Proof Of Funds Form

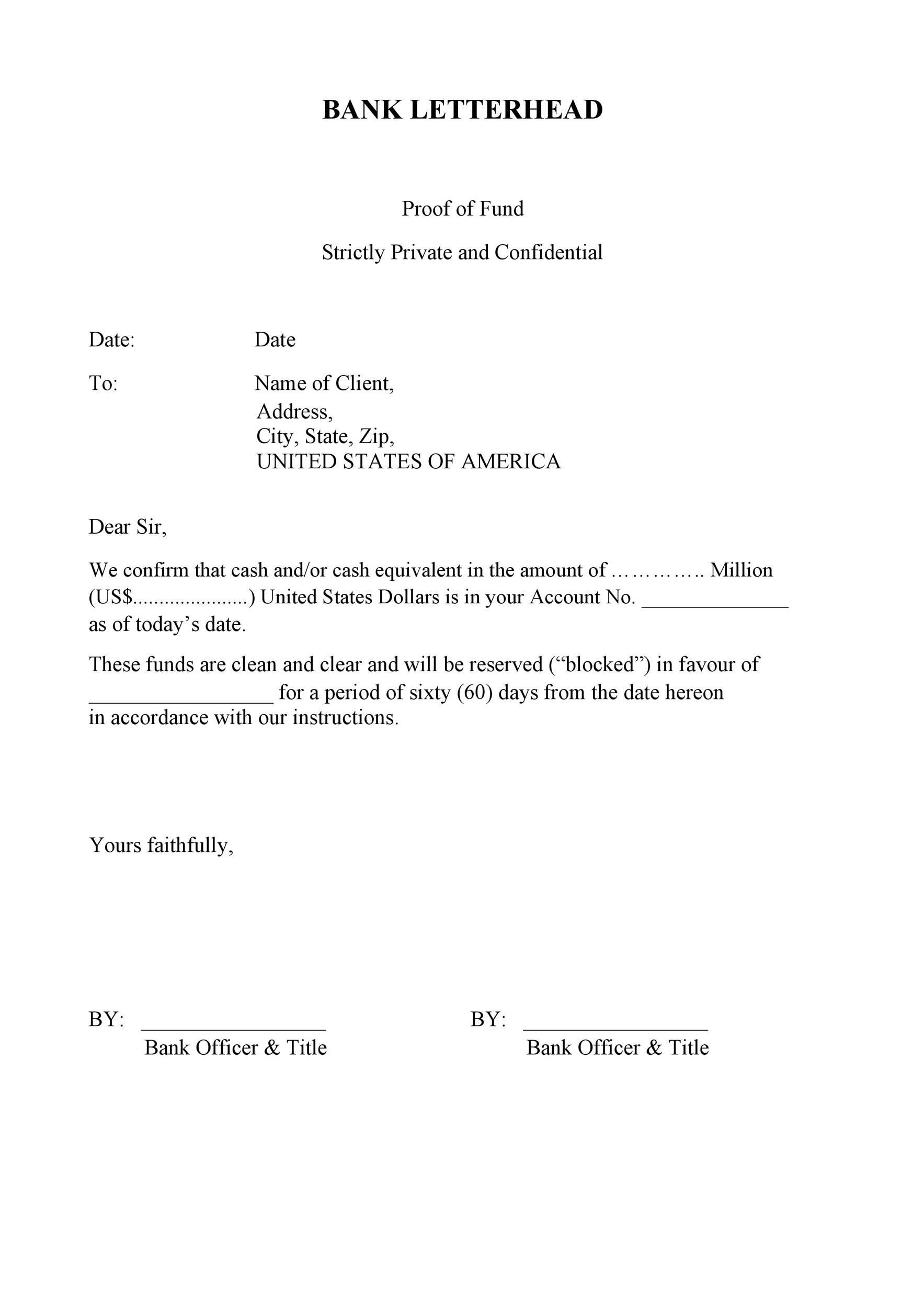

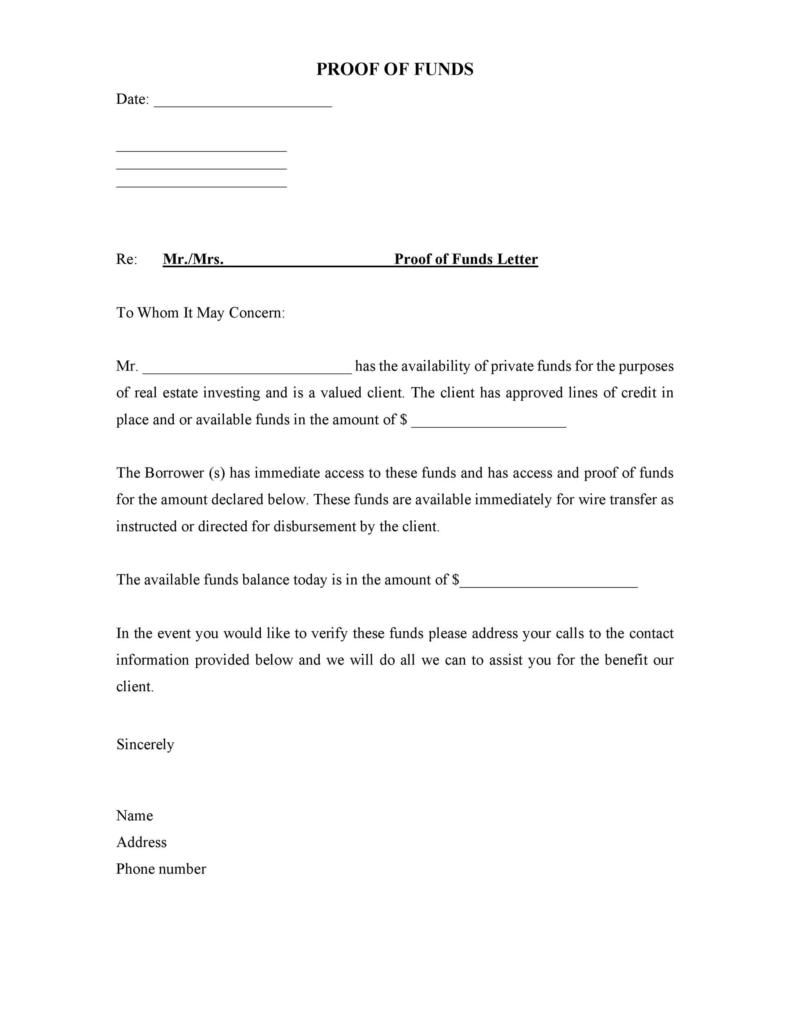

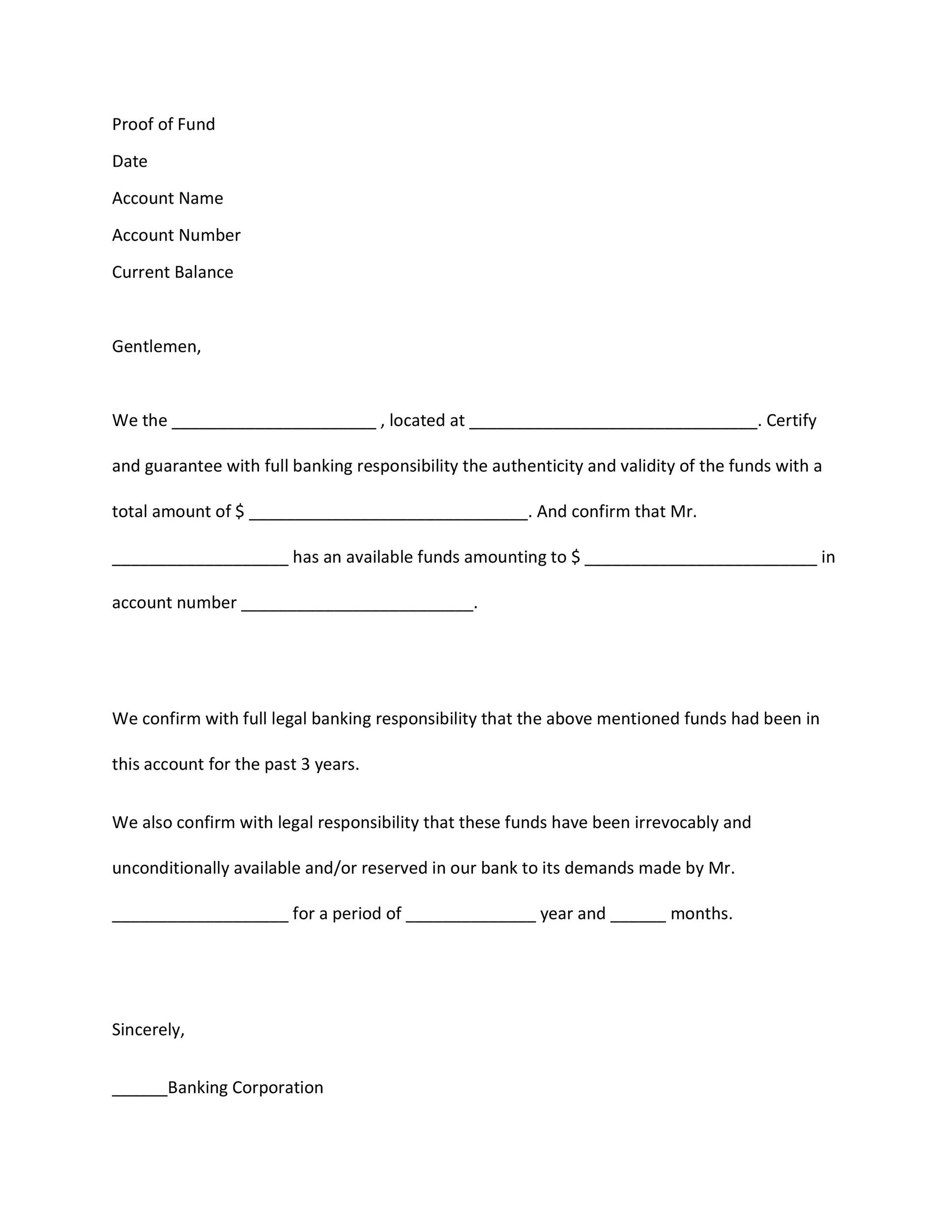

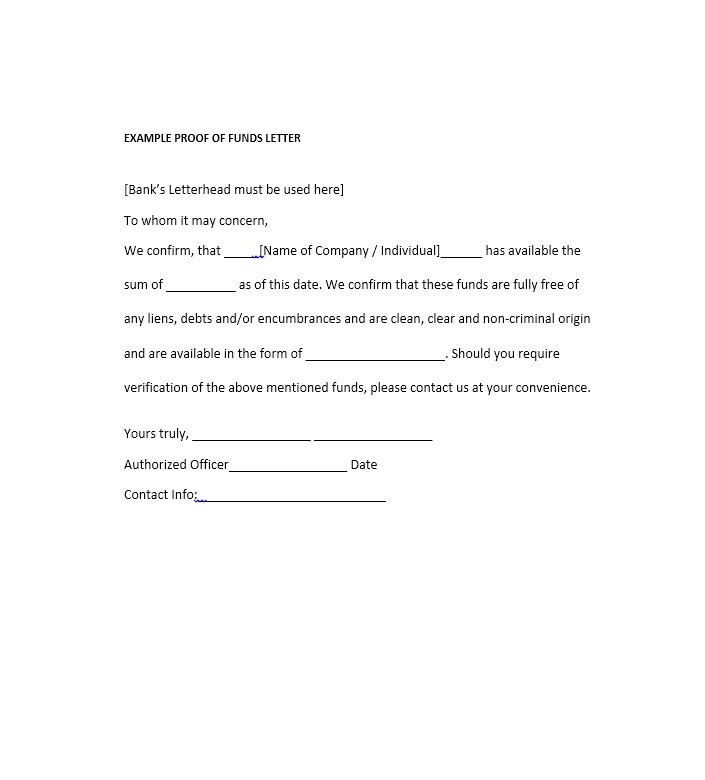

Proof Of Funds Form - An instant proof of funds letter is a formal financial document that certifies the available amount of funds a buyer has deposited in a bank. Proof of funds can come from multiple sources, including bank statements or a proof of funds letter. There are different ways to verify those funds. A newly declassified fbi document proves that joe biden and his son hunter biden each received $5 million in bribes from burisma founder mykola zlochevsky. A homebuyer may need more than one proof of funds letter if their funds are held by multiple institutions. Web a proof of funds letter effectively guarantees that a homebuyer has the resources available to make the agreed down payment and pay closing costs. Web other forms of proof of funds letters are: If you have money in different accounts, you may need to move the necessary funds into one bank account. The purpose of the proof of funds letter is that the buyer has enough liquid funds to cover the down payment, closing costs. Proof of funds (pof) is a letter or documentation that certifies that an individual, institution, or corporation has sufficient funds (money) to.

Proof of blocked funds that indicates restricted funds for a specific purpose. Simply create your proof of funds letter once and send it multiple times. How a proof of funds letter works in real estate mortgage financing? Most forms can be completed online, or you can download a pdf where it's offered to fill out a paper copy. Bank's name and address official bank statement balance of funds in the checking and savings accounts balance of total funds signature of authorized bank personnel The client will receive verification of the funds and proof that the funds are the clients (for verification purposes only). Request the letter from your bank. Access our most popular forms below, or select all forms to see a complete list. Enter your official identification and contact details. The buyer can be an individual homebuyer or a larger entity such as a corporation or real estate investment trust.

Proof of funds can come from multiple sources, including bank statements or a proof of funds letter. How a proof of funds letter works in real estate mortgage financing? Proof of funds letters should be obtained before they are needed, although some banks will provide a. To request a proof of funds, please fill out the form on this page or email a request to kevin. An instant proof of funds letter is a formal financial document that certifies the available amount of funds a buyer has deposited in a bank. Original tax returns from the last three years (form 16) Web a proof of funds letter is a document providing evidence you have enough liquid assets, or cash, to buy a home. Web you'll be asked to share personal information such as your date of birth, parents' names and details about your current occupation and previous criminal convictions. You need this paperwork to demonstrate to the seller you can cover purchase costs,. The buyer can be an individual homebuyer or a larger entity such as a corporation or real estate investment trust.

Proof Of Funds Letter Peterainsworth

There are a few situations where you may be asked to provide proof of funds, but this is most common in real estate transactions. Proof of funds can come from multiple sources, including bank statements or a proof of funds letter. The advanced tools of the editor will lead you through the editable pdf template. How it works open the.

proof of funds letter bank of america How To Have A AH STUDIO Blog

The buyer can be an individual homebuyer or a larger entity such as a corporation or real estate investment trust. Records have been marked to prohibit withdrawal except by written order of this court. Web verify the funds of your banking customers with this proof of funds letter — seamlessly created with jotform sign. Web a proof of funds (pof).

FREE 7+ Sample Proof of Funds Letter Templates in PDF MS Word

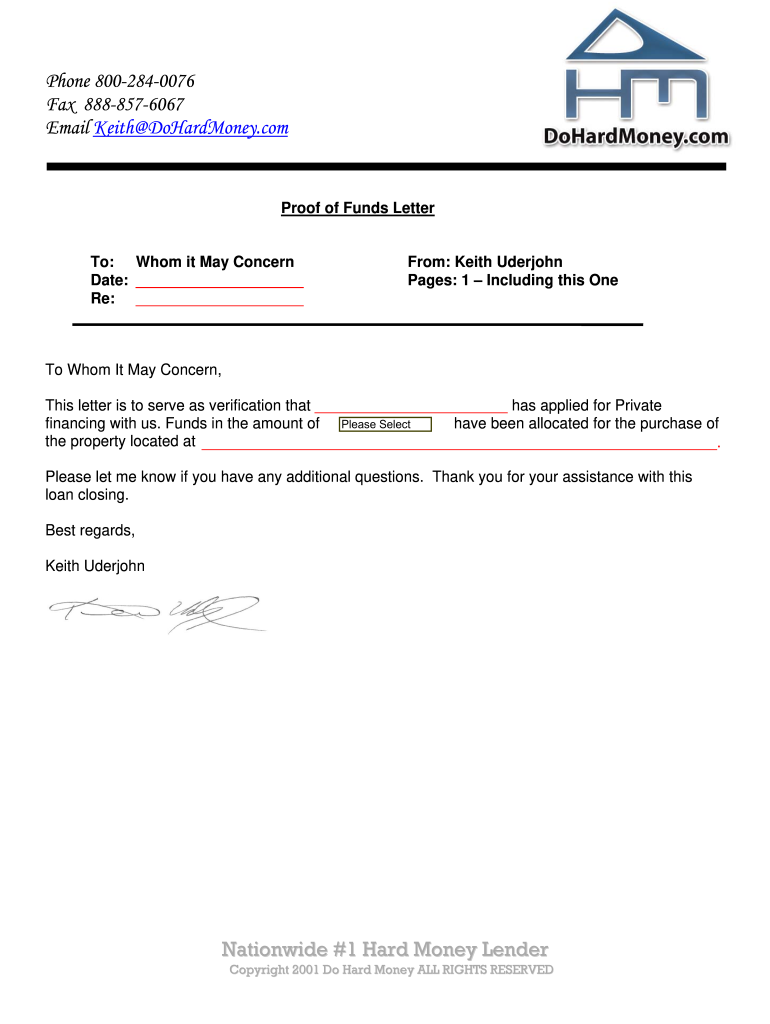

An instant proof of funds letter is a formal financial document that certifies the available amount of funds a buyer has deposited in a bank. Web the proof of funds (pof) letter is used by borrowers looking to purchase a property to rehab and flip. Proof of funds letters should be obtained before they are needed, although some banks will.

25 Best Proof of Funds Letter Templates ᐅ TemplateLab

Documents that guarantee payment of a set amount of money, which are payable to you, such as: Web proof of liquid assets. Request the letter from your bank. Records have been marked to prohibit withdrawal except by written order of this court. Web a proof of funds (pof) letter is a document that shows you have the cash necessary to.

35 Proof Of Payment forms Hamiltonplastering

The client will receive verification of the funds and proof that the funds are the clients (for verification purposes only). If your funds are all in one place, you can likely get your pof in 1 day. Proof of blocked funds that indicates restricted funds for a specific purpose. You'll also need to share a. How a proof of funds.

35 Free Proof Of Funds Hamiltonplastering

Web all the forms and brochures you need to help you meet your financial goals—all in one place. If you're a homebuyer, the pof letter demonstrates that you have enough money to submit a down payment, pay closing costs or buy a home outright with cash. Most forms can be completed online, or you can download a pdf where it's.

Proof Of Funds Letter For Real Estate Purchase Sample Database Letter

The buyer can be an individual homebuyer or a larger entity such as a corporation or real estate investment trust. Frequently requested forms membership application change of information/add joint owner direct deposit of net pay enrollment statement of forgery for credit card certificates/iras/trust applications & forms application for deposit trust account Web a copy of the corresponding financial institution’s statement.

Sample Proof Funds Letter 7 Proof of Funds Letters to

A newly declassified fbi document proves that joe biden and his son hunter biden each received $5 million in bribes from burisma founder mykola zlochevsky. Web verify the funds of your banking customers with this proof of funds letter — seamlessly created with jotform sign. Web a proof of funds (pof) letter is a document that shows you have the.

25 Best Proof of Funds Letter Templates ᐅ TemplateLab

The buyer can be an individual homebuyer or a larger entity such as a corporation or real estate investment trust. Web a proof of funds letter effectively guarantees that a homebuyer has the resources available to make the agreed down payment and pay closing costs. If you're a homebuyer, the pof letter demonstrates that you have enough money to submit.

Proof Of Funds Letter Fill Out and Sign Printable PDF Template signNow

You need this paperwork to demonstrate to the seller you can cover purchase costs,. Proof of funds (pof) is a letter or documentation that certifies that an individual, institution, or corporation has sufficient funds (money) to. Web a proof of funds (pof) is a document proving that a person or a company has the financial ability to perform a transaction.the.

The Purpose Of The Proof Of Funds Letter Is That The Buyer Has Enough Liquid Funds To Cover The Down Payment, Closing Costs.

Web a proof of funds (pof) letter is a document that shows you have the cash necessary to close a real estate deal. Web proof of funds (pof) is a document that provides evidence that an individual or organization has the financial resources necessary to complete a transaction or investment. Frequently requested forms membership application change of information/add joint owner direct deposit of net pay enrollment statement of forgery for credit card certificates/iras/trust applications & forms application for deposit trust account Web essentially, a proof of funds letter includes the account holder’s name and current balance of available funds—all on bank letterhead and signed by a bank official.

Web Instant Proof Of Funds Letter.

Web other forms of proof of funds letters are: Most forms can be completed online, or you can download a pdf where it's offered to fill out a paper copy. Web proof of funds is a document you provide to assert that you have money on hand to cover specific expenses. Web a copy of the corresponding financial institution’s statement accompanies this proof of restricted account.* i further certify that 1.

Web The Following Are Some Of The Most Common Pieces Of Information That Will Need To Be Disclosed On A Proof Of Funds Document:

There are a few situations where you may be asked to provide proof of funds, but this is most common in real estate transactions. Simply create your proof of funds letter once and send it multiple times. Web show details we are not affiliated with any brand or entity on this form. The advanced tools of the editor will lead you through the editable pdf template.

Proof Of Blocked Funds That Indicates Restricted Funds For A Specific Purpose.

The client will receive verification of the funds and proof that the funds are the clients (for verification purposes only). Bank's name and address official bank statement balance of funds in the checking and savings accounts balance of total funds signature of authorized bank personnel You'll also need to share a. Documents that guarantee payment of a set amount of money, which are payable to you, such as: