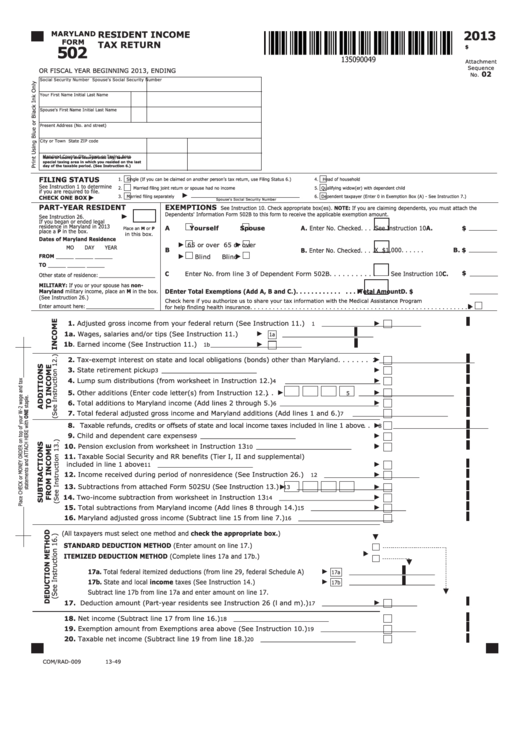

Maryland Form 502

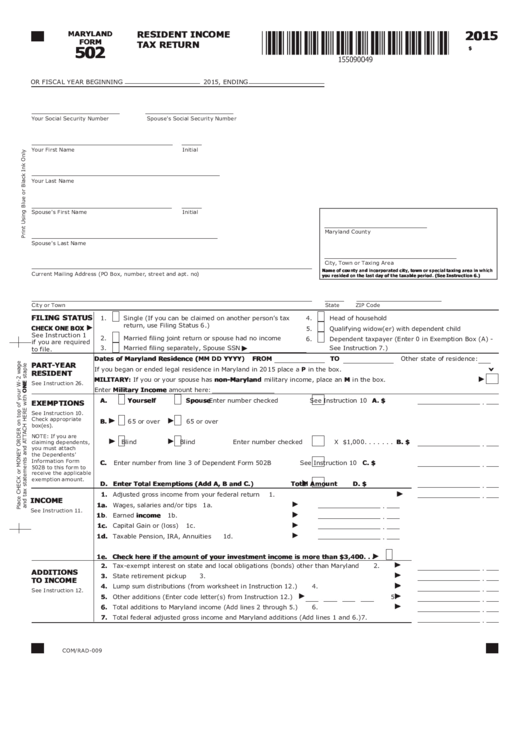

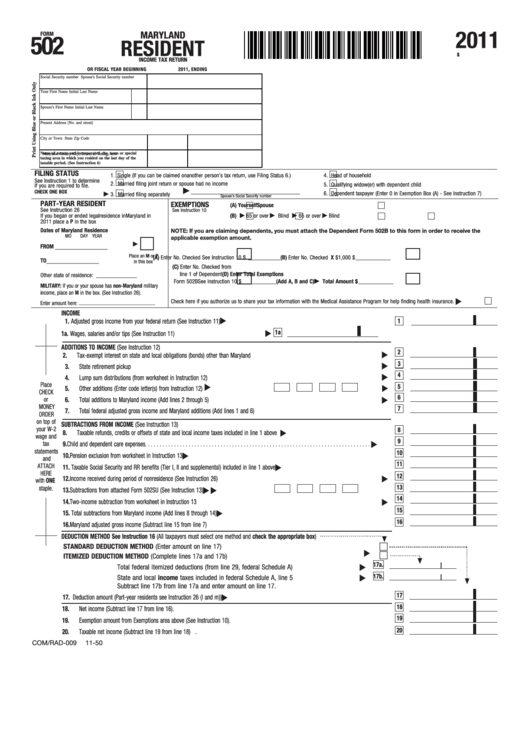

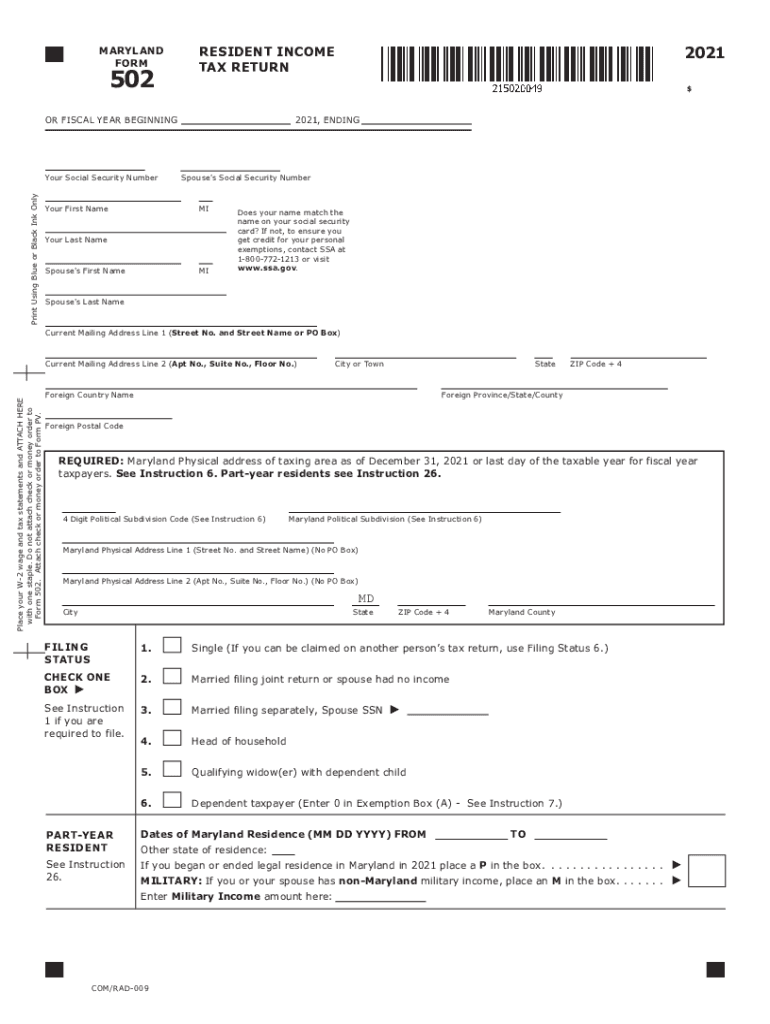

Maryland Form 502 - Enter the maryland adjusted gross income reported on your maryland state income tax return form 502 (line 16) for the most recent prior tax. If you are claiming any. Web maryland adjusted gross income. Web individual tax forms are ready taxpayers eligible to subtract unemployment benefits must use maryland form 502lu annapolis, md. Maryland physical address of taxing area as of december 31, 2020 or last day of the taxable year for fiscal year taxpayers. Get ready for tax season deadlines by completing any required tax forms today. Web maryland form 502b ependents' information 2015 tta t rm 502 505 r 515 d026 page 2 dependent 7 dependent 8 dependent 9 dependent 10 dependent 11. Get ready for tax season deadlines by completing any required tax forms today. Form 502 is the individual income tax return form for residents that are not claiming any dependants. Web subject to maryland corporation income tax.

Form to be used when claiming. Web according to maryland instructions for form 502, you are required to file a maryland income tax return if you are or were a maryland resident, you are required to file a. Maryland resident income tax return: Web maryland form 502b ependents' information 2015 tta t rm 502 505 r 515 d026 page 2 dependent 7 dependent 8 dependent 9 dependent 10 dependent 11. Check here if you authorize your paid. Do not attach form pv or check/money order to form 502. (1) enter the corporation name,. Web we last updated the retirement income form in january 2023, so this is the latest version of form 502r, fully updated for tax year 2022. Web individual tax forms are ready taxpayers eligible to subtract unemployment benefits must use maryland form 502lu annapolis, md. Web maryland adjusted gross income.

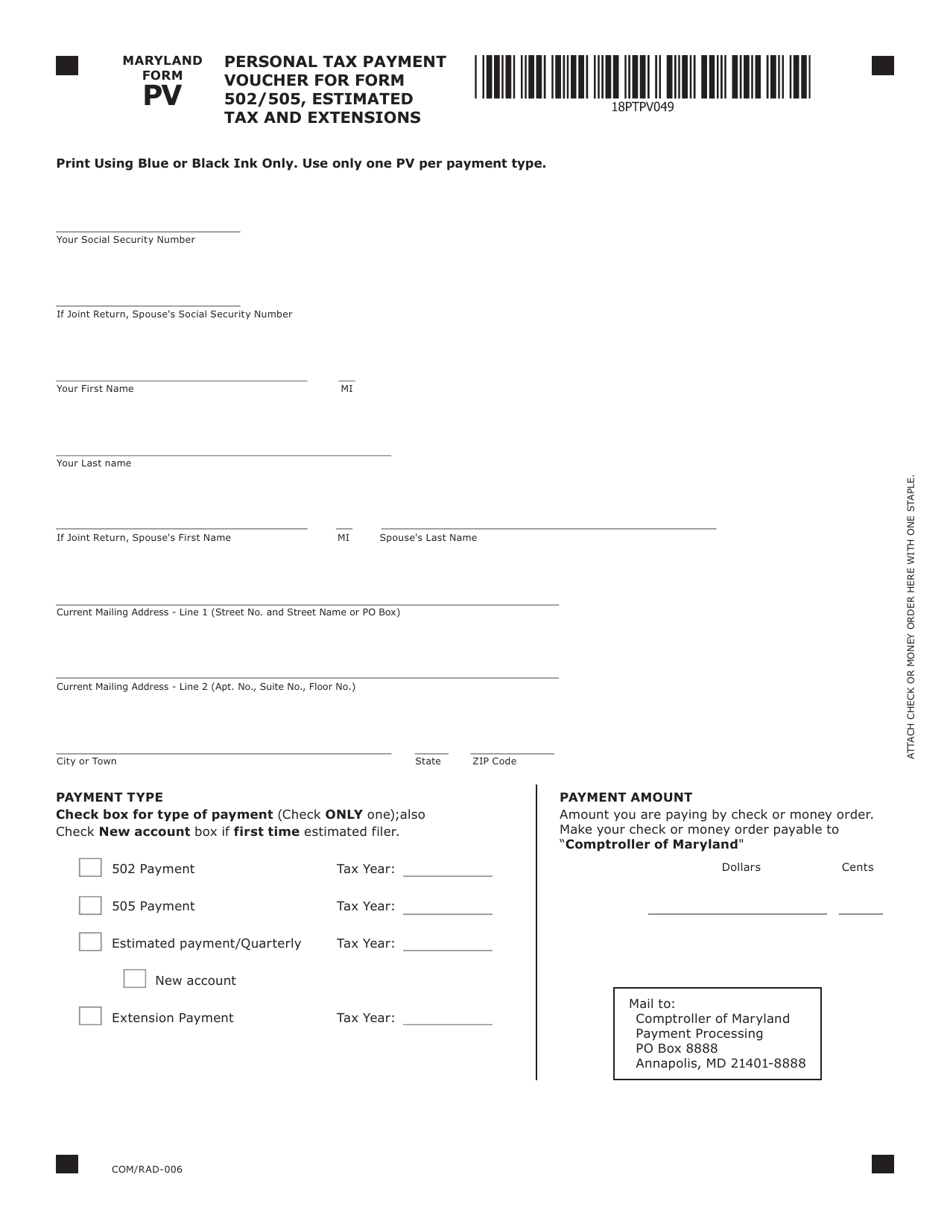

If you are claiming any. Get ready for tax season deadlines by completing any required tax forms today. Use form 500 to calculate the amount of maryland corporation income tax. When and where to file. Web we last updated the retirement income form in january 2023, so this is the latest version of form 502r, fully updated for tax year 2022. Web we last updated maryland form 502 in january 2023 from the maryland comptroller of maryland. You can download or print. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Place form pv with attached check/money order on top of form 502 and mail to:

Maryland Form 502 Resident Tax Return 2014 printable pdf

Enter the maryland adjusted gross income reported on your maryland state income tax return form 502 (line 16) for the most recent prior tax. Complete, edit or print tax forms instantly. If you are claiming any. You can download or print current or past. When and where to file.

Fillable Maryland Form 502 Resident Tax Return 2015

Get ready for tax season deadlines by completing any required tax forms today. Form and instructions for individuals claiming personal income tax credits,. If you wish to calculate your maryland 502 (resident) return on paper before using this application, click here for forms and. Web according to maryland instructions for form 502, you are required to file a maryland income.

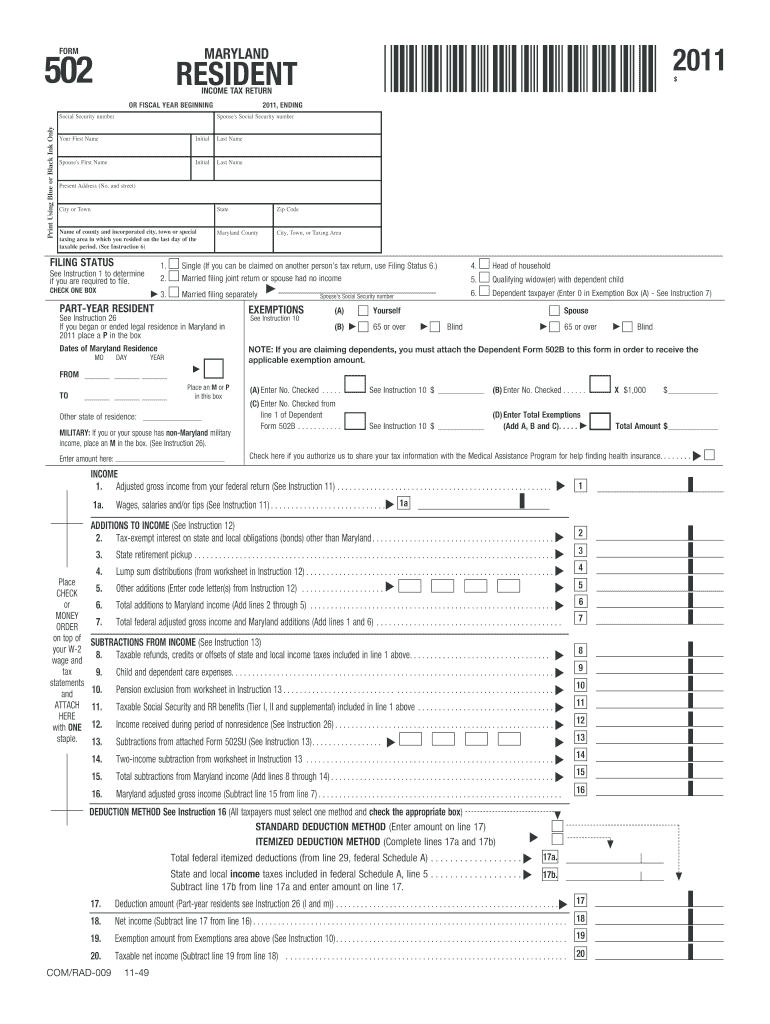

Fillable Form 502 Maryland Resident Tax Return 2011

Place form pv with attached check/money order on top of form 502 and mail to: Web maryland adjusted gross income. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505,.

2021 Form MD Comptroller 502 Fill Online, Printable, Fillable, Blank

Web maryland form 502b ependents' information 2015 tta t rm 502 505 r 515 d026 page 2 dependent 7 dependent 8 dependent 9 dependent 10 dependent 11. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Web individual tax forms.

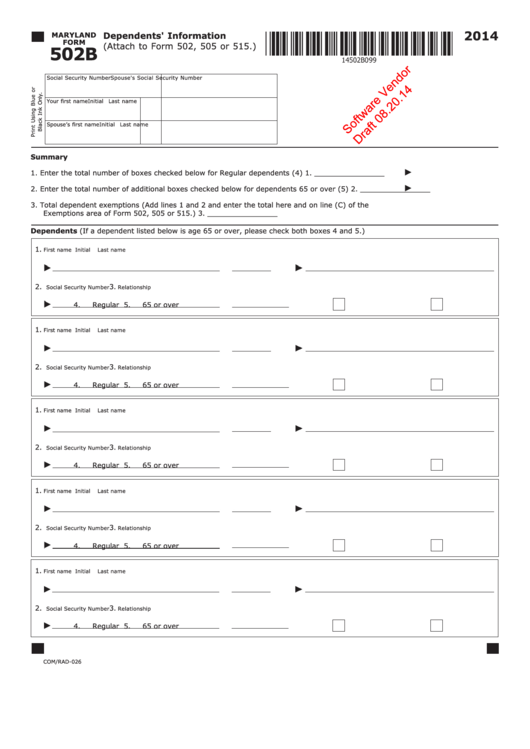

Maryland Form 502b Draft Dependents' Information 2014 printable pdf

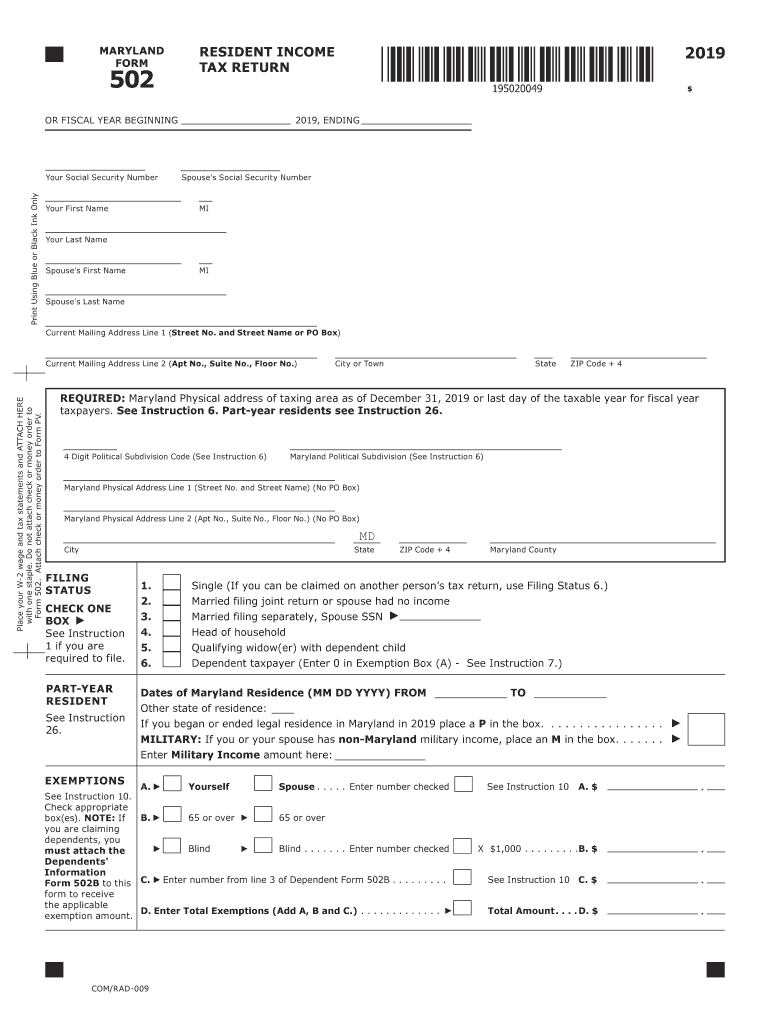

Maryland resident income tax return: Web we last updated the maryland resident income tax return in january 2023, so this is the latest version of form 502, fully updated for tax year 2022. Form to be used when claiming. Web maryland form 502b ependents' information 2015 tta t rm 502 505 r 515 d026 page 2 dependent 7 dependent 8.

2019 Maryland Form 502 Instructions designshavelife

Place form pv with attached check/money order on top of form 502 and mail to: Enter the social security number for each taxpayer. Web maryland adjusted gross income. Web maryland form 502b ependents' information 2015 tta t rm 502 505 r 515 d026 page 2 dependent 7 dependent 8 dependent 9 dependent 10 dependent 11. Maryland physical address of taxing.

2019 Form MD Comptroller 502 Fill Online, Printable, Fillable, Blank

Get ready for tax season deadlines by completing any required tax forms today. (1) enter the corporation name,. Complete, edit or print tax forms instantly. Maryland resident income tax return: Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs

2011 Form MD Comptroller 502 Fill Online, Printable, Fillable, Blank

When and where to file. This form is for income earned in tax year 2022, with tax returns due in april. Do not attach form pv or check/money order to form 502. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Maryland Form PV Download Fillable PDF or Fill Online

Check here if you authorize your paid. Web printable maryland income tax form 502. Enter the maryland adjusted gross income reported on your maryland state income tax return form 502 (line 16) for the most recent prior tax. Complete, edit or print tax forms instantly. You can download or print current or past.

Fillable Maryland Form 502 Resident Tax Return 2013

Use form 500 to calculate the amount of maryland corporation income tax. Maryland resident income tax return: Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying.

Web Individual Tax Forms Are Ready Taxpayers Eligible To Subtract Unemployment Benefits Must Use Maryland Form 502Lu Annapolis, Md.

You can download or print current or past. Web shown on form 502, form 505, form 515 or form 504 in the designated area. Get ready for tax season deadlines by completing any required tax forms today. Web subject to maryland corporation income tax.

Web We Last Updated Maryland Form 502 In January 2023 From The Maryland Comptroller Of Maryland.

Web maryland form 502b ependents' information 2015 tta t rm 502 505 r 515 d026 page 2 dependent 7 dependent 8 dependent 9 dependent 10 dependent 11. Form to be used when claiming. When and where to file. If you wish to calculate your maryland 502 (resident) return on paper before using this application, click here for forms and.

You Can Download Or Print.

Enter the maryland adjusted gross income reported on your maryland state income tax return form 502 (line 16) for the most recent prior tax. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. Web we last updated the maryland resident income tax return in january 2023, so this is the latest version of form 502, fully updated for tax year 2022. Web we last updated the retirement income form in january 2023, so this is the latest version of form 502r, fully updated for tax year 2022.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Web according to maryland instructions for form 502, you are required to file a maryland income tax return if you are or were a maryland resident, you are required to file a. Complete, edit or print tax forms instantly. Web visit the irs free file web page to see if you qualify. Do not attach form pv or check/money order to form 502.