Irs Form 941 Refund Status

Irs Form 941 Refund Status - As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web check the status of your income tax refund for recent tax years. The request for mail order forms may be used to order one copy or. Web to claim or correct your credit by adjusting your employment tax return, use the adjusted return and instructions that apply to your business or organization and the relevant tax. Those returns are processed in. Get an identity protection pin (ip pin) pay. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Web payroll tax returns. You must complete all five pages.

As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web november 30, 2021 08:20 am hello! Web for businesses, corporations, partnerships and trusts who need information and/or help regarding their business returns or business (bmf) accounts. You must complete all five pages. Get an identity protection pin (ip pin) pay. Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Type or print within the boxes. Web how to file when to file where to file update my information popular get your tax record file your taxes for free apply for an employer id number (ein) check your. Web check your amended return status. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty.

The request for mail order forms may be used to order one copy or. Request for transcript of tax return. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Web to claim or correct your credit by adjusting your employment tax return, use the adjusted return and instructions that apply to your business or organization and the relevant tax. Those returns are processed in. You must complete all five pages. Web for businesses, corporations, partnerships and trusts who need information and/or help regarding their business returns or business (bmf) accounts. Web check the status of your income tax refund for recent tax years. Web april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround time as to when a refund from filing your 941 quarterly. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty.

what can i do if i lost my irs refund check Fill Online, Printable

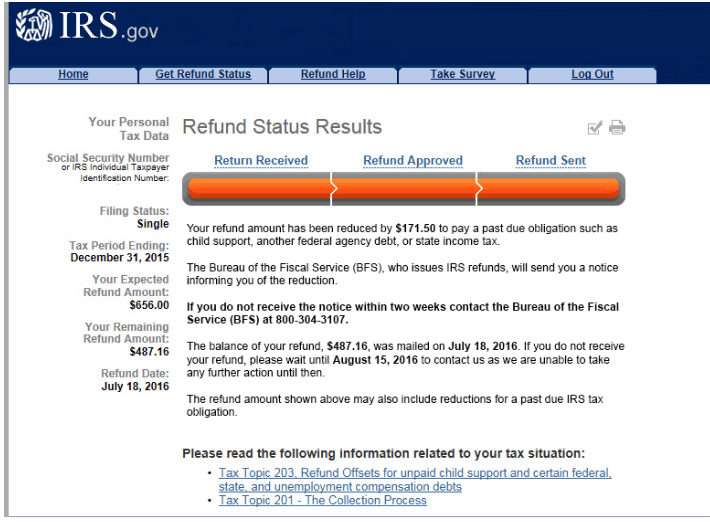

Those returns are processed in. Web to obtain the refund status of your 2022 tax return, you must enter your social security number, your date of birth, the type of tax and whether it is an amended return. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. However, if.

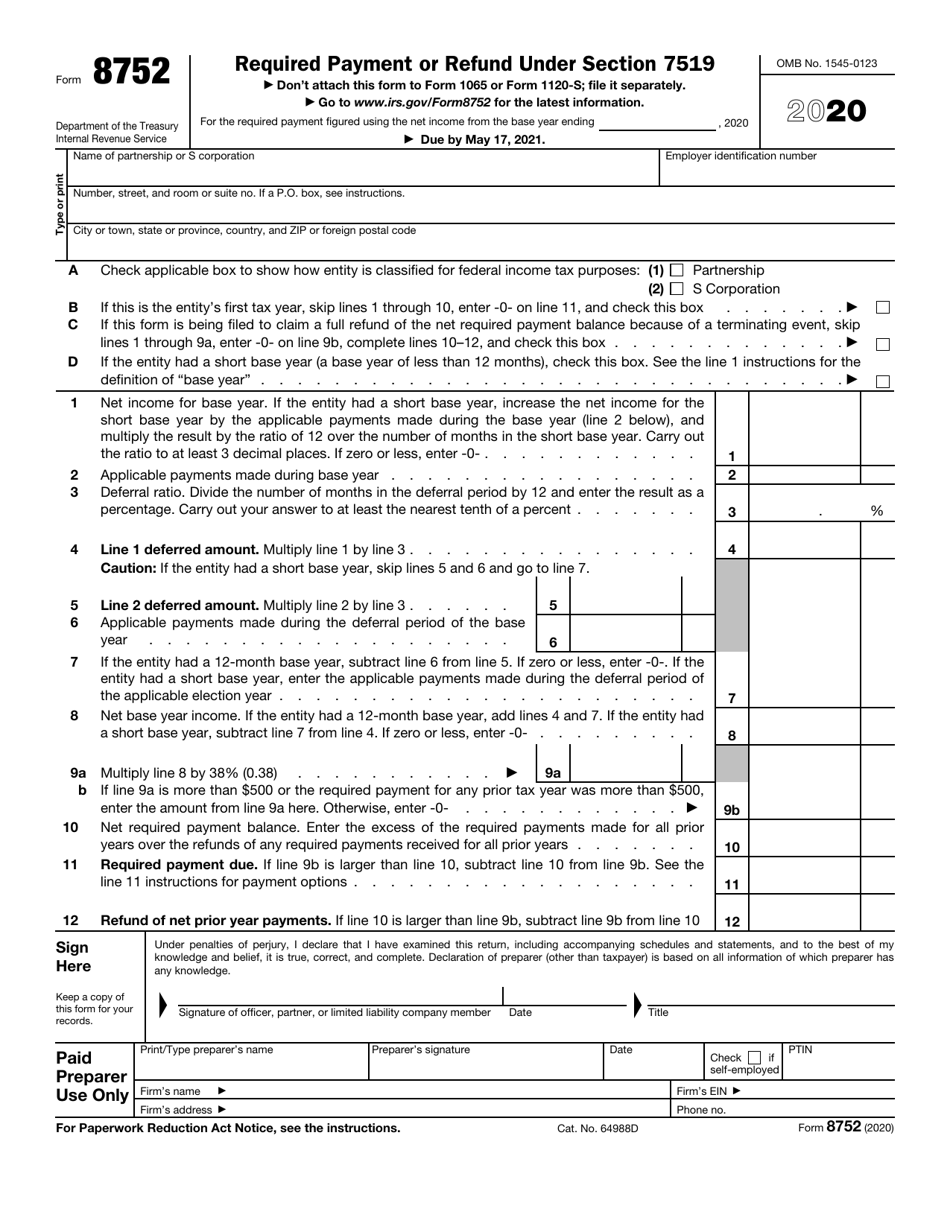

IRS Form 8752 Download Fillable PDF or Fill Online Required Payment or

The request for mail order forms may be used to order one copy or. Web check your federal tax refund status. Web check the status of your income tax refund for recent tax years. Web payroll tax returns. Irs2go app check your refund status, make a payment, find free tax preparation assistance,.

How to fill out IRS Form 941 2019 PDF Expert

As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web to claim or correct your credit by adjusting your employment tax return, use the adjusted return and instructions that apply to your business or organization and the relevant tax. Before checking on your refund, have your social security number, filing status, and.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Web to obtain the refund status of your 2022 tax return, you must enter your social security number, your date of birth, the type of tax and whether it is an amended return. The request for mail order forms may.

IRS Form 941— Tax Filing Basics for Business Owners

Web to claim or correct your credit by adjusting your employment tax return, use the adjusted return and instructions that apply to your business or organization and the relevant tax. Web april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround time as to when a refund from filing your 941 quarterly..

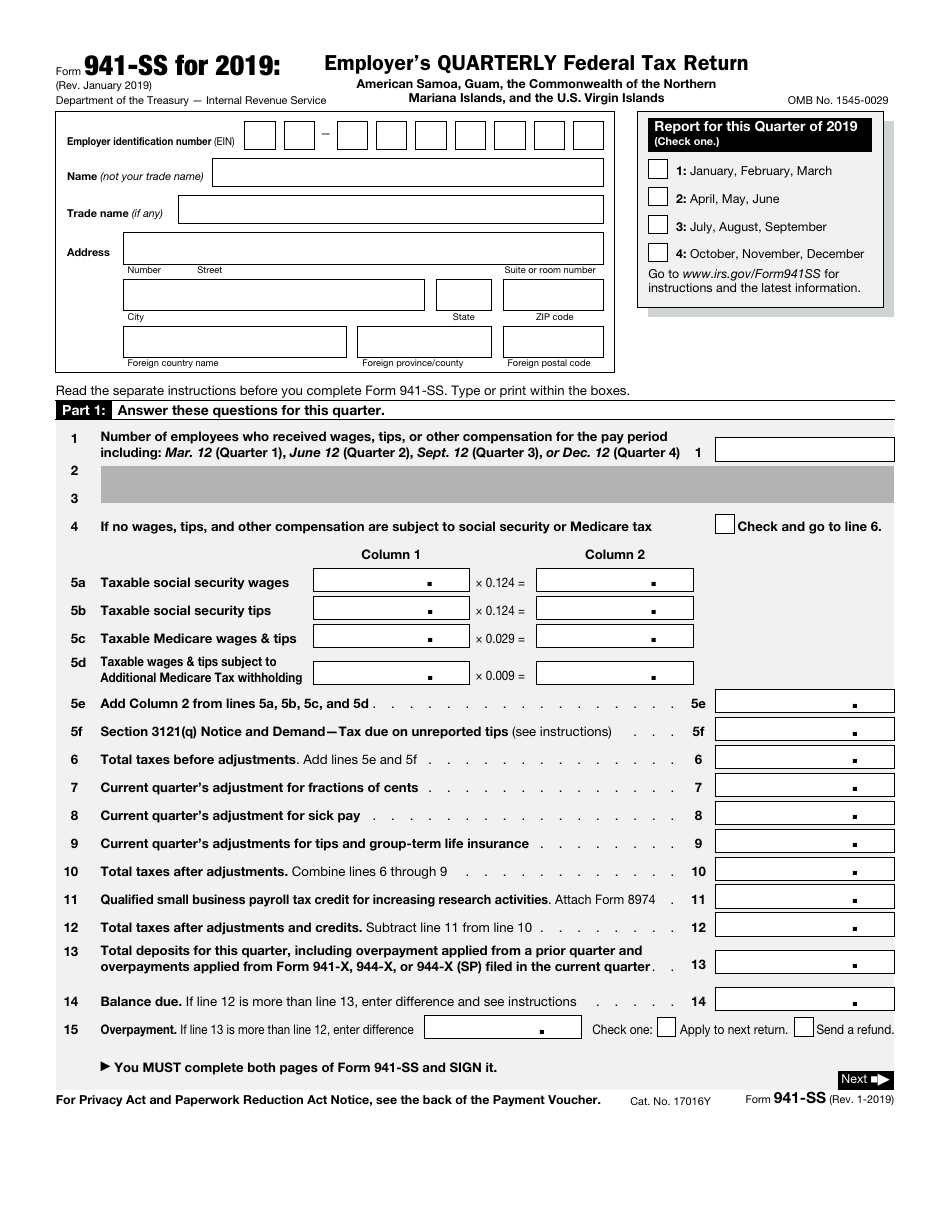

IRS Form 941SS 2019 Fill Out, Sign Online and Download Fillable

Web payroll tax returns. Web april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround time as to when a refund from filing your 941 quarterly. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Web to obtain the refund status.

Form 941 Instructions & FICA Tax Rate [+ Mailing Address]

Web check your amended return status. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. However, if you pay an amount with form 941 that should’ve been deposited, you.

The IRS just announced the first day to receive federal tax refunds

Those returns are processed in. Web for businesses, corporations, partnerships and trusts who need information and/or help regarding their business returns or business (bmf) accounts. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Web check your amended return status. Web to claim or correct your credit by adjusting.

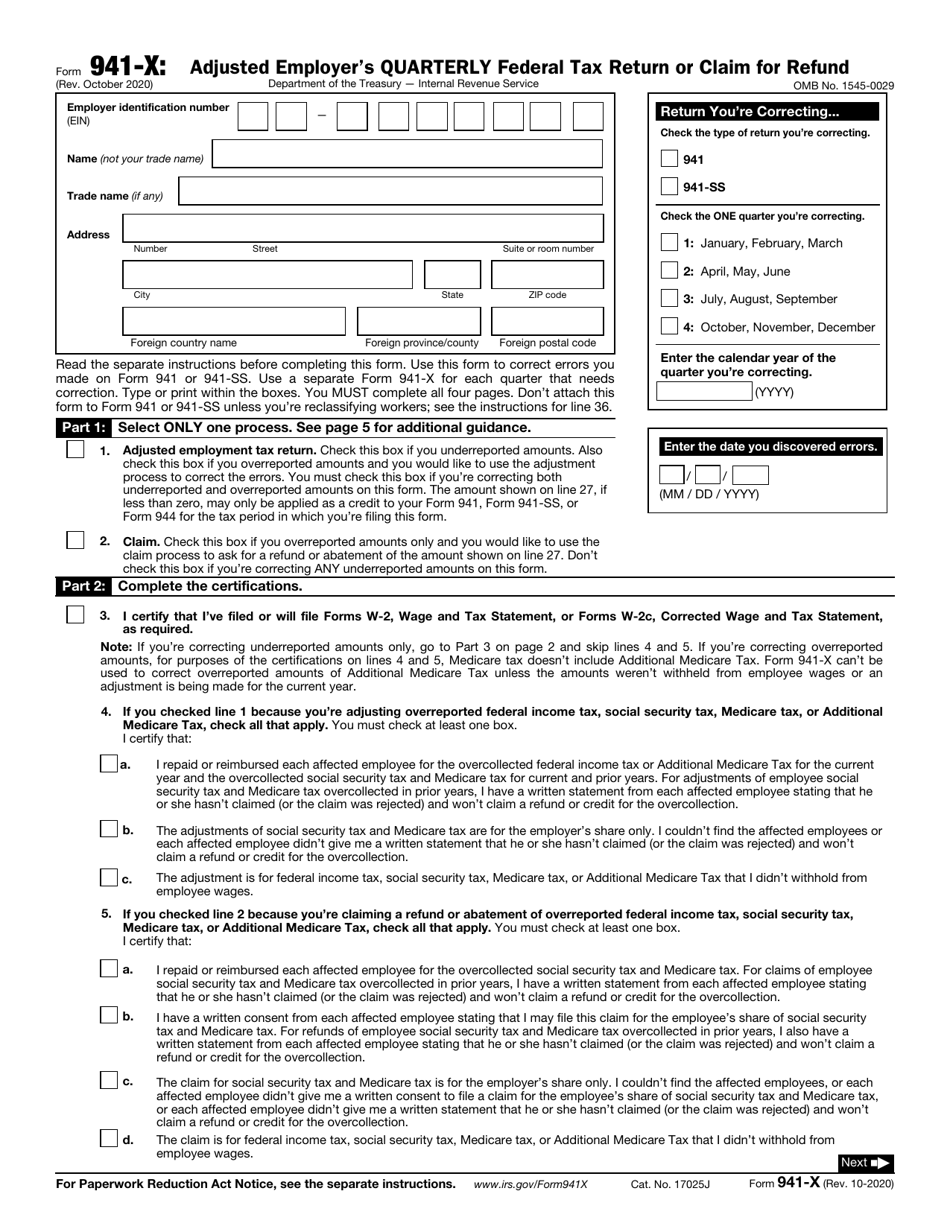

IRS Form 941X Download Fillable PDF or Fill Online Adjusted Employer's

However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Type or print within the boxes. Web check your federal tax refund status. You must complete all five pages. Web to claim or correct your credit by adjusting your employment tax return, use the adjusted return and instructions that apply.

mattpencedesign Missouri State Tax Refund Status

Web april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround time as to when a refund from filing your 941 quarterly. Web check the status of your income tax refund for recent tax years. Request for transcript of tax return. Web check your amended return status. Before checking on your refund,.

You Must Complete All Five Pages.

The request for mail order forms may be used to order one copy or. Web april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround time as to when a refund from filing your 941 quarterly. Web how to file when to file where to file update my information popular get your tax record file your taxes for free apply for an employer id number (ein) check your. Get an identity protection pin (ip pin) pay.

As Of July 13, 2023, The Irs Had 266,000 Unprocessed Forms 941, Employer's Quarterly Federal Tax Return.

However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Employers engaged in a trade or business who pay compensation form 9465; Request for transcript of tax return. Web check your amended return status.

Those Returns Are Processed In.

Web check your federal tax refund status. Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Web to claim or correct your credit by adjusting your employment tax return, use the adjusted return and instructions that apply to your business or organization and the relevant tax. Web november 30, 2021 08:20 am hello!

However, If You Pay An Amount With Form 941 That Should’ve Been Deposited, You May Be Subject To A Penalty.

Web to obtain the refund status of your 2022 tax return, you must enter your social security number, your date of birth, the type of tax and whether it is an amended return. Irs2go app check your refund status, make a payment, find free tax preparation assistance,. Web check the status of your income tax refund for recent tax years. Web for businesses, corporations, partnerships and trusts who need information and/or help regarding their business returns or business (bmf) accounts.

![Form 941 Instructions & FICA Tax Rate [+ Mailing Address]](https://fitsmallbusiness.com/wp-content/uploads/2018/12/word-image-1461.png)