Payroll Correction Form

Payroll Correction Form - Web taxpayers use a form 940 for correcting a previously filed return by checking the amended return box in the top right corner of the form 940. If you have any questions or need assistance completing the above mentioned forms, please email our payroll staff at payroll@palmspringsca.gov. Payroll correction, or payroll change forms are submitted in the event that any form of error in a payroll has been noticed. Employers should use the corresponding x forms listed below to correct employment. Get everything done in minutes. This is most commonly used in the event that an employee has spotted an irregularity concerning his or her salary. Web what is a payroll correction form? Web a payroll correction form includes the following details: Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Latest revision september 22, 2022 page | 1.

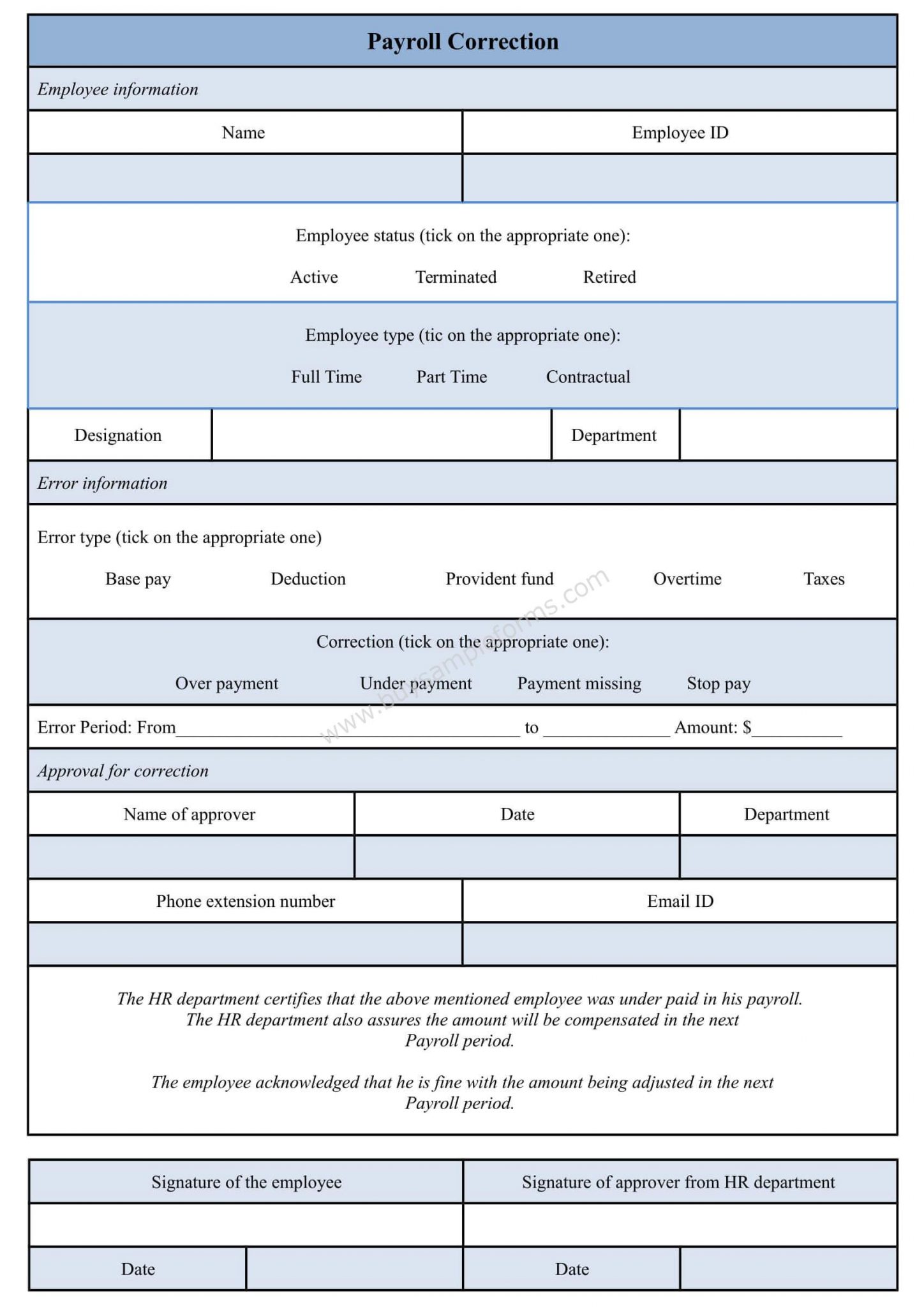

Employers should use the corresponding x forms listed below to correct employment. Web payroll correction payment request form. Name and other details of the employee who has been issued the payroll mention the department in which the employee works the details of correction that employee wants to be done in the payroll the amount of pay that needs to be changed the. Web 2023 edd form de4. Get everything done in minutes. Payroll customer service can be reached at: Web a payroll correction form includes the following details: Web taxpayers use a form 940 for correcting a previously filed return by checking the amended return box in the top right corner of the form 940. This is most commonly used in the event that an employee has spotted an irregularity concerning his or her salary. For the exceptions, the kronos correction form may be used to submit time directly to payroll.

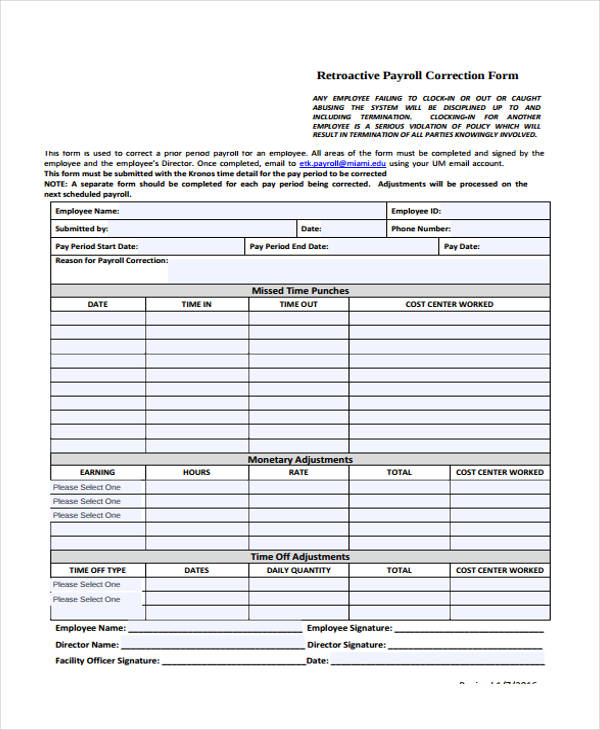

For the exceptions, the kronos correction form may be used to submit time directly to payroll. This is most commonly used in the event that an employee has spotted an irregularity concerning his or her salary. Payroll correction, or payroll change forms are submitted in the event that any form of error in a payroll has been noticed. Employers should use the corresponding x forms listed below to correct employment. Web taxpayers use a form 940 for correcting a previously filed return by checking the amended return box in the top right corner of the form 940. Icma change form (2023) (mission square) nationwide contribution form. Web payroll correction form template. Web timekeeping approvals corrections paying employees user accounts corrections kronos is the university's official timekeeping system. Web payroll discrepancy correction form *submit form to payroll specialist* *employee will be reimbursed on the following payroll paycheck* employee information name:phone number: If you have any questions or need assistance completing the above mentioned forms, please email our payroll staff at payroll@palmspringsca.gov.

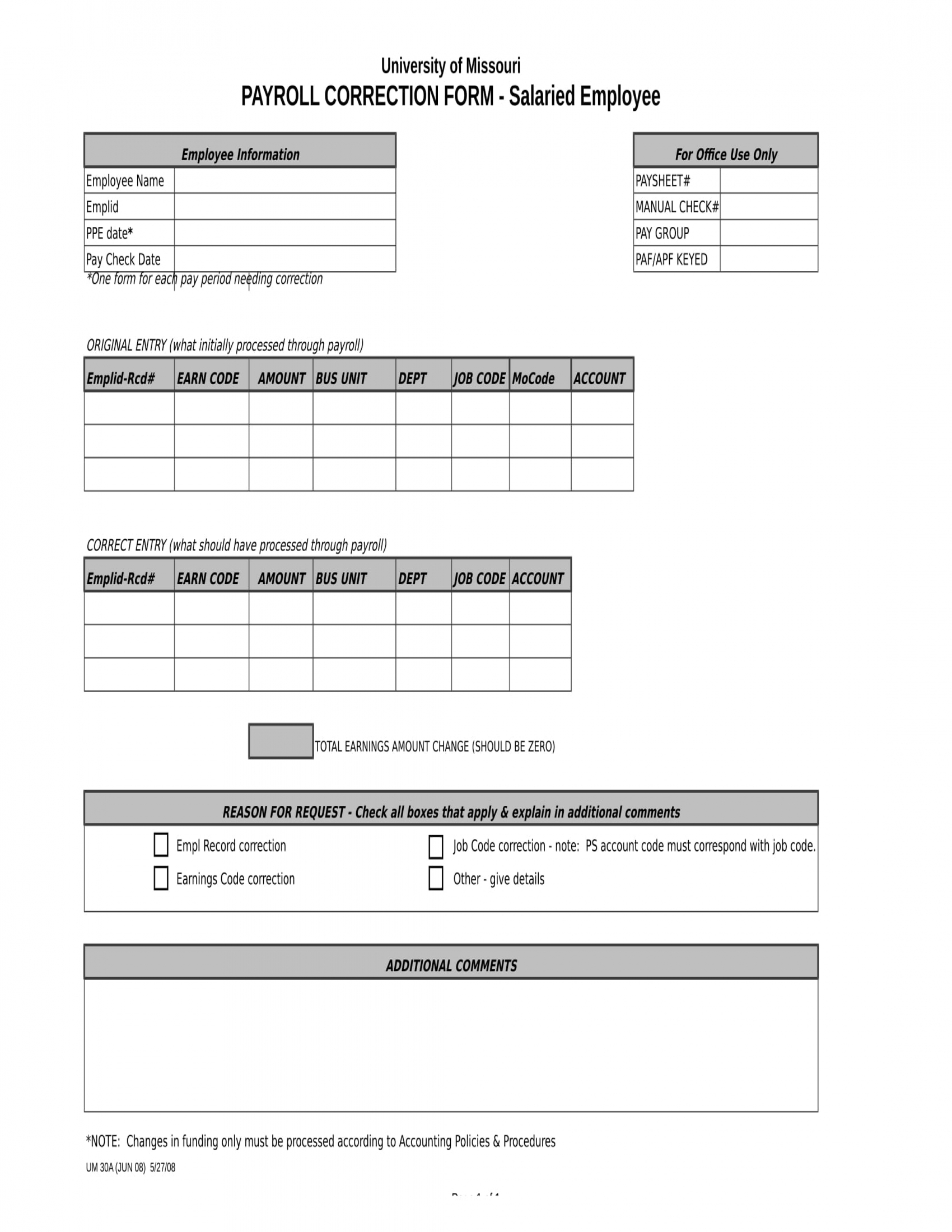

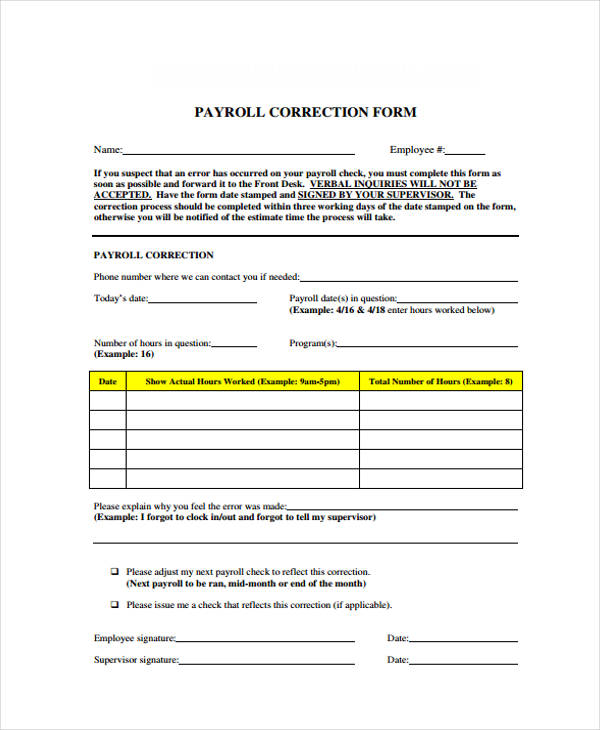

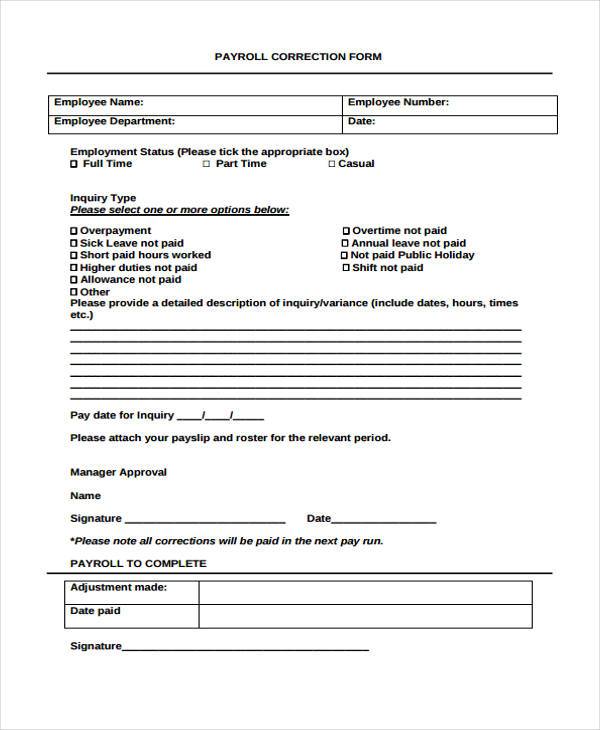

Payroll Correction Form Template, Sample Payroll Correction Form

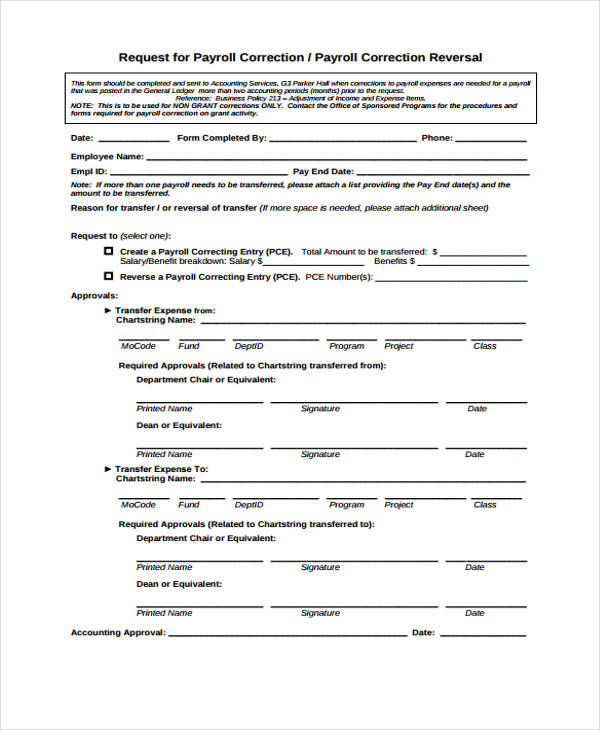

Web 2023 edd form de4. For the exceptions, the kronos correction form may be used to submit time directly to payroll. Web a payroll correction form includes the following details: This is most commonly used in the event that an employee has spotted an irregularity concerning his or her salary. Web taxpayers use a form 940 for correcting a previously.

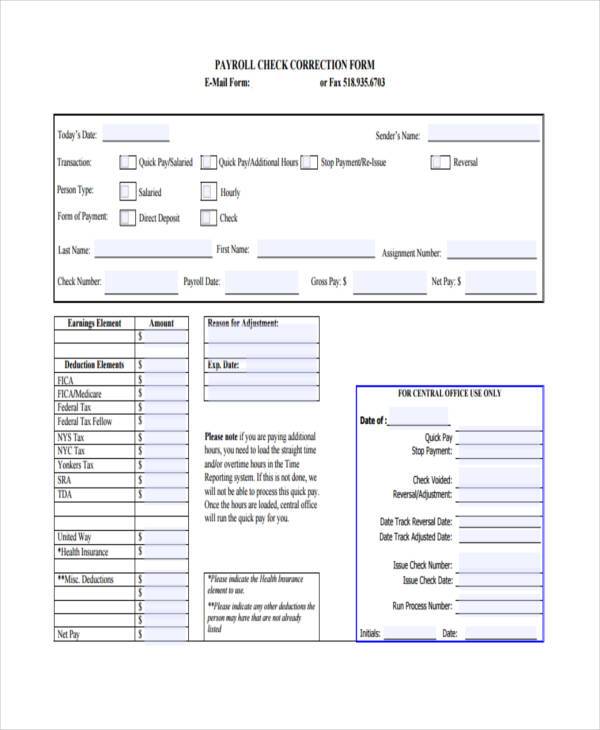

Download Request For Payroll Correction Check for Free FormTemplate

Web a payroll correction form includes the following details: Web 2023 edd form de4. Web taxpayers use a form 940 for correcting a previously filed return by checking the amended return box in the top right corner of the form 940. This is most commonly used in the event that an employee has spotted an irregularity concerning his or her.

FA1 correction SVT Free

Web taxpayers use a form 940 for correcting a previously filed return by checking the amended return box in the top right corner of the form 940. Web payroll correction payment request form. Web payroll discrepancy correction form *submit form to payroll specialist* *employee will be reimbursed on the following payroll paycheck* employee information name:phone number: Payroll correction, or payroll.

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

For the exceptions, the kronos correction form may be used to submit time directly to payroll. Web timekeeping approvals corrections paying employees user accounts corrections kronos is the university's official timekeeping system. Web payroll correction form template. Payroll customer service can be reached at: Get everything done in minutes.

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

Web payroll correction form template. Web taxpayers use a form 940 for correcting a previously filed return by checking the amended return box in the top right corner of the form 940. Web a payroll correction form includes the following details: For the exceptions, the kronos correction form may be used to submit time directly to payroll. Web what is.

Payroll Correction Review Form G4SDRMC Security Training Fill and

Payroll customer service can be reached at: Web timekeeping approvals corrections paying employees user accounts corrections kronos is the university's official timekeeping system. Latest revision september 22, 2022 page | 1. Web what is a payroll correction form? Hours should be entered using kronos whenever possible.

FREE 14+ Employee Correction Forms in PDF

Icma change form (2023) (mission square) nationwide contribution form. Web 2023 edd form de4. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. If you have any questions or need assistance completing the above mentioned forms, please email our payroll staff at payroll@palmspringsca.gov. Name and other details of the employee.

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

Web payroll correction form template. Web payroll discrepancy correction form *submit form to payroll specialist* *employee will be reimbursed on the following payroll paycheck* employee information name:phone number: Web payroll correction payment request form. Web 2023 edd form de4. If you have any questions or need assistance completing the above mentioned forms, please email our payroll staff at payroll@palmspringsca.gov.

Discrepancy Form Template Master Template

Web what is a payroll correction form? Web payroll correction form template. Hours should be entered using kronos whenever possible. Web payroll discrepancy correction form *submit form to payroll specialist* *employee will be reimbursed on the following payroll paycheck* employee information name:phone number: Latest revision september 22, 2022 page | 1.

OR PCL Payroll Correction Form Fill and Sign Printable Template

Web a payroll correction form includes the following details: Latest revision september 22, 2022 page | 1. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Payroll customer service can be reached at: Web taxpayers use a form 940 for correcting a previously filed return by checking the amended return.

Web 2023 Edd Form De4.

Hours should be entered using kronos whenever possible. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Employers should use the corresponding x forms listed below to correct employment. Web payroll correction payment request form.

If You Have Any Questions Or Need Assistance Completing The Above Mentioned Forms, Please Email Our Payroll Staff At Payroll@Palmspringsca.gov.

Icma change form (2023) (mission square) nationwide contribution form. Name and other details of the employee who has been issued the payroll mention the department in which the employee works the details of correction that employee wants to be done in the payroll the amount of pay that needs to be changed the. Get everything done in minutes. Payroll customer service can be reached at:

Web A Payroll Correction Form Includes The Following Details:

Payroll correction, or payroll change forms are submitted in the event that any form of error in a payroll has been noticed. Web taxpayers use a form 940 for correcting a previously filed return by checking the amended return box in the top right corner of the form 940. This is most commonly used in the event that an employee has spotted an irregularity concerning his or her salary. Web what is a payroll correction form?

Latest Revision September 22, 2022 Page | 1.

Web payroll correction form template. For the exceptions, the kronos correction form may be used to submit time directly to payroll. Web payroll discrepancy correction form *submit form to payroll specialist* *employee will be reimbursed on the following payroll paycheck* employee information name:phone number: Web timekeeping approvals corrections paying employees user accounts corrections kronos is the university's official timekeeping system.