Non Dc Resident Tax Form

Non Dc Resident Tax Form - Withholding tax, this form must be filed with your employer upon his request. Web if you are not redirected please download directly from the link provided. Rental properties may be liable for sales and use tax or occupancy tax, if the tax is not. On or before april 18, 2022. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. If you work in dc but are a resident of another state, you are not subject to dc income tax. Web verify through the office of tax and revenue (otr). You must complete and attach a copy. Web a dc resident is an individual that maintains a place of abode within dc for 183 days or more. Web nonresidents are not required to file a dc return.

Web if you are not redirected please download directly from the link provided. On or before april 18, 2022. Web individual income tax forms. Web nonresidents are not required to file a dc return. You qualify as a nonresident if: Web a dc resident is an individual that maintains a place of abode within dc for 183 days or more. Web verify through the office of tax and revenue (otr). Web if you are not redirected please download directly from the link provided. Rental properties may be liable for sales and use tax or occupancy tax, if the tax is not. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers.

You qualify as a nonresident if: You must complete and attach a copy. On or before april 18, 2022. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Web to establish that you are not a resident of the district and therefore not subject to t}ie d.c. If the individual is domiciled in the state at anytime, you are considered to be a dc. If you work in dc but are a resident of another state, you are not subject to dc income tax. Web if you are not redirected please download directly from the link provided. Web if you are not redirected please download directly from the link provided. Web registration and exemption tax forms.

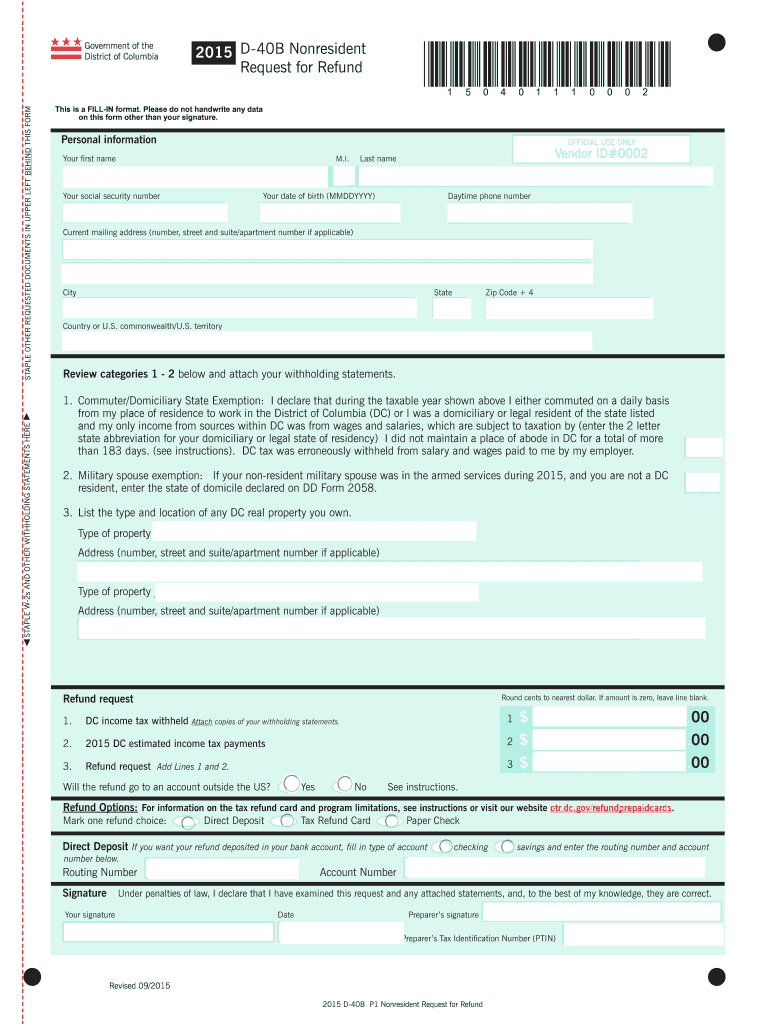

D 40B Fill Out and Sign Printable PDF Template signNow

You qualify as a nonresident if: Web if you are not redirected please download directly from the link provided. If you work in dc but are a resident of another state, you are not subject to dc income tax. You must complete and attach a copy. Individual income tax forms and instructions for single and joint filers with no dependents.

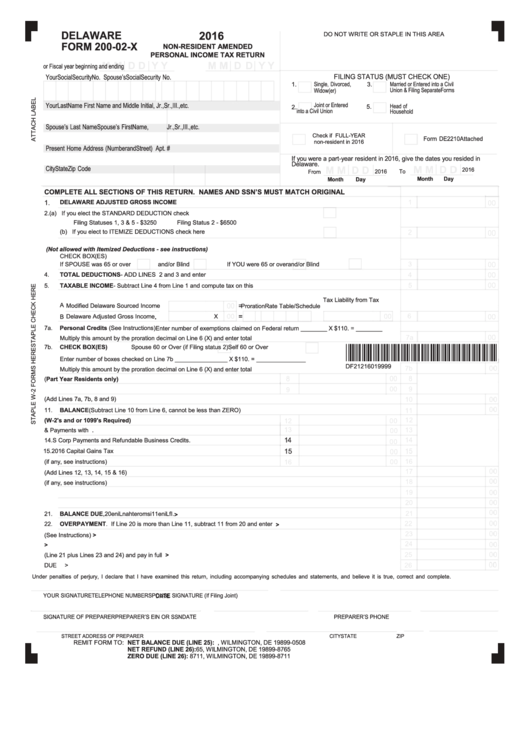

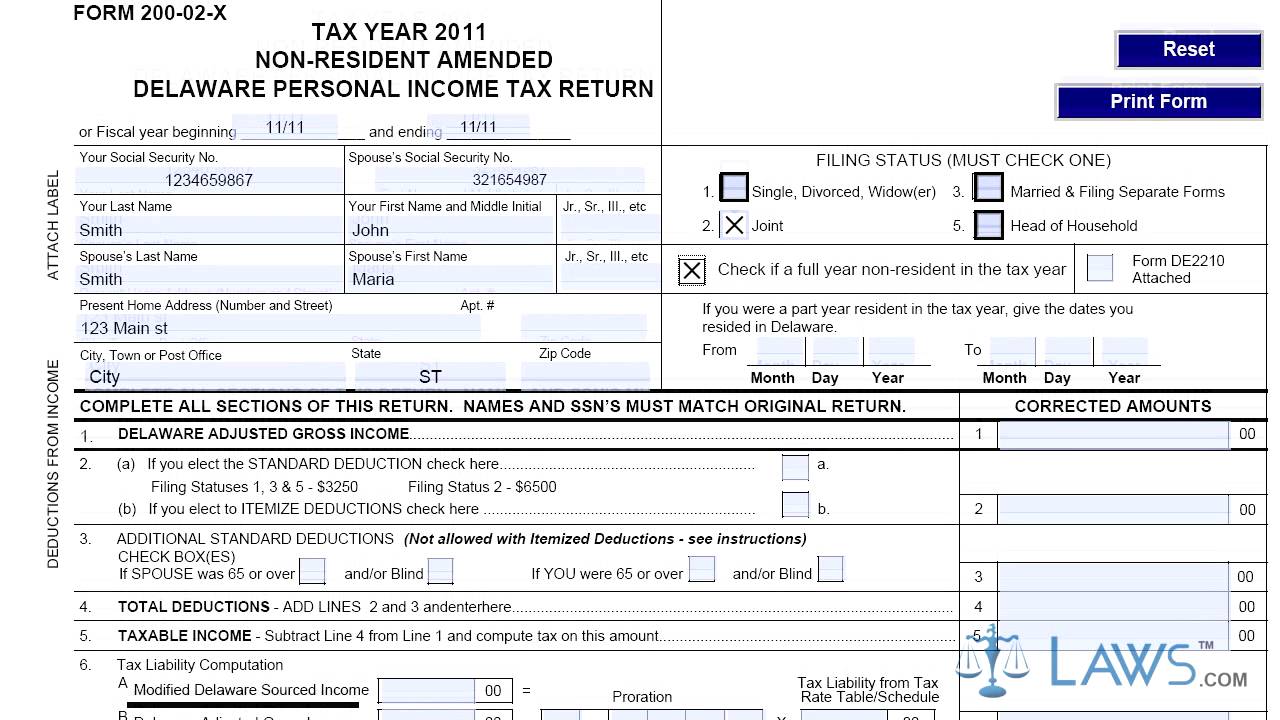

Fillable Form 20002X NonResident Amended Personal Tax

If you work in dc but are a resident of another state, you are not subject to dc income tax. Web you are not required to file a dc return if you are a nonresident of dc unless you are claiming a refund of dc taxes withheld or dc estimated taxes paid. You must complete and attach a copy. If.

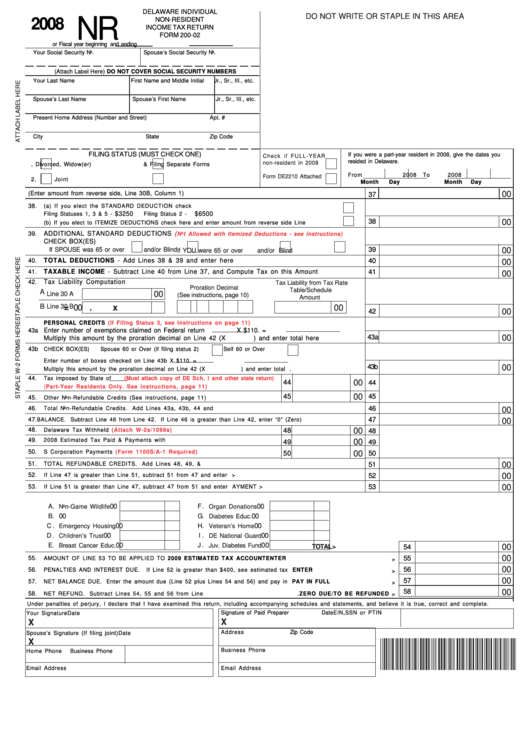

Fillable Form 20002 Delaware Individual NonResident Tax

Web if you are not redirected please download directly from the link provided. On or before april 18, 2022. Web if you are not redirected please download directly from the link provided. Rental properties may be liable for sales and use tax or occupancy tax, if the tax is not. Web to establish that you are not a resident of.

Nonresident Landlord Tax Form Taxes Government Finances

Web individual income tax forms. Web to establish that you are not a resident of the district and therefore not subject to t}ie d.c. Web if you are not redirected please download directly from the link provided. You must complete and attach a copy. Rental properties may be liable for sales and use tax or occupancy tax, if the tax.

US NonResident Tax Return 2019 Delaware Company Formation LLC

You must complete and attach a copy. Sales and use tax forms. Withholding tax, this form must be filed with your employer upon his request. You qualify as a nonresident if: On or before april 18, 2022.

Tax Rules as a NonResidentAlien US Business Owner

Web if you are not redirected please download directly from the link provided. Web registration and exemption tax forms. On or before april 18, 2022. Rental properties may be liable for sales and use tax or occupancy tax, if the tax is not. Withholding tax, this form must be filed with your employer upon his request.

20162022 Form DC D4A Fill Online, Printable, Fillable, Blank pdfFiller

Web verify through the office of tax and revenue (otr). Withholding tax, this form must be filed with your employer upon his request. If the individual is domiciled in the state at anytime, you are considered to be a dc. You qualify as a nonresident if: If you work in dc but are a resident of another state, you are.

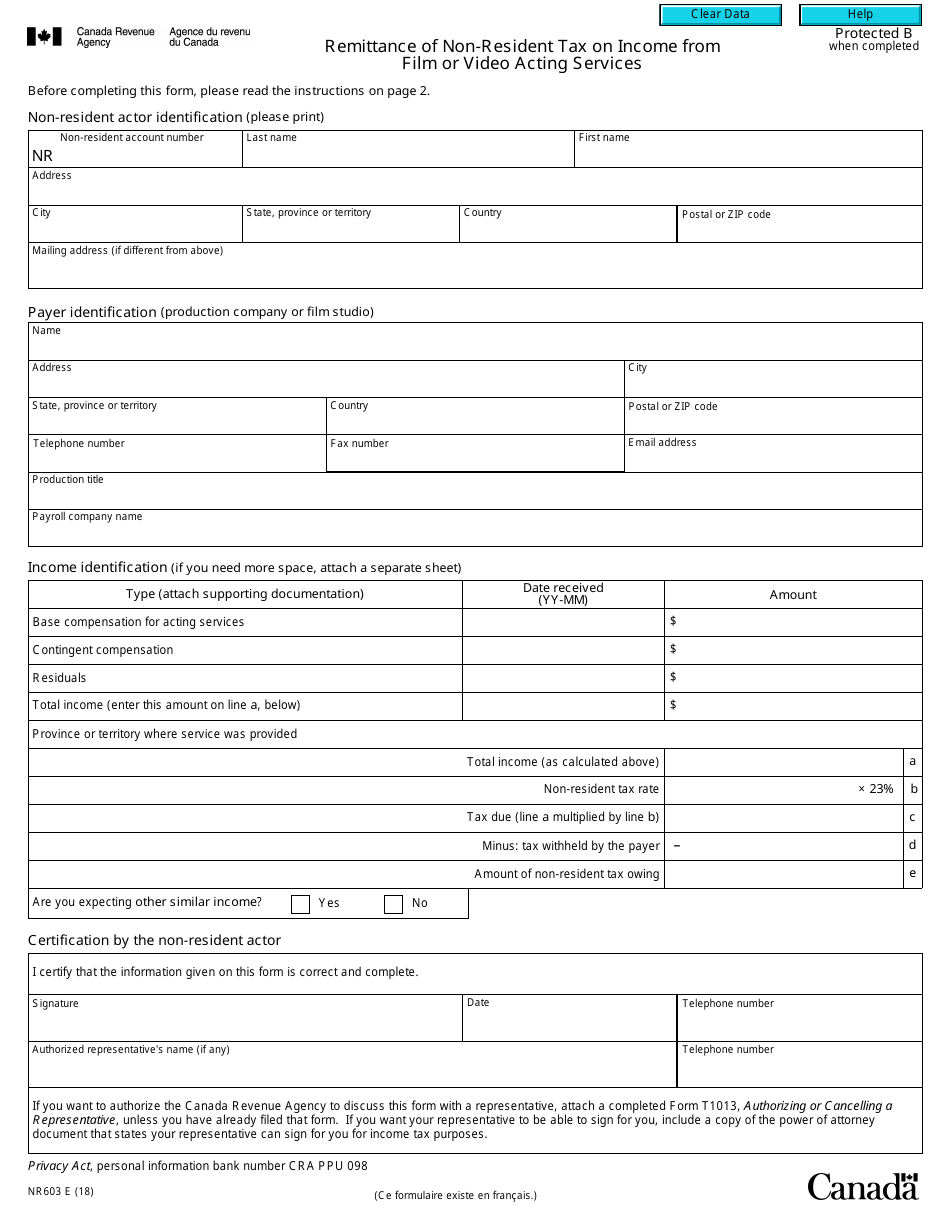

Form NR603 Download Fillable PDF or Fill Online Remittance of Non

Rental properties may be liable for sales and use tax or occupancy tax, if the tax is not. Web a dc resident is an individual that maintains a place of abode within dc for 183 days or more. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Web if you are.

NonResident Speculation Tax What Does it Mean For You? Fuller

Web you are not required to file a dc return if you are a nonresident of dc unless you are claiming a refund of dc taxes withheld or dc estimated taxes paid. Rental properties may be liable for sales and use tax or occupancy tax, if the tax is not. Withholding tax, this form must be filed with your employer.

Form 200 02 X Non Resident Amended Delaware Personal Tax Return

Web if you are not redirected please download directly from the link provided. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Web a dc resident is an individual that maintains a place of abode within dc for 183 days or more. You must complete and attach a copy. Web verify.

You Qualify As A Nonresident If:

Web if you are not redirected please download directly from the link provided. You must complete and attach a copy. Web individual income tax forms. Sales and use tax forms.

On Or Before April 18, 2022.

Web if you are not redirected please download directly from the link provided. Rental properties may be liable for sales and use tax or occupancy tax, if the tax is not. Web to establish that you are not a resident of the district and therefore not subject to t}ie d.c. Web registration and exemption tax forms.

If The Individual Is Domiciled In The State At Anytime, You Are Considered To Be A Dc.

Web verify through the office of tax and revenue (otr). Withholding tax, this form must be filed with your employer upon his request. If you work in dc but are a resident of another state, you are not subject to dc income tax. Web you are not required to file a dc return if you are a nonresident of dc unless you are claiming a refund of dc taxes withheld or dc estimated taxes paid.

Individual Income Tax Forms And Instructions For Single And Joint Filers With No Dependents And All Other Filers.

Web nonresidents are not required to file a dc return. Web a dc resident is an individual that maintains a place of abode within dc for 183 days or more.