Llc To C Corp Form

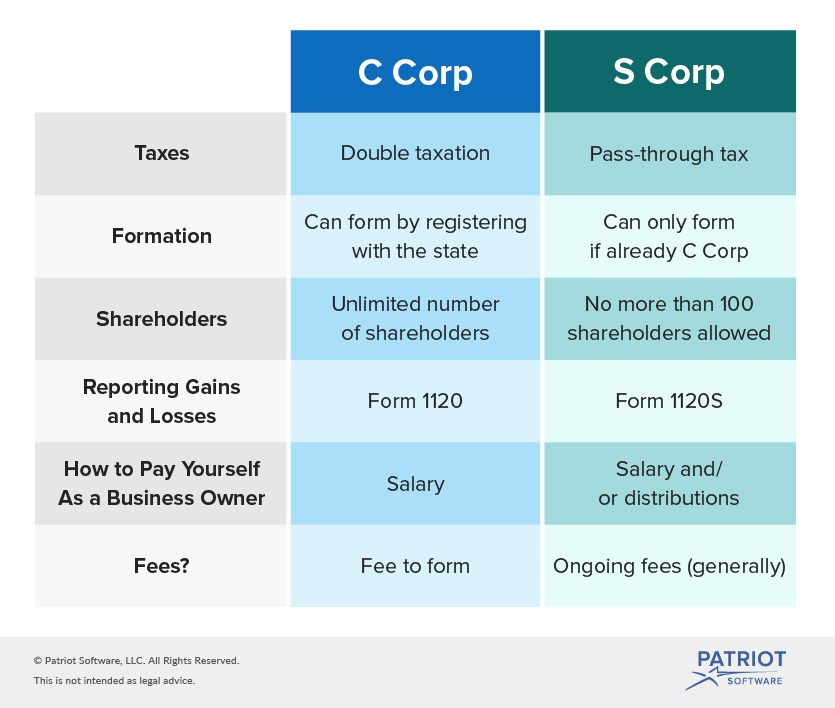

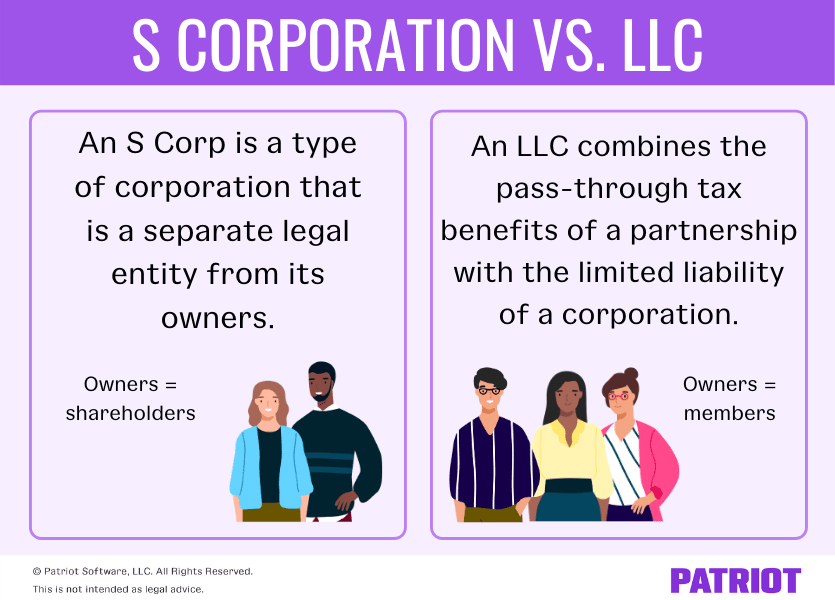

Llc To C Corp Form - File a merger certificate and other legal paperwork with the state regulatory office step 4: Enter the information for the new card or bank account, and then select add. You’ll also need to consider whether to structure as an s corporation or a c corporation. Go to billing > bills & payments > payment methods. Prepare a merger agreement step 2: Web just like bing chat, bing chat enterprise is grounded in web data and provides complete, verifiable answers with citations, along with visual answers that include graphs, charts and images, and is designed in line with our ai principles. Sign in to the microsoft 365 admin center with your admin credentials. An entity disregarded as separate from its owner. Introduction irs form 8832 is also known as entity classification election. Web llcs can also provide for “pass through” tax treatment so that there is not the double level of tax found with c corporations.

Go to billing > bills & payments > payment methods. Web just like bing chat, bing chat enterprise is grounded in web data and provides complete, verifiable answers with citations, along with visual answers that include graphs, charts and images, and is designed in line with our ai principles. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: Only the owners of the llc are taxed (unless a voluntary. Bing chat enterprise is rolling out in preview today and is included at no additional cost in microsoft. File a merger certificate and other legal paperwork with the state regulatory office step 4: Select add a payment method. Enter the information for the new card or bank account, and then select add. The irs offers three tax classification entities to businesses: Web add a payment method.

You’ll also need to consider whether to structure as an s corporation or a c corporation. Go to billing > bills & payments > payment methods. Select add a payment method. Bing chat enterprise is rolling out in preview today and is included at no additional cost in microsoft. Sign in to the microsoft 365 admin center with your admin credentials. The irs offers three tax classification entities to businesses: Prepare a merger agreement step 2: Web add a payment method. Dissolve the old llc and start running the c corporation An entity disregarded as separate from its owner.

Ccorp vs. LLC Which is best for your business Carta

An entity disregarded as separate from its owner. Introduction irs form 8832 is also known as entity classification election. Only the owners of the llc are taxed (unless a voluntary. You’ll also need to consider whether to structure as an s corporation or a c corporation. Select add a payment method.

LLC vs S Corp vs C Corp vs Partnership vs Sole Prop Mazuma USA

You’ll also need to consider whether to structure as an s corporation or a c corporation. Web add a payment method. File a merger certificate and other legal paperwork with the state regulatory office step 4: Web just like bing chat, bing chat enterprise is grounded in web data and provides complete, verifiable answers with citations, along with visual answers.

CCorporation Formation Services EZ Incorporate C corporation

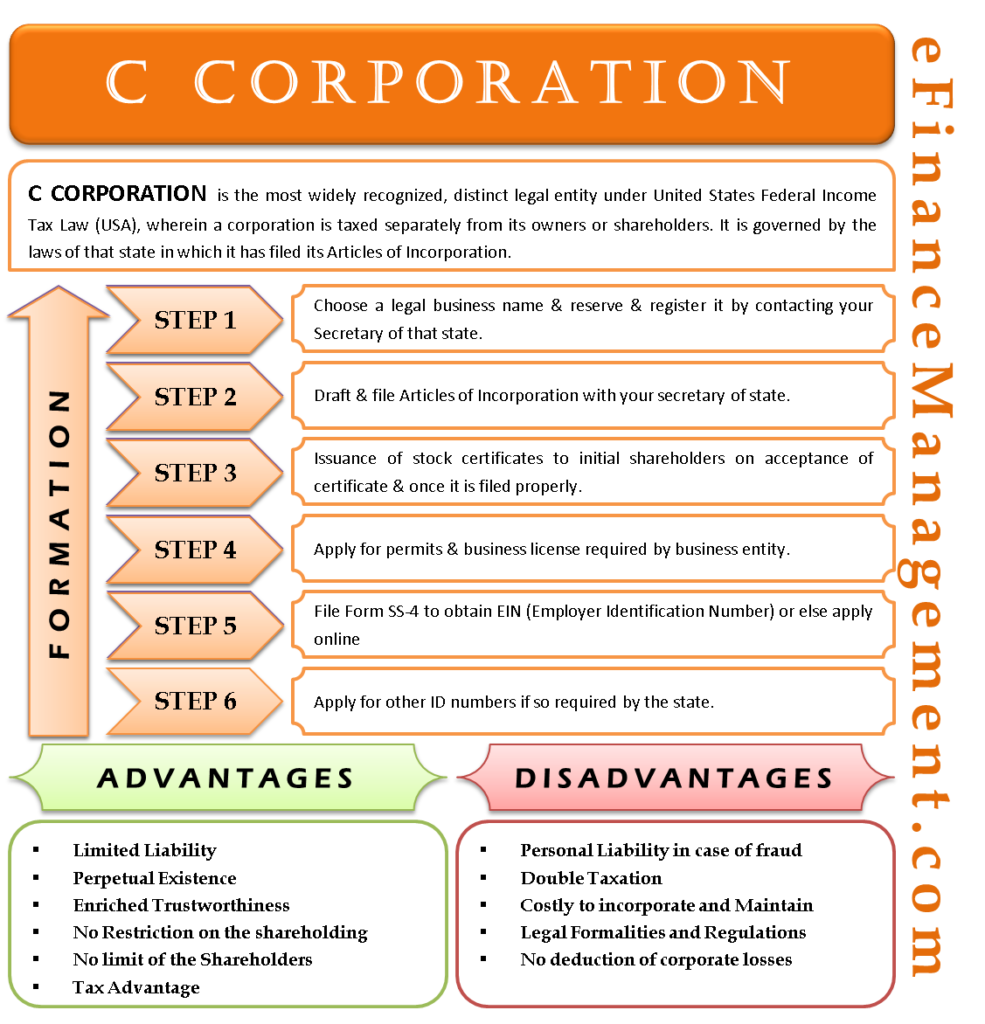

January 7, 2023 by the truic team convert llc to c corp from simplifying stock compensation to lowering taxes, there are multiple reasons to consider converting your llc into a corporation. An entity disregarded as separate from its owner. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: Web if.

Hvad er forskellen mellem S Corp og C Corp? / Virksomhedsoversigt

Sign in to the microsoft 365 admin center with your admin credentials. Introduction irs form 8832 is also known as entity classification election. Web if the llc is a corporation, normal corporate tax rules will apply to the llc and it should file a form 1120, u.s. Web llcs can also provide for “pass through” tax treatment so that there.

LLC & C CORP Form (Form A)

You’ll also need to consider whether to structure as an s corporation or a c corporation. Sign in to the microsoft 365 admin center with your admin credentials. File a merger certificate and other legal paperwork with the state regulatory office step 4: Web an eligible entity uses form 8832 to elect how it will be classified for federal tax.

LLC VS. C CORP Key Points To Help You Choose ALCOR FUND

Dissolve the old llc and start running the c corporation Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: You’ll also need to consider whether to structure as an s corporation or a c corporation. Go to billing > bills & payments > payment methods. Sign in to the microsoft.

SCorp Vs CCorp Business structure, Accounting services, Corporate

Go to billing > bills & payments > payment methods. Prepare a merger agreement step 2: Web just like bing chat, bing chat enterprise is grounded in web data and provides complete, verifiable answers with citations, along with visual answers that include graphs, charts and images, and is designed in line with our ai principles. Web llcs can also provide.

S Corp vs. LLC Q&A, Pros & Cons of Each, & More

Web if the llc is a corporation, normal corporate tax rules will apply to the llc and it should file a form 1120, u.s. Only the owners of the llc are taxed (unless a voluntary. An entity disregarded as separate from its owner. Have the llc’s members (also the shareholders of the c corporation) approve the merger and give up.

C Corporation Defintiion, Formation (Steps), Advantages, Disadvantages

Web add a payment method. Select add a payment method. The irs offers three tax classification entities to businesses: Introduction irs form 8832 is also known as entity classification election. Web llcs can also provide for “pass through” tax treatment so that there is not the double level of tax found with c corporations.

LLC taxed as CCorp (Form 8832) [Pros and cons] LLCU® (2023)

Dissolve the old llc and start running the c corporation Introduction irs form 8832 is also known as entity classification election. Web add a payment method. You’ll also need to consider whether to structure as an s corporation or a c corporation. Go to billing > bills & payments > payment methods.

Web If The Llc Is A Corporation, Normal Corporate Tax Rules Will Apply To The Llc And It Should File A Form 1120, U.s.

An entity disregarded as separate from its owner. Web llcs can also provide for “pass through” tax treatment so that there is not the double level of tax found with c corporations. Dissolve the old llc and start running the c corporation Go to billing > bills & payments > payment methods.

Bing Chat Enterprise Is Rolling Out In Preview Today And Is Included At No Additional Cost In Microsoft.

January 7, 2023 by the truic team convert llc to c corp from simplifying stock compensation to lowering taxes, there are multiple reasons to consider converting your llc into a corporation. Introduction irs form 8832 is also known as entity classification election. The irs offers three tax classification entities to businesses: Only the owners of the llc are taxed (unless a voluntary.

Select Add A Payment Method.

Web add a payment method. File a merger certificate and other legal paperwork with the state regulatory office step 4: Sign in to the microsoft 365 admin center with your admin credentials. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as:

Have The Llc’s Members (Also The Shareholders Of The C Corporation) Approve The Merger And Give Up Their Llc Membership Rights Step 3:

Prepare a merger agreement step 2: Web just like bing chat, bing chat enterprise is grounded in web data and provides complete, verifiable answers with citations, along with visual answers that include graphs, charts and images, and is designed in line with our ai principles. Enter the information for the new card or bank account, and then select add. You’ll also need to consider whether to structure as an s corporation or a c corporation.

![LLC taxed as CCorp (Form 8832) [Pros and cons] LLCU® (2023)](https://www.llcuniversity.com/wp-content/uploads/IRS-CP277-Form-8832-Approval.jpg)