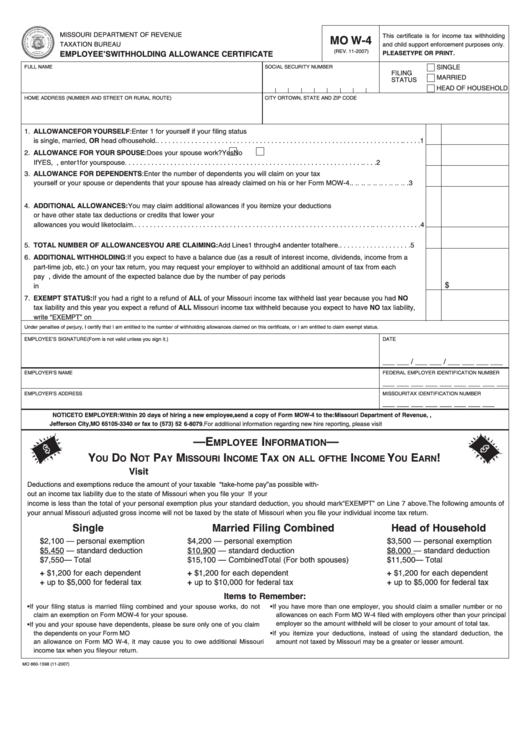

Mo W4 Form

Mo W4 Form - Withholding@dor.mo.gov this form is to be completed by a nonresident who performs a determinable percentage of services within missouri. Deductions and exemptions reduce the amount of your taxable income. Employee’s withholding certificate mail to: Get ready for tax season deadlines by completing any required tax forms today. The request for mail order forms may be used to order one copy or. This form is for income earned in tax year 2022, with tax returns due in april. Web visit www.dor.mo.gov to try our online withholding calculator. Web employee’ssignature (form is not valid unless you sign it.) underpenaltiesofperjury,icertifythatiamentitledtothenumberofwithholdingallowancesclaimedonthiscertificate,oriamentitledtoclaimexemptstatus. Get ready for tax season deadlines by completing any required tax forms today. Box 3340, jefferson city, mo 65105.

Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Web employee’ssignature (form is not valid unless you sign it.) underpenaltiesofperjury,icertifythatiamentitledtothenumberofwithholdingallowancesclaimedonthiscertificate,oriamentitledtoclaimexemptstatus. Box 3340, jefferson city, mo 65105. Withholding@dor.mo.gov this form is to be completed by a nonresident who performs a determinable percentage of services within missouri. Web visit www.dor.mo.gov to try our online withholding calculator. Deductions and exemptions reduce the amount of your taxable income. The request for mail order forms may be used to order one copy or. This form is for income earned in tax year 2022, with tax returns due in april. Employee’s withholding certificate mail to:

Get ready for tax season deadlines by completing any required tax forms today. Deductions and exemptions reduce the amount of your taxable income. Get ready for tax season deadlines by completing any required tax forms today. Withholding@dor.mo.gov this form is to be completed by a nonresident who performs a determinable percentage of services within missouri. Web employee’ssignature (form is not valid unless you sign it.) underpenaltiesofperjury,icertifythatiamentitledtothenumberofwithholdingallowancesclaimedonthiscertificate,oriamentitledtoclaimexemptstatus. Box 3340, jefferson city, mo 65105. Employee’s withholding certificate mail to: The request for mail order forms may be used to order one copy or. This form is for income earned in tax year 2022, with tax returns due in april. Web visit www.dor.mo.gov to try our online withholding calculator.

2010 Form MO W4 Fill Online, Printable, Fillable, Blank pdfFiller

Web employee’ssignature (form is not valid unless you sign it.) underpenaltiesofperjury,icertifythatiamentitledtothenumberofwithholdingallowancesclaimedonthiscertificate,oriamentitledtoclaimexemptstatus. This form is for income earned in tax year 2022, with tax returns due in april. The request for mail order forms may be used to order one copy or. Get ready for tax season deadlines by completing any required tax forms today. Withholding@dor.mo.gov this form is to be.

mo w4 2019 2020 Fill Online, Printable, Fillable Blank w4form

Withholding@dor.mo.gov this form is to be completed by a nonresident who performs a determinable percentage of services within missouri. Get ready for tax season deadlines by completing any required tax forms today. Web visit www.dor.mo.gov to try our online withholding calculator. The request for mail order forms may be used to order one copy or. Get ready for tax season.

Fillable Form Mo W4 Employee'S Withholding Allowance Certificate

Box 3340, jefferson city, mo 65105. The request for mail order forms may be used to order one copy or. Withholding@dor.mo.gov this form is to be completed by a nonresident who performs a determinable percentage of services within missouri. Web employee’ssignature (form is not valid unless you sign it.) underpenaltiesofperjury,icertifythatiamentitledtothenumberofwithholdingallowancesclaimedonthiscertificate,oriamentitledtoclaimexemptstatus. This form is for income earned in tax year 2022,.

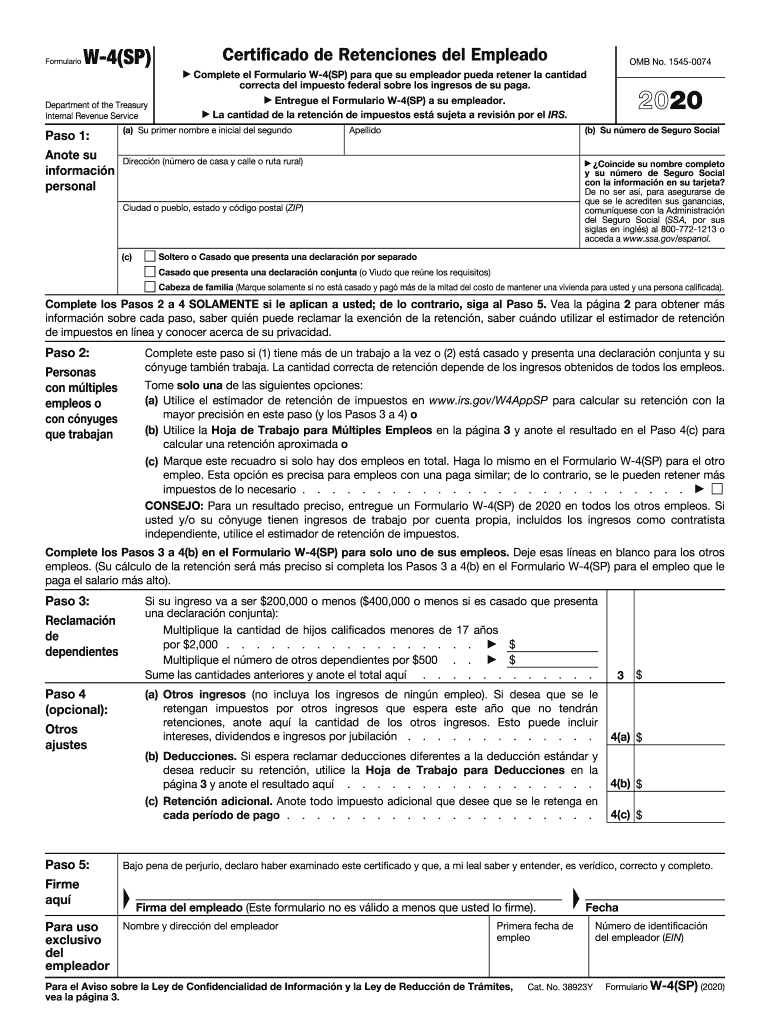

IRS W4(SP) 20202022 Fill out Tax Template Online US Legal Forms

Web employee’ssignature (form is not valid unless you sign it.) underpenaltiesofperjury,icertifythatiamentitledtothenumberofwithholdingallowancesclaimedonthiscertificate,oriamentitledtoclaimexemptstatus. Web visit www.dor.mo.gov to try our online withholding calculator. Box 3340, jefferson city, mo 65105. The request for mail order forms may be used to order one copy or. Withholding@dor.mo.gov this form is to be completed by a nonresident who performs a determinable percentage of services within missouri.

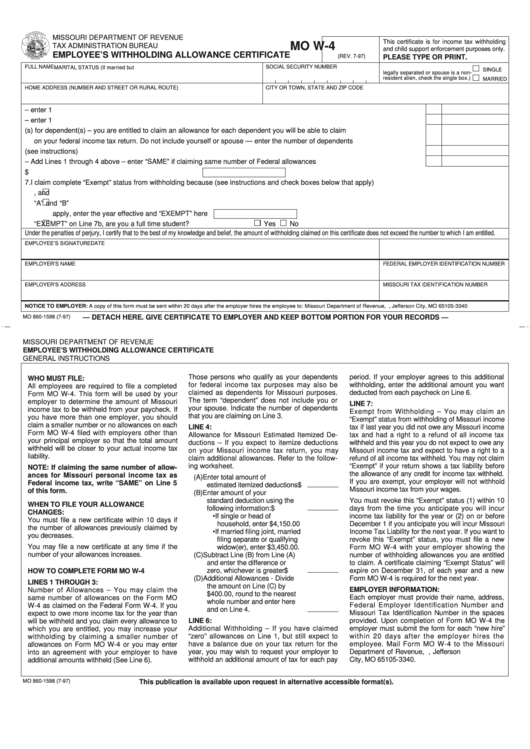

Fillable Form Mo W4 Employee'S Withholding Allowance Certificate

Employee’s withholding certificate mail to: Deductions and exemptions reduce the amount of your taxable income. Get ready for tax season deadlines by completing any required tax forms today. Box 3340, jefferson city, mo 65105. Web employee’ssignature (form is not valid unless you sign it.) underpenaltiesofperjury,icertifythatiamentitledtothenumberofwithholdingallowancesclaimedonthiscertificate,oriamentitledtoclaimexemptstatus.

2019 Form MO W4 Fill Online, Printable, Fillable, Blank pdfFiller

Employee’s withholding certificate mail to: The request for mail order forms may be used to order one copy or. Box 3340, jefferson city, mo 65105. Web visit www.dor.mo.gov to try our online withholding calculator. Deductions and exemptions reduce the amount of your taxable income.

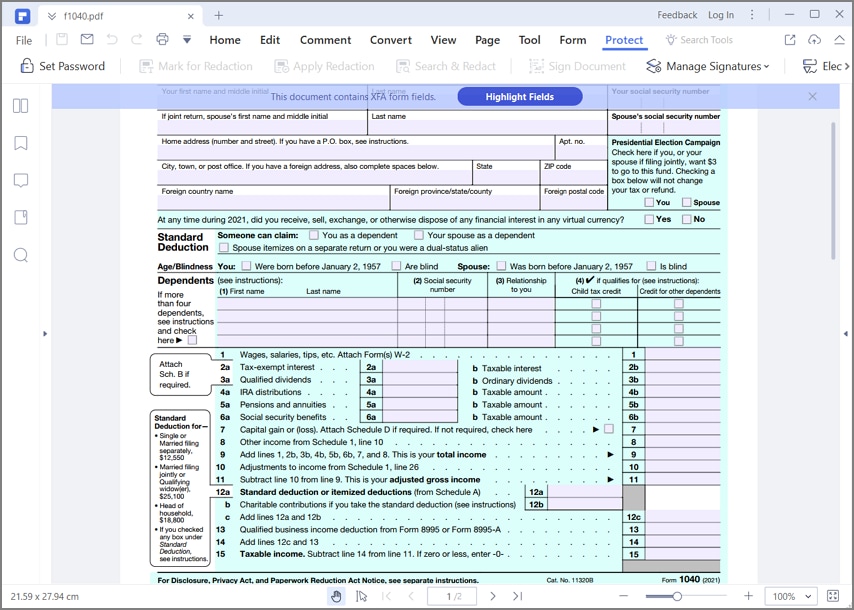

IRS Form W4P Fill it out in an Efficient Way

Withholding@dor.mo.gov this form is to be completed by a nonresident who performs a determinable percentage of services within missouri. Get ready for tax season deadlines by completing any required tax forms today. Web visit www.dor.mo.gov to try our online withholding calculator. Web employee’ssignature (form is not valid unless you sign it.) underpenaltiesofperjury,icertifythatiamentitledtothenumberofwithholdingallowancesclaimedonthiscertificate,oriamentitledtoclaimexemptstatus. Box 3340, jefferson city, mo 65105.

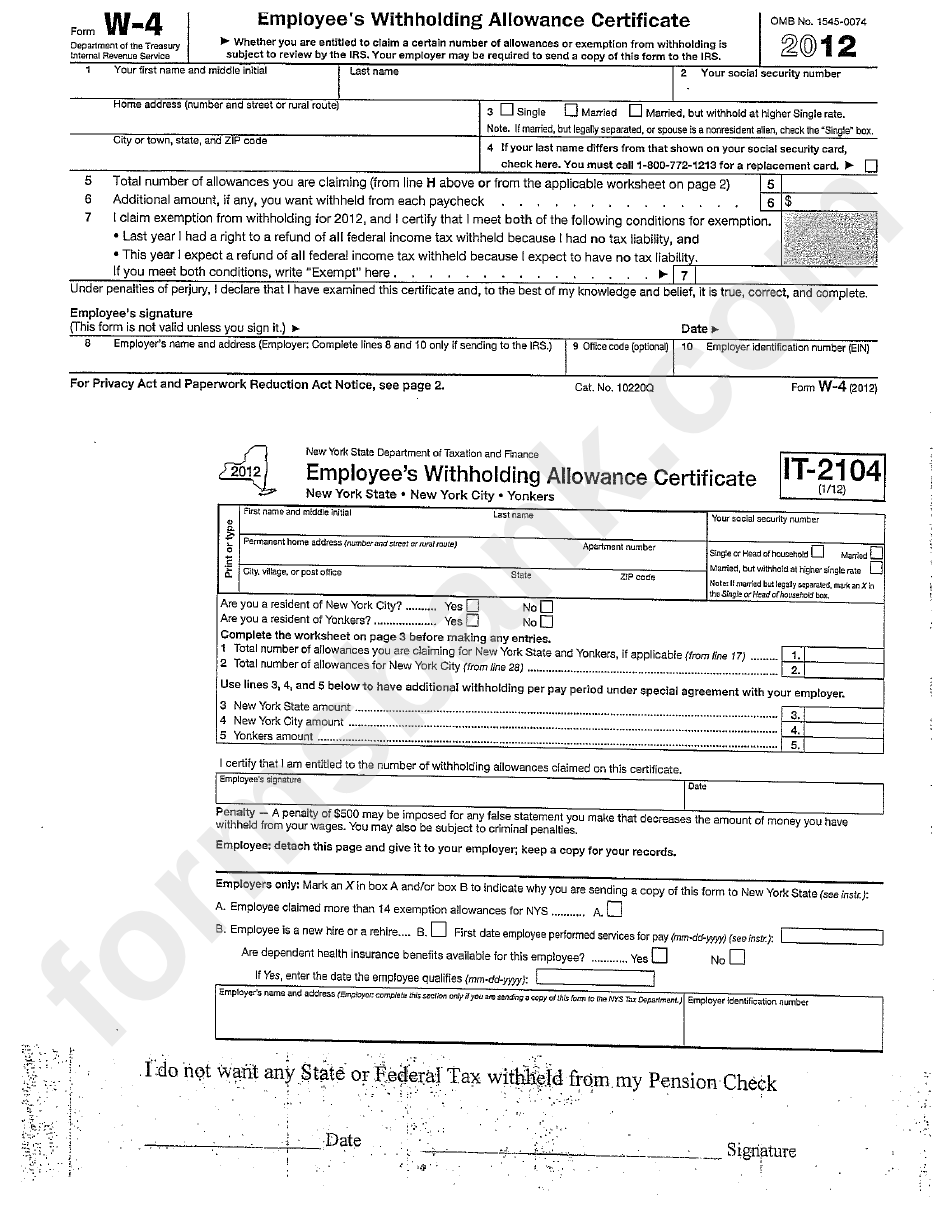

Form W4 Employee'S Withholding Allowance Certificate 2012, New

Employee’s withholding certificate mail to: Deductions and exemptions reduce the amount of your taxable income. Web visit www.dor.mo.gov to try our online withholding calculator. Withholding@dor.mo.gov this form is to be completed by a nonresident who performs a determinable percentage of services within missouri. The request for mail order forms may be used to order one copy or.

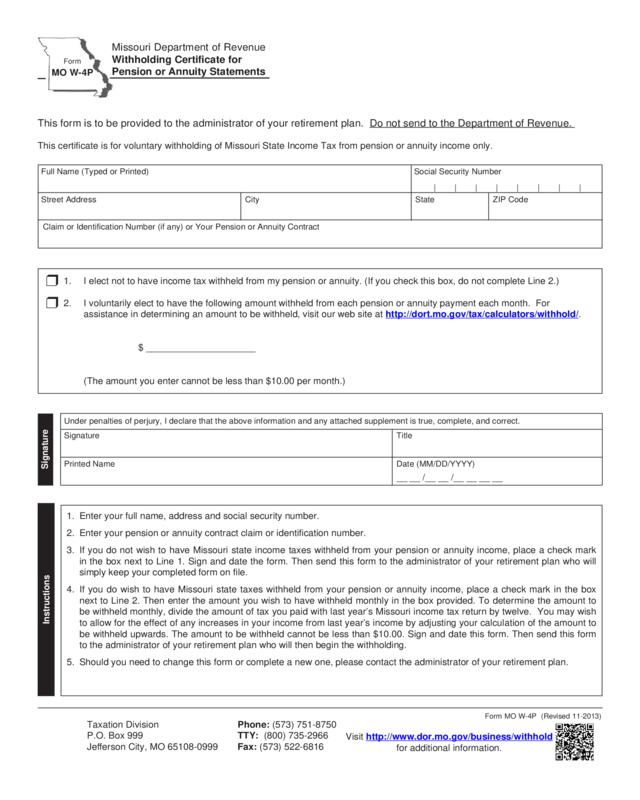

Form Mo W4P Missouri Department Of Revenue Edit, Fill, Sign Online

The request for mail order forms may be used to order one copy or. Web visit www.dor.mo.gov to try our online withholding calculator. Box 3340, jefferson city, mo 65105. Get ready for tax season deadlines by completing any required tax forms today. Deductions and exemptions reduce the amount of your taxable income.

Form Mo W4 Employee'S Withholding Allowance Certificate printable

Get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns due in april. Employee’s withholding certificate mail to: Withholding@dor.mo.gov this form is to be completed by a nonresident who performs a determinable percentage of services within missouri. Deductions and exemptions reduce the amount of.

The Request For Mail Order Forms May Be Used To Order One Copy Or.

Withholding@dor.mo.gov this form is to be completed by a nonresident who performs a determinable percentage of services within missouri. Box 3340, jefferson city, mo 65105. This form is for income earned in tax year 2022, with tax returns due in april. Deductions and exemptions reduce the amount of your taxable income.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web employee’ssignature (form is not valid unless you sign it.) underpenaltiesofperjury,icertifythatiamentitledtothenumberofwithholdingallowancesclaimedonthiscertificate,oriamentitledtoclaimexemptstatus. Web visit www.dor.mo.gov to try our online withholding calculator. Get ready for tax season deadlines by completing any required tax forms today. Employee’s withholding certificate mail to: