Printable Oklahoma Tax Form 511

Printable Oklahoma Tax Form 511 - Oklahoma resident income tax return • form 511: Oklahoma state income tax form 511 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Web we last updated the individual resident income tax return in january 2023, so this is the latest version of form 511, fully updated for tax year 2022. More about the oklahoma form 511 tax return we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. • generally, your return must be postmarked by april 15, 2020. You can print other oklahoma tax forms here. Web free printable 2022 oklahoma form 511 and 2022 oklahoma form 511 instructions booklet in pdf format to print, fill in, and mail your state income tax return due april 18, 2023. Sales tax relief credit • instructions for the direct deposit option • 2019 income tax tables filing date: The due date for an electronic payment is april 20th. Web 2022 oklahoma resident individual income tax forms and instructions this packet contains:

You can print other oklahoma tax forms here. Web we last updated the individual resident income tax return in january 2023, so this is the latest version of form 511, fully updated for tax year 2022. More about the oklahoma form 511 tax return we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Form 511 can be efiled, or a paper copy can be filed via mail. Sales tax relief credit • instructions for the direct deposit option • 2019 income tax tables filing date: For more information about the oklahoma income tax, see the oklahoma income tax page. Form 511 is the general income tax return for oklahoma residents. Web printable oklahoma income tax form 511. Oklahoma resident income tax return • form 511: Oklahoma state income tax form 511 must be postmarked by april 18, 2023 in order to avoid penalties and late fees.

The due date for an electronic payment is april 20th. • instructions for completing the form 511: Sales tax relief credit form • instructions for the direct deposit option • 2021 income tax tables filing date: Form 511 can be efiled, or a paper copy can be filed via mail. • instructions for completing the form 511: Web we last updated the individual resident income tax return in january 2023, so this is the latest version of form 511, fully updated for tax year 2022. Oklahoma resident income tax return • form 511: Web printable oklahoma income tax form 511. You can print other oklahoma tax forms here. Web 2022 oklahoma resident individual income tax forms and instructions this packet contains:

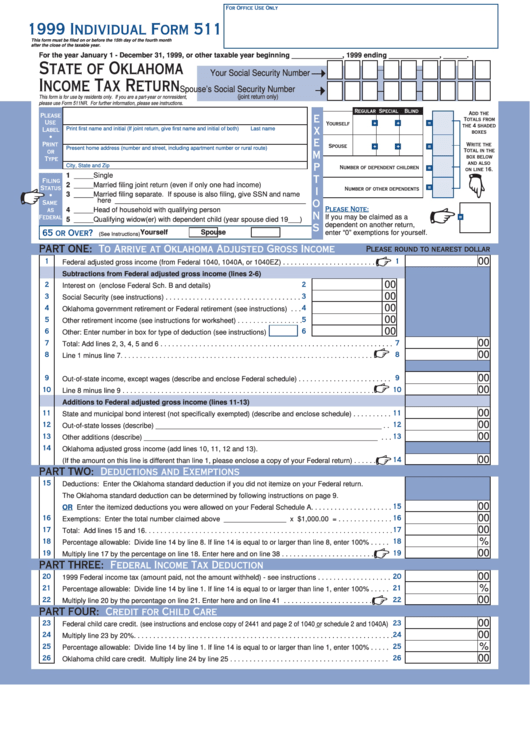

Form 511 State Of Oklahoma Tax Return 1999 printable pdf

• generally, your return must be postmarked by april 15, 2020. Web 2022 oklahoma resident individual income tax forms and instructions this packet contains: Oklahoma resident income tax return • form 511: Web free printable 2022 oklahoma form 511 and 2022 oklahoma form 511 instructions booklet in pdf format to print, fill in, and mail your state income tax return.

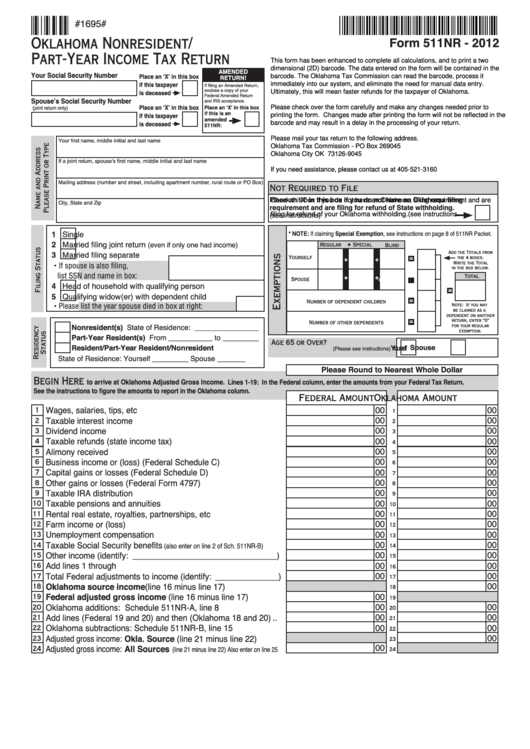

Fillable Form 511nr Oklahoma NonResident/partYear Tax Return

Web printable oklahoma income tax form 511. Form 511 can be efiled, or a paper copy can be filed via mail. The due date for an electronic payment is april 20th. Sales tax relief credit • instructions for the direct deposit option • 2019 income tax tables filing date: Web we last updated the individual resident income tax return in.

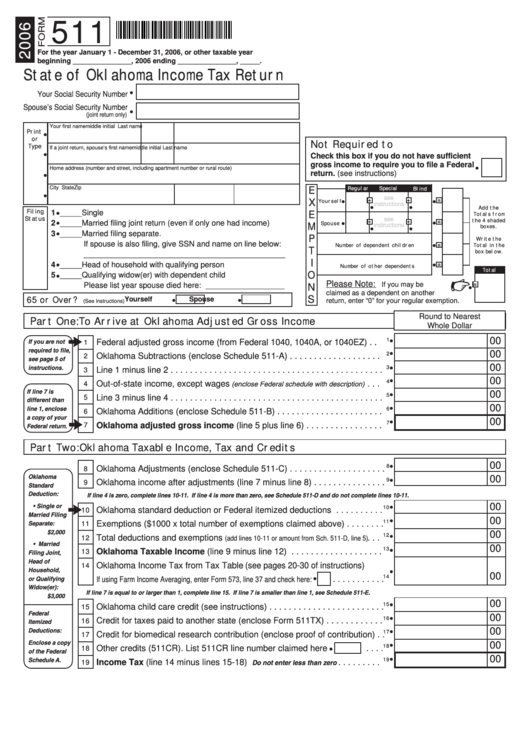

Form 511 State Of Oklahoma Tax Return 2006 printable pdf

Sales tax relief credit form • instructions for the direct deposit option • 2021 income tax tables filing date: More about the oklahoma form 511 tax return we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. • instructions for completing the form 511: This form is for income earned in tax year 2022, with tax.

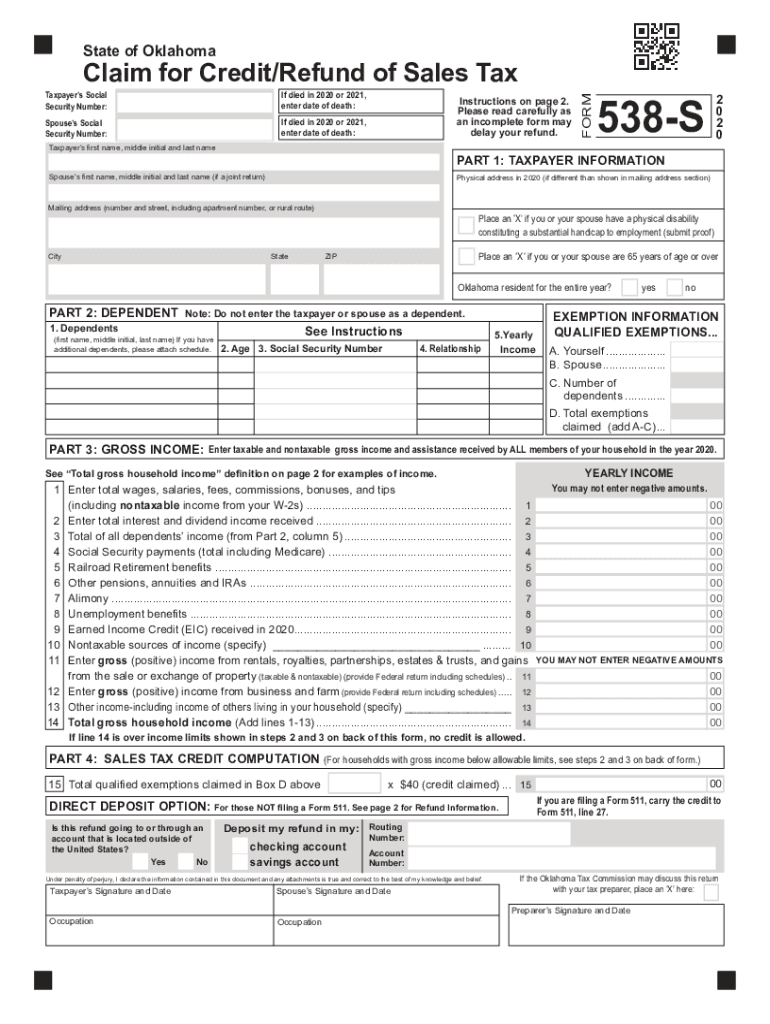

OK 538S 20202022 Fill out Tax Template Online US Legal Forms

• instructions for completing the form 511: Web we last updated the individual resident income tax return in january 2023, so this is the latest version of form 511, fully updated for tax year 2022. • generally, your return must be postmarked by april 15, 2020. For more information about the oklahoma income tax, see the oklahoma income tax page..

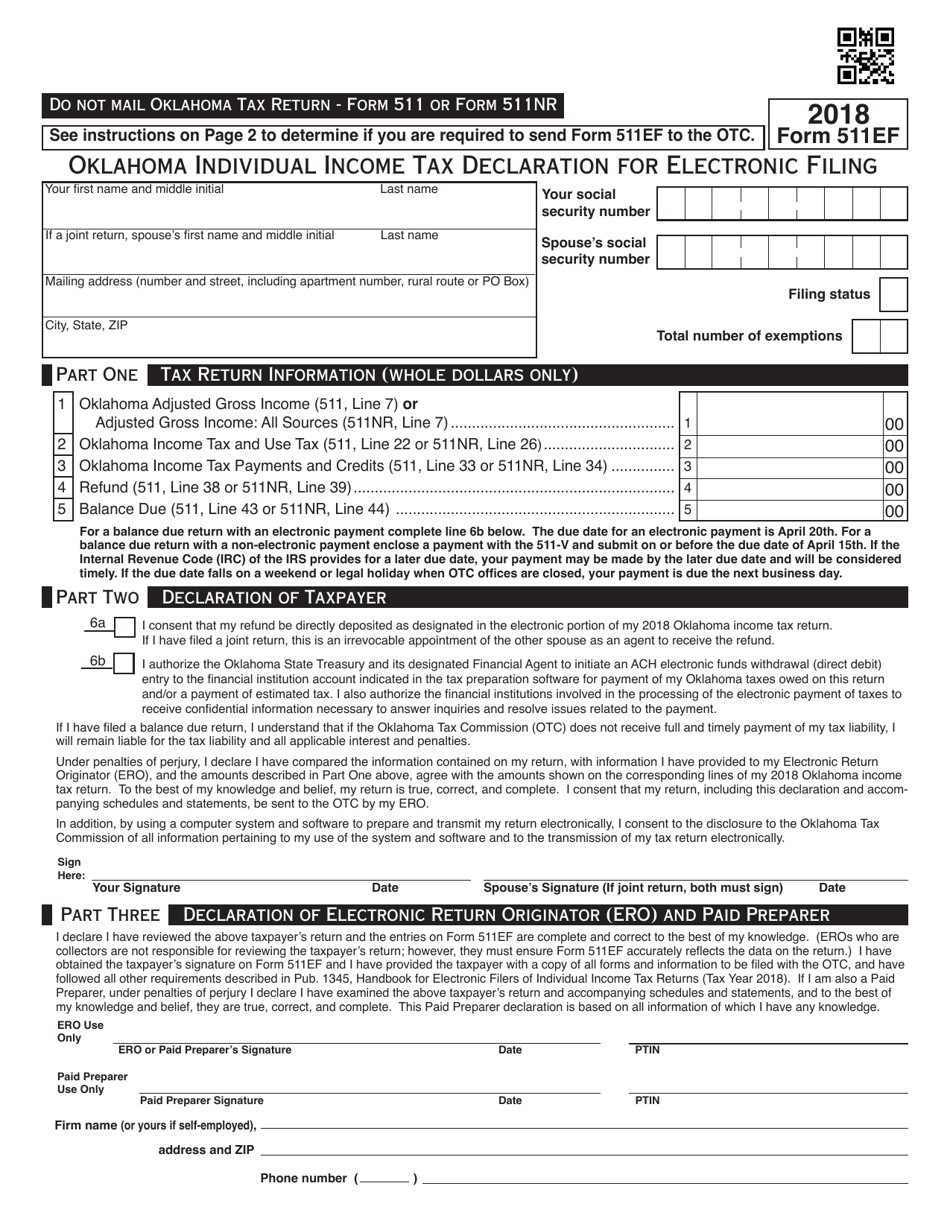

OTC Form 511EF Download Fillable PDF or Fill Online Oklahoma Individual

• generally, your return must be postmarked by april 15, 2020. Oklahoma resident income tax return • form 511: The due date for an electronic payment is april 20th. • instructions for completing the form 511: This form is for income earned in tax year 2022, with tax returns due in april 2023.

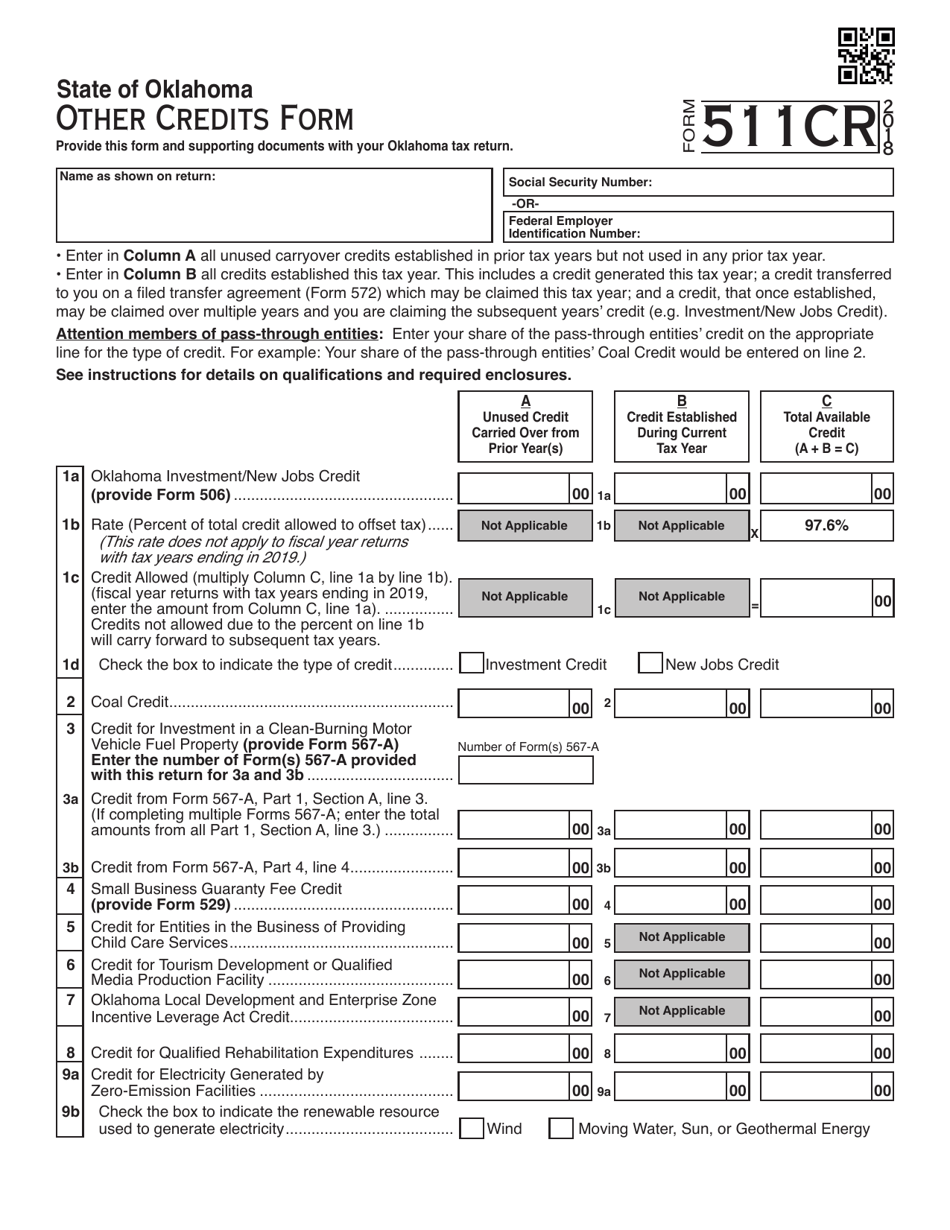

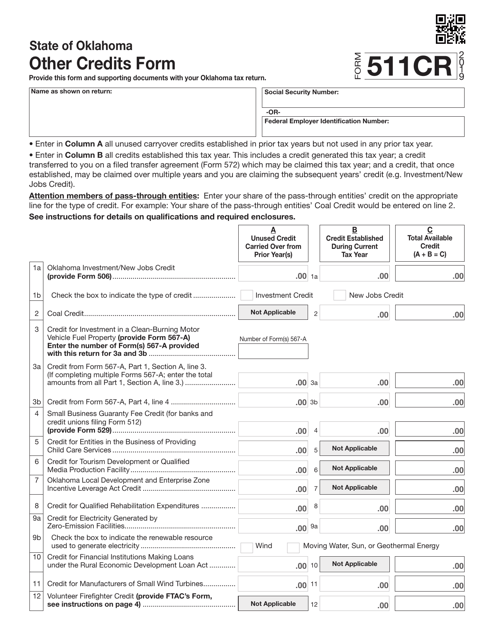

OTC Form 511CR Download Fillable PDF or Fill Online Other Credits Form

• generally, your return must be postmarked by april 15, 2022. Form 511 can be efiled, or a paper copy can be filed via mail. More about the oklahoma form 511 tax return we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Oklahoma resident income tax return • form 511: • instructions for completing the.

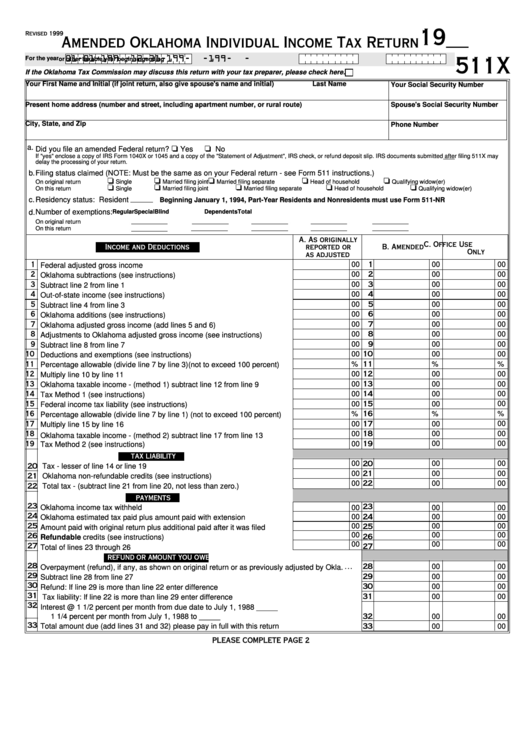

Form 511x Amended Oklahoma Individual Tax Return printable pdf

Oklahoma state income tax form 511 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Form 511 can be efiled, or a paper copy can be filed via mail. More about the oklahoma form 511 tax return we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Sales tax relief.

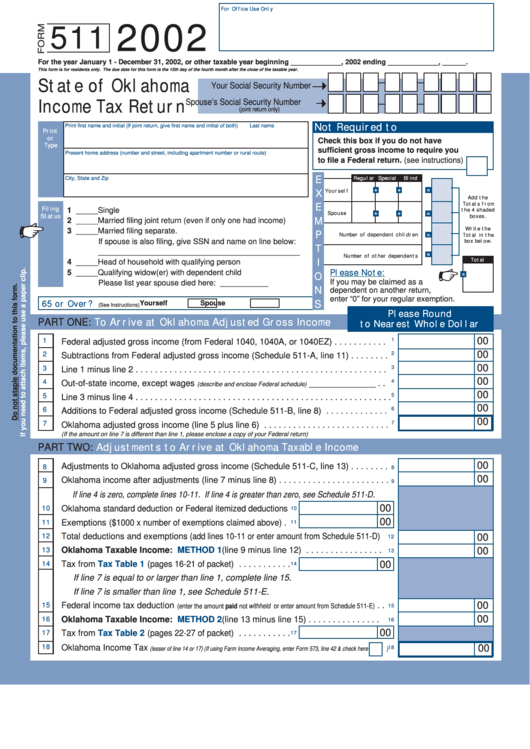

Form 511 State Of Oklahoma Tax Return 2002 printable pdf

Form 511 can be efiled, or a paper copy can be filed via mail. This form is for income earned in tax year 2022, with tax returns due in april 2023. • generally, your return must be postmarked by april 15, 2022. • instructions for completing the form 511: More about the oklahoma form 511 tax return we last updated.

Oklahoma Form 511 (Individual Resident Tax Return) 2021

Sales tax relief credit • instructions for the direct deposit option • 2019 income tax tables filing date: This form is for income earned in tax year 2022, with tax returns due in april 2023. • instructions for completing the form 511: • generally, your return must be postmarked by april 15, 2020. More about the oklahoma form 511 tax.

Form 511CR Download Fillable PDF or Fill Online Other Credits Form

• generally, your return must be postmarked by april 15, 2020. Sales tax relief credit form • instructions for the direct deposit option • 2021 income tax tables filing date: • instructions for completing the form 511: For more information about the oklahoma income tax, see the oklahoma income tax page. • generally, your return must be postmarked by april.

• Instructions For Completing The Form 511:

• generally, your return must be postmarked by april 15, 2020. For more information about the oklahoma income tax, see the oklahoma income tax page. Web free printable 2022 oklahoma form 511 and 2022 oklahoma form 511 instructions booklet in pdf format to print, fill in, and mail your state income tax return due april 18, 2023. Form 511 is the general income tax return for oklahoma residents.

Form 511 Can Be Efiled, Or A Paper Copy Can Be Filed Via Mail.

You can print other oklahoma tax forms here. • instructions for completing the form 511: The due date for an electronic payment is april 20th. This form is for income earned in tax year 2022, with tax returns due in april 2023.

More About The Oklahoma Form 511 Tax Return We Last Updated Oklahoma Form 511 In January 2023 From The Oklahoma Tax Commission.

Web we last updated the individual resident income tax return in january 2023, so this is the latest version of form 511, fully updated for tax year 2022. Sales tax relief credit form • instructions for the direct deposit option • 2021 income tax tables filing date: Web 2022 oklahoma resident individual income tax forms and instructions this packet contains: • generally, your return must be postmarked by april 15, 2022.

Sales Tax Relief Credit • Instructions For The Direct Deposit Option • 2019 Income Tax Tables Filing Date:

Web printable oklahoma income tax form 511. Oklahoma state income tax form 511 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Oklahoma resident income tax return • form 511: