Instructions Form 8615

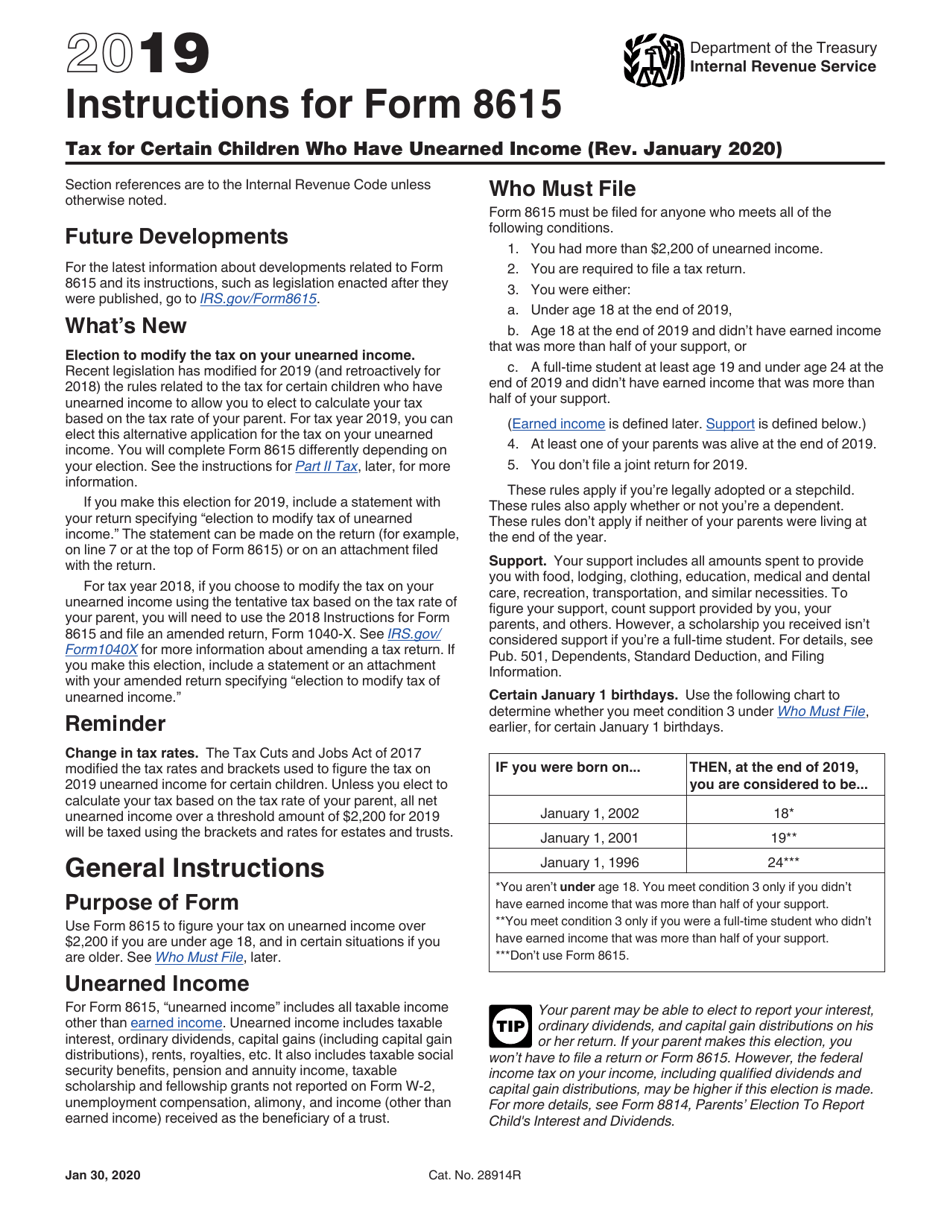

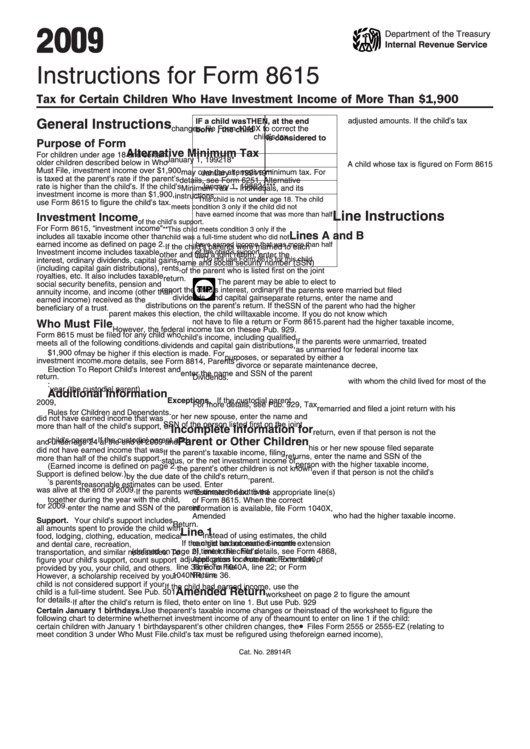

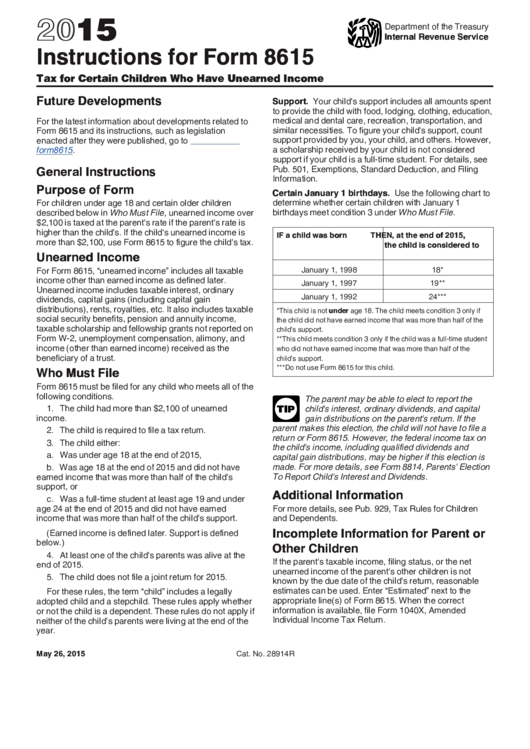

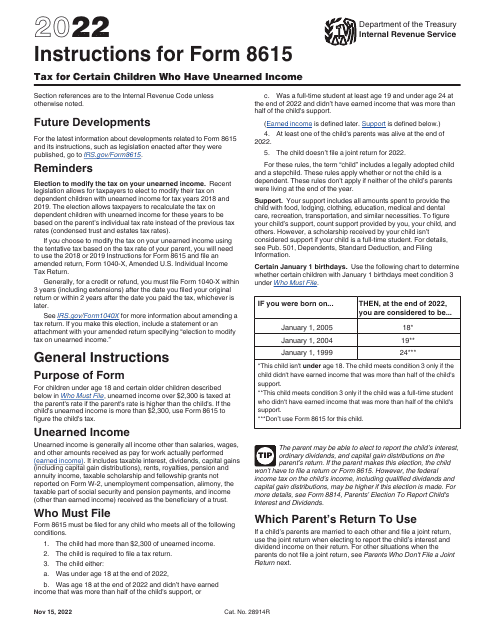

Instructions Form 8615 - Complete, edit or print tax forms instantly. If applicable, include this amount on your form 1040, line. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web for children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's rate is higher. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations if you are older. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Register and subscribe now to work on your irs form 8615 & more fillable forms. You had more than $2,300 of unearned income.

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. The service delivery logs are available for the documentation of a service event for individualized skills and socialization. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. You are required to file a tax return. If applicable, include this amount on your form 1040, line. Web enter the parent’s tax from form 1040, line 44; Web form 8615, tax for certain children who have unearned income. Register and subscribe now to work on your irs form 8615 & more fillable forms. Web for children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's rate is higher.

Web for children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's rate is higher. Web for the latest information about developments related to form 8615 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8615. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web march 14, 2023. If applicable, include this amount on your form 1040, line. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Register and subscribe now to work on your irs form 8615 & more fillable forms. Complete, edit or print tax forms instantly. Web enter the parent’s tax from form 1040, line 44; Form 1040a, line 28, minus any alternative minimum tax;

Instructions For Form 8615 Tax For Certain Children Who Have

Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations if you are older. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations.

Form 8615 Tax Pro Community

Web for children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's rate is higher. Web form 8615, tax for certain children who have unearned income. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over.

Instructions For Form 8615 Tax For Children Under Age 18 With

Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations if you are older. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web for the latest information about developments related to form 8615.

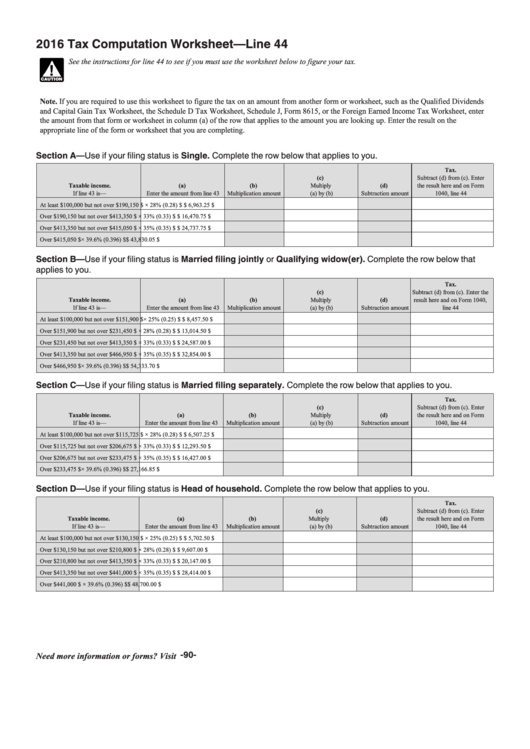

Tax Computation Worksheet Line 44 2016 printable pdf download

Web for the latest information about developments related to form 8615 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8615. Form 1040a, line 28, minus any alternative minimum tax; You had more than $2,300 of unearned income. You are required to file a tax return. Web general instructions purpose of form use form 8615 to.

Form 568 instructions 2012

Web form 8615, tax for certain children who have unearned income. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web form 8615 must be filed with the child’s tax return if all of the following apply:.

Instructions For Form 8615 Tax For Certain Children Who Have

Form 1040a, line 28, minus any alternative minimum tax; Web form 8615, tax for certain children who have unearned income. You had more than $2,300 of unearned income. If applicable, include this amount on your form 1040, line. Web for children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed.

Form 8615 Instructions (2015) printable pdf download

Web for children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's rate is higher. Web enter the parent’s tax from form 1040, line 44; Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations.

IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]

Web form 8615, tax for certain children who have unearned income. Web enter the parent’s tax from form 1040, line 44; Register and subscribe now to work on your irs form 8615 & more fillable forms. Web march 14, 2023. You are required to file a tax return.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Web for children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's rate is higher. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations.

Web General Instructions Purpose Of Form Use Form 8615 To Figure Your Tax On Unearned Income Over $2,200 If You Are Under Age 18, And In Certain Situations If You Are Older.

Web march 14, 2023. Web form 8615 must be filed with the child’s tax return if all of the following apply: If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. If applicable, include this amount on your form 1040, line.

Web General Instructions Purpose Of Form Use Form 8615 To Figure Your Tax On Unearned Income Over $2,200 If You Are Under Age 18, And In Certain Situations If You Are Older.

Web for children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's rate is higher. Register and subscribe now to work on your irs form 8615 & more fillable forms. You had more than $2,300 of unearned income. Form 1040a, line 28, minus any alternative minimum tax;

Complete, Edit Or Print Tax Forms Instantly.

Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. When using form 8615 in proseries, you should enter the child as the taxpayer on the. You are required to file a tax return. Web enter the parent’s tax from form 1040, line 44;

Web General Instructions Purpose Of Form Use Form 8615 To Figure Your Tax On Unearned Income Over $2,100 If You Are Under Age 18, And In Certain Situations If You Are Older.

Web form 8615, tax for certain children who have unearned income. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income a attach only to the child’s form 1040 or form. The service delivery logs are available for the documentation of a service event for individualized skills and socialization. Web for the latest information about developments related to form 8615 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8615.

![IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]](https://help.taxreliefcenter.org/wp-content/uploads/2018/04/9465-usa-federal-tax-form-form-9465-instructions-ss.jpg)