Minnesota Form Awc

Minnesota Form Awc - Web when electronic filing form awc, a signed copy should be retained for your records. Web minnesota information group box. Enter total tax withheld on interview form mn7, box 70, and. Preparer withholding certificate to generate form awc;. If you intend to have 7.85 percent of your distributive income to be withheld or you choose to be included in. Include a copy of each awc you receive when you file your form m3 or m8 tax return. Web k:\adc\bbht applications and forms\ladc application.12.18.doc. What if i am exempt from minnesota withholding? Mark this checkbox if the partner is a nonresident partner and filed form awc. Easily fill out pdf blank, edit, and sign them.

If you intend to have 7.85 percent of your distributive income to be withheld or you choose to be included in. Web k:\adc\bbht applications and forms\ladc application.12.18.doc. Any forms awc received after the filing of the original return will be denied. Web claims attachment cover sheet claims appeal request form ufef/prescription drug pa request form minnesota's universal outpatient mental. Choose from the following form awc withholding options: Web go to the section for minnesota. Form awc should not be attached as a pdf to the electronic file. Minnesota application for alcohol and drug counselor licensure please print legibly in ink. What if i am exempt from minnesota withholding? Web filing form awc, alternative withholding certificate [+] the partnership or s corporation may withhold less than the 9.85% if requested by a partner or shareholder if the smaller.

Mark this checkbox if the partner is a nonresident partner and filed form awc. Minnesota application for alcohol and drug counselor licensure please print legibly in ink. Web minnesota information group box. Include a copy of each awc you receive when you file your form m3 or m8 tax return. Web filing form awc, alternative withholding certificate [+] the partnership or s corporation may withhold less than the 9.85% if requested by a partner or shareholder if the smaller. Web minnesota tax id numbers in the boxes to the right. Web when electronic filing form awc, a signed copy should be retained for your records. Preparer withholding certificate to generate form awc;. Web claims attachment cover sheet claims appeal request form ufef/prescription drug pa request form minnesota's universal outpatient mental. If you intend to have 7.85 percent of your distributive income to be withheld or you choose to be included in.

Form AWC Download Fillable PDF or Fill Online Alternative Withholding

Mark this checkbox if the partner is a nonresident partner and filed form awc. Web minnesota tax id numbers in the boxes to the right. Web tax and carries the amount to form m3 minnesota forms and schedules form m3—partnership return schedule m3a—apportionment and minimum fee form. Web claims attachment cover sheet claims appeal request form ufef/prescription drug pa request.

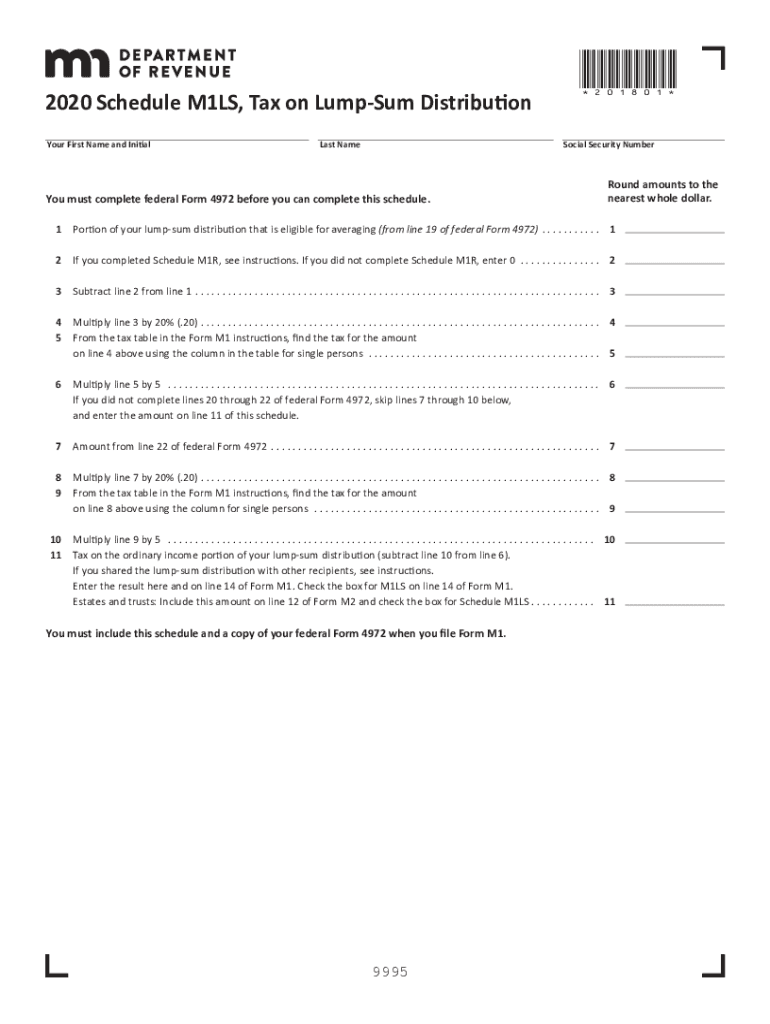

Printable Minnesota Form M1LS Tax On Lump Sum Distribution Fill Out

What if i am exempt from minnesota withholding? Web there is minnesota source distributive income for partner [#] but no tax withheld nor form awc on file for the partner. Minnesota application for alcohol and drug counselor licensure please print legibly in ink. If you intend to have 7.85 percent of your distributive income to be withheld or you choose.

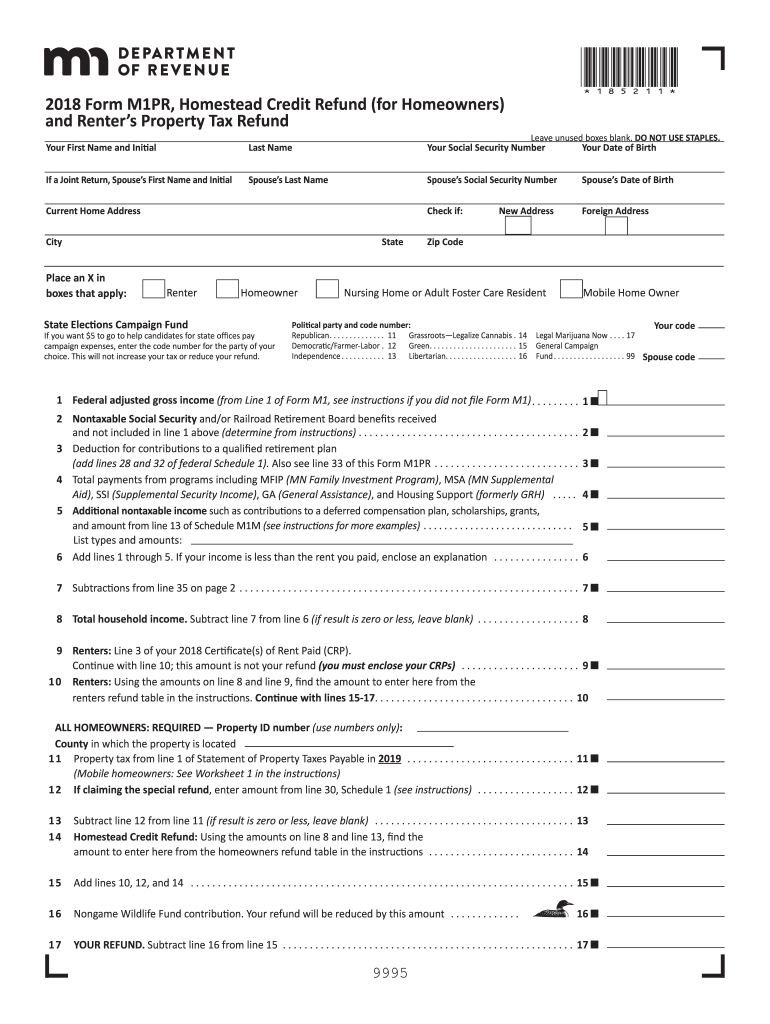

How To File Minnesota Property Tax Refund

Minnesota application for alcohol and drug counselor licensure please print legibly in ink. If you intend to have 7.85 percent of your distributive income to be withheld or you choose to be included in. What if i am exempt from minnesota withholding? Enter total tax withheld on interview form mn7, box 70, and. Form awc should not be attached as.

Home Association of Women Contractors AWC Saint Paul, Minnesota

Web k:\adc\bbht applications and forms\ladc application.12.18.doc. Form awc should not be attached as a pdf to the electronic file. Web minnesota source distributive income to be withheld by the entity. Minnesota application for alcohol and drug counselor licensure please print legibly in ink. Include a copy of each awc you receive when you file your form m3 or m8 tax.

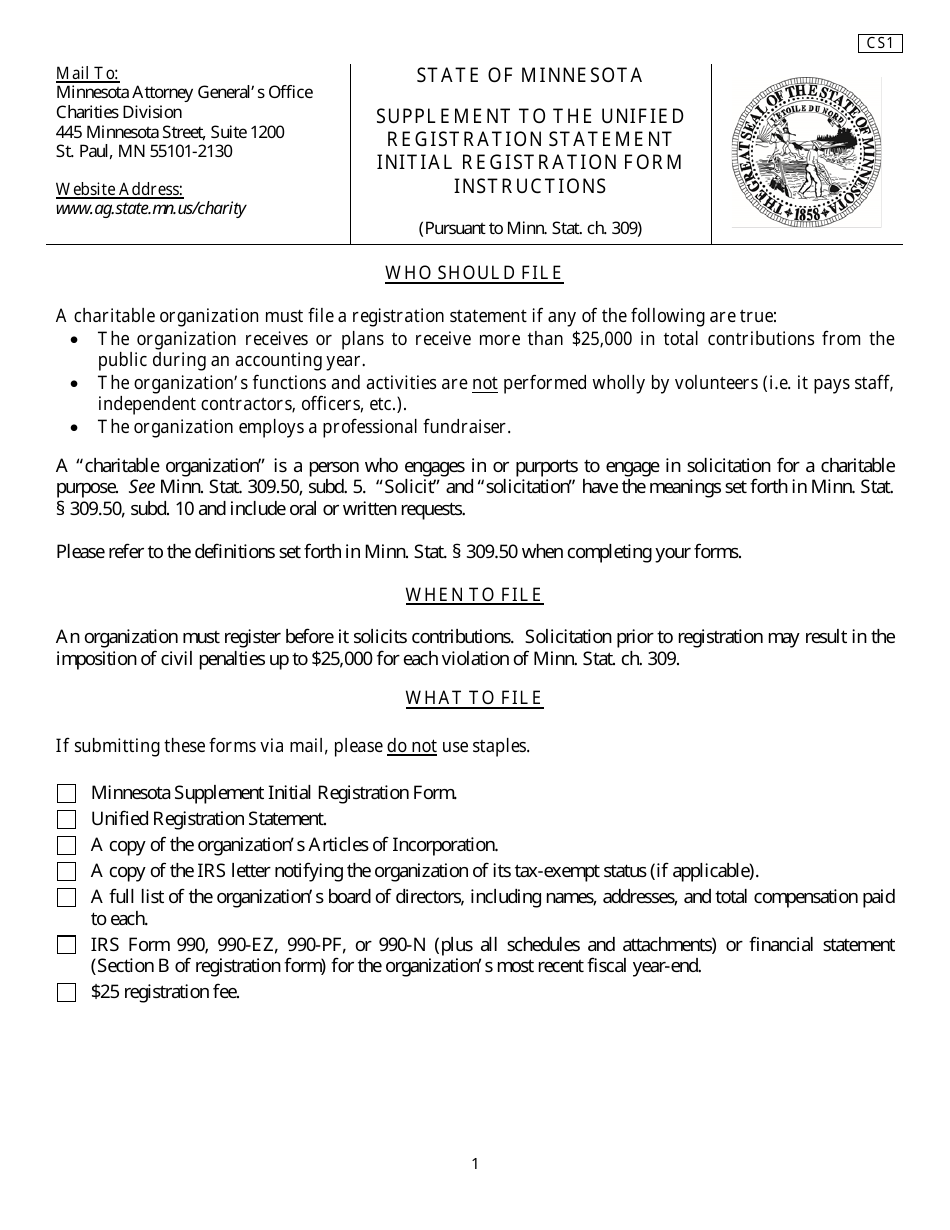

Form CS1 Download Fillable PDF or Fill Online Supplement to the Unified

Ultratax cs prints y on the nonresident. Easily fill out pdf blank, edit, and sign them. Web tax and carries the amount to form m3 minnesota forms and schedules form m3—partnership return schedule m3a—apportionment and minimum fee form. Web filing form awc, alternative withholding certificate [+] the partnership or s corporation may withhold less than the 9.85% if requested by.

M1nr Residents Fill Out and Sign Printable PDF Template signNow

Web to generate and indicate that form awc has been filed, choose view > partner information > minnesota tab and mark the form awc filed checkbox. Web minnesota tax id numbers in the boxes to the right. Web there is minnesota source distributive income for partner [#] but no tax withheld nor form awc on file for the partner. Web.

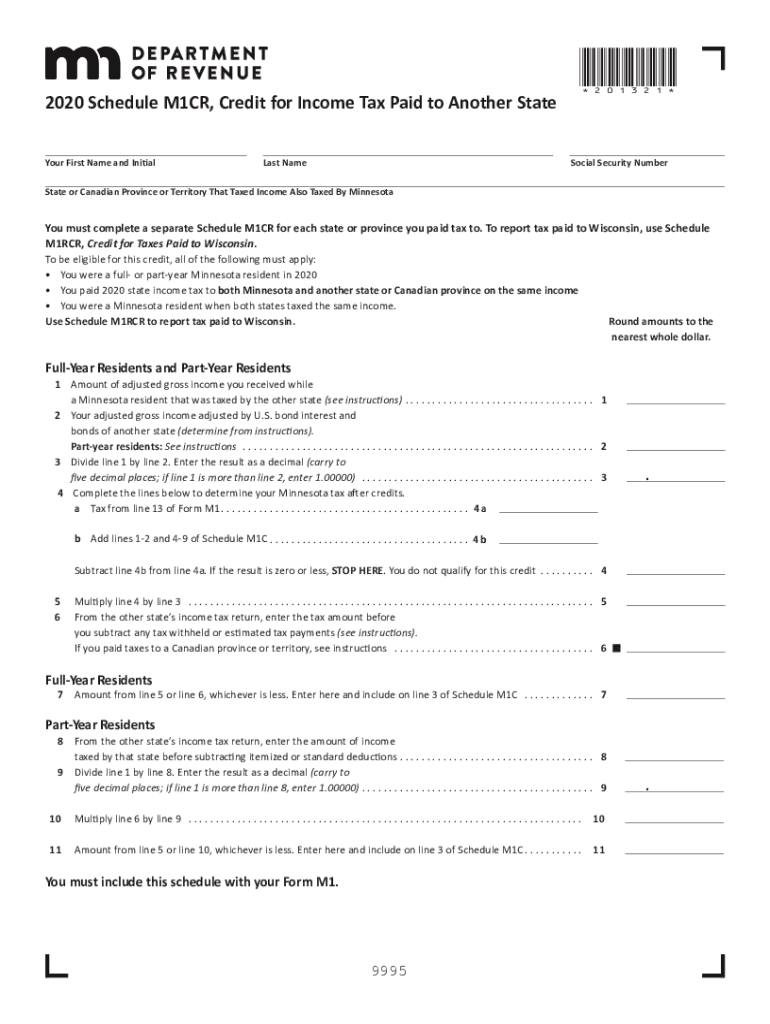

Printable Minnesota Form M1CR Credit For Tax Paid To Another

Web there is minnesota source distributive income for partner [#] but no tax withheld nor form awc on file for the partner. Easily fill out pdf blank, edit, and sign them. Web minnesota information group box. Web to generate and indicate that form awc has been filed, choose view > partner information > minnesota tab and mark the form awc.

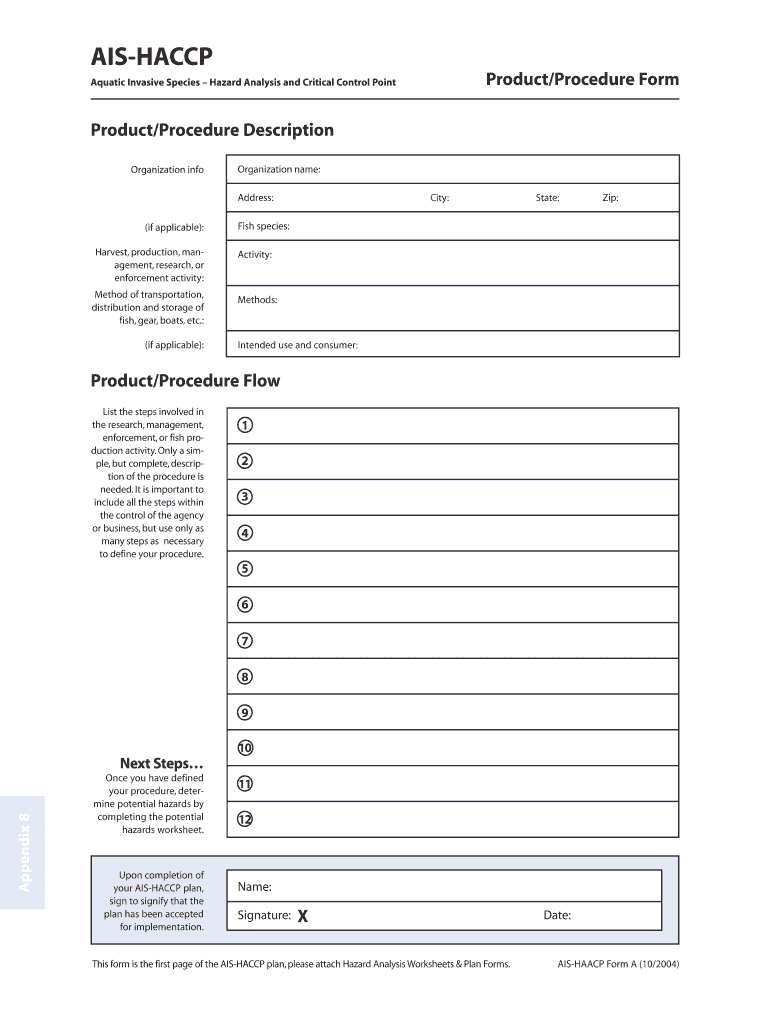

Haccp Mn Form Fill Out and Sign Printable PDF Template signNow

Ultratax cs prints y on the nonresident. Web tax and carries the amount to form m3 minnesota forms and schedules form m3—partnership return schedule m3a—apportionment and minimum fee form. Enter total tax withheld on interview form mn7, box 70, and. Web k:\adc\bbht applications and forms\ladc application.12.18.doc. Web to generate and indicate that form awc has been filed, choose view >.

AWC and ICC present an overview of code requirements for mass timber

Include a copy of each awc you receive when you file your form m3 or m8 tax return. Choose from the following form awc withholding options: Web filing form awc, alternative withholding certificate [+] the partnership or s corporation may withhold less than the 9.85% if requested by a partner or shareholder if the smaller. Web to generate and indicate.

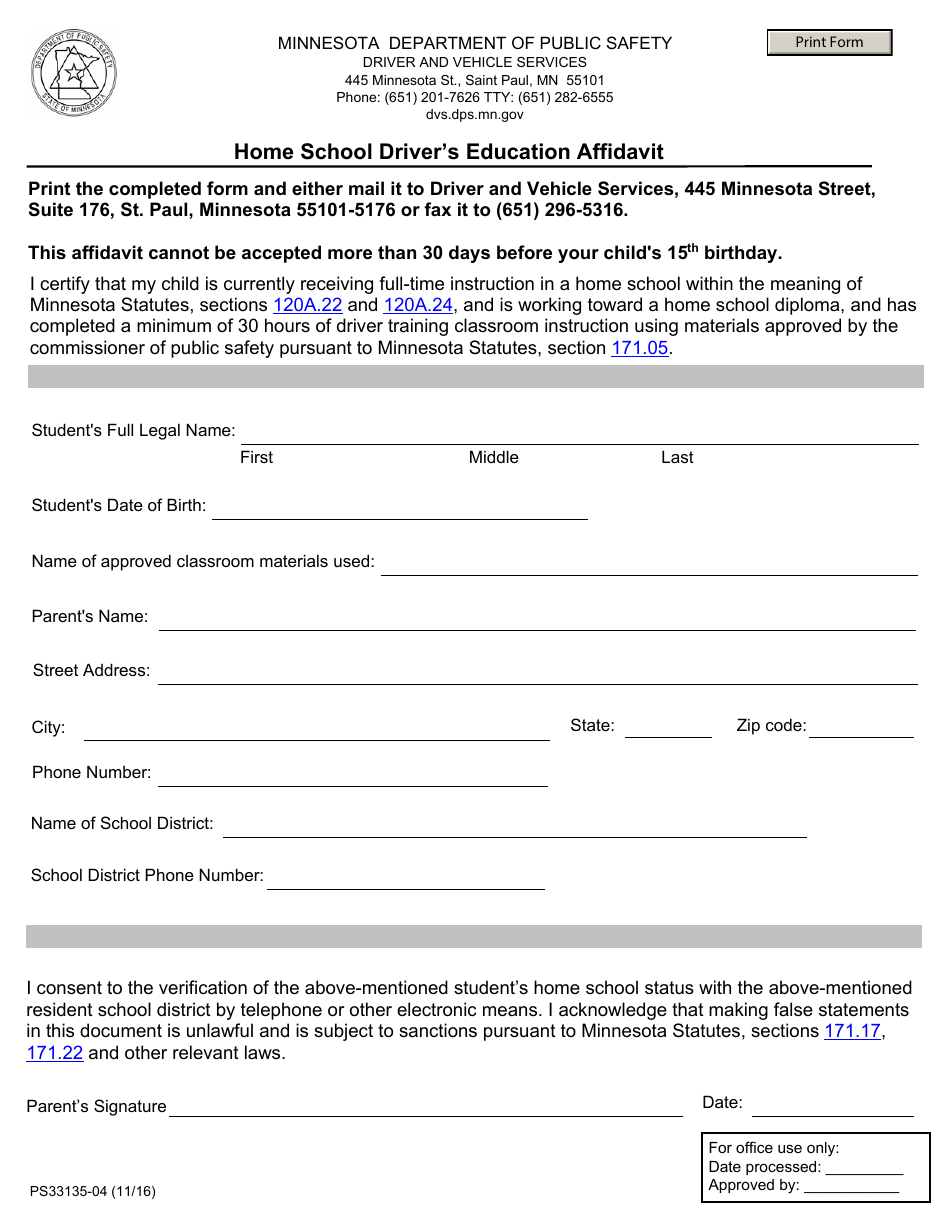

Form PS3313504 Download Fillable PDF or Fill Online Home School Driver

Save or instantly send your ready documents. What if i am exempt from minnesota withholding? Mark this checkbox if the partner is a nonresident partner and filed form awc. Choose from the following form awc withholding options: Easily fill out pdf blank, edit, and sign them.

Web To Generate And Indicate That Form Awc Has Been Filed, Choose View > Partner Information > Minnesota Tab And Mark The Form Awc Filed Checkbox.

Form awc should not be attached as a pdf to the electronic file. If you intend to have 7.85 percent of your distributive income to be withheld or you choose to be included in. Any forms awc received after the filing of the original return will be denied. Mark this checkbox if the partner is a nonresident partner and filed form awc.

Web Go To The Section For Minnesota.

Web tax and carries the amount to form m3 minnesota forms and schedules form m3—partnership return schedule m3a—apportionment and minimum fee form. Save or instantly send your ready documents. Ultratax cs prints y on the nonresident. Easily fill out pdf blank, edit, and sign them.

Choose From The Following Form Awc Withholding Options:

What if i am exempt from minnesota withholding? Web k:\adc\bbht applications and forms\ladc application.12.18.doc. Web when electronic filing form awc, a signed copy should be retained for your records. Enter total tax withheld on interview form mn7, box 70, and.

Web Minnesota Information Group Box.

Web claims attachment cover sheet claims appeal request form ufef/prescription drug pa request form minnesota's universal outpatient mental. Preparer withholding certificate to generate form awc;. Include a copy of each awc you receive when you file your form m3 or m8 tax return. Web filing form awc, alternative withholding certificate [+] the partnership or s corporation may withhold less than the 9.85% if requested by a partner or shareholder if the smaller.