Oklahoma Tax Withholding Form

Oklahoma Tax Withholding Form - Employee’s state withholding allowance certicate. Business forms withholding alcohol & tobacco motor fuel miscellaneous taxes payment options forms & publications. Irrespective of the state a business owner sets up his business, he is liable to pay the payroll taxes to the government. Web oklahoma taxable income and tax withheld. View bulk orders tax professional bulk orders download tbor 1 declaration of tax representative. You must submit form wth10006 by regular mail. You can download blank forms from the business forms section of the otc website. To register your account with oktap you will need the following information: Both methods use a series of tables for single and married taxpayers for Web both federal and oklahoma state tax withholding forms are available to complete through a digital form with an electronic signature.

You must submit form wth10006 by regular mail. You can download blank forms from the business forms section of the otc website. Web to apply on paper, use form wth10006, oklahoma wage withholding tax application. If you register on paper, it can take up to six weeks to receive a state tax id number. Web opers has two forms to provide tax withholding preferences for federal and state taxes. Web both federal and oklahoma state tax withholding forms are available to complete through a digital form with an electronic signature. Business forms withholding alcohol & tobacco motor fuel miscellaneous taxes payment options forms & publications. 505, tax withholding and estimated tax. Request a state of ohio income tax form be mailed to you. Web change the entries on the form.

Pay period 03, 2022 summary the single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. Tax withholding tables the federal and state tax withholding tables calculate income tax on employee wages. Opers has extracted specific pages, however, full publications with tables can be found at: Employee’s state withholding allowance certicate. Employers engaged in a trade or business who pay compensation form 9465; Web oklahoma taxable income and tax withheld. What are the requirements for oklahoma payroll tax withholding? Your first name and middle initial employee’s signature (form is not valid unless you sign it)date (mm/dd/yyyy) home address (number and street or rural route) city or town state zip code filing status single married married, but withhold at higher single rate last. You must submit form wth10006 by regular mail. Employee's withholding certificate form 941;

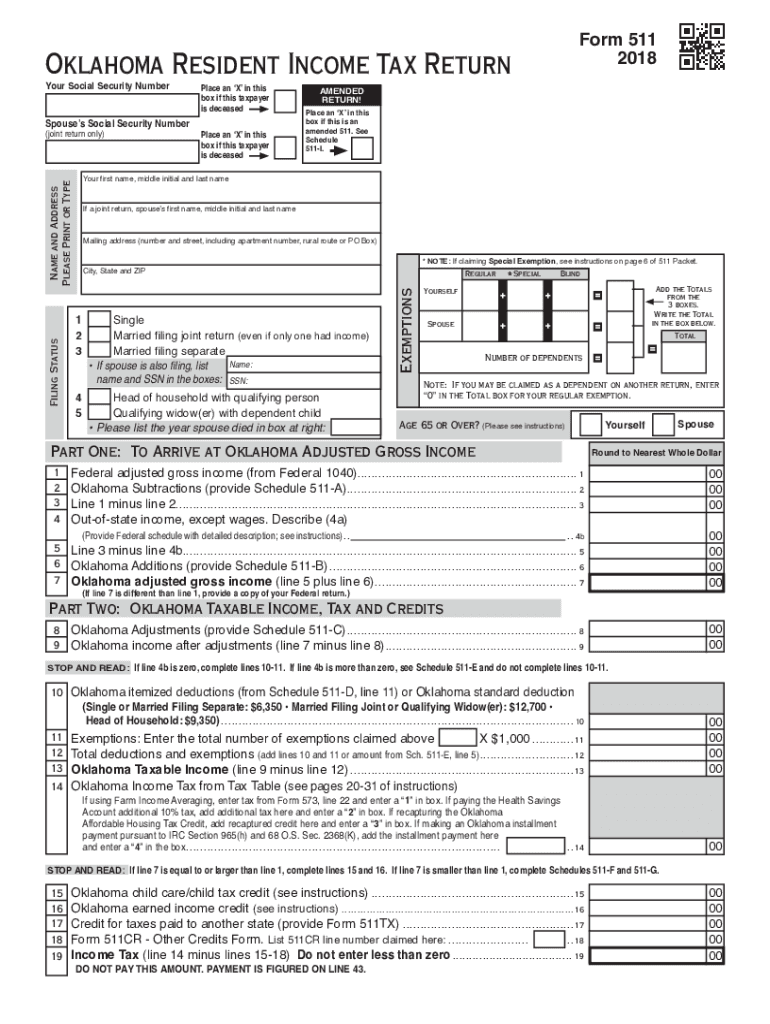

2018 Form OK 511 & 538S Fill Online, Printable, Fillable, Blank

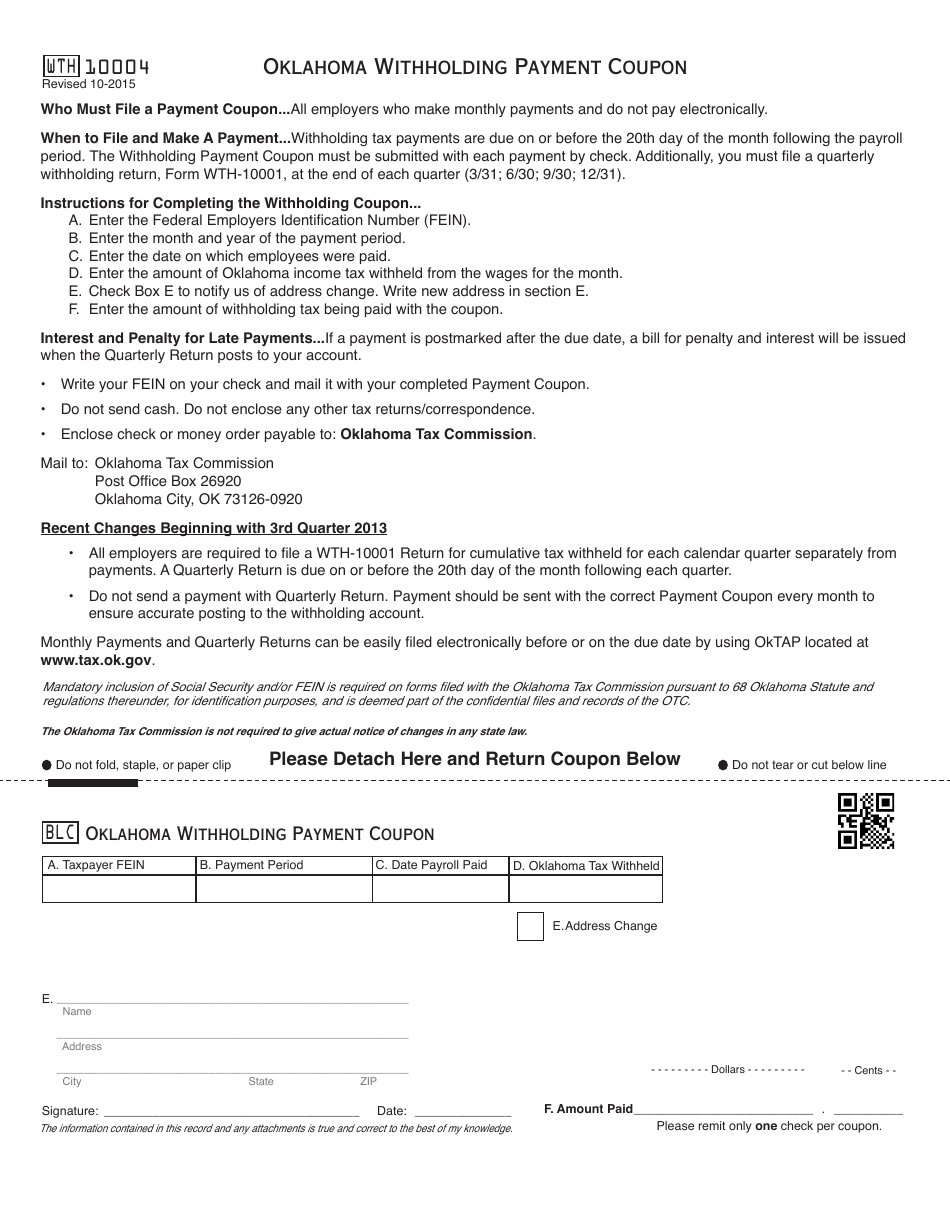

Non resident royalty withholding tax; Deductions and exemptions reduce the amount of your taxable income. Business forms withholding alcohol & tobacco motor fuel miscellaneous taxes payment options forms & publications. A quarterly return is due on or before the 20th day of the month following each quarter. You may claim exemption from withholding for 2022 if you meet both of.

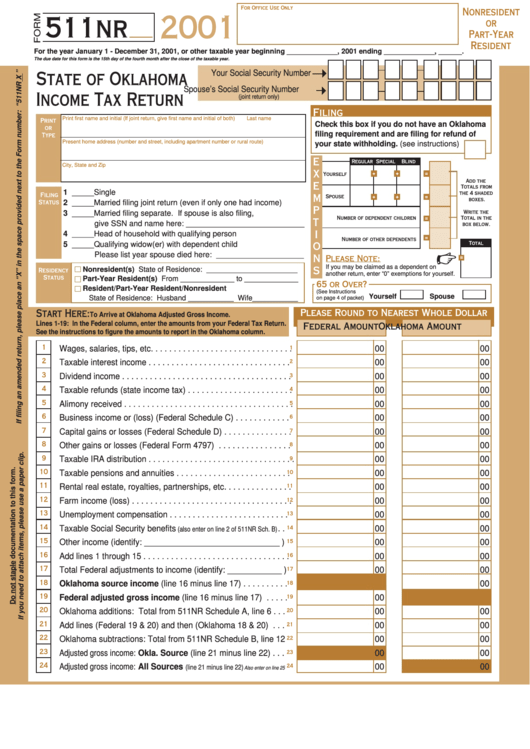

Form 511nr Oklahoma Tax Return 2001 printable pdf download

Non resident royalty withholding tax; Tax formula withholding formula (effective pay period 03, 2022) Estimated withholding tax payments you were required to make estimated withholding tax payments if the amount required to be withheld from all nonresident members (line 2 of annual report) Web to apply on paper, use form wth10006, oklahoma wage withholding tax application. A quarterly return is.

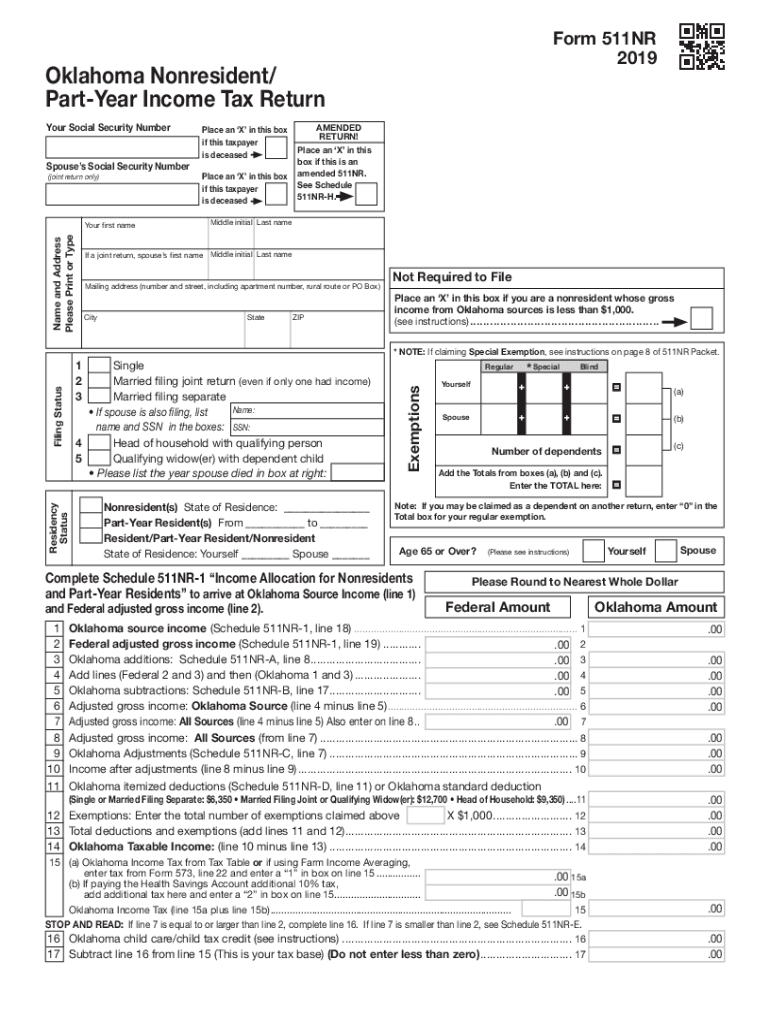

Oklahoma Employee Tax Withholding Form 2023

Deductions and exemptions reduce the amount of your taxable income. View bulk orders tax professional bulk orders download tbor 1 declaration of tax representative. Tax formula withholding formula (effective pay period 03, 2022) To register your account with oktap you will need the following information: Do not send a payment with quarterly return.

Oklahoma Tax Commission Forms Fill Out and Sign Printable PDF

To register your account with oktap you will need the following information: No action on the part of the employee or the personnel office is necessary. Employee’s state withholding allowance certicate. A quarterly return is due on or before the 20th day of the month following each quarter. Employers engaged in a trade or business who pay compensation form 9465;

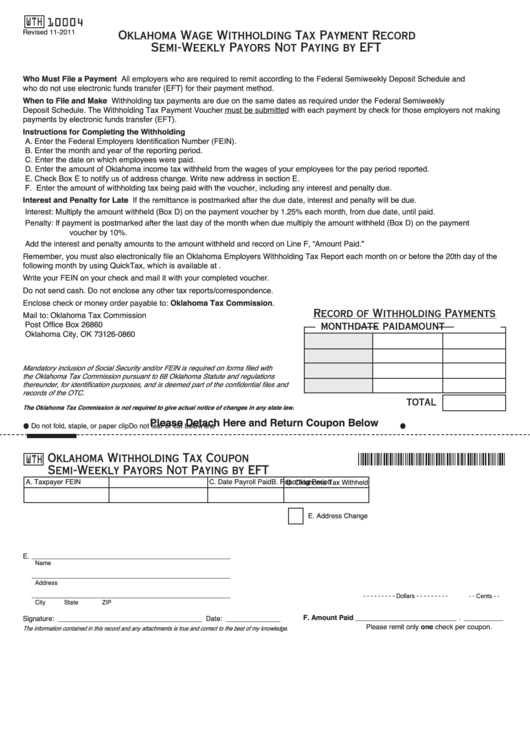

OTC Form WTH10004 Download Fillable PDF or Fill Online Oklahoma

Tax withholding tables the federal and state tax withholding tables calculate income tax on employee wages. To register your account with oktap you will need the following information: Request a state of ohio income tax form be mailed to you. Married, but withhold at higher single rate. Employee’s state withholding allowance certicate.

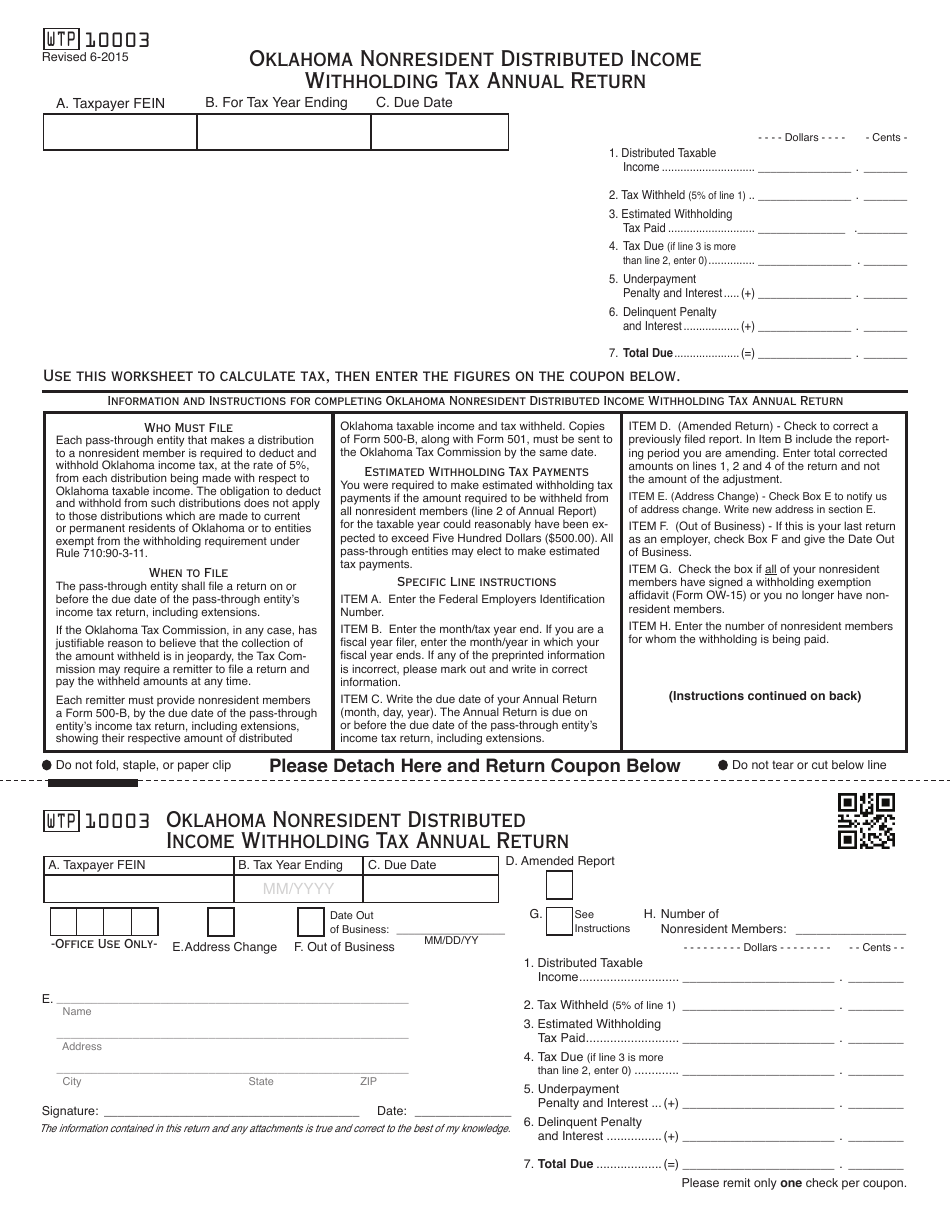

OTC Form WTP10003 Download Fillable PDF or Fill Online Oklahoma

You must submit form wth10006 by regular mail. If you register on paper, it can take up to six weeks to receive a state tax id number. You can download blank forms from the business forms section of the otc website. What are the requirements for oklahoma payroll tax withholding? Web opers has two forms to provide tax withholding preferences.

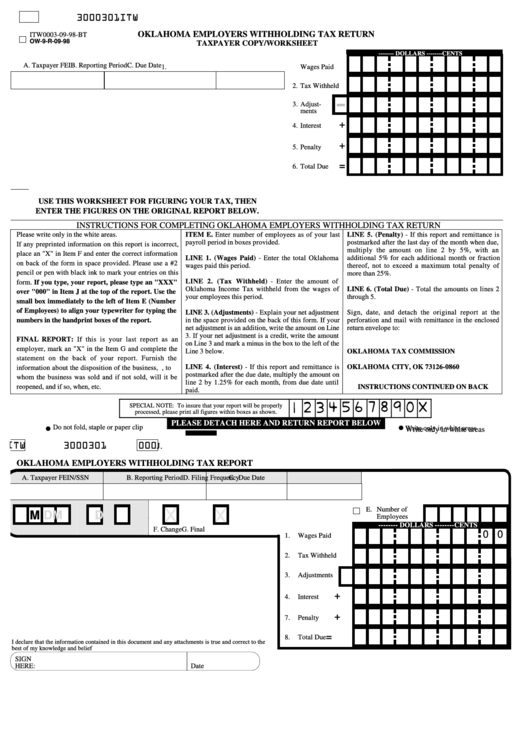

Oklahoma Employers Withholding Tax Return Oklahoma Tax Commission

Deductions and exemptions reduce the amount of your taxable income. Web both federal and oklahoma state tax withholding forms are available to complete through a digital form with an electronic signature. Employee's withholding certificate form 941; 505, tax withholding and estimated tax. You must submit form wth10006 by regular mail.

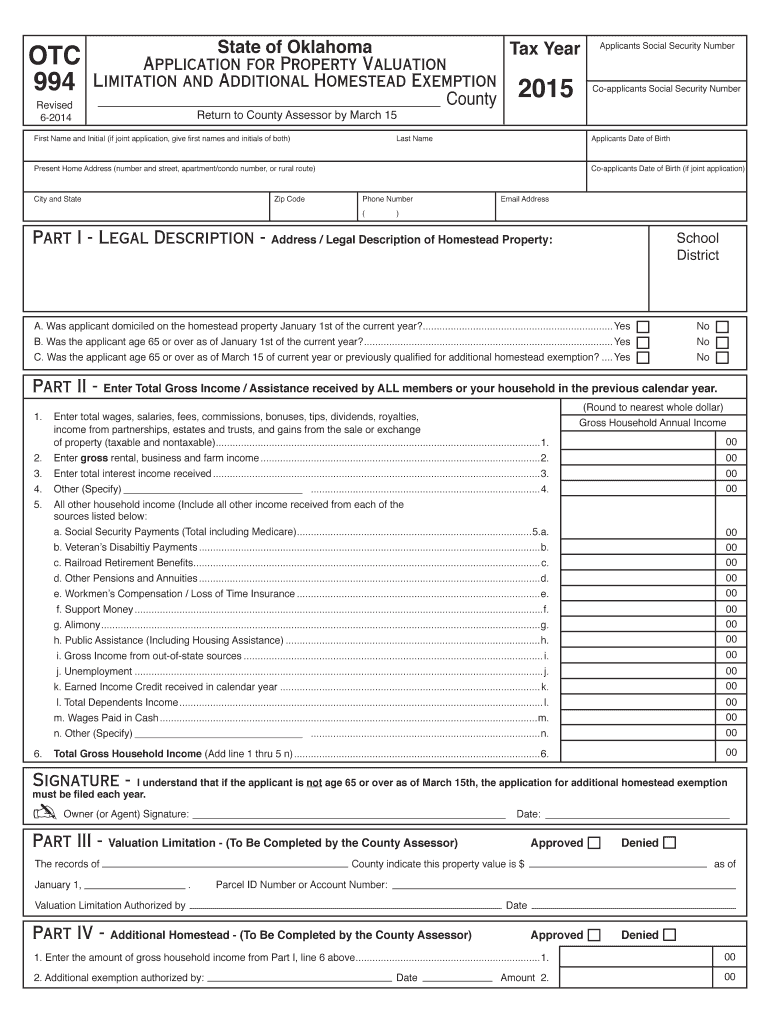

Oklahoma Tax Homestead Exemption Form Fill Out and Sign Printable PDF

Web change the entries on the form. Do not send a payment with quarterly return. A quarterly return is due on or before the 20th day of the month following each quarter. Non resident royalty withholding tax; Both methods use a series of tables for single and married taxpayers for

Fillable Form Wth10004 Oklahoma Wage Withholding Tax Payment Record

Irrespective of the state a business owner sets up his business, he is liable to pay the payroll taxes to the government. Business forms withholding alcohol & tobacco motor fuel miscellaneous taxes payment options forms & publications. Web opers has two forms to provide tax withholding preferences for federal and state taxes. Estimated withholding tax payments you were required to.

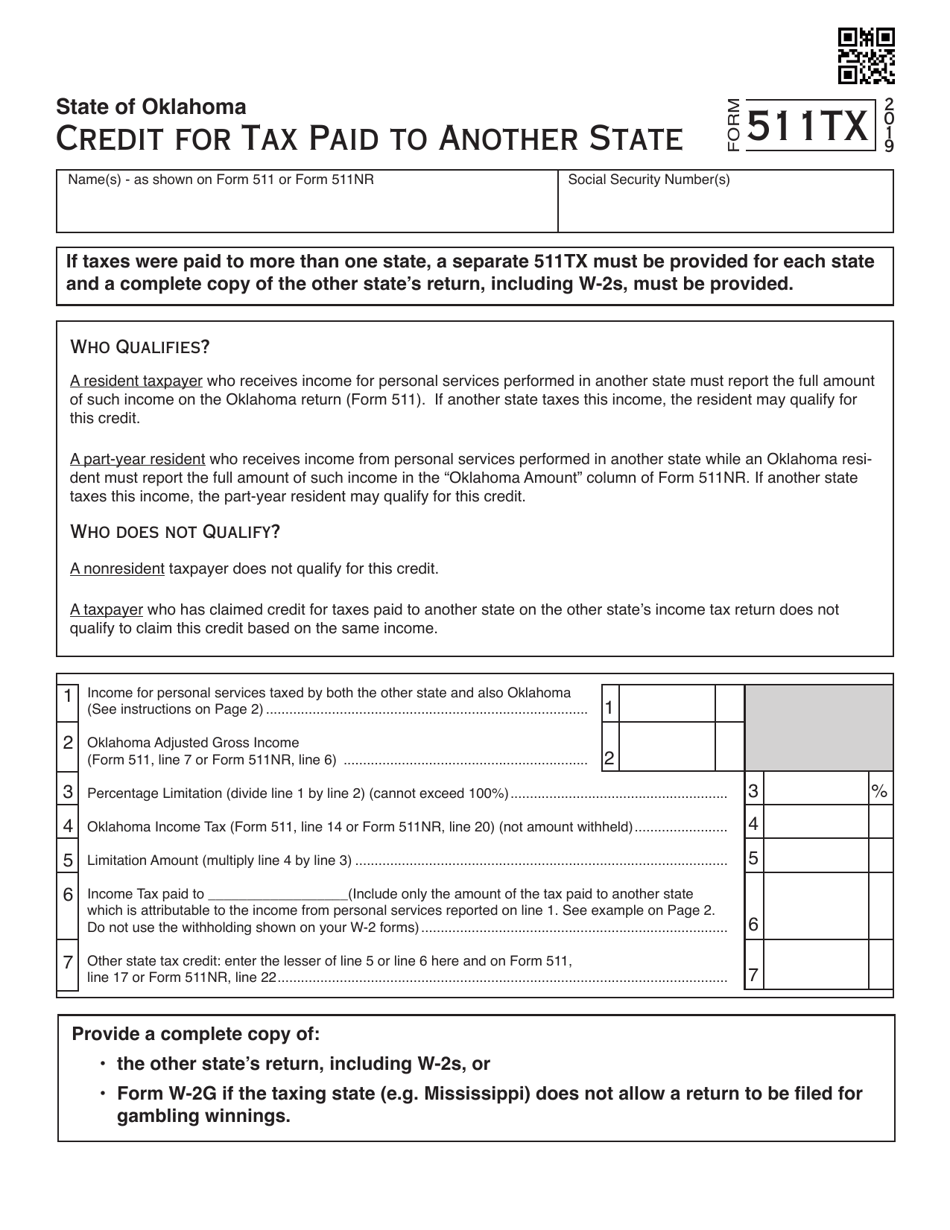

Form 511TX Download Fillable PDF or Fill Online Oklahoma Credit for Tax

Non resident royalty withholding tax; Complete this section if you want to withhold based on the oklahoma tax withholding tables: What are the requirements for oklahoma payroll tax withholding? Request a state of ohio income tax form be mailed to you. Interest is calculated by 1.25% for each month on the unpaid tax liability and.

Employers Engaged In A Trade Or Business Who Pay Compensation Form 9465;

Irrespective of the state a business owner sets up his business, he is liable to pay the payroll taxes to the government. You may claim exemption from withholding for 2022 if you meet both of the following conditions: If you register on paper, it can take up to six weeks to receive a state tax id number. What are the requirements for oklahoma payroll tax withholding?

Opers Has Extracted Specific Pages, However, Full Publications With Tables Can Be Found At:

Business forms withholding alcohol & tobacco motor fuel miscellaneous taxes payment options forms & publications. Employee’s state withholding allowance certicate. Web change the entries on the form. Non resident royalty withholding tax;

Web Any Oklahoma Income Tax Withheld From Your Pension.

A quarterly return is due on or before the 20th day of the month following each quarter. Tax withholding tables the federal and state tax withholding tables calculate income tax on employee wages. Do not send a payment with quarterly return. 505, tax withholding and estimated tax.

No Action On The Part Of The Employee Or The Personnel Office Is Necessary.

Both methods use a series of tables for single and married taxpayers for View bulk orders tax professional bulk orders download tbor 1 declaration of tax representative. Tax formula withholding formula (effective pay period 03, 2022) Estimated withholding tax payments you were required to make estimated withholding tax payments if the amount required to be withheld from all nonresident members (line 2 of annual report)