana durable power of attorney form can be used to appoint a representative or “agent” to exercise control over a person’s finances. An indiana power of attorney legally allows an individual to select an agent to represent their affairs related to finances, health care, minor children, and any custom. Web a durable poa allows someone to help you with.

General Durable Power of Attorney Indiana Free Download

Durable (financial) power of attorney. If the field is not complete, this form will be returned to the sender. An indiana durable power of attorney form can be used to appoint a representative or “agent” to exercise control over a person’s finances. Web dor tax professionals power of attorney procedures and form power of attorney allows an individual to act.

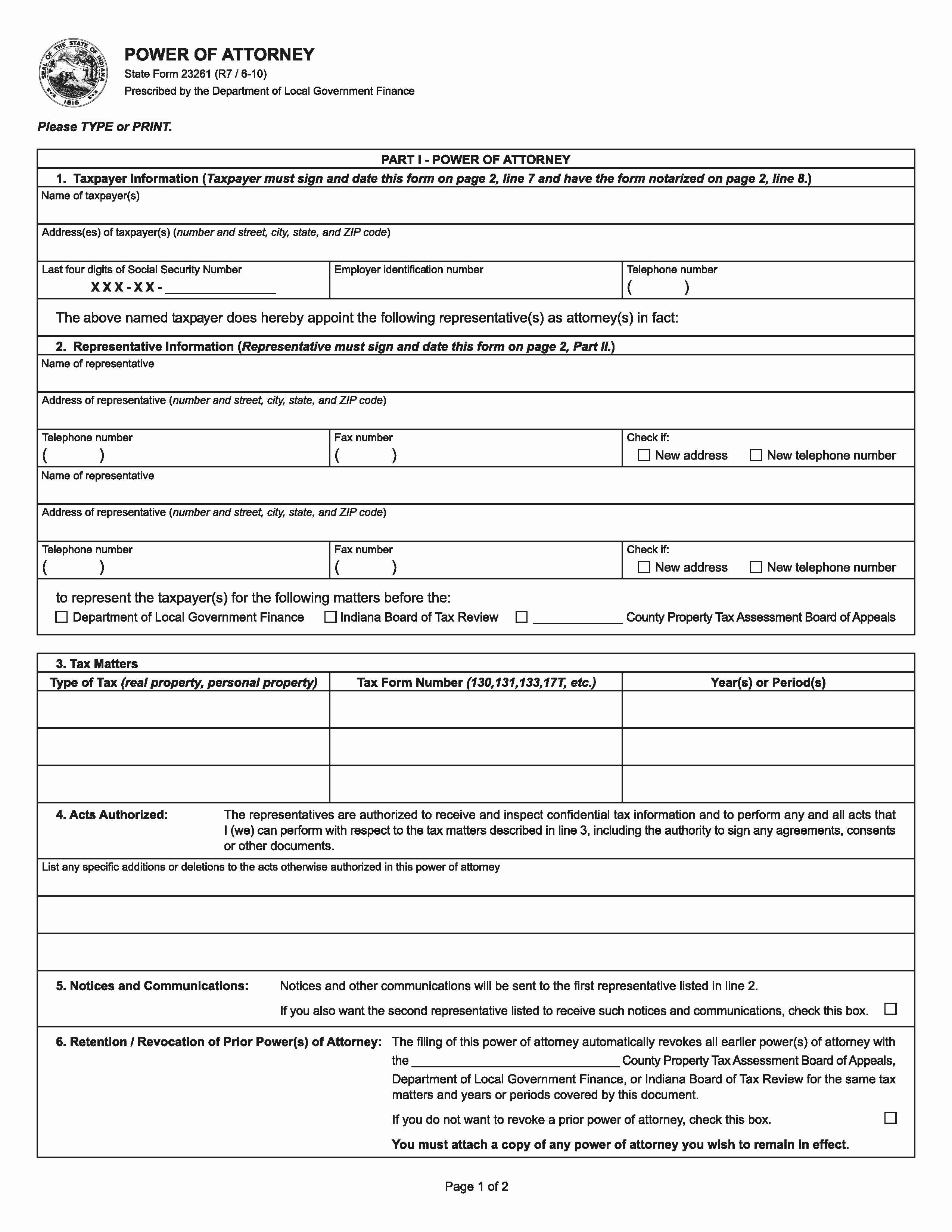

Free Indiana Tax Power of Attorney (Form 23261) (R7/610) Adobe PDF

An indiana power of attorney legally allows an individual to select an agent to represent their affairs related to finances, health care, minor children, and any custom. If the field is not complete, this form will be returned to the sender. Web to accept, receipt for, exercise, release, reject, renounce, assign, disclaim, demand, sue for, claim and recover any legacy,.

Free Indiana Power of Attorney Forms (10 Types) PDF Word eForms

Web an indiana durable power of attorney form is a legal document that allows an individual (“the principal”) to designate another person (“the agent”) to make decisions on their behalf. By jennie lin , attorney if you want someone to be able to deposit your checks at your bank, file your taxes, or even sell or mortgage your home, you.

Free Indiana Power of Attorney Forms PDF WORD

Web indiana durable (financial) power of attorney form. Identification numbers* indiana taxpayer identification number (tid) (10 digits) Assert any interest in and exercise any power over any trust, estate or property subject to fiduciary control; Under indiana law, the agent is allowed to make primarily financial decisions during the principal’s lifetime and in case he or she becomes incapacitated. Web.

Indiana Durable Power Of Attorney Form Free Form Resume Examples

Prepare for your care advance health care directive. Identification numbers* indiana taxpayer identification number (tid) (10 digits) Durable (financial) power of attorney. This authorization is used primarily for making financial decisions in the principal’s interest. Web a durable poa allows someone to help you with your financial matters if you ever become incapacitated—here's how to make one in indiana.

Web Indiana Durable (Financial) Power Of Attorney Form.

Durable (financial) power of attorney. Web an indiana durable power of attorney form is a legal document that allows an individual (“the principal”) to designate another person (“the agent”) to make decisions on their behalf. Prepare for your care advance health care directive. Web to accept, receipt for, exercise, release, reject, renounce, assign, disclaim, demand, sue for, claim and recover any legacy, bequest, devise, gift or other property interest or payment due or payable to or for the principal;

Web Updated On May 5Th, 2023.

Assert any interest in and exercise any power over any trust, estate or property subject to fiduciary control; By jennie lin , attorney if you want someone to be able to deposit your checks at your bank, file your taxes, or even sell or mortgage your home, you can create a handy document called a power of attorney. An indiana power of attorney legally allows an individual to select an agent to represent their affairs related to finances, health care, minor children, and any custom. An indiana durable power of attorney form can be used to appoint a representative or “agent” to exercise control over a person’s finances.

Web Dor Tax Professionals Power Of Attorney Procedures And Form Power Of Attorney Allows An Individual To Act As The Authority For Another Person In Specific Instances.

This authorization is used primarily for making financial decisions in the principal’s interest. If the field is not complete, this form will be returned to the sender. Web a durable poa allows someone to help you with your financial matters if you ever become incapacitated—here's how to make one in indiana. Under indiana law, the agent is allowed to make primarily financial decisions during the principal’s lifetime and in case he or she becomes incapacitated.