Oklahoma State Withholding Form

Oklahoma State Withholding Form - Web up to 25% cash back to apply on paper, use form wth10006, oklahoma wage withholding tax application. Web will not be taxed by the state of oklahoma when you file your individual income tax return. • if your filing status is married filing joint and your spouse works, do not claim. Web this form is to change oklahoma withholding allowances. Web opers has two forms to provide tax withholding preferences for federal and state taxes. The amount of income tax to withhold is: Your first name and middle initial. $0 $488 $ 0 $488 $565 $ 0 +(0.50%. Oklahoma quarterly wage withholding tax return (oklahoma) form. If the oklahoma income tax you withhold from your employee(s) is $500 or more per quarter, the amount withheld must be remitted monthly.

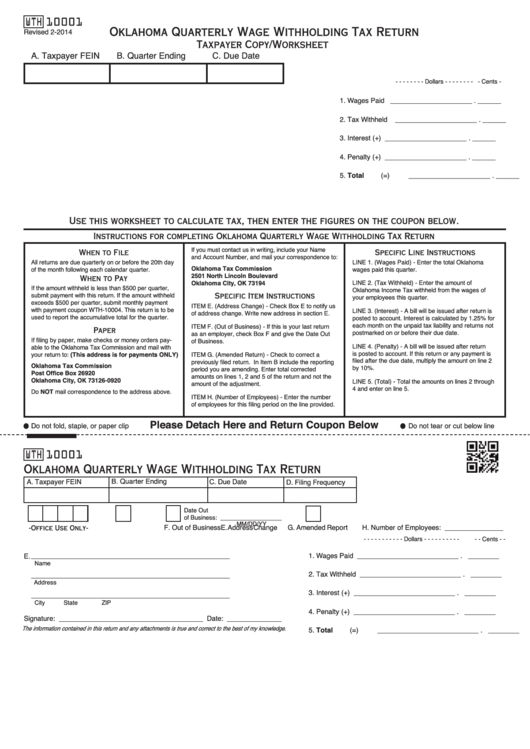

Web federal and state law requires the oklahoma public employees retirement system (opers) to withhold income tax from your benefit payment. Web federal and state income tax withholding instructions. Oklahoma quarterly wage withholding tax return (oklahoma) form. Web fill online, printable, fillable, blank form 10001: Mailing address for this form: Business forms withholding alcohol &. Your first name and middle initial. If the oklahoma income tax you withhold from your employee(s) is $500 or more per quarter, the amount withheld must be remitted monthly. $0 $488 $ 0 $488 $565 $ 0 +(0.50%. • if your filing status is married filing joint and your spouse works, do not claim.

Employee’s signature (form is not valid unless you sign it)date (mm/dd/yyyy) home. If the oklahoma income tax you withhold from your employee(s) is $500 or more per quarter, the amount withheld must be remitted monthly. Web federal and state law requires the oklahoma public employees retirement system (opers) to withhold income tax from your benefit payment. Web will not be taxed by the state of oklahoma when you file your individual income tax return. Non resident royalty withholding tax; Oklahoma quarterly wage withholding tax return (oklahoma) form. Your first name and middle initial. If you do not file a. Web (after subtracting withholding allowances) over but less than. Web most states also have withholding forms.

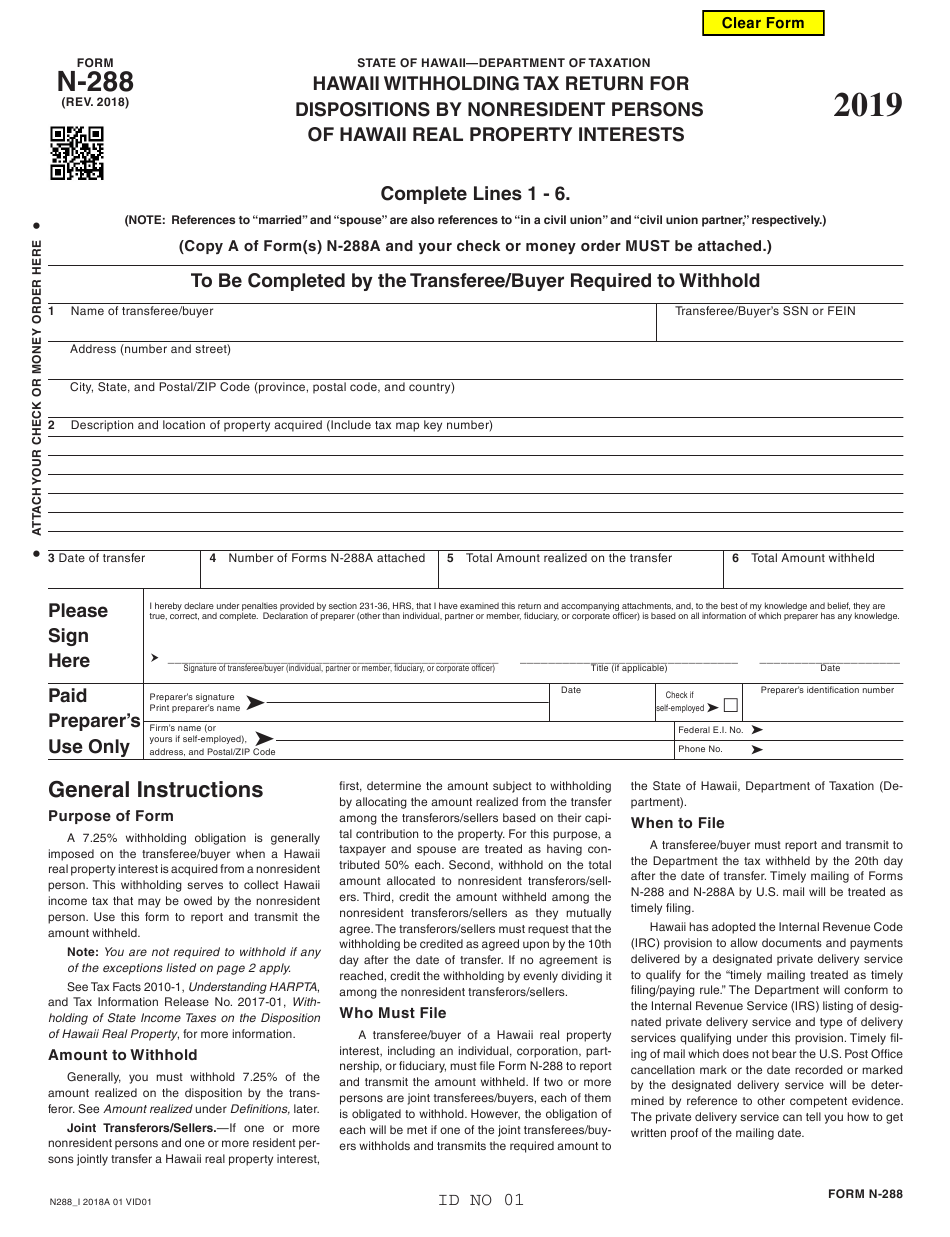

Hawaii State Tax Withholding Form 2022

Your tax withholding status will default to single and 0 dependents for both federal and oklahoma state taxes. Oklahoma quarterly wage withholding tax return (oklahoma) form. Web this form is to change oklahoma withholding allowances. Employee’s signature (form is not valid unless you sign it)date (mm/dd/yyyy) home. Web employee’s withholding allowance certificate.

Oklahoma Employee Tax Withholding Form 2023

If you do not file a. Web this form is to change oklahoma withholding allowances. You can download blank forms from the business forms. The amount of income tax to withhold is: Mailing address for this form:

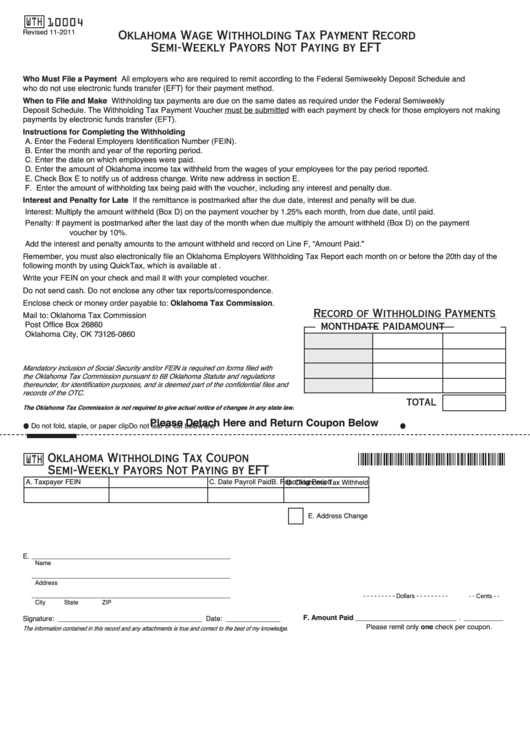

Fillable Form Wth10004 Oklahoma Wage Withholding Tax Payment Record

505, tax withholding and estimated tax. Your tax withholding status will default to single and 0 dependents for both federal and oklahoma state taxes. Employee’s signature (form is not valid unless you sign it)date (mm/dd/yyyy) home. Web federal and state income tax withholding instructions. Oklahoma quarterly wage withholding tax return (oklahoma) form.

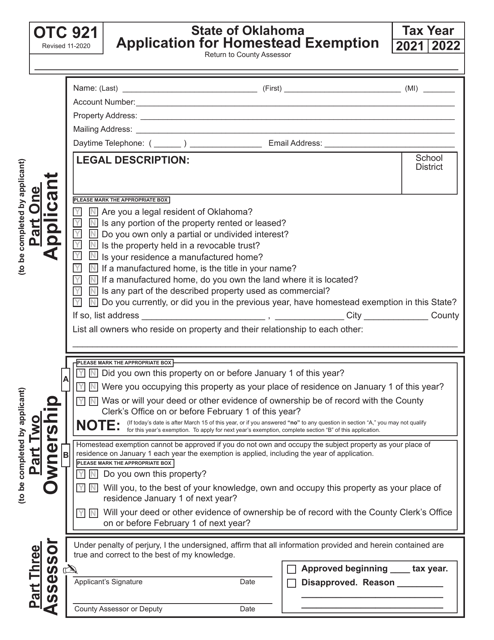

OTC Form 921 Download Fillable PDF or Fill Online Application for

Web this form is to change oklahoma withholding allowances. Web federal and state law requires the oklahoma public employees retirement system (opers) to withhold income tax from your benefit payment. Web change the entries on the form. Non resident royalty withholding tax; Employee’s signature (form is not valid unless you sign it)date (mm/dd/yyyy) home.

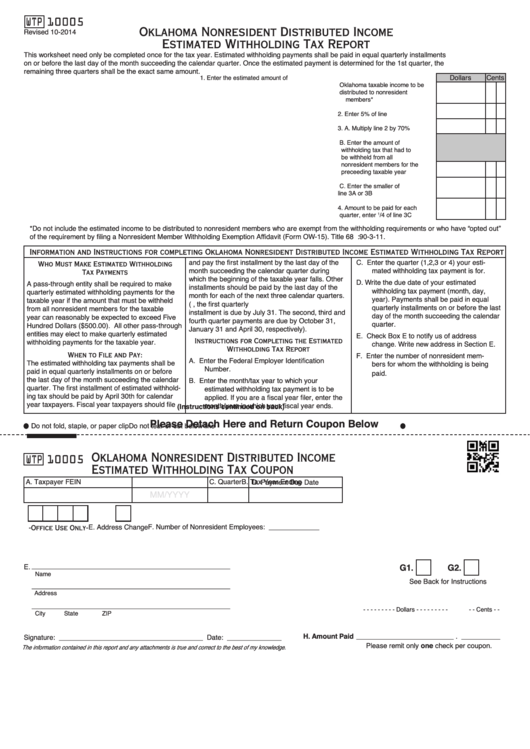

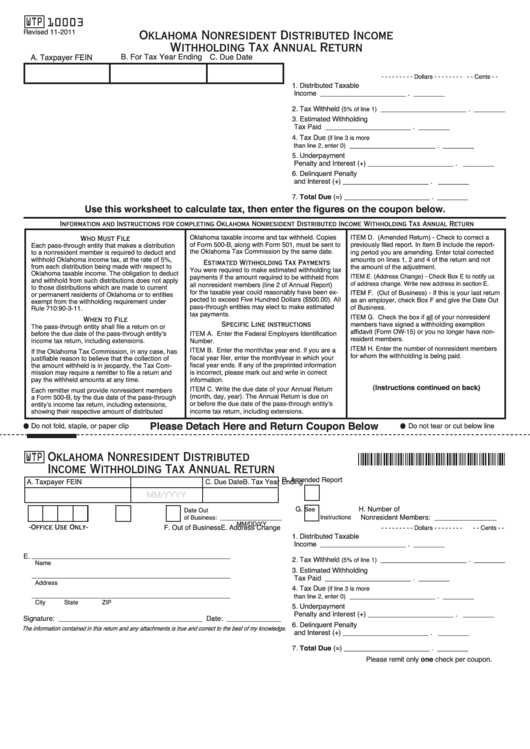

Fillable Oklahoma Nonresident Distributed Estimated Withholding

Web up to 25% cash back to apply on paper, use form wth10006, oklahoma wage withholding tax application. Web (after subtracting withholding allowances) over but less than. You can download blank forms from the business forms. Web change the entries on the form. Web this form must be submitted to the office of the registrar in person with appropriate id.

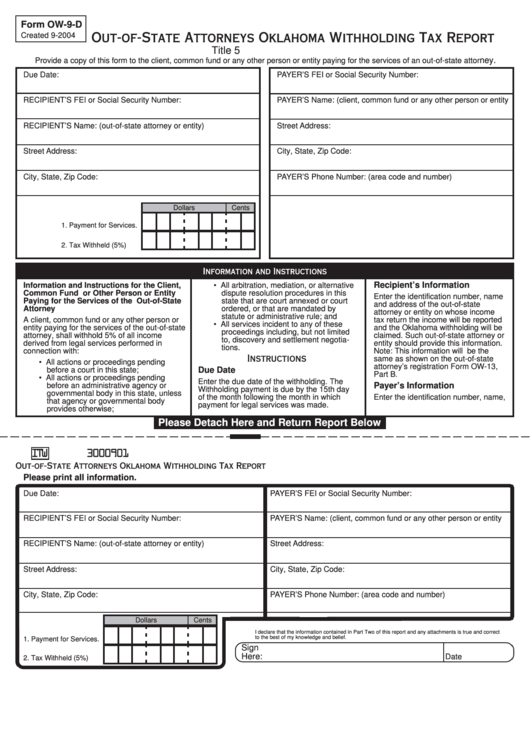

Form Ow9D OutOfState Attorneys Oklahoma Withholding Tax Report

The amount of income tax to withhold is: $0 $488 $ 0 $488 $565 $ 0 +(0.50%. Web will not be taxed by the state of oklahoma when you file your individual income tax return. Web employee’s withholding allowance certificate. Web oklahoma taxpayer access point complete a withholding application request 1 complete a withholding application request did your business receive.

Fillable Form Wth 10001 Oklahoma Quarterly Wage Withholding Tax

$0 $488 $ 0 $488 $565 $ 0 +(0.50%. Opers is required to withhold income tax from your monthly retirement benefit, unless you indicate on the withholding. Web federal and state law requires the oklahoma public employees retirement system (opers) to withhold income tax from your benefit payment. Web up to 25% cash back to apply on paper, use form.

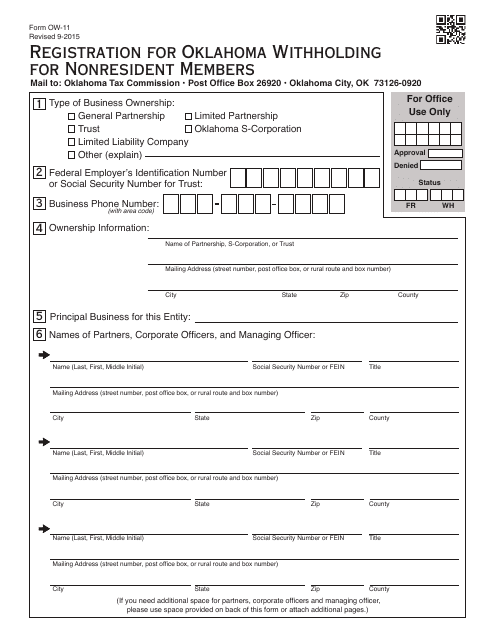

OTC Form OW11 Download Fillable PDF or Fill Online Registration for

Web oklahoma taxpayer access point complete a withholding application request 1 complete a withholding application request did your business receive a. Employee’s signature (form is not valid unless you sign it)date (mm/dd/yyyy) home. Web will not be taxed by the state of oklahoma when you file your individual income tax return. Web federal and state income tax withholding instructions. Oklahoma.

Fillable Oklahoma Nonresident Distributed Withholding Tax Annual

Your first name and middle initial. Oklahoma quarterly wage withholding tax return (oklahoma) form. Upon receipt of the fein employers. You can download blank forms from the business forms. Web opers has two forms to provide tax withholding preferences for federal and state taxes.

How To Fill Out Oklahoma Employers Withholding Tax Return Form

Opers is required to withhold income tax from your monthly retirement benefit, unless you indicate on the withholding. Employee’s signature (form is not valid unless you sign it)date (mm/dd/yyyy) home. The amount of income tax to withhold is: 505, tax withholding and estimated tax. Web (after subtracting withholding allowances) over but less than.

505, Tax Withholding And Estimated Tax.

Web this form is to change oklahoma withholding allowances. Web oklahoma taxpayer access point complete a withholding application request 1 complete a withholding application request did your business receive a. Opers is required to withhold income tax from your monthly retirement benefit, unless you indicate on the withholding. Web employee’s withholding allowance certificate.

Web Up To 25% Cash Back To Apply On Paper, Use Form Wth10006, Oklahoma Wage Withholding Tax Application.

Web most states also have withholding forms. Non resident royalty withholding tax; Web this form must be submitted to the office of the registrar in person with appropriate id (a valid driver’s license, osu student id, or. If you do not file a.

If The Oklahoma Income Tax You Withhold From Your Employee(S) Is $500 Or More Per Quarter, The Amount Withheld Must Be Remitted Monthly.

Upon receipt of the fein employers. Web change the entries on the form. Web fill online, printable, fillable, blank form 10001: • if your filing status is married filing joint and your spouse works, do not claim.

$0 $488 $ 0 $488 $565 $ 0 +(0.50%.

Web (after subtracting withholding allowances) over but less than. Business forms withholding alcohol &. Web federal and state income tax withholding instructions. Web opers has two forms to provide tax withholding preferences for federal and state taxes.