Mileage Expense Form

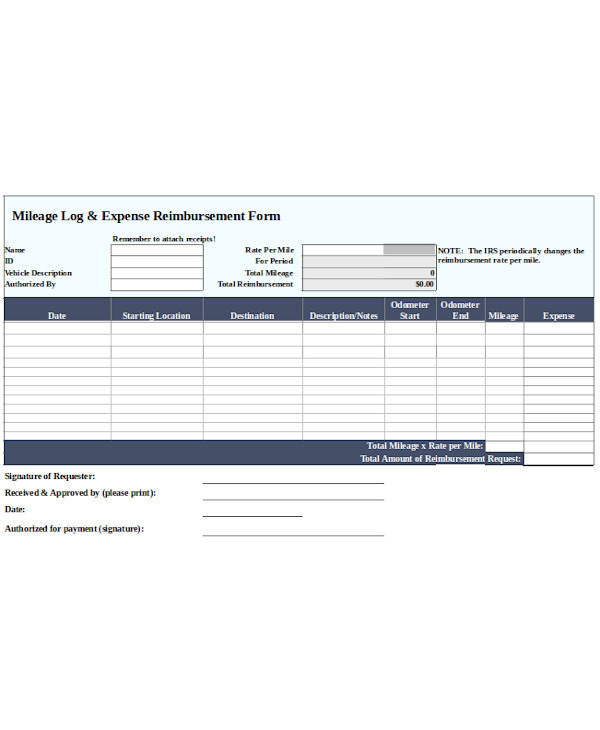

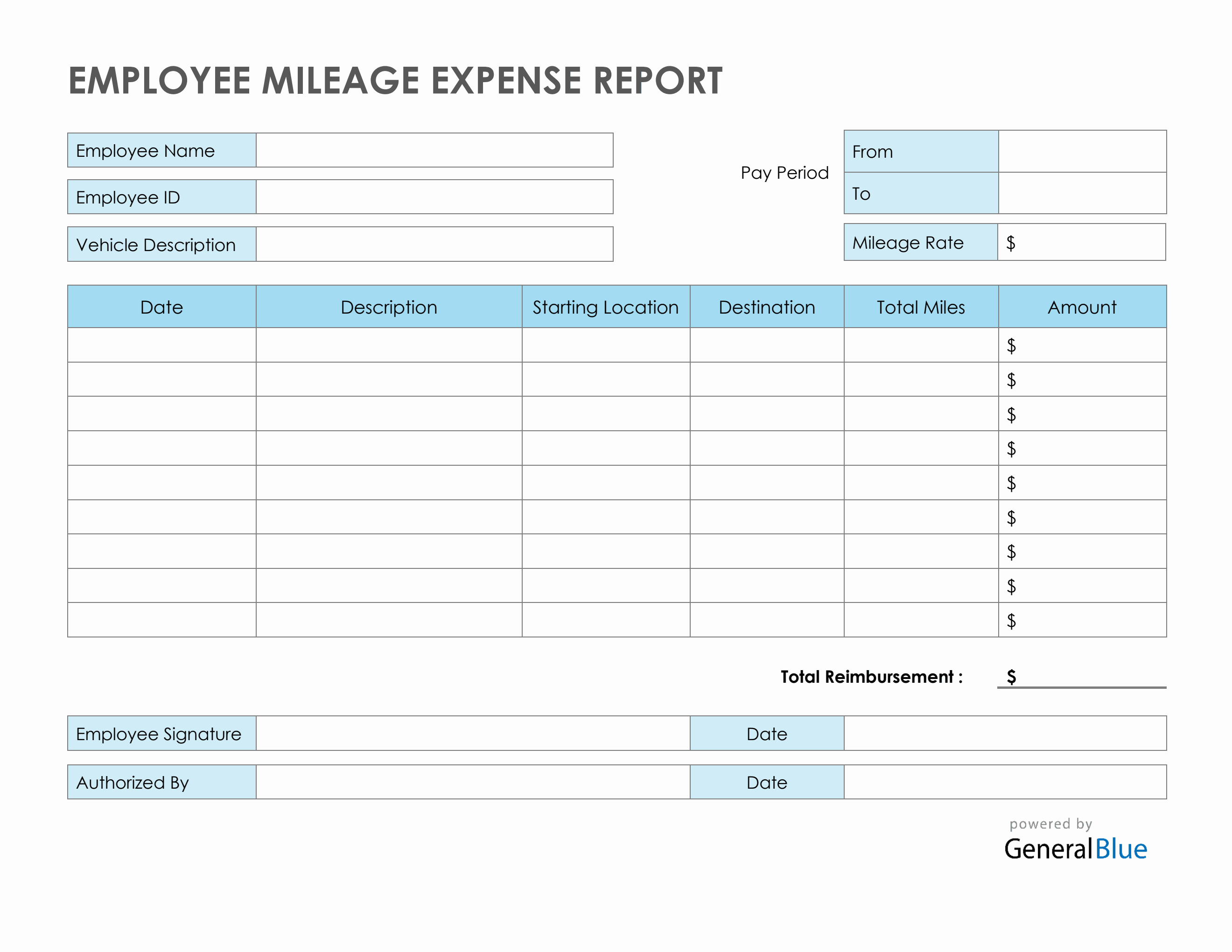

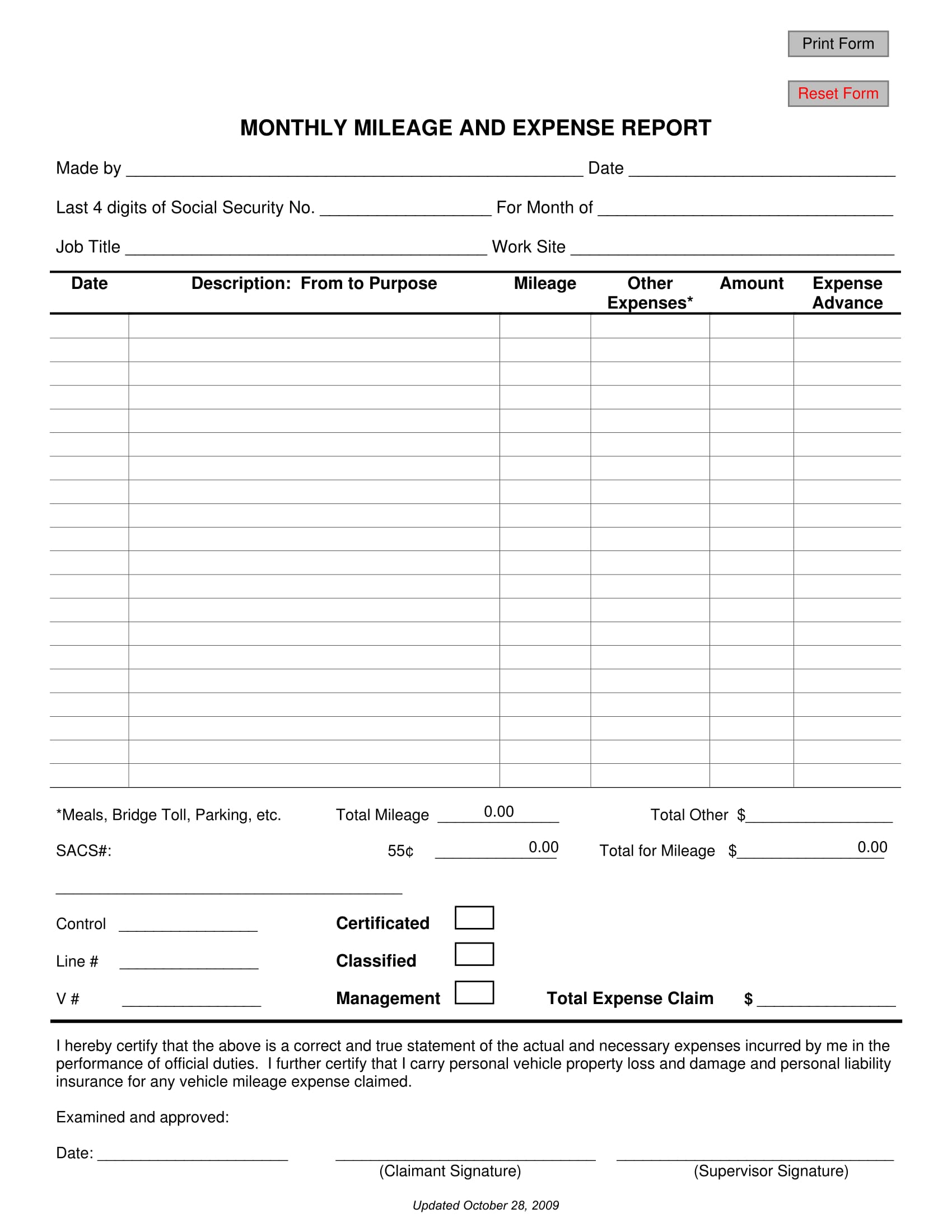

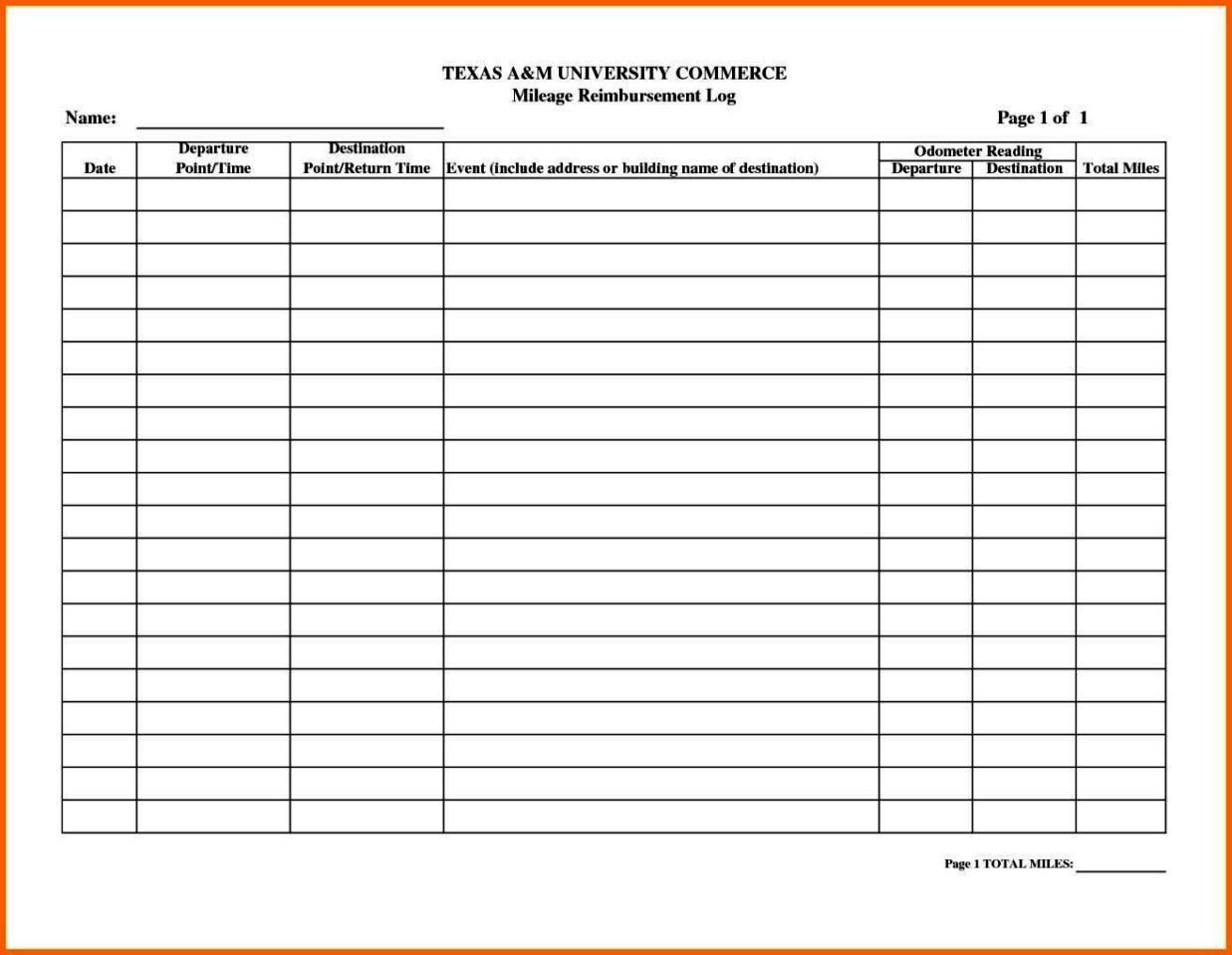

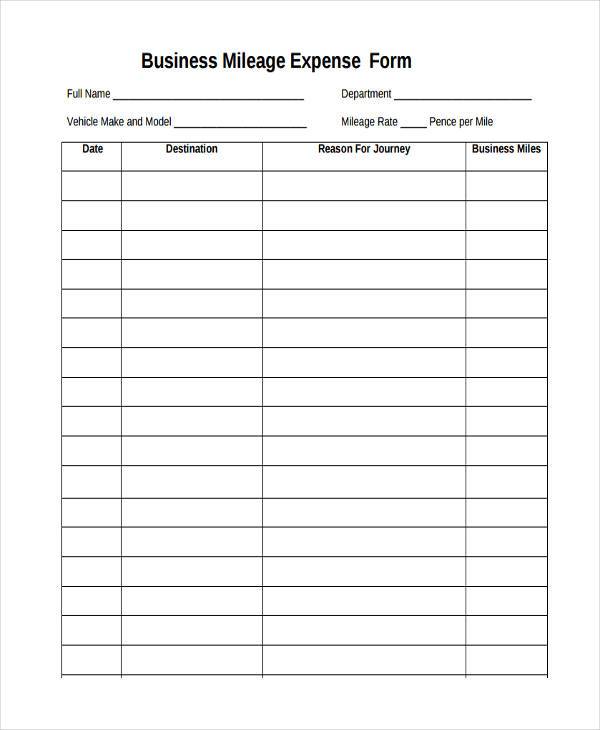

Mileage Expense Form - Vehicle expenses (insurance, registration, etc.); Web it’s downloadable, editable, and printable in excel. Web mileage expense mileage expense templates free downloadable and printable mileage expense templates that are compatible with pdf and microsoft word and excel. Web / business / operations / mileage log templates 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. The 2022 per mile rate for business use of your vehicle is 58.5 cents (0.585) from january 1, 2022, to june 30, 2022, and 62.5 cents (0.625) from july 1, 2022, to december 31, 2022. You can also customize the forms and templates according to your needs. Simple per diem expense report in pdf Many business owners are able to deduct the costs associated with their vehicle, expenses for repairs and the miles it’s driven. Web medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers’ compensation appeals board. This employee mileage reimbursement template features sections for employee name, employee id, vehicle description, pay period, mileage rate, date, description, starting location,.

Vehicle expenses (insurance, registration, etc.); Table of contents [ show] Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. This employee mileage reimbursement template features sections for employee name, employee id, vehicle description, pay period, mileage rate, date, description, starting location,. Simple per diem expense report in pdf Common maintenance due to wear and tear. The depreciation limits apply under section 179 and section 280f. Web mileage expense mileage expense templates free downloadable and printable mileage expense templates that are compatible with pdf and microsoft word and excel. Web the irs mileage rate covers: Web / business / operations / mileage log templates 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes.

Web mileage expense mileage expense templates free downloadable and printable mileage expense templates that are compatible with pdf and microsoft word and excel. Many business owners are able to deduct the costs associated with their vehicle, expenses for repairs and the miles it’s driven. Web the irs mileage rate covers: Web medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers’ compensation appeals board. You can also customize the forms and templates according to your needs. Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. Table of contents [ show] Web it’s downloadable, editable, and printable in excel. This employee mileage reimbursement template features sections for employee name, employee id, vehicle description, pay period, mileage rate, date, description, starting location,. Common maintenance due to wear and tear.

8 Travel Expense Report with Mileage Log Excel Templates Excel

This employee mileage reimbursement template features sections for employee name, employee id, vehicle description, pay period, mileage rate, date, description, starting location,. Web / business / operations / mileage log templates 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. Web find optional standard mileage rates.

FREE 9+ Sample Mileage Reimbursement Forms in PDF Word Excel

Web / business / operations / mileage log templates 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. The 2022 per mile rate.

Employee Mileage Expense Report Template in Word

Many business owners are able to deduct the costs associated with their vehicle, expenses for repairs and the miles it’s driven. Web it’s downloadable, editable, and printable in excel. Web the irs mileage rate covers: Common maintenance due to wear and tear. Web mileage expense mileage expense templates free downloadable and printable mileage expense templates that are compatible with pdf.

Medical Mileage Expense Form PDFSimpli

Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. Web the irs mileage rate covers: The 2022 per mile rate for business use of your vehicle is 58.5 cents (0.585) from january 1, 2022, to june 30, 2022, and 62.5 cents (0.625) from july 1, 2022,.

FREE 8+ Sample Expense Forms in PDF MS Word

Common maintenance due to wear and tear. Web medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers’ compensation appeals board. Web / business / operations / mileage log templates 20 printable mileage log templates (free) the.

8+ Printable Mileage Log Templates for Personal or Commercial Use

You can also customize the forms and templates according to your needs. Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. The 2022 per mile rate for business use of your vehicle is 58.5 cents (0.585) from january 1, 2022, to june 30, 2022, and 62.5.

FREE 5+ Mileage Report Forms in MS Word PDF Excel

Web this expense form was designed for you to print out and keep in the vehicle so you can enter your starting and ending miles using a pen or paper. Common maintenance due to wear and tear. Web / business / operations / mileage log templates 20 printable mileage log templates (free) the irs has strict rules about the types.

Mileage Expense Form Template Free SampleTemplatess SampleTemplatess

Web it’s downloadable, editable, and printable in excel. You can also customize the forms and templates according to your needs. Common maintenance due to wear and tear. Table of contents [ show] Web mileage expense mileage expense templates free downloadable and printable mileage expense templates that are compatible with pdf and microsoft word and excel.

FREE 11+ Sample Mileage Reimbursement Forms in MS Word PDF Excel

Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. Many business owners are able to deduct the costs associated with their vehicle, expenses for repairs and the miles it’s driven. You can also customize the forms and templates according to your needs. Simple per diem expense.

FREE 44+ Expense Forms in PDF MS Word Excel

Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. Web the irs mileage rate covers: Web this expense form was designed for you to print out and keep in the vehicle so you can enter your starting and ending miles using a pen or paper. This.

Web It’s Downloadable, Editable, And Printable In Excel.

The depreciation limits apply under section 179 and section 280f. Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. Web this expense form was designed for you to print out and keep in the vehicle so you can enter your starting and ending miles using a pen or paper. Simple per diem expense report in pdf

Web Mileage Expense Mileage Expense Templates Free Downloadable And Printable Mileage Expense Templates That Are Compatible With Pdf And Microsoft Word And Excel.

Many business owners are able to deduct the costs associated with their vehicle, expenses for repairs and the miles it’s driven. You can also customize the forms and templates according to your needs. Table of contents [ show] Vehicle expenses (insurance, registration, etc.);

Web The Irs Mileage Rate Covers:

This employee mileage reimbursement template features sections for employee name, employee id, vehicle description, pay period, mileage rate, date, description, starting location,. Web / business / operations / mileage log templates 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. Common maintenance due to wear and tear. The 2022 per mile rate for business use of your vehicle is 58.5 cents (0.585) from january 1, 2022, to june 30, 2022, and 62.5 cents (0.625) from july 1, 2022, to december 31, 2022.