Oklahoma Tax Form 511A

Oklahoma Tax Form 511A - Web when completing this form, it is recommended you have the resident individual income tax instructions booklet (511 packet) for the tax year you are amending. We last updated oklahoma form 511nr in january 2023 from the oklahoma tax commission. Web for any balance due on your 2022 form 511 or 511nr. Web regular spouse special blind yourself name add the totals from boxes (a), (b) and (c). Complete, edit or print tax forms instantly. Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return. Ssn number of dependents age 65 or older? Form 511 can be efiled, or a paper copy can be filed via mail. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. Web this form is for income earned in tax year 2022, with tax returns due in april 2023.

Complete, edit or print tax forms instantly. Sales tax relief credit •. Complete, edit or print tax forms instantly. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. Web if you need to change or amend an accepted oklahoma state income tax return for the current or previous taxyear, you need to complete form 511 (residents) or form 511nr. Credit for taxes paid to another state (enclose 511tx) c. Name(s) shown on form 511: • instructions for completing the form 511: We strongly encourage you to use. Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return.

Name as shown on return: Web file now with turbotax. Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. Complete, edit or print tax forms instantly. Web if you need to change or amend an accepted oklahoma state income tax return for the current or previous taxyear, you need to complete form 511 (residents) or form 511nr. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web how is the amount calculated on line 6 of schedule 511a for an oklahoma individual tax return? Web 2021 oklahoma resident individual income tax forms and instructions. • instructions for completing the form 511:

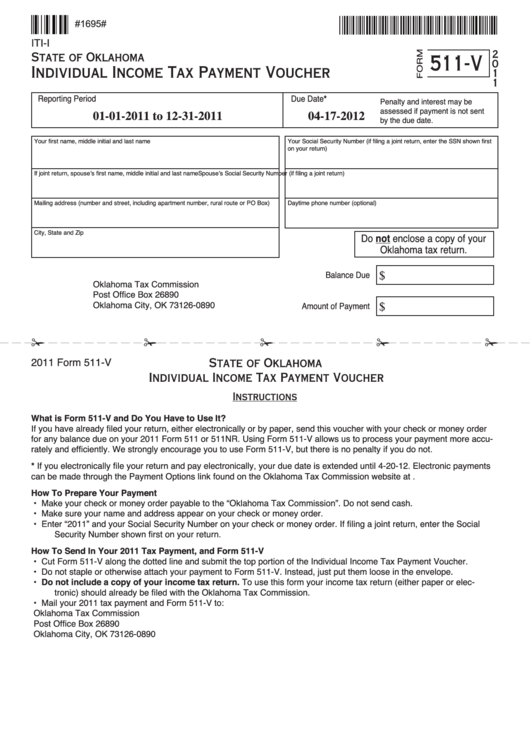

Fillable Form 511V Oklahoma Individual Tax Payment Voucher

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Agency code '695' form title: 2011 oklahoma resident individual income tax forms: Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return. Name as shown on return:

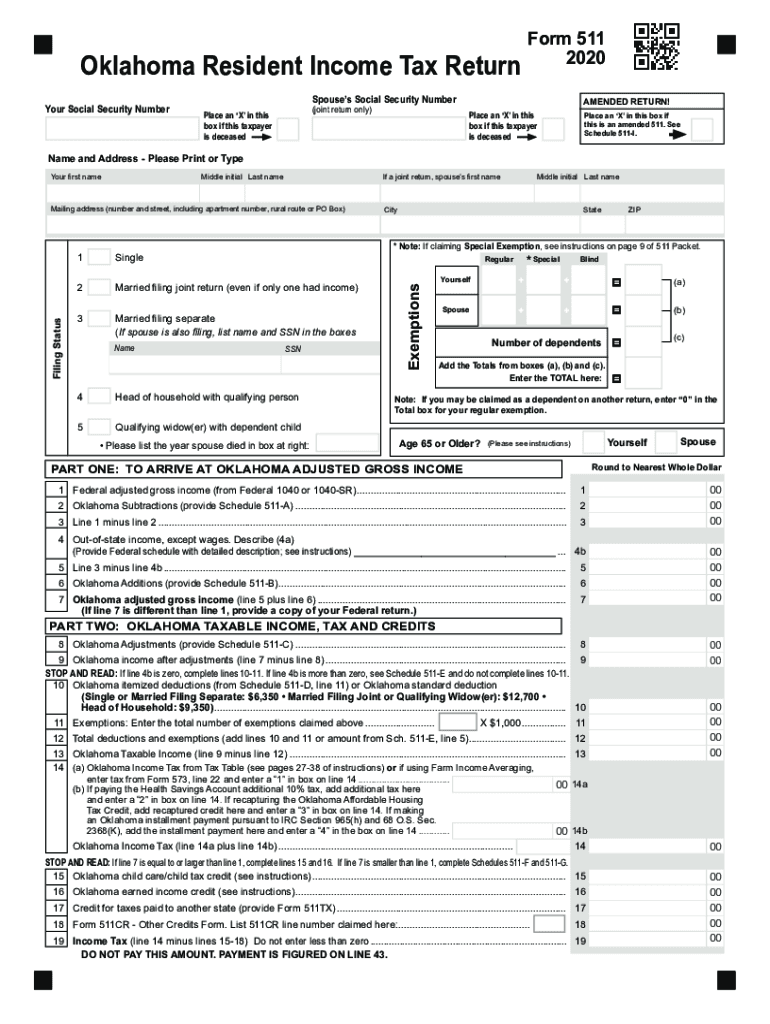

Oklahoma State Tax Form Fill Out and Sign Printable PDF Template

We strongly encourage you to use. Get ready for tax season deadlines by completing any required tax forms today. Ssn number of dependents age 65 or older? Complete, edit or print tax forms instantly. Edit, sign and print tax forms on any device with uslegalforms.

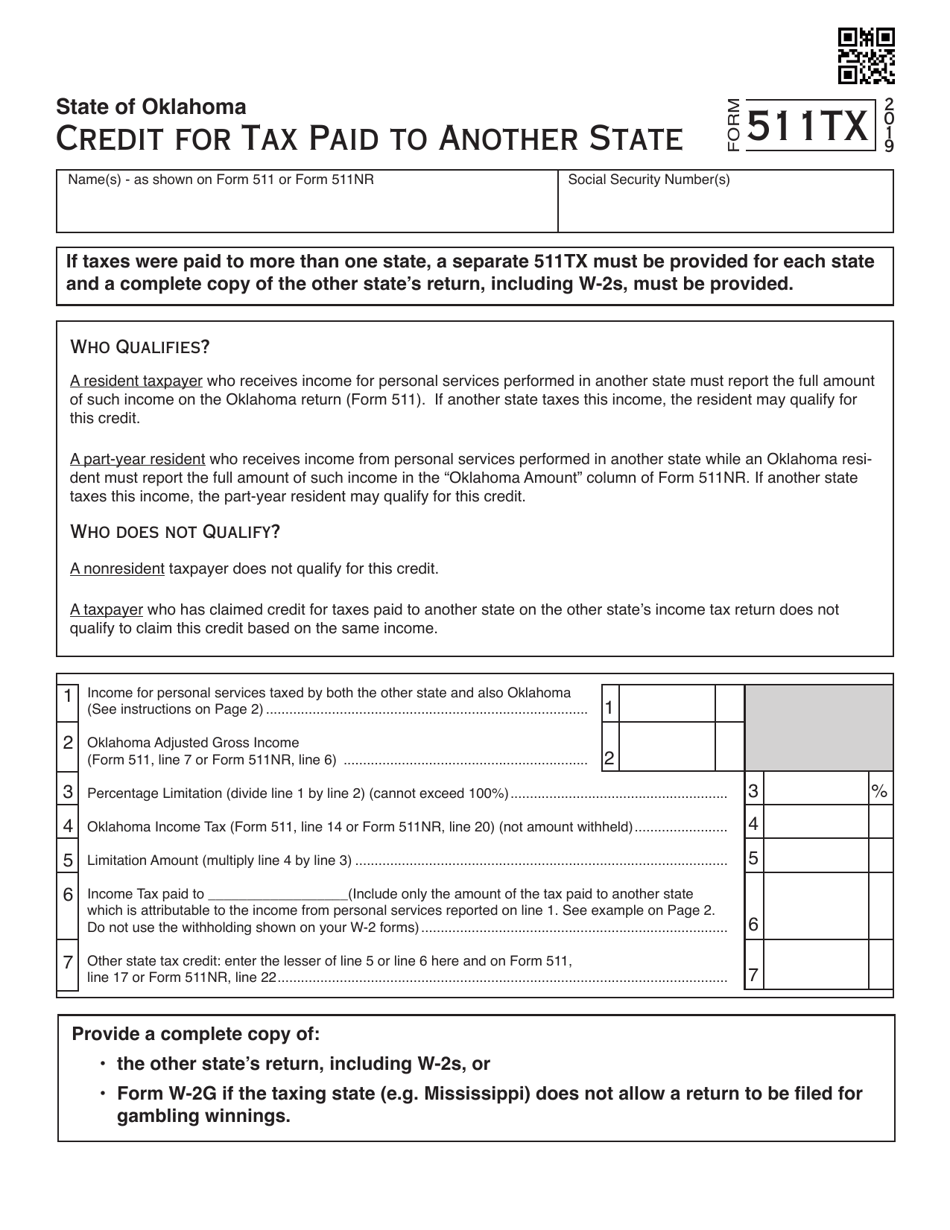

Form 511TX Download Fillable PDF or Fill Online Oklahoma Credit for Tax

Ssn number of dependents age 65 or older? • instructions for completing the form 511: We strongly encourage you to use. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Form 511 can be efiled, or a paper copy can be filed via mail.

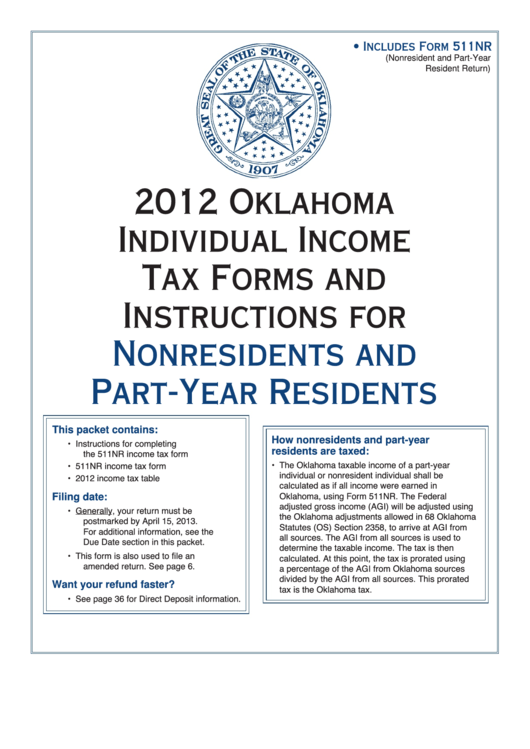

2019 Form OK 511NR Packet Fill Online, Printable, Fillable, Blank

Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return. Oklahoma allows the following subtractions from income: Web file now with turbotax. • instructions for completing the form 511: Complete, edit or print tax forms instantly.

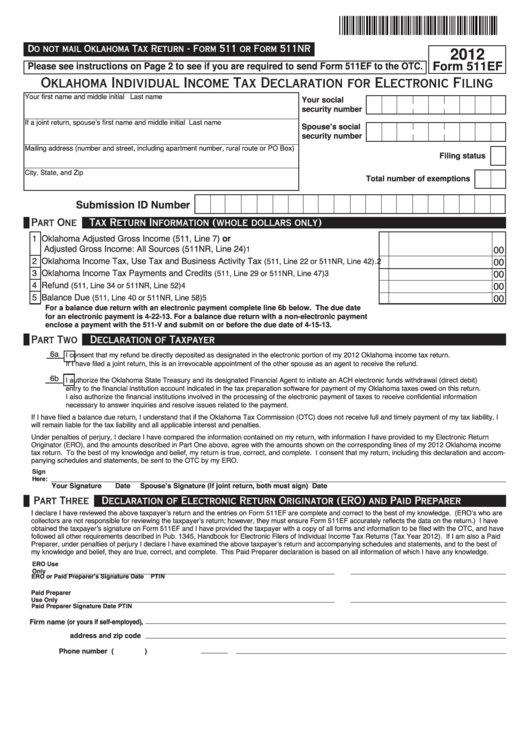

Fillable Form 511ef Oklahoma Individual Tax Declaration For

Web if you need to change or amend an accepted oklahoma state income tax return for the current or previous taxyear, you need to complete form 511 (residents) or form 511nr. Name(s) shown on form 511: • instructions for completing the form 511: Form 511 can be efiled, or a paper copy can be filed via mail. Web when completing.

Fillable Form 511nr Oklahoma Nonresident/ PartYear Tax Return

Complete, edit or print tax forms instantly. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Name(s) shown on form 511: Web for any balance due on your 2022 form 511 or 511nr. Web regular spouse special blind yourself name add the totals from boxes (a), (b) and (c).

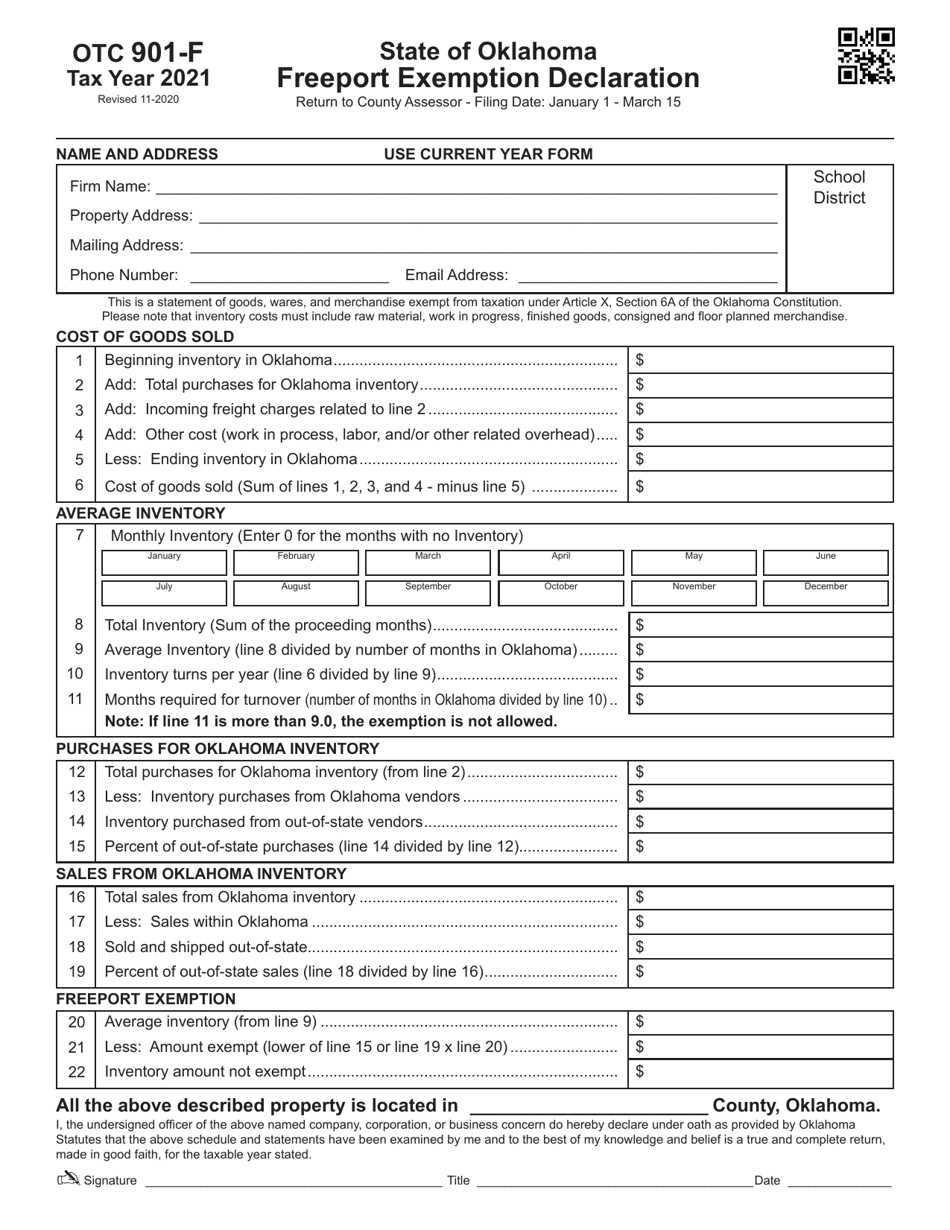

OTC Form 901F Download Fillable PDF or Fill Online Freeport Exemption

Ssn number of dependents age 65 or older? • instructions for completing the form 511: Get ready for tax season deadlines by completing any required tax forms today. Name(s) shown on form 511: Web if you need to change or amend an accepted oklahoma state income tax return for the current or previous taxyear, you need to complete form 511.

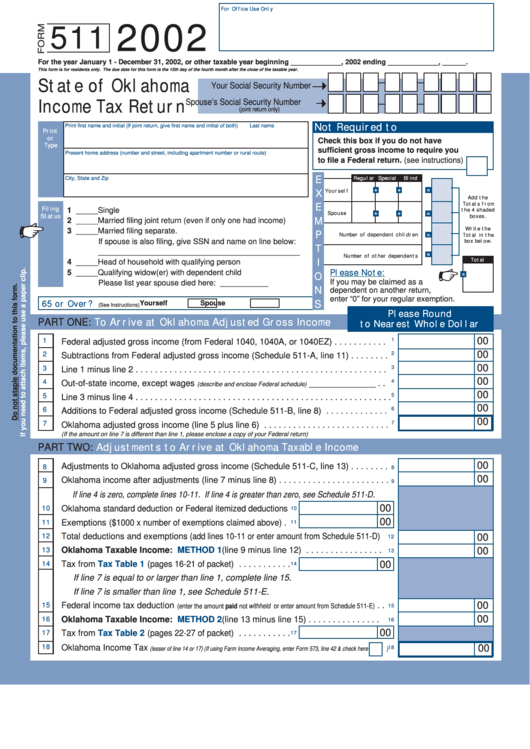

Form 511 State Of Oklahoma Tax Return 2002 printable pdf

We will update this page with a new version of the form for 2024 as soon as it is made available. To see the calculation for line 6, click on the government form line 6 and. Sales tax relief credit •. We last updated oklahoma form 511nr in january 2023 from the oklahoma tax commission. Web this form is for.

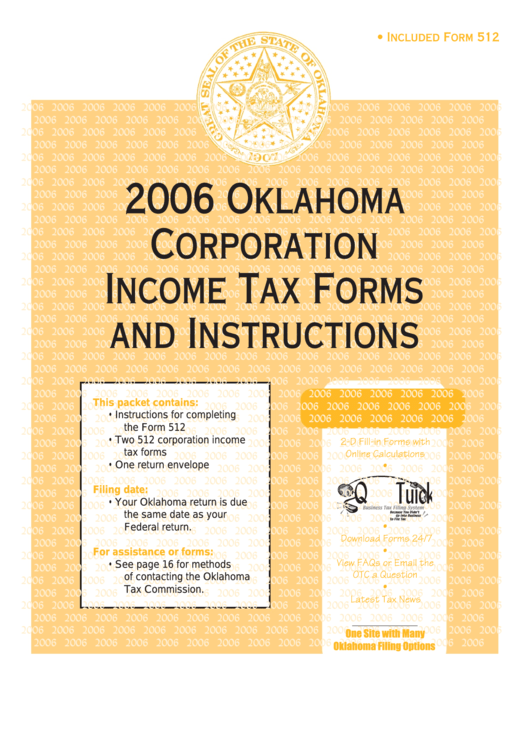

Instructions For Form 512 Oklahoma Corporation Tax 2006

Agency code '695' form title: Sales tax relief credit •. Web 2021 oklahoma resident individual income tax forms and instructions. Name as shown on return: • instructions for completing the form 511:

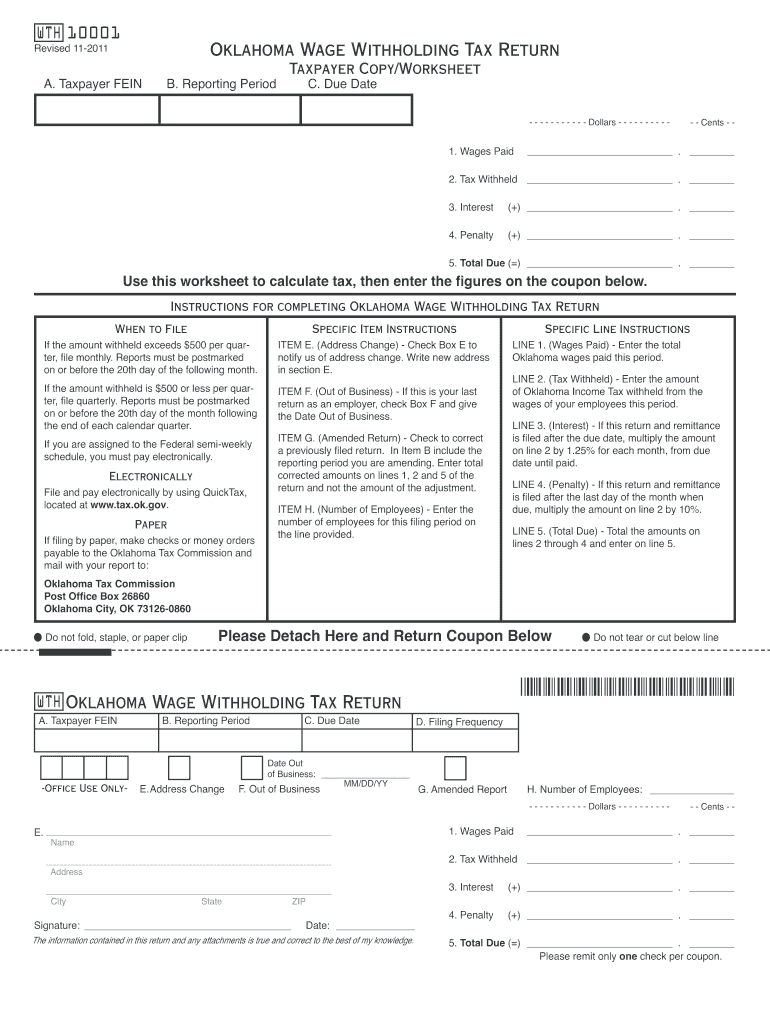

Oklahoma Withholding Tax Fill Out and Sign Printable PDF Template

• instructions for completing the form 511: We will update this page with a new version of the form for 2024 as soon as it is made available. Credit for taxes paid to another state (enclose 511tx) c. Web if you need to change or amend an accepted oklahoma state income tax return for the current or previous taxyear, you.

Web Regular Spouse Special Blind Yourself Name Add The Totals From Boxes (A), (B) And (C).

Web how is the amount calculated on line 6 of schedule 511a for an oklahoma individual tax return? 2011 oklahoma resident individual income tax forms: Ssn number of dependents age 65 or older? We strongly encourage you to use.

To See The Calculation For Line 6, Click On The Government Form Line 6 And.

Edit, sign and print tax forms on any device with uslegalforms. Agency code '695' form title: Web file now with turbotax. Web for any balance due on your 2022 form 511 or 511nr.

We Last Updated Oklahoma Form 511Nr In January 2023 From The Oklahoma Tax Commission.

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. • instructions for completing the form 511: This form is for income earned in tax year 2022, with tax. Credit for taxes paid to another state (enclose 511tx) c.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available.

Name(s) shown on form 511: Web if you need to change or amend an accepted oklahoma state income tax return for the current or previous taxyear, you need to complete form 511 (residents) or form 511nr. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. Get ready for tax season deadlines by completing any required tax forms today.