Oregon W-2 Form

Oregon W-2 Form - Oregon state university aabc sec, suite 350 2251 sw jefferson way corvallis or 97331 phone: From there, you will follow the steps listed here on irs.gov. Ad upload, modify or create forms. W2s are required to be in the mail to employees by january 31st. Try it for free now! The name of your employee needs to be corrected o should be a hyphenated name o incorrect spelling of name This is the way what, who, when, where & why what: Add and customize text, images, and fillable areas, whiteout unneeded details, highlight the significant. 01) employer name employee signature (this form isn’t valid unless signed.) social security number (ssn) Web oregon w2 form is a required document for all businesses who employ workers in the state.

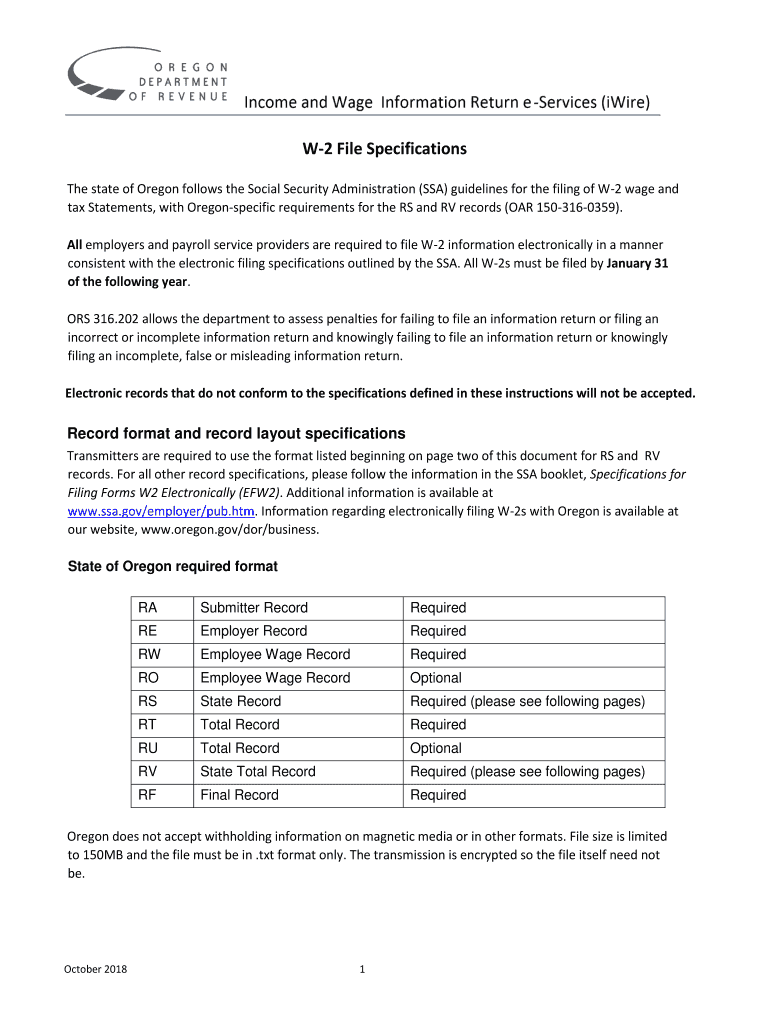

The w2 is a summary of taxable wages paid, taxes withheld, and certain benefits provided during a calendar year. (a) total state and local wages; (b) state and local tax withheld during the calendar year; Ad upload, modify or create forms. Any osu employeepaid through payroll during the calendar year. Try it for free now! Oregon state university aabc sec, suite 350 2251 sw jefferson way corvallis or 97331 phone: Select the employer or institution. 01) employer name employee signature (this form isn’t valid unless signed.) social security number (ssn) Find information quickly using the search, sort and filter functions.

This form serves as an important piece in filing employee's income tax returns reliably. Web click on new document and choose the form importing option: (b) state and local tax withheld during the calendar year; And (c) the oregon business identification number of the employer. Add and customize text, images, and fillable areas, whiteout unneeded details, highlight the significant. Find information quickly using the search, sort and filter functions. From there, you will follow the steps listed here on irs.gov. (a) total state and local wages; 01) employer name employee signature (this form isn’t valid unless signed.) social security number (ssn) This is the way what, who, when, where & why what:

Fill Free fillable forms for the state of Oregon

Choose the year of earnings you want to display from the drop down field. Ad upload, modify or create forms. Find information quickly using the search, sort and filter functions. Oregon state university aabc sec, suite 350 2251 sw jefferson way corvallis or 97331 phone: A typed, drawn or uploaded signature.

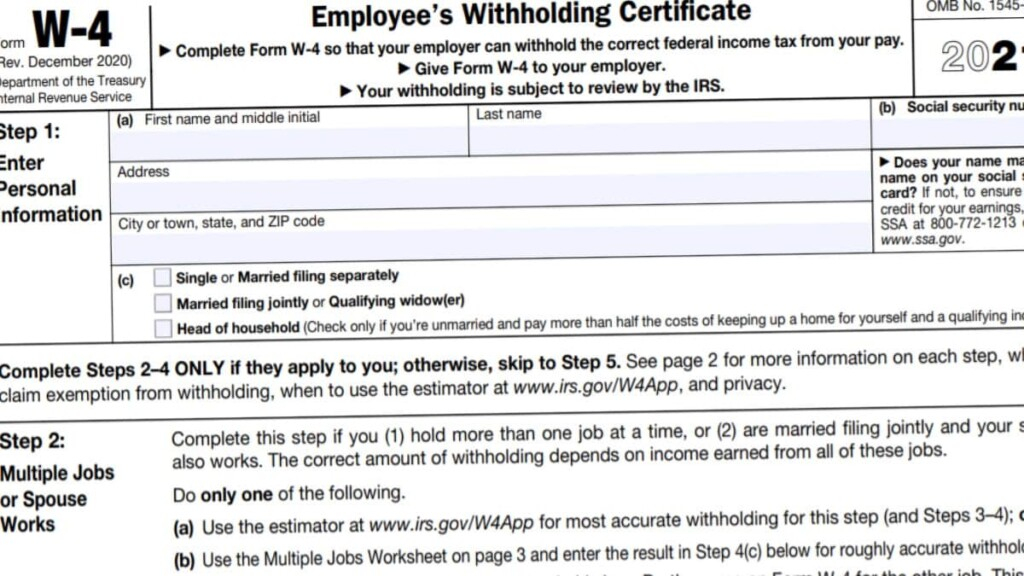

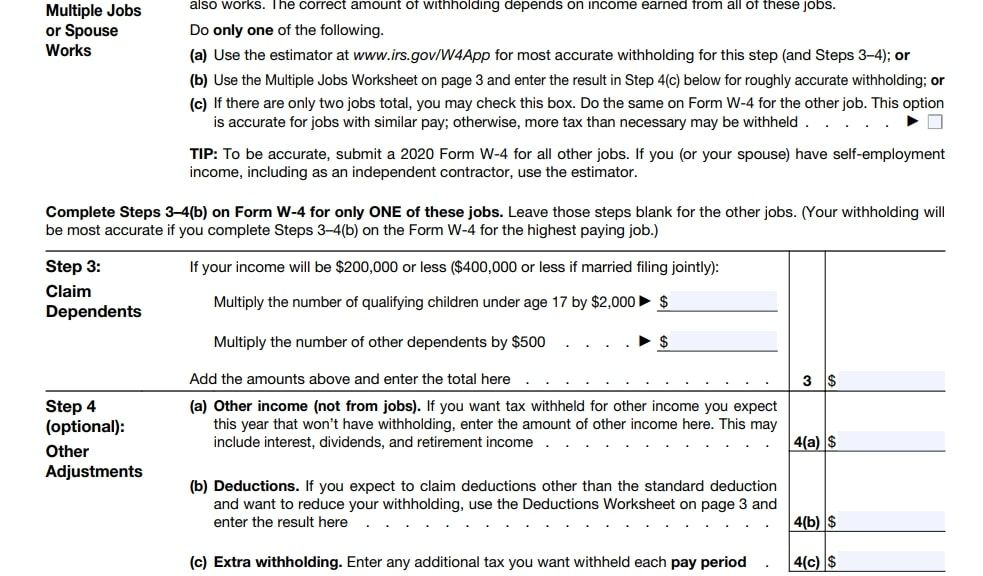

Federal W4 2022 W4 Form 2022 Printable

This form serves as an important piece in filing employee's income tax returns reliably. Web click on new document and choose the form importing option: Businesses must use this form to accurately report the information of their employee's annual wages and taxes withheld from those earnings. A typed, drawn or uploaded signature. The w2 is a summary of taxable wages.

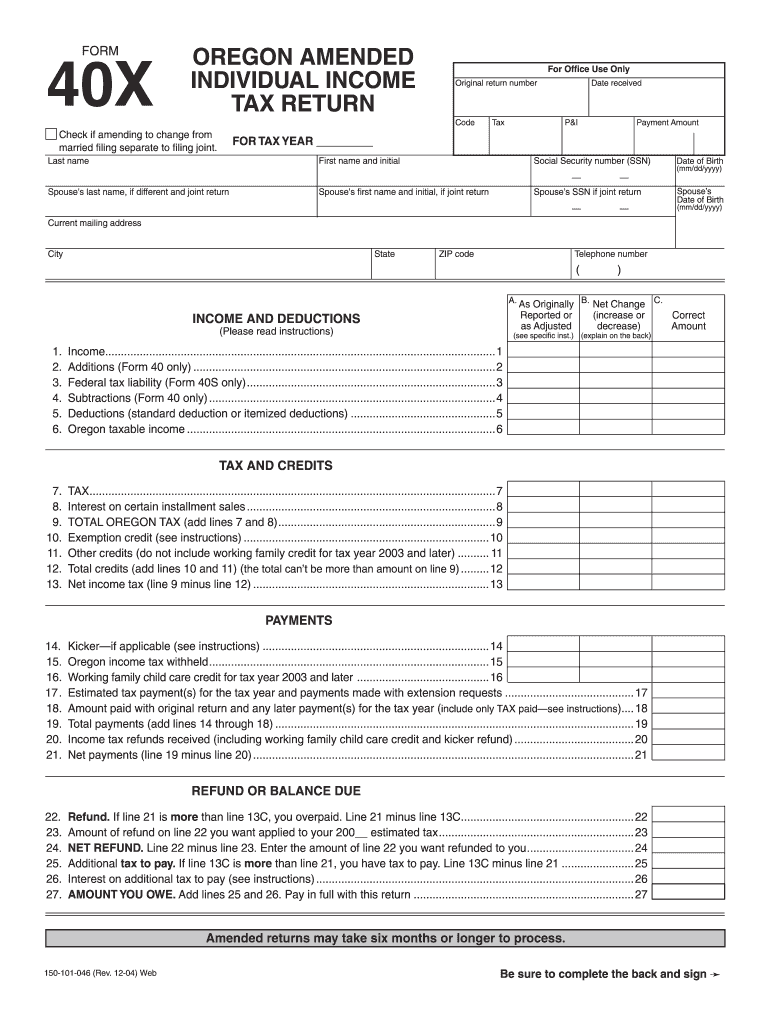

2015 Form OR DoR 41 Fill Online, Printable, Fillable, Blank pdfFiller

(a) total state and local wages; 01) employer name employee signature (this form isn’t valid unless signed.) social security number (ssn) Find information quickly using the search, sort and filter functions. Select the document you want to sign and click upload. (b) state and local tax withheld during the calendar year;

Oregon W2 Form Fill Out and Sign Printable PDF Template signNow

Web oregon w2 form is a required document for all businesses who employ workers in the state. (a) total state and local wages; Businesses must use this form to accurately report the information of their employee's annual wages and taxes withheld from those earnings. 01) employer name employee signature (this form isn’t valid unless signed.) social security number (ssn) Web.

Oregon Form 40X Fill Out and Sign Printable PDF Template signNow

Choose the year of earnings you want to display from the drop down field. Any osu employeepaid through payroll during the calendar year. This form serves as an important piece in filing employee's income tax returns reliably. The name of your employee needs to be corrected o should be a hyphenated name o incorrect spelling of name If you're looking.

Oregon W4 2021 With Instructions 2022 W4 Form

Web oregon w2 form is a required document for all businesses who employ workers in the state. This form serves as an important piece in filing employee's income tax returns reliably. Find information quickly using the search, sort and filter functions. The name of your employee needs to be corrected o should be a hyphenated name o incorrect spelling of.

Corporate Tax Return Form Maryland Free Download

This form serves as an important piece in filing employee's income tax returns reliably. Add and customize text, images, and fillable areas, whiteout unneeded details, highlight the significant. Decide on what kind of signature to create. If you're looking for workday information, visit the workday site. Oregon state university aabc sec, suite 350 2251 sw jefferson way corvallis or 97331.

New Date for When 2016 W2 Forms Come Out in 2017 National Tax Reports

The name of your employee needs to be corrected o should be a hyphenated name o incorrect spelling of name And (c) the oregon business identification number of the employer. Create your signature and click ok. From there, you will follow the steps listed here on irs.gov. If you're looking for workday information, visit the workday site.

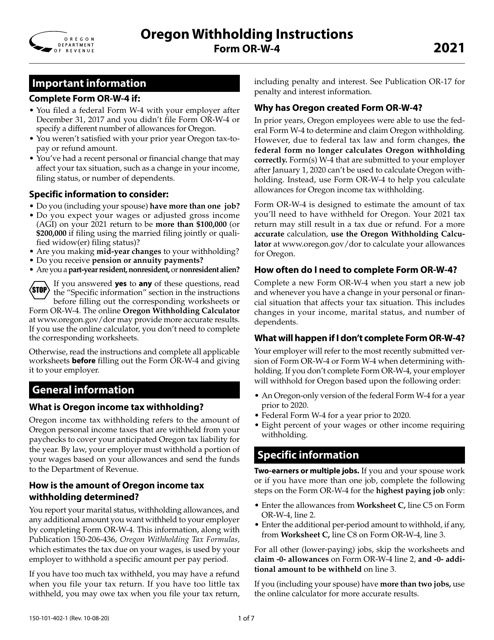

Download Instructions for Form ORW4, 150101402 Oregon Employee's

Find information quickly using the search, sort and filter functions. Web the oregon department of revenue mandates the filing of w2 forms only if there is a state tax withholding. Select the employer or institution. Any osu employeepaid through payroll during the calendar year. Web oregon w2 form is a required document for all businesses who employ workers in the.

Checking your W2 FireWalker Development Group

If you're looking for workday information, visit the workday site. W2s are required to be in the mail to employees by january 31st. This is the way what, who, when, where & why what: (b) state and local tax withheld during the calendar year; Make adjustments to the template.

Try It For Free Now!

And (c) the oregon business identification number of the employer. Web federal form no longer calculates oregon withholding correctly. From there, you will follow the steps listed here on irs.gov. Businesses must use this form to accurately report the information of their employee's annual wages and taxes withheld from those earnings.

This Form Serves As An Important Piece In Filing Employee's Income Tax Returns Reliably.

Oregon state university aabc sec, suite 350 2251 sw jefferson way corvallis or 97331 phone: If you're looking for workday information, visit the workday site. (a) total state and local wages; (b) state and local tax withheld during the calendar year;

Add And Customize Text, Images, And Fillable Areas, Whiteout Unneeded Details, Highlight The Significant.

Create your signature and click ok. W2s are required to be in the mail to employees by january 31st. Select the employer or institution. 01) employer name employee signature (this form isn’t valid unless signed.) social security number (ssn)

Make Adjustments To The Template.

Select the document you want to sign and click upload. Web the oregon department of revenue mandates the filing of w2 forms only if there is a state tax withholding. Find information quickly using the search, sort and filter functions. The w2 is a summary of taxable wages paid, taxes withheld, and certain benefits provided during a calendar year.