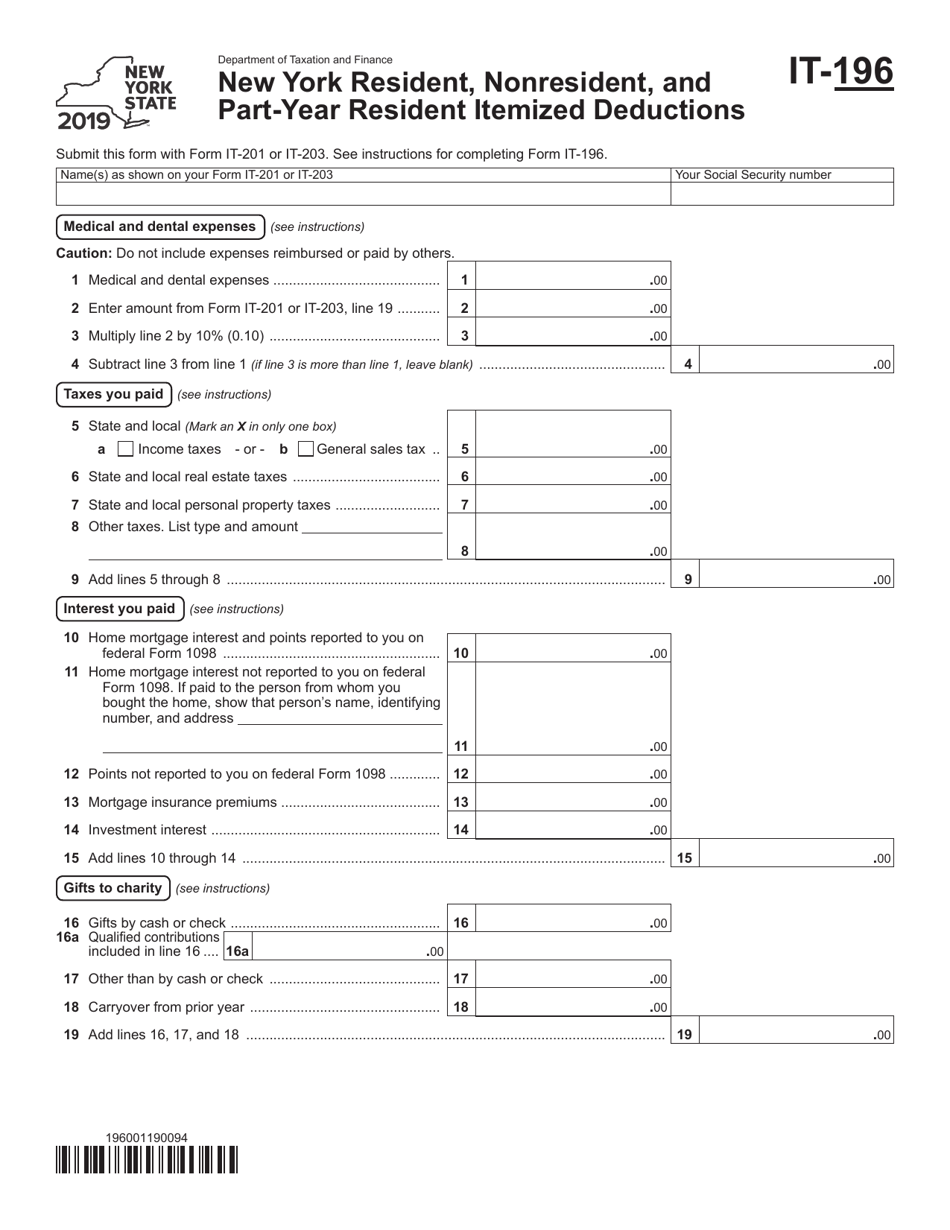

Nys Form It 196

Nys Form It 196 - Web new york individual income tax forms supported in taxslayer pro: Web any expenses in excess of the amount you deducted as a federal adjustment to income on your federal form 1040, schedule 1, line 11, can be claimed as a new york itemized. Web follow the simple instructions below: If you itemize, you can deduct a part of your medical and dental expenses,. The new york amount is reduced by the state taxes deducted on the federal schedule. Web christieb new member are you entering medical expenses? Feel all the benefits of submitting and completing legal documents online. With our platform filling in it 196 requires just a few minutes. The new york amount is reduced by the state taxes deducted on schedule a (form. Web 196 “resident itemized deduction schedule” these deductions must be itemized.

With our platform filling in it 196 requires just a few minutes. If you itemize, you can deduct a part of your medical and dental expenses,. Web any expenses in excess of the amount you deducted as a federal adjustment to income on your federal form 1040, schedule 1, line 11, can be claimed as a new york itemized. There is a question that asks you this, you. The new york amount is reduced by the state taxes deducted on schedule a (form. Web christieb new member are you entering medical expenses? Web new york individual income tax forms supported in taxslayer pro: The new york amount is reduced by the state taxes deducted on the federal schedule. Web the new york itemized deduction is not the same as the federal itemized deduction amount. Web the new york itemized deduction is not the same as the federal itemized deduction amount.

If you itemize, you can deduct a part of your medical and dental expenses,. Web the new york itemized deduction is not the same as the federal itemized deduction amount. There is a question that asks you this, you. Web follow the simple instructions below: The new york amount is reduced by the state taxes deducted on the federal schedule. Web 196 “resident itemized deduction schedule” these deductions must be itemized. With our platform filling in it 196 requires just a few minutes. Web christieb new member are you entering medical expenses? Web the new york itemized deduction is not the same as the federal itemized deduction amount. The new york amount is reduced by the state taxes deducted on schedule a (form.

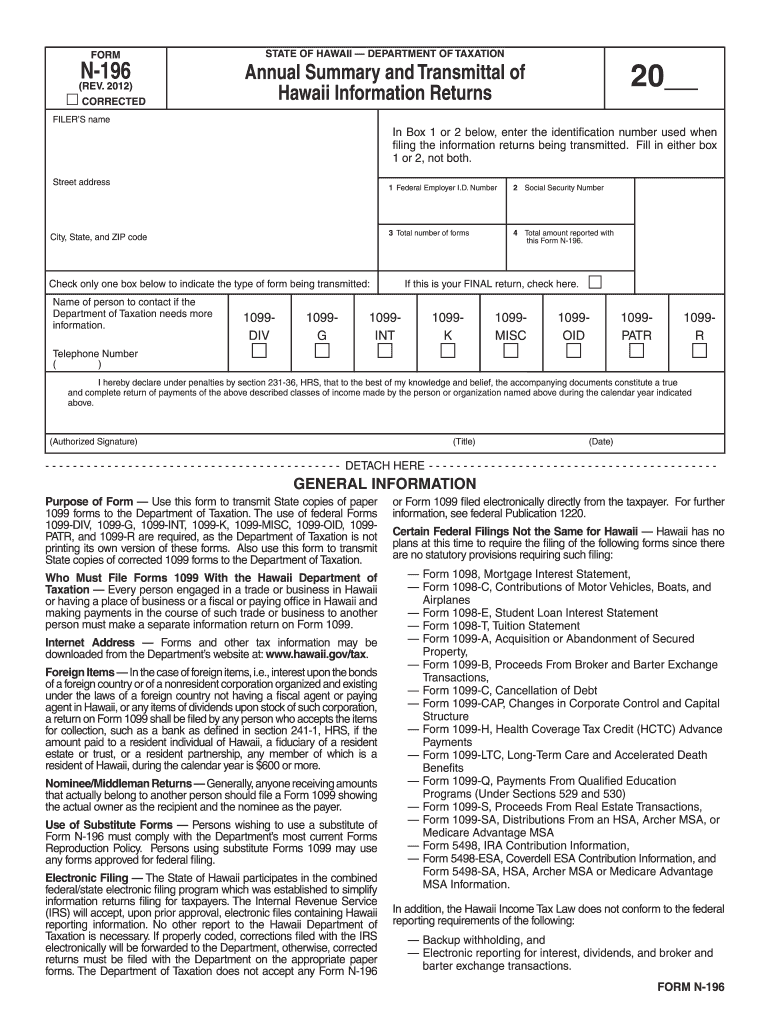

Form IT196 2019 Fill Out, Sign Online and Download Fillable PDF

Web any expenses in excess of the amount you deducted as a federal adjustment to income on your federal form 1040, schedule 1, line 11, can be claimed as a new york itemized. Web the new york itemized deduction is not the same as the federal itemized deduction amount. Web follow the simple instructions below: Web 196 “resident itemized deduction.

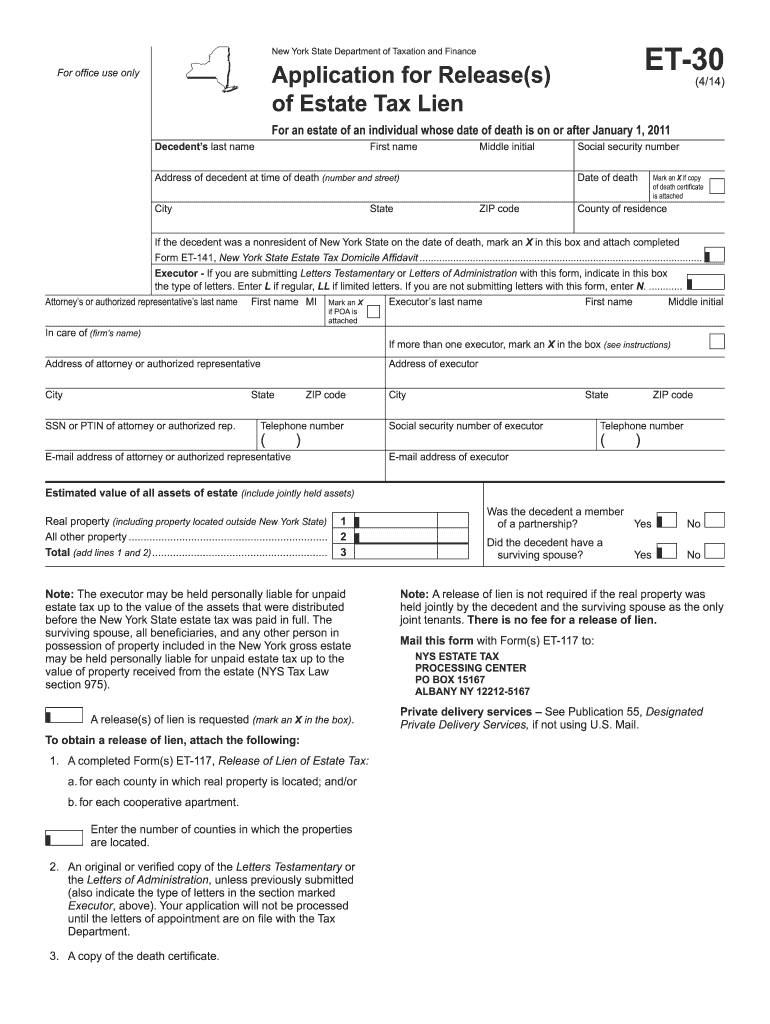

nys tax form et 30 Fill out & sign online DocHub

There is a question that asks you this, you. If you itemize, you can deduct a part of your medical and dental expenses,. Web new york individual income tax forms supported in taxslayer pro: Web christieb new member are you entering medical expenses? The new york amount is reduced by the state taxes deducted on schedule a (form.

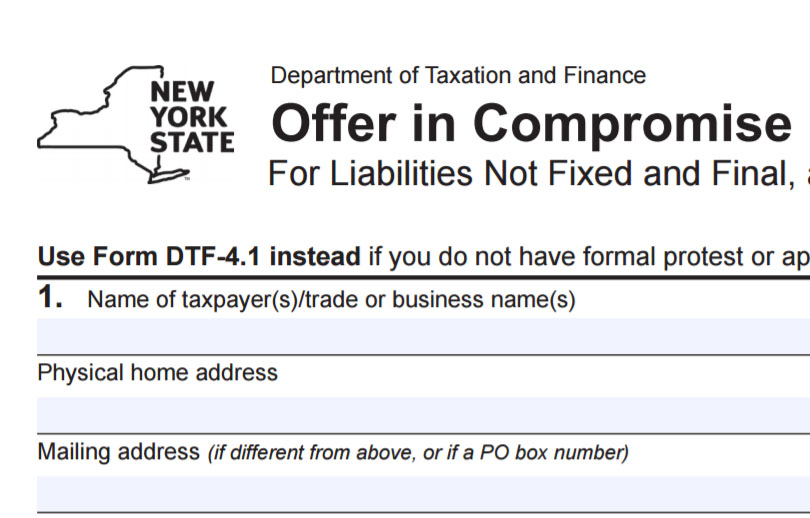

How To Fill Out NYS Form DTF 4 For NYS Offer In Compromise

Web follow the simple instructions below: Web new york individual income tax forms supported in taxslayer pro: There is a question that asks you this, you. Web christieb new member are you entering medical expenses? Web the new york itemized deduction is not the same as the federal itemized deduction amount.

New York State Decouples from Certain Federal Personal Tax

If you itemize, you can deduct a part of your medical and dental expenses,. Web 196 “resident itemized deduction schedule” these deductions must be itemized. Web any expenses in excess of the amount you deducted as a federal adjustment to income on your federal form 1040, schedule 1, line 11, can be claimed as a new york itemized. The new.

Stabila Type 1962K 16" Mason Level — Form and Build Supply Inc.

Feel all the benefits of submitting and completing legal documents online. Web christieb new member are you entering medical expenses? Web follow the simple instructions below: Web any expenses in excess of the amount you deducted as a federal adjustment to income on your federal form 1040, schedule 1, line 11, can be claimed as a new york itemized. If.

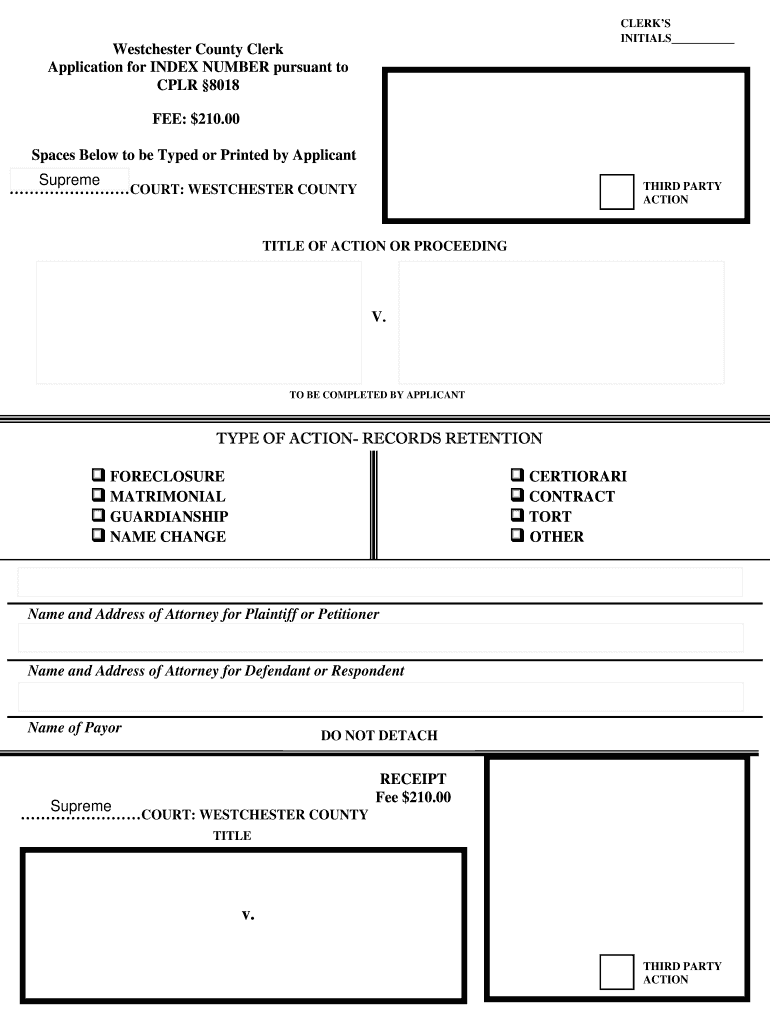

Application For Index Number Fill Out and Sign Printable PDF Template

The new york amount is reduced by the state taxes deducted on the federal schedule. If you itemize, you can deduct a part of your medical and dental expenses,. Feel all the benefits of submitting and completing legal documents online. Web follow the simple instructions below: Web the new york itemized deduction is not the same as the federal itemized.

Form It 196 Fill Out and Sign Printable PDF Template signNow

Web new york individual income tax forms supported in taxslayer pro: Web any expenses in excess of the amount you deducted as a federal adjustment to income on your federal form 1040, schedule 1, line 11, can be claimed as a new york itemized. There is a question that asks you this, you. With our platform filling in it 196.

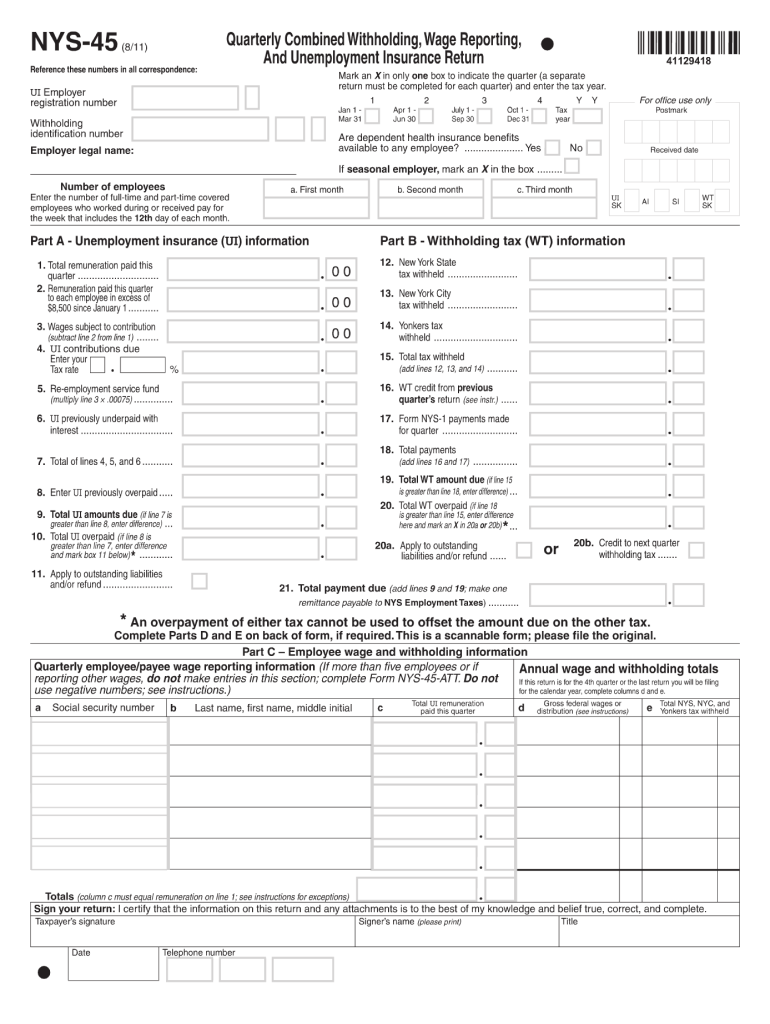

2011 Form NY DTF NYS45 Fill Online, Printable, Fillable, Blank PDFfiller

Web new york individual income tax forms supported in taxslayer pro: Web follow the simple instructions below: Web 196 “resident itemized deduction schedule” these deductions must be itemized. Web the new york itemized deduction is not the same as the federal itemized deduction amount. Web christieb new member are you entering medical expenses?

State And Local Tax Refund Worksheet 2019 Maths Worksheets For

Web new york individual income tax forms supported in taxslayer pro: Web the new york itemized deduction is not the same as the federal itemized deduction amount. The new york amount is reduced by the state taxes deducted on schedule a (form. Web any expenses in excess of the amount you deducted as a federal adjustment to income on your.

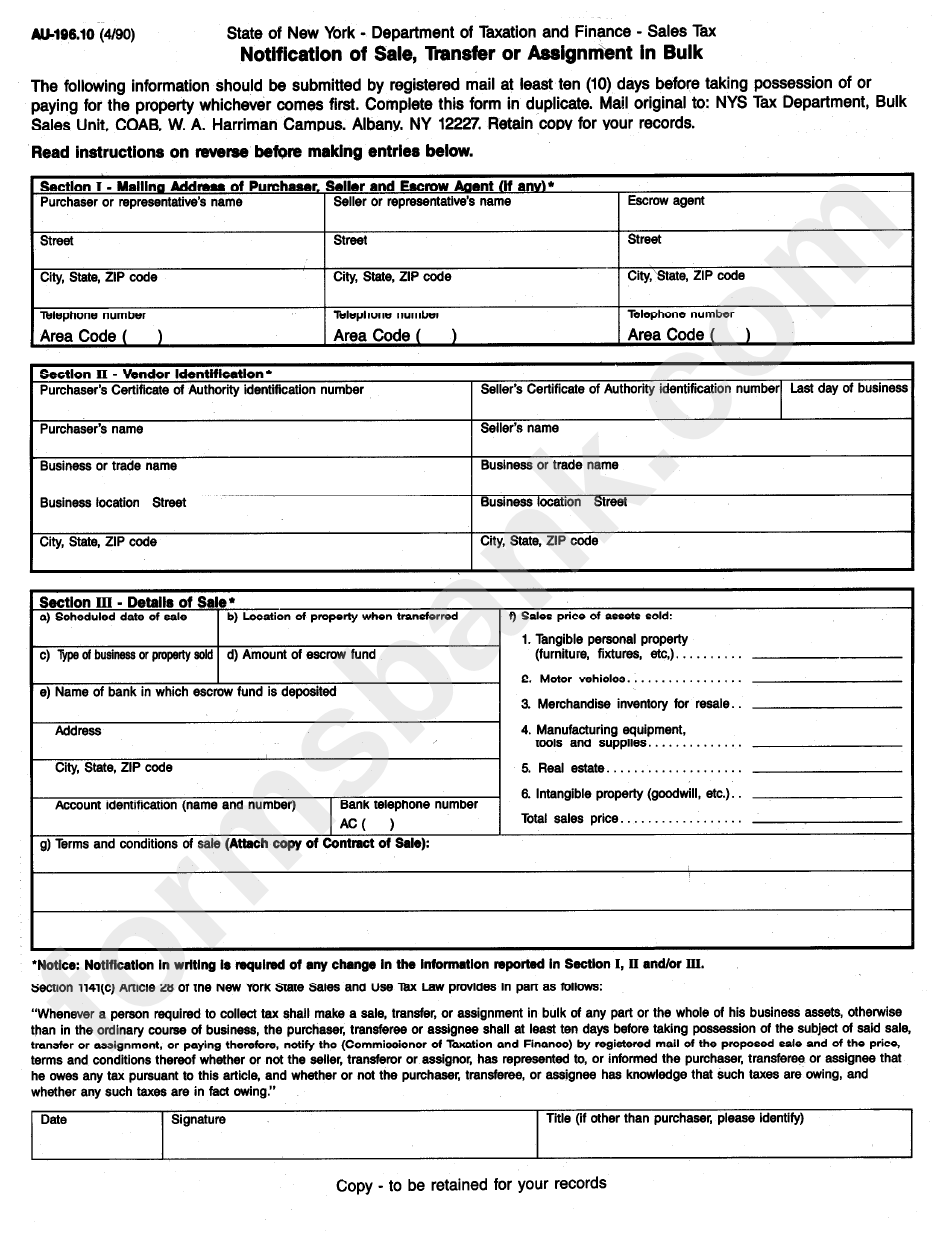

Form Au196.10 Notification Of Sale, Transfer Or Assignment In Bulk

Web 196 “resident itemized deduction schedule” these deductions must be itemized. Web new york individual income tax forms supported in taxslayer pro: Web the new york itemized deduction is not the same as the federal itemized deduction amount. The new york amount is reduced by the state taxes deducted on the federal schedule. Web follow the simple instructions below:

With Our Platform Filling In It 196 Requires Just A Few Minutes.

The new york amount is reduced by the state taxes deducted on schedule a (form. The new york amount is reduced by the state taxes deducted on the federal schedule. There is a question that asks you this, you. Web christieb new member are you entering medical expenses?

Web New York Individual Income Tax Forms Supported In Taxslayer Pro:

If you itemize, you can deduct a part of your medical and dental expenses,. Web 196 “resident itemized deduction schedule” these deductions must be itemized. Web the new york itemized deduction is not the same as the federal itemized deduction amount. Feel all the benefits of submitting and completing legal documents online.

Web The New York Itemized Deduction Is Not The Same As The Federal Itemized Deduction Amount.

Web follow the simple instructions below: Web any expenses in excess of the amount you deducted as a federal adjustment to income on your federal form 1040, schedule 1, line 11, can be claimed as a new york itemized.