It-20 Form

It-20 Form - Web what form should be filed to amend a return. Current year corporate adjusted gross income tax forms and schedules. This form is for income earned in tax year 2022, with tax returns due in april. Web if you falsify information on this form, you will be subject to criminal prosecution note to applicant: The threshold for estimated quarterly payments is $2,500, instead of $1,000. Web of the two nonprofits, covenant families for brighter tomorrows will focus on education around the impact and prevention of school shootings and improving. Employers and authorized preparers must read the general instructions carefully before completing the form eta. Web apply for a nonimmigrant visa: Web the national hurricane center continues to project a medium chance an atlantic system could form into the season’s next tropical depression or storm. Log on to www.identogo.com or call 1.

Web l do you have on file a valid extension of time to file your return (federal form 7004 or an electronic extension of time)? Web of the two nonprofits, covenant families for brighter tomorrows will focus on education around the impact and prevention of school shootings and improving. Employers and authorized preparers must read the general instructions carefully before completing the form eta. Current year corporate adjusted gross income tax forms and schedules. Date of incorporation in the state of l. This form is for income earned in tax year 2022, with tax returns due in april. Log on to www.identogo.com or call 1. Web what form should be filed to amend a return. Web federal form 8832, entity classification election, to be treated as a corporation.if this election is made for federal tax purposes, the llc will file form 1120 and indiana’s. Web the national hurricane center continues to project a medium chance an atlantic system could form into the season’s next tropical depression or storm.

Web l do you have on file a valid extension of time to file your return (federal form 7004 or an electronic extension of time)? Web federal form 8832, entity classification election, to be treated as a corporation.if this election is made for federal tax purposes, the llc will file form 1120 and indiana’s. Current year corporate adjusted gross income tax forms and schedules. State of commercial domicile m. Web of the two nonprofits, covenant families for brighter tomorrows will focus on education around the impact and prevention of school shootings and improving. Employers and authorized preparers must read the general instructions carefully before completing the form eta. Web if you falsify information on this form, you will be subject to criminal prosecution note to applicant: Log on to www.identogo.com or call 1. The threshold for estimated quarterly payments is $2,500, instead of $1,000. Web what form should be filed to amend a return.

Ultimate Guide to the Form I20 Sojourning Scholar

Log on to www.identogo.com or call 1. Web l do you have on file a valid extension of time to file your return (federal form 7004 or an electronic extension of time)? Web the national hurricane center continues to project a medium chance an atlantic system could form into the season’s next tropical depression or storm. Web if you falsify.

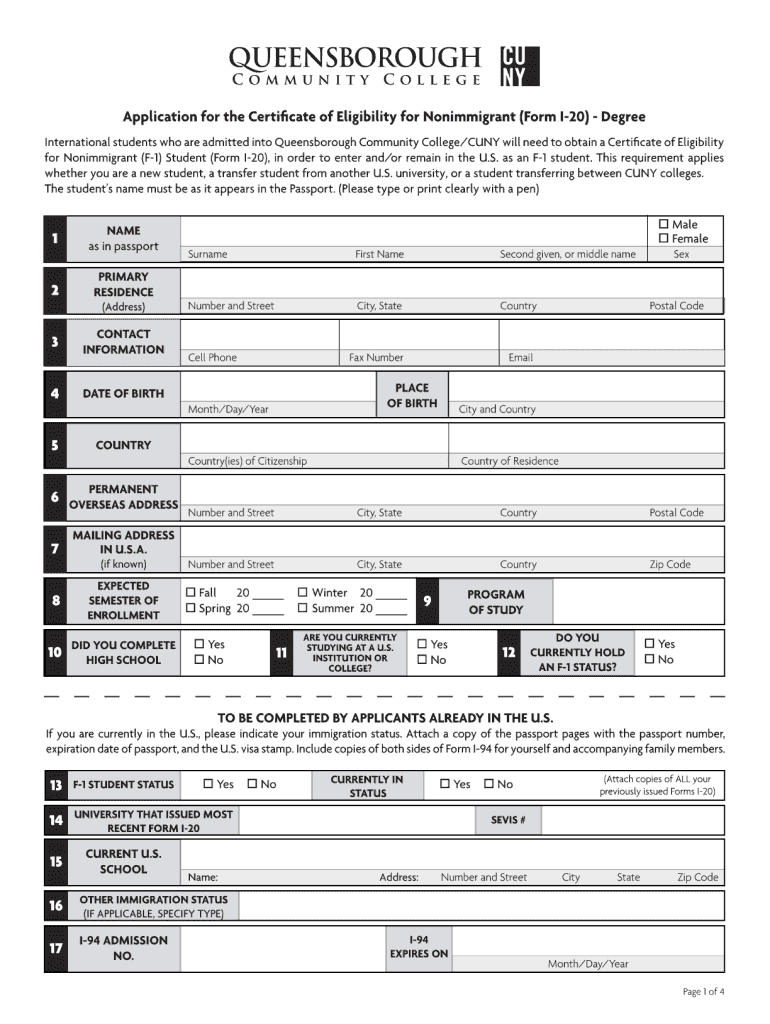

QCC Form I20 Fill and Sign Printable Template Online US Legal Forms

This form is for income earned in tax year 2022, with tax returns due in april. Date of incorporation in the state of l. Web if you falsify information on this form, you will be subject to criminal prosecution note to applicant: Log on to www.identogo.com or call 1. Web what form should be filed to amend a return.

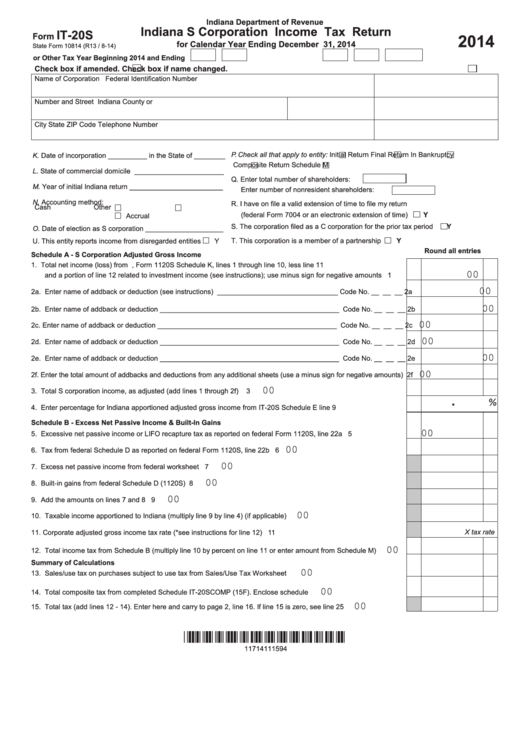

Fillable Form It20s Indiana S Corporation Tax Return 2014

9988 (hkd counter) and 89988 (rmb counter)) today. Web the national hurricane center continues to project a medium chance an atlantic system could form into the season’s next tropical depression or storm. Web l do you have on file a valid extension of time to file your return (federal form 7004 or an electronic extension of time)? Web if you.

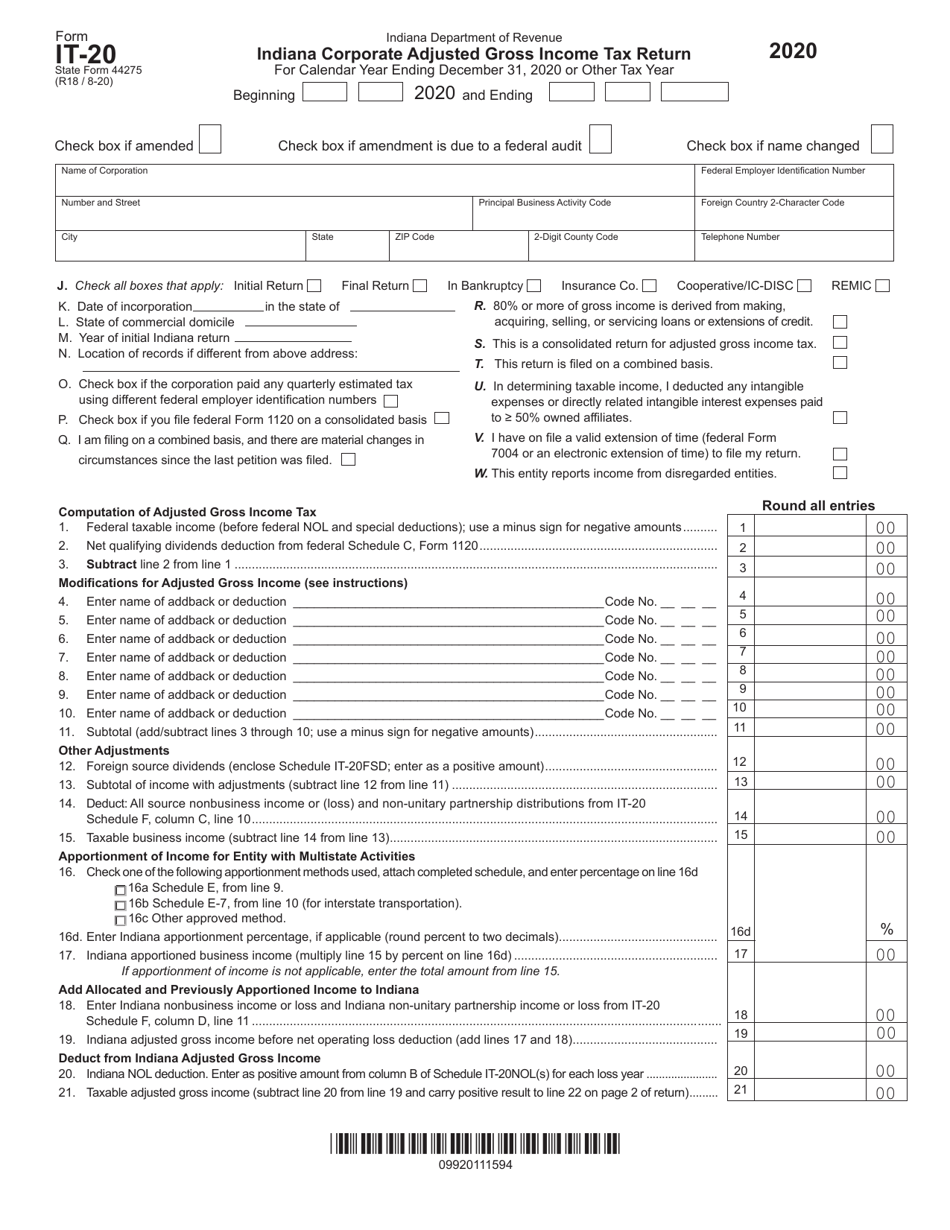

Form IT20 (State Form 44275) Download Fillable PDF or Fill Online

Web l do you have on file a valid extension of time to file your return (federal form 7004 or an electronic extension of time)? The threshold for estimated quarterly payments is $2,500, instead of $1,000. Web federal form 8832, entity classification election, to be treated as a corporation.if this election is made for federal tax purposes, the llc will.

2017 Form IN IT40RNR Fill Online, Printable, Fillable, Blank pdfFiller

Web l do you have on file a valid extension of time to file your return (federal form 7004 or an electronic extension of time)? State of commercial domicile m. 9988 (hkd counter) and 89988 (rmb counter)) today. Web the national hurricane center continues to project a medium chance an atlantic system could form into the season’s next tropical depression.

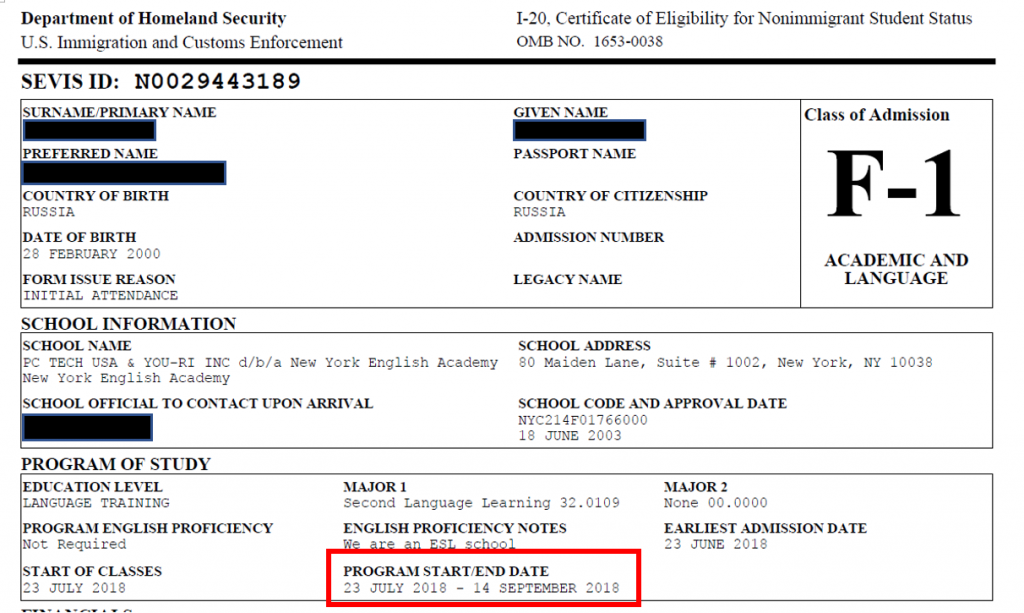

I20 Form for USA VISA

Current year corporate adjusted gross income tax forms and schedules. Web l do you have on file a valid extension of time to file your return (federal form 7004 or an electronic extension of time)? Web what form should be filed to amend a return. State of commercial domicile m. Web apply for a nonimmigrant visa:

EPF Form 20 for Withdrawal After Death Instructions & How to File Claim

Web what form should be filed to amend a return. The threshold for estimated quarterly payments is $2,500, instead of $1,000. Web if you falsify information on this form, you will be subject to criminal prosecution note to applicant: Web l do you have on file a valid extension of time to file your return (federal form 7004 or an.

The I20 and the Student Visa Validity Period New York City Your Best

The threshold for estimated quarterly payments is $2,500, instead of $1,000. Current year corporate adjusted gross income tax forms and schedules. Web l do you have on file a valid extension of time to file your return (federal form 7004 or an electronic extension of time)? Web the national hurricane center continues to project a medium chance an atlantic system.

Acceptance Materials & I20 Form Seattle Colleges

The threshold for estimated quarterly payments is $2,500, instead of $1,000. Web l do you have on file a valid extension of time to file your return (federal form 7004 or an electronic extension of time)? This form is for income earned in tax year 2022, with tax returns due in april. Date of incorporation in the state of l..

I20 Form for the US student visa [2021] Study in USA

Web the national hurricane center continues to project a medium chance an atlantic system could form into the season’s next tropical depression or storm. Log on to www.identogo.com or call 1. State of commercial domicile m. Web of the two nonprofits, covenant families for brighter tomorrows will focus on education around the impact and prevention of school shootings and improving..

The Threshold For Estimated Quarterly Payments Is $2,500, Instead Of $1,000.

Web if you falsify information on this form, you will be subject to criminal prosecution note to applicant: 9988 (hkd counter) and 89988 (rmb counter)) today. This form is for income earned in tax year 2022, with tax returns due in april. Web the national hurricane center continues to project a medium chance an atlantic system could form into the season’s next tropical depression or storm.

Log On To Www.identogo.com Or Call 1.

Web what form should be filed to amend a return. Current year corporate adjusted gross income tax forms and schedules. Web federal form 8832, entity classification election, to be treated as a corporation.if this election is made for federal tax purposes, the llc will file form 1120 and indiana’s. Employers and authorized preparers must read the general instructions carefully before completing the form eta.

Web Apply For A Nonimmigrant Visa:

State of commercial domicile m. Web l do you have on file a valid extension of time to file your return (federal form 7004 or an electronic extension of time)? Web of the two nonprofits, covenant families for brighter tomorrows will focus on education around the impact and prevention of school shootings and improving. Date of incorporation in the state of l.

![I20 Form for the US student visa [2021] Study in USA](https://blog.zolve.com/content/images/2021/04/I-2o-new-1.PNG)