Instructions For Form 1116

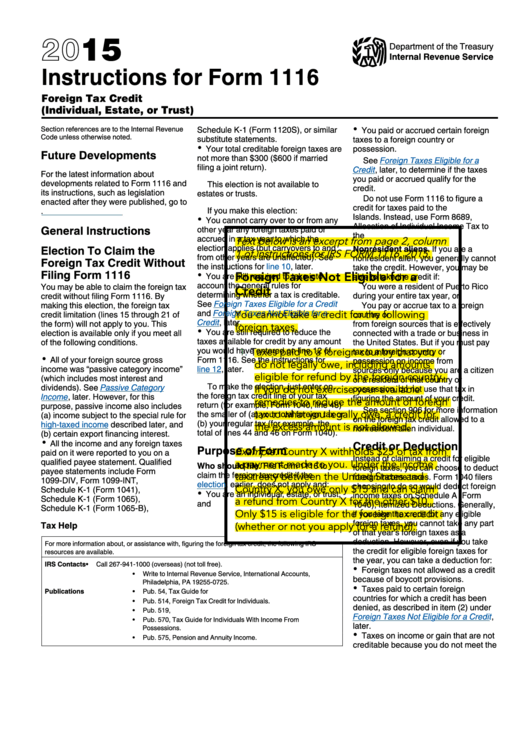

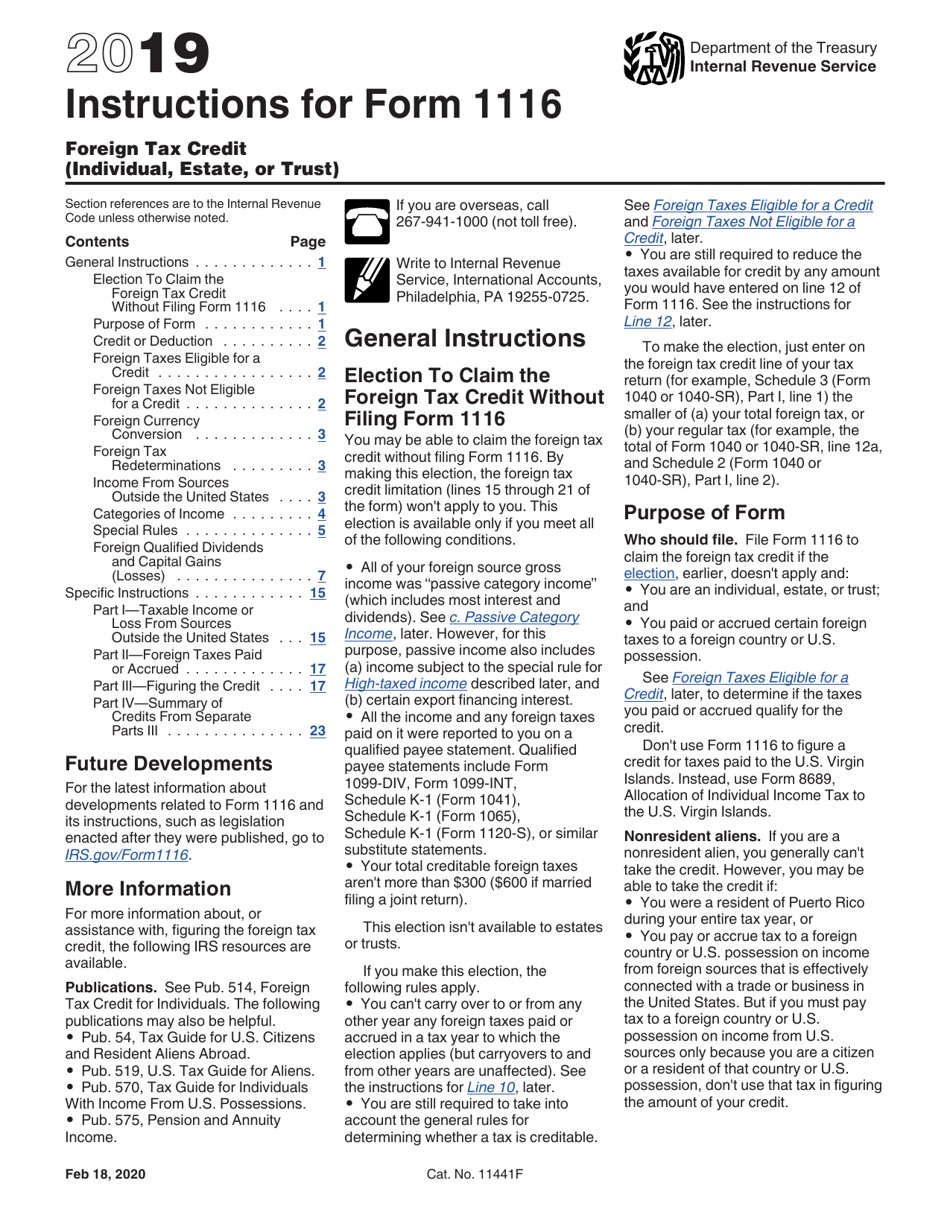

Instructions For Form 1116 - See the instructions for line without filing form 1116 • you are still required to take into 13. Web added for taxes reclassified under high instructions for line 10 later. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. Since the irs requires you to use a separate form 1116 for each income category, you must categorize your income so you can know. Line 4a found in the form 1116 instructions to calculate the amount on this line. In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive. When a us person individual earns foreign income abroad and pays foreign tax on that income, they may be able to claim a foreign. Taxpayers are therefore reporting running. Web on one form 1116, check box a (passive category income), enter the dividends on line 1a, and write dividends on the dotted line. Web election to claim the foreign tax credit without filing form 1116.

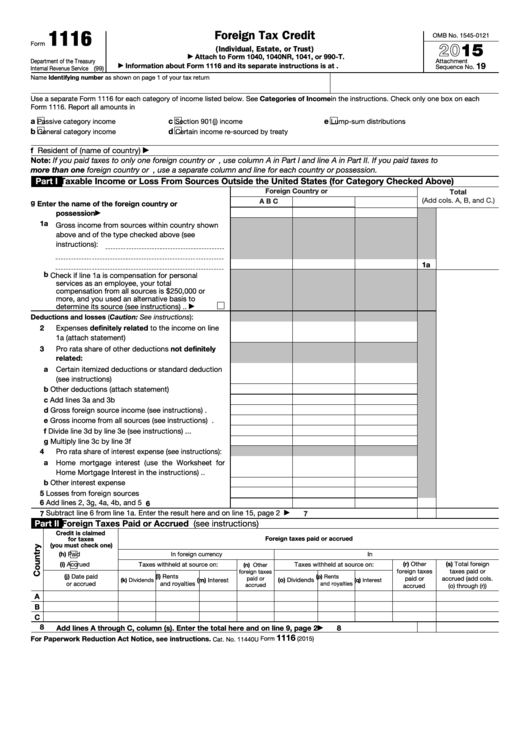

Web per irs instructions for form 1116, on page 16: Web election to claim the foreign tax credit without filing form 1116. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. Web form 1116 is used to claim the foreign tax credit to reduce your us income tax liability, dollar for dollar for income tax paid to a foreign country. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web the form 1116 instructions provide the mechanics of how the reclassification is done. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer. Election to claim the foreign tax credit without filing form 1116. Web on one form 1116, check box a (passive category income), enter the dividends on line 1a, and write dividends on the dotted line. Web on form 1116, there are seven categories of source income, and a separate form needs to be completed for each category and for each country within the category.

Web added for taxes reclassified under high instructions for line 10 later. Web on one form 1116, check box a (passive category income), enter the dividends on line 1a, and write dividends on the dotted line. Web the form 1116 instructions provide the mechanics of how the reclassification is done. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web election to claim the foreign tax credit without filing form 1116. In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive. Web form 1116 instructions for foreign tax credits: Web form 1116 is used to claim the foreign tax credit to reduce your us income tax liability, dollar for dollar for income tax paid to a foreign country. Since the irs requires you to use a separate form 1116 for each income category, you must categorize your income so you can know. Enter the gross income (not the tax) of this category type where indicated.

Tax form 1116 instructions

Foreign taxes eligible for a credit. Web per irs instructions for form 1116, on page 16: Web generating form 1116 foreign tax credit for an individual return; On the other form 1116, check box b (general. Web election to claim the foreign tax credit without filing form 1116.

Fill Free fillable Form 1116 2019 Foreign Tax Credit PDF form

Web on form 1116, there are seven categories of source income, and a separate form needs to be completed for each category and for each country within the category. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Web added for taxes reclassified under high instructions for line 10.

Fillable Form 1116 Foreign Tax Credit printable pdf download

In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive. Taxpayers are therefore reporting running. Election to claim the foreign tax credit without filing form 1116. Foreign taxes eligible for a credit. Web on one form 1116, check box a (passive category income), enter the dividends on line 1a, and write.

Form 1116Foreign Tax Credit

Web election to claim the foreign tax credit without filing form 1116. Web form 1116 instructions for foreign tax credits: In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive. On the other form 1116, check box b (general. Foreign taxes not eligible for a credit.

2015 Instructions For Form 1116 printable pdf download

Web the form 1116 instructions provide the mechanics of how the reclassification is done. Line 4a found in the form 1116 instructions to calculate the amount on this line. Foreign taxes eligible for a credit. For lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),. Web use form 1116 to.

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

Foreign taxes not eligible for a credit. Web generating form 1116 foreign tax credit for an individual return; Web on form 1116, there are seven categories of source income, and a separate form needs to be completed for each category and for each country within the category. Web election to claim the foreign tax credit without filing form 1116. For.

Fill Free fillable Form 1116 2019 Foreign Tax Credit PDF form

There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Foreign taxes not eligible for a credit. Since the irs requires you to use a separate form 1116 for each income category, you must categorize your income so you can know. Generally, if you take the described on. Web filing.

Form 1116 Instructions 2021 2022 IRS Forms Zrivo

Foreign taxes eligible for a credit. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. Election to claim the foreign tax credit without filing form 1116. In a nutshell, the high tax passive income on page one, line 1a is backed out.

Foreign Tax Credit Form 1116 Instructions

When a us person individual earns foreign income abroad and pays foreign tax on that income, they may be able to claim a foreign. Generally, if you take the described on. In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive. Web the form 1116 instructions provide the mechanics of how.

Are capital loss deductions included on Form 1116 for Deductions and

Foreign taxes eligible for a credit. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Enter the gross income (not the tax) of this category type where indicated. Web form 1116 instructions for foreign tax credits: Web on form 1116, there are seven categories of source income, and a.

Generally, If You Take The Described On.

See the instructions for line without filing form 1116 • you are still required to take into 13. Enter the gross income (not the tax) of this category type where indicated. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Web form 1116 is used to claim the foreign tax credit to reduce your us income tax liability, dollar for dollar for income tax paid to a foreign country.

Web Generating Form 1116 Foreign Tax Credit For An Individual Return;

Election to claim the foreign tax credit without filing form 1116. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer.

In A Nutshell, The High Tax Passive Income On Page One, Line 1A Is Backed Out Of The Passive.

Line 4a found in the form 1116 instructions to calculate the amount on this line. Foreign taxes not eligible for a credit. Taxpayers are therefore reporting running. Foreign taxes eligible for a credit.

On The Other Form 1116, Check Box B (General.

Web election to claim the foreign tax credit without filing form 1116. A credit for foreign taxes can be claimed only for foreign tax. Web per irs instructions for form 1116, on page 16: When a us person individual earns foreign income abroad and pays foreign tax on that income, they may be able to claim a foreign.