Oregon Non Resident Tax Form

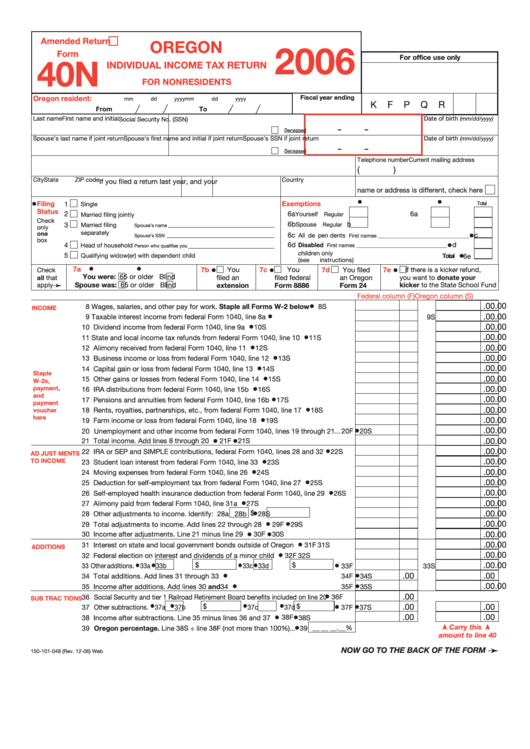

Oregon Non Resident Tax Form - Direct deposit is available for oregon. Web oregon state university requires nonresident aliens to complete the nonresident alien tax status form and submit it with copies of the recent i20 or ds2019 (if applicable for visa. Use the do i need to file? Select a heading to view its forms, then u se the search feature to locate a form or publication. Chart and filing requirement chart for your residency status to see if you. Web if you are a nonresident of oregon who makes income from oregon, and therefore need to file an income tax form, file form 40n as well as any other tax forms you are required. Oregon is available to be filed with your federal return. *oregon taxes the income you earned while working in. Web 1 best answer tomd8 level 15 from page 47 of the 2020 oregon tax instructions: Web oregon requires a withholding of tax on certain real estate transactions of nonresident individuals and c corporations that do not do business in oregon

Web how to determine if you need to file an oregon income tax return for 2022. Direct deposit is available for oregon. Web view all of the current year's forms and publications by popularity or program area. Web complete 2011 nonresident oregon tax return fillable form online with us legal forms. Use the do i need to file? Oregon has a state income tax that ranges between 5% and 9.9%. (a) proof of residency in oregon; Web if you are a nonresident of oregon who makes income from oregon, and therefore need to file an income tax form, file form 40n as well as any other tax forms you are required. Separate or joint determination of income for spouses in a marriage. Web please let us know so we can fix it!

(a) proof of residency in oregon; Oregon has a state income tax that ranges between 5% and 9.9%. Direct deposit is available for oregon. Easily fill out pdf blank, edit, and sign them. Web view all of the current year's forms and publications by popularity or program area. Web 1 best answer tomd8 level 15 from page 47 of the 2020 oregon tax instructions: Web (1) the taxable income of a nonresident is the taxpayer’s federal taxable income from oregon sources as defined in ors 316.127 (income of nonresident from. Web oregon requires a withholding of tax on certain real estate transactions of nonresident individuals and c corporations that do not do business in oregon Use the do i need to file? Chart and filing requirement chart for your residency status to see if you.

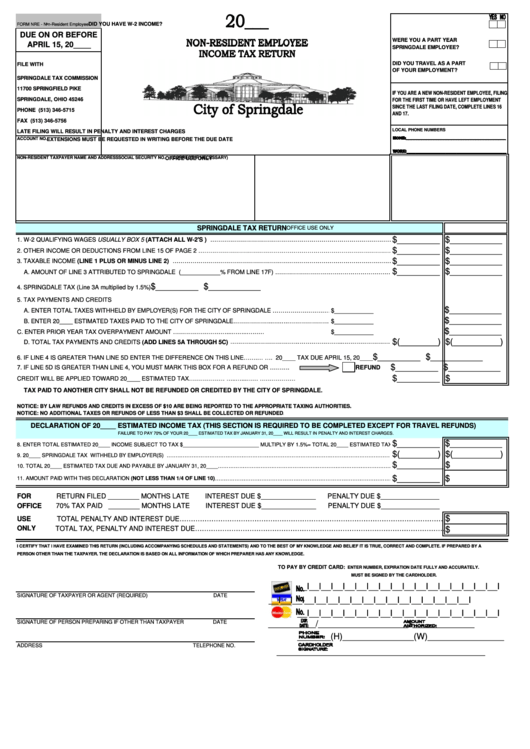

Form Nre NonResident Employee Tax Return printable pdf download

*oregon taxes the income you earned while working in. Web the net amount of items of income, gain, loss and deduction entering into the nonresident’s federal adjusted gross income that are derived from or connected with. Select a heading to view its forms, then u se the search feature to locate a form or publication. There are restrictions imposed when.

Oregon Form 40 2021 Printable Printable Form 2022

Web oregon state university requires nonresident aliens to complete the nonresident alien tax status form and submit it with copies of the recent i20 or ds2019 (if applicable for visa. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Chart and filing requirement chart for your residency status to see if you. Web.

Fillable Form 40n Oregon Individual Tax Return For

Web (1) the taxable income of a nonresident is the taxpayer’s federal taxable income from oregon sources as defined in ors 316.127 (income of nonresident from. There are restrictions imposed when completing the. Web complete 2011 nonresident oregon tax return fillable form online with us legal forms. Web if you are a nonresident of oregon who makes income from oregon,.

Tax on Dividend for Resident & Non residents & How to avoid TDS in

Chart and filing requirement chart for your residency status to see if you. Easily fill out pdf blank, edit, and sign them. Web oregon state university requires nonresident aliens to complete the nonresident alien tax status form and submit it with copies of the recent i20 or ds2019 (if applicable for visa. Web as a result, at the time of.

1040ez Oregon State Tax Forms Universal Network

Web oregon requires a withholding of tax on certain real estate transactions of nonresident individuals and c corporations that do not do business in oregon Web the net amount of items of income, gain, loss and deduction entering into the nonresident’s federal adjusted gross income that are derived from or connected with. Chart and filing requirement chart for your residency.

US NonResident Tax Return 2019 Delaware Company Formation LLC

There are restrictions imposed when completing the. (a) proof of residency in oregon; Save or instantly send your ready documents. Web if you are a nonresident of oregon who makes income from oregon, and therefore need to file an income tax form, file form 40n as well as any other tax forms you are required. Web oregon state university requires.

Tax from nonresidents in Spain, what is it and how to do it properly

Separate or joint determination of income for spouses in a marriage. Web if you are a nonresident of oregon who makes income from oregon, and therefore need to file an income tax form, file form 40n as well as any other tax forms you are required. There are restrictions imposed when completing the. Oregon is available to be filed with.

oregon tax tables

Chart and filing requirement chart for your residency status to see if you. Oregon has a state income tax that ranges between 5% and 9.9%. Oregon is available to be filed with your federal return. Easily fill out pdf blank, edit, and sign them. Web if you are a nonresident of oregon who makes income from oregon, and therefore need.

FORM 210 NON RESIDENT TAX DECLARATION AF Consulting

(a) proof of residency in oregon; Web view all of the current year's forms and publications by popularity or program area. Oregon has a state income tax that ranges between 5% and 9.9%. *oregon taxes the income you earned while working in. Web how to determine if you need to file an oregon income tax return for 2022.

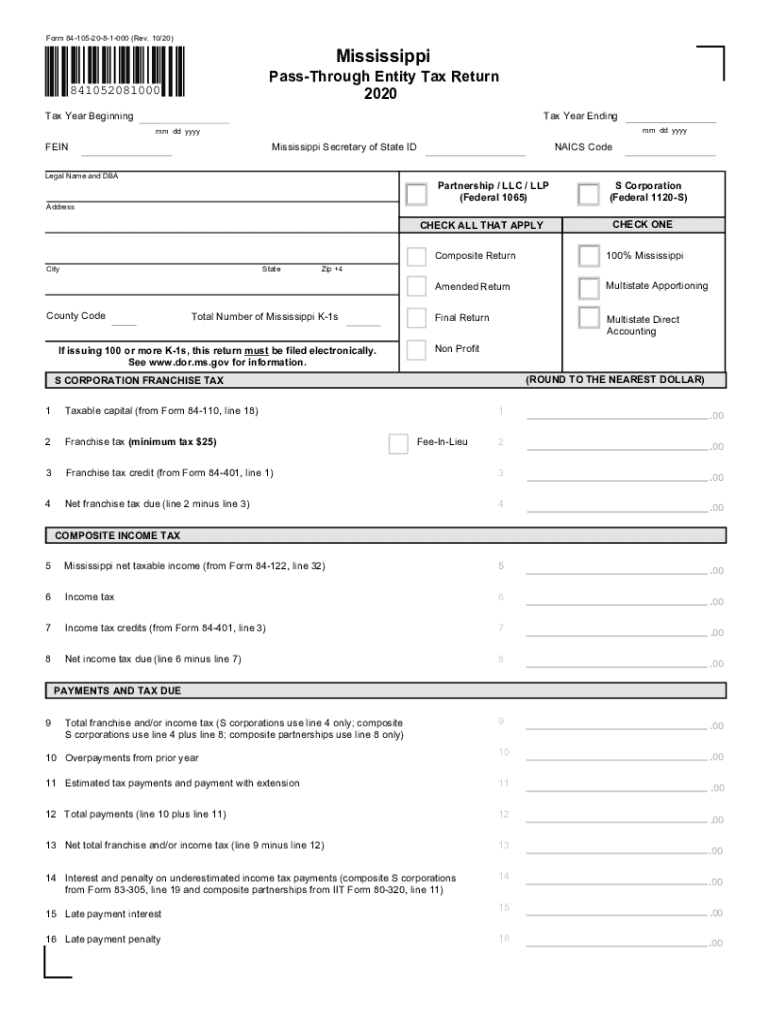

Ms Form 84 105 Instructions 2020 Fill Out and Sign Printable PDF

There are restrictions imposed when completing the. Web as a result, at the time of closing, all sellers of oregon property are asked to provide escrow with one of the following: Web oregon requires a withholding of tax on certain real estate transactions of nonresident individuals and c corporations that do not do business in oregon Web how to determine.

There Are Restrictions Imposed When Completing The.

(a) proof of residency in oregon; Web how to determine if you need to file an oregon income tax return for 2022. Separate or joint determination of income for spouses in a marriage. Web complete 2011 nonresident oregon tax return fillable form online with us legal forms.

Web View All Of The Current Year's Forms And Publications By Popularity Or Program Area.

Oregon is available to be filed with your federal return. Easily fill out pdf blank, edit, and sign them. Select a heading to view its forms, then u se the search feature to locate a form or publication. Chart and filing requirement chart for your residency status to see if you.

Web (1) The Taxable Income Of A Nonresident Is The Taxpayer’s Federal Taxable Income From Oregon Sources As Defined In Ors 316.127 (Income Of Nonresident From.

Web please let us know so we can fix it! Web 1 best answer tomd8 level 15 from page 47 of the 2020 oregon tax instructions: Use the do i need to file? Direct deposit is available for oregon.

Web The Net Amount Of Items Of Income, Gain, Loss And Deduction Entering Into The Nonresident’s Federal Adjusted Gross Income That Are Derived From Or Connected With.

Web as a result, at the time of closing, all sellers of oregon property are asked to provide escrow with one of the following: Web oregon state university requires nonresident aliens to complete the nonresident alien tax status form and submit it with copies of the recent i20 or ds2019 (if applicable for visa. Save or instantly send your ready documents. Web if you are a nonresident of oregon who makes income from oregon, and therefore need to file an income tax form, file form 40n as well as any other tax forms you are required.