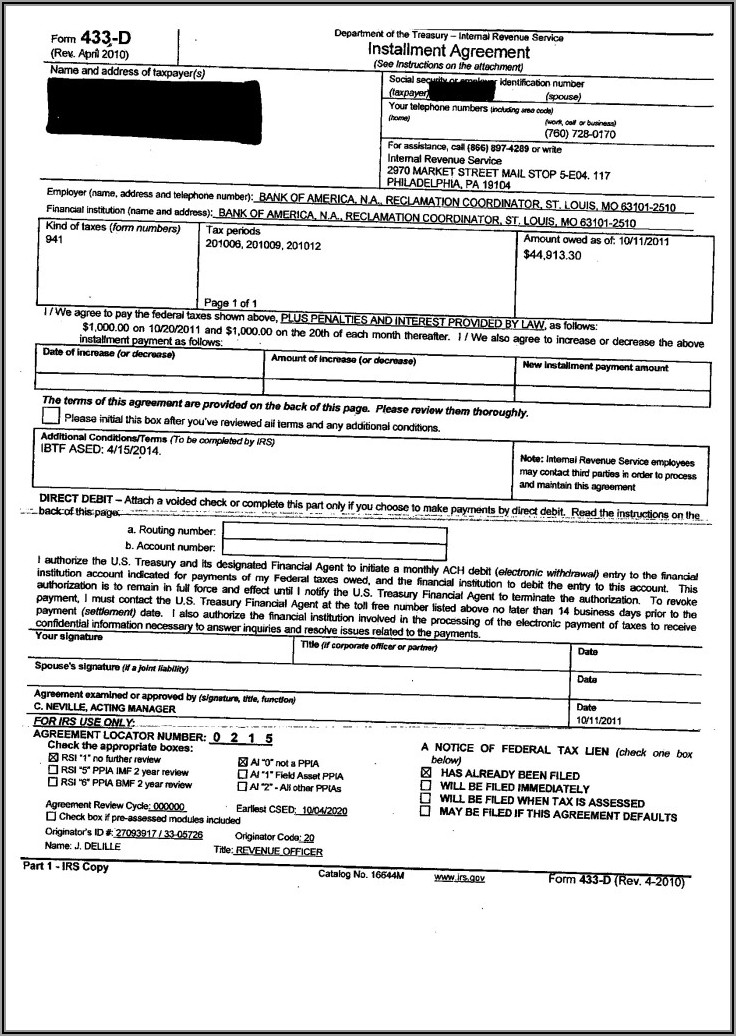

Irs Form 433D

Irs Form 433D - 7 minutes watch video get the form! This form is used by the united states internal revenue service. It is a form taxpayers can submit to authorize a direct debit payment method. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. Web the document you are trying to load requires adobe reader 8 or higher. Web what is an irs form 433d? However, you need a form 9465 from the irs to initiate the tax resolution. You may not have the adobe reader installed or your viewing environment may not be properly. Step by step instructions comments if you’ve accumulated tax debt, you might have set up an installment agreement with internal revenue service to pay down your back taxes in regular monthly payments. The document finalizes the agreement between an individual or a business and the irs.

Web what is an irs form 433d? 7 minutes watch video get the form! Web the document you are trying to load requires adobe reader 8 or higher. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. However, you need a form 9465 from the irs to initiate the tax resolution. You may not have the adobe reader installed or your viewing environment may not be properly. The document finalizes the agreement between an individual or a business and the irs. Step by step instructions comments if you’ve accumulated tax debt, you might have set up an installment agreement with internal revenue service to pay down your back taxes in regular monthly payments. It is a form taxpayers can submit to authorize a direct debit payment method. This form is used by the united states internal revenue service.

It is a form taxpayers can submit to authorize a direct debit payment method. The document finalizes the agreement between an individual or a business and the irs. 7 minutes watch video get the form! You may not have the adobe reader installed or your viewing environment may not be properly. Web the document you are trying to load requires adobe reader 8 or higher. Web what is an irs form 433d? However, you need a form 9465 from the irs to initiate the tax resolution. Step by step instructions comments if you’ve accumulated tax debt, you might have set up an installment agreement with internal revenue service to pay down your back taxes in regular monthly payments. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. This form is used by the united states internal revenue service.

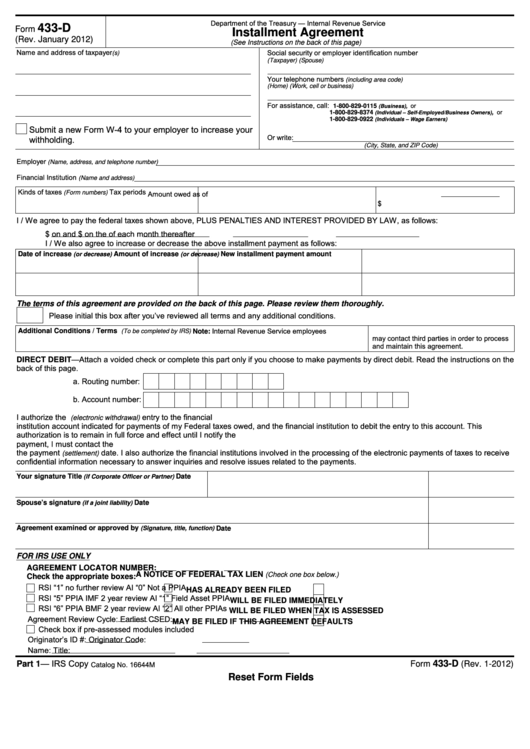

Fillable Form 433D Installment Agreement printable pdf download

Web what is an irs form 433d? However, you need a form 9465 from the irs to initiate the tax resolution. It is a form taxpayers can submit to authorize a direct debit payment method. 7 minutes watch video get the form! Step by step instructions comments if you’ve accumulated tax debt, you might have set up an installment agreement.

Irs Form 433 D Fillable Form Resume Examples YL5zejyDzV

However, you need a form 9465 from the irs to initiate the tax resolution. You may not have the adobe reader installed or your viewing environment may not be properly. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. Web what is an irs form 433d? Step by step instructions.

Form 433 d Fill out & sign online DocHub

However, you need a form 9465 from the irs to initiate the tax resolution. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. It is a form taxpayers can submit to authorize a direct debit payment method. Web the document you are trying to load requires adobe reader 8 or.

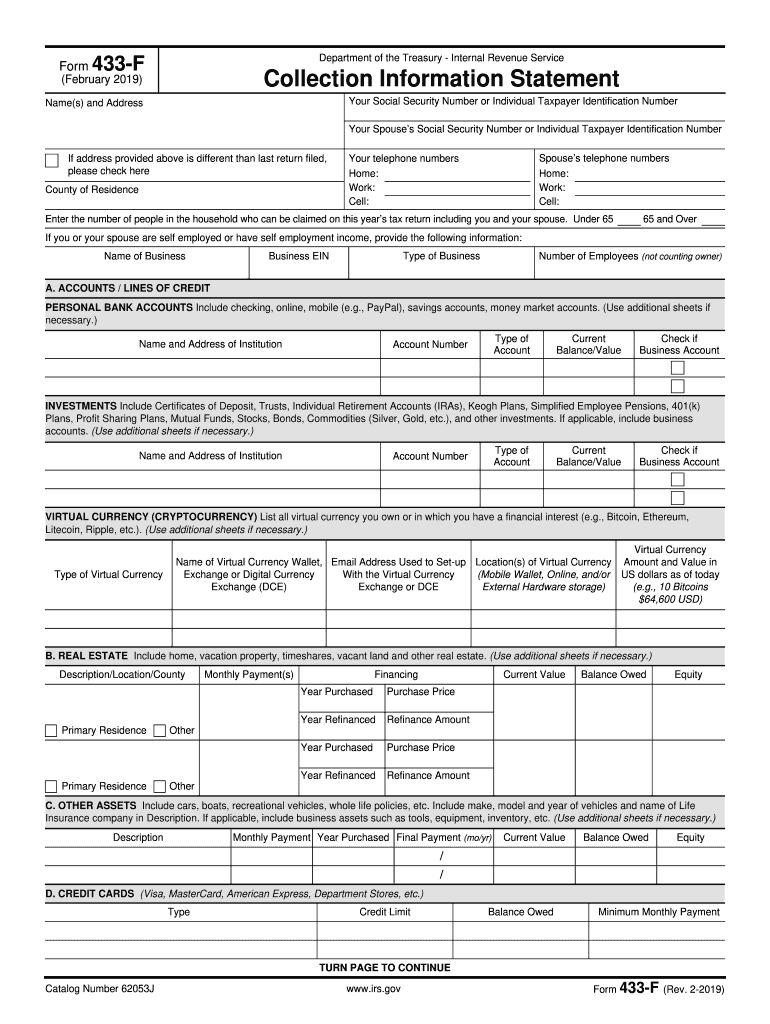

2019 Form IRS 433F Fill Online, Printable, Fillable, Blank pdfFiller

It is a form taxpayers can submit to authorize a direct debit payment method. Web the document you are trying to load requires adobe reader 8 or higher. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. Web what is an irs form 433d? This form is used by the.

Fax Number For Irs Form 433 D Form Resume Examples MW9p3OO2AJ

It is a form taxpayers can submit to authorize a direct debit payment method. The document finalizes the agreement between an individual or a business and the irs. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. 7 minutes watch video get the form! However, you need a form 9465.

2007 Form IRS 433D Fill Online, Printable, Fillable, Blank pdfFiller

This form is used by the united states internal revenue service. Step by step instructions comments if you’ve accumulated tax debt, you might have set up an installment agreement with internal revenue service to pay down your back taxes in regular monthly payments. You may not have the adobe reader installed or your viewing environment may not be properly. Web.

Form 433d Edit, Fill, Sign Online Handypdf

However, you need a form 9465 from the irs to initiate the tax resolution. This form is used by the united states internal revenue service. Web the document you are trying to load requires adobe reader 8 or higher. Step by step instructions comments if you’ve accumulated tax debt, you might have set up an installment agreement with internal revenue.

Form 433d Edit, Fill, Sign Online Handypdf

7 minutes watch video get the form! Web what is an irs form 433d? However, you need a form 9465 from the irs to initiate the tax resolution. Step by step instructions comments if you’ve accumulated tax debt, you might have set up an installment agreement with internal revenue service to pay down your back taxes in regular monthly payments..

Fax Irs Form 433 D Form Resume Examples gq96lD1VOR

The document finalizes the agreement between an individual or a business and the irs. However, you need a form 9465 from the irs to initiate the tax resolution. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. 7 minutes watch video get the form! This form is used by the.

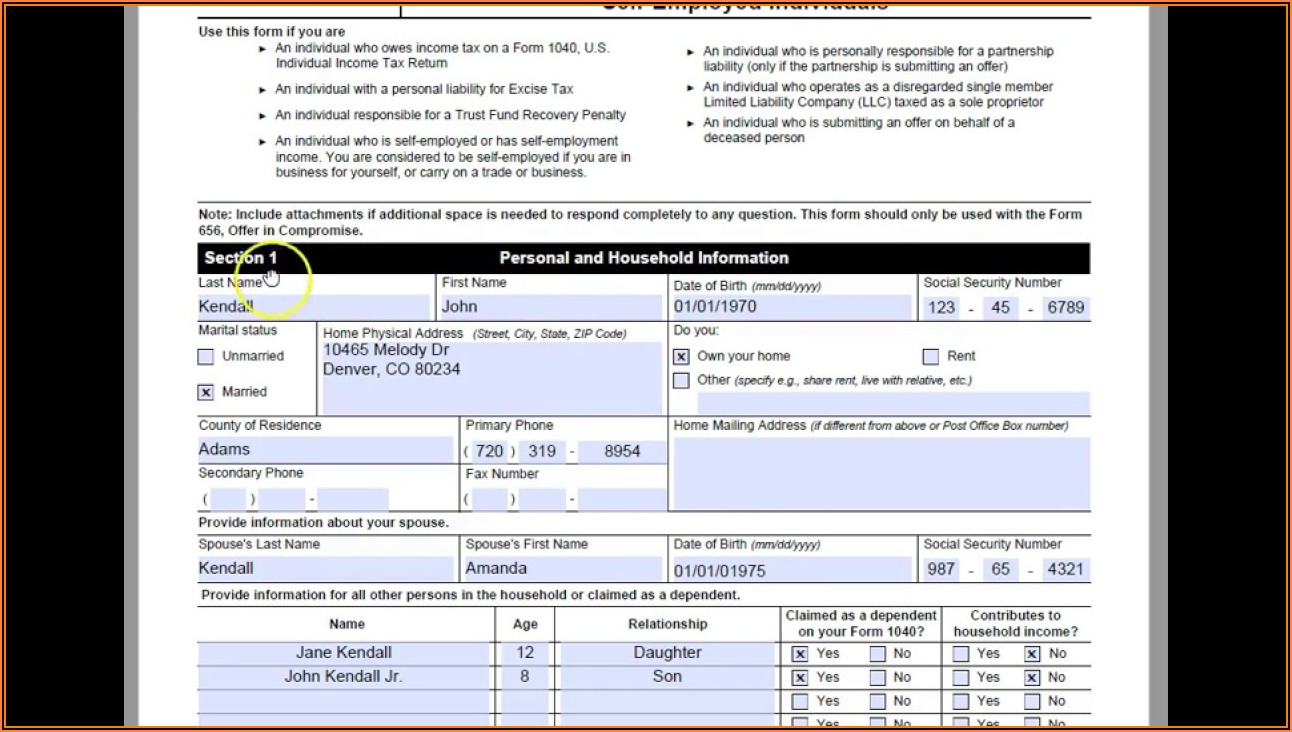

Form 433 A Tax Alloble Expenses 433D Instructions —

Web what is an irs form 433d? This form is used by the united states internal revenue service. It is a form taxpayers can submit to authorize a direct debit payment method. However, you need a form 9465 from the irs to initiate the tax resolution. Web the document you are trying to load requires adobe reader 8 or higher.

Step By Step Instructions Comments If You’ve Accumulated Tax Debt, You Might Have Set Up An Installment Agreement With Internal Revenue Service To Pay Down Your Back Taxes In Regular Monthly Payments.

Web the document you are trying to load requires adobe reader 8 or higher. 7 minutes watch video get the form! The document finalizes the agreement between an individual or a business and the irs. Web what is an irs form 433d?

This Form Is Used By The United States Internal Revenue Service.

It is a form taxpayers can submit to authorize a direct debit payment method. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. You may not have the adobe reader installed or your viewing environment may not be properly. However, you need a form 9465 from the irs to initiate the tax resolution.