Payflex Dependent Care Form

Payflex Dependent Care Form - Web complete this form and attach an itemized statement from your day care provider or have your provider complete the information below. Web flexible spending account claim form. Like other fsas, the dependent care flexible spending account. Irs regulations allow payment of services. These expenses are for eligible medical care. I certify that i have incurred the dependent care expenses for me and, if married, my spouse to work or attend school. Web dependent care fsas offer financial flexibility for employees, with reimbursement for eligible child and adult care expenses. If so, you can use the card to pay for eligible expenses at qualified merchants. Web the dependent care flexible spending account or fsa allows you to contribute pretax dollars to pay for eligible dependent care expenses. Web the payflex® dependent care fsa want to reduce your taxable income and increase your take home pay?

Want to reduce your taxable income and increase your take home pay? Web flexible spending account claim form. These expenses are for eligible medical care. These expenses are for eligible medical care. Web the payflex® dependent care fsa want to reduce your taxable income and increase your take home pay? I certify that i have incurred the dependent care expenses for me and, if married, my spouse to work or attend school. Web for dependent care flexible spending account: Enroll in a dependent care flexible spending account (fsa) and. Web flexible spending account claim form. Sign in here if the.

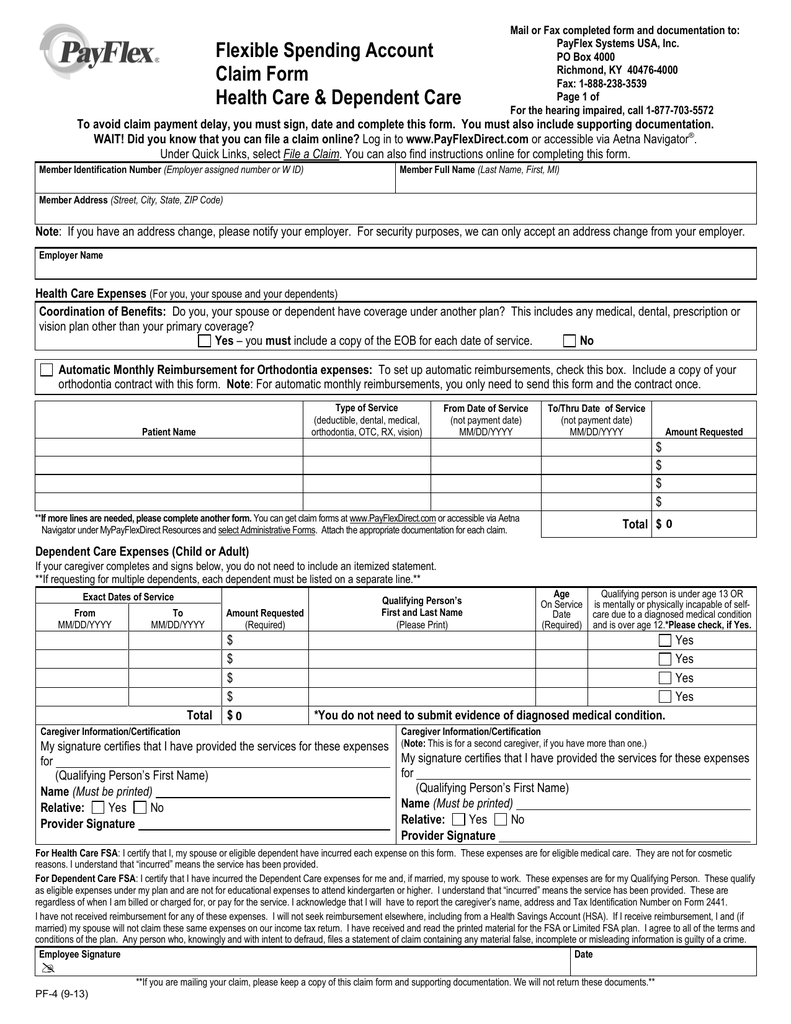

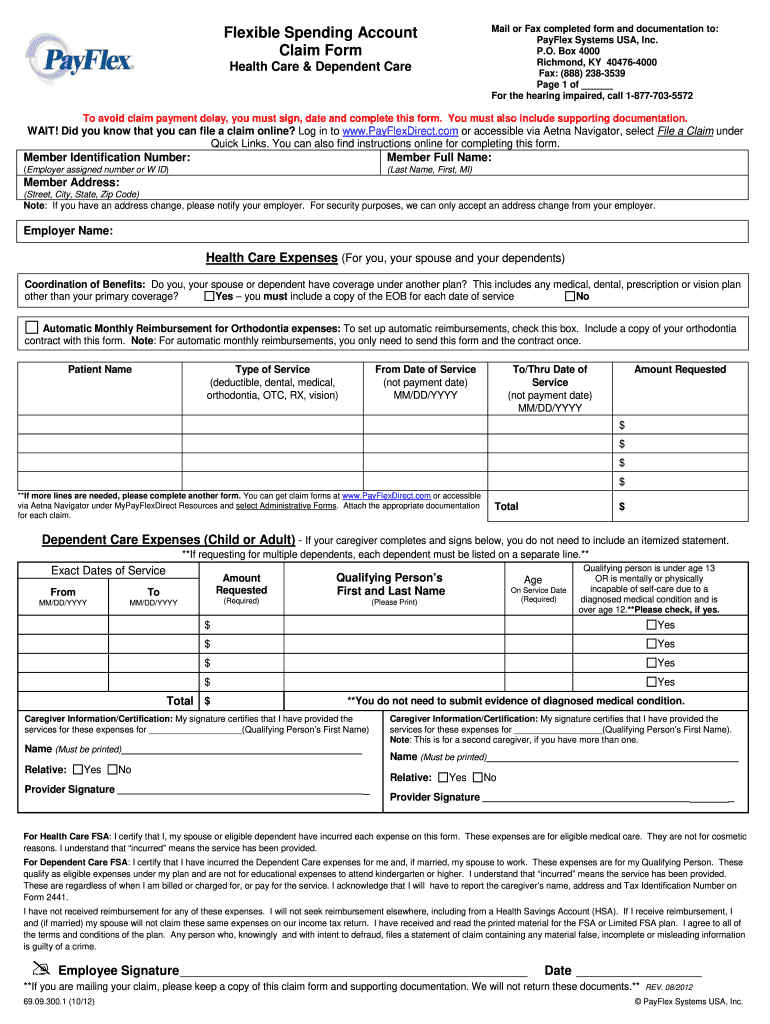

Web 2441 (if you have more than two care providers, see the instructions.) (a) care provider’s name (b) address (number, street, apt. I certify that i, my spouse or eligible dependent have incurred each expense on this form. Web the payflex® dependent care fsa want to reduce your taxable income and increase your take home pay? Web dependent care flexible spending account (dcfsa) your employer’s plan sets the minimum contribution amount. Web complete this form and attach an itemized statement from your day care provider or have your provider complete the information below. Mail or fax completed form and documentation to: These expenses are for eligible medical care. Health care & dependent care. If so, you can use the card to pay for eligible expenses at qualified merchants. The maximum contribution amount is $5,000, as set by.

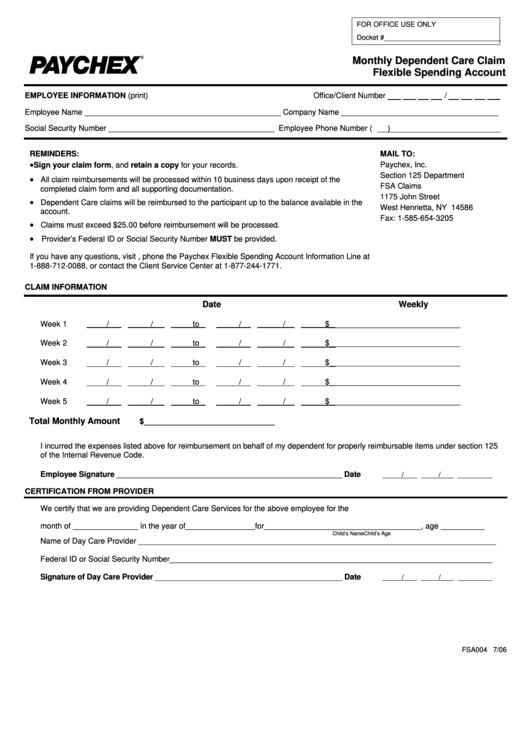

Form Fsa004 Monthly Dependent Care Claim Flexible Spending Account

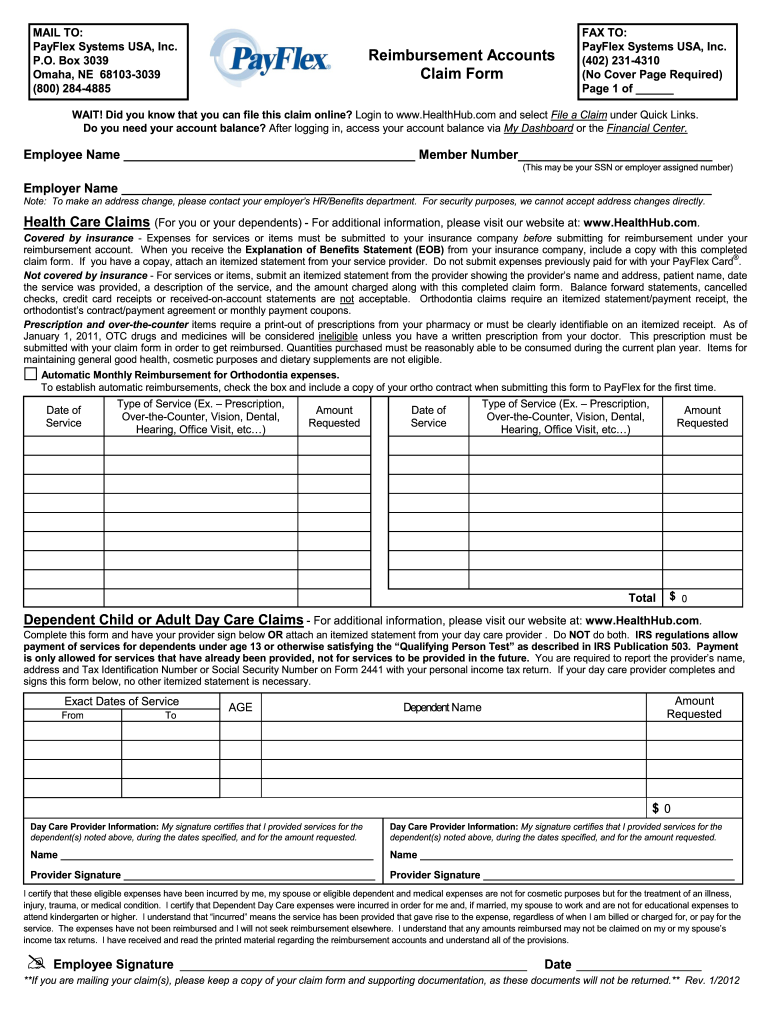

Web employer name health care expenses (for you, your spouse and your eligible dependents) dependent care expenses (child or adult) if your caregiver completes and signs below,. Mail or fax completed form and documentation to: If so, you can use the card to pay for eligible expenses at qualified merchants. These expenses are for eligible medical care. These include preschool,.

Flexible Spending Account Claim Form

These expenses are for eligible medical care. Want to reduce your taxable income and increase your take home pay? Web dependent care fsas offer financial flexibility for employees, with reimbursement for eligible child and adult care expenses. If so, you can use the card to pay for eligible expenses at qualified merchants. Web employer name health care expenses (for you,.

Health Care Flexible Spending Account (FSA) with Carryover Basics YouTube

Web flexible spending account claim form. Want to reduce your taxable income and increase your take home pay? Expenses can be for you, your spouse or any of your dependents, even if they are on a different insurance plan. Web employer name health care expenses (for you, your spouse and your eligible dependents) dependent care expenses (child or adult) if.

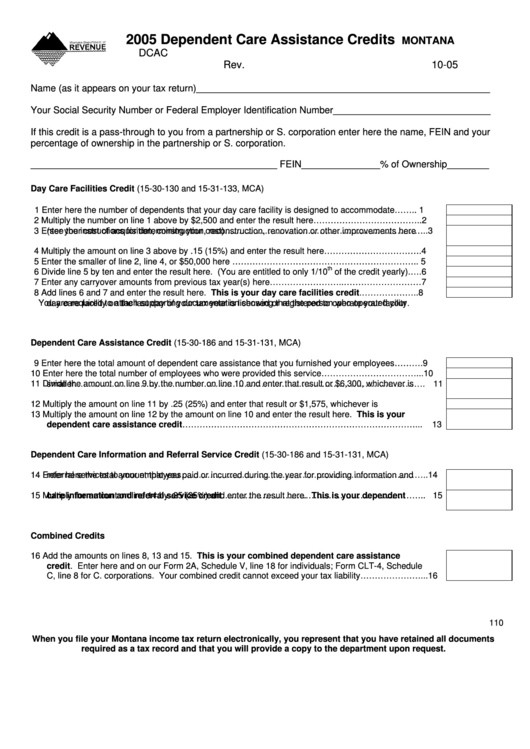

Fillable Form Dcac Dependent Care Assistance Credits 2005 printable

Web the dependent care flexible spending account or fsa allows you to contribute pretax dollars to pay for eligible dependent care expenses. These expenses are for eligible medical care. Click the go green link. Web flexible spending account claim form. Sign in here if the.

Payflex Northwestern Fill Out and Sign Printable PDF Template signNow

Health care & dependent care. Sign in here if the back of your payment card says optumfinancial.com or connectyourcare.com. Want to reduce your taxable income and increase your take home pay? Mail or fax completed form and documentation to: Health care fsa for 2023:

Fill Free fillable DependentCareClaimForm DEPENDENT CARE CLAIM

These expenses are for eligible medical care. Expenses can be for you, your spouse or any of your dependents, even if they are on a different insurance plan. Want to reduce your taxable income and increase your take home pay? These expenses are for eligible medical care. I certify that i, my spouse or eligible dependent have incurred each expense.

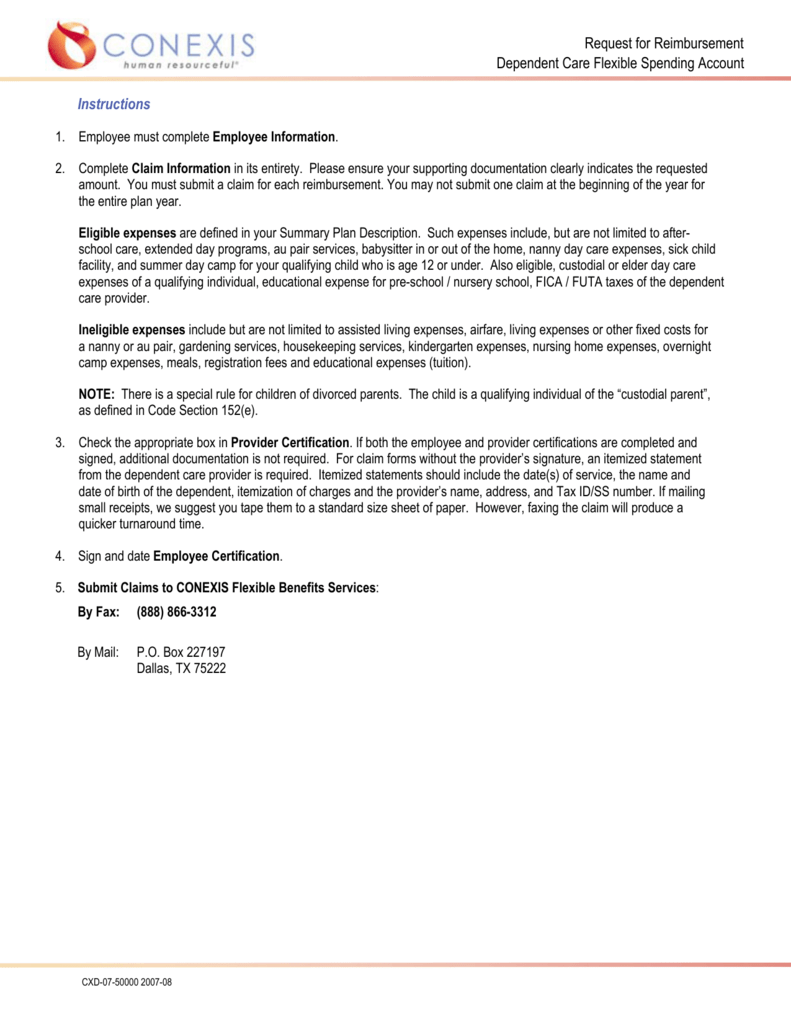

CONEXIS Dependent Care FSA Claim Form

Web for health care flexible spending account: Like other fsas, the dependent care flexible spending account. Health care & dependent care. Web i certify that i, my spouse or eligible dependent have incurred each expense on this form. Expenses can be for you, your spouse or any of your dependents, even if they are on a different insurance plan.

Payflex Forms 2020 Fill Online, Printable, Fillable, Blank pdfFiller

Health care fsa for 2023: Enroll in a dependent care flexible spending account (fsa) and. Web the dependent care flexible spending account or fsa allows you to contribute pretax dollars to pay for eligible dependent care expenses. They are not for cosmetic reasons. Web flexible spending account claim form.

Plans

Want to reduce your taxable income and increase your take home pay? Web your employer may offer the payflex card ® with your health care fsa. Web dependent care fsas offer financial flexibility for employees, with reimbursement for eligible child and adult care expenses. Health care fsa for 2023: Web the payflex® dependent care fsa.

Dependent Care FSAs for Individuals Pretax Account for Eligible Child

Web 21% clear calculate potential tax savings4 † for best estimate, enter an amount less than or equal to the pretax contribution limit: Want to reduce your taxable income and increase your take home pay? These expenses are for eligible medical care. Web flexible spending account claim form. Web the dependent care flexible spending account or fsa allows you to.

Click The Go Green Link.

The maximum contribution amount is $5,000, as set by. These expenses are for eligible medical care. Sign in here if the. I certify that i, my spouse or eligible dependent have incurred each expense on this form.

Web Dependent Care Flexible Spending Account (Dcfsa) Your Employer’s Plan Sets The Minimum Contribution Amount.

Health care & dependent care. Web i certify that i, my spouse or eligible dependent have incurred each expense on this form. Mail or fax completed form and documentation to: Web the dependent care flexible spending account or fsa allows you to contribute pretax dollars to pay for eligible dependent care expenses.

Want To Reduce Your Taxable Income And Increase Your Take Home Pay?

I certify that i have incurred the dependent care expenses for me and, if married, my spouse to work or attend school. Health care & dependent care. They are not for cosmetic reasons. Expenses can be for you, your spouse or any of your dependents, even if they are on a different insurance plan.

Enroll In A Dependent Care Flexible Spending Account (Fsa) And.

Irs regulations allow payment of services. Like other fsas, the dependent care flexible spending account. Health care fsa for 2023: Web 21% clear calculate potential tax savings4 † for best estimate, enter an amount less than or equal to the pretax contribution limit: