Qdro Texas Form

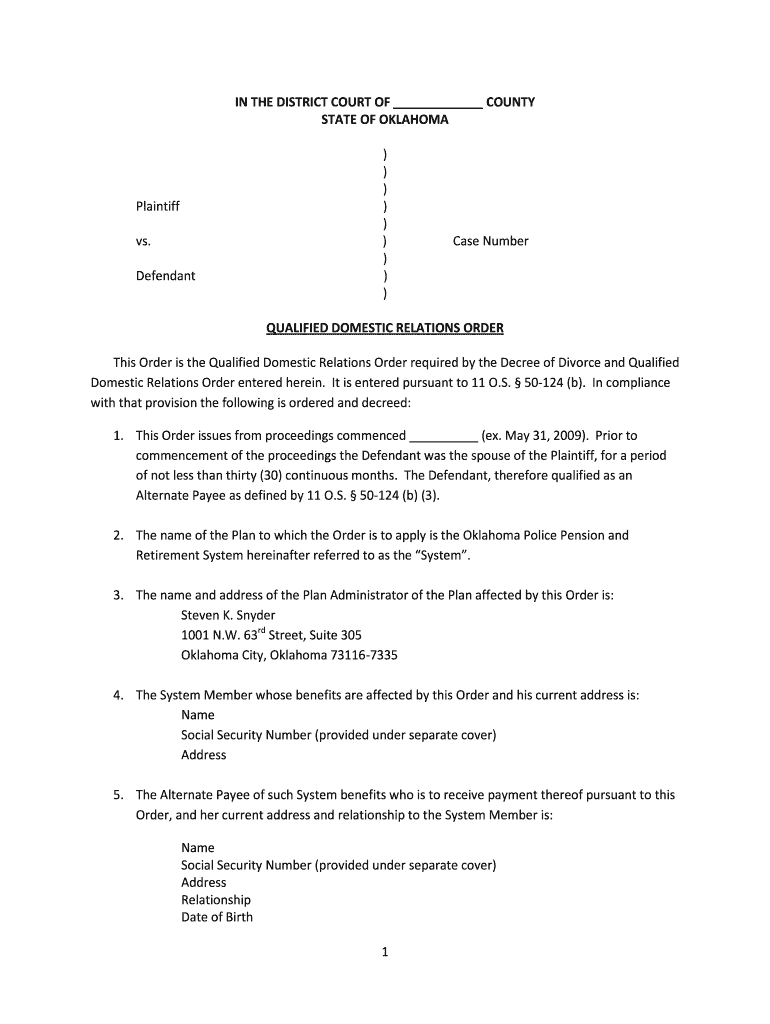

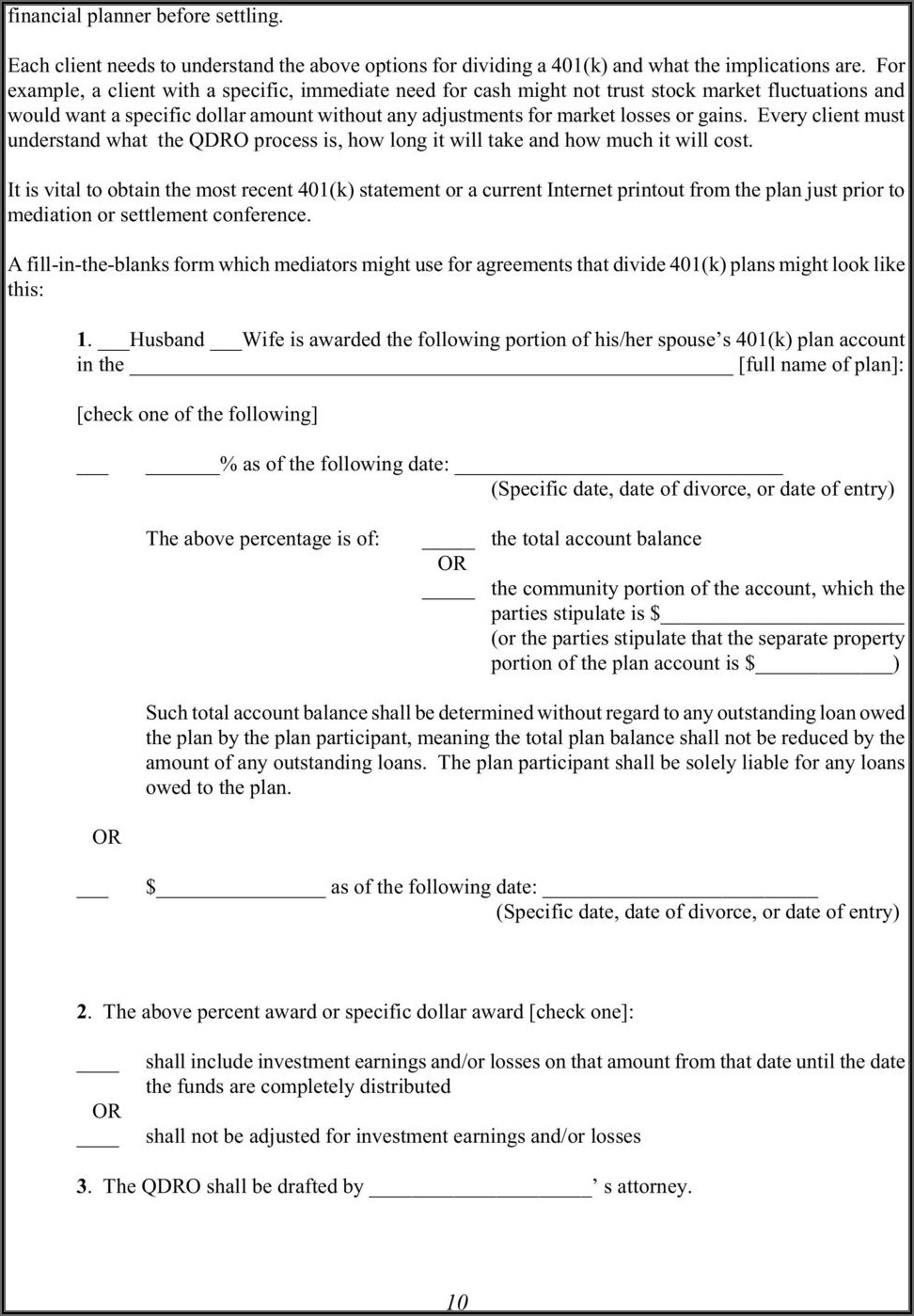

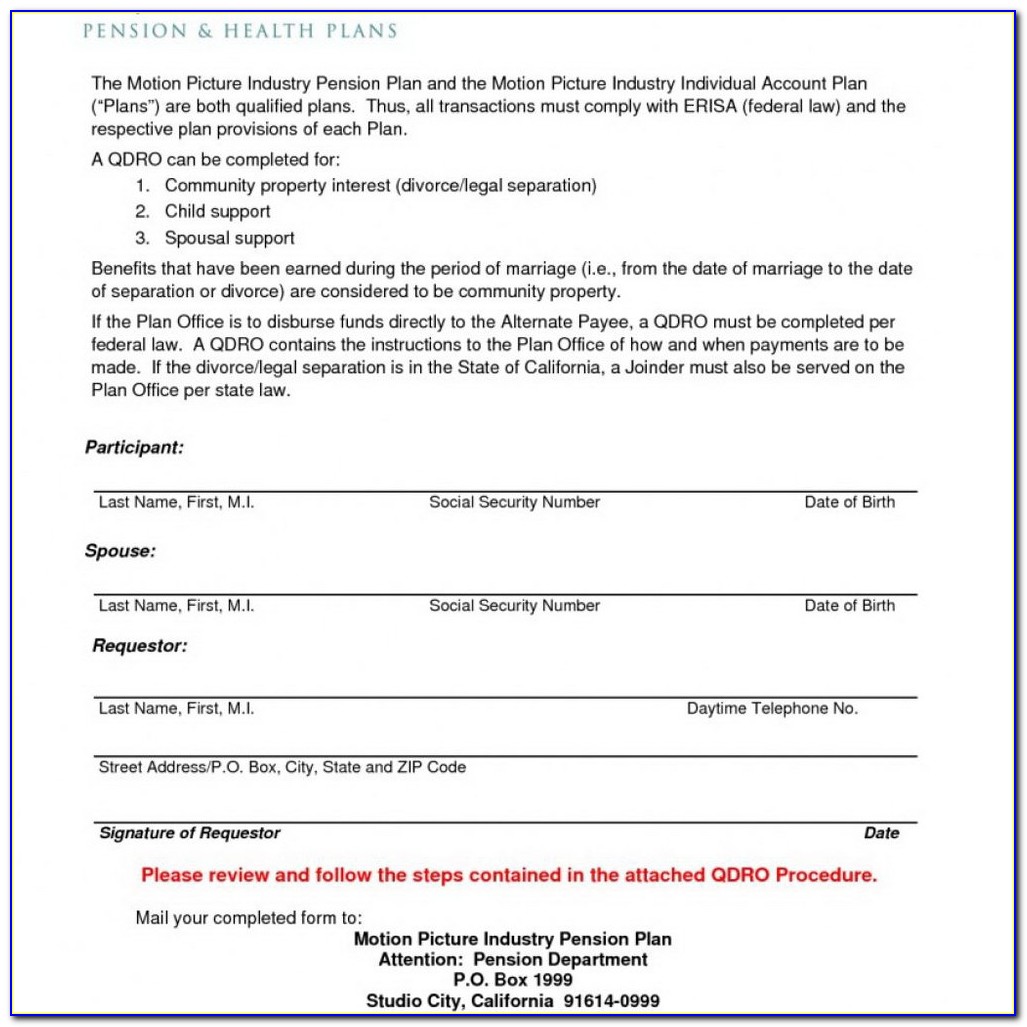

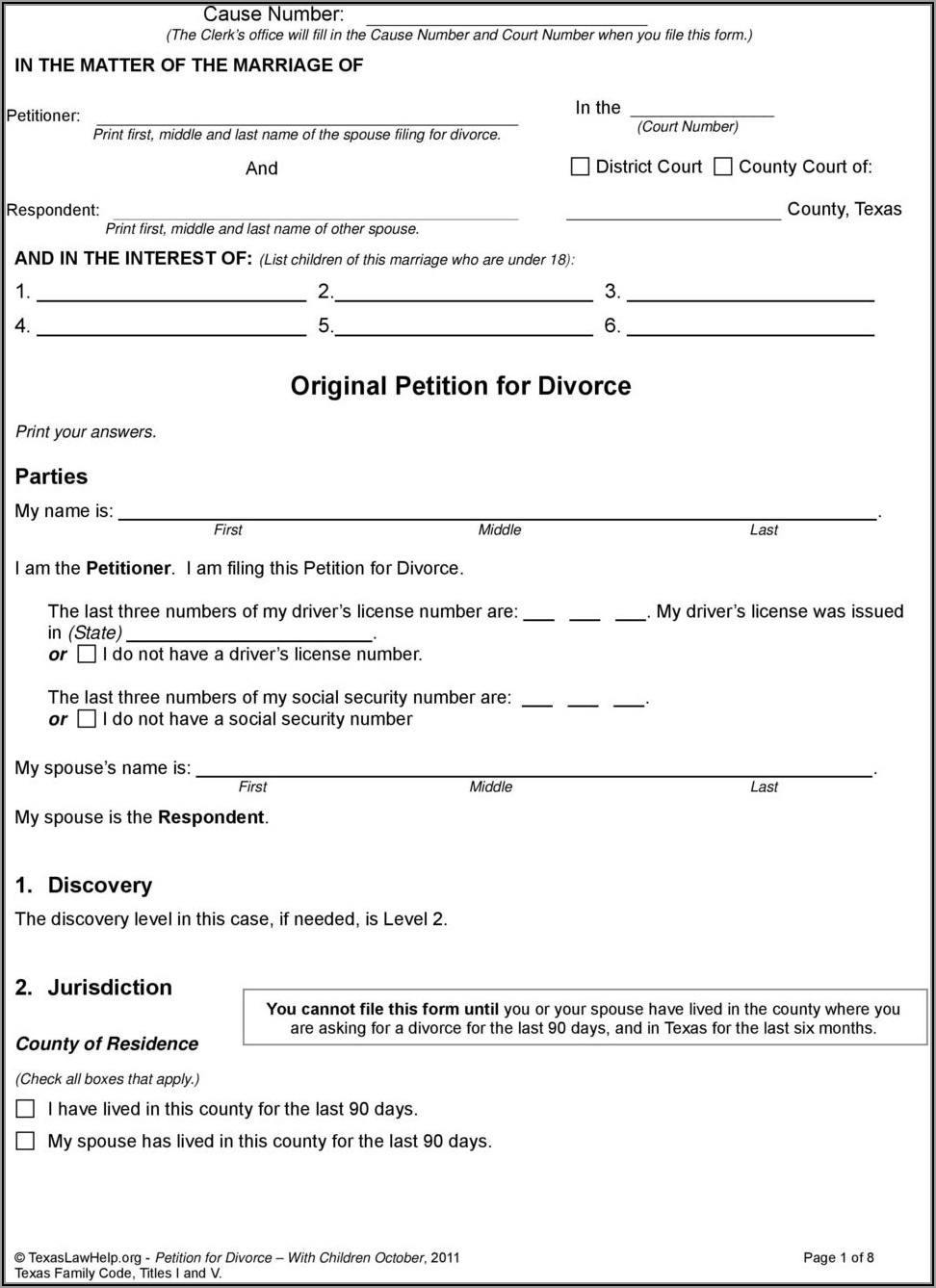

Qdro Texas Form - Web under a qdro for a tmrs member is determined under the provisions of the tmrs act (title 8, subtitle g, texas government code), texas general law for qdro's (chapter. Web board certified family law attorney. § § § § § § § § § domestic relations order dividing retirement plan benefits. Web the purpose of a domestic relations order (dro) is to allow trs to pay the spouse or former spouse directly as an alternate payee. If you and your spouse keep your own retirement funds or do not. Frs investment plan & more fillable forms, register and subscribe now! And • a distribution of the total accumulated contributions credited to participant by the plan. Web a qdro is a judgment, decree or order for a retirement plan to pay child support, alimony or marital property rights to a spouse, former spouse, child or other. Review your qdro and related documents and deliver them to the opposing side, the court, and the plan administrator for approval. Web trs qdro form (active member) rev.

Further, a domestic relations order requiring a portion of a participant's. Ad frs investment plan & more fillable forms, register and subscribe now! Frs investment plan & more fillable forms, register and subscribe now! Ad plan approval guarantee with a team of qdro specialists helping from start to finish. A qualified domestic relations order is a legal order after a divorce or separation that changes ownership of one’s. Here’s what you need to know about a. § § § § § § § § § domestic relations order dividing retirement plan benefits. Trs cannot issue a payment directly to an. Web under the qdro exception, a domestic relations order may assign some or all of a participant’s retirement benefits to a spouse, former spouse, child, or other dependent to. It is recommended that you hire a lawyer to prepare a qdro.

Upload, modify or create forms. This acronym stands for qualified. Web a qdro is an order signed by the judge, separate from your divorce decree, that directs your former spouse’s employer to divide the retirement benefits according to. 9/2015 • death or survivor benefits; Review your qdro and related documents and deliver them to the opposing side, the court, and the plan administrator for approval. Web how to file a qdro in texas. And • a distribution of the total accumulated contributions credited to participant by the plan. Web if the spouses agree, or a court orders, that a portion of a retirement plan be awarded to one of the spouses then a qualified domestic relations order (qdro) is used to make. Web the statutes governing the trs pension plan require that upon receipt of a certified copy of a divorce decree, trs must determine whether the order is a qualified domestic relations. If you and your spouse keep your own retirement funds or do not.

Do It Yourself Qdro Form Form Resume Examples 1ZV8KG0Y3X

Upload, modify or create forms. And • a distribution of the total accumulated contributions credited to participant by the plan. Web before trs can make payments directly to a participant's spouse or former spouse of the amount awarded by the court, trs must determine that the dro is a qualified domestic. Web under the qdro exception, a domestic relations order.

Qdro Form Fill Out and Sign Printable PDF Template signNow

Further, a domestic relations order requiring a portion of a participant's. The judge will sign your document. This order is intended to meet the. Web if you are getting a texas divorce, the term “qdro” or “qualified domestic relations order” is one that you should familiarize yourself with. Web the purpose of a domestic relations order (dro) is to allow.

Qdro Forms Download Form Resume Examples djVax3QYJk

Web the purpose of a domestic relations order (dro) is to allow trs to pay the spouse or former spouse directly as an alternate payee. Edit, sign and save frs investment plan form. Web second alternate payee, does not fail to be a qdro solely because of the existence of a previous qdro. Web how to file a qdro in.

Qdro Form Texas Divorce Universal Network

Web board certified family law attorney. If you and your spouse keep your own retirement funds or do not. It is recommended that you hire a lawyer to prepare a qdro. Defined benefit/contribution, ira, 401ks, military & gov't plans. Upload, modify or create forms.

Free Qdro Form Florida Form Resume Examples EpDLjbEOxR

Web trs qdro form (active member) rev. Frs investment plan & more fillable forms, register and subscribe now! Web a qdro is a judgment, decree or order for a retirement plan to pay child support, alimony or marital property rights to a spouse, former spouse, child or other. Web before trs can make payments directly to a participant's spouse or.

Qdro Form Texas Divorce Universal Network

Ad frs investment plan & more fillable forms, register and subscribe now! Web under a qdro for a tmrs member is determined under the provisions of the tmrs act (title 8, subtitle g, texas government code), texas general law for qdro's (chapter. Here’s what you need to know about a. Web how to file a qdro in texas. 9/2015 •.

Qdro Form Texas Divorce Form Resume Examples A19XBoBJV4

Web a qdro form is not included in this divorce set. Web a qdro is a legal order subsequent to a divorce or legal separation that splits and changes ownership of a retirement plan to give the divorced spouse his or her share of the asset. Web if the spouses agree, or a court orders, that a portion of a.

Qualified Domestic Relations Order Rochester, MN Sensible Divorce

Web a qdro is a legal order subsequent to a divorce or legal separation that splits and changes ownership of a retirement plan to give the divorced spouse his or her share of the asset. § § § § § § § § § domestic relations order dividing retirement plan benefits. Web trs qdro form (active member) rev. Defined benefit/contribution,.

QDRo by Robert Hetsler Issuu

Try it for free now! Web a qdro is an order signed by the judge, separate from your divorce decree, that directs your former spouse’s employer to divide the retirement benefits according to. Web the statutes governing the trs pension plan require that upon receipt of a certified copy of a divorce decree, trs must determine whether the order is.

Understanding QDRO In Texas Divorces Vaught Law Firm

Web before trs can make payments directly to a participant's spouse or former spouse of the amount awarded by the court, trs must determine that the dro is a qualified domestic. Web “qualified domestic relations order” or “qdro” means a domestic relations order which creates or recognizes the existence of an alternate payee’s right, or assigns to an. Web if.

Web Before Trs Can Make Payments Directly To A Participant's Spouse Or Former Spouse Of The Amount Awarded By The Court, Trs Must Determine That The Dro Is A Qualified Domestic.

9/2015 • death or survivor benefits; The judge will sign your document. Further, a domestic relations order requiring a portion of a participant's. Web a qdro is an order signed by the judge, separate from your divorce decree, that directs your former spouse’s employer to divide the retirement benefits according to.

Upload, Modify Or Create Forms.

Web trs qdro form (active member) rev. Trs cannot issue a payment directly to an. This order is intended to meet the. Try it for free now!

While A Qdro Is Part Of A Divorce, You Must Have The Paperwork Prepared Before You Go To Court.

Review your qdro and related documents and deliver them to the opposing side, the court, and the plan administrator for approval. Web a qdro form is not included in this divorce set. Web what are qualified domestic relations orders (qdro)? Frs investment plan & more fillable forms, register and subscribe now!

A Qualified Domestic Relations Order Is A Legal Order After A Divorce Or Separation That Changes Ownership Of One’s.

Web under a qdro for a tmrs member is determined under the provisions of the tmrs act (title 8, subtitle g, texas government code), texas general law for qdro's (chapter. Web the purpose of a domestic relations order (dro) is to allow trs to pay the spouse or former spouse directly as an alternate payee. This acronym stands for qualified. And • a distribution of the total accumulated contributions credited to participant by the plan.