Nr4 Tax Form

Nr4 Tax Form - Complete the registration or exemption change request (form 126) and submit it with your return. Click the federal taxes tab, select deductions and credits, and then select estimates and other taxes paid. $250.00 we applied $500.00 of your 2016 form 1040 overpayment to an amount owed. Terry.brock@nrc.gov res/dsa/rpb senior health physicist. Web nr4 retirement income for u.s. We applied your 2016 form 1040 overpayment to an unpaid balance refund due: Then, go to the deductions and credits section and select foreign taxes under ‘ estimates and other taxes paid ’ to enter any foreign tax you already paid to canada on that income Employee's withholding allowance certificate, so that your employer can withhold the correct amount of state income tax from your pay. Date closed (mm/dd/yy) out of business Web tips for filling out nr4 slips follow the instructions below carefully.

For best results, download and open this form in adobe reader. Complete the registration or exemption change request (form 126) and submit it with your return. Terry.brock@nrc.gov res/dsa/rpb senior health physicist. See general information for details. • the instructions for estates and trusts on the main form may, in certain instances, align more with the instructions for form 1041, u.s. The slip issuer must withhold tax from the payment to the nonresident and remit it to the government. Nonresident alien who becomes a resident alien. Then, go to the deductions and credits section and select foreign taxes under ‘ estimates and other taxes paid ’ to enter any foreign tax you already paid to canada on that income 31, 2022, or other tax year beginning, 2022, ending. Web enter the tax on schedule 2 (form 1040), line 4.

You can view this form in: Report a problem or mistake on this page. Web enter the tax on schedule 2 (form 1040), line 4. Residents must record the information found on an nr4 on irs form 8891. See general information for details. Irs use only—do not write or staple in this space. $250.00 we applied $500.00 of your 2016 form 1040 overpayment to an amount owed. Complete the registration or exemption change request (form 126) and submit it with your return. See the instructions for schedule se (form 1040) for additional information. We applied your 2016 form 1040 overpayment to an unpaid balance refund due:

NR4 Pro Forma Letter Checklist Madan CA

Instructions and additional information pertinent to the completion of this form are on page 2 of the form. Complete the registration or exemption change request (form 126) and submit it with your return. For best results, download and open this form in adobe reader. See general information for details. $250.00 we applied $500.00 of your 2016 form 1040 overpayment to.

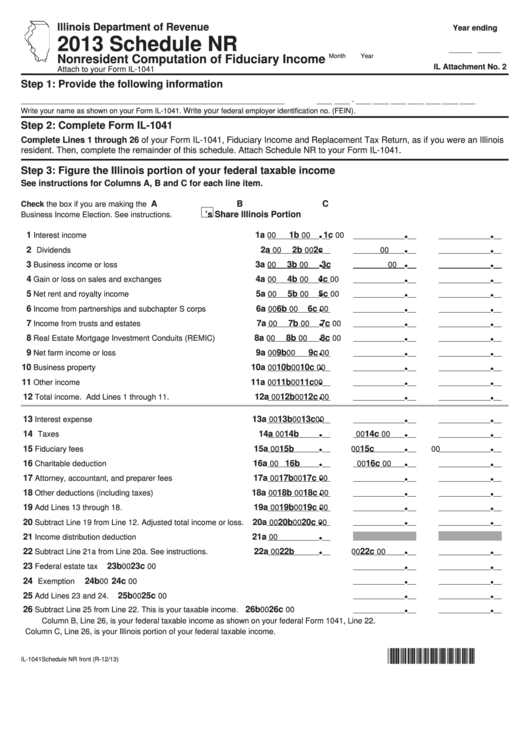

Fillable Schedule Nr Nonresident Computation Of Fiduciary

Web tips for filling out nr4 slips follow the instructions below carefully. Nonresident alien income tax return. Web 10 cfr part 20. Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce or eliminate u.s. To report this information to the irs, u.s.

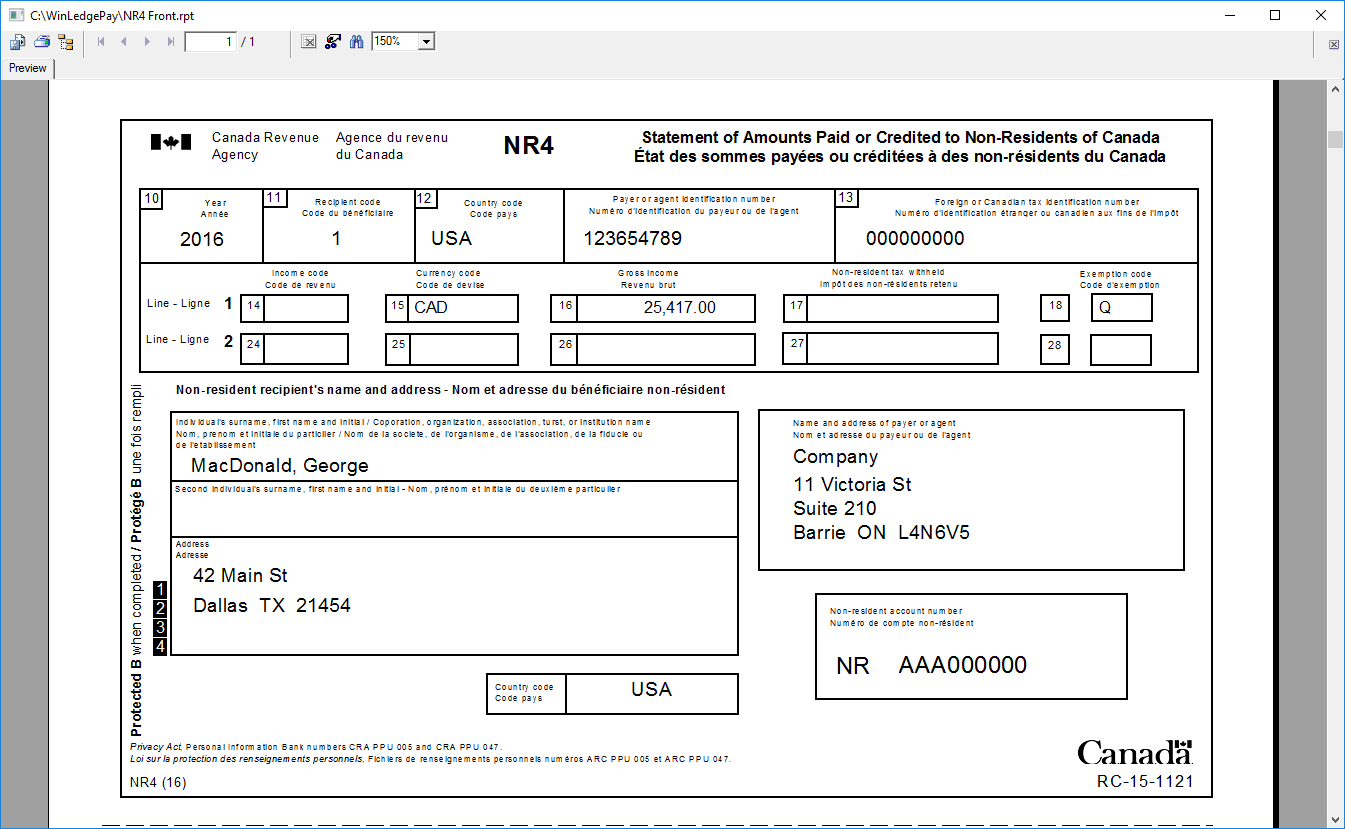

Classic Software

Instructions and additional information pertinent to the completion of this form are on page 2 of the form. For best results, download and open this form in adobe reader. Department of the treasury—internal revenue service. Then, go to the deductions and credits section and select foreign taxes under ‘ estimates and other taxes paid ’ to enter any foreign tax.

What is Form 1040NR? All you wanted to know about NonResident Alien

Click the federal taxes tab, select deductions and credits, and then select estimates and other taxes paid. The canada revenue agency (cra) may have to return incorrectly filled out nr4 slips to you for corrections. Nonresident alien income tax return. $250.00 we applied $500.00 of your 2016 form 1040 overpayment to an amount owed. Web an nr4 slip is issued.

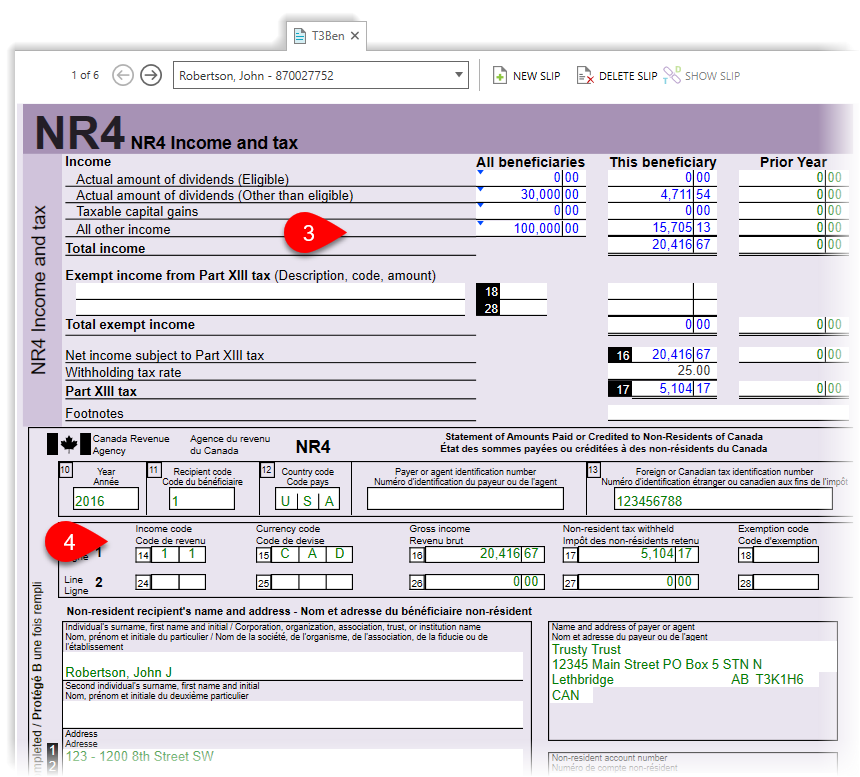

NR4 slips for nonresident trust beneficiaries TaxCycle

Attach schedule se (form 1040). The slip issuer must withhold tax from the payment to the nonresident and remit it to the government. • the instructions for estates and trusts on the main form may, in certain instances, align more with the instructions for form 1041, u.s. Click the federal taxes tab, select deductions and credits, and then select estimates.

What is Form 1040NR? All you wanted to know about NonResident Alien

Report a problem or mistake on this page. Nonresident alien who becomes a resident alien. Residents must record the information found on an nr4 on irs form 8891. To report this information to the irs, u.s. See general information for details.

Sample Forms

To report this information to the irs, u.s. Date closed (mm/dd/yy) out of business Click the federal taxes tab, select deductions and credits, and then select estimates and other taxes paid. Complete the registration or exemption change request (form 126) and submit it with your return. Web enter the tax on schedule 2 (form 1040), line 4.

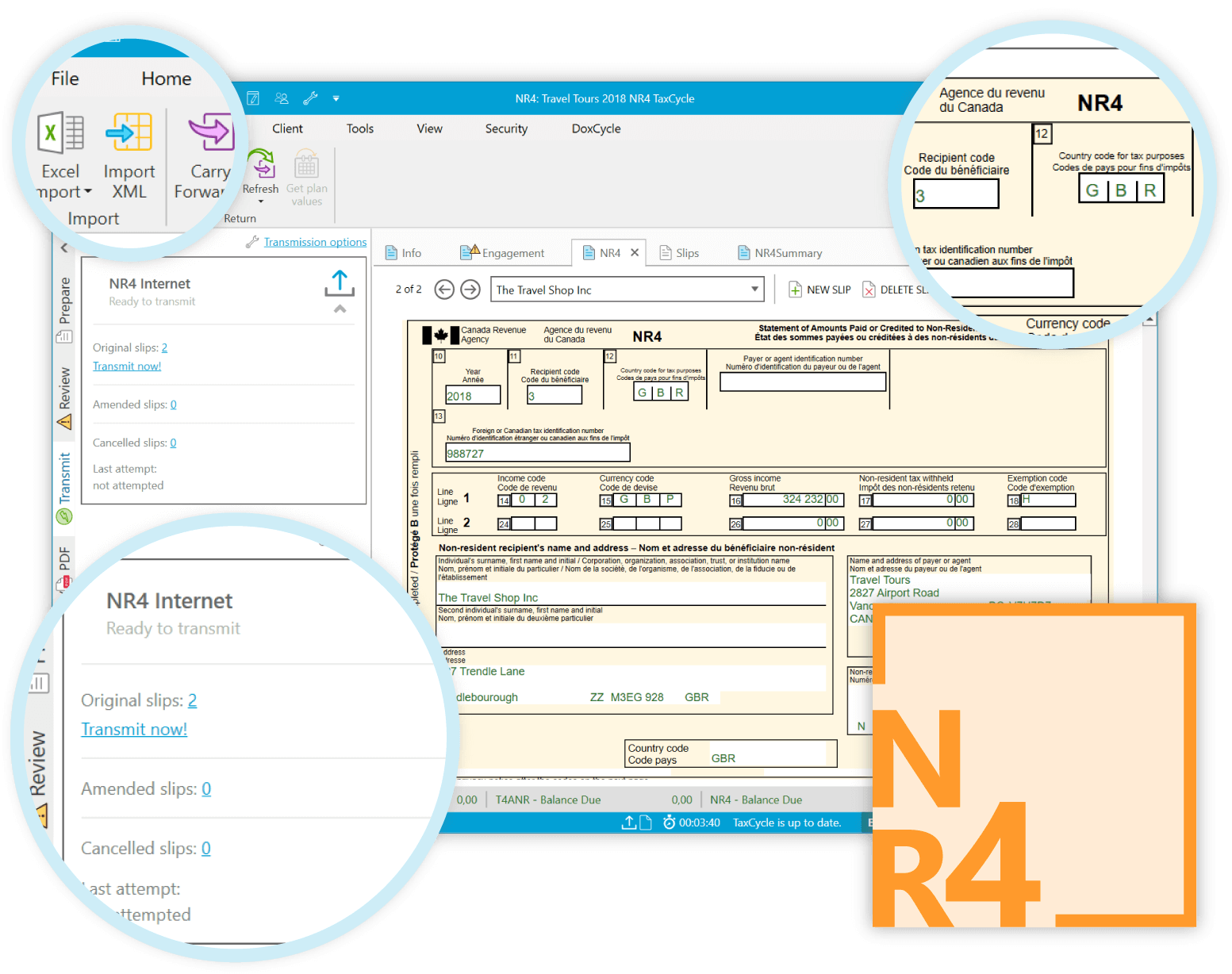

TaxCycle NR4 TaxCycle

Date closed (mm/dd/yy) out of business The slip issuer must withhold tax from the payment to the nonresident and remit it to the government. Report a problem or mistake on this page. Complete the registration or exemption change request (form 126) and submit it with your return. Web nr4 retirement income for u.s.

NR4 Form and Withholding Taxes YouTube

Instructions and additional information pertinent to the completion of this form are on page 2 of the form. Irs use only—do not write or staple in this space. 31, 2022, or other tax year beginning, 2022, ending. See general information for details. Report a problem or mistake on this page.

Section 216 Checklist (With NR4) Madan CA

Instructions and additional information pertinent to the completion of this form are on page 2 of the form. Terry.brock@nrc.gov res/dsa/rpb senior health physicist. The canada revenue agency (cra) may have to return incorrectly filled out nr4 slips to you for corrections. See general information for details. Make sure your nr4 slips are easy to read.

Web Nr4 Retirement Income For U.s.

• the instructions for estates and trusts on the main form may, in certain instances, align more with the instructions for form 1041, u.s. Nonresident alien income tax return. Then, go to the deductions and credits section and select foreign taxes under ‘ estimates and other taxes paid ’ to enter any foreign tax you already paid to canada on that income You can view this form in:

Web 10 Cfr Part 20.

$250.00 we applied $500.00 of your 2016 form 1040 overpayment to an amount owed. Instructions and additional information pertinent to the completion of this form are on page 2 of the form. See general information for details. Web tips for filling out nr4 slips follow the instructions below carefully.

To Report This Information To The Irs, U.s.

The canada revenue agency (cra) may have to return incorrectly filled out nr4 slips to you for corrections. For best results, download and open this form in adobe reader. See line 4 under instructions for schedule 2, later, for additional information. See the instructions for schedule se (form 1040) for additional information.

Residents Must Record The Information Found On An Nr4 On Irs Form 8891.

Attach schedule se (form 1040). Web enter the tax on schedule 2 (form 1040), line 4. Click the federal taxes tab, select deductions and credits, and then select estimates and other taxes paid. Report a problem or mistake on this page.