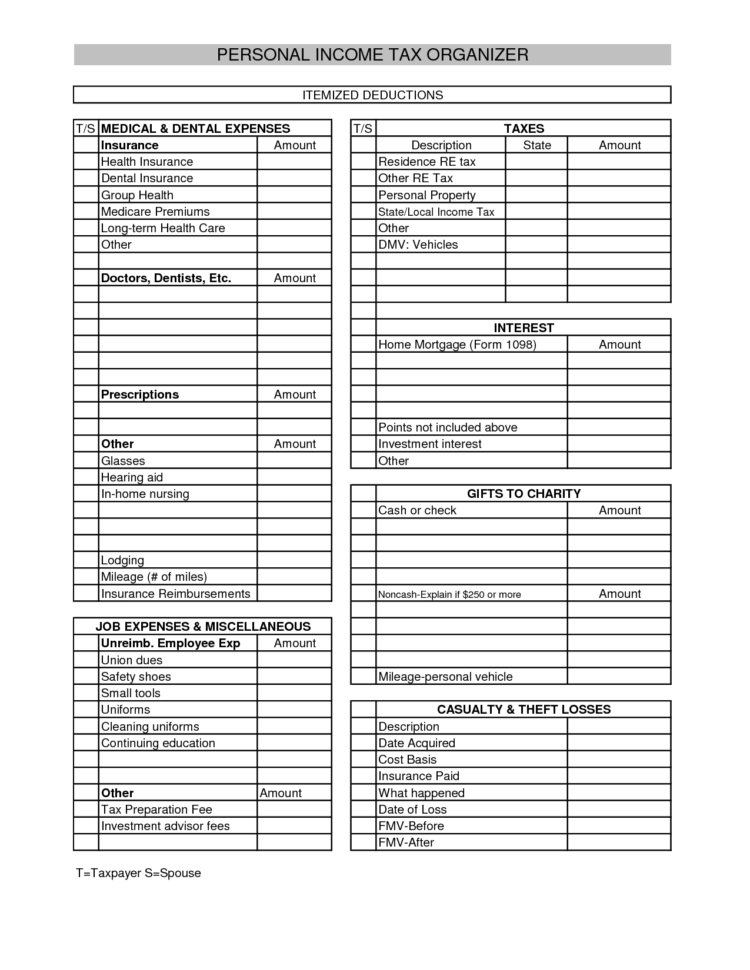

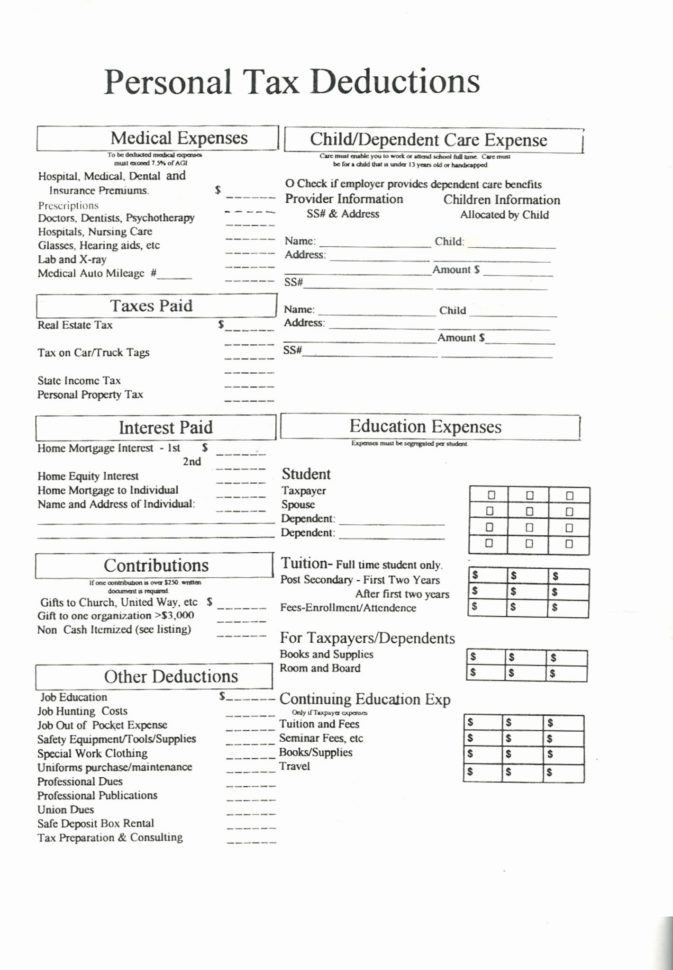

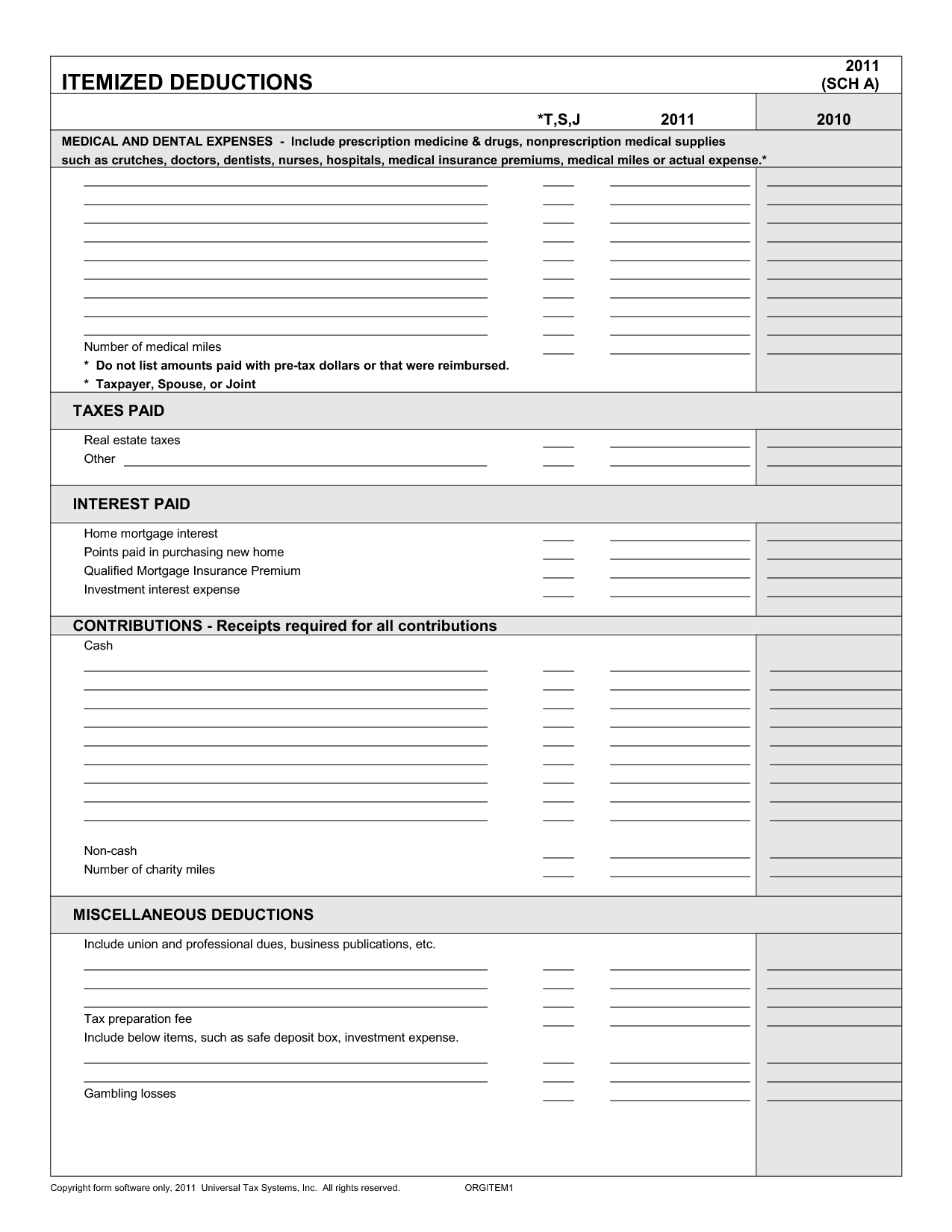

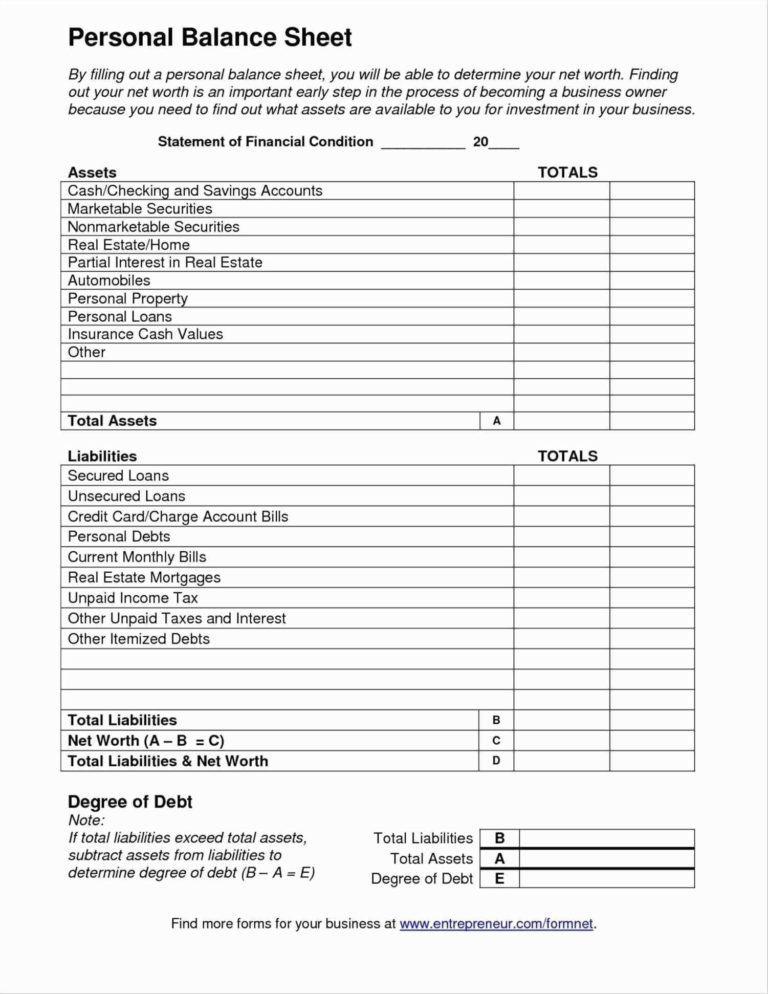

Printable Itemized Deductions Worksheet

Printable Itemized Deductions Worksheet - In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): This is a federal income tax excel template. • determine if a taxpayer should itemize deductions. Web medical and dental expenses. In most cases, your federal income tax will be less if you take the larger of your itemized. • determine the type of expenses that qualify as. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. If you are claiming a net qualified. Web an itemized deduction is exactly what it sounds like:

Web miscellaneous itemized deductions subject to the 2% agi limitation are no longer deductible on the federal return. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your. • determine if a taxpayer should itemize deductions. Web this will be completed by the tax preparer and will need information on the organization (address, name), dates (of donation and purchase), the costs (value of donation, method. • determine the type of expenses that qualify as. Web if you're a freelancer, independent contractor, or small business owner who uses your home for business purposes, the home office tax deduction can be huge. Enter amount from form 1098, box 1 (and box 2, if applicable). Web complete itemized deductions worksheet online with us legal forms. Worksheets are schedule a itemized deductions, deductions form 1040 itemized, itemized dedu.

Web at the end of this lesson, using your resource materials, you will be able to: Web use schedule a (form 1040) to figure your itemized deductions. Save or instantly send your ready documents. Web itemized deductions are specific expenses that taxpayers can subtract from their adjusted gross income to decrease their taxable income, potentially lowering their overall tax bill. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. This is a federal income tax excel template. Web an itemized deduction is exactly what it sounds like: However, these expenses may still be deductible on. Web use schedule a (form 1040) to figure your itemized deductions.

Itemized Deduction Small Business Tax Deductions Worksheet

Web complete itemized deductions worksheet online with us legal forms. You choose between the two based on whether. Go to www.irs.gov/schedulea for instructions and the latest information. Worksheets are schedule a itemized deductions, deductions form 1040 itemized, itemized dedu. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750.

Printable Yearly Itemized Tax Deduction Worksheet Fill and Sign

Web we’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married): Web use schedule a (form 1040) to figure your itemized deductions. Medical and dental expenses are deductible only to the extent they exceed 7.5% of your adjusted gross income for tax year 2020 and. •.

Itemized Deductions Worksheet 2016 —

Web this will be completed by the tax preparer and will need information on the organization (address, name), dates (of donation and purchase), the costs (value of donation, method. Easily fill out pdf blank, edit, and sign them. If you are claiming a net qualified. Mortgage interest you pay on. Download this itemized deduction calculator in microsoft excel and spreadsheet.

Printable Itemized Deductions Worksheet

Worksheets are schedule a itemized deductions, deductions form 1040 itemized, itemized dedu. Download this itemized deduction calculator in microsoft excel and spreadsheet. • determine if a taxpayer should itemize deductions. Web an itemized deduction is exactly what it sounds like: This is a federal income tax excel template.

Printable Itemized Deductions Worksheet

Download this itemized deduction calculator in microsoft excel and spreadsheet. Web complete itemized deductions worksheet online with us legal forms. Enter amount from form 1098, box 1 (and box 2, if applicable). Web if you're a freelancer, independent contractor, or small business owner who uses your home for business purposes, the home office tax deduction can be huge. Web itemized.

List Of Itemized Deductions Worksheet

Web if you're a freelancer, independent contractor, or small business owner who uses your home for business purposes, the home office tax deduction can be huge. Web complete itemized deductions worksheet online with us legal forms. Web we’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if.

Itemized Deductions Worksheet 2017 Printable Worksheets and

Web this will be completed by the tax preparer and will need information on the organization (address, name), dates (of donation and purchase), the costs (value of donation, method. You choose between the two based on whether. Save or instantly send your ready documents. Worksheets are schedule a itemized deductions, deductions form 1040 itemized, itemized dedu. Web use schedule a.

Printable Itemized Deductions Worksheet

Web medical and dental expenses. Web an itemized deduction is exactly what it sounds like: In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your. Web use schedule a (form 1040) to figure your itemized deductions. Medical and dental expenses are deductible only to the extent they exceed 7.5%.

Deductions Worksheet Fill Online, Printable, Fillable, Blank pdfFiller

Download this itemized deduction calculator in microsoft excel and spreadsheet. • determine the type of expenses that qualify as. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add.

List Of Itemized Deductions Worksheet

In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your. Web we’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married): Download this itemized deduction calculator in microsoft excel and spreadsheet. Web complete itemized deductions.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Go to www.irs.gov/schedulea for instructions and the latest information. This is a federal income tax excel template. • determine the type of expenses that qualify as. Save or instantly send your ready documents.

Worksheets Are Schedule A Itemized Deductions, Deductions Form 1040 Itemized, Itemized Dedu.

In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your. • determine if a taxpayer should itemize deductions. Enter amount from form 1098, box 1 (and box 2, if applicable). Web if you're a freelancer, independent contractor, or small business owner who uses your home for business purposes, the home office tax deduction can be huge.

Web Use Schedule A (Form 1040) To Figure Your Itemized Deductions.

Download this itemized deduction calculator in microsoft excel and spreadsheet. Medical and dental expenses are deductible only to the extent they exceed 7.5% of your adjusted gross income for tax year 2020 and. However, these expenses may still be deductible on. If you are claiming a net qualified.

Web This Will Be Completed By The Tax Preparer And Will Need Information On The Organization (Address, Name), Dates (Of Donation And Purchase), The Costs (Value Of Donation, Method.

Web miscellaneous itemized deductions subject to the 2% agi limitation are no longer deductible on the federal return. An itemized list of the deductions that qualify for tax breaks. Web complete itemized deductions worksheet online with us legal forms. In most cases, your federal income tax will be less if you take the larger of your itemized.