Minnesota Renters Rebate Form 2022

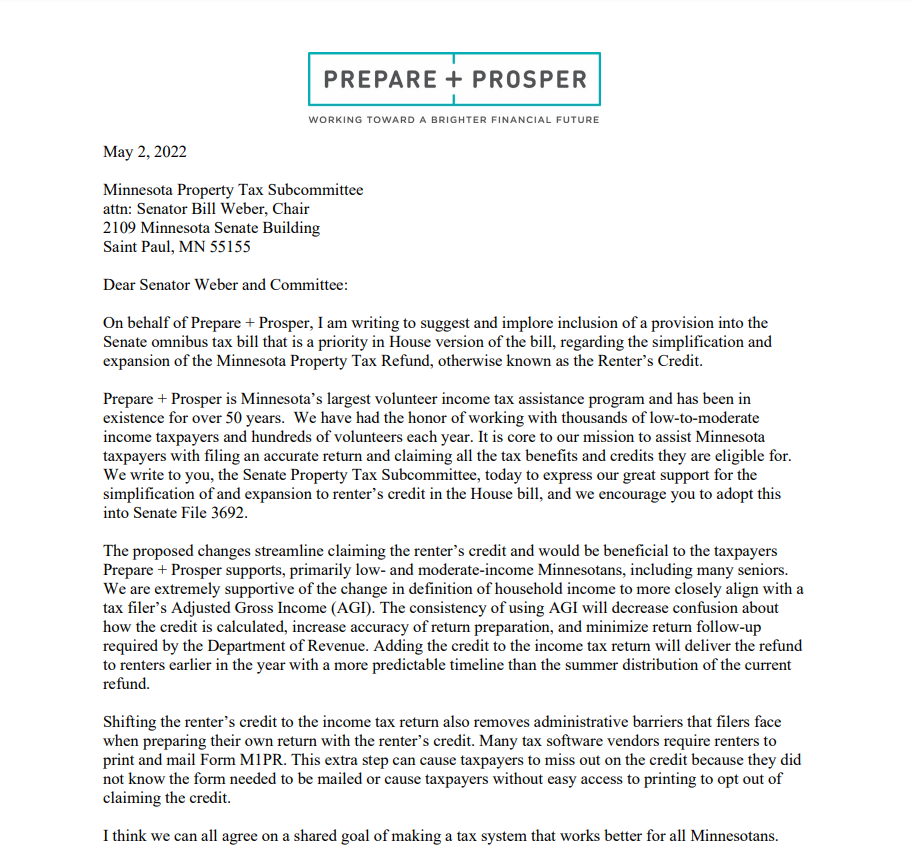

Minnesota Renters Rebate Form 2022 - Complete, edit or print tax forms instantly. Minnesota property tax refund st. Refund claims are filed using minnesota department of revenue (dor) schedule m1pr. Schedule m1pr is filed separately from the individual income. Download or email mn crp form & more fillable forms, register and subscribe now! Web september 2, 2022 by tamble. Web for this year, renters are eligible to receive up to $654. However, for homes that qualify, the refund amount can be somewhat higher, with the typical refund amount. Web how are claims filed? Web 2022 mn renters rebate form minn kota rebate form.

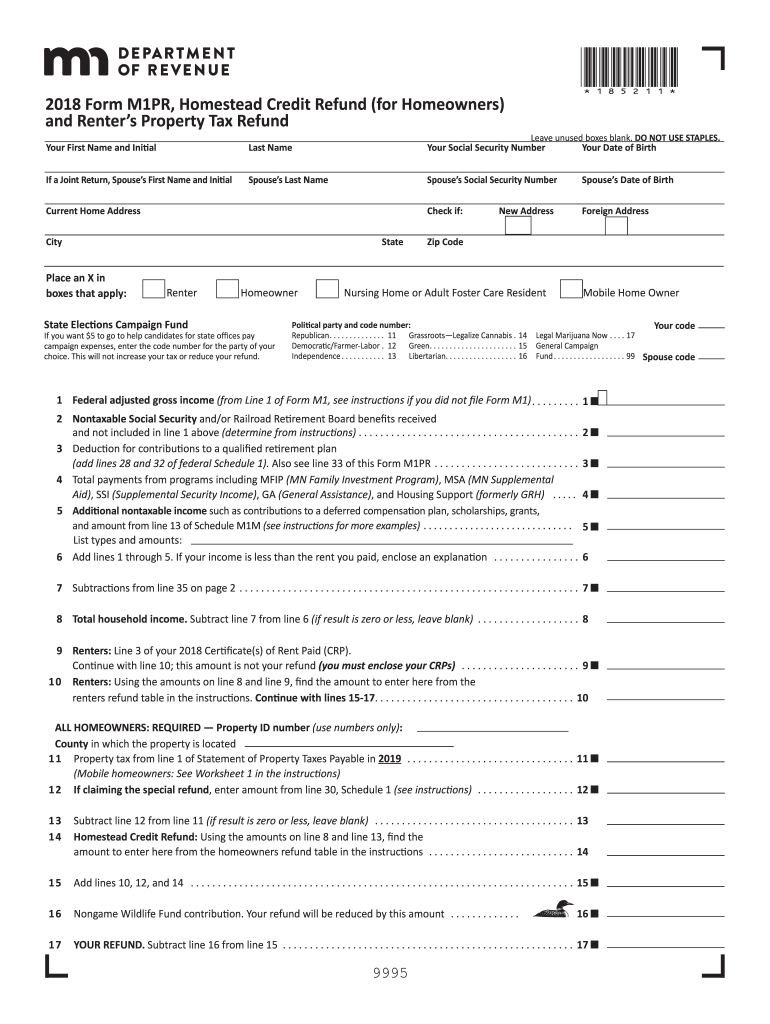

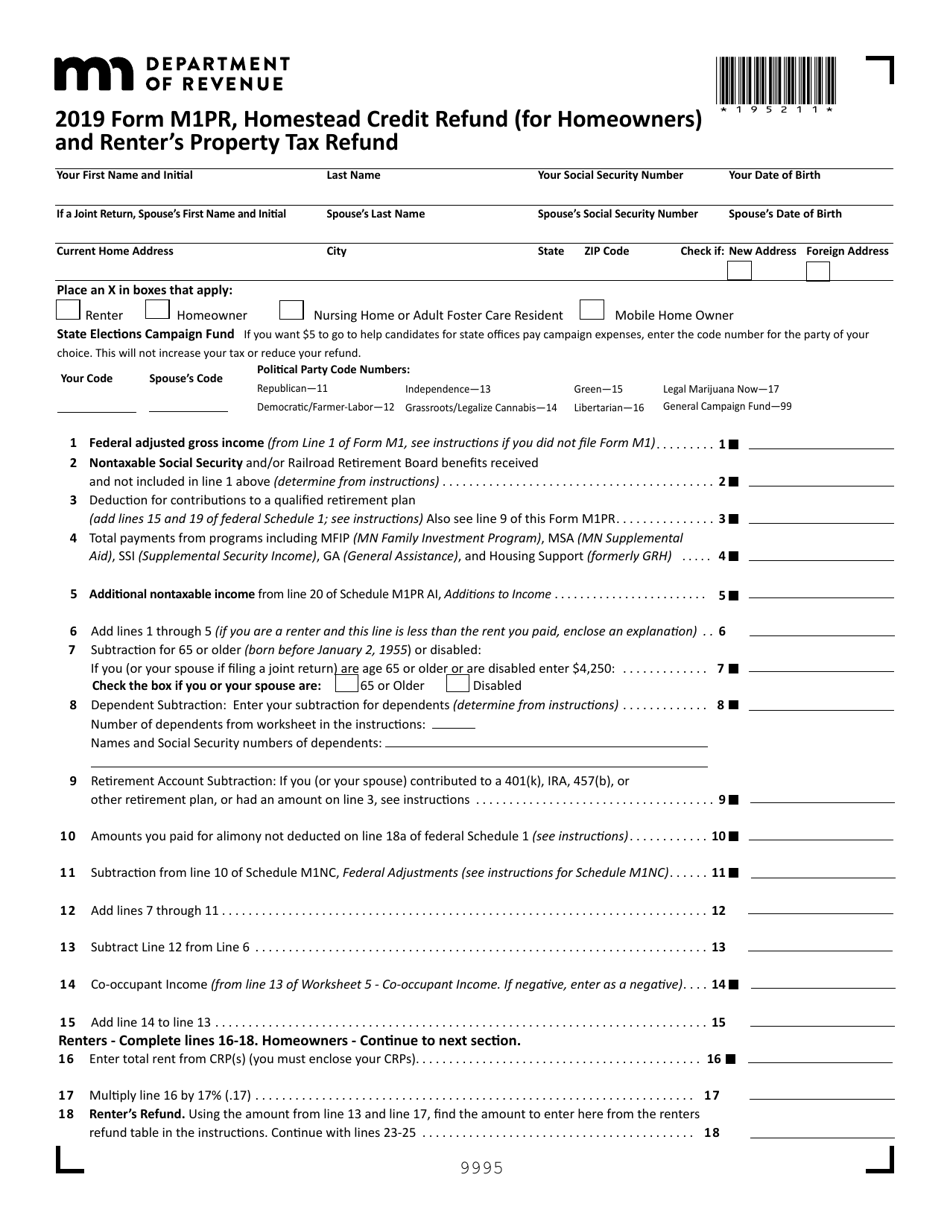

However, for homes that qualify, the refund amount can be somewhat higher, with the typical refund amount. Taxpayers filing claims after that date will not receive a refund. Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) city state zip code check all that apply:. Web we last updated the certificate of rent paid (for landlord use only) in december 2022, so this is the latest version of form crp, fully updated for tax year 2022. How many renters receive refunds, and. Homeowners and renters who meet income requirements may claim up to $700 in property taxes. Complete, edit or print tax forms instantly. Web for this year, renters are eligible to receive up to $654. The rebate amount depends on a graduated. Regular property tax refund income requirements if you are and you may qualify for a refund of up to a.

Web the deadline for filing claims based on rent paid in 2020 is august 15, 2022; Web property taxes or rent paid on your primary residence in minnesota. Web we last updated the homestead credit refund and renter’s property tax refund instruction booklet in february 2023, so this is the latest version of form m1pr. Web if you're a minnesota homeowner or renter, you may qualify for a property tax refund. What if my landlord doesn’t give me the crp? Web september 2, 2022 by tamble. Web we last updated the certificate of rent paid (for landlord use only) in december 2022, so this is the latest version of form crp, fully updated for tax year 2022. Web the refund season is for two years. Homeowners and renters who meet income requirements may claim up to $700 in property taxes. Taxpayers filing claims after that date will not receive a refund.

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Refund claims are filed using minnesota department of revenue (dor) schedule m1pr. Ad download or email mn crp form & more fillable forms, register and subscribe now! Web property taxes or rent paid on your primary residence in minnesota. 2021 form m1, minnesota individual income tax 2021 form m1pr, homestead credit refund (for. Web september 2, 2022 by tamble.

PR141 Renter Rebate Claim

Web 2022 mn renters rebate form minn kota rebate form. Web september 2, 2022 by tamble. Refund claims are filed using minnesota department of revenue (dor) schedule m1pr. However, for homes that qualify, the refund amount can be somewhat higher, with the typical refund amount. Web you filed one of the following returns by december 31, 2022:

Do Home Owners Qualify For Rental Credit cmdesignstyle

Refund claims are filed using minnesota department of revenue (dor) schedule m1pr. Taxpayers filing claims after that date will not receive a refund. Web • if you want to file by regular mail, fill out the form, attach the crp if you rent, and send it. Web 2022 mn renters rebate form minn kota rebate form. However, for homes that.

M1pr form Fill out & sign online DocHub

Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) city state zip code check all that apply:. Taxpayers filing claims after that date will not receive a refund. How do i get my refund? Web the refund season is for two years. Web who can get a refund?

Form M1PR Download Fillable PDF or Fill Online Homestead Credit Refund

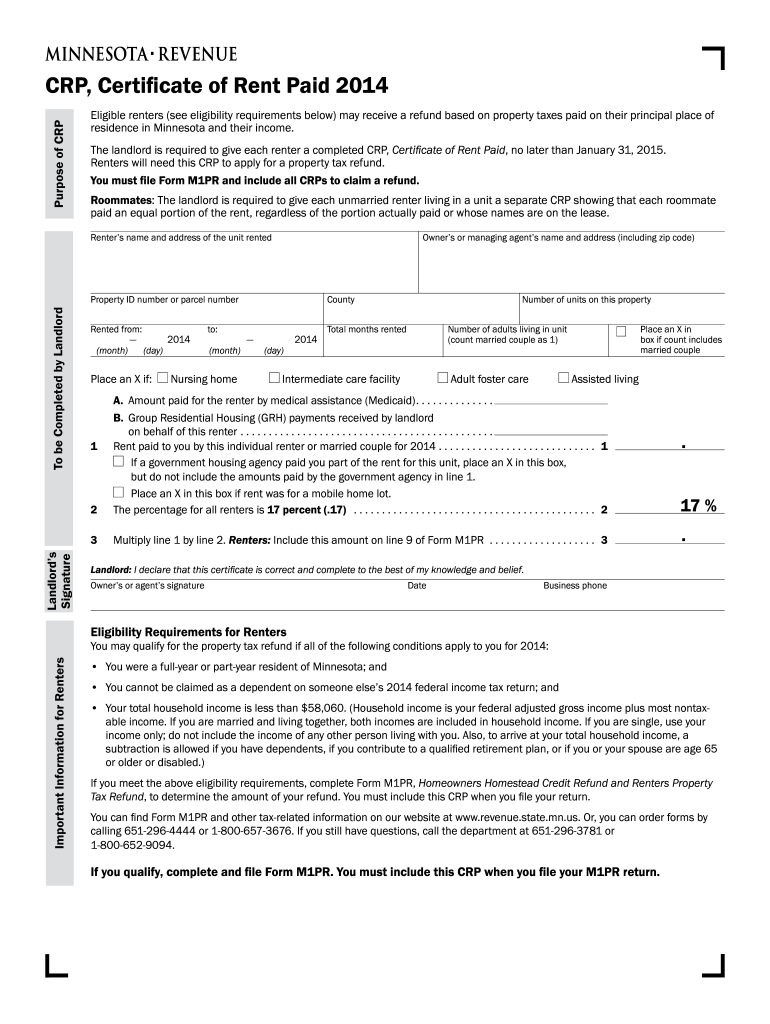

How many renters receive refunds, and. What if my landlord doesn’t give me the crp? Taxpayers filing claims after that date will not receive a refund. Web use this certificate to complete form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Refund claims are filed using minnesota department of revenue (dor) schedule m1pr.

Renters Rebate Form MN 2022 Class Profile Printable Rebate Form

Web you filed one of the following returns by december 31, 2022: Refund claims are filed using minnesota department of revenue (dor) schedule m1pr. Ad download or email mn crp form & more fillable forms, register and subscribe now! Web the department of revenue on monday opened a portal for eligible minnesotans to enter their new address or banking details..

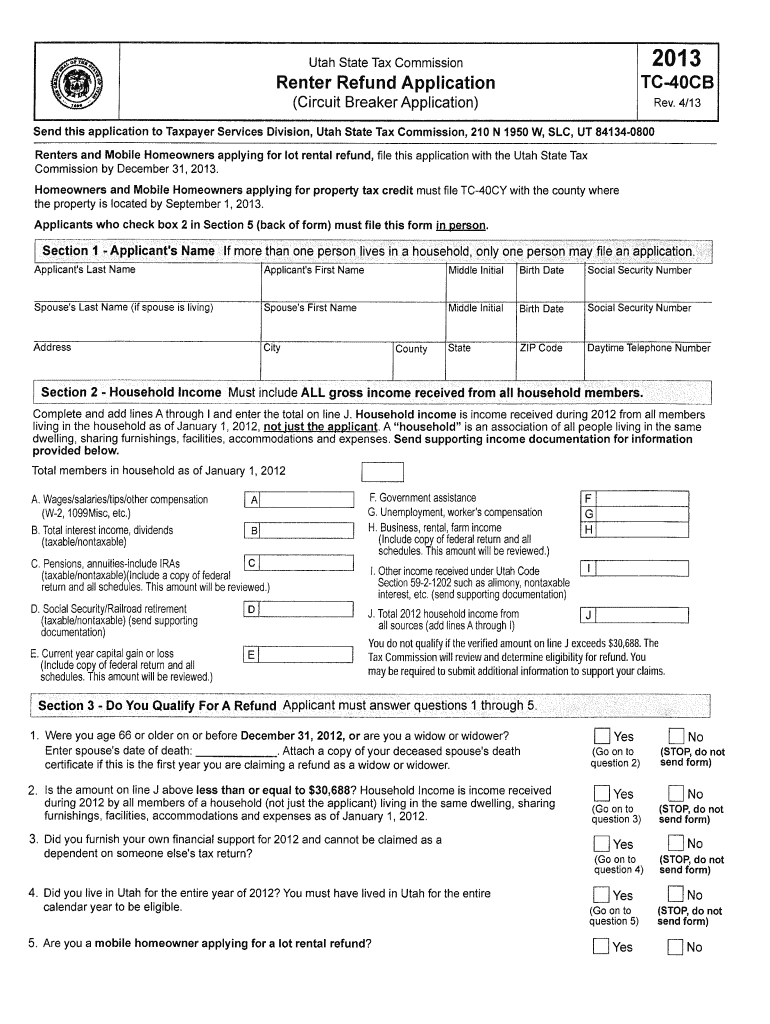

Form Tc 40 Fill Out and Sign Printable PDF Template signNow

Web use this certificate to complete form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. When you file form m1pr, you must attach all. Taxpayers filing claims after that date will not receive a refund. Web september 2, 2022 by tamble. Web we last updated the certificate of rent paid (for landlord use only) in december 2022,.

Alliant Energy Rebates 2022 Printable Rebate Form

Schedule m1pr is filed separately from the individual income. Web if you're a minnesota homeowner or renter, you may qualify for a property tax refund. Web how are claims filed? Download or email mn crp form & more fillable forms, register and subscribe now! Web we last updated the certificate of rent paid (for landlord use only) in december 2022,.

Minnesota Property Tax Refund Fill Out and Sign Printable PDF

Taxpayers filing claims after that date will not receive a refund. Web • if you want to file by regular mail, fill out the form, attach the crp if you rent, and send it. Web the deadline for filing claims based on rent paid in 2020 is august 15, 2022; Refund claims are filed using minnesota department of revenue (dor).

Renter's Property Tax Refund Minnesota Department Of Revenue Fill Out

Web the department of revenue on monday opened a portal for eligible minnesotans to enter their new address or banking details. Homeowners and renters who meet income requirements may claim up to $700 in property taxes. However, for homes that qualify, the refund amount can be somewhat higher, with the typical refund amount. What if my landlord doesn’t give me.

Web The Deadline For Filing Claims Based On Rent Paid In 2020 Is August 15, 2022;

Homeowners and renters who meet income requirements may claim up to $700 in property taxes. Regular property tax refund income requirements if you are and you may qualify for a refund of up to a. Web for this year, renters are eligible to receive up to $654. Web who can get a refund?

Web • If You Want To File By Regular Mail, Fill Out The Form, Attach The Crp If You Rent, And Send It.

Schedule m1pr is filed separately from the individual income. However, for homes that qualify, the refund amount can be somewhat higher, with the typical refund amount. Refund claims are filed using minnesota department of revenue (dor) schedule m1pr. It is due august 15, 2022.

Web The Refund Season Is For Two Years.

Web we last updated the homestead credit refund and renter’s property tax refund instruction booklet in february 2023, so this is the latest version of form m1pr. What if my landlord doesn’t give me the crp? Where can i get help with tax forms? People who made $75,000 or.

Web The Department Of Revenue On Monday Opened A Portal For Eligible Minnesotans To Enter Their New Address Or Banking Details.

The rebate amount depends on a graduated. How many renters receive refunds, and. Web september 24, 2022 by fredrick fernando. Complete, edit or print tax forms instantly.