Indiana State Tax Form It 40

Indiana State Tax Form It 40 - Web indiana has three different individual income tax returns. Web file now with turbotax related indiana individual income tax forms: If filing for a fiscal year, enter the dates (see. Are available for download at. Refunds are issued in a matter of. Read the following to find the right one for you to file. Returns should be mailed to one of the following addresses: Get ready for tax season deadlines by completing any required tax forms today. Web claim the $200 atr tax credit on your 2022 indiana income tax return. Forms downloaded and printed from this page may be used to file taxes unless otherwise specified.

Get ready for tax season deadlines by completing any required tax forms today. Find federal tax forms (e.g. Web indiana department of revenue. Web indiana has three different individual income tax returns. Web dor tax forms indiana state prior year tax forms 2019 individual income tax forms attention: Web file now with turbotax related indiana individual income tax forms: Web claim the $200 atr tax credit on your 2022 indiana income tax return. If filing for a fiscal year, enter the dates (see. You may qualify for free online tax. Returns should be mailed to one of the following addresses:

Web indiana department of revenue. Find federal tax forms (e.g. Web claim the $200 atr tax credit on your 2022 indiana income tax return. Web individual income tax forms. Complete, edit or print tax forms instantly. The easiest way to complete a filing is to file your individual income taxes online. Returns should be mailed to one of the following addresses: Web indiana current year tax forms. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

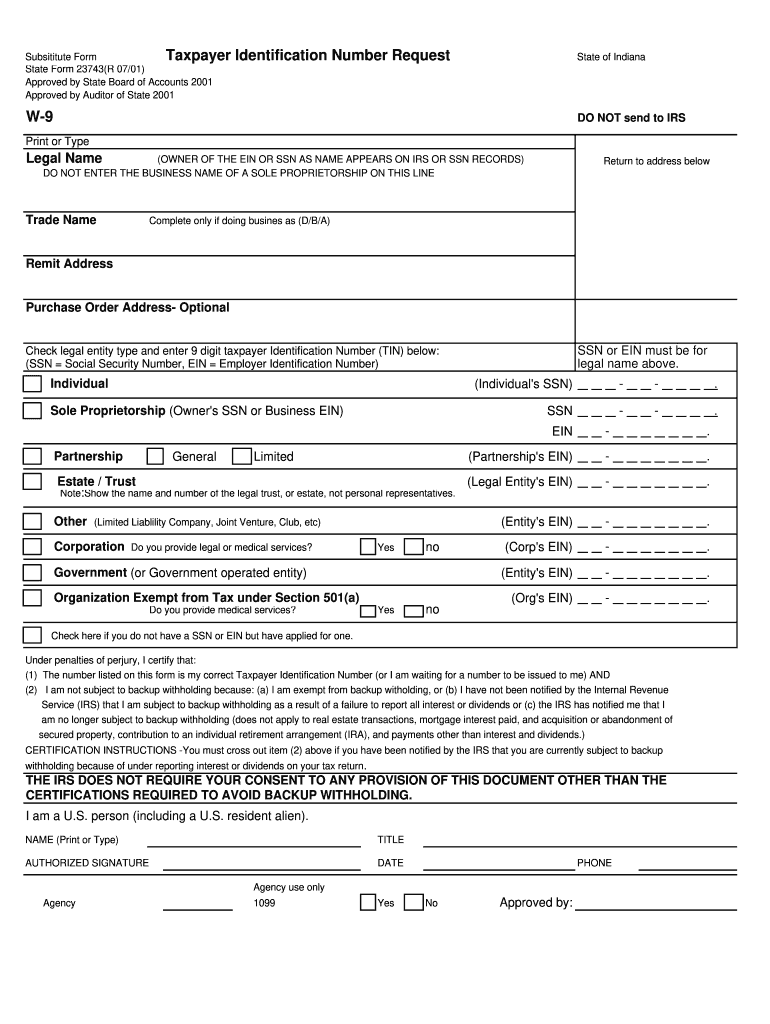

Indiana Taxpayer Id Number Fill Online, Printable, Fillable, Blank

Complete, edit or print tax forms instantly. Web indiana department of revenue. Complete, edit or print tax forms instantly. You may qualify for free online tax. Read the following to find the right one for you to file.

2008 IT40EZ Tax Booklet with Form and Schedule

Read the following to find the right one for you to file. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. You may qualify for free online tax. Web indiana department of revenue.

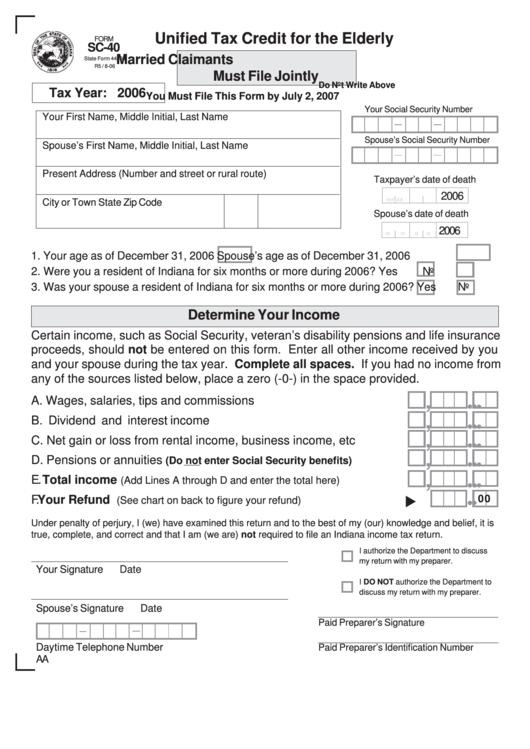

Form Sc40 Unified Tax Credit For The Elderly State Of Indiana

The easiest way to complete a filing is to file your individual income taxes online. You may qualify for free online tax. If filing for a fiscal year, enter the dates (see. Web file now with turbotax related indiana individual income tax forms: Read the following to find the right one for you to file.

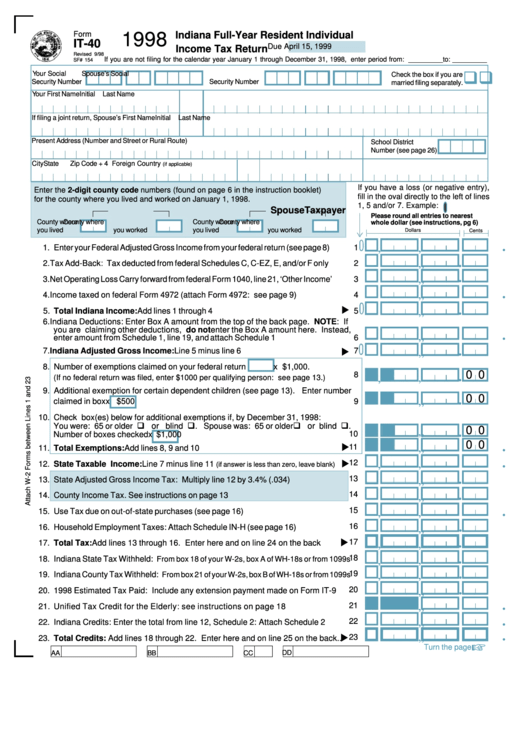

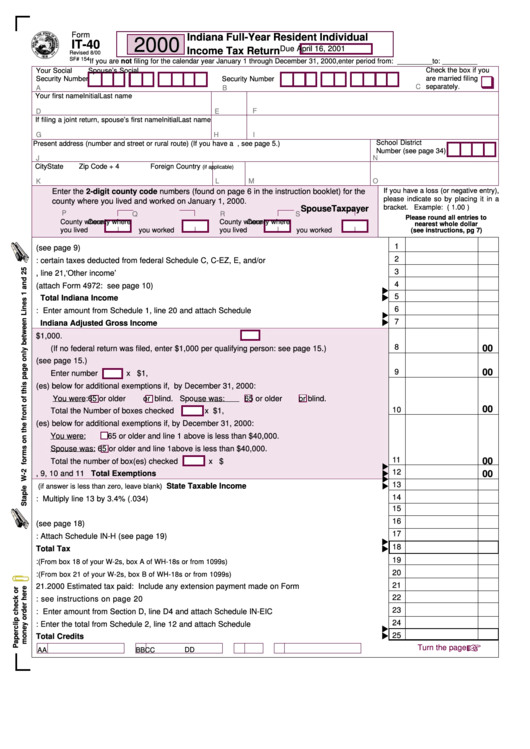

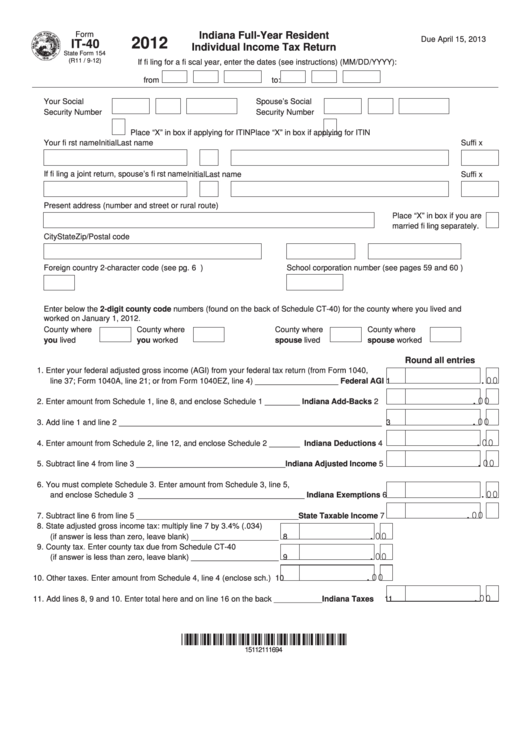

Fillable Form It40 Indiana FullYear Resident Individual Tax

Web indiana department of revenue. Web individual income tax forms. Web indiana current year tax forms. Refunds are issued in a matter of. Web file now with turbotax related indiana individual income tax forms:

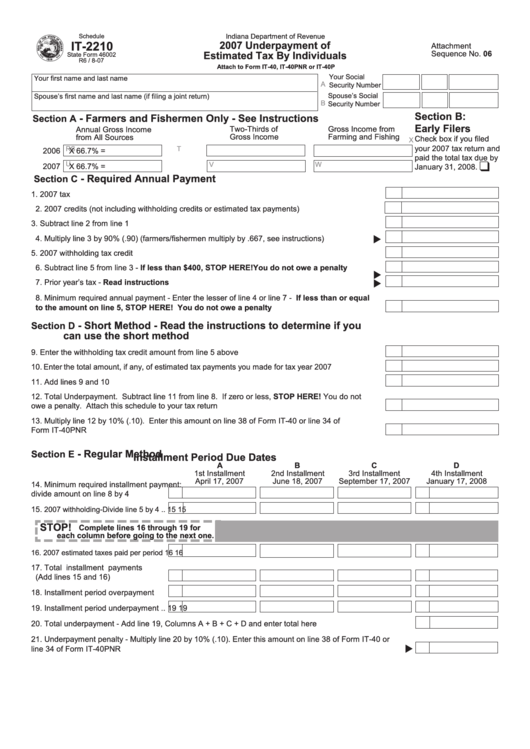

Form 46002 Indiana Department Of Revenue 2007 Underpayment Of

Web individual income tax forms. Find federal tax forms (e.g. Returns should be mailed to one of the following addresses: Web indiana current year tax forms. Web indiana has three different individual income tax returns.

Form It40 Indiana FullYear Resident Individual Tax Return

If filing for a fiscal year, enter the dates (see. Web indiana current year tax forms. Web indiana has three different individual income tax returns. Get ready for tax season deadlines by completing any required tax forms today. Web claim the $200 atr tax credit on your 2022 indiana income tax return.

Fillable Form It40 Indiana FullYear Resident Individual Tax

Web indiana has three different individual income tax returns. Web indiana current year tax forms. Taxformfinder has an additional 69 indiana income tax forms that you may need, plus all federal income. If filing for a fiscal year, enter the dates (see. Complete, edit or print tax forms instantly.

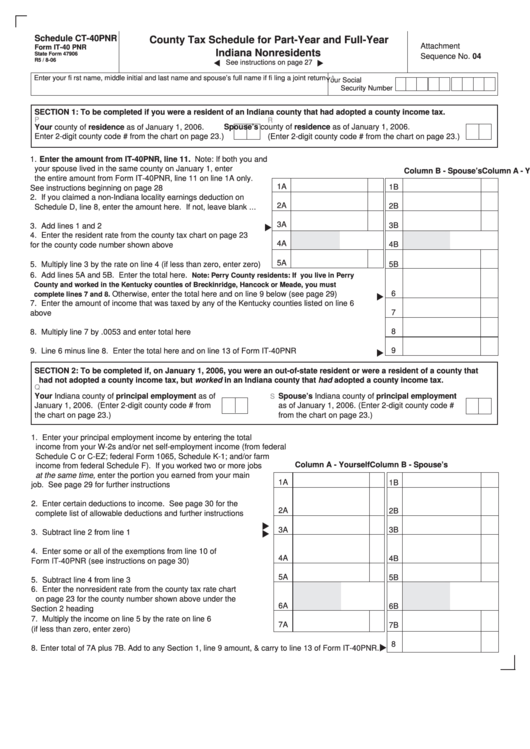

Form It40 Pnr County Tax Schedule For PartYear And FullYear

Read the following to find the right one for you to file. Web indiana department of revenue. Web indiana has three different individual income tax returns. Find federal tax forms (e.g. Taxformfinder has an additional 69 indiana income tax forms that you may need, plus all federal income.

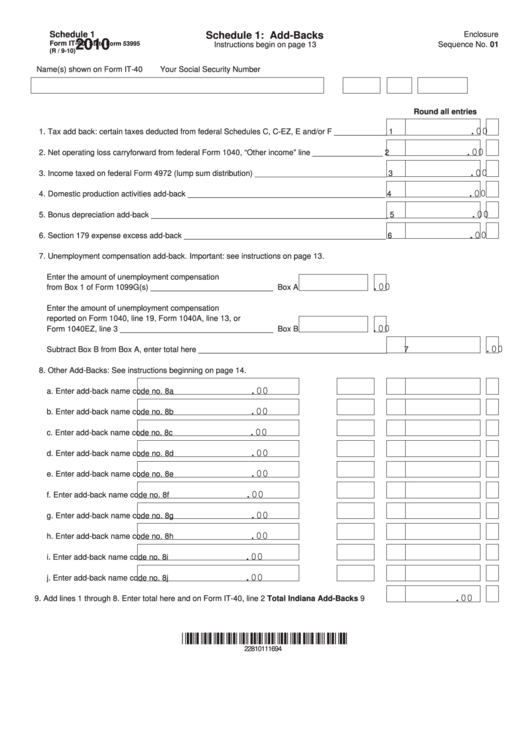

Fillable Form It40 Schedule 1 AddBacks 2010 Indiana printable

Complete, edit or print tax forms instantly. Web individual income tax forms. Find federal tax forms (e.g. Get ready for tax season deadlines by completing any required tax forms today. Web file now with turbotax related indiana individual income tax forms:

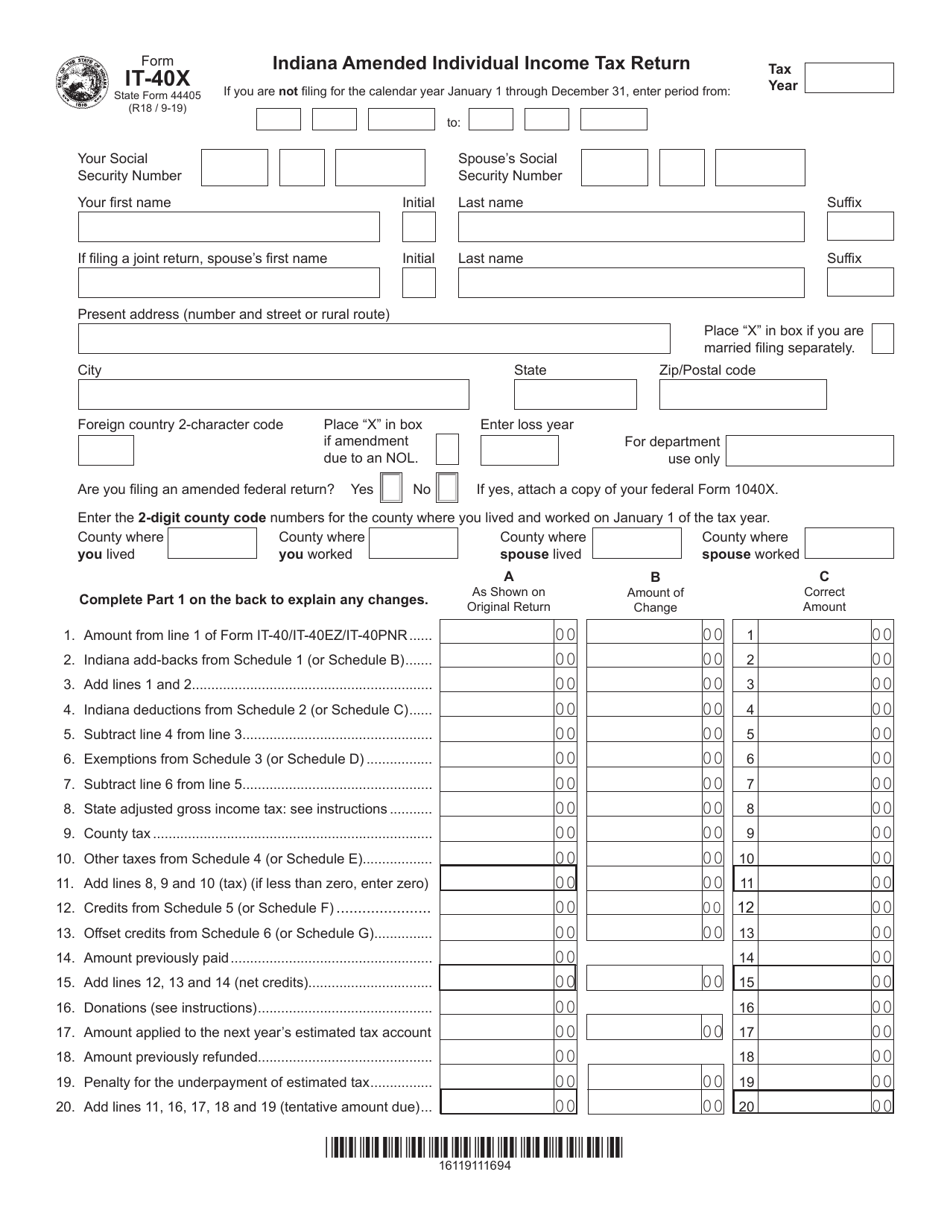

Form IT40X (State Form 44405) Download Fillable PDF or Fill Online

Web indiana current year tax forms. Refunds are issued in a matter of. Returns should be mailed to one of the following addresses: Web indiana has three different individual income tax returns. Read the following to find the right one for you to file.

Web Claim The $200 Atr Tax Credit On Your 2022 Indiana Income Tax Return.

Web individual income tax forms. Web indiana department of revenue. Returns should be mailed to one of the following addresses: Web indiana has three different individual income tax returns.

Taxformfinder Has An Additional 69 Indiana Income Tax Forms That You May Need, Plus All Federal Income.

Web indiana current year tax forms. You may qualify for free online tax. Web dor tax forms indiana state prior year tax forms 2019 individual income tax forms attention: Refunds are issued in a matter of.

The Easiest Way To Complete A Filing Is To File Your Individual Income Taxes Online.

Complete, edit or print tax forms instantly. Read the following to find the right one for you to file. Get ready for tax season deadlines by completing any required tax forms today. If filing for a fiscal year, enter the dates (see.

Are Available For Download At.

Find federal tax forms (e.g. Complete, edit or print tax forms instantly. Web file now with turbotax related indiana individual income tax forms: Forms downloaded and printed from this page may be used to file taxes unless otherwise specified.