Md Withholding Form

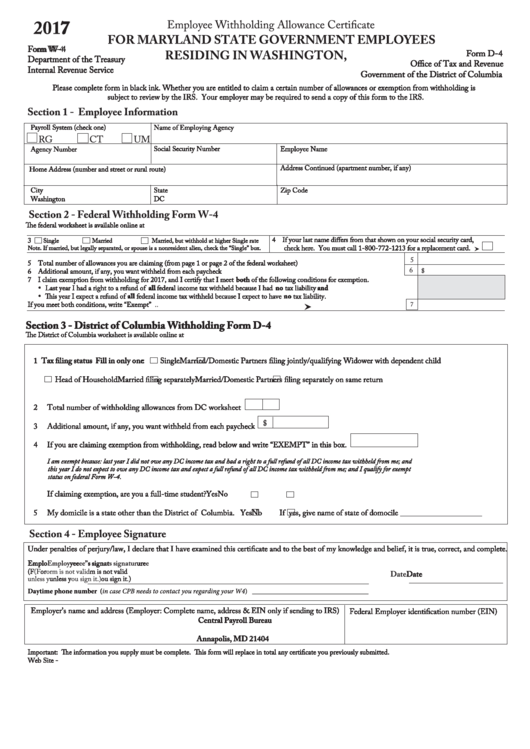

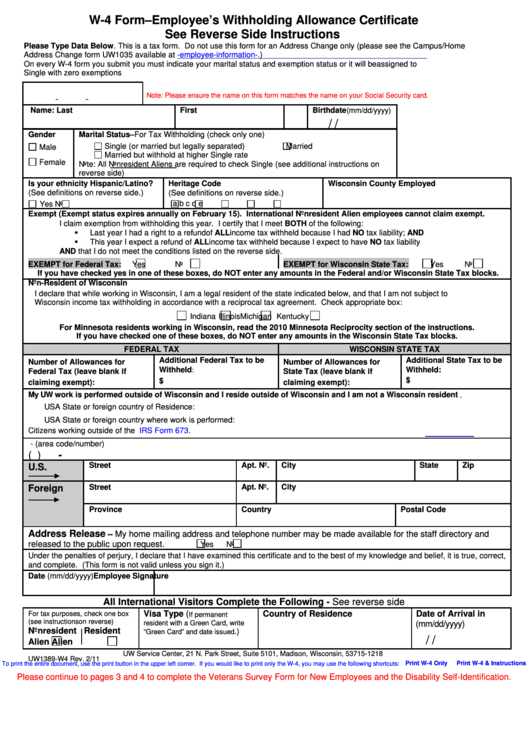

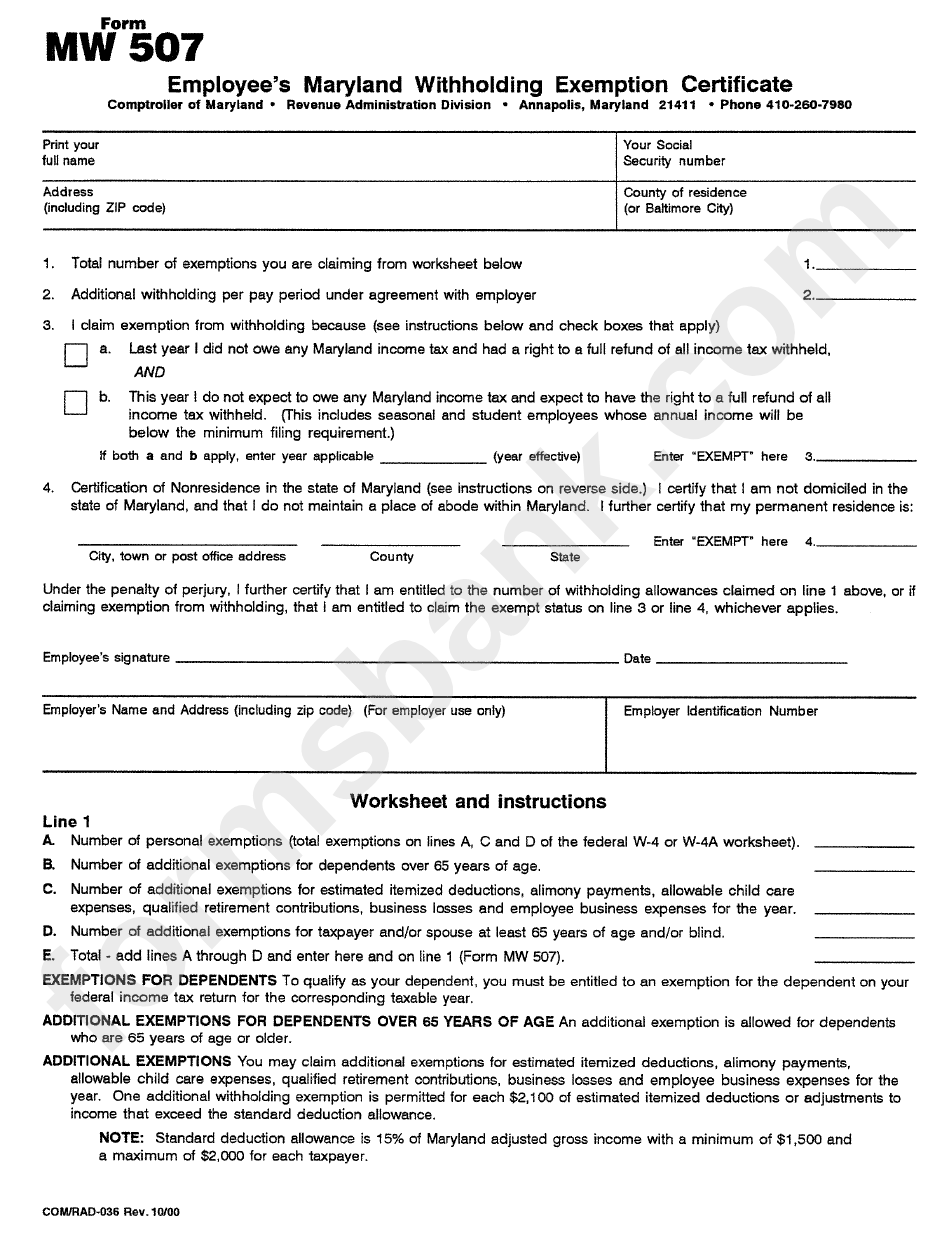

Md Withholding Form - For maryland state government employees only. To learn how many exemptions you’re entitled to, continue to the personal exemptions. Consider completing a new form mw507 each year and when your. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. For maryland state government employees only. Web 7 rows form used by individuals to direct their employer to withhold maryland income. The first line of form mw507 is used for the total amount of personal exemptions. Form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their. Web 2023 individual income tax forms. All employers must register with maryland.

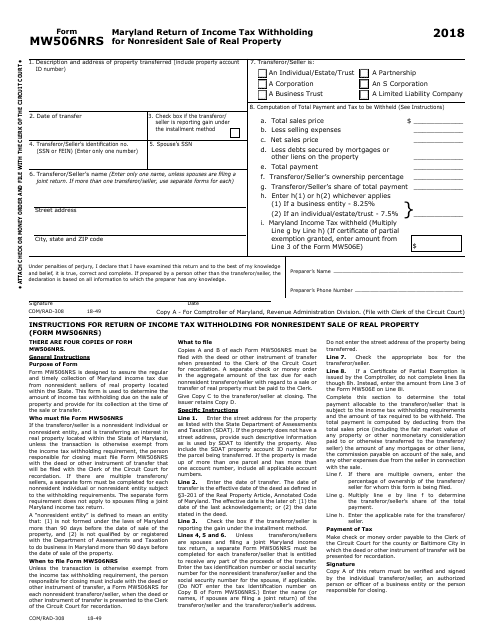

I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Web form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time. Web the law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold federal and state income tax. Web 7 rows form used by individuals to direct their employer to withhold maryland income. Web employee's maryland withholding exemption certificate: Use this form to designate your withholding allowances if you live in maryland. For additional information, visit income tax for individual taxpayers > filing information. All employers must register with maryland. Web the maryland withholding and payment requirements. To learn how many exemptions you’re entitled to, continue to the personal exemptions.

Web 7 rows form used by individuals to direct their employer to withhold maryland income. Web the law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold federal and state income tax. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. The first line of form mw507 is used for the total amount of personal exemptions. All employers must register with maryland. Web form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time. For additional information, visit income tax for individual taxpayers > filing information. Use this form to designate your withholding allowances if you live in maryland. All employers are required to register with the revenue administration. Web enter the amount of maryland state income tax withheld for the period being filed.

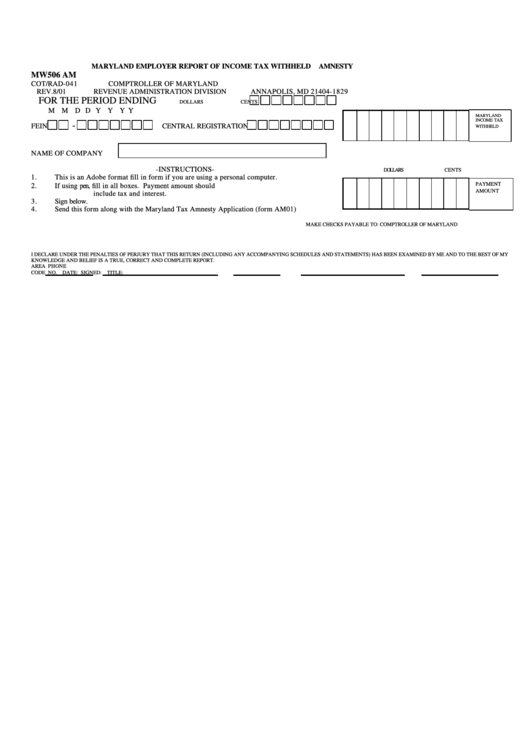

Fillable Form Mw506 Am Maryland Employer Report Of Tax

I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. For maryland state government employees only. Web 7 rows form used by individuals to direct their employer to withhold maryland income. All employers are required to register with the revenue administration..

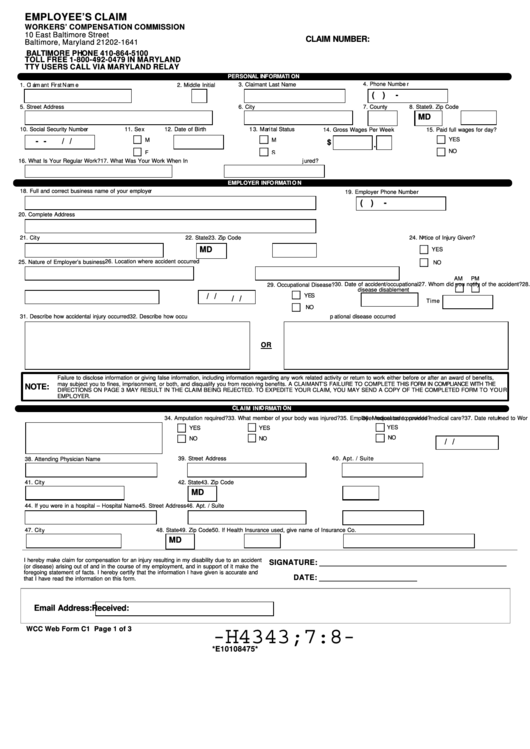

Fillable Employee'S Claim Form Workers' Compensation Commission

Ad register and subscribe now to work on your md employee's withholding certificate form. For maryland state government employees only. All employers are required to register with the revenue administration. Use this form to designate your withholding allowances if you live in maryland. ) bill pay ( make.

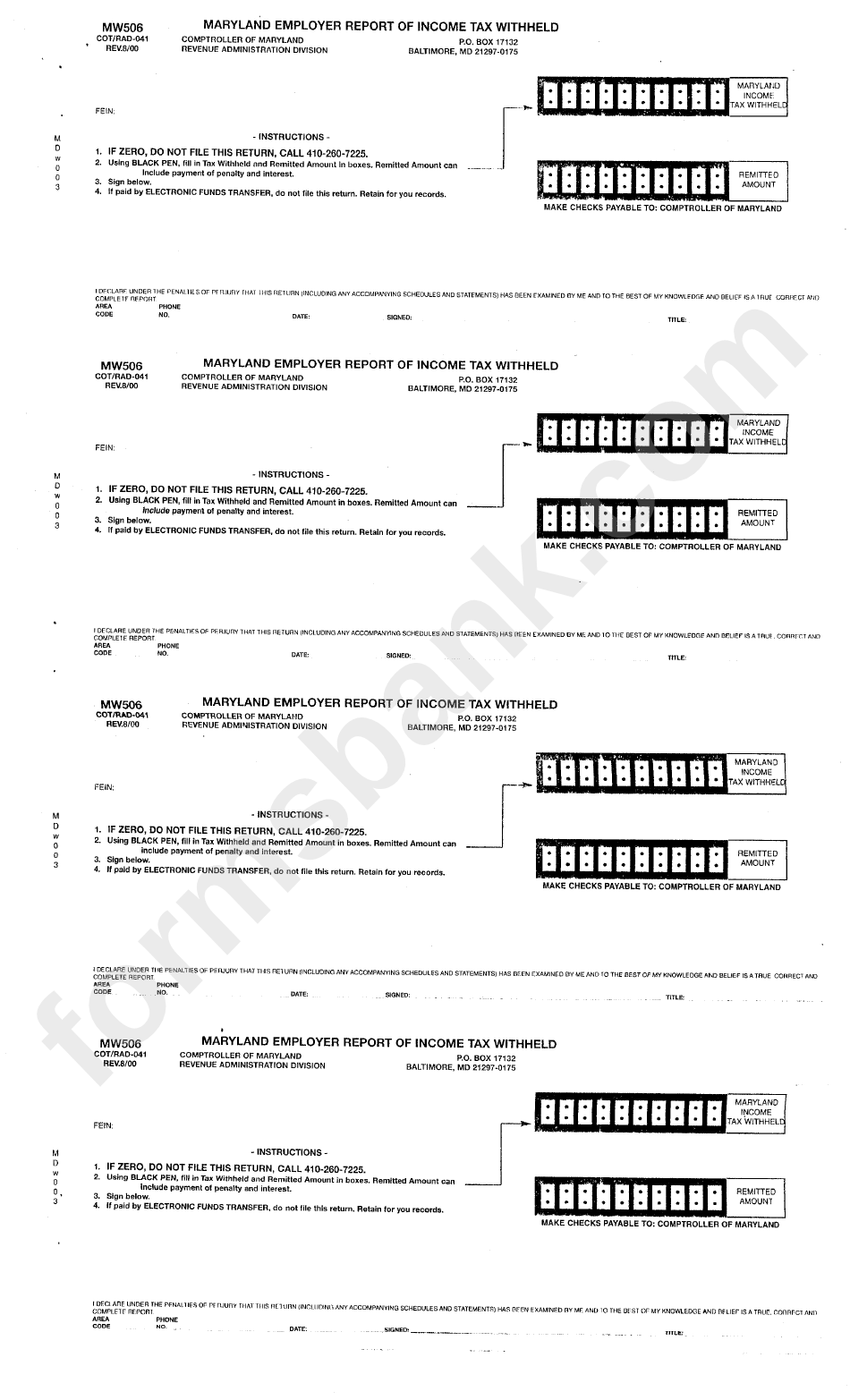

Form Mw506 Maryland Employer Report Of Tax Withheld printable

To learn how many exemptions you’re entitled to, continue to the personal exemptions. Web md tax withholding form. Web completing withholding forms for maryland state employees the law requires that you complete an employee’s withholding allowance certificate so that. For maryland state government employees only. I certify that i am a legal resident of thestate of and am not subject.

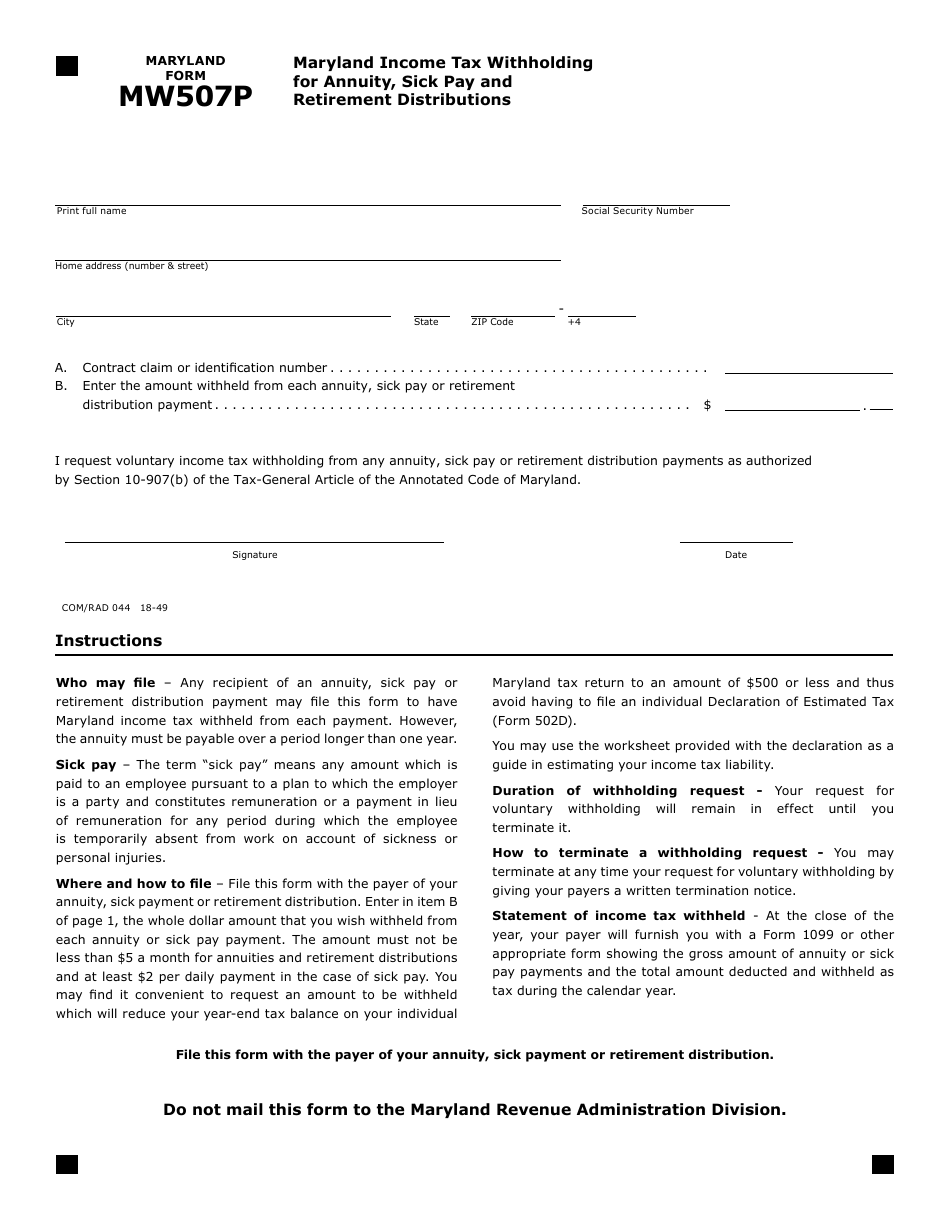

Form MW507P Download Fillable PDF or Fill Online Maryland Tax

Use this form to designate your withholding allowances if you live in maryland. Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. For maryland state government employees only. Web enter the amount of maryland state income tax withheld for the period being filed. For additional information, visit income tax for individual.

Form MW 506NRS Download Fillable PDF 2018, Maryland Return of

Web 2023 individual income tax forms. Edit, sign and print tax forms on any device with pdffiller. For maryland state government employees only. All employers must register with maryland. For maryland state government employees only.

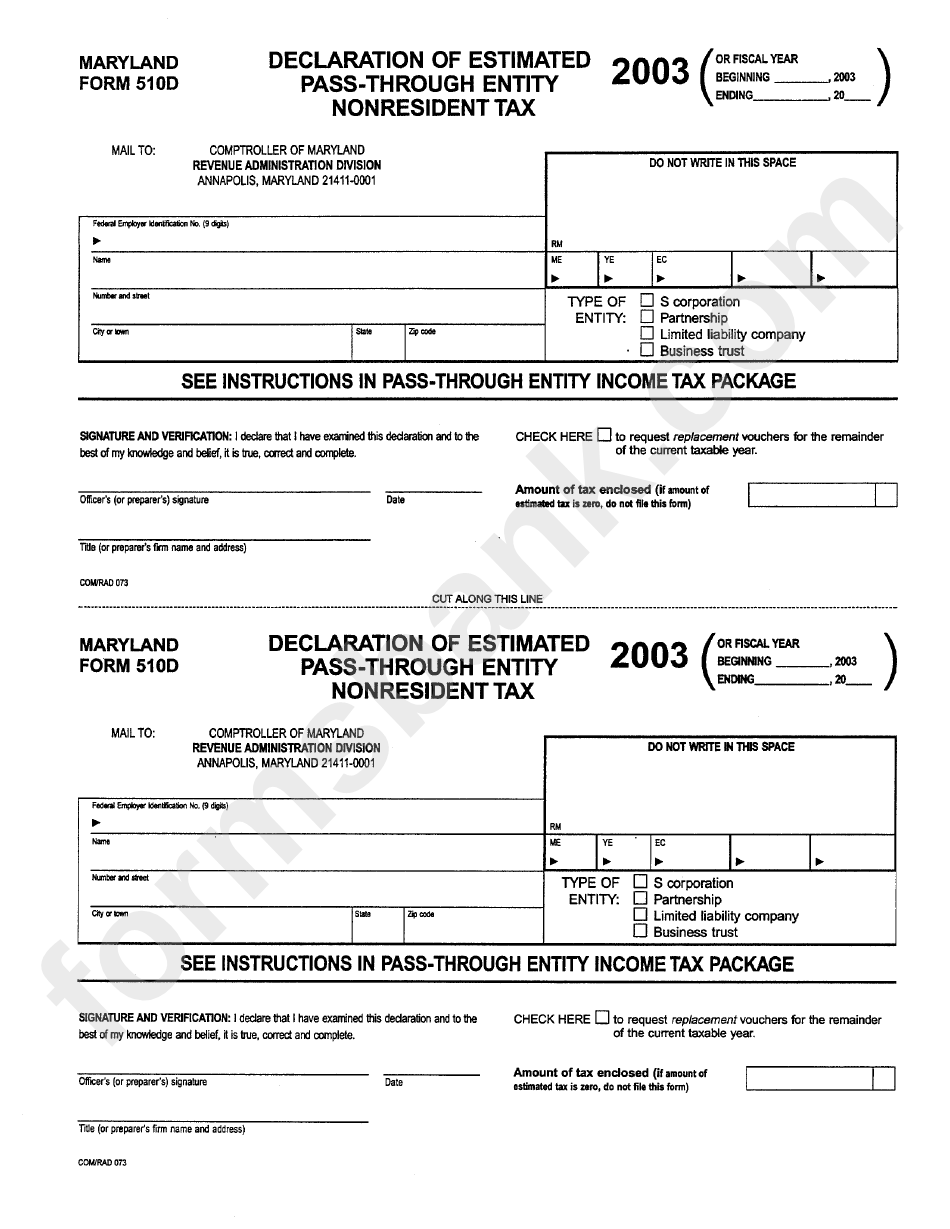

Maryland Form 510d Declaration Of Estimated PassThrough Entity

For maryland state government employees only. Web 7 rows form used by individuals to direct their employer to withhold maryland income. Web enter the amount of maryland state income tax withheld for the period being filed. Ad register and subscribe now to work on your md employee's withholding certificate form. Web completing withholding forms for maryland state employees the law.

Maryland Withholding

Web the maryland withholding and payment requirements. For maryland state government employees only. For maryland state government employees only. Web form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time. Web completing withholding forms for maryland state employees the.

Fillable Form W4 Employee Withholding Allowance Certificate

Web form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time. For maryland state government employees only. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the.

Fillable Form Mw 507 Employee S Maryland Withholding Exemption

All employers are required to register with the revenue administration. For maryland state government employees only. Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web employee's maryland withholding exemption certificate: Web form used to determine the amount of income tax withholding due on the sale of property located in maryland.

Form Mw 507 Employee'S Maryland Withholding Exemption Certificate

To learn how many exemptions you’re entitled to, continue to the personal exemptions. For maryland state government employees only. Amount remitted ( table of contents ) enter the amount you are paying for maryland state. Web the maryland withholding and payment requirements. For additional information, visit income tax for individual taxpayers > filing information.

I Certify That I Am A Legal Resident Of Thestate Of And Am Not Subject To Maryland Withholding Because I Meet The Requirements Set Forth Under The Servicemembers Civil.

All employers must register with maryland. Web completing withholding forms for maryland state employees the law requires that you complete an employee’s withholding allowance certificate so that. Ad register and subscribe now to work on your md employee's withholding certificate form. Web the maryland withholding and payment requirements.

Web 2023 Individual Income Tax Forms.

Consider completing a new form mw507 each year and when your. For additional information, visit income tax for individual taxpayers > filing information. For maryland state government employees only. Web 7 rows form used by individuals to direct their employer to withhold maryland income.

Use This Form To Designate Your Withholding Allowances If You Live In Maryland.

Web md tax withholding form. All employers are required to register with the revenue administration. For maryland state government employees only. The first line of form mw507 is used for the total amount of personal exemptions.

Web Form Used To Determine The Amount Of Income Tax Withholding Due On The Sale Of Property Located In Maryland And Owned By Nonresidents, And Provide For Tax Collection At The Time.

Form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Amount remitted ( table of contents ) enter the amount you are paying for maryland state.