Maryland Tax Form 505

Maryland Tax Form 505 - Complete, edit or print tax forms instantly. Web amended tax return maryland form 505x 2021 20. Any income that is related to tangible or intangible property that was seized, misappropriated. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated maryland form 505nr in january 2023 from the maryland comptroller of maryland. Multiply line 13 by.0125 (1.25%). Form to be used when claiming dependents. Get the most out of. Web maryland tax, you must also file form 505. If you must amend a tax year prior to 01/01/2011, you should obtain a form 505x and a nonresident tax booklet for the year you wish to amend so.

Multiply line 13 by.0125 (1.25%). Web form 505x requires you to list multiple forms of income, such as wages, interest, or alimony. Enter this amount on line. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Download or email md 505nr & more fillable forms, register and subscribe now! Web maryland resident income tax return: Get the most out of. Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Download or email md 505nr & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly.

Web • 502x maryland amended tax form and instructions • 505 nonresident income tax return • 505x nonresident amended tax return all forms will be available at. We last updated the maryland nonresident amended tax return in january. This year i do not expect to owe any maryland income tax. Complete, edit or print tax forms instantly. Web maryland tax, you must also file form 505. Web maryland resident income tax return: Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Enter this amount on line. For returns filed without payments, mail your completed return to: You can download or print.

Fill Free fillable forms Comptroller of Maryland

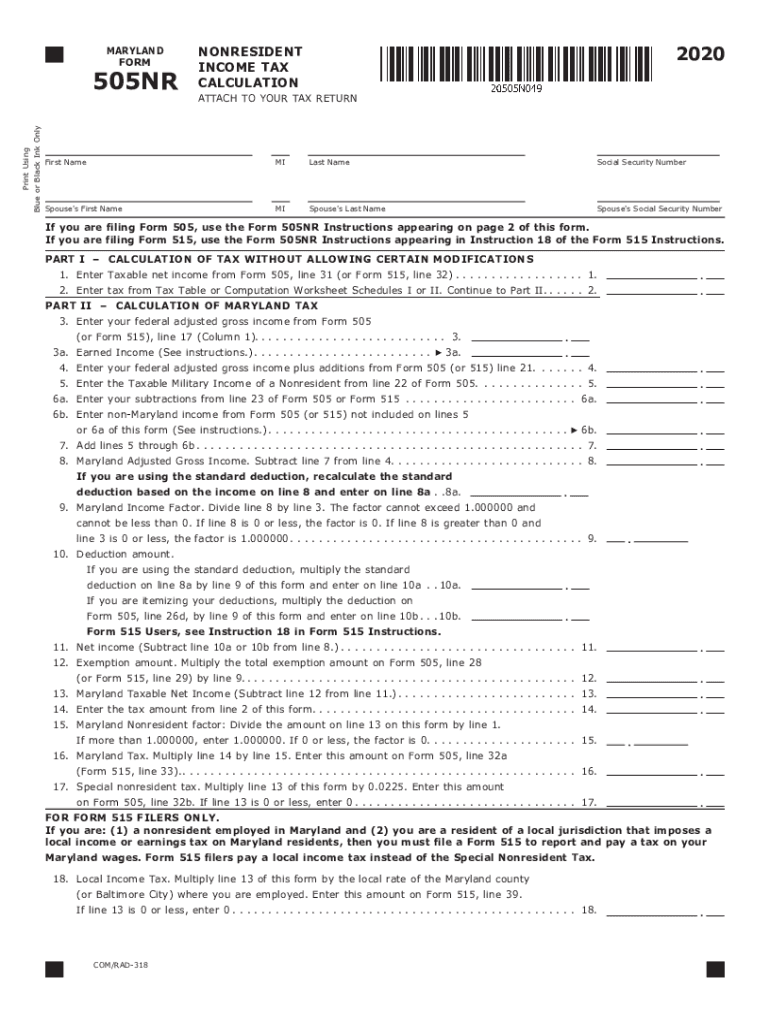

Web maryland resident income tax return: Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income. Multiply line 13 by.0125 (1.25%). Complete, edit or print tax forms instantly. Form to be used when claiming dependents.

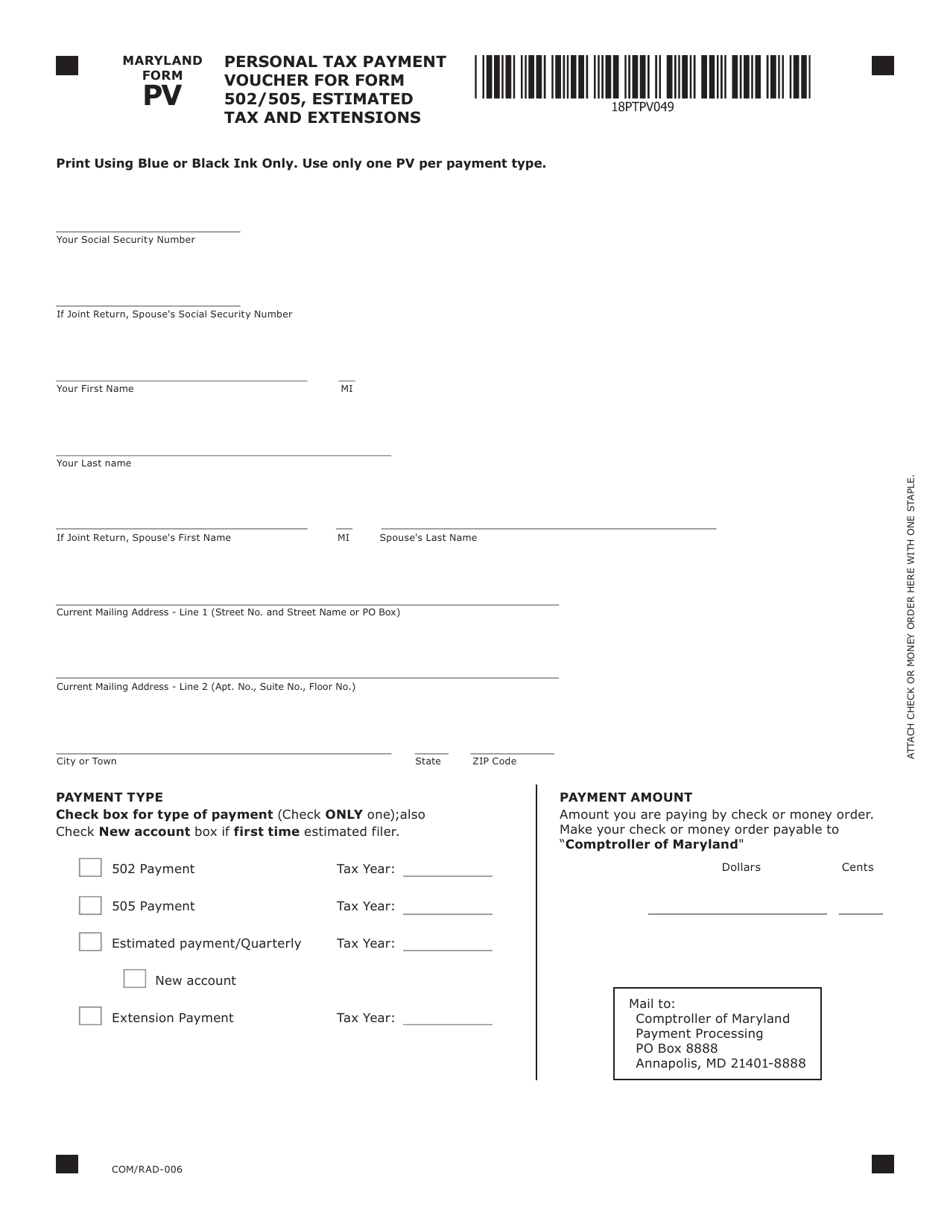

Maryland Form PV Download Fillable PDF or Fill Online

Download or email md 505nr & more fillable forms, register and subscribe now! Any income that is related to tangible or intangible property that was seized, misappropriated. Web last year i did not owe any maryland income tax and had a right to a full refund of all income tax withheld and b. We last updated the maryland nonresident amended.

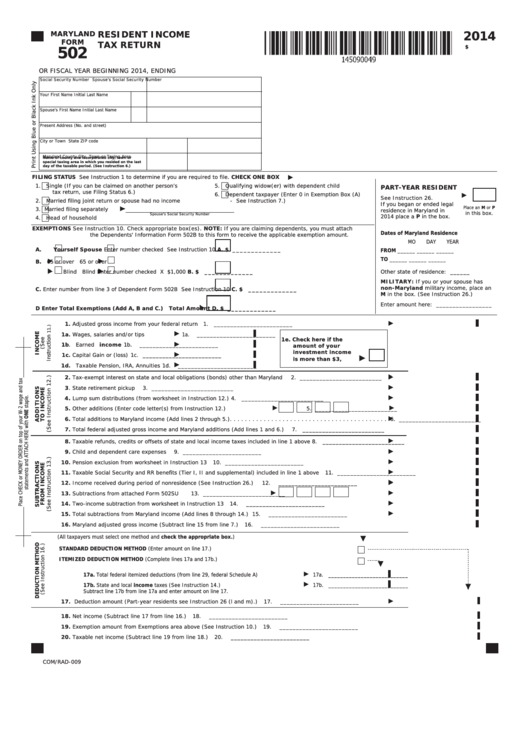

Fillable Form 502 Maryland Resident Tax Return 2014

Web maryland 2021 form 505 nonresident income tax return or fiscal year beginning 2021, ending social security number spouse's social security number. Your signature date spouse’s signature date signature of preparer other than taxpayer. Web amended tax return maryland form 505x 2021 20. Balance due (if line 14 is more than line 19, subtract line 19 from line 14. Complete,.

Fill Free fillable forms Comptroller of Maryland

Get the most out of. Balance due (if line 14 is more than line 19, subtract line 19 from line 14. Web maryland resident income tax return: Web we last updated the nonresident income tax computation in january 2023, so this is the latest version of form 505nr, fully updated for tax year 2022. Enter this amount on line 16.

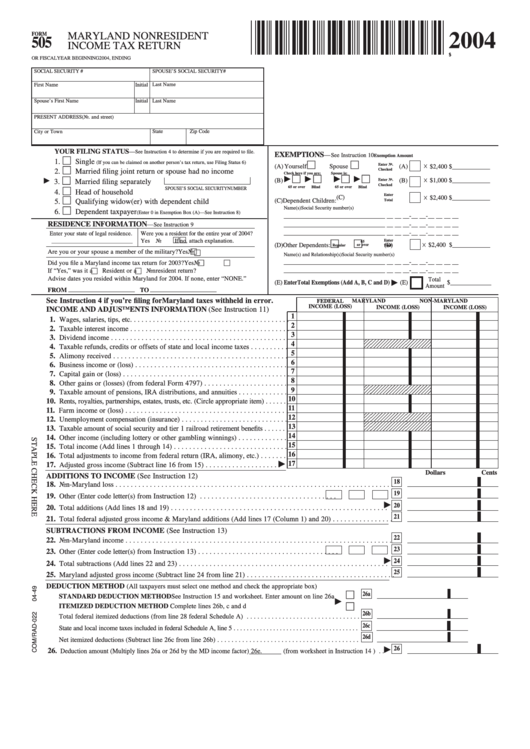

Fillable Form 505 Maryland Nonresident Tax Return 2004

This form is for income earned in tax year 2022, with tax returns due in april. Web multiply line 14 by line 15 to arrive at your maryland tax. Web maryland 2021 form 505 nonresident income tax return or fiscal year beginning 2021, ending social security number spouse's social security number. Web if both spouses have income subject to maryland.

Fill Free fillable Form 505 2019 NONRESIDENT TAX RETURN

Your signature date spouse’s signature date signature of preparer other than taxpayer. Web maryland resident income tax return: Web multiply line 14 by line 15 to arrive at your maryland tax. This year i do not expect to owe any maryland income tax. Web form 505x requires you to list multiple forms of income, such as wages, interest, or alimony.

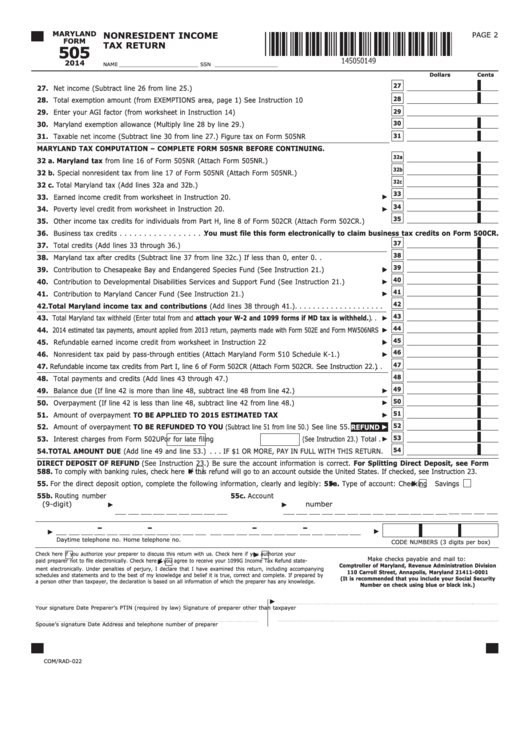

Fillable Maryland Form 505 Nonresident Tax Return 2014

If you must amend a tax year prior to 01/01/2011, you should obtain a form 505x and a nonresident tax booklet for the year you wish to amend so. Web we last updated maryland form 505nr in january 2023 from the maryland comptroller of maryland. This form is for income earned in tax year 2022, with tax returns due in.

Fill Free fillable Form 505 2019 NONRESIDENT TAX RETURN

Download or email md 505nr & more fillable forms, register and subscribe now! Web multiply line 14 by line 15 to arrive at your maryland tax. This form is for income earned in tax year 2022, with tax returns due in april. Web form 505 nonresident return taxpayer who maintains a place of abode (that is, a place to live).

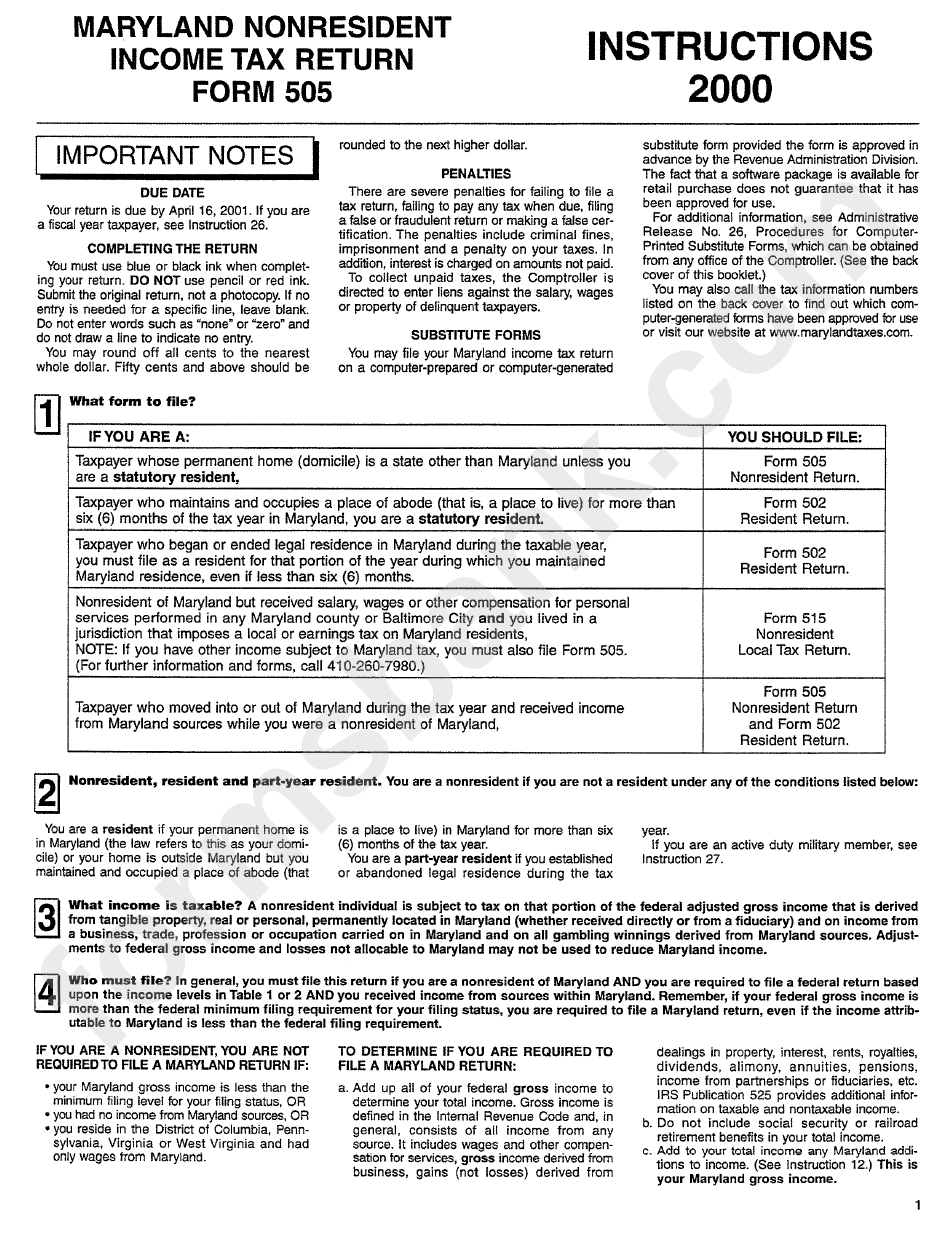

Form 505 Maryland Nonresident Tax Return 2000 printable pdf

We last updated the maryland nonresident amended tax return in january. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Enter this amount on line 16 and on form 505, line 32a. Balance due (if line 14 is more than line 19, subtract line 19 from line 14. You can download or print.

Maryland Form 505 Fill Out and Sign Printable PDF Template signNow

Your signature date spouse’s signature date signature of preparer other than taxpayer. Web form 505 nonresident return taxpayer who maintains a place of abode (that is, a place to live) for more than six (6) months of the tax year in maryland and you are physically. Return taxpayer who moved into or out. Enter this amount on line 16 and.

Overpayment (If Line 14 Is Less.

We last updated the maryland nonresident amended tax return in january. Web maryland 2021 form 505 nonresident income tax return or fiscal year beginning 2021, ending social security number spouse's social security number. Multiply line 13 by.0125 (1.25%). Web form 505x requires you to list multiple forms of income, such as wages, interest, or alimony.

Enter This Amount On Line.

Web maryland resident income tax return: Web form 505 nonresident return taxpayer who maintains a place of abode (that is, a place to live) for more than six (6) months of the tax year in maryland and you are physically. Web last year i did not owe any maryland income tax and had a right to a full refund of all income tax withheld and b. For returns filed without payments, mail your completed return to:

Web Maryland Tax, You Must Also File Form 505.

Web • 502x maryland amended tax form and instructions • 505 nonresident income tax return • 505x nonresident amended tax return all forms will be available at. Download or email md 505nr & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. This year i do not expect to owe any maryland income tax.

Get The Most Out Of.

Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Download or email md 505nr & more fillable forms, register and subscribe now! This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated the nonresident income tax computation in january 2023, so this is the latest version of form 505nr, fully updated for tax year 2022.