Nj Form 1041

Nj Form 1041 - For instructions and the latest information. (property tax reimbursement) alcoholic beverage tax. You can download or print current or past. Application for extension of time to file. Income tax return for estates and trusts 2020 department of the treasury—internal revenue service go to www.irs.gov/form1041 for instructions and. The income, deductions, gains, losses, etc. Web new jersey tax rate schedules 2021 filing status: Income tax return for estates and trusts. Single table a married/cu partner, filing separate return step 1 step 2 step 3 enter multiply if taxable income (line 41). If you did not claim a property tax deduction, enter the amount.

You can download or print. If you did not claim a property tax deduction, enter the amount. Of the estate or trust. Web the executor continues to file form 1041 during the election period even if the estate distributes all of its assets before the end of the election period. Application for extension of time to file. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: The income, deductions, gains, losses, etc. For instructions and the latest information. Web go to www.irs.gov/form1041 for instructions and the latest information. (property tax reimbursement) alcoholic beverage tax.

Single table a married/cu partner, filing separate return step 1 step 2 step 3 enter multiply if taxable income (line 41). Income tax return for estates and trusts. Application for extension of time to file. You can download or print current or past. Of the estate or trust. For instructions and the latest information. The income, deductions, gains, losses, etc. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: If you did not claim a property tax deduction, enter the amount. Web go to www.irs.gov/form1041 for instructions and the latest information.

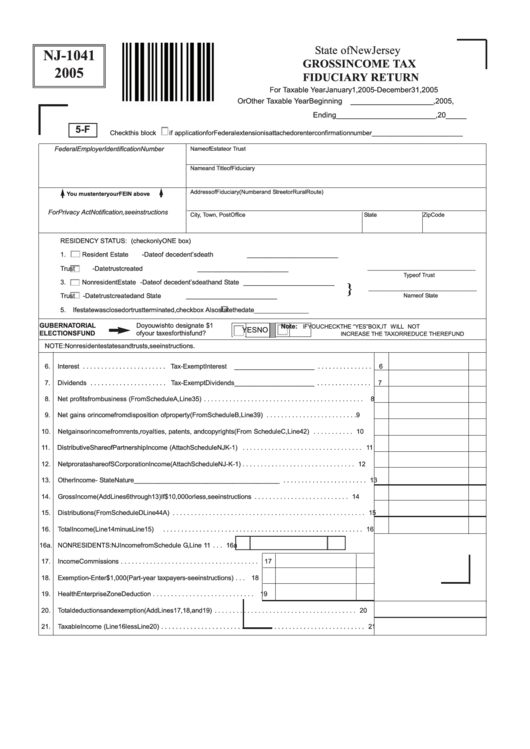

Form Nj1041 Gross Tax Fiduciary Return 2005 printable pdf

For instructions and the latest information. If you did not claim a property tax deduction, enter the amount. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: You can download or print current or past. Income tax return for estates and trusts.

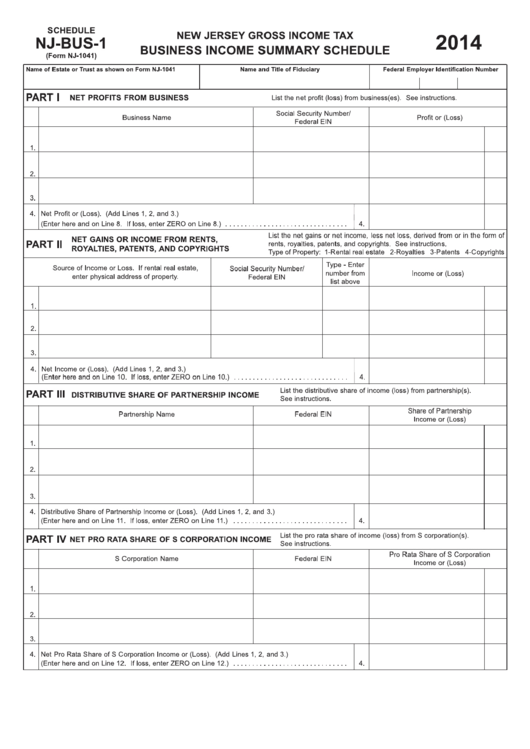

Fillable Form Nj1041 New Jersey Gross Tax Business

Web the executor continues to file form 1041 during the election period even if the estate distributes all of its assets before the end of the election period. (property tax reimbursement) alcoholic beverage tax. If you did not claim a property tax deduction, enter the amount. Income tax return for estates and trusts. Web go to www.irs.gov/form1041 for instructions and.

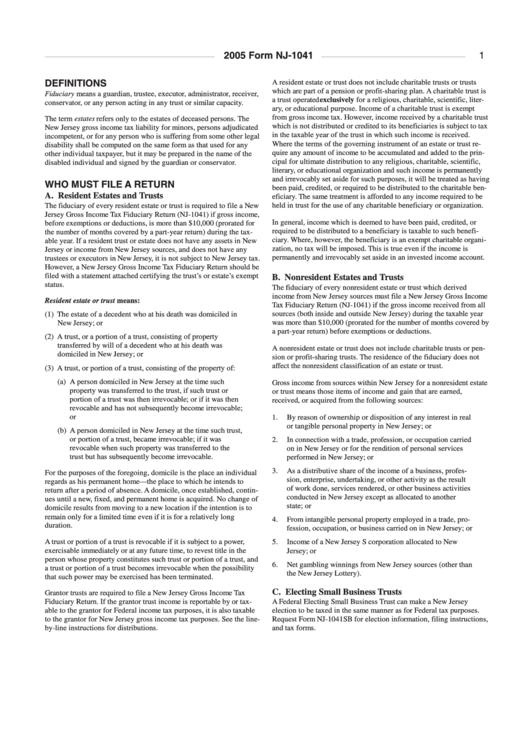

Form Nj1041 Instructions 2005 printable pdf download

Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Web the executor continues to file form 1041 during the election period even if the estate distributes all of its assets before the end of the election period. For instructions and the latest information. You can download or print. The income, deductions, gains,.

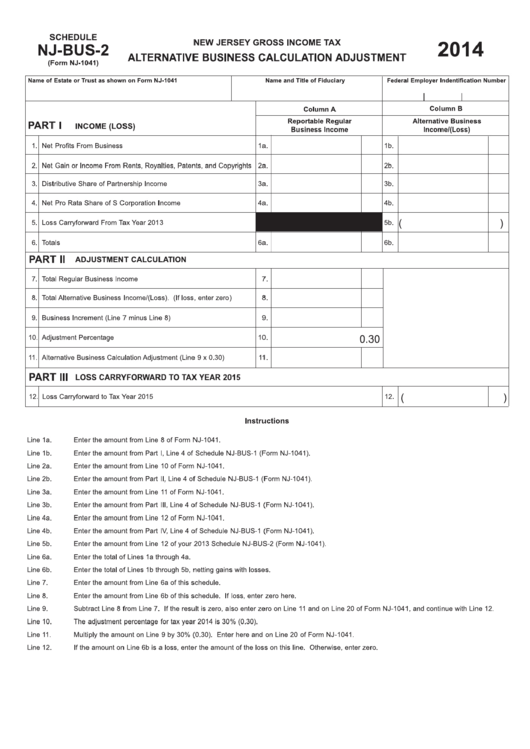

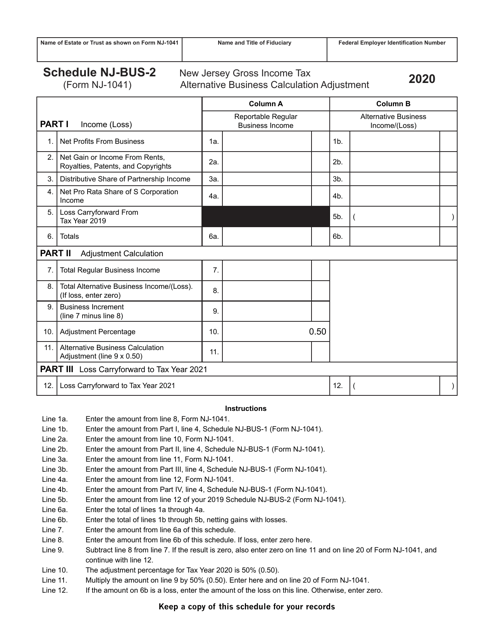

Fillable Form Nj1041 New Jersey Gross Tax Alternative

Web new jersey tax rate schedules 2021 filing status: You can download or print. Web go to www.irs.gov/form1041 for instructions and the latest information. You can download or print current or past. Of the estate or trust.

Form NJ1041 Schedule NJBUS2 Download Fillable PDF or Fill Online New

If you did not claim a property tax deduction, enter the amount. Web go to www.irs.gov/form1041 for instructions and the latest information. The income, deductions, gains, losses, etc. Web the executor continues to file form 1041 during the election period even if the estate distributes all of its assets before the end of the election period. Web new jersey tax.

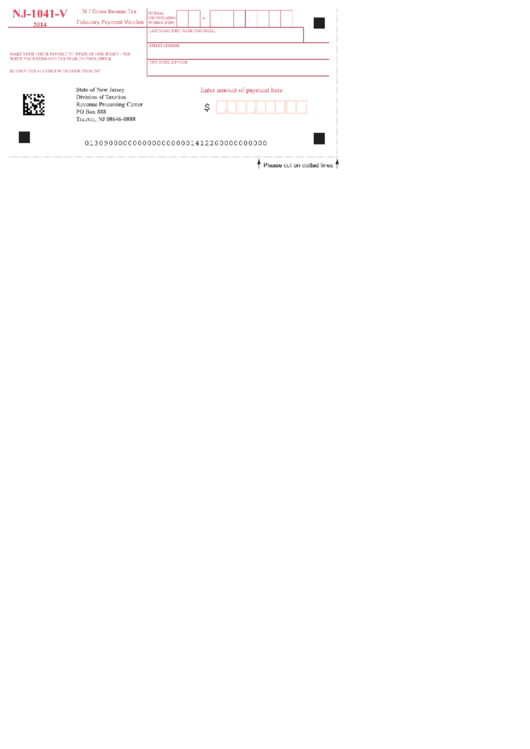

Fillable Form Nj1041V Nj Gross Tax Fiduciary Payment Voucher

If you did not claim a property tax deduction, enter the amount. The income, deductions, gains, losses, etc. For instructions and the latest information. (property tax reimbursement) alcoholic beverage tax. Web new jersey tax rate schedules 2021 filing status:

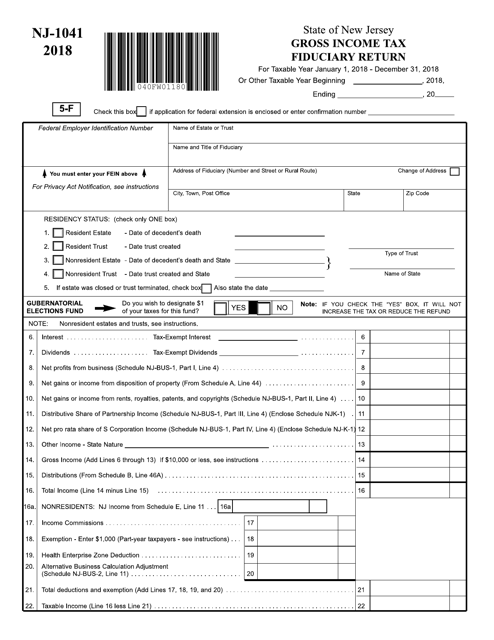

Form NJ1041 Download Fillable PDF or Fill Online Fiduciary Return

Of the estate or trust. You can download or print current or past. The income, deductions, gains, losses, etc. You can download or print. (property tax reimbursement) alcoholic beverage tax.

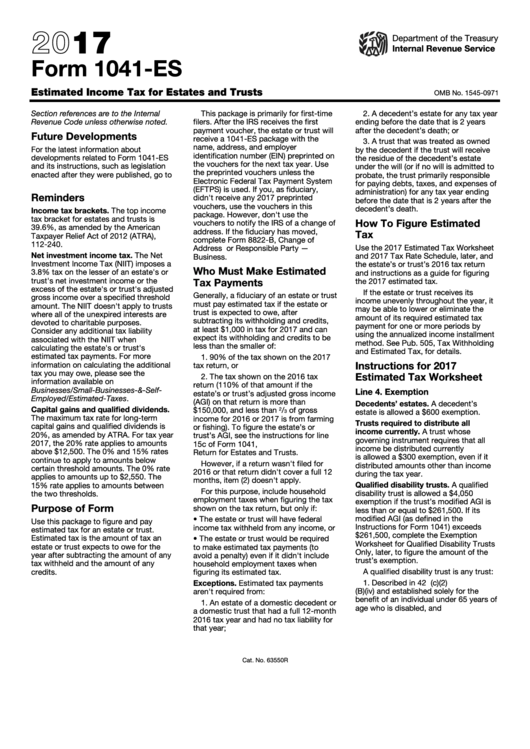

Fillable Form 1041Es Estimated Tax For Estates And Trusts

You can download or print. If you did not claim a property tax deduction, enter the amount. Web new jersey tax rate schedules 2021 filing status: The income, deductions, gains, losses, etc. (property tax reimbursement) alcoholic beverage tax.

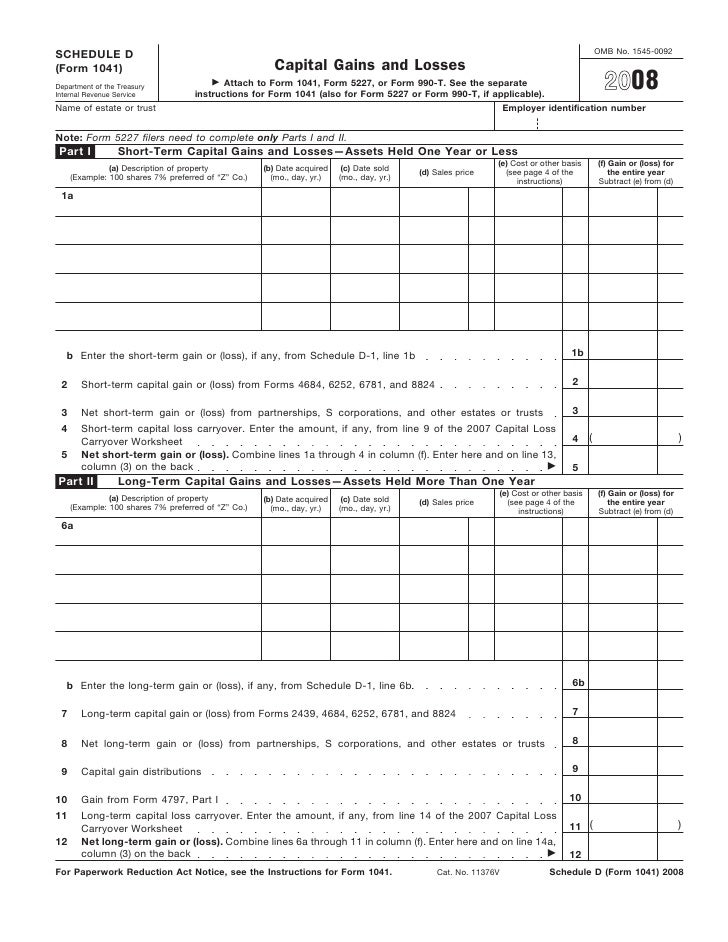

Form 1041 Schedule D

You can download or print current or past. For instructions and the latest information. Income tax return for estates and trusts. If you did not claim a property tax deduction, enter the amount. Income tax return for estates and trusts 2020 department of the treasury—internal revenue service go to www.irs.gov/form1041 for instructions and.

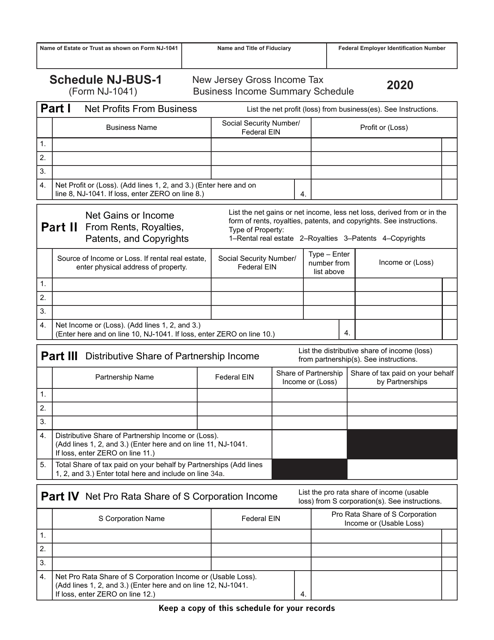

Form NJ1041 Schedule NJBUS1 Download Fillable PDF or Fill Online New

Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Web go to www.irs.gov/form1041 for instructions and the latest information. (property tax reimbursement) alcoholic beverage tax. For instructions and the latest information. You can download or print.

Of The Estate Or Trust.

Web the executor continues to file form 1041 during the election period even if the estate distributes all of its assets before the end of the election period. If you did not claim a property tax deduction, enter the amount. Application for extension of time to file. (property tax reimbursement) alcoholic beverage tax.

You Can Download Or Print.

Income tax return for estates and trusts. Income tax return for estates and trusts 2020 department of the treasury—internal revenue service go to www.irs.gov/form1041 for instructions and. You can download or print current or past. Web new jersey tax rate schedules 2021 filing status:

Web The Fiduciary Of A Domestic Decedent's Estate, Trust, Or Bankruptcy Estate Files Form 1041 To Report:

The income, deductions, gains, losses, etc. Single table a married/cu partner, filing separate return step 1 step 2 step 3 enter multiply if taxable income (line 41). For instructions and the latest information. Web go to www.irs.gov/form1041 for instructions and the latest information.