North Carolina Form D-400V

North Carolina Form D-400V - Web north carolina taxable income. Were you a resident of n.c. For more information about the north. Single married filing joint head of household widow. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. This payment application should be used only for the payment of tax owed on an amended north carolina individual. Were you a resident of n.c. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. However, with our preconfigured web templates, everything gets.

This payment application should be used only for the payment of tax owed on an amended north carolina individual. Were you a resident of n.c. Single married filing joint head of household widow. Web north carolina taxable income. Were you a resident of n.c. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. For more information about the north. However, with our preconfigured web templates, everything gets. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north.

Web follow the simple instructions below: Web north carolina taxable income. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. However, with our preconfigured web templates, everything gets. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. This payment application should be used only for the payment of tax owed on an amended north carolina individual. Single married filing joint head of household widow. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Were you a resident of n.c. For more information about the north.

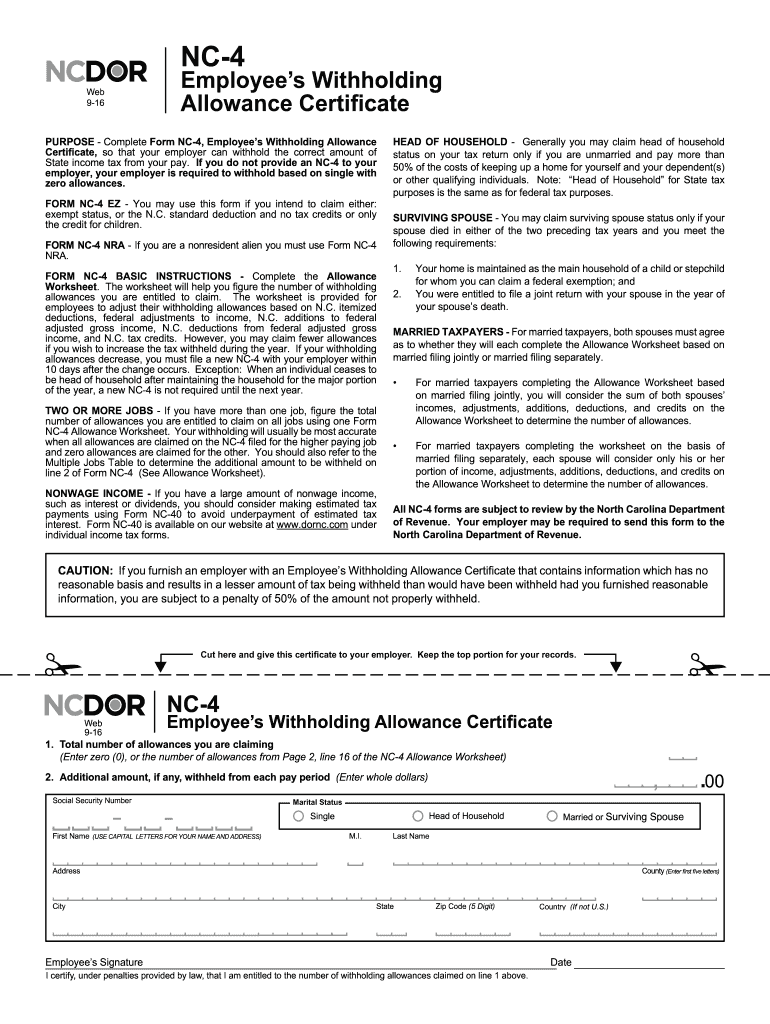

Form NC 4 North Carolina Department of Revenue Fill Out and Sign

However, with our preconfigured web templates, everything gets. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. This payment application should be used only for the payment of tax owed on an amended.

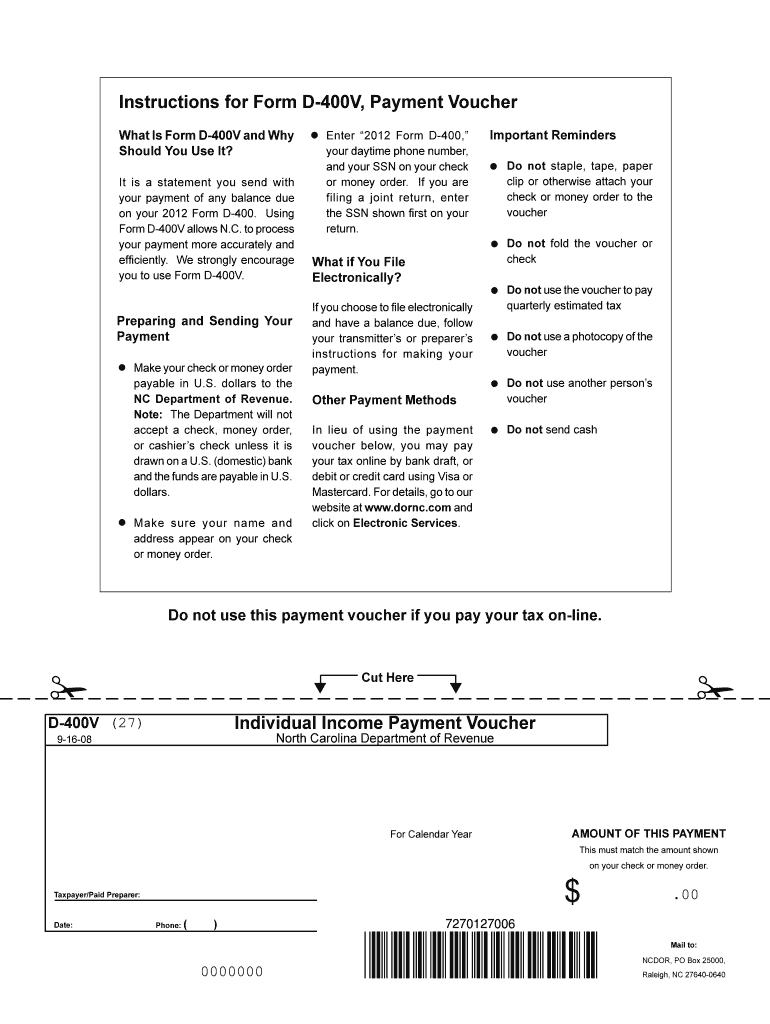

D 400v Payment Voucher 2020 Fill Online, Printable, Fillable, Blank

Were you a resident of n.c. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Single married filing joint head of household widow. For more information about the north. Fill in circle if you or, if married filing jointly, your spouse were out of the country on.

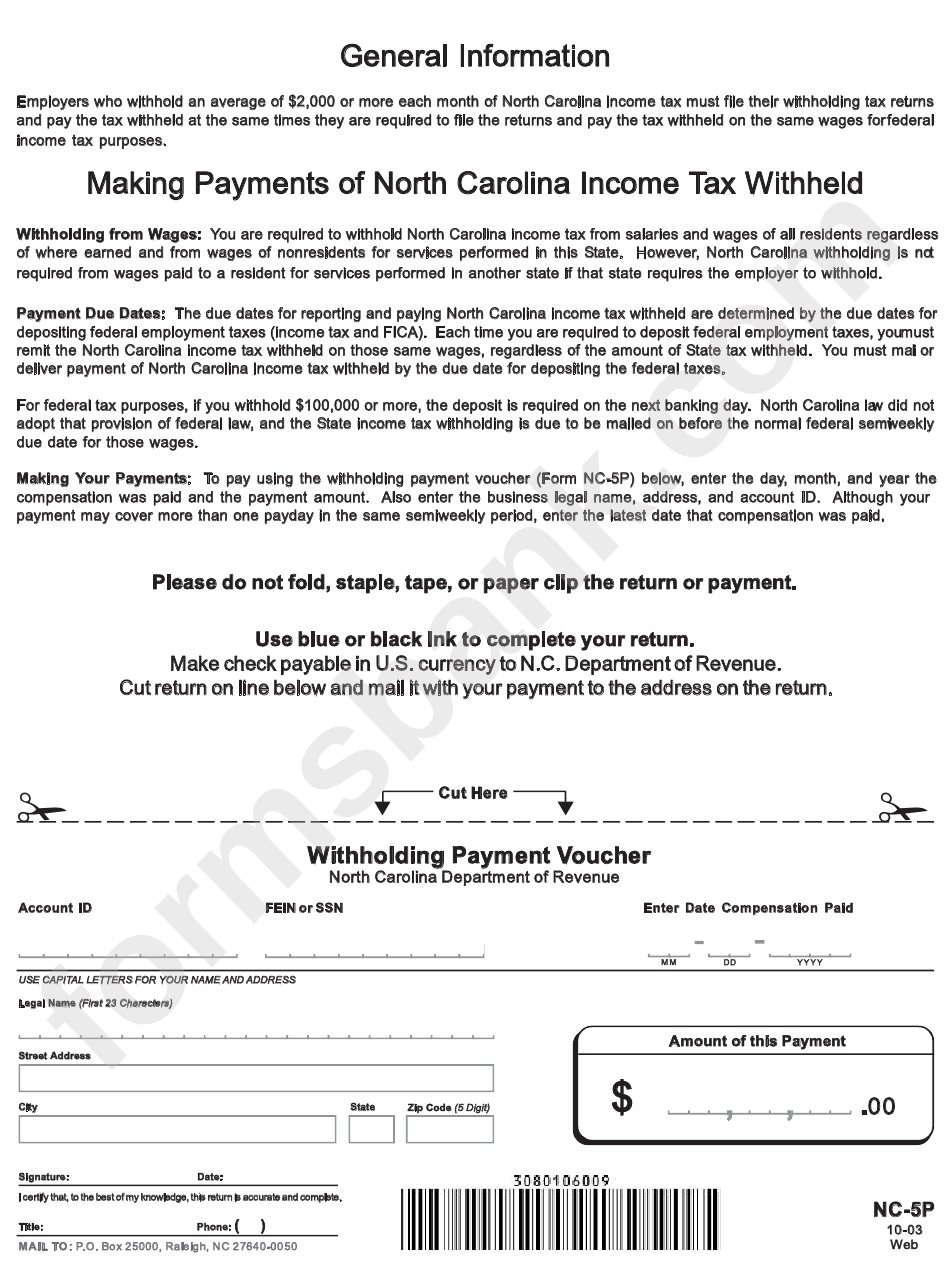

Form Nc5p Withholding Payment Voucher North Carolina Department Of

Fill in circle if you, or if married filing jointly, your spouse were out of the country on. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Web follow the simple instructions below: This payment application should be used only for the payment of tax owed on an amended north carolina individual..

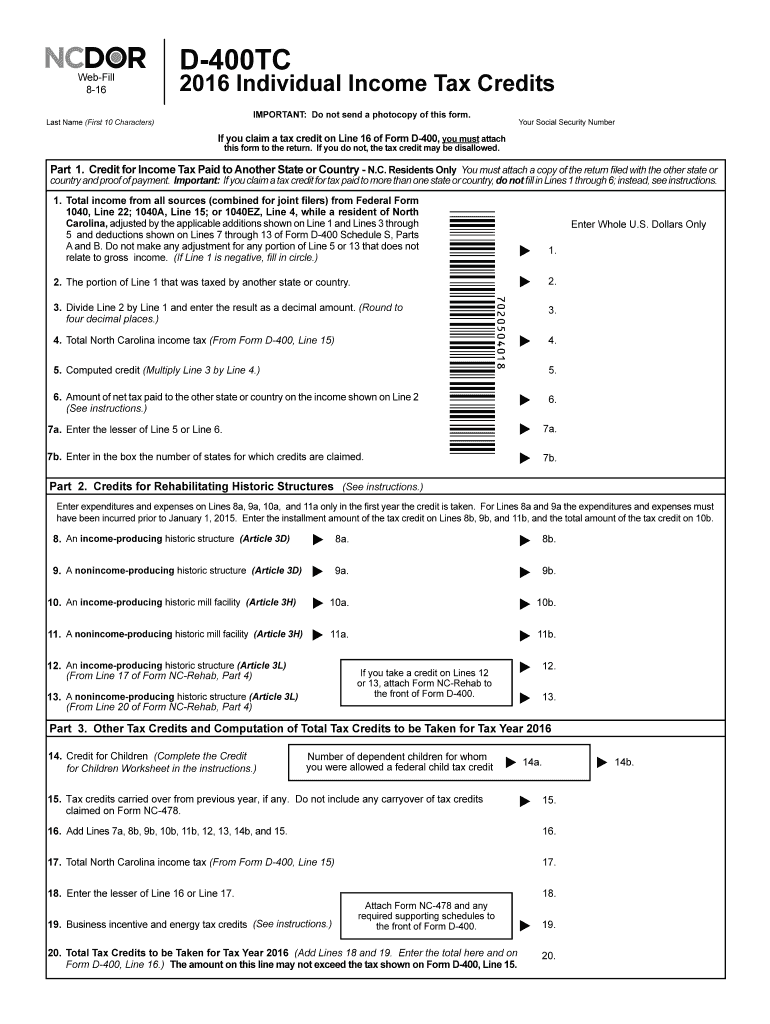

Nc d400 instructions 2016

For more information about the north. However, with our preconfigured web templates, everything gets. This payment application should be used only for the payment of tax owed on an amended north carolina individual. Web north carolina taxable income. Single married filing joint head of household widow.

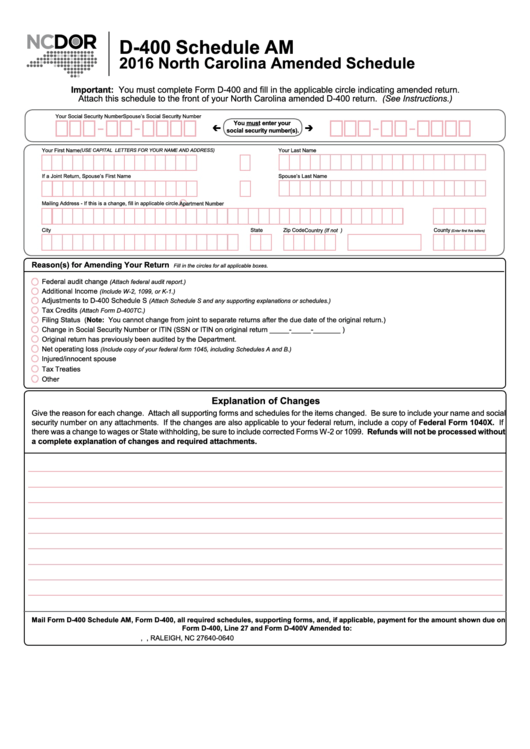

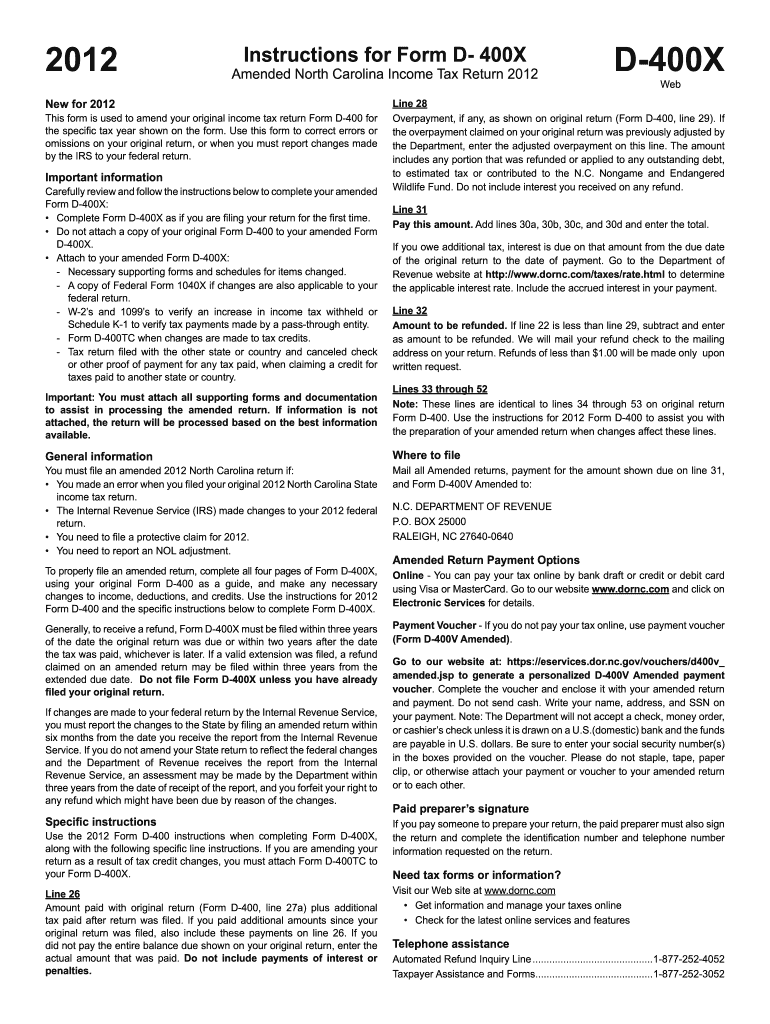

Form D400 Schedule Am North Carolina Amended Schedule 2016

If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Web follow the simple instructions below: Were you a resident of n.c. Single married filing joint head of household widow. Fill in circle if you or, if married filing jointly, your spouse were out of the country on.

Nc d400 instructions 2016

This payment application should be used only for the payment of tax owed on an amended north carolina individual. Web follow the simple instructions below: If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Fill in circle if you, or if married filing jointly, your spouse were out of the country on..

NC DoR D400TC 2016 Fill out Tax Template Online US Legal Forms

Web follow the simple instructions below: Web north carolina taxable income. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Were you a resident of n.c. Single married filing joint head of household widow.

Nc d400 instructions 2016

For more information about the north. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. However, with our preconfigured web templates, everything gets. Were you a resident of n.c. Web follow the simple instructions below:

Printable D 400v Form Fill Online, Printable, Fillable, Blank pdfFiller

Were you a resident of n.c. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. For more information about the north. Single married filing joint head of household widow. Web north carolina taxable income.

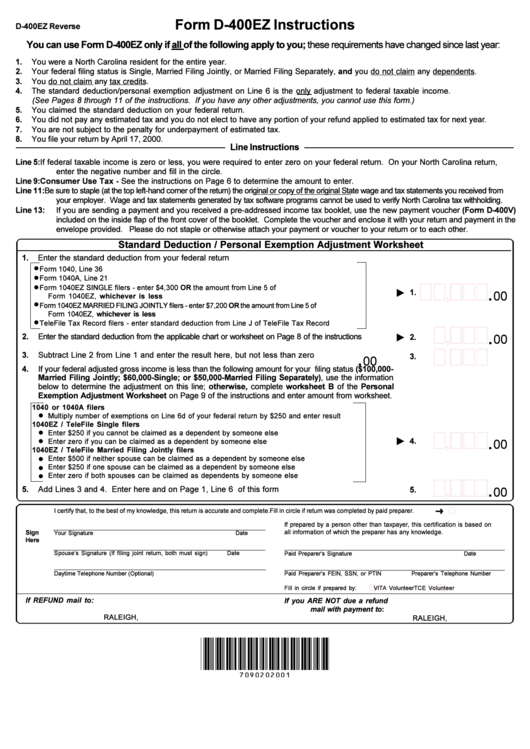

Form D400ez Instructions North Carolina Department Of Revenue

Were you a resident of n.c. Were you a resident of n.c. For more information about the north. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. This payment application should be used only for the payment of tax owed on an amended north carolina individual.

Fill In Circle If You Or, If Married Filing Jointly, Your Spouse Were Out Of The Country On.

Were you a resident of n.c. This payment application should be used only for the payment of tax owed on an amended north carolina individual. Web north carolina taxable income. Were you a resident of n.c.

However, With Our Preconfigured Web Templates, Everything Gets.

Single married filing joint head of household widow. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. For more information about the north.