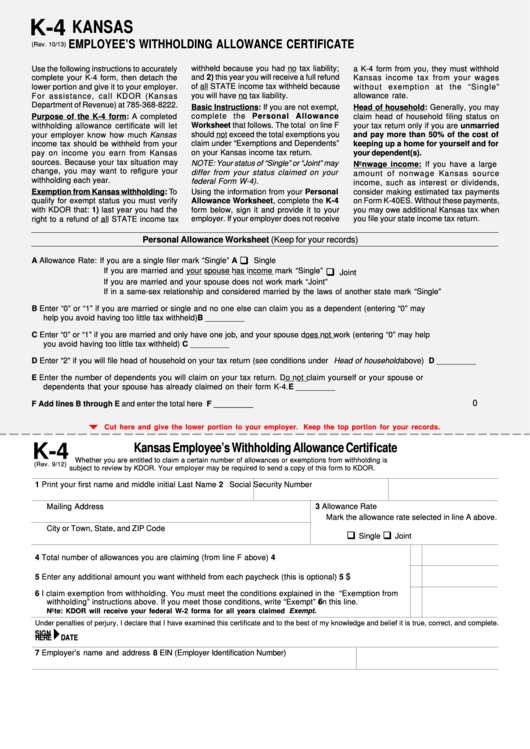

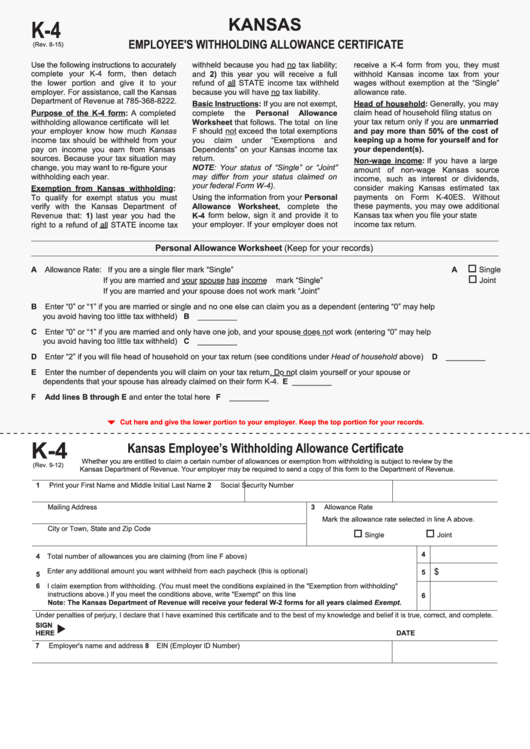

Kansas K 4 Form

Kansas K 4 Form - Enter the date the k4 should be effective.* enter the date the k4 should be effective step 2. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. 5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable income for federal and state. Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. To allow for these differences. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web click on the links below to view the forms for that tax type. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Individual incomeand estimated income schedules. There are a few situations in which you can want to request.

The form can be filed electronically or on. First and last name * please enter your first and last name step 3. However, due to differences between state and. Income tax should be withheld from your pay on income you. Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. Enter the date the k4 should be effective.* enter the date the k4 should be effective step 2. Get ready for tax season deadlines by completing any required tax forms today. There are a few situations in which you can want to request. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. 5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable income for federal and state.

This form is for income earned in tax year 2022, with tax returns due in april. First and last name * please enter your first and last name step 3. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. The form can be filed electronically or on. However, due to differences between state and. State and federal tax policies and laws differ. 5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable income for federal and state. Income tax should be withheld from your pay on income you. Web click on the links below to view the forms for that tax type. There are a few situations in which you can want to request.

Kansas Withholding Form K 4 2022 W4 Form

Income tax should be withheld from your pay on income you. This form is for income earned in tax year 2022, with tax returns due in april. The form can be filed electronically or on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web kansas form.

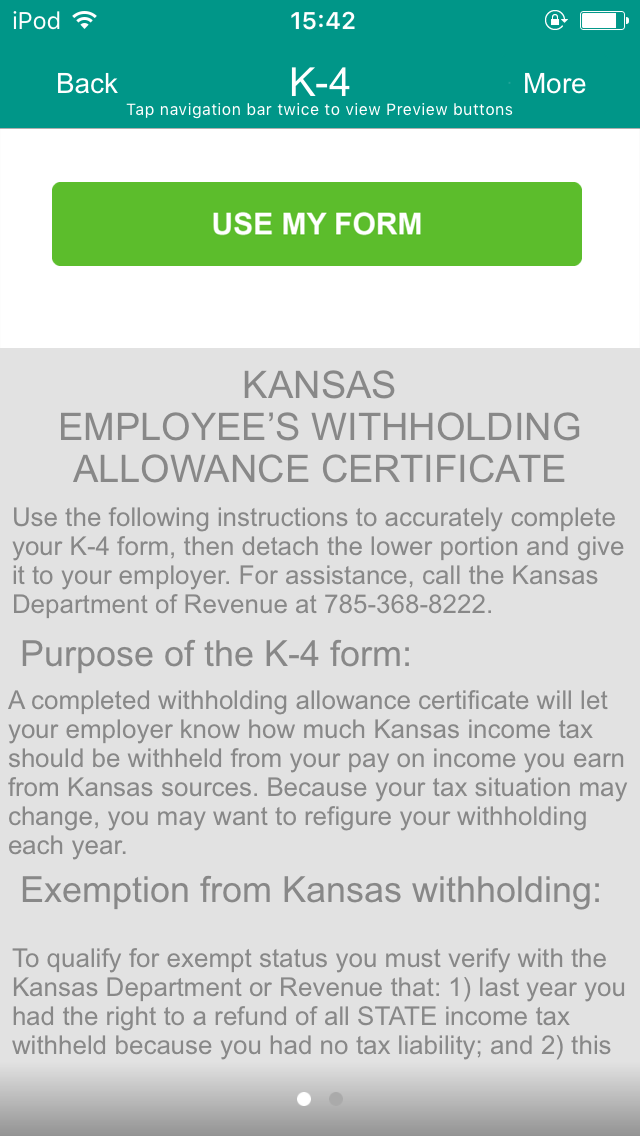

Kansas K4 App

There are a few situations in which you can want to request. A completed withholding allowance certiicate will let your employer know how much. This form is for income earned in tax year 2022, with tax returns due in april. However, due to differences between state and. Get ready for tax season deadlines by completing any required tax forms today.

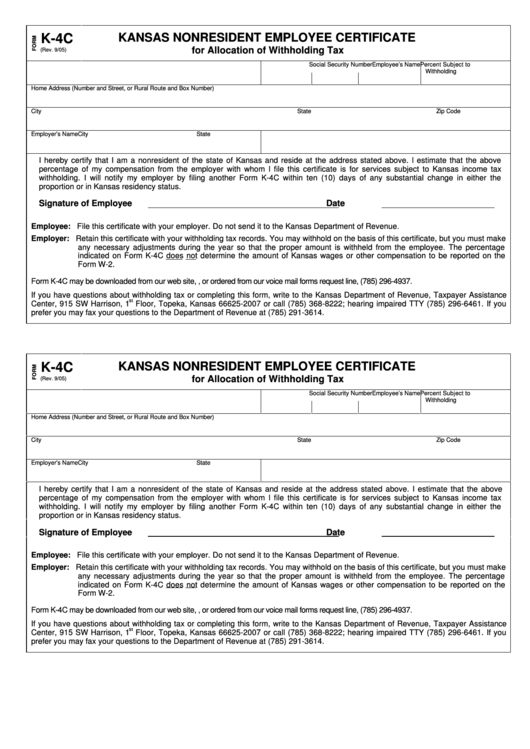

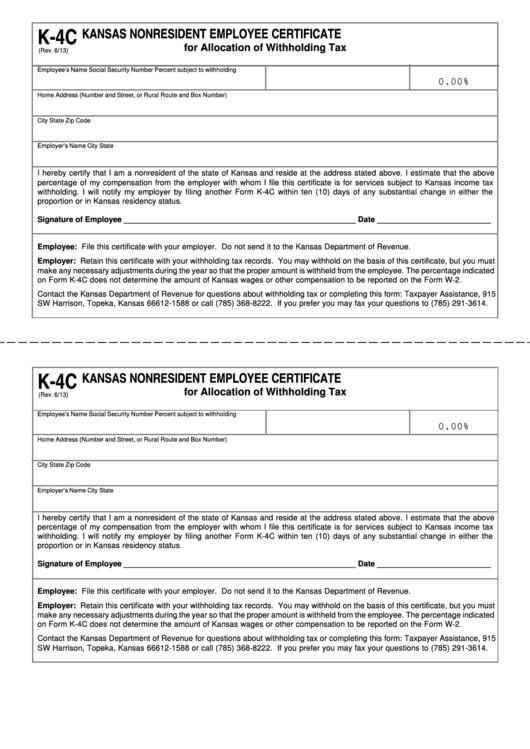

Fillable Form K4c Kansas Nonresident Employee Certificate For

Get ready for tax season deadlines by completing any required tax forms today. Enter the date the k4 should be effective.* enter the date the k4 should be effective step 2. To allow for these differences. The form can be filed electronically or on. First and last name * please enter your first and last name step 3.

Kansas K4 Form For State Withholding

5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable income for federal and state. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from.

Kansas Form C 2 2 A Fill Online, Printable, Fillable, Blank pdfFiller

State and federal tax policies and laws differ. This form is for income earned in tax year 2022, with tax returns due in april. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. 5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable.

2015 Form KS DoR K120 Fill Online, Printable, Fillable, Blank pdfFiller

Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. A completed withholding allowance certiicate will let your employer know how much. 5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable income for federal and state. Individual incomeand estimated.

Free K4 Kansas PDF 75KB 1 Page(s)

A completed withholding allowance certiicate will let your employer know how much. Get ready for tax season deadlines by completing any required tax forms today. State and federal tax policies and laws differ. 5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable income for federal and state. Individual incomeand estimated income schedules.

Employees Withholding Allowance Certificate Kansas Free Download

Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. State and federal tax policies and laws differ. Individual incomeand estimated income schedules. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay.

Fillable Form K4 Kansas Employee'S Withholding Allowance Certificate

There are a few situations in which you can want to request. To allow for these differences. State and federal tax policies and laws differ. Web click on the links below to view the forms for that tax type. 5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable income for federal and state.

Fillable Form K4c Kansas Nonresident Employee Certificate For

There are a few situations in which you can want to request. Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. However, due to differences between state and. Enter the date the k4 should be effective.* enter the date the k4 should be.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. Web click on the links below to view the forms for that tax type.

The Form Can Be Filed Electronically Or On.

State and federal tax policies and laws differ. 5/11) kansas withholding from unemployment insurance benefits unemployment benefits you receive are considered taxable income for federal and state. Enter the date the k4 should be effective.* enter the date the k4 should be effective step 2. First and last name * please enter your first and last name step 3.

However, Due To Differences Between State And.

Get ready for tax season deadlines by completing any required tax forms today. There are a few situations in which you can want to request. Income tax should be withheld from your pay on income you. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

A Completed Withholding Allowance Certiicate Will Let Your Employer Know How Much.

To allow for these differences. Individual incomeand estimated income schedules.