Michigan 2290 Form

Michigan 2290 Form - Ad get ready for tax season deadlines by completing any required tax forms today. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Web who must file & who is exempt. Web form 2290 and schedule 1 is used to report heavy vehicle use tax. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web michigan department of state farm plate number(s) issued: The heaviness of the vehicle is accounted after its first use from registered gross weight equal to or exceeding. Web use form 2290 to: You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable. For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31.

See when to file form 2290 for more details. Complete, edit or print tax forms instantly. The heaviness of the vehicle is accounted after its first use from registered gross weight equal to or exceeding. The registrant has an established place of business in michiganor can. Web form 2290 and schedule 1 is used to report heavy vehicle use tax. Web when form 2290 taxes are due. Web a registrant should obtain an irp registration with michigan as its base jurisdiction if: Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; Do your truck tax online & have it efiled to the irs! Month form 2290 must be filed.

Web when form 2290 taxes are due. File form 2290 easily with eform2290.com. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web michigan department of state farm plate number(s) issued: The current period begins july 1, 2023, and ends june 30,. Web file form 2290 by the last day of the month following the month in which you first used the vehicle on a public highway. Web get all the information required for michigan truck tax in one place. Web if you have paid your heavy vehicle use tax (hvut) for the current reporting year and have not received your stamped irs form 2290 schedule 1 form by the time of registration,.

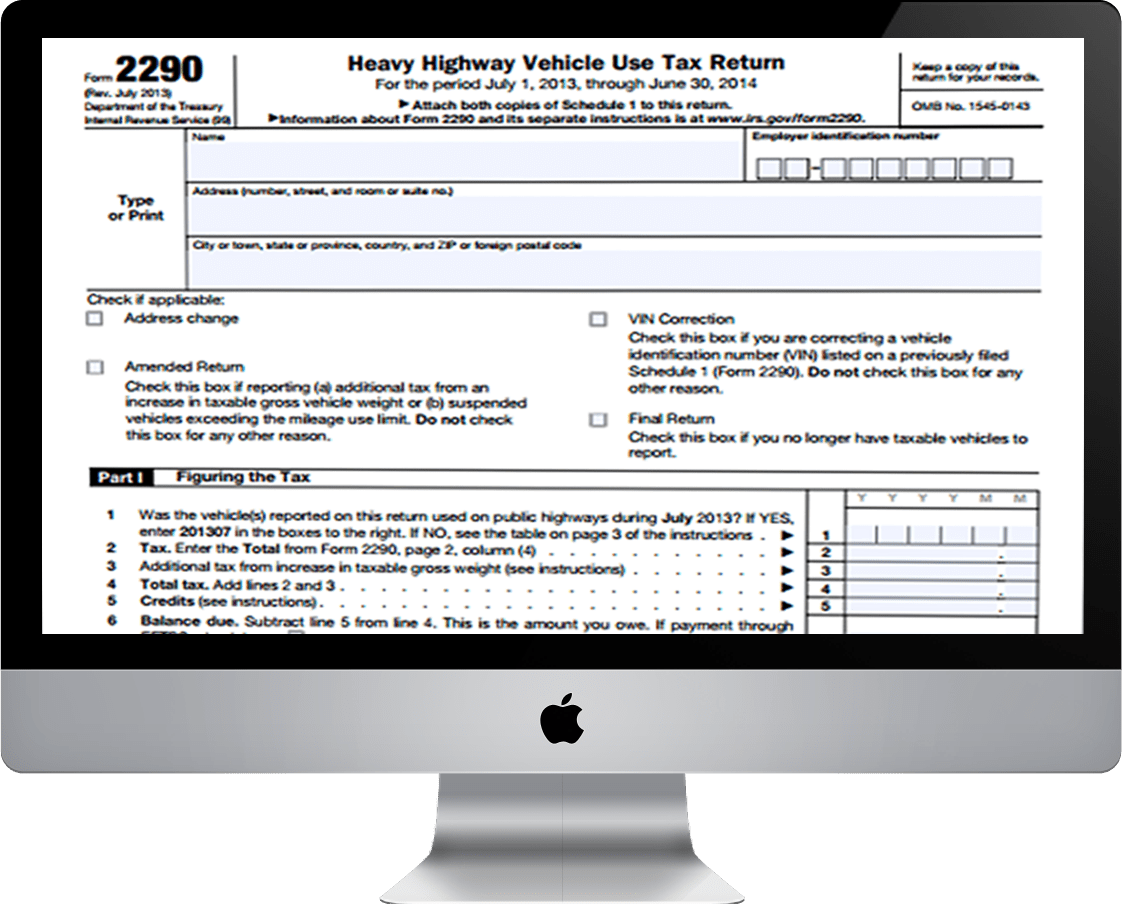

Get your Form 2290 Schedule 1 in Minutes Efile Form 2290 Now

Web if you have paid your heavy vehicle use tax (hvut) for the current reporting year and have not received your stamped irs form 2290 schedule 1 form by the time of registration,. Ad get ready for tax season deadlines by completing any required tax forms today. File form 2290 easily with eform2290.com. You must file form 2290 and schedule.

ExpressTruckTax Efile Form 2290 & Get Schedule 1 in Minutes

Month new vehicle is first used. Web when form 2290 taxes are due. The heaviness of the vehicle is accounted after its first use from registered gross weight equal to or exceeding. The irs 2290 tax is known as heavy vehicle use tax hvut is an annual charge collected from heavy. The registrant has an established place of business in.

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

Web who must file & who is exempt. Web with over 5 million trucks filed, truckers trust expresstrucktax with their form 2290 create an account for free *email address *password tax professional (optional). Month form 2290 must be filed. File your hvut form 2290 & generate the ifta report online. Web if you have paid your heavy vehicle use tax.

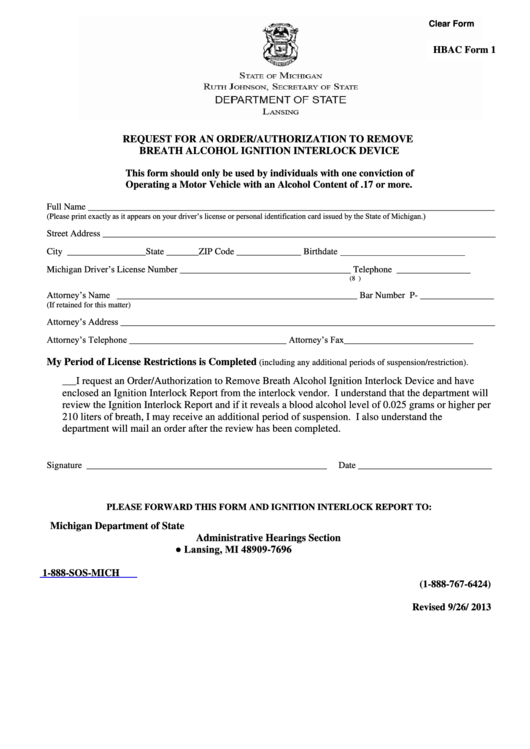

Fillable Request For An Order/authorization Michigan Secretary Of

Web when form 2290 taxes are due. The registrant has an established place of business in michiganor can. See when to file form 2290 for more details. Web file form 2290 by the last day of the month following the month in which you first used the vehicle on a public highway. Enjoy hassle free tax preparation and filing through.

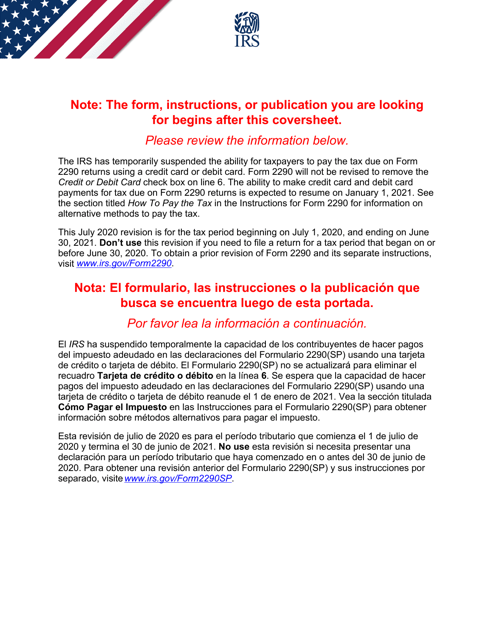

IRS 2290 (SP) 2020 Fill and Sign Printable Template Online US Legal

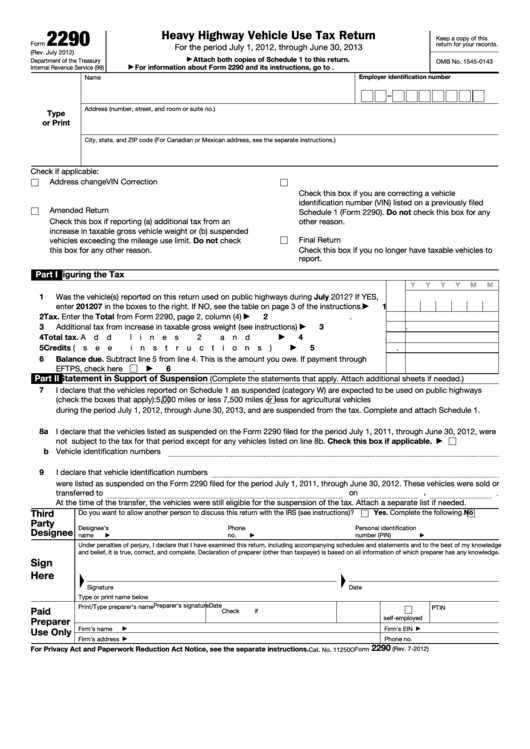

Web form 2290 and schedule 1 is used to report heavy vehicle use tax. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; Use coupon code get20b & get 20% off. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue.

File 20222023 Form 2290 Electronically 2290 Schedule 1

Web file form 2290 by the last day of the month following the month in which you first used the vehicle on a public highway. Web who must file & who is exempt. File form 2290 easily with eform2290.com. Web form 2290 due dates for vehicles placed into service during reporting period. Month form 2290 must be filed.

Viewing a thread Renewing Michigan farm plate. Form 2290?

Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web if you have paid your heavy vehicle use tax (hvut) for the current reporting year and have not received your stamped irs form 2290 schedule 1 form by the time of registration,. File your hvut form 2290.

√99以上 2290 form irs.gov 6319142290 form irs.gov

Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; Web who must file & who is exempt. Month form 2290 must be filed. The irs 2290 tax is known as heavy vehicle use tax hvut is an annual charge collected from heavy. Web when form.

Viewing a thread Renewing Michigan farm plate. Form 2290?

The registrant has an established place of business in michiganor can. Do your truck tax online & have it efiled to the irs! File your hvut form 2290 & generate the ifta report online. Use coupon code get20b & get 20% off. Web michigan department of state farm plate number(s) issued:

Fillable Form 2290 Heavy Highway Vehicle Use Tax Return printable pdf

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Enjoy hassle free tax preparation and filing through. Web form 2290 due dates for vehicles placed into service during reporting period. Easy, fast, secure & free to try. Web who must file & who is exempt.

Complete, Edit Or Print Tax Forms Instantly.

The irs 2290 tax is known as heavy vehicle use tax hvut is an annual charge collected from heavy. Ad get ready for tax season deadlines by completing any required tax forms today. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Web when form 2290 taxes are due.

Ad Get Schedule 1 In Minutes, Your Form 2290 Is Efiled Directly To The Irs.

Web who must file & who is exempt. Web michigan department of state farm plate number(s) issued: Web get all the information required for michigan truck tax in one place. Web if you have paid your heavy vehicle use tax (hvut) for the current reporting year and have not received your stamped irs form 2290 schedule 1 form by the time of registration,.

The Current Period Begins July 1, 2023, And Ends June 30,.

See when to file form 2290 for more details. Month form 2290 must be filed. The registrant has an established place of business in michiganor can. Enjoy hassle free tax preparation and filing through.

For Vehicles First Used On A Public Highway During The Month Of July, File Form 2290 And Pay The Appropriate Tax Between July 1 And August 31.

Web form 2290 due dates for vehicles placed into service during reporting period. Web form 2290 | find answers to your accounting questions and stay informed on accounting matters with the michigan accounting blog published by bht&d cpas. File your hvut form 2290 & generate the ifta report online. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable.