Ny Withholding Form

Ny Withholding Form - Web what is this form for. This may result in the wrong amount of tax withheld for new york state, new york city, and yonkers. Web employee’s withholding allowance certificate new york state • new york city • yonkers single or head of household married married, but withhold at higher single rate note: Wage reporting resources for withholding tax filers. Web the wrong amount of tax withheld for new york state, new york city, and yonkers. If you've already registered with new. Keep this certificate with your records. Web use withholding tax web file to file your quarterly return. What is this form for. To identify and withhold the correct new york state, new york city, and/or yonkers tax.

Web use withholding tax web file to file your quarterly return. If married but legally separated, mark an x in the single or head of household box. If you do not submit this form, your withholdings will default to a filing status of “single” and you claim “1” allowances. Web what is this form for. How to complete this form. Web employee’s withholding allowance certificate new york state • new york city • yonkers single or head of household married married, but withhold at higher single rate note: Before you can file for withholding tax, you must first register as an employer with new york state. If you've already registered with new. What is this form for. This may result in the wrong amount of tax withheld for new york state, new york city, and yonkers.

Automatic calculation of amounts due; Web employee's withholding allowance certificate. Direct payment from your bank account; What is this form for. Web employee’s withholding allowance certificate new york state • new york city • yonkers single or head of household married married, but withhold at higher single rate note: Web the wrong amount of tax withheld for new york state, new york city, and yonkers. Web what is this form for. If married but legally separated, mark an x in the single or head of household box. If you do not submit this form, your withholdings will default to a filing status of “single” and you claim “1” allowances. Are you a new employer?

Download NY IT2104 Employee's Withholding Allowance Form for Free

If you do not submit this form, your withholdings will default to a filing status of “single” and you claim “1” allowances. Certificate of exemption from withholding. Web employee's withholding allowance certificate. This may result in the wrong amount of tax withheld for new york state, new york city, and yonkers. Are you a new employer?

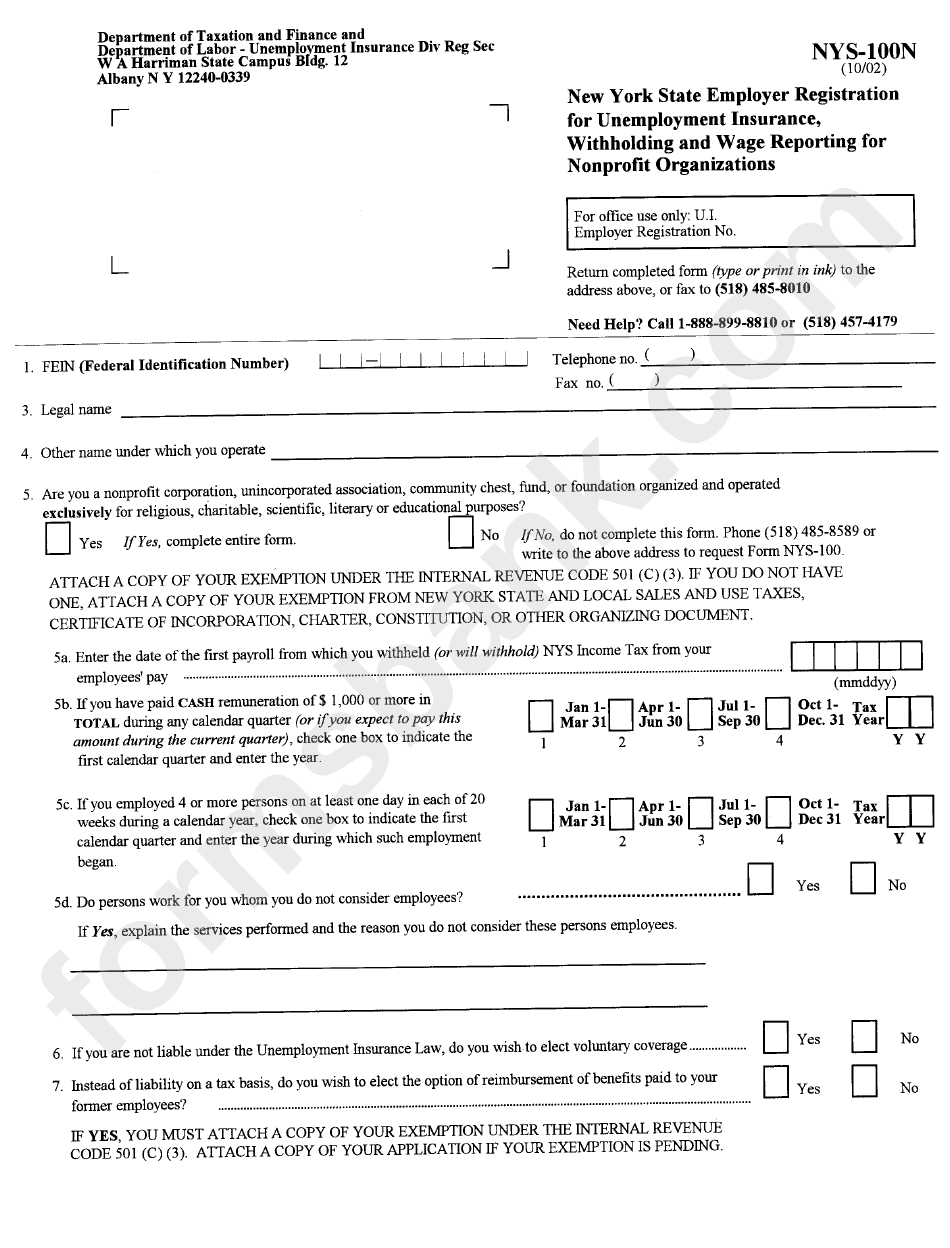

Form Nys100n Employer Registration For Unemployment Insurance

Web employee's withholding allowance certificate. Keep this certificate with your records. Web what is this form for. Web employee's withholding allowance certificate. Automatic calculation of amounts due;

1+ New York Last Will and Testament Form Free Download

Certificate of exemption from withholding. Web the wrong amount of tax withheld for new york state, new york city, and yonkers. If you do not submit this form, your withholdings will default to a filing status of “single” and you claim “1” allowances. How to complete this form. Web employee’s withholding allowance certificate new york state • new york city.

How To Avoid Withholding Tax Economicsprogress5

Web employee’s withholding allowance certificate new york state • new york city • yonkers single or head of household married married, but withhold at higher single rate note: Web the wrong amount of tax withheld for new york state, new york city, and yonkers. Are you a new employer? This may result in the wrong amount of tax withheld for.

how to fill out new york state withholding form Fill Online

Are you a new employer? Before you can file for withholding tax, you must first register as an employer with new york state. If you've already registered with new. Certificate of exemption from withholding. Web employee's withholding allowance certificate.

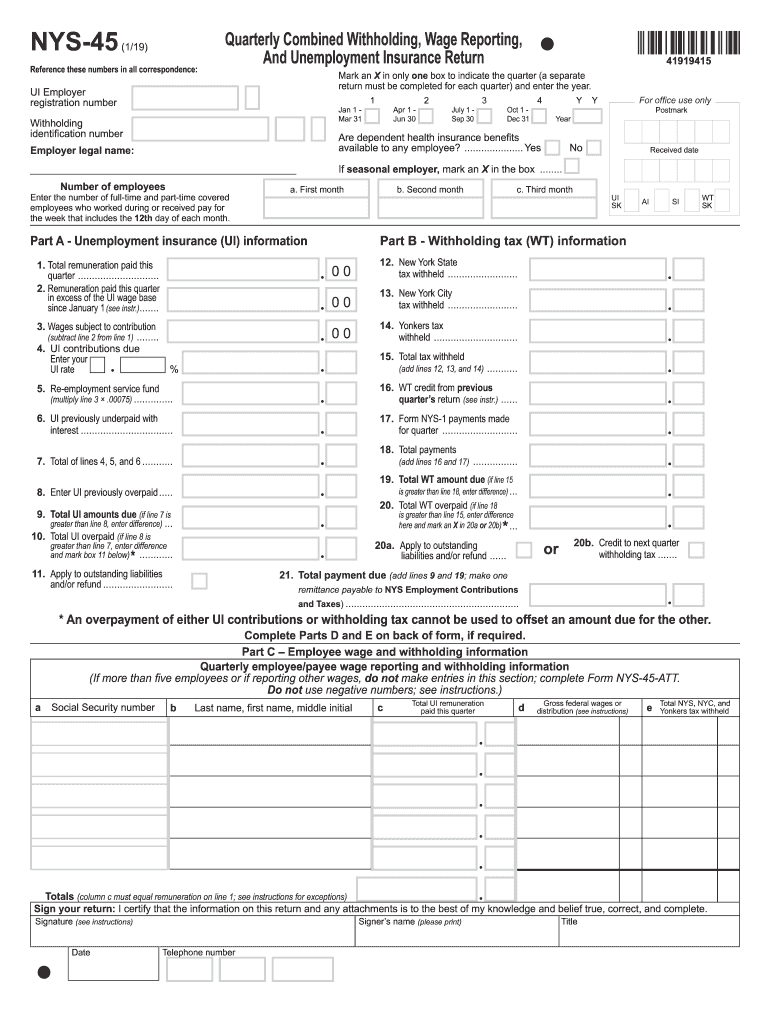

Ny State Qtly Withholding Form

If married but legally separated, mark an x in the single or head of household box. If you do not submit this form, your withholdings will default to a filing status of “single” and you claim “1” allowances. Web the wrong amount of tax withheld for new york state, new york city, and yonkers. Web employee's withholding allowance certificate. Certificate.

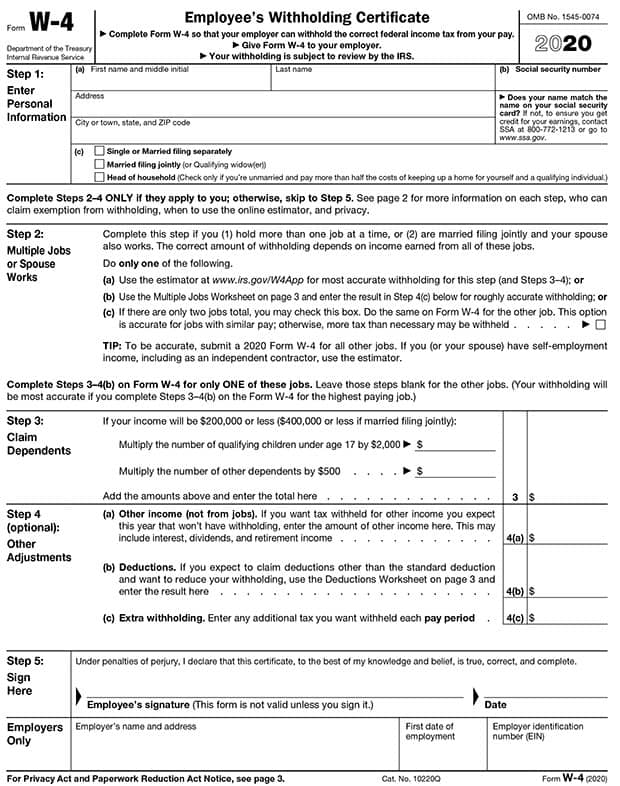

How to Calculate 2020 Federal Withhold Manually with New 2020 W4

Web employee’s withholding allowance certificate new york state • new york city • yonkers single or head of household married married, but withhold at higher single rate note: Before you can file for withholding tax, you must first register as an employer with new york state. This may result in the wrong amount of tax withheld for new york state,.

Ny State Qtly Withholding Form

Web employee's withholding allowance certificate. If you've already registered with new. How to complete this form. Web use withholding tax web file to file your quarterly return. Before you can file for withholding tax, you must first register as an employer with new york state.

A New Form W4 for 2020 Alloy Silverstein

Before you can file for withholding tax, you must first register as an employer with new york state. Keep this certificate with your records. Web employee's withholding allowance certificate. How to complete this form. Web what is this form for.

Wage Reporting Resources For Withholding Tax Filers.

Direct payment from your bank account; Automatic calculation of amounts due; If you do not submit this form, your withholdings will default to a filing status of “single” and you claim “1” allowances. Certificate of exemption from withholding.

Web What Is This Form For.

Are you a new employer? Web employee’s withholding allowance certificate new york state • new york city • yonkers single or head of household married married, but withhold at higher single rate note: Web use withholding tax web file to file your quarterly return. Keep this certificate with your records.

Web Employee's Withholding Allowance Certificate.

Certificate of exemption from withholding. This may result in the wrong amount of tax withheld for new york state, new york city, and yonkers. Web the wrong amount of tax withheld for new york state, new york city, and yonkers. If you've already registered with new.

Web Employee's Withholding Allowance Certificate.

How to complete this form. Before you can file for withholding tax, you must first register as an employer with new york state. What is this form for. To identify and withhold the correct new york state, new york city, and/or yonkers tax.