Pan Card Nri Application Form

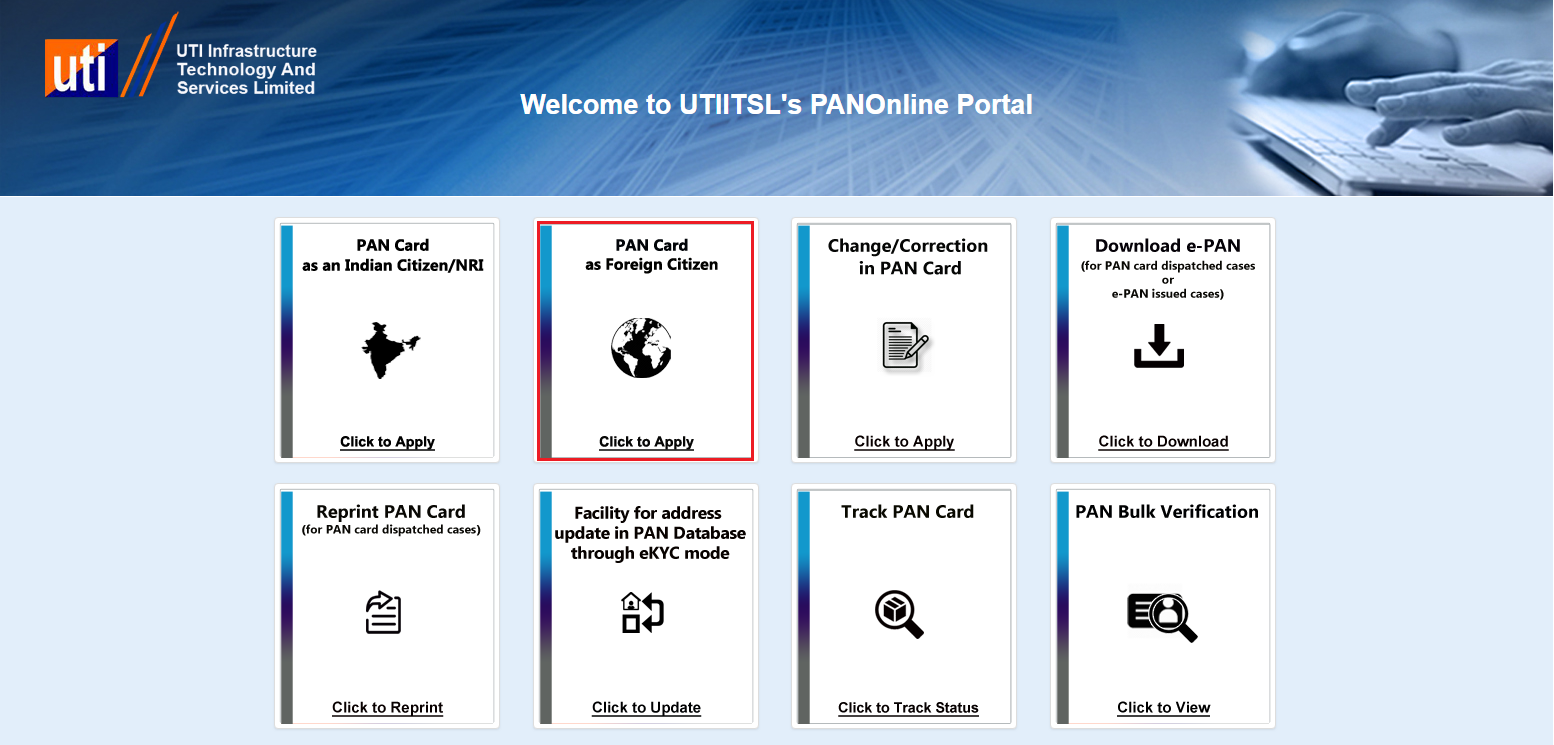

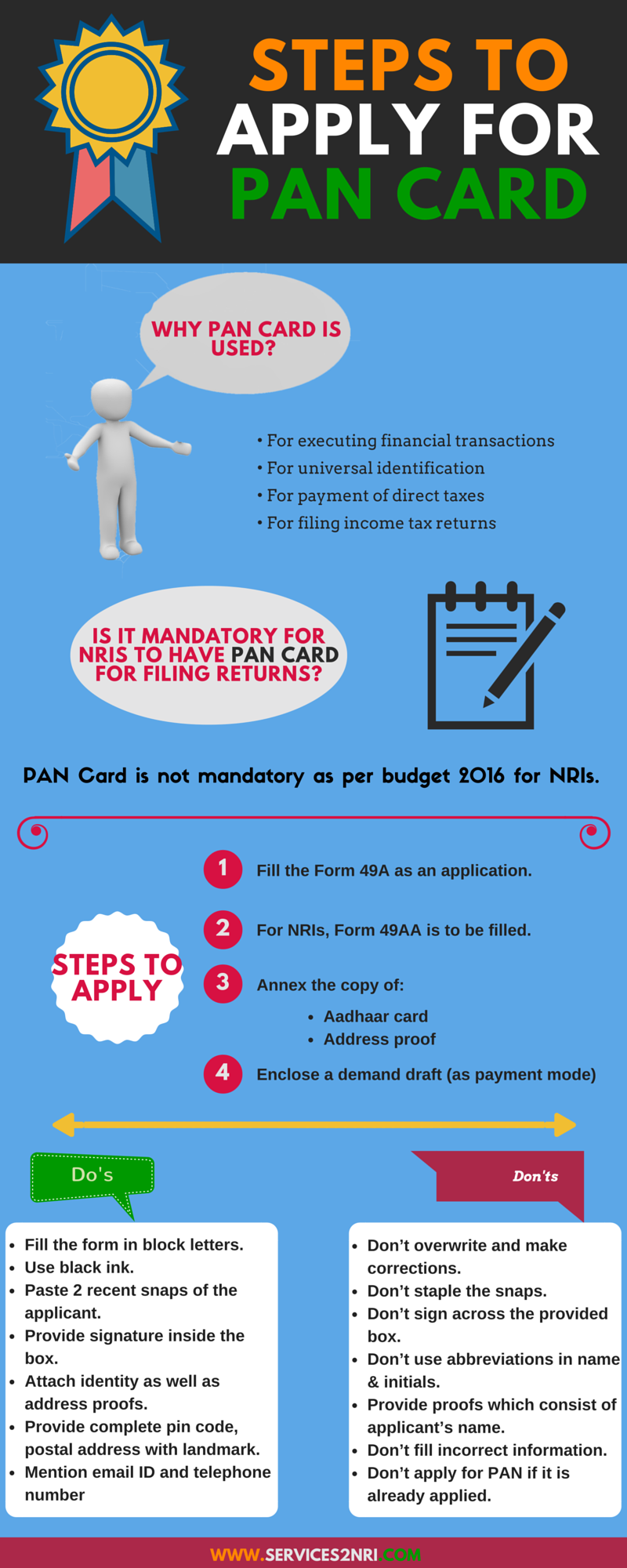

Pan Card Nri Application Form - Web this form should be used when the applicant has never applied for a pan or does not have pan allotted to him. Web with over 150,000 satisfied customers since 2007, our goal at pancardnri.com is to make the application process for a permanent account number as quick and easy as possible. 49aa application for allotment of permanent account number [individuals not being a citizen of india/entities incorporated outside india/. Web pdf fillable form form no. Web explore steps to apply for pan card for nri visit the utiitsl portal visit the utiitsl portal to start the process select “for pan cards > apply pan card“ click on. These are the standard rules for filing for a pan card. Get easy to understand instructions along. The ultimate guide 2022 process of application of. An applicant can visit income tax department (itd) website to find. Web this online pan card application form captures all the pan card details required to apply for a new pan card.

Pay online make an online payment using credit card / debit card / paypal. Web with over 150,000 satisfied customers since 2007, our goal at pancardnri.com is to make the application process for a permanent account number as quick and easy as possible. Ad special service for nri, oci, and pio. Visit the tin ndsl website and select the online pan application tab on the homepage. Web the complete information, forms, guidance and appropriate links for making an application for obtaining a pan from income tax department india are provided below. Select form 49a, which is the form for indian. Web steps to apply for an nri pan card: Web get pan application form relevant to foreign passport holders including us citizens and nris. 49aa application for allotment of permanent account number [individuals not being a citizen of india/entities incorporated outside india/. Web fill an online application form for a new pan card.

Select form 49a, which is the form for indian. These are the standard rules for filing for a pan card. Download 49aa or 49a pan card form. Web this form should be used when the applicant has never applied for a pan or does not have pan allotted to him. Sign & send the docs by post/courier. An applicant can visit income tax department (itd) website to find. Web the complete information, forms, guidance and appropriate links for making an application for obtaining a pan from income tax department india are provided below. Ad special service for nri, oci, and pio. The ultimate guide 2022 process of application of. Web this online pan card application form captures all the pan card details required to apply for a new pan card.

PAN Card for NRIs Application, Documents, Fees, Processing Time Wise

Web this form should be used when the applicant has never applied for a pan or does not have pan allotted to him. An applicant can visit income tax department (itd) website to find. 49aa application for allotment of permanent account number [individuals not being a citizen of india/entities incorporated outside india/. The ultimate guide 2022 process of application of..

PAN Card Application for NRI h20ho Papers

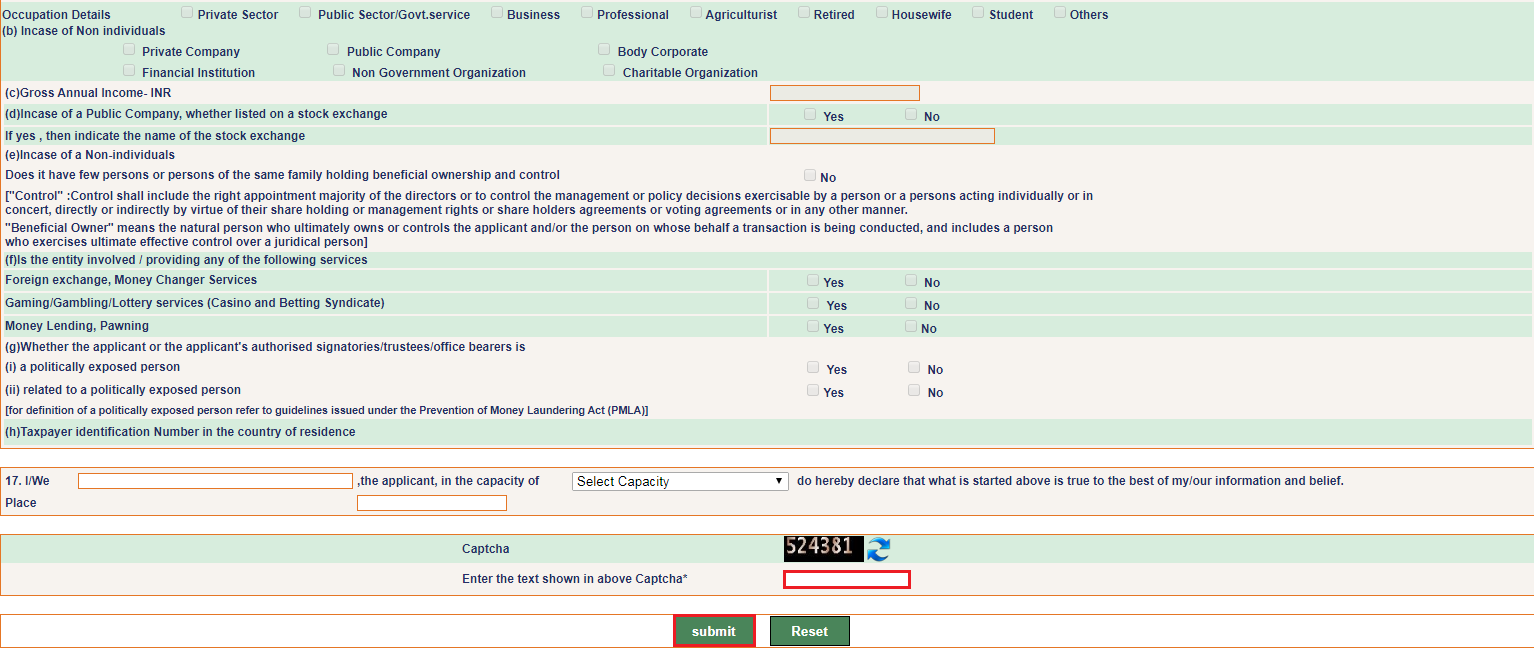

The ultimate guide 2022 process of application of. 93 (excluding goods and services tax ) for indian communication address and rs. These are the standard rules for filing for a pan card. Web filing return investment in the indian market (shares, mutual funds, etc.) identity proof pan card for nri: 864 (excluding goods and services tax) for foreign.

Pan Card Application Form Government Politics Free 30day Trial

Web fill an online application form for a new pan card. Web with over 150,000 satisfied customers since 2007, our goal at pancardnri.com is to make the application process for a permanent account number as quick and easy as possible. Web this online pan card application form captures all the pan card details required to apply for a new pan.

PAN Application (Form 49AA) for NRI on UTIITSL Learn by Quicko

864 (excluding goods and services tax) for foreign. After filling this pan card application form, download, print, sign. Web online application for new pan (form 49aa) do's and don'ts for new pan application: Nri needs to fill in form 49a if they have indian citizenship. Web the application process it’s a simple process to apply for a pan card, even.

PAN Application (Form 49AA) for NRI on UTIITSL Learn by Quicko

Web the charges for applying for pan is rs. The ultimate guide 2022 process of application of. Important instructions and guidelines at a glance An applicant can visit income tax department (itd) website to find. These are the standard rules for filing for a pan card.

Important Details You Should Know About Student PAN Card How To Apply

Web this form should be used when the applicant has never applied for a pan or does not have pan allotted to him. Important instructions and guidelines at a glance Web online application for new pan (form 49aa) do's and don'ts for new pan application: Sign & send the docs by post/courier. Get easy to understand instructions along.

NRI Tax Consultant Services Hyderabad PAN card Application forms

After filling this pan card application form, download, print, sign. Web explore steps to apply for pan card for nri visit the utiitsl portal visit the utiitsl portal to start the process select “for pan cards > apply pan card“ click on. Web filing return investment in the indian market (shares, mutual funds, etc.) identity proof pan card for nri:.

PAN Card for NRI The Ultimate Guide 2023 SBNRI

These are the standard rules for filing for a pan card. Fill the online nri pan card application. 49aa application for allotment of permanent account number [individuals not being a citizen of india/entities incorporated outside india/. The form the pan application,. Web the application process it’s a simple process to apply for a pan card, even for an nri.

NRIs without PAN Will Not Be Charged Higher TDS S2NRI

93 (excluding goods and services tax ) for indian communication address and rs. Important instructions and guidelines at a glance After filling this pan card application form, download, print, sign. Web the charges for applying for pan is rs. Web explore steps to apply for pan card for nri visit the utiitsl portal visit the utiitsl portal to start the.

Services Services For NRI

After filling this pan card application form, download, print, sign. Important instructions and guidelines at a glance 864 (excluding goods and services tax) for foreign. Nris with citizenship of another country have to fill in form. 49aa application for allotment of permanent account number [individuals not being a citizen of india/entities incorporated outside india/.

Ad Special Service For Nri, Oci, And Pio.

Nris with citizenship of another country have to fill in form. After filling this pan card application form, download, print, sign. Select form 49a, which is the form for indian. Web the application process it’s a simple process to apply for a pan card, even for an nri.

Web Online Application For New Pan (Form 49Aa) Do's And Don'ts For New Pan Application:

Web filing return investment in the indian market (shares, mutual funds, etc.) identity proof pan card for nri: Web how to apply for nri pan card online. Web this online pan card application form captures all the pan card details required to apply for a new pan card. The form the pan application,.

Get Easy To Understand Instructions Along.

Web explore steps to apply for pan card for nri visit the utiitsl portal visit the utiitsl portal to start the process select “for pan cards > apply pan card“ click on. Upload documents to validate upload scanned. 49aa application for allotment of permanent account number [individuals not being a citizen of india/entities incorporated outside india/. An applicant can visit income tax department (itd) website to find.

Download 49Aa Or 49A Pan Card Form.

The ultimate guide 2022 process of application of. Web this form should be used when the applicant has never applied for a pan or does not have pan allotted to him. Web fill an online application form for a new pan card. Visit the tin ndsl website and select the online pan application tab on the homepage.