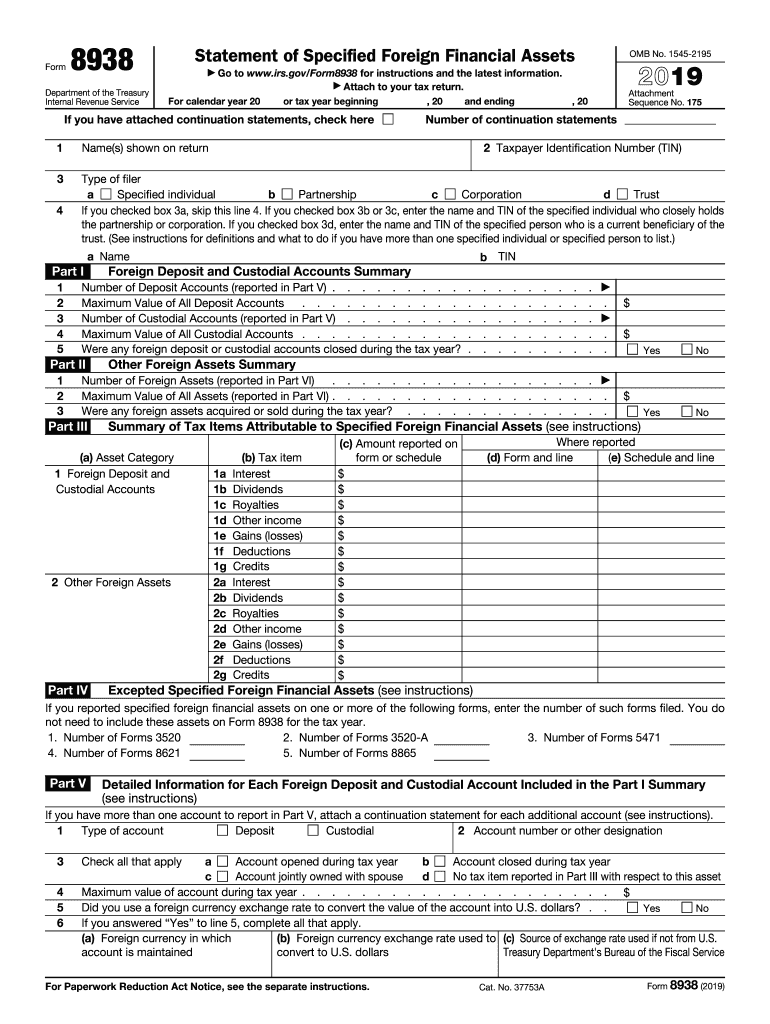

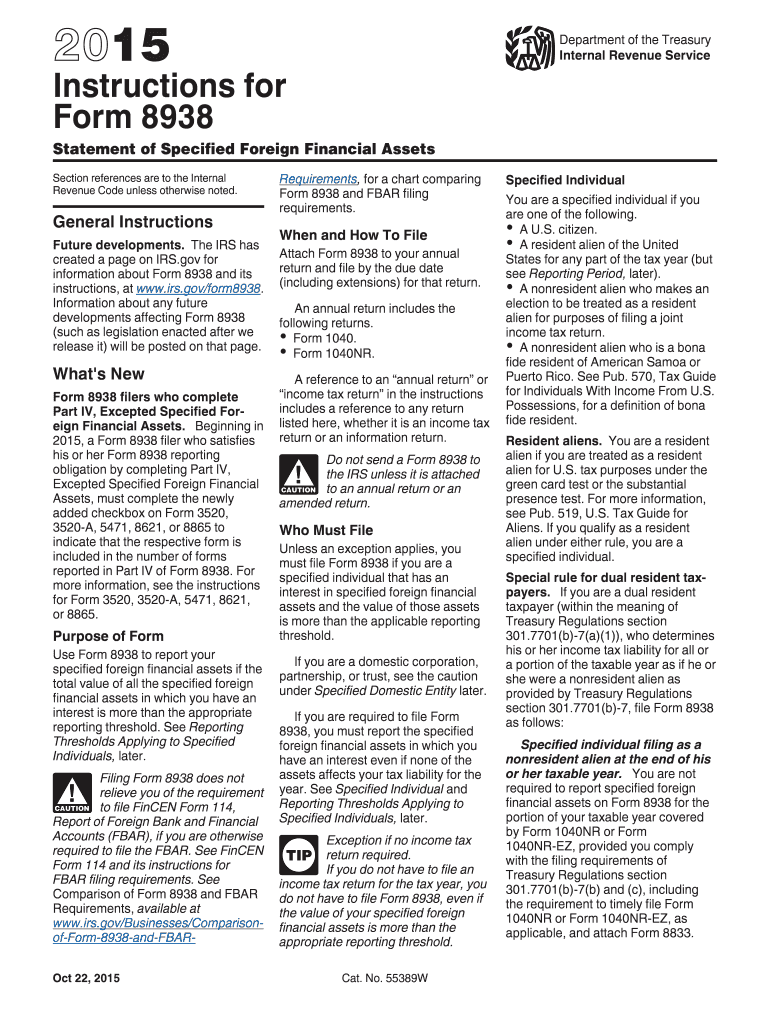

Instructions For Form 8938

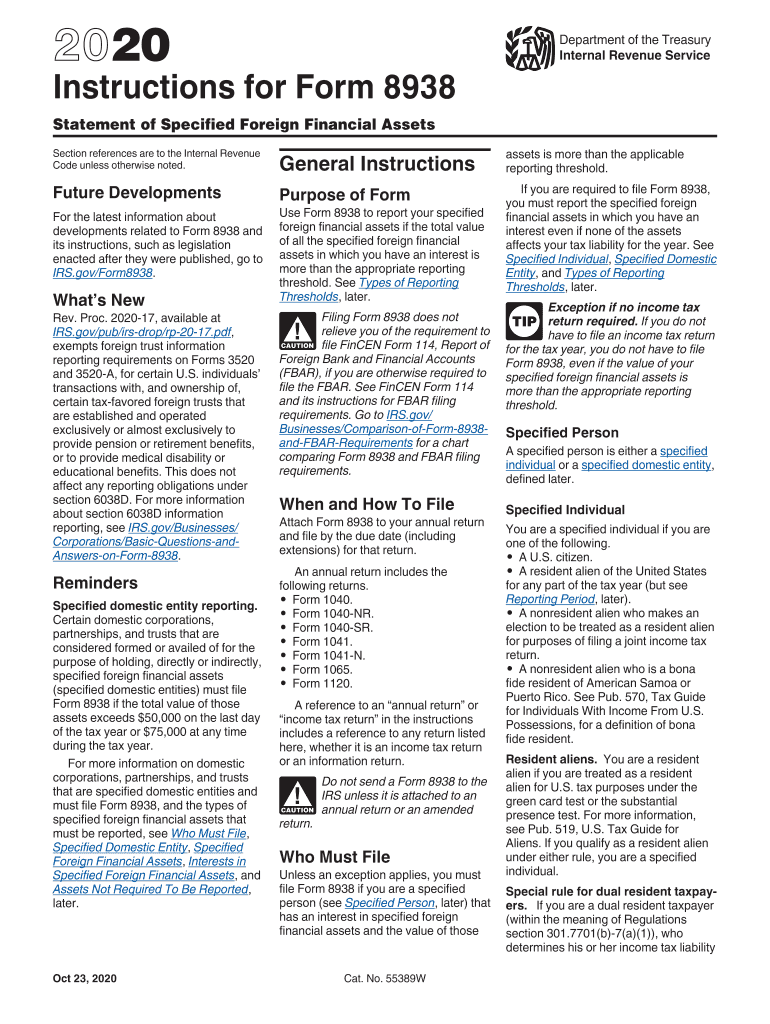

Instructions For Form 8938 - Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. See the irs instructions for form 8938 and basic questions and answers on form 8938 for more information. To get to the 8938 section in turbotax, refer to the following instructions: Solved • by intuit • 7 • updated july 13, 2022. When living and working abroad, it’s common for americans to acquire different types of foreign financial assets — having a foreign pension plan or shares of a foreign company. Web officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad. Web general information about form 8938, statement of specified foreign financial assets. Open or continue your return if you're not already in it; Examples of financial accounts include: Web filing form 8938 is only available to those using turbotax deluxe or higher.

Web if you are required to file form 8938, you must report your financial accounts maintained by a foreign financial institution. Web each year, the us government requires us taxpayers who own foreign assets, investments and accounts to disclose this information on internal revenue service form 8938 — in addition to filing a us tax return — to comply with fatca. In recent years, the irs has increased offshore enforcement of foreign accounts compliance, including assets. When living and working abroad, it’s common for americans to acquire different types of foreign financial assets — having a foreign pension plan or shares of a foreign company. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Solved • by intuit • 7 • updated july 13, 2022. Web the fbar, form 8938, form 3520, form 5471, form 8621—these are all information reporting forms used to report various types of foreign assets to different bureaus within the u.s. The form 8938 instructions are complex. See the irs instructions for form 8938 and basic questions and answers on form 8938 for more information. Examples of financial accounts include:

To get to the 8938 section in turbotax, refer to the following instructions: Web each year, the us government requires us taxpayers who own foreign assets, investments and accounts to disclose this information on internal revenue service form 8938 — in addition to filing a us tax return — to comply with fatca. Search for 8938 and select the jump to link at the top of the search results Web filing form 8938 is only available to those using turbotax deluxe or higher. In recent years, the irs has increased offshore enforcement of foreign accounts compliance, including assets. Web general information about form 8938, statement of specified foreign financial assets. Web if you are required to file form 8938, you must report your financial accounts maintained by a foreign financial institution. Below, you'll find general information about form 8938 and instructions on accessing the form in proseries professional and proseries basic. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. See types of reporting thresholds, later.

Foreign Financial Asset Reporting Guidance Matrix Form 8938 and/or FBAR

Below, you'll find general information about form 8938 and instructions on accessing the form in proseries professional and proseries basic. When living and working abroad, it’s common for americans to acquire different types of foreign financial assets — having a foreign pension plan or shares of a foreign company. Web the fbar, form 8938, form 3520, form 5471, form 8621—these.

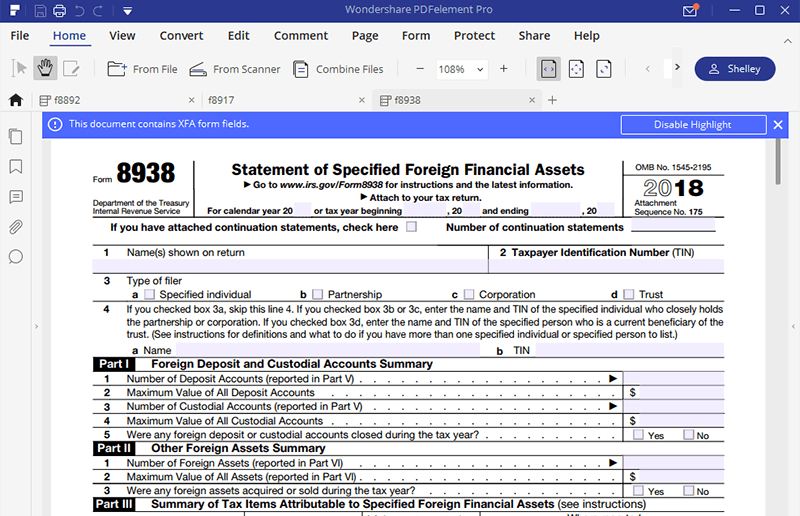

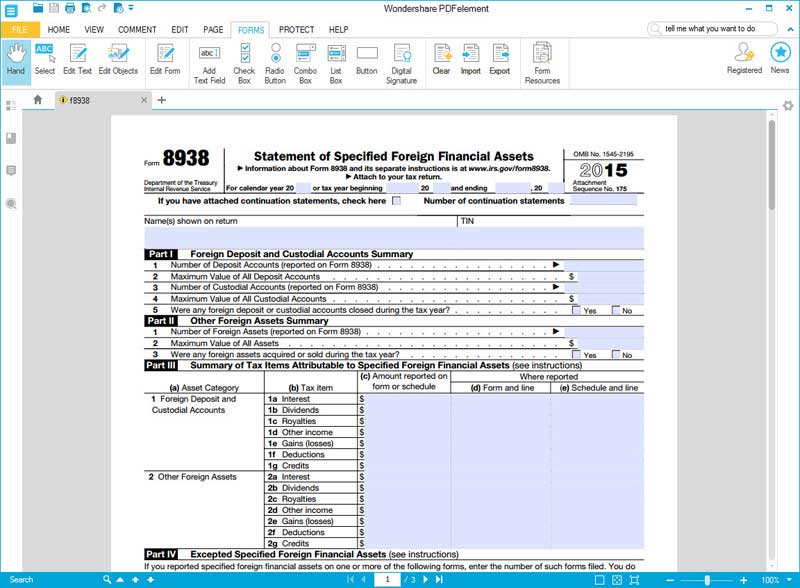

IRS Instructions 8938 2018 2019 Fillable and Editable PDF Template

Taxpayers to report specified foreign financial assets each year on a form 8938. See types of reporting thresholds, later. Web general information about form 8938, statement of specified foreign financial assets. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is.

Form 8938 Meadows Urquhart Acree and Cook, LLP

Taxpayers to report specified foreign financial assets each year on a form 8938. Web the fbar, form 8938, form 3520, form 5471, form 8621—these are all information reporting forms used to report various types of foreign assets to different bureaus within the u.s. The form 8938 instructions are complex. Open or continue your return if you're not already in it;.

Form 8938 Statement of Specified Foreign Financial Assets 2018 DocHub

Department of the treasury, such as the internal revenue service (the irs) or the financial crimes enforcement network (fincen). Web if you are required to file form 8938, you must report your financial accounts maintained by a foreign financial institution. To get to the 8938 section in turbotax, refer to the following instructions: Web the fbar, form 8938, form 3520,.

USCs and LPRs Who Are Having Their NonU.S. Accounts Closed Is it hype

Web general information about form 8938, statement of specified foreign financial assets. Web the fbar, form 8938, form 3520, form 5471, form 8621—these are all information reporting forms used to report various types of foreign assets to different bureaus within the u.s. Web each year, the us government requires us taxpayers who own foreign assets, investments and accounts to disclose.

Form 54087 Edit, Fill, Sign Online Handypdf

Web filing form 8938 is only available to those using turbotax deluxe or higher. Below, you'll find general information about form 8938 and instructions on accessing the form in proseries professional and proseries basic. Solved • by intuit • 7 • updated july 13, 2022. The form 8938 instructions are complex. To get to the 8938 section in turbotax, refer.

Ir's 8938 Instructions Form Fill Out and Sign Printable PDF Template

Department of the treasury, such as the internal revenue service (the irs) or the financial crimes enforcement network (fincen). Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Below, you'll find general information about.

IRS Form 8938 How to Fill it with the Best Form Filler

Solved • by intuit • 7 • updated july 13, 2022. Web general information about form 8938, statement of specified foreign financial assets. Department of the treasury, such as the internal revenue service (the irs) or the financial crimes enforcement network (fincen). See the irs instructions for form 8938 and basic questions and answers on form 8938 for more information..

IRS Form 8938 How to Fill it with the Best Form Filler

Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. When most people think of. See the irs instructions for form 8938 and basic questions and answers on form 8938 for more information. Department of.

2020 8938 Instructions Form Fill Out and Sign Printable PDF Template

Below, you'll find general information about form 8938 and instructions on accessing the form in proseries professional and proseries basic. Taxpayers to report specified foreign financial assets each year on a form 8938. Examples of financial accounts include: See types of reporting thresholds, later. Web use form 8938 to report your specified foreign financial assets if the total value of.

To Get To The 8938 Section In Turbotax, Refer To The Following Instructions:

Web filing form 8938 is only available to those using turbotax deluxe or higher. When most people think of. Web general information about form 8938, statement of specified foreign financial assets. Web the fbar, form 8938, form 3520, form 5471, form 8621—these are all information reporting forms used to report various types of foreign assets to different bureaus within the u.s.

See The Irs Instructions For Form 8938 And Basic Questions And Answers On Form 8938 For More Information.

Web each year, the us government requires us taxpayers who own foreign assets, investments and accounts to disclose this information on internal revenue service form 8938 — in addition to filing a us tax return — to comply with fatca. Department of the treasury, such as the internal revenue service (the irs) or the financial crimes enforcement network (fincen). Web if you are required to file form 8938, you must report your financial accounts maintained by a foreign financial institution. Below, you'll find general information about form 8938 and instructions on accessing the form in proseries professional and proseries basic.

In Recent Years, The Irs Has Increased Offshore Enforcement Of Foreign Accounts Compliance, Including Assets.

Web officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad. Examples of financial accounts include: Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Search for 8938 and select the jump to link at the top of the search results

When Living And Working Abroad, It’s Common For Americans To Acquire Different Types Of Foreign Financial Assets — Having A Foreign Pension Plan Or Shares Of A Foreign Company.

Solved • by intuit • 7 • updated july 13, 2022. Open or continue your return if you're not already in it; Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. See types of reporting thresholds, later.