Mileage Form 2022

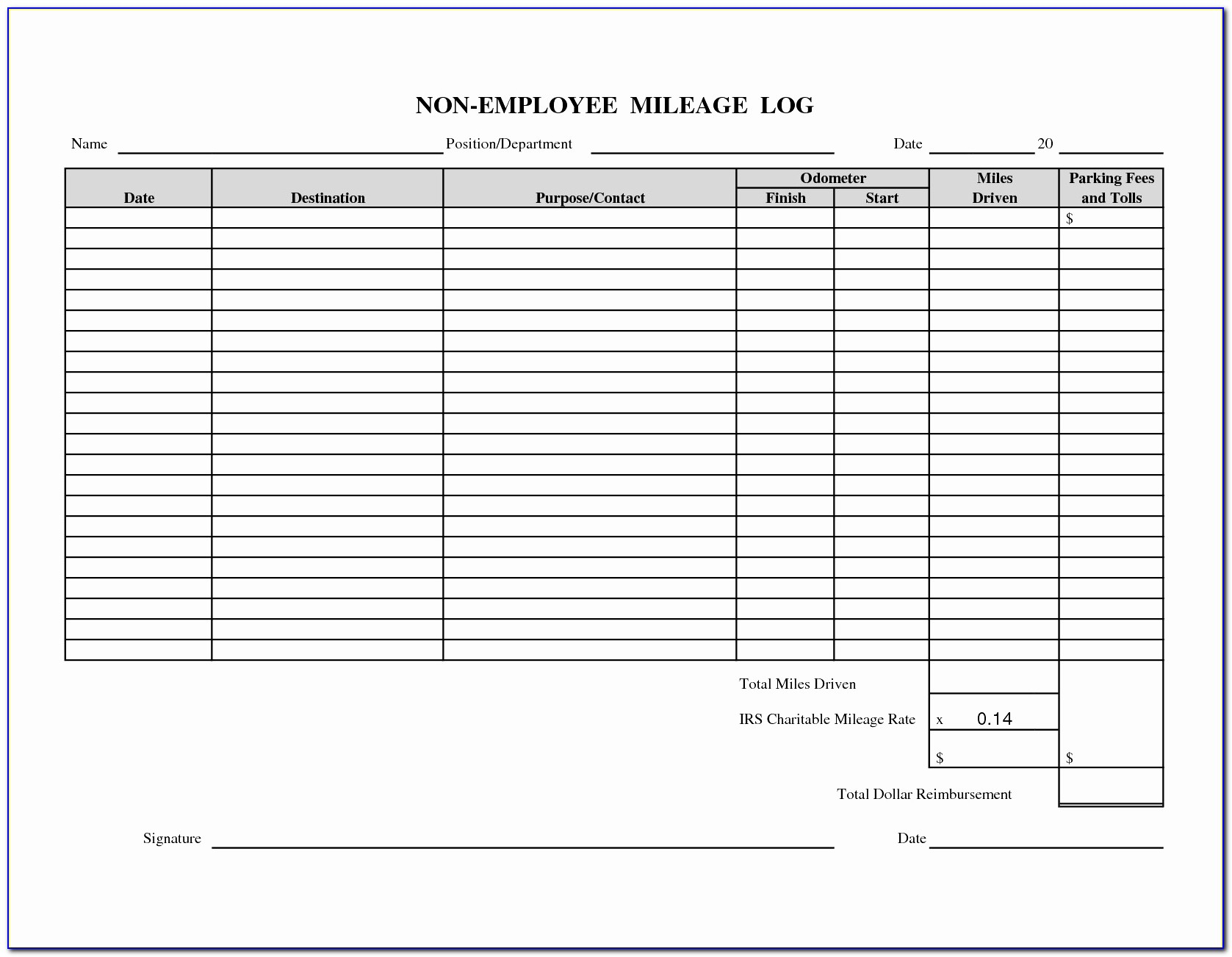

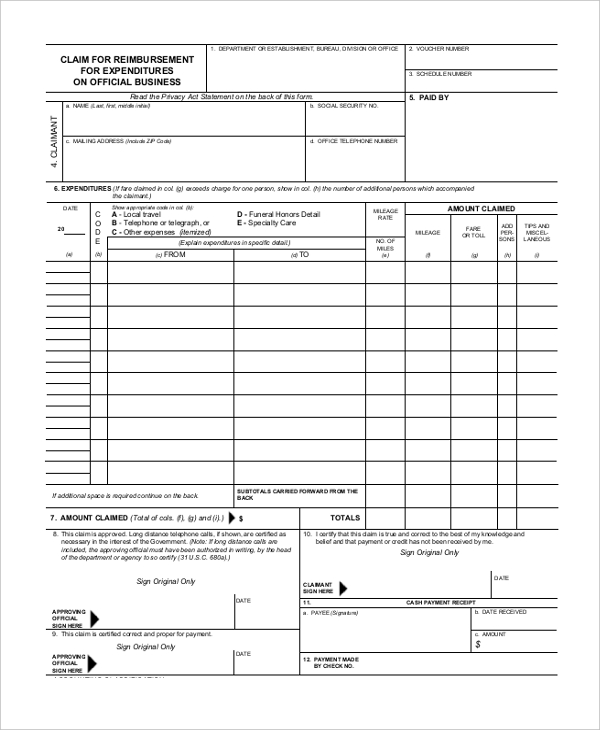

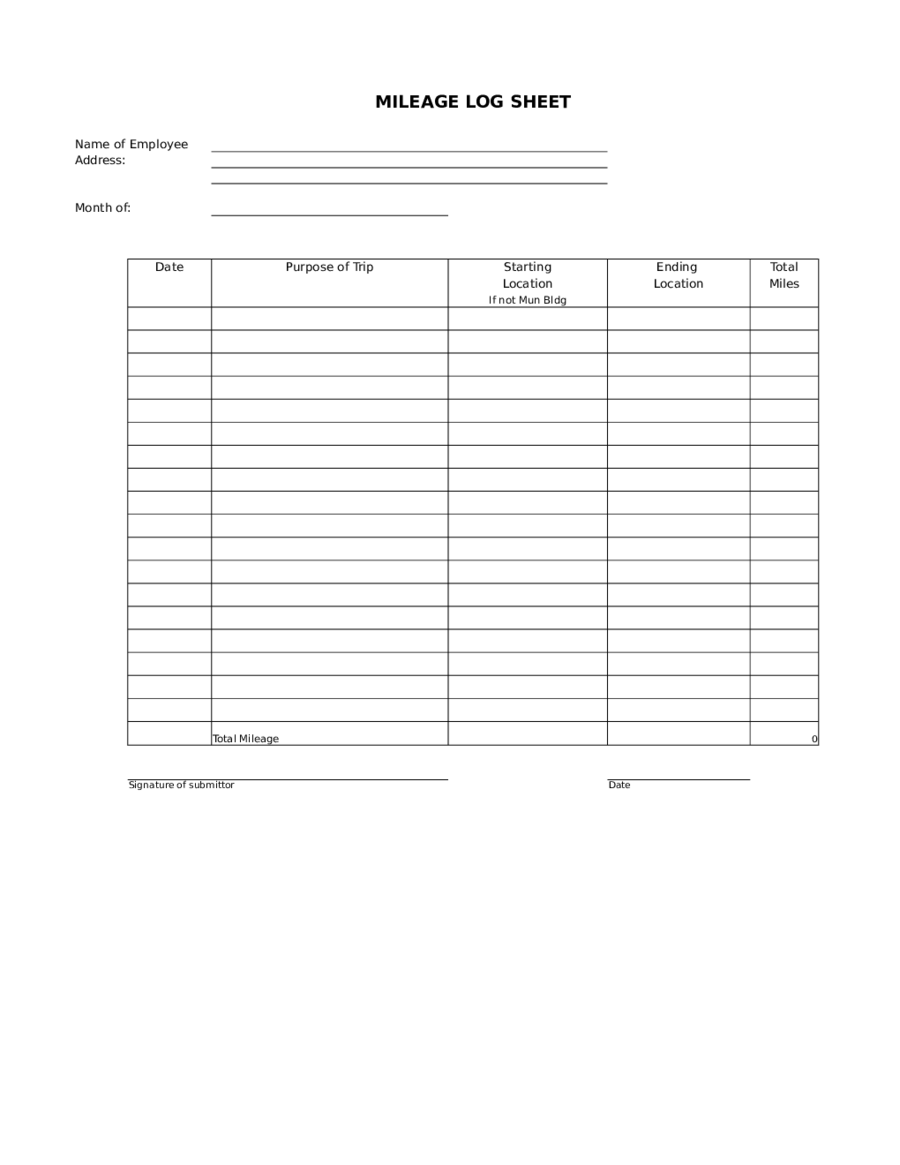

Mileage Form 2022 - An irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to. Web find and fill out the correct form mileage fillable. The company or employer that will be. 798 park avenue nw, norton, va 24273 fax: Web the mileage rate is 62.5 cents ($0.625) per mile. Web beginning january 1, 2023, the mileage rate will remain 0.22 cents per mile. Web irs standard mileage rates from jan 1, 2022, to june 30, 2022: Web 1list mileage/related receipts (i.e. Swc does not reimburse for sr 125 toll. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses.

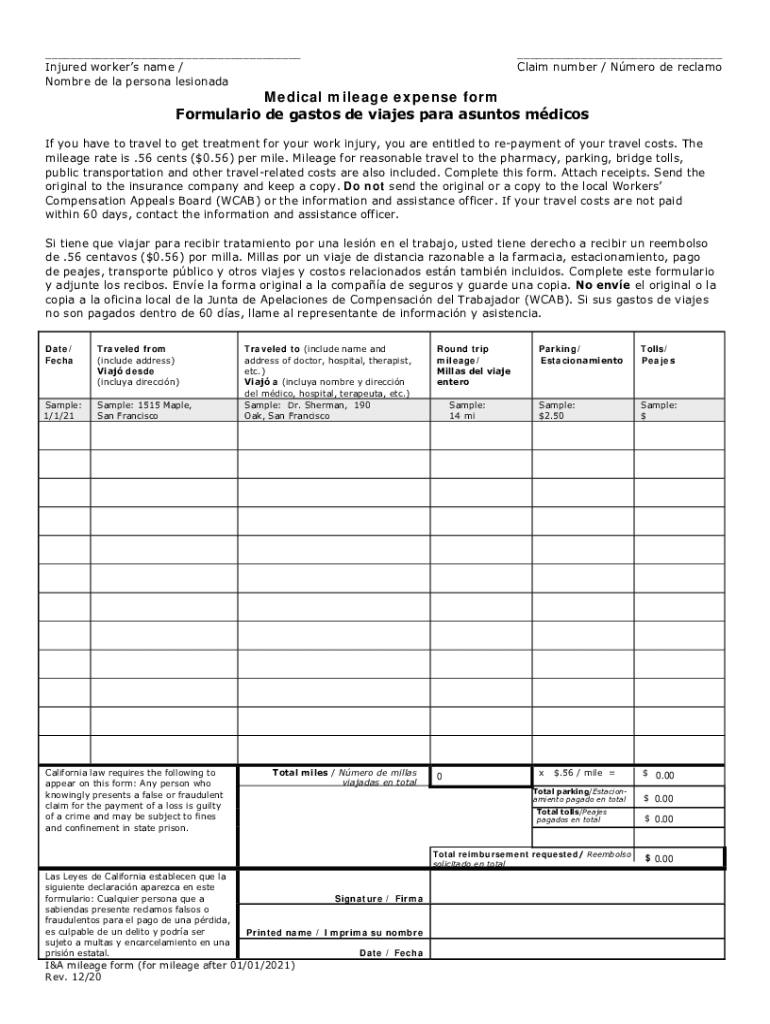

Web washington — the internal revenue service today announced an increase in the optional standard mileage rate for the final 6 months of 2022. The 2022 benefit period has. The deadline for submitting 2023 benefit period claims is april 30, 2024. Swc does not reimburse for sr 125 toll. Choose the correct version of the editable pdf form. An irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to. Web posted on march 30, 2022 by exceltmp. Web medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district. Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2023. Web medical mileage expense form formulario de gastos de viajes para ________________________________ claim number / número de reclamo asuntos.

We use bing maps to calculate your mileage, based on. The irs sets a standard mileage rate every year. Washington — the internal revenue service today issued the 2022 optional. Web medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district. Web beginning january 1, 2023, the mileage rate will remain 0.22 cents per mile. Easy to use word, excel and ppt templates. Web mileage rate is.56 cents ($0.56) per mile. Web 1list mileage/related receipts (i.e. 18 cents per mile for medical and moving purposes. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses.

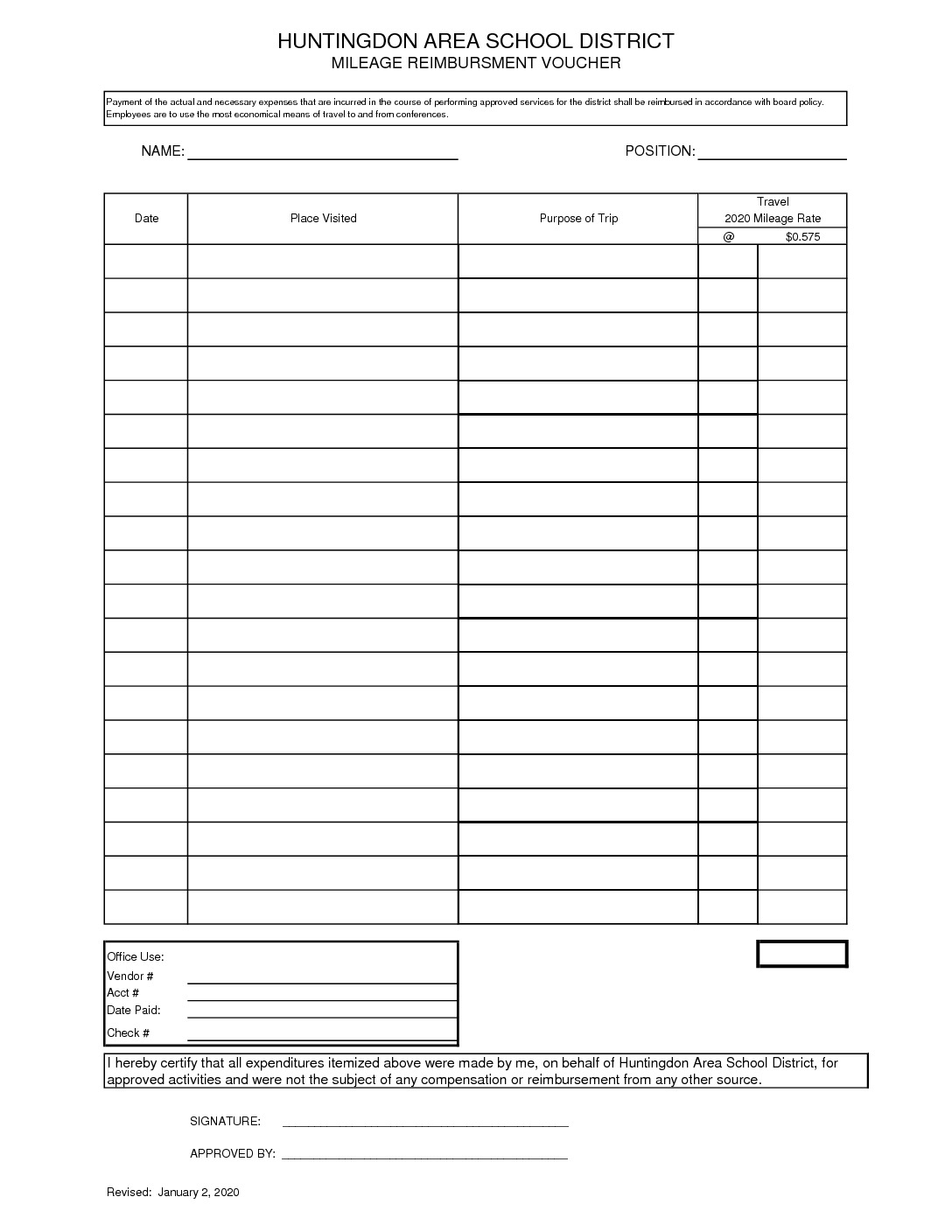

Expense Reimbursement Form Mileage Only 2020 Huntingdon Area School

798 park avenue nw, norton, va 24273 fax: Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. 2hit “enter” upon final entry in order for form to. Web 1list mileage/related receipts (i.e. Web mileage rate is.56 cents ($0.56) per mile.

Example Mileage Reimbursement Form Printable Form, Templates and Letter

Swc does not reimburse for sr 125 toll. Web posted on march 30, 2022 by exceltmp. Web find your mileage reimbursement form 2022 template, contract, form or document. Web privately owned vehicle (pov) mileage reimbursement rates. Web mileage reimbursement rate.

2020 CA I&A mileage Form Fill Online, Printable, Fillable, Blank

Web find your mileage reimbursement form 2022 template, contract, form or document. Web the irs increased the standard mileage rate for the remainder of 2022 due to the increase in fuel cost. Swc does not reimburse for sr 125 toll. Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2023. Web south korean regulators earlier this year fined.

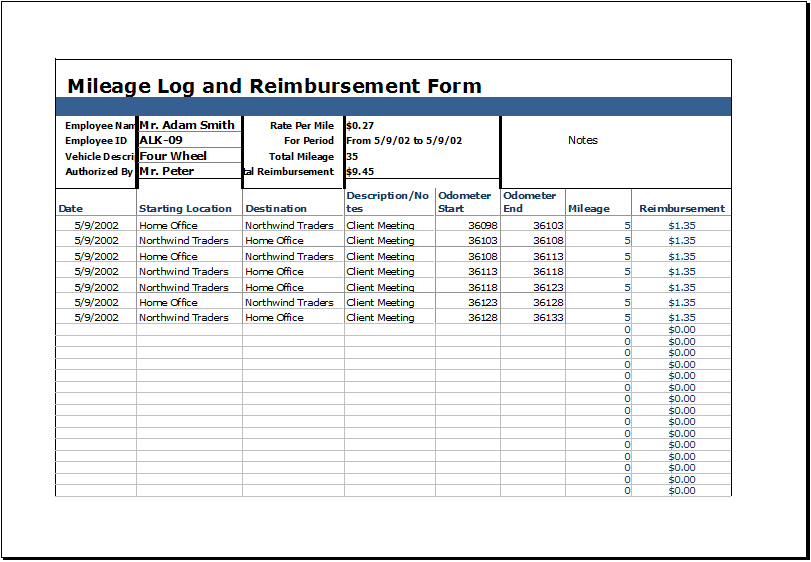

Mileage Reimbursement Form Excel charlotte clergy coalition

2hit “enter” upon final entry in order for form to. The deadline for submitting 2023 benefit period claims is april 30, 2024. Web find your mileage reimbursement form 2022 template, contract, form or document. Web south korean regulators earlier this year fined tesla about $2.1 million for falsely advertised driving ranges on its local website between august 2019 and. Web.

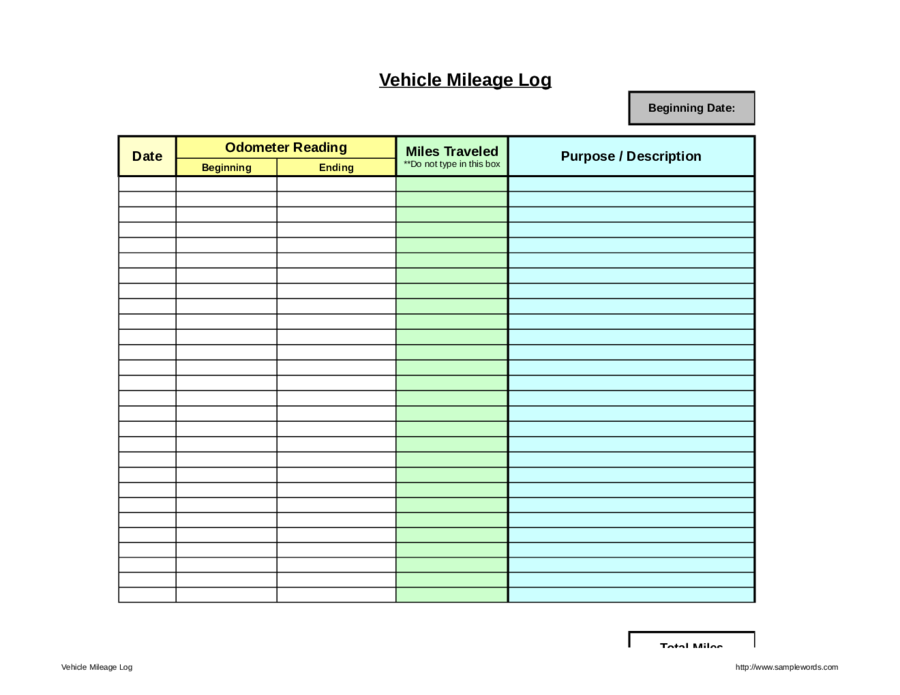

Sample Mileage Log The Document Template

Web irs mileage reimbursement form (2023) 0 %. Web medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district. Web medical mileage expense form formulario de gastos de viajes para ________________________________ claim number / número de reclamo asuntos. Documents and forms.

Workers Comp Mileage Reimbursement 2021 Form Fill Out and Sign

The 2022 benefit period has. Web medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district. Easy to use word, excel and ppt templates. The deadline for submitting 2023 benefit period claims is april 30, 2024. Web find and fill out.

Mileage Log Template Excel Excel Templates

Web washington — the internal revenue service today announced an increase in the optional standard mileage rate for the final 6 months of 2022. Web irs standard mileage reimbursement rates for 2023. Web the mileage rate is 62.5 cents ($0.625) per mile. Web medical mileage expense form formulario de gastos de viajes para ________________________________ claim number / número de reclamo.

Mileage Form Pdf 20202022 Fill and Sign Printable Template Online

Web the mileage rate is 62.5 cents ($0.625) per mile. Documents and forms regarding the work of the commissioner of. Swc does not reimburse for sr 125 toll. Web find and fill out the correct form mileage fillable. Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2023.

FREE 9+ Sample Mileage Reimbursement Forms in PDF Word Excel

Web 1list mileage/related receipts (i.e. The company or employer that will be. Web the irs increased the standard mileage rate for the remainder of 2022 due to the increase in fuel cost. Web irs standard mileage reimbursement rates for 2023. Web 2023 high mileage form (pdf) freedom of information act (pdf) property tax exemption application (pdf).

Web Posted On March 30, 2022 By Exceltmp.

Documents and forms regarding the work of the commissioner of. Web mileage reimbursement rate. Web mileage rate is.56 cents ($0.56) per mile. Web find and fill out the correct form mileage fillable.

Web To Be Reimbursed For A Ride, Transportation Needs To Be Scheduled With Veyo At Least Two Business Days Before Your Appointment.

2hit “enter” upon final entry in order for form to. Web find your mileage reimbursement form 2022 template, contract, form or document. The deadline for submitting 2023 benefit period claims is april 30, 2024. Web medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district.

Easy To Use Word, Excel And Ppt Templates.

Web washington — the internal revenue service today announced an increase in the optional standard mileage rate for the final 6 months of 2022. 58.5 cents per mile for business purposes. The irs sets a standard mileage rate every year. Choose the correct version of the editable pdf form.

The 2022 Benefit Period Has.

Washington — the internal revenue service today issued the 2022 optional. Web the mileage rate is 62.5 cents ($0.625) per mile. We use bing maps to calculate your mileage, based on. 18 cents per mile for medical and moving purposes.