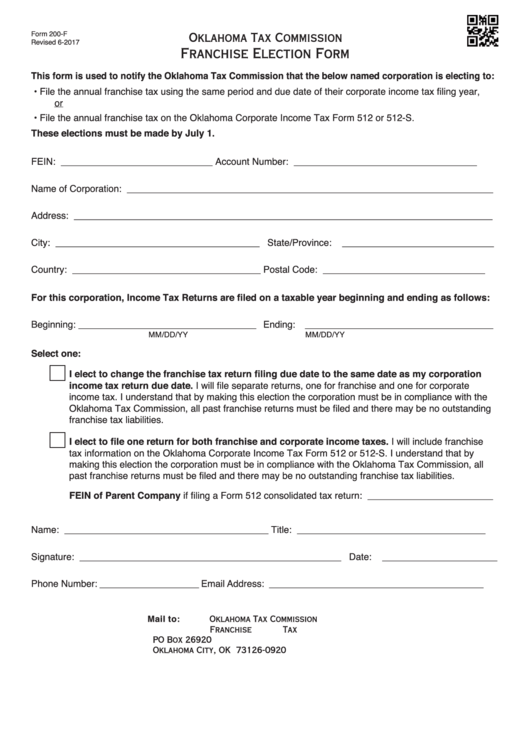

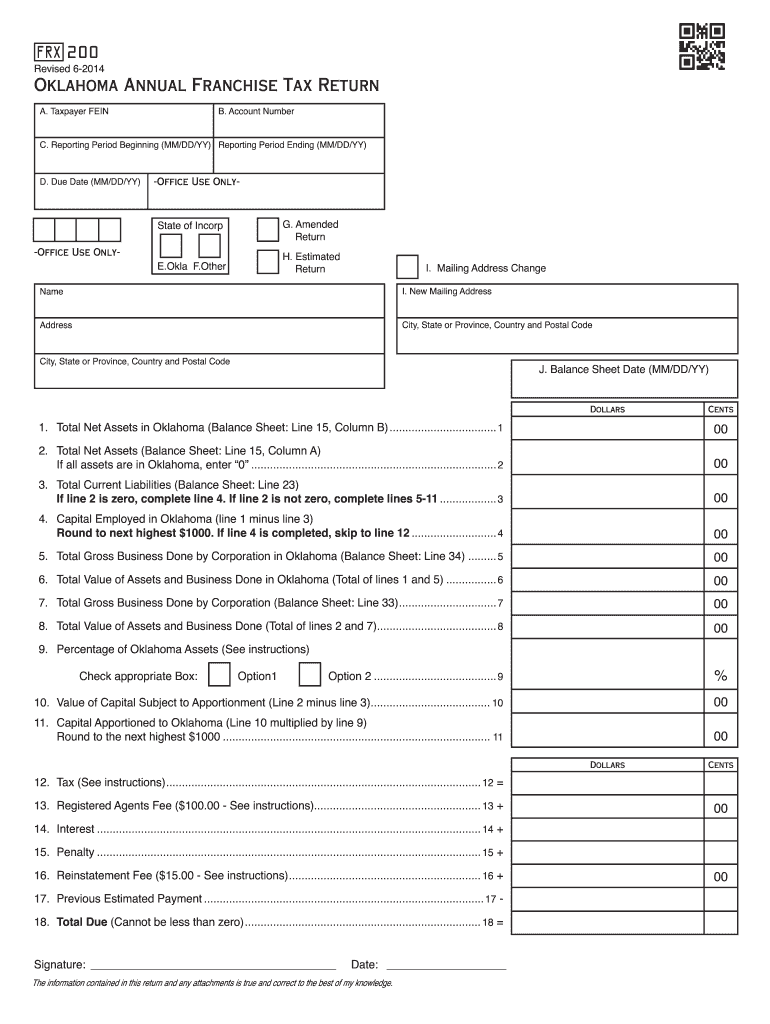

Oklahoma Form 200-F

Oklahoma Form 200-F - You may file this form online or download it at www.tax.ok.gov. Web this form is used to notify the oklahoma tax commission that the below named corporation is electing to: Once the corporation has filed the form, it does not have to file again unless it wishes to change the filing period. Web get the form 200 f you need. Start completing the fillable fields and carefully type in required information. Share your form with others send oklahoma form 200 f via email, link, or fax. Use fill to complete blank online state of oklahoma (ok) pdf forms for free. After you have filed the request to change your filing. The report and tax will be delinquent if not paid on or before september 15. Involved parties names, addresses and phone numbers etc.

Web if you wish to make an election to change your filing frequency for your next reporting period, please complete otc form 200f: Corporations that remitted the maximum amount of franchise tax for the preceding tax Involved parties names, addresses and phone numbers etc. Fill in the blank areas; I elect to file one return for both franchise and corporate income taxes. Web get the form 200 f you need. Start completing the fillable fields and carefully type in required information. Use fill to complete blank online state of oklahoma (ok) pdf forms for free. Edit your form 200 f online type text, add images, blackout confidential details, add comments, highlights and more. Use the cross or check marks in the top toolbar to select your answers in the list boxes.

Use get form or simply click on the template preview to open it in the editor. After you have filed the request to change your filing. You may ile this form online or download it at tax.ok.gov. Show details how it works browse for the form 200 f customize and esign ok 200 f form send out signed oklahoma form 200 f or print it rate the form 200f 4.6 satisfied 86 votes what makes the form 200 f legally binding? Change the template with smart fillable fields. Open it up with online editor and begin adjusting. • franchise tax computation the basis for computing oklahoma franchise tax is the balance sheet as shown by your books of account at the close of the last preceding Web this form is used to notify the oklahoma tax commission that the below named corporation is electing to: Edit your form 200 f online type text, add images, blackout confidential details, add comments, highlights and more. Add oklahoma frx 200 instructions 2020 from your device, the cloud, or a secure link.

Fillable Form 200F Franchise Election Oklahoma Tax Commission

Edit your form 200 f online type text, add images, blackout confidential details, add comments, highlights and more. You may file this form online or download it at www.tax.ok.gov. Use the cross or check marks in the top toolbar to select your answers in the list boxes. You may ile this form online or download it at tax.ok.gov. Make changes.

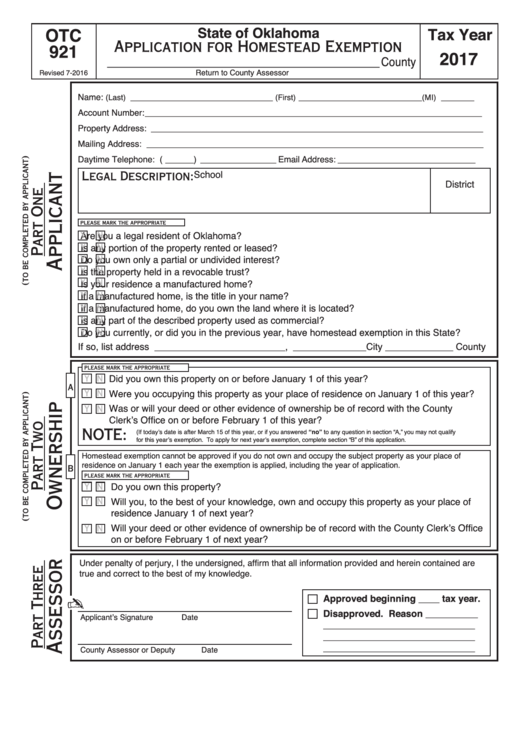

936 Form Oklahoma Fill Online, Printable, Fillable, Blank pdfFiller

Edit your form 200 f online type text, add images, blackout confidential details, add comments, highlights and more. Web get the form 200 f you need. The report and tax will be delinquent if not paid on or before september 15. Web corporations required to file a franchise tax return may elect to file a combined corporate income and franchise.

915 Oklahoma Tax Forms And Templates free to download in PDF

This page contains schedules b, c, and d for the completion of form 200: You may file this form online or download it at www.tax.ok.gov. Web fill online, printable, fillable, blank form 200: Web corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Once the corporation has filed the.

20192022 Form OK OTC STS20002 Fill Online, Printable, Fillable, Blank

Web if you wish to make an election to change your filing frequency for your next reporting period, please complete otc form 200f: Web click on new document and select the file importing option: Involved parties names, addresses and phone numbers etc. Oklahoma annual franchise tax return (state of oklahoma) form. Once the corporation has filed the form, it does.

Oklahoma Limited Liability Company / Form an Oklahoma LLC

This page contains schedules b, c, and d for the completion of form 200: Open it up with online editor and begin adjusting. You may ile this form online or download it at tax.ok.gov. Involved parties names, addresses and phone numbers etc. Web get the form 200 f you need.

Fill Free fillable forms for the state of Oklahoma

All forms are printable and downloadable. You may file this form online or download it at www.tax.ok.gov. Open it up with online editor and begin adjusting. You may ile this form online or download it at tax.ok.gov. Once completed you can sign your fillable form or send for signing.

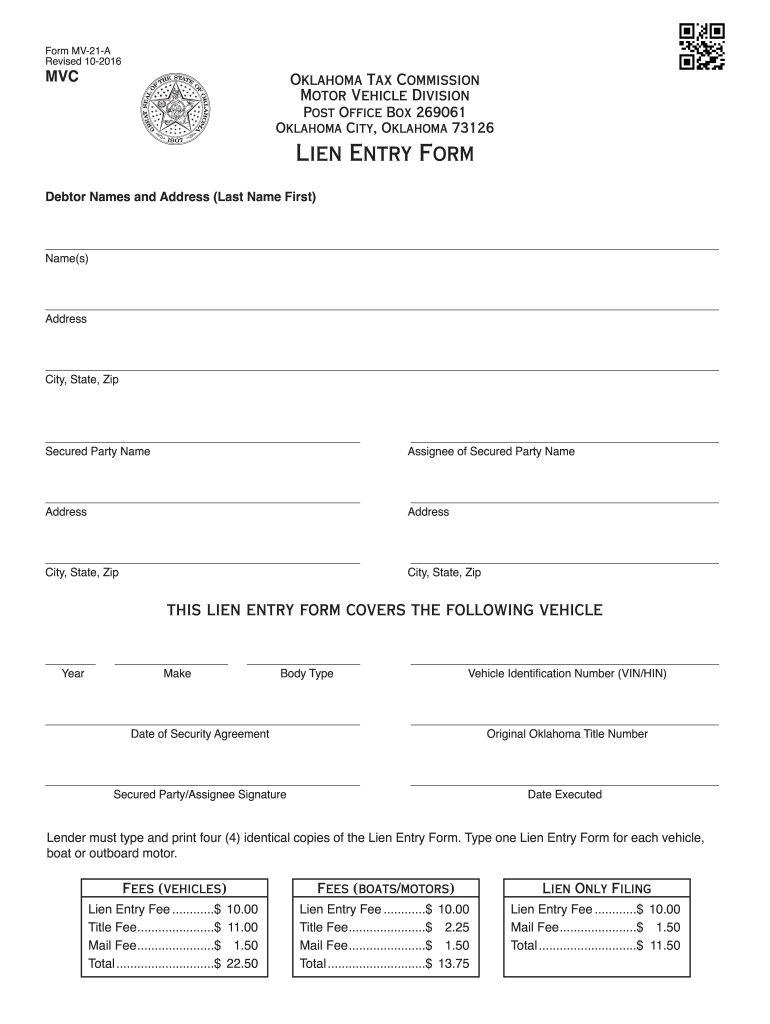

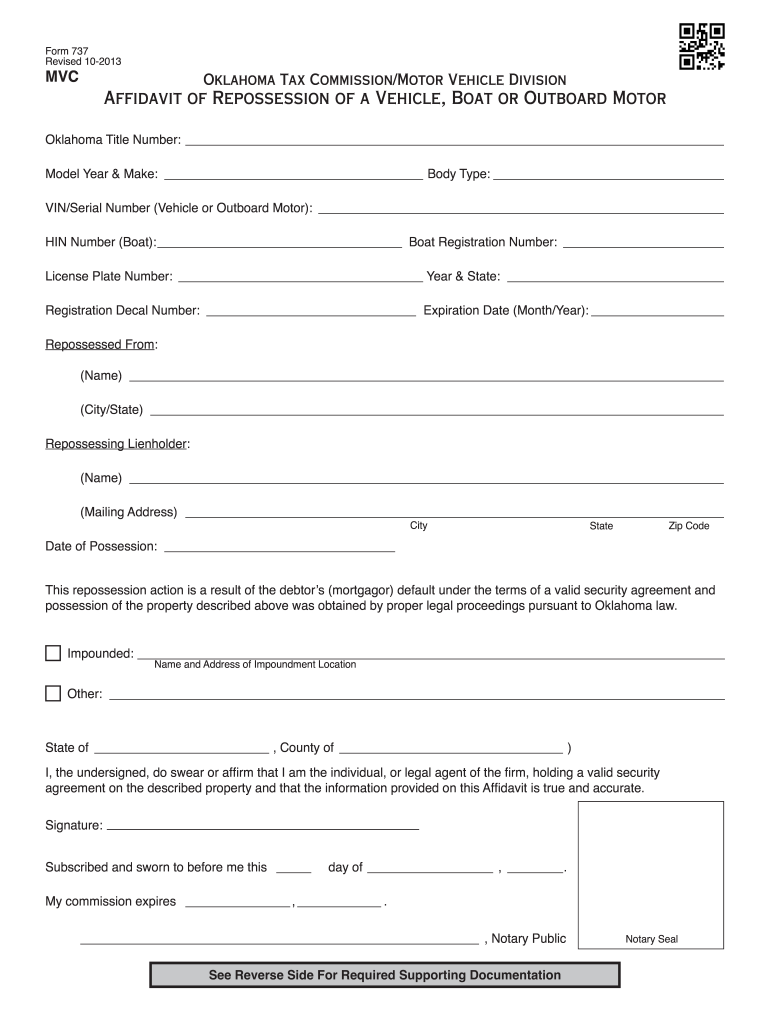

Oklahoma Form Mv 21 A Fill Out and Sign Printable PDF Template signNow

Web click on new document and select the file importing option: Fill in the blank areas; You can download this form from the oklahoma tax commission website @ www.tax.ok.gov. The report and tax will be delinquent if not paid on or before september 15. Once the corporation has filed the form, it does not have to file again unless it.

Oklahoma form franchise tax 2014 Fill out & sign online DocHub

Fill in the blank areas; Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. You may file this form online or download it at www.tax.ok.gov. Web fill online, printable, fillable, blank form 200: • franchise tax computation the basis for computing oklahoma franchise tax is the.

2013 Form OK OTC 737 Fill Online, Printable, Fillable, Blank pdfFiller

Web click on new document and select the file importing option: Share your form with others send oklahoma form 200 f via email, link, or fax. Web if you wish to make an election to change your filing frequency for your next reporting period, please complete otc form 200f: Web oklahoma form 200 f use a ok form 200 f.

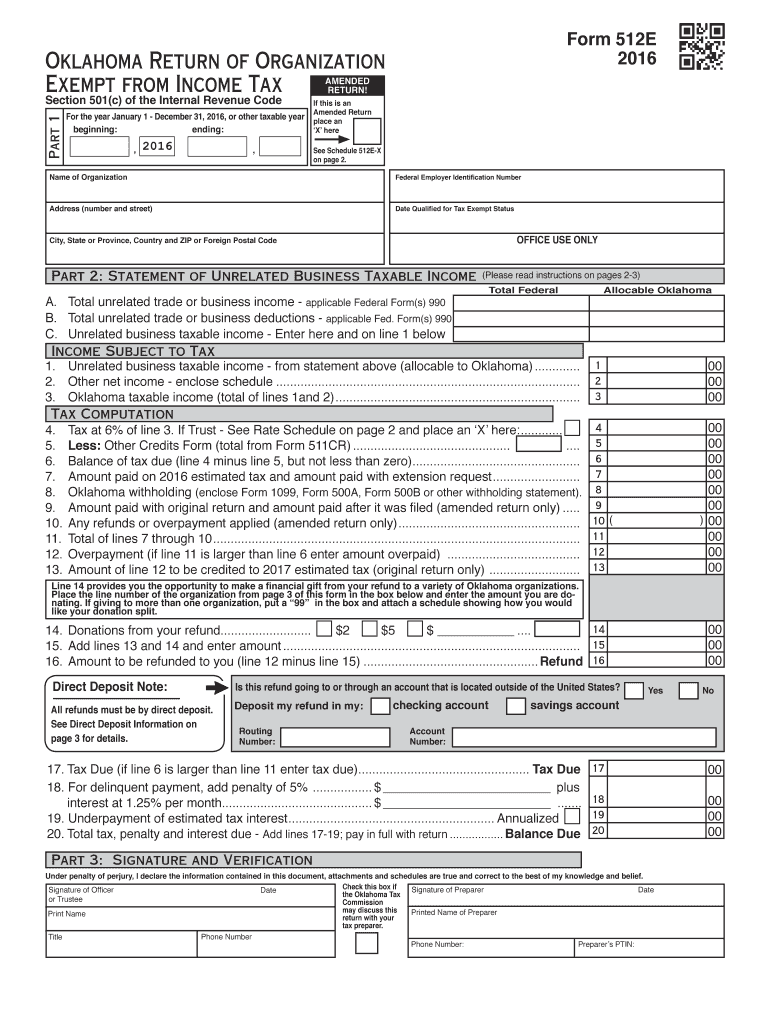

Oklahoma Form 512E Fill Out and Sign Printable PDF Template signNow

This government document is issued by tax commission for use in oklahoma. Once the corporation has filed the form, it does not have to file again unless it wishes to change the filing period. Use fill to complete blank online state of oklahoma (ok) pdf forms for free. Open it up with online editor and begin adjusting. All forms are.

Once Completed You Can Sign Your Fillable Form Or Send For Signing.

Web if you wish to make an election to change your filing frequency for your next reporting period, please complete otc form 200f: Oklahoma annual franchise tax return (state of oklahoma) form. You can download this form from the oklahoma tax commission website @ www.tax.ok.gov. You may file this form online or download it at www.tax.ok.gov.

Sign It In A Few Clicks Draw Your Signature, Type It, Upload Its Image, Or Use Your Mobile Device As A Signature Pad.

Show details how it works browse for the form 200 f customize and esign ok 200 f form send out signed oklahoma form 200 f or print it rate the form 200f 4.6 satisfied 86 votes what makes the form 200 f legally binding? Once the corporation has filed the form, it does not have to file again unless it wishes to change the filing period. • franchise tax computation the basis for computing oklahoma franchise tax is the balance sheet as shown by your books of account at the close of the last preceding Add oklahoma frx 200 instructions 2020 from your device, the cloud, or a secure link.

Web Fill Online, Printable, Fillable, Blank Form 200:

Web get the form 200 f you need. I elect to file one return for both franchise and corporate income taxes. This government document is issued by tax commission for use in oklahoma. • franchise tax computation the basis for computing oklahoma franchise tax is the balance sheet as shown by your books of account at the close of the last preceding

You May File This Form Online Or Download It At Www.tax.ok.gov.

Insert and customize text, images, and fillable areas, whiteout unnecessary details. Involved parties names, addresses and phone numbers etc. All forms are printable and downloadable. The report and tax will be delinquent if not paid on or before september 15.