Iowa State Income Tax Form

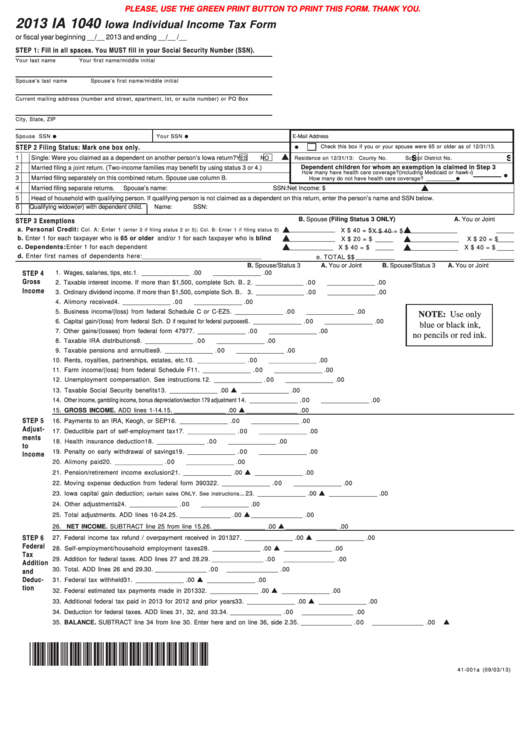

Iowa State Income Tax Form - Web the state of iowa 2022 tax return deadline is may 1, 2023. Related iowa individual income tax forms: Taxformfinder has an additional 43 iowa income tax forms that you may need, plus all. Download or email ia 1040 & more fillable forms, register and subscribe now! In iowa you will use form ia1040 to file your state tax return. If more than $1,500, complete sch. This form is for income earned in tax year 2022, with tax. Beginning in tax year 2026, iowa will have a flat individual income tax rate of 3.9%. Complete, edit or print tax forms instantly. If more than $1,500, complete sch.

Web country of origin: If more than $1,500, complete sch. Than one state return, you must file a. Web start with filing an income tax return under i am. Income tax forms for 2022. Web 1 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income tax return in april. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. The steps listed below correspond to the 2022 ia 1040 iowa individual income tax. Related iowa individual income tax forms: Taxformfinder has an additional 43 iowa income tax forms that you may need, plus all.

Web the iowa state income tax return is due on april 30th of the following year, which allows you and extra 15 days more than most states. Taxformfinder has an additional 43 iowa income tax forms that you may need, plus all. Download or email ia 1040 & more fillable forms, register and subscribe now! Web start with filing an income tax return under i am. Web instructions iowa state income tax forms for current and previous tax years. Web 1 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income tax return in april. Web file now with turbotax we last updated iowa form ia 1040 in february 2023 from the iowa department of revenue. For most individual taxpayers, this page contains all the information you need, including links to forms,. Guidance on iowa tax return. Web note that this form will fill in some information automatically and do all the calculations for you.

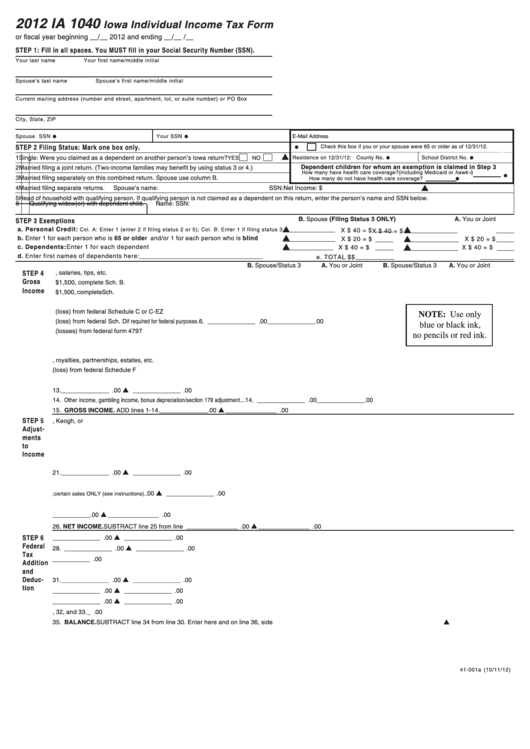

Form Ia 1040 Iowa Individual Tax 2012 printable pdf download

If more than $1,500, complete sch. Web the iowa state income tax return is due on april 30th of the following year, which allows you and extra 15 days more than most states. Web file now with turbotax we last updated iowa form ia 1040 in february 2023 from the iowa department of revenue. Income tax forms for 2022. Web.

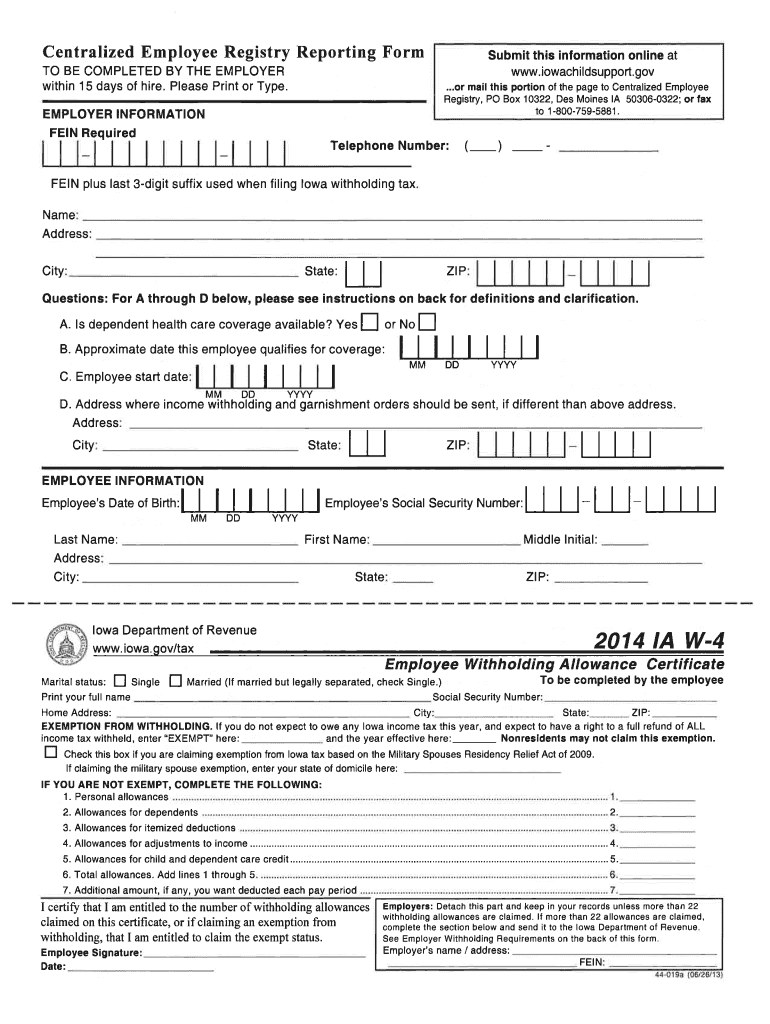

Ms State Tax Form 2022 W4 Form

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. The steps listed below correspond to the 2022 ia 1040 iowa individual income tax. Web start with filing an income tax return under i am. Beginning in tax.

Iowa W 4 2021 Printable 2022 W4 Form

Guidance on iowa tax return. Web start with filing an income tax return under i am. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Download or email ia 1040 & more fillable forms, register and subscribe now!

25 Pros And Cons Of Living In Iowa (Updated 2023)

If more than $1,500, complete sch. Beginning in tax year 2026, iowa will have a flat individual income tax rate of 3.9%. Web 1 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income tax return in april. Many of the forms are fillable, adobe.

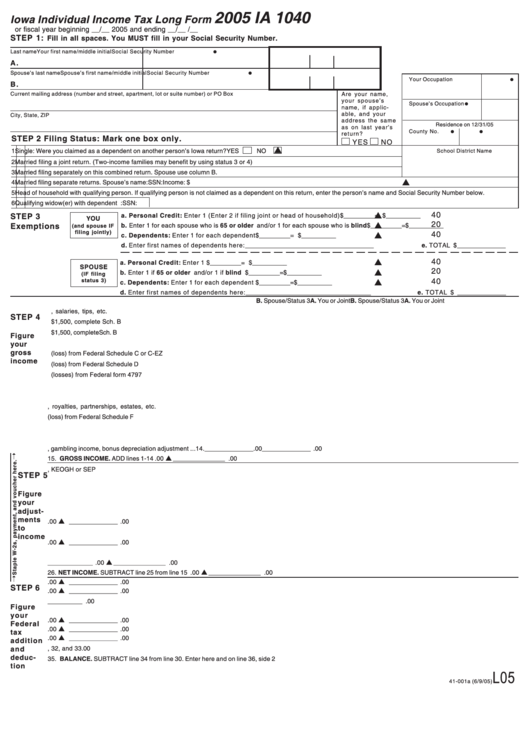

Fillable Form Ia 1040 Iowa Individual Tax Long Form 2005

Related iowa individual income tax forms: Download or email ia 1040 & more fillable forms, register and subscribe now! Web 1 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income tax return in april. Tax forms and regulations vary from state to state. Web.

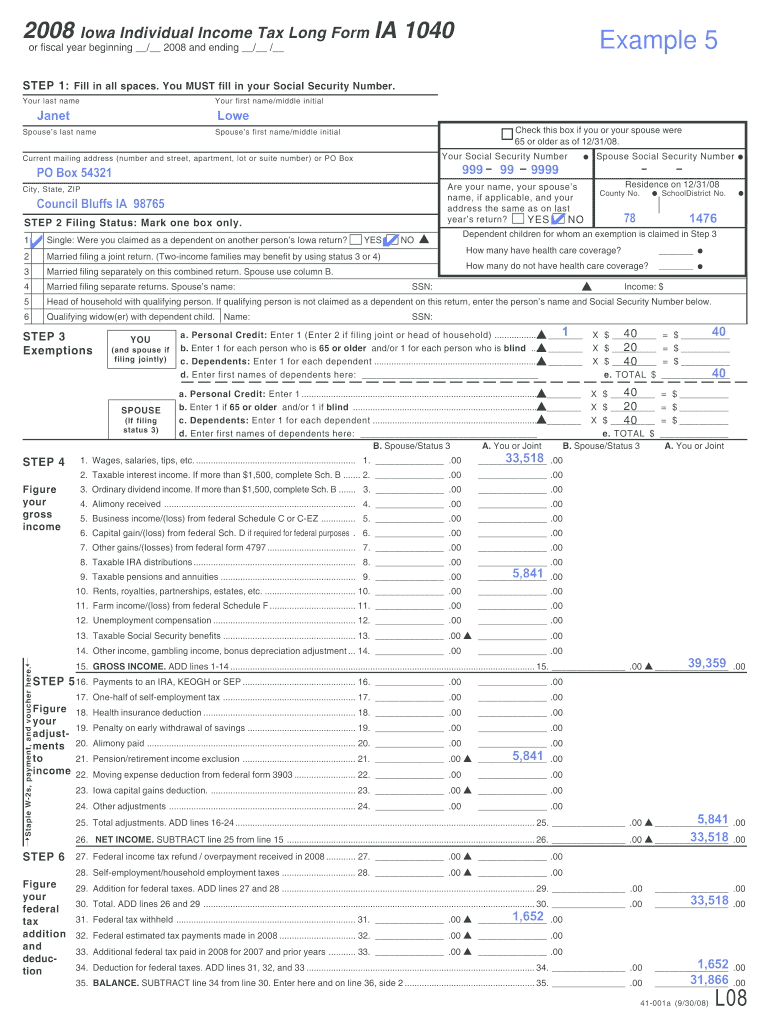

Fillable Online iowa 2008 Iowa Individual Tax Long Form IA 1040

Web the state of iowa 2022 tax return deadline is may 1, 2023. Tax forms and regulations vary from state to state. Web the table below lists the income tax rates which will be in effect for tax years 2023 through 2026. If more than $1,500, complete sch. Many of the forms are fillable, adobe reader version 11+ includes a.

Fillable Form Ia1040 Iowa Individual Tax Form 2013

This form is for income earned in tax year 2022, with tax. If more than $1,500, complete sch. Web the state of iowa 2022 tax return deadline is may 1, 2023. Web 1 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income tax return.

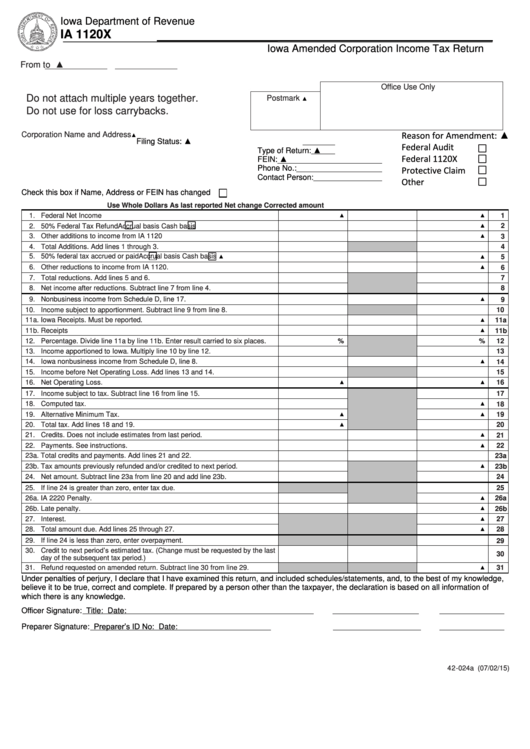

Fillable Ia 1120x, Iowa Amended Corporation Tax Return printable

The steps listed below correspond to the 2022 ia 1040 iowa individual income tax. If more than $1,500, complete sch. Web you can print other iowa tax forms here. Web note that this form will fill in some information automatically and do all the calculations for you. Download or email ia 1040 & more fillable forms, register and subscribe now!

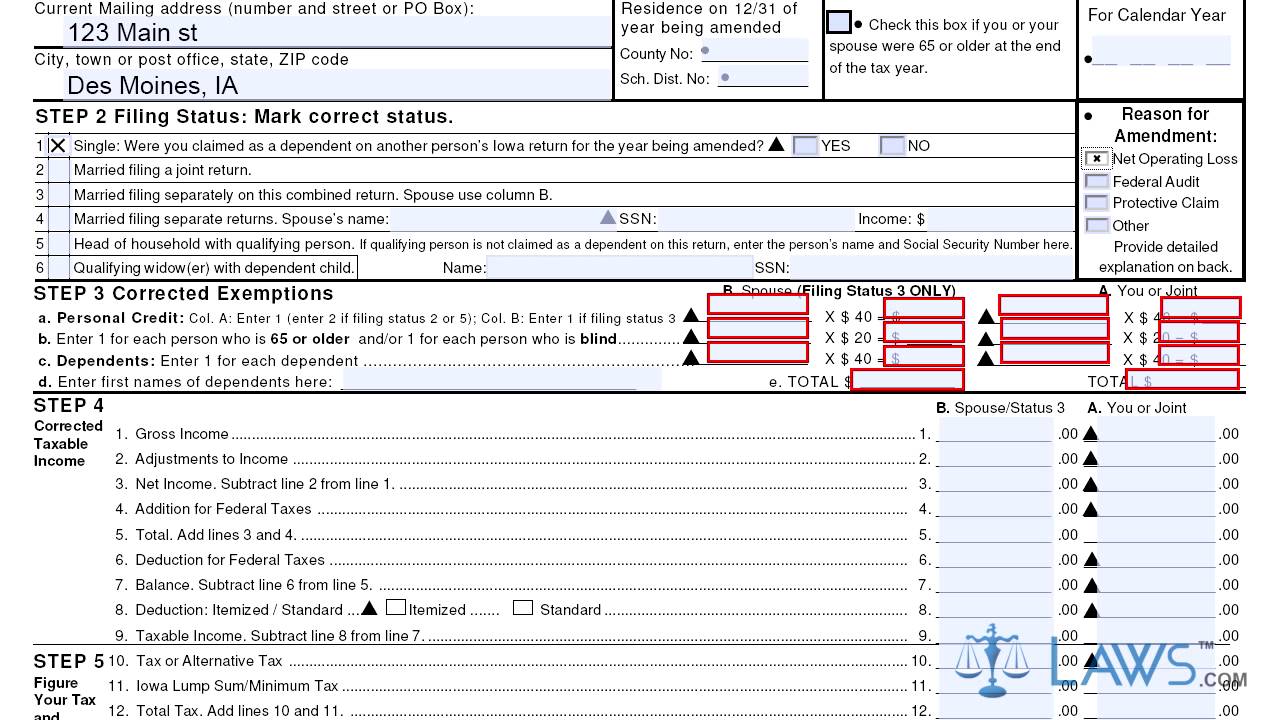

Form IA 1040X Amended Iowa Individual Tax Return YouTube

Taxformfinder has an additional 43 iowa income tax forms that you may need, plus all. Web note that this form will fill in some information automatically and do all the calculations for you. Web 1 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income.

State tax deadlines extended amid COVID19 outbreak Radio Iowa

Download or email ia 1040 & more fillable forms, register and subscribe now! Web instructions iowa state income tax forms for current and previous tax years. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web file.

Web Start With Filing An Income Tax Return Under I Am.

Web country of origin: If more than $1,500, complete sch. Many of the forms are fillable, adobe reader version 11+ includes a feature that allows a fillable form to be saved. Beginning in tax year 2026, iowa will have a flat individual income tax rate of 3.9%.

Web You Can Print Other Iowa Tax Forms Here.

Income tax forms for 2022. Tax forms and regulations vary from state to state. Complete, edit or print tax forms instantly. The steps listed below correspond to the 2022 ia 1040 iowa individual income tax.

Taxformfinder Has An Additional 43 Iowa Income Tax Forms That You May Need, Plus All.

Web the table below lists the income tax rates which will be in effect for tax years 2023 through 2026. If more than $1,500, complete sch. In iowa you will use form ia1040 to file your state tax return. Web how do i prepare my state taxes?

Download Or Email Ia 1040 & More Fillable Forms, Register And Subscribe Now!

Related iowa individual income tax forms: Download or email ia 1040 & more fillable forms, register and subscribe now! Web forms see form for instructions on how to submit. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax.