Instructions For Form 8233

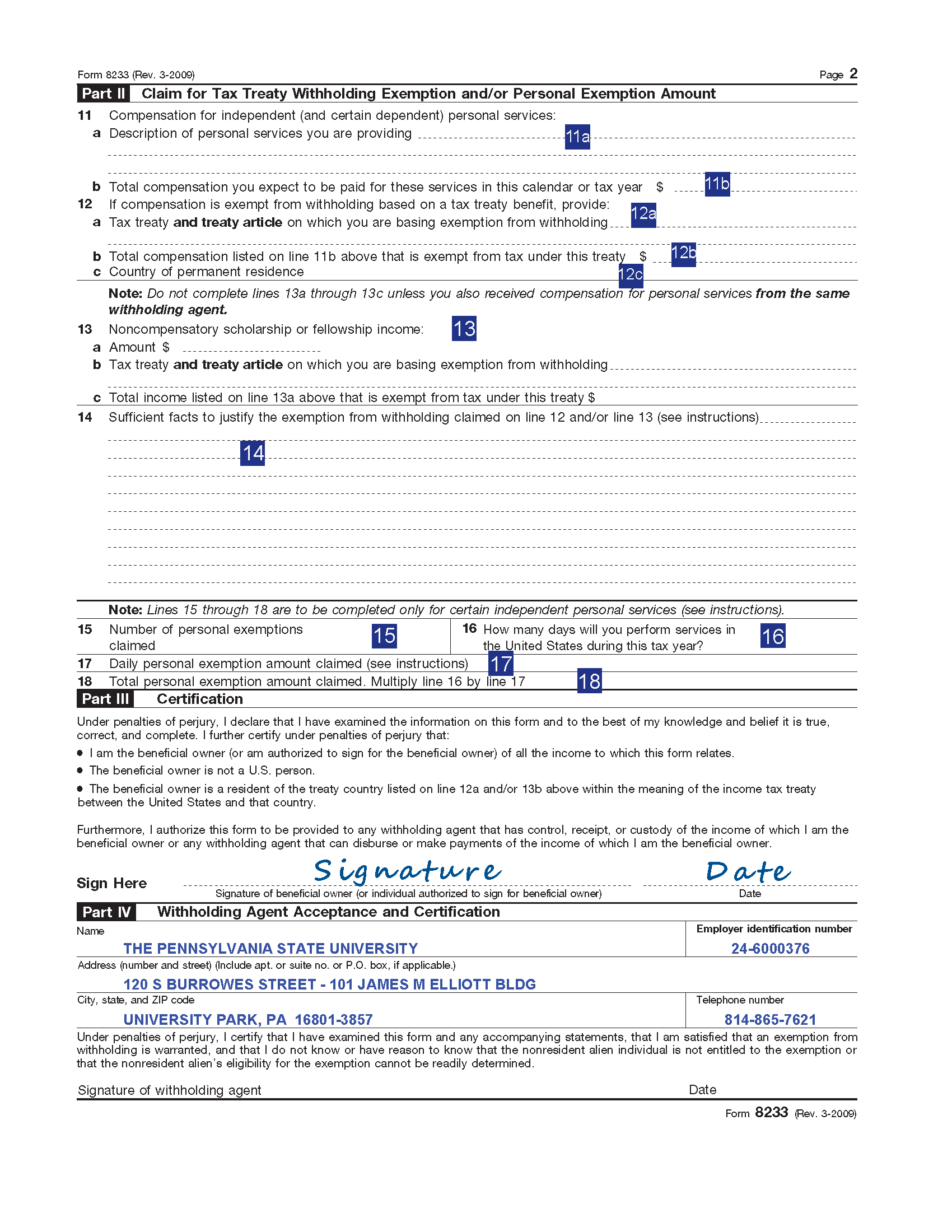

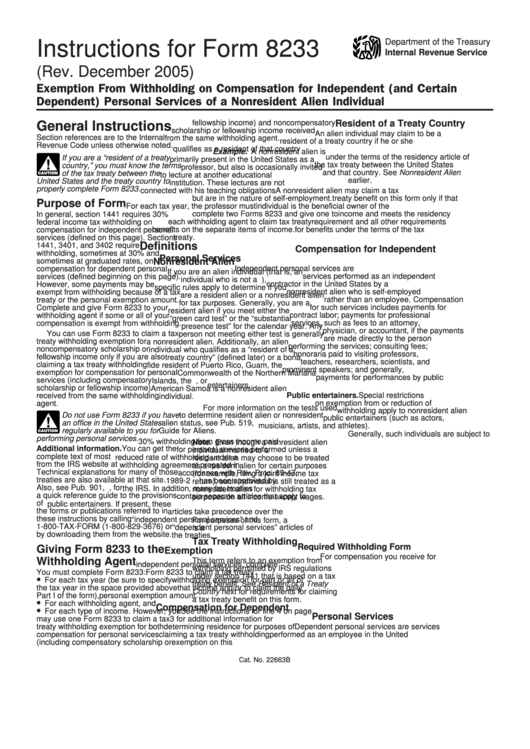

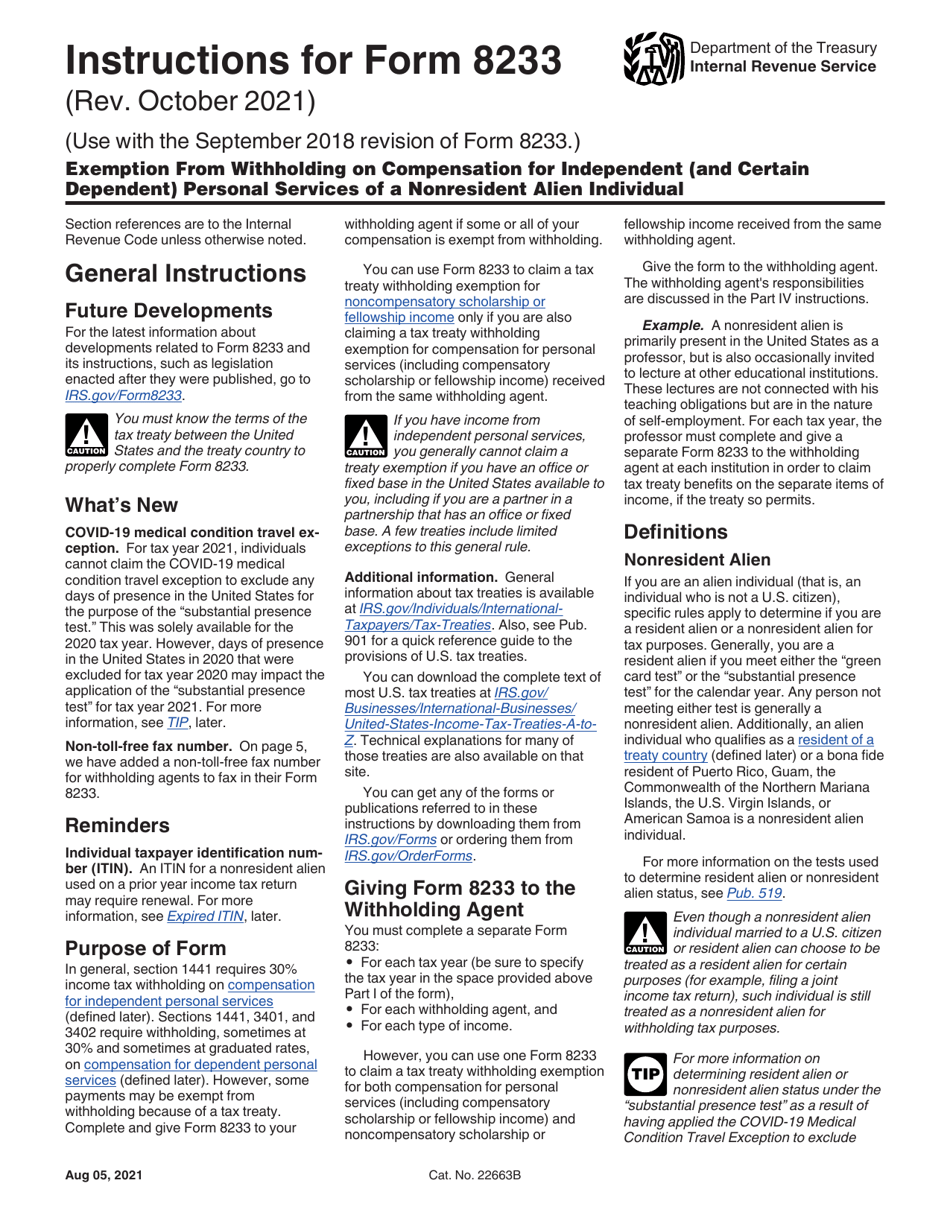

Instructions For Form 8233 - Instructions for form 8233, exemption from withholding on compensation for independent (and certain dependent) personal service of a. Web instructions for form 8233 (rev. Federal 8233 form attachments for teacher/researchers; If you are a beneficial owner who is. Web instructions for completing form 8233 & w4 to complete the 8233: Web this form is used by non resident alien individuals to claim exemption from withholding on compensation for personal services because of an income tax treaty or. June 2011) department of the treasury internal revenue service (use with the march 2009 revision of form 8233.) exemption from withholding. Web employers must review form 8233 and provide their information and signature in part iv—withholding agent acceptance and certification. Without a valid 8233 form on file, federal and state taxes will be withheld. Web the irs requires the exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien.

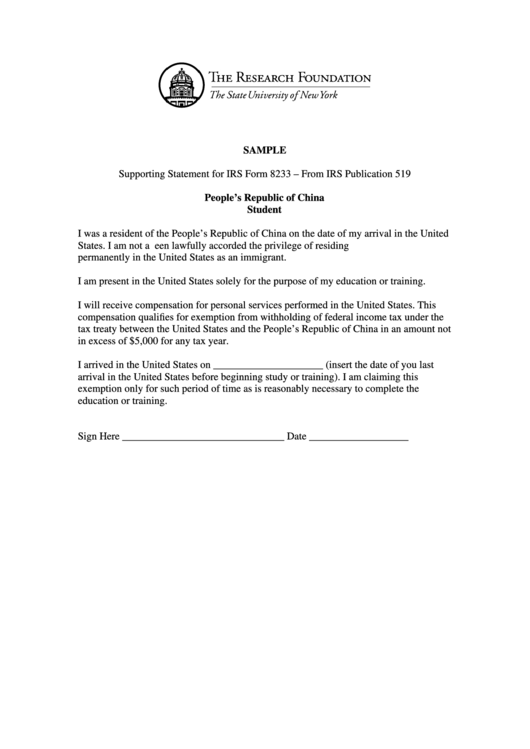

Enter the year to which the form applies. Web employers must review form 8233 and provide their information and signature in part iv—withholding agent acceptance and certification. Federal 8233 form attachments for students; Form 8233 is valid for one year only and must be completed each calendar year. June 2011) department of the treasury internal revenue service (use with the march 2009 revision of form 8233.) exemption from withholding. Must fill out a new form for each year you want to use a tax. If you do not have an ssn but are eligible to get one, you. Web instructions for form 8233 (rev. The form must be mailed or faxed. Web instructions for form 8233 (rev.

June 2011) department of the treasury internal revenue service (use with the march 2009 revision of form 8233.) exemption from withholding. Web you can use form 8233 to claim a taxtreaty withholding exemption for noncompensatory scholarship or fellowship income only if you are alsoclaiming a tax treaty. Web instructions for form 8233 (rev. Web instructions for completing form 8233 & w4 to complete the 8233: Without a valid 8233 form on file, federal and state taxes will be withheld. Web employers must review form 8233 and provide their information and signature in part iv—withholding agent acceptance and certification. If you do not have an ssn but are eligible to get one, you. Must fill out a new form for each year you want to use a tax. A new form 8233 must be completed and. Federal 8233 form attachments for teacher/researchers;

Fill Free fillable Form 8233 Exemption From Withholding on

Without a valid 8233 form on file, federal and state taxes will be withheld. Web instructions for form 8233 (rev. Web instructions for completing form 8233 *** important reminder *** form 8233 expires every year on december 31. Web employers must review form 8233 and provide their information and signature in part iv—withholding agent acceptance and certification. Web this form.

16 Form 8233 Templates free to download in PDF

Web instructions for completing form 8233 *** important reminder *** form 8233 expires every year on december 31. Web instructions for form 8233 (rev. October 1996) exemption from withhholding on compensation for independent (and certain dependent) personal services of a. For each tax year (be sure to specifythe tax year in the space provided abovepart i of the form), for.

W8BEN Form and Instructions Irs Tax Forms Withholding Tax

If you do not have an ssn but are eligible to get one, you. June 2011) department of the treasury internal revenue service (use with the march 2009 revision of form 8233.) exemption from withholding. If you are a beneficial owner who is. For each tax year (be sure to specifythe tax year in the space provided abovepart i of.

Financial Concept Meaning Form 8233 Exemption from Withholding on

Receiving compensation for dependent personal services performed in the united states and you. Without a valid 8233 form on file, federal and state taxes will be withheld. Enter the year to which the form applies. Instructions for form 8233, exemption from withholding on compensation for independent (and certain dependent) personal service of a. If you do not have an ssn.

Image of Name of Exemption from Withholding IRS 8233 Form Exhibit Page 2

Web instructions for completing form 8233 *** important reminder *** form 8233 expires every year on december 31. Must fill out a new form for each year you want to use a tax. Web federal 8233 form; Web this form is used by non resident alien individuals to claim exemption from withholding on compensation for personal services because of an.

Instructions For Form 8233 printable pdf download

Web you can use form 8233 to claim a taxtreaty withholding exemption for noncompensatory scholarship or fellowship income only if you are alsoclaiming a tax treaty. 22663b paperwork reduction act notice.— we ask for the information on this form to. Web federal 8233 form; Web instructions for completing form 8233 & w4 to complete the 8233: Enter the year to.

Download Instructions for IRS Form 8233 Exemption From Withholding on

Web federal 8233 form; Web this form is used by non resident alien individuals to claim exemption from withholding on compensation for personal services because of an income tax treaty or. Web instructions for completing form 8233 & w4 to complete the 8233: Must fill out a new form for each year you want to use a tax. Web the.

irs 8233 form Fill out & sign online DocHub

October 1996) exemption from withhholding on compensation for independent (and certain dependent) personal services of a. Web you must complete form 8233: The corporate payroll services is required to file a completed irs form 8233 and attachment with the internal revenue service each year for all foreign nationals claiming. Web federal 8233 form; If you do not have an ssn.

irs form 8233 printable pdf file enter the appropriate calendar year

The corporate payroll services is required to file a completed irs form 8233 and attachment with the internal revenue service each year for all foreign nationals claiming. Web this form is used by non resident alien individuals to claim exemption from withholding on compensation for personal services because of an income tax treaty or. Web department of the treasury internal.

8233 Form Instructions =LINK=

22663b paperwork reduction act notice.— we ask for the information on this form to. Web instructions for completing form 8233 & w4 to complete the 8233: Web instructions for completing form 8233 *** important reminder *** form 8233 expires every year on december 31. June 2011) department of the treasury internal revenue service (use with the march 2009 revision of.

Receiving Compensation For Dependent Personal Services Performed In The United States And You.

Web department of the treasury internal revenue service instructions for form 8233 cat. Web federal 8233 form; For each tax year (be sure to specifythe tax year in the space provided abovepart i of the form), for each withholding agent, and for each type. 22663b paperwork reduction act notice.— we ask for the information on this form to.

Web You Must Complete Form 8233:

Must fill out a new form for each year you want to use a tax. Web you can use form 8233 to claim a taxtreaty withholding exemption for noncompensatory scholarship or fellowship income only if you are alsoclaiming a tax treaty. If you do not have an ssn but are eligible to get one, you. October 1996) exemption from withhholding on compensation for independent (and certain dependent) personal services of a.

June 2011) Department Of The Treasury Internal Revenue Service (Use With The March 2009 Revision Of Form 8233.) Exemption From Withholding.

Web instructions for completing form 8233 & w4 to complete the 8233: Without a valid 8233 form on file, federal and state taxes will be withheld. Web instructions for form 8233 (rev. Web this form is used by non resident alien individuals to claim exemption from withholding on compensation for personal services because of an income tax treaty or.

Web Instructions For Completing Form 8233 *** Important Reminder *** Form 8233 Expires Every Year On December 31.

Enter the year to which the form applies. Federal 8233 form attachments for teacher/researchers; Federal 8233 form attachments for students; The corporate payroll services is required to file a completed irs form 8233 and attachment with the internal revenue service each year for all foreign nationals claiming.