Irs Form 2553 Fax Number

Irs Form 2553 Fax Number - Web where to fax form 2553. If the corporation (entity) files this election by fax, keep the original form 2553 with the corporation's (entity’s) permanent records. Download and install an online fax app on your device. The irs has straightforward form 2553 fax instructions, but the number you’ll fax the form to will vary depending on your state. Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business. Web the irs will be able to provide you the form 2553 by mail or fax. Open the app and enter the fax number. For details, see where to file your taxes for form 2553. When faxing, include a cover sheet with your name, phone. You can fax this form to the irs.

Web where to fax form 2553. Prepare your form 2553 in a paper or electronic form and get it filled with your information compatible with requirements. For details, see where to file your taxes for form 2553. When faxing, include a cover sheet with your name, phone. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota,. The irs has straightforward form 2553 fax instructions, but the number you’ll fax the form to will vary depending on your state. Web generally, send the original election (no photocopies) or fax it to the internal revenue service center listed below. Tried all day yesterday and trying again today, but several times get our fax confirmation back that the number was busy and was not accepted. Filing tax forms by fax can be a fast, secure, and convenient option for those who need to meet tax deadlines, have an urgent matter to resolve with the irs, or want. Has anybody else had this issue lately?

Tried all day yesterday and trying again today, but several times get our fax confirmation back that the number was busy and was not accepted. Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business. When faxing, include a cover sheet with your name, phone. Web use the following irs center address or fax number connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont, virginia, west virginia, wisconsin If the corporation (entity) files this election by fax, keep the original form 2553 with the corporation's (entity’s) permanent records. Filing tax forms by fax can be a fast, secure, and convenient option for those who need to meet tax deadlines, have an urgent matter to resolve with the irs, or want. Web fax form 2553 to irs from an online fax app. Web the irs will be able to provide you the form 2553 by mail or fax. Web fax number for s election form 2553 down/busy? Web generally, send the original election (no photocopies) or fax it to the internal revenue service center listed below.

What is IRS Form 2553? Bench Accounting

Web use the following irs center address or fax number connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont, virginia, west virginia, wisconsin If the corporation (entity) files this election by fax, keep the original form 2553 with the corporation's.

2002 Form IRS 2553 Fill Online, Printable, Fillable, Blank pdfFiller

Web fax number for s election form 2553 down/busy? Web where to fax form 2553. Download and install an online fax app on your device. Web the irs will be able to provide you the form 2553 by mail or fax. Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

Tried all day yesterday and trying again today, but several times get our fax confirmation back that the number was busy and was not accepted. Effective june 18, 2019, the filing address has changed for form 2553 filers located in certain states. Web where to fax form 2553. Prepare your form 2553 in a paper or electronic form and get.

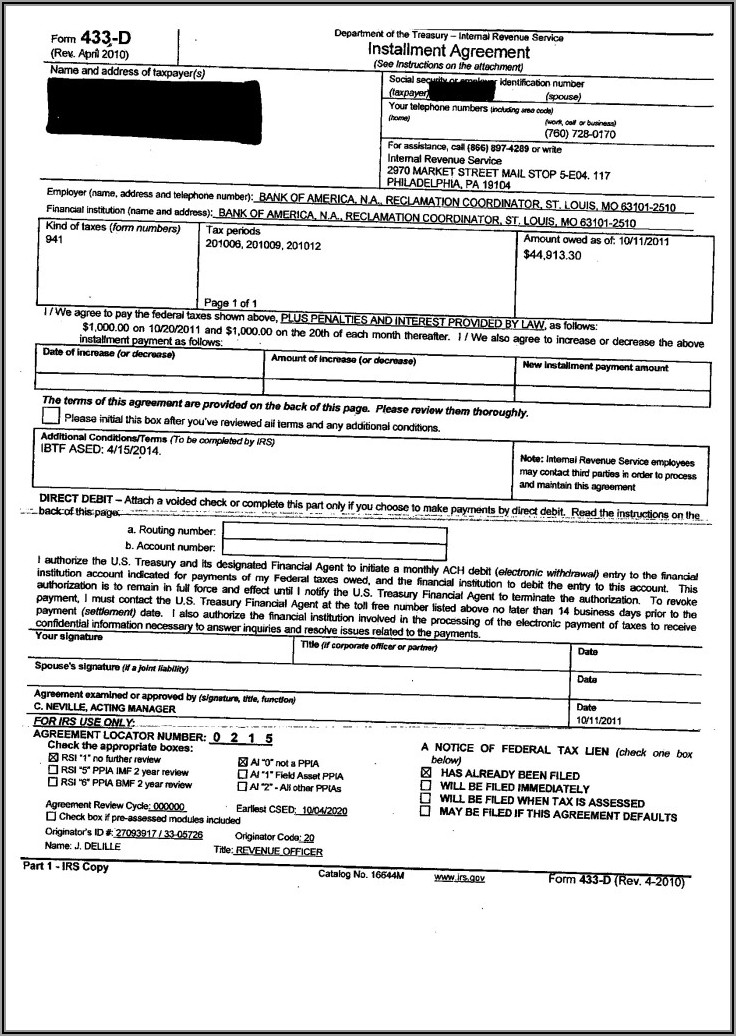

Fax Irs Form 433 D Form Resume Examples gq96lD1VOR

Effective june 18, 2019, the filing address has changed for form 2553 filers located in certain states. Web internal revenue service. Open the app and enter the fax number. Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business. Web use the following.

Where and How to Fax IRS Form 2553? Dingtone Fax

If the corporation (entity) files this election by fax, keep the original form 2553 with the corporation's (entity’s) permanent records. Has anybody else had this issue lately? Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business. You can fax this form to.

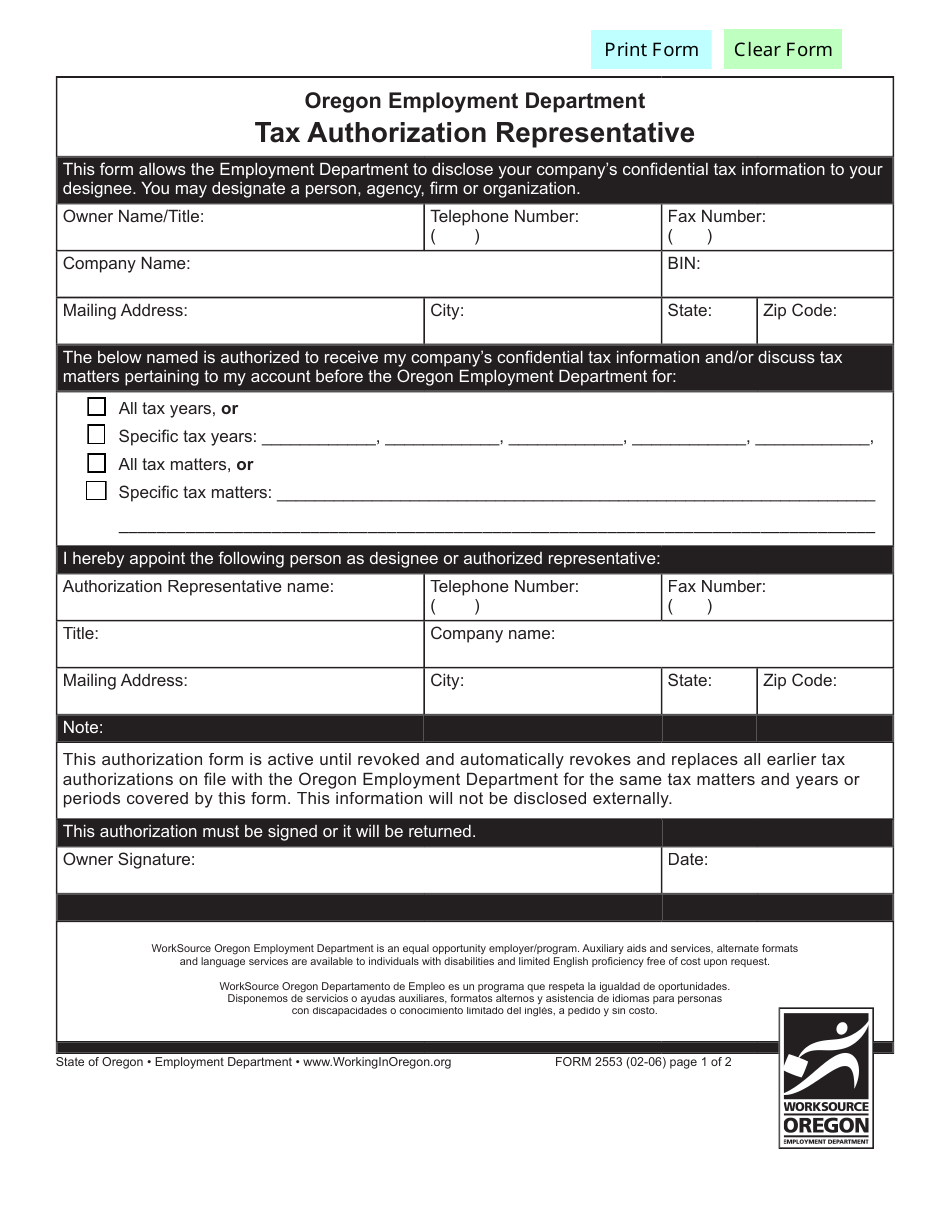

Form 2553 Download Fillable PDF or Fill Online Tax Authorization

Web generally, send the original election (no photocopies) or fax it to the internal revenue service center listed below. The irs has straightforward form 2553 fax instructions, but the number you’ll fax the form to will vary depending on your state. Download and install an online fax app on your device. When faxing, include a cover sheet with your name,.

IRS Form 2553 How to Register as an SCorporation for Your Business

Tried all day yesterday and trying again today, but several times get our fax confirmation back that the number was busy and was not accepted. If the corporation (entity) files this election by fax, keep the original form 2553 with the corporation's (entity’s) permanent records. Effective june 18, 2019, the filing address has changed for form 2553 filers located in.

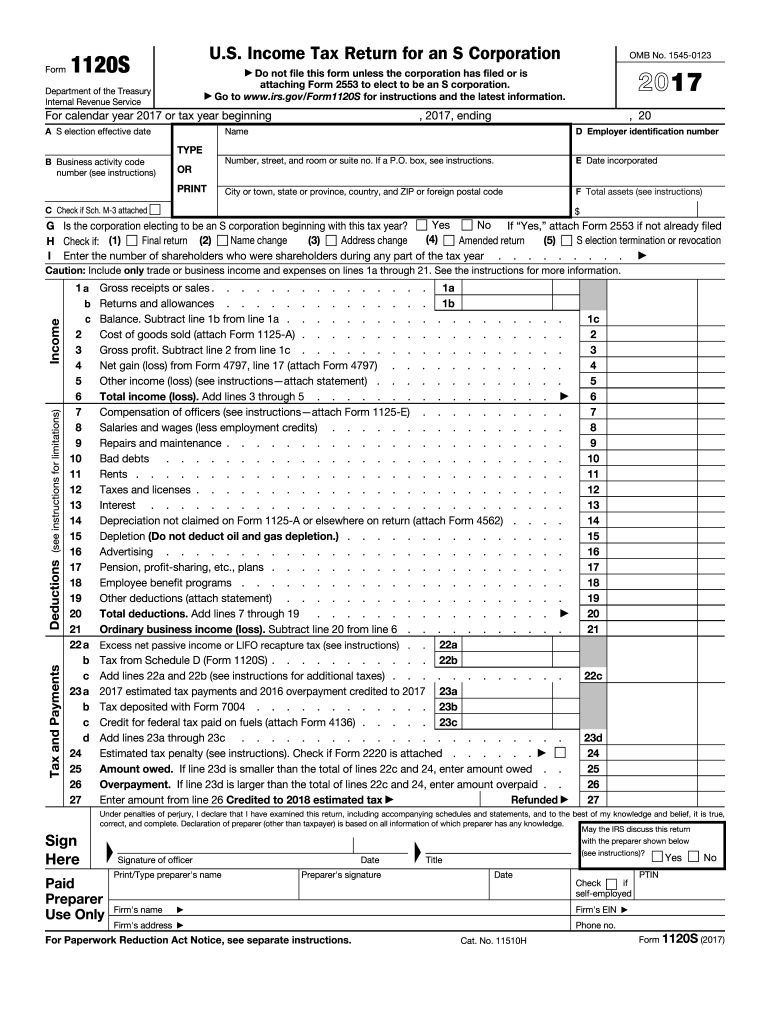

1120S Fill Out and Sign Printable PDF Template signNow

Web the irs will be able to provide you the form 2553 by mail or fax. Web fax number for s election form 2553 down/busy? Web where to fax form 2553. Prepare your form 2553 in a paper or electronic form and get it filled with your information compatible with requirements. Web fax form 2553 to irs from an online.

IRS Form 2553 Instructions How and Where to File This Tax Form

The irs has straightforward form 2553 fax instructions, but the number you’ll fax the form to will vary depending on your state. When faxing, include a cover sheet with your name, phone. Web fax number for s election form 2553 down/busy? If the corporation (entity) files this election by fax, keep the original form 2553 with the corporation's (entity’s) permanent.

Ssurvivor Form 2553 Irs Fax Number

Effective june 18, 2019, the filing address has changed for form 2553 filers located in certain states. Prepare your form 2553 in a paper or electronic form and get it filled with your information compatible with requirements. Web internal revenue service. Open the app and enter the fax number. Web fax number for s election form 2553 down/busy?

Attach To Form 2553 A Statement Describing The Relevant Facts And Circumstances And, If Applicable, The Gross Receipts From Sales And Services Necessary To Establish A Business.

Download and install an online fax app on your device. Filing tax forms by fax can be a fast, secure, and convenient option for those who need to meet tax deadlines, have an urgent matter to resolve with the irs, or want. Has anybody else had this issue lately? For details, see where to file your taxes for form 2553.

Effective June 18, 2019, The Filing Address Has Changed For Form 2553 Filers Located In Certain States.

Web where to fax form 2553. You can fax this form to the irs. When faxing, include a cover sheet with your name, phone. The irs has straightforward form 2553 fax instructions, but the number you’ll fax the form to will vary depending on your state.

Web Fax Number For S Election Form 2553 Down/Busy?

Web use the following irs center address or fax number connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont, virginia, west virginia, wisconsin Web generally, send the original election (no photocopies) or fax it to the internal revenue service center listed below. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota,. Web internal revenue service.

If The Corporation (Entity) Files This Election By Fax, Keep The Original Form 2553 With The Corporation's (Entity’s) Permanent Records.

Tried all day yesterday and trying again today, but several times get our fax confirmation back that the number was busy and was not accepted. Web fax form 2553 to irs from an online fax app. Open the app and enter the fax number. Web the irs will be able to provide you the form 2553 by mail or fax.