Indiana State Withholding Tax Form

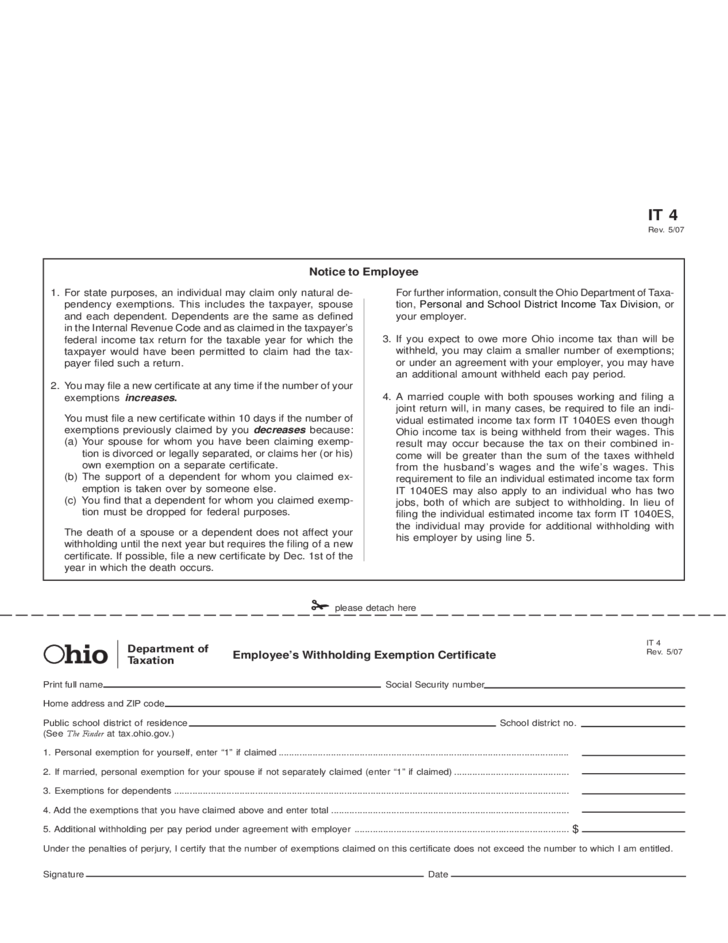

Indiana State Withholding Tax Form - Web beginning january 1, 2009 an annuitant can request the payor of an annuity or pension to withhold a portion of their pension or annuity to offset their county tax liability under ic 6. Annual nonresident military spouse earned income withholding tax exemption. Print or type your full name, social. Web how to register to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. If i am a software developer. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Print or type your full name, social. Web state of indiana employee’s withholding exemption and county status certificate.

Do not send this form to the department of revenue. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. If i am service provider. If i am a software developer. Quarterly payroll and excise tax returns normally due on may 1. Sign up & make payroll a breeze. Ditional amount, it should be submitted along with the regular state and county tax. Print or type your full name, social. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax.

Streamlined document workflows for any industry. It works similarly to a. If i am service provider. If i am a software developer. Do not send this form to the department of revenue. Web beginning january 1, 2009 an annuitant can request the payor of an annuity or pension to withhold a portion of their pension or annuity to offset their county tax liability under ic 6. Get the most out of your team with gusto’s global payroll and hr features. Web how to register to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Print or type your full name, social.

Delaware State Tax Withholding Form

Intime allows you to file and. Print or type your full name, social. Find forms for your industry in minutes. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. It works similarly to a.

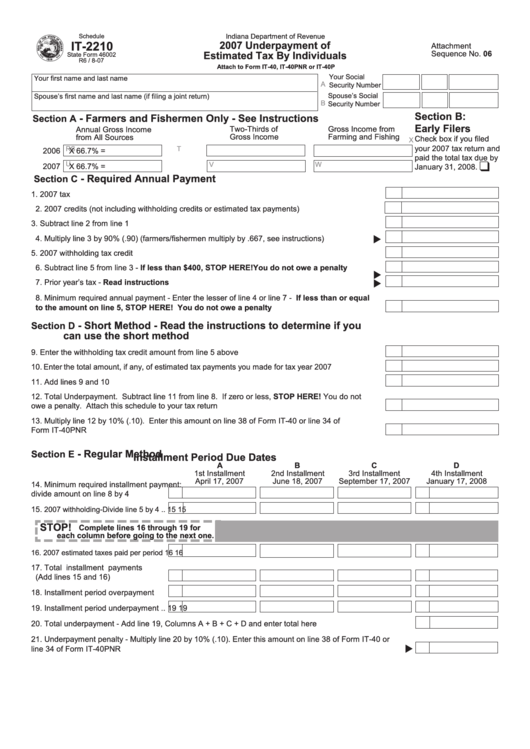

Form 46002 Indiana Department Of Revenue 2007 Underpayment Of

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Print or type your full name, social. Quarterly payroll and excise tax returns normally due on may 1. If i am service provider. Web beginning january 1, 2009 an annuitant can request the payor of an annuity or.

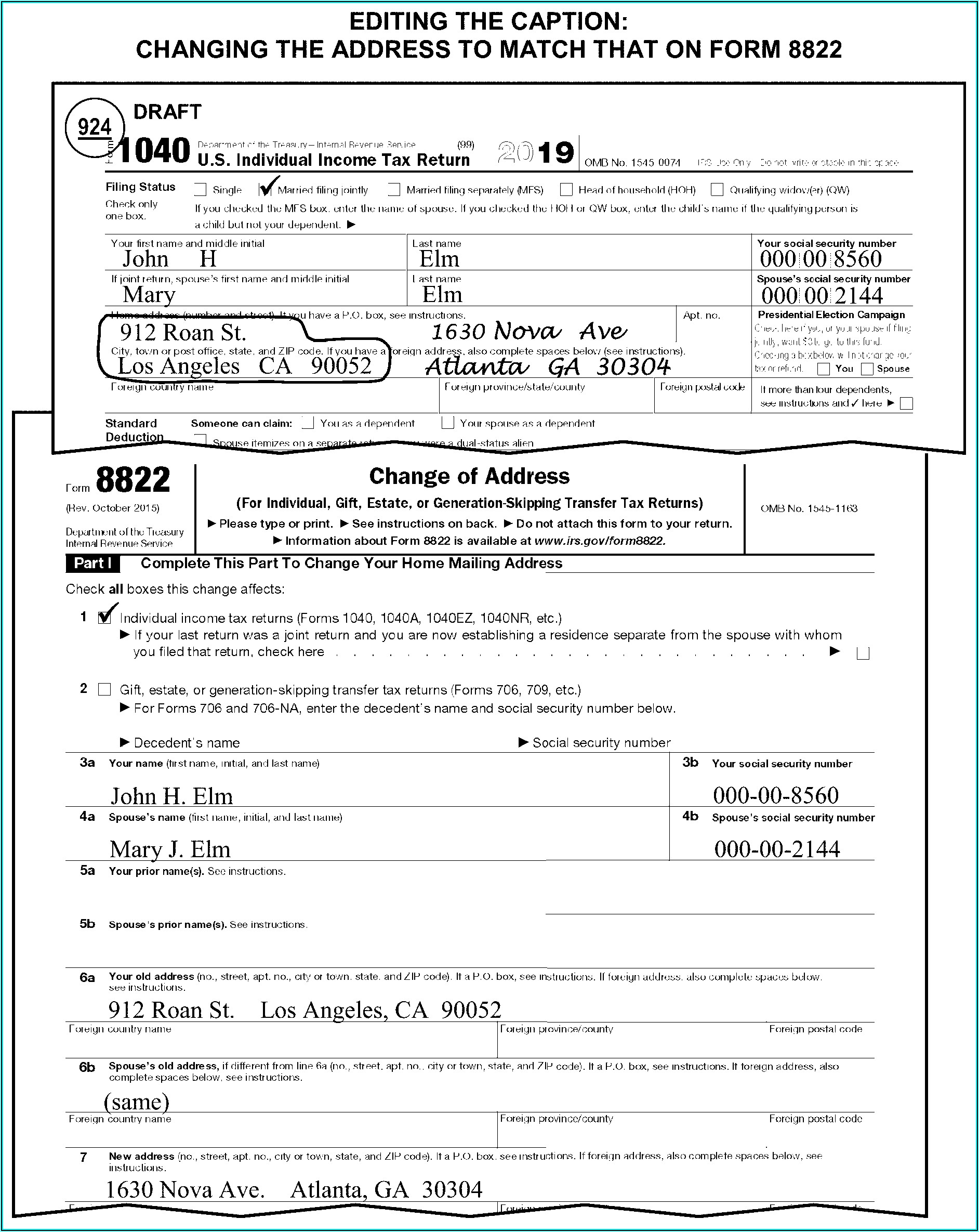

Calif State Tax Forms 2019 Form Resume Examples MW9pgrr2AJ

Print or type your full name, social. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Annual nonresident military spouse earned income withholding tax exemption..

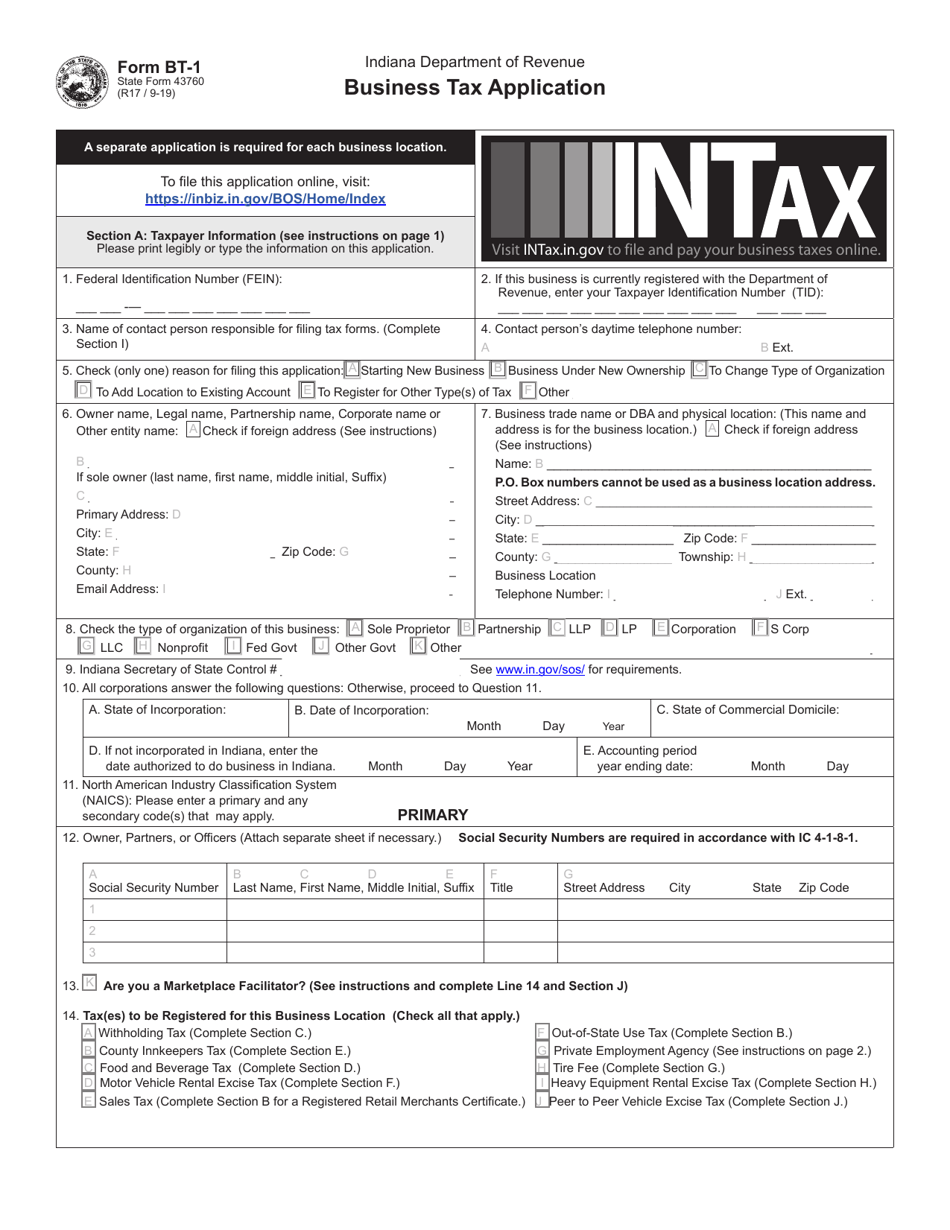

State Form 43760 (BT1) Download Fillable PDF or Fill Online Business

Web where do i go for tax forms? Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Do not send this form to the department of revenue. Streamlined document workflows for any industry. Web state of indiana employee’s withholding exemption and county status certificate.

Worksheet A State Tax Withholding 2022 Pdf Tripmart

Get the most out of your team with gusto’s global payroll and hr features. Find forms for your industry in minutes. Ditional amount, it should be submitted along with the regular state and county tax. Print or type your full name, social. Web where do i go for tax forms?

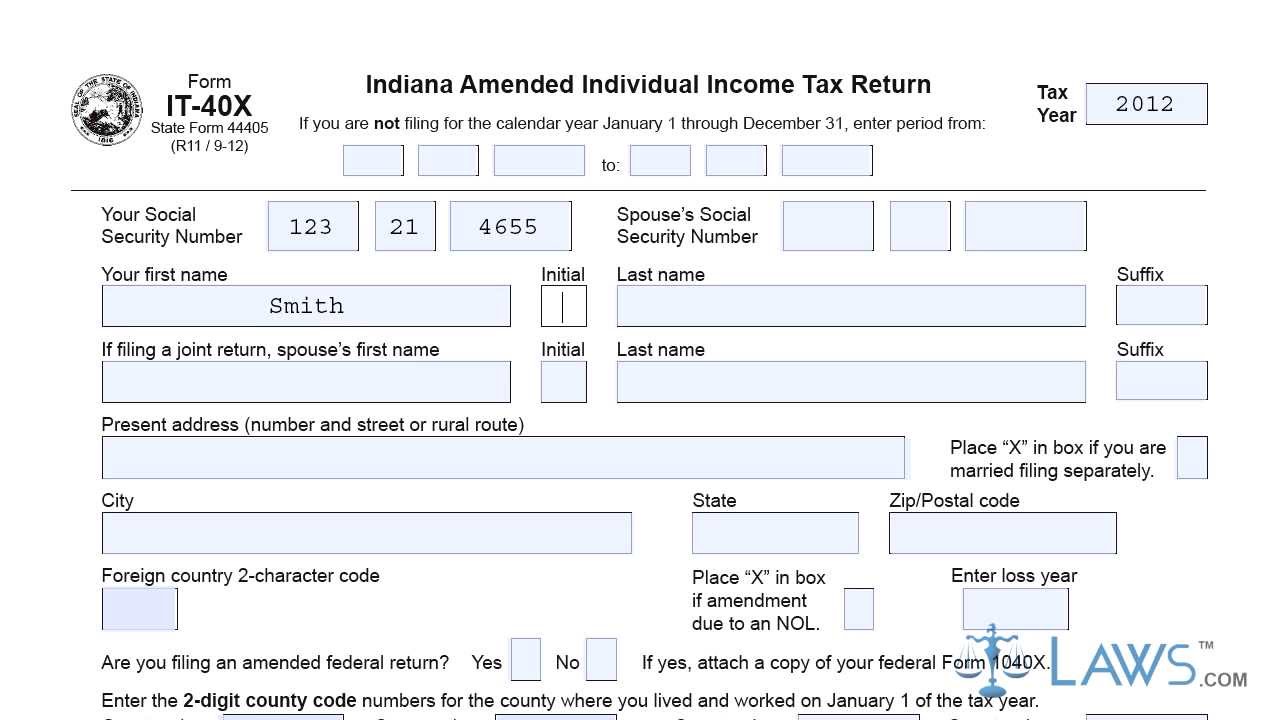

Form IT 40X Indiana Amended Individual Tax Return YouTube

Web state of indiana employee’s withholding exemption and county status certificate. Ad simply the best payroll service for small business. Print or type your full name, social. Intime allows you to file and. Find forms for your industry in minutes.

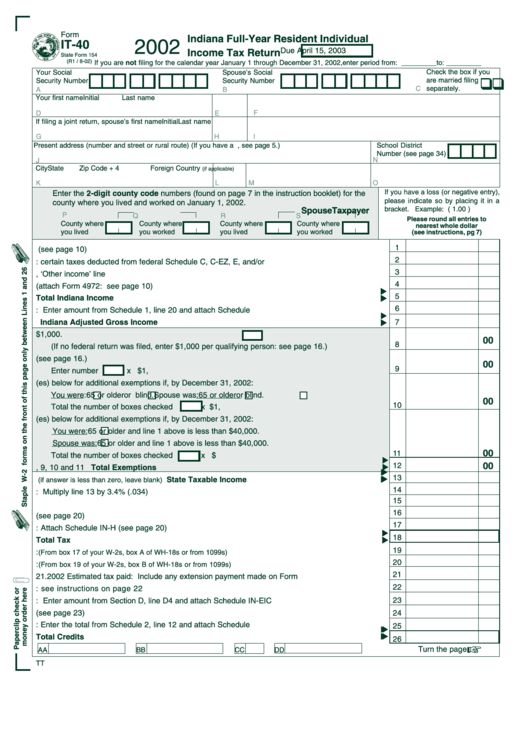

Form It40 Indiana FullYear Resident Individual Tax Return

Ad simply the best payroll service for small business. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. Web this form should be completed by all resident and nonresident.

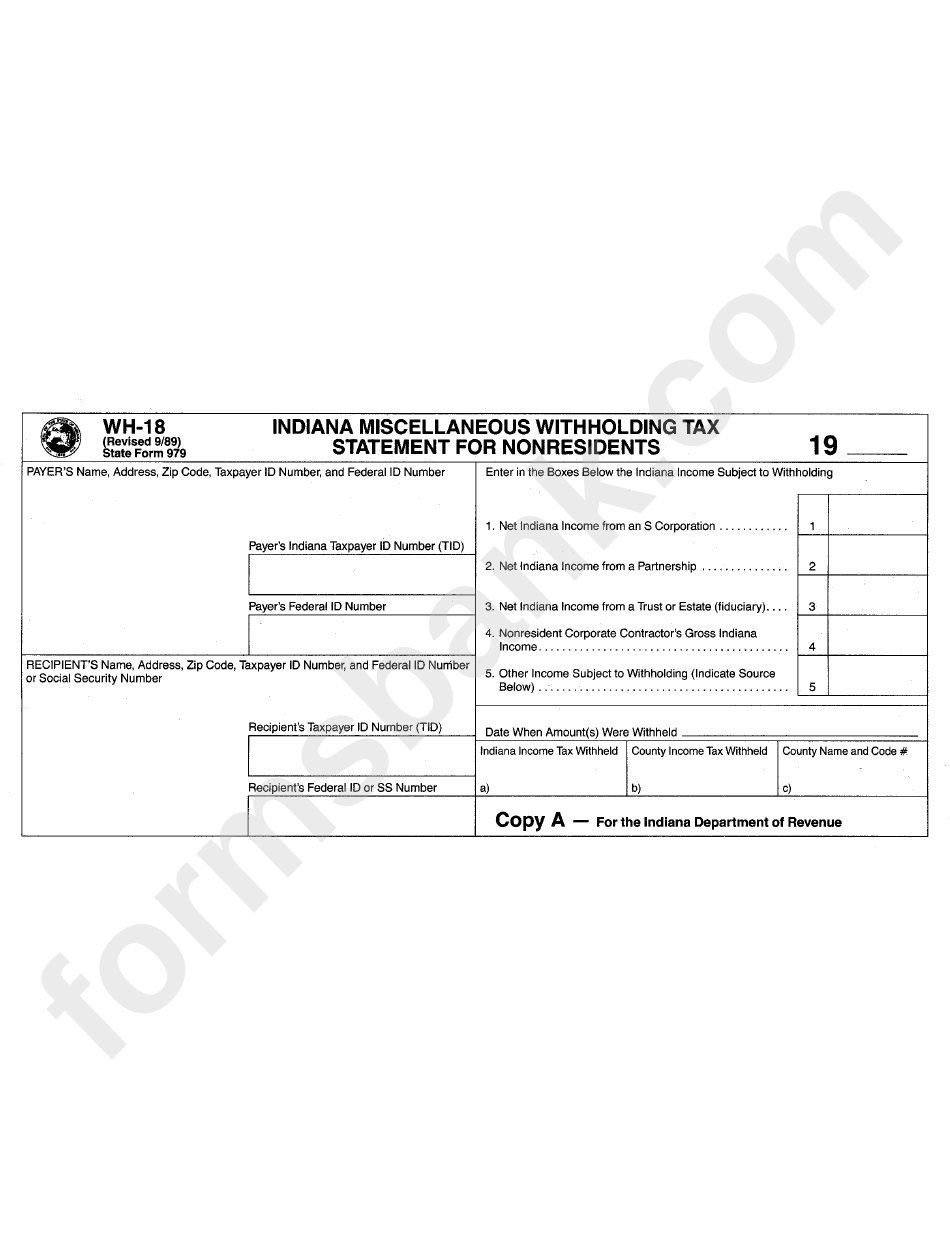

Fillable Form Wh18 Indiana Miscellaneous Withholding Tax Statement

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. Intime allows you to file and. Quarterly payroll and excise tax returns normally due on may 1. Print or type.

Spouse Is A Nonresident Alien Check The Single Box

Get the most out of your team with gusto’s global payroll and hr features. Do not send this form to the department of revenue. Intime allows you to file and. Web state of indiana employee’s withholding exemption and county status certificate. Quarterly payroll and excise tax returns normally due on may 1.

Web Beginning January 1, 2009 An Annuitant Can Request The Payor Of An Annuity Or Pension To Withhold A Portion Of Their Pension Or Annuity To Offset Their County Tax Liability Under Ic 6.

Ad simply the best payroll service for small business. Do not send this form to the department of revenue. Web employee's withholding exemption & county status certificate. Get the most out of your team with gusto’s global payroll and hr features.

It Works Similarly To A.

Web where do i go for tax forms? Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. Intime allows you to file and. Annual nonresident military spouse earned income withholding tax exemption.

Sign Up & Make Payroll A Breeze.

Web state of indiana employee’s withholding exemption and county status certificate. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. If i am service provider. Streamlined document workflows for any industry.

Print Or Type Your Full Name, Social.

If i am a software developer. Web how to register to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Ditional amount, it should be submitted along with the regular state and county tax. Quarterly payroll and excise tax returns normally due on may 1.