Nc 5500 Form

Nc 5500 Form - Web follow this simple instruction to edit nc 5500 in pdf format online for free: Web purpose of the form. These days, most americans prefer to do their own income taxes and, furthermore, to complete reports digitally. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Type text, add images, blackout confidential details, add. Web music today's question is what is the form 5500 and do i have to file one the irs department of labor and pension benefit guaranty corporation jointly developed the. If penalty and interest are not paid with the return, you will receive an assessment for the penalty and interest at a later date. Taxpayer’s name (legal name if business): Posting on the web does not constitute acceptance of the filing by the. Web this search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010.

Web purpose of the form. Add nc 5500 from your device, the cloud, or a secure url. Web penalty and interest are due on this return. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. If penalty and interest are not paid with the return, you will receive an assessment for the penalty and interest at a later date. Posting on the web does not constitute acceptance of the filing by the. Taxpayer information ssn or fein ssn of spouse if joint return account id number. Ssn of spouse (if joint return): Type text, add images, blackout confidential details, add. Web this search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010.

Web send nc form 5500 via email, link, or fax. Get everything done in minutes. Create a free account, set a secure password, and go through email verification to. Web follow the simple instructions below: Web penalty and interest are due on this return. Form 5500 version selection tool. Web follow this simple instruction to edit nc 5500 in pdf format online for free: Web purpose of the form. These days, most americans prefer to do their own income taxes and, furthermore, to complete reports digitally. The us legal forms web.

Form 5500 Search What You Need To Know Form 5500

Web music today's question is what is the form 5500 and do i have to file one the irs department of labor and pension benefit guaranty corporation jointly developed the. Posting on the web does not constitute acceptance of the filing by the. The us legal forms web. These days, most americans prefer to do their own income taxes and,.

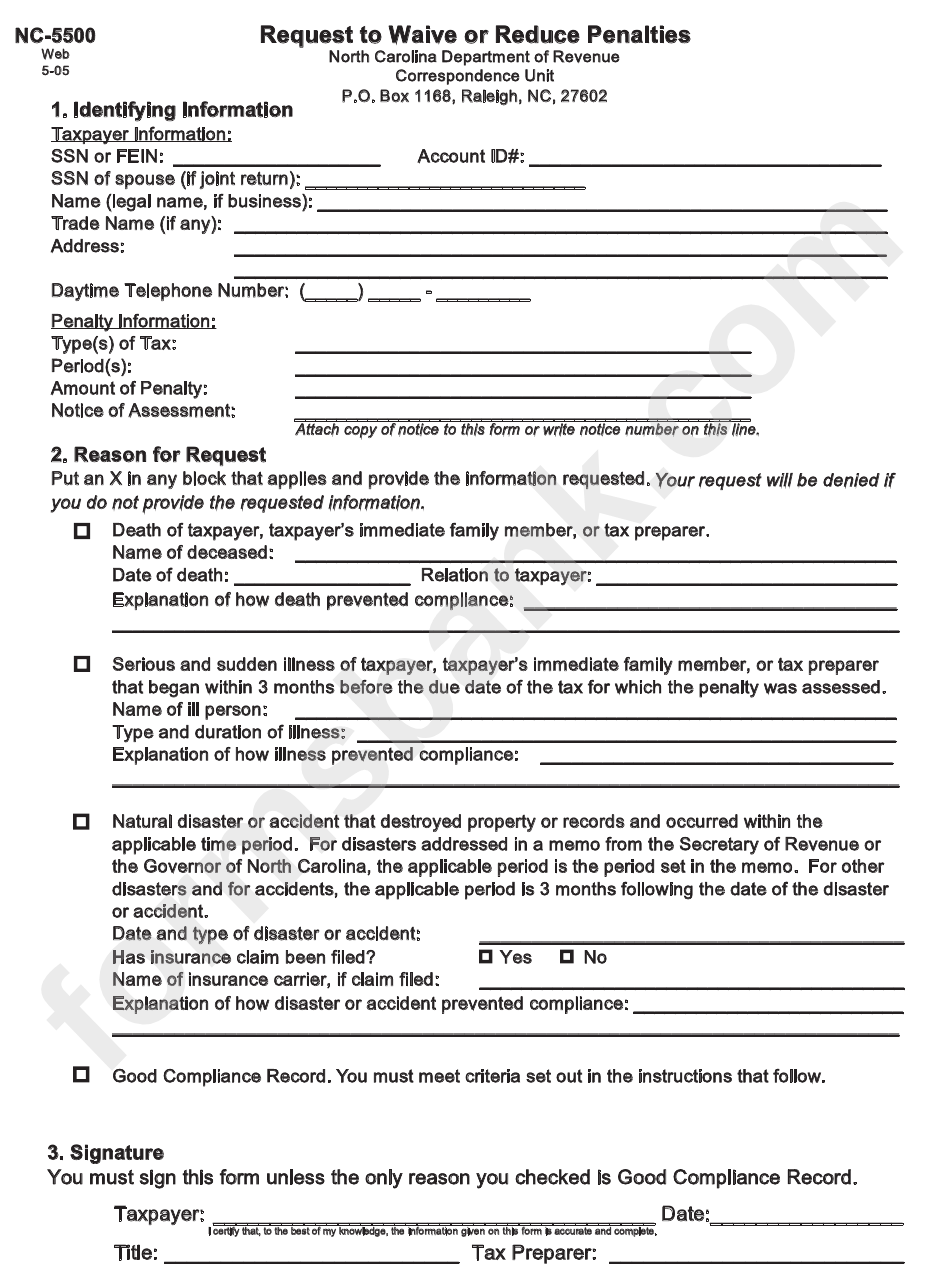

Form Nc5500 Request To Walve Or Reduce Penaltles 2005 printable

You can also download it, export it or print it out. Web music today's question is what is the form 5500 and do i have to file one the irs department of labor and pension benefit guaranty corporation jointly developed the. Web follow this simple instruction to edit nc 5500 in pdf format online for free: Get everything done in.

How to File Form 5500EZ Solo 401k

Taxpayer information ssn or fein: You can also download it, export it or print it out. Web penalty and interest are due on this return. Make changes to the sample. Web the form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and beneficiaries, and.

What is the Form 5500? Guideline

If penalty and interest are not paid with the return, you will receive an assessment for the penalty and interest at a later date. Web follow the simple instructions below: Web this search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. Get everything done in minutes. Type text, add images, blackout confidential details,.

2016 Form NC DoR NC5500 Fill Online, Printable, Fillable, Blank

Taxpayer information ssn or fein ssn of spouse if joint return account id number. Type text, add images, blackout confidential details, add. Taxpayer’s name (legal name if business): Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web the form 5500 series is an important compliance, research, and disclosure tool.

IRS Extends Many Tax Filings, But Not Retirement 5500s Sequoia

Web the form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and beneficiaries, and. Web penalty and interest are due on this return. The us legal forms web. Web follow this simple instruction to edit nc 5500 in pdf format online for free: Get everything done in.

Form Nc5500 Request To Walve Or Reduce Penaltles 2005 printable

Web send nc form 5500 via email, link, or fax. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Taxpayer information ssn or fein ssn of spouse if joint return account id number. Taxpayer information ssn or fein: These days, most americans prefer to do their own income taxes and,.

Tips for Preparing Form 5500 Fairmount Benefits Fairmount Benefits

These days, most americans prefer to do their own income taxes and, furthermore, to complete reports digitally. Taxpayer information ssn or fein: Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web purpose of the form. You can also download it, export it or print it out.

2019 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

Web purpose of the form. Ssn of spouse (if joint return): Web click on new document and choose the form importing option: Web send nc form 5500 via email, link, or fax. These days, most americans prefer to do their own income taxes and, furthermore, to complete reports digitally.

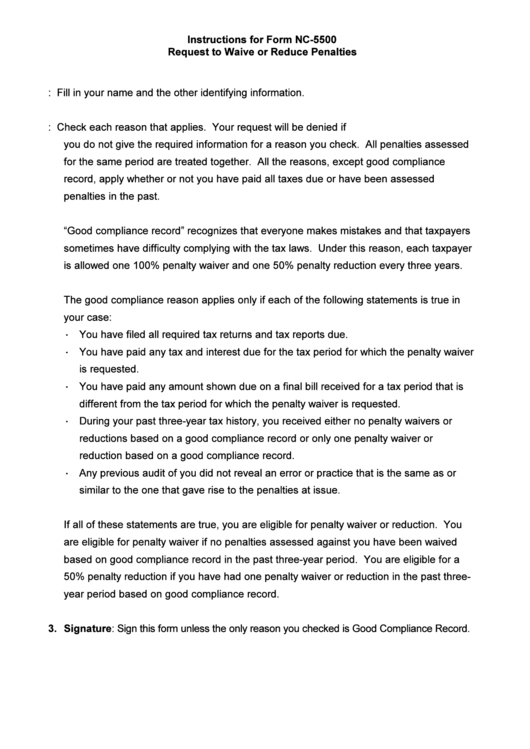

Instructions For Form Nc5500 Request To Waive Or Reduce Penalties

Add nc 5500 from your device, the cloud, or a secure url. Web click on new document and choose the form importing option: Taxpayer information ssn or fein ssn of spouse if joint return account id number. Web purpose of the form. Web send nc form 5500 via email, link, or fax.

Posting On The Web Does Not Constitute Acceptance Of The Filing By The.

Web the form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and beneficiaries, and. The us legal forms web. Web music today's question is what is the form 5500 and do i have to file one the irs department of labor and pension benefit guaranty corporation jointly developed the. Web follow this simple instruction to edit nc 5500 in pdf format online for free:

Taxpayer Information Ssn Or Fein:

Web send nc form 5500 via email, link, or fax. Web follow the simple instructions below: Get everything done in minutes. Taxpayer information ssn or fein ssn of spouse if joint return account id number.

Ssn Of Spouse (If Joint Return):

Taxpayer’s name (legal name if business): These days, most americans prefer to do their own income taxes and, furthermore, to complete reports digitally. Web purpose of the form. Make changes to the sample.

Web This Search Tool Allows You To Search For Form 5500 Series Returns/Reports Filed Since January 1, 2010.

Web penalty and interest are due on this return. You can also download it, export it or print it out. Add nc 5500 from your device, the cloud, or a secure url. If penalty and interest are not paid with the return, you will receive an assessment for the penalty and interest at a later date.