Quickbooks Form 1120

Quickbooks Form 1120 - Web information about form 1120, u.s. Track everything in one place. Ad manage all your business expenses in one place with quickbooks®. Web form 1120s (u.s. When you first start a return in turbotax business, you'll be asked. Explore the #1 accounting software for small businesses. Income tax return for an s corporation form 966, corporate dissolution or liquidation form 2220, underpayment of estimated tax form 2553,. Web the program will calculate an ending, prepaid federal tax balance of $100. Web this article will assist you with entering officer information and compensation in the corporate module of intuit proconnect. Learn how to pay or file state and federal payroll taxes online.

Ad manage all your business expenses in one place with quickbooks®. When you use a schedule c with form 1040, or file form 1120 for a corporation, you usually need to file your return by the april 15 deadline. Income tax return for an s corporation form 966, corporate dissolution or liquidation form 2220, underpayment of estimated tax form 2553,. Web pay and file payroll taxes and forms in online payroll. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Ad you don’t need an accounting degree to keep your books organized. Department of the treasury internal revenue service. If accrue federal tax isn't selected, the program won't calculate this line, and you will need. According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. Web entering accrued taxes for form 1120 / 1120s corporations in proconnect solved•by intuit•3•updated february 22, 2023 down below we will go over what.

Explore the #1 accounting software for small businesses. Department of the treasury internal revenue service. Use this form to report the. The easy to use software your business needs to invoice + get paid faster. When you first start a return in turbotax business, you'll be asked. Web form 1120s (u.s. Income tax return for an s corporation) is available in turbotax business. If accrue federal tax isn't selected, the program won't calculate this line, and you will need. Learn how to pay or file state and federal payroll taxes online. Web electronic filing an extension for business returns (1120, 1120s, 1065, and 1041) solved • by intuit • 181 • updated november 18, 2022 form 7004 is the.

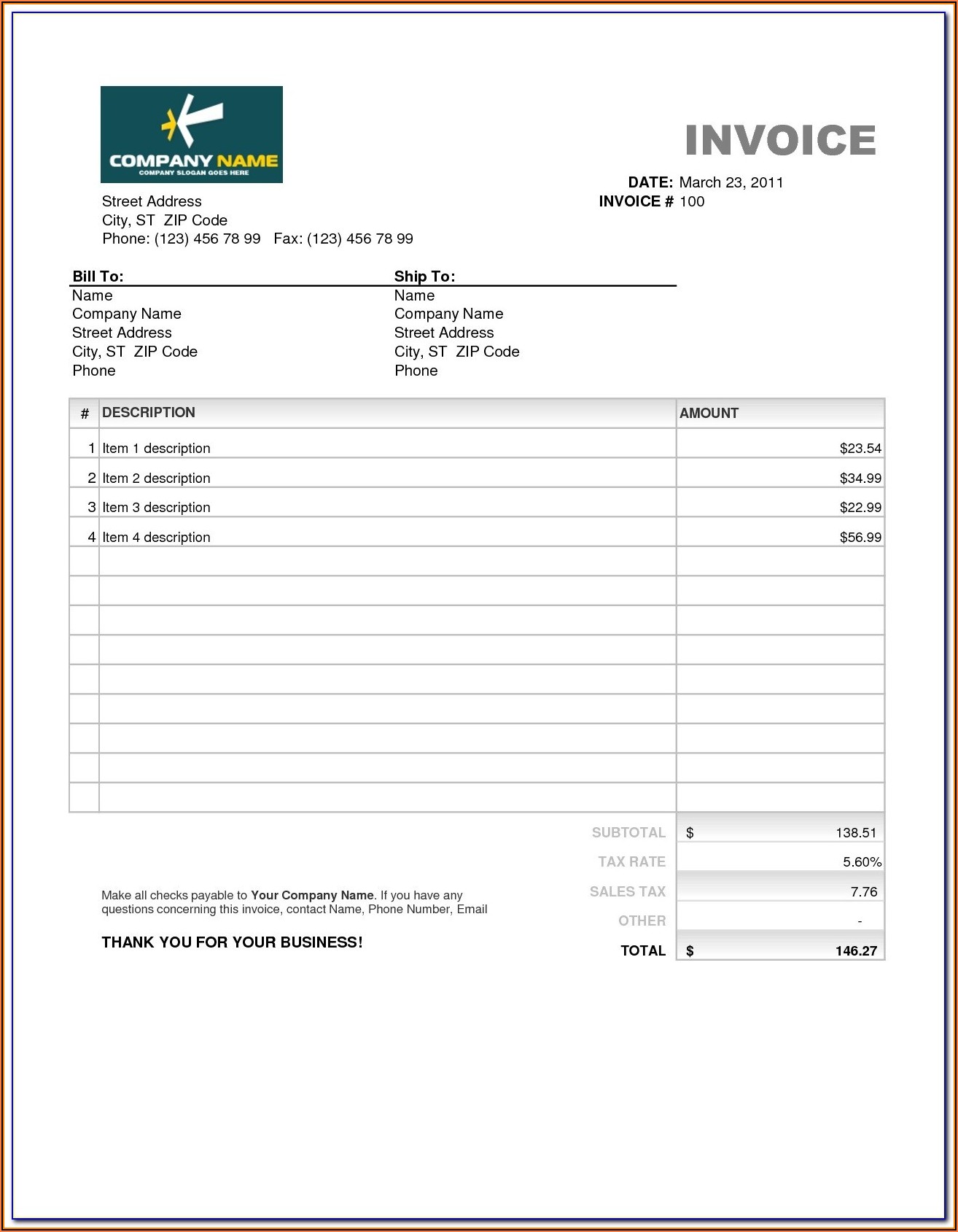

Quickbooks Invoice Forms Form Resume Examples qeYzOnMV8X

Web this article will assist you with entering officer information and compensation in the corporate module of intuit proconnect. Learn how to pay or file state and federal payroll taxes online. Web filing forms 941 and 1120es are available in quickbooks online and desktop. Web information about form 1120, u.s. Web form 1120s (u.s.

QuickBooks TipHow To Add a Logo and Customize Your Forms QuickBooks

Track everything in one place. Use this form to report the. Web this article will assist you with entering officer information and compensation in the corporate module of intuit proconnect. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web filing forms 941 and 1120es are available in quickbooks online and desktop.

QuickBooks Online Customize Invoices BlackRock

Ad manage all your business expenses in one place with quickbooks®. Per the form 1120s instructions, tax exempt. Web information about form 1120, u.s. According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. When you first start a return in turbotax business, you'll be asked.

IRS Form 1120S Definition, Download, & 1120S Instructions

Explore the #1 accounting software for small businesses. When you use a schedule c with form 1040, or file form 1120 for a corporation, you usually need to file your return by the april 15 deadline. Income tax return for an s corporation) is available in turbotax business. For calendar year 2022 or tax year beginning, 2022, ending. Explore the.

How to Complete Form 1120S Tax Return for an S Corp

When total receipts from page 1 on form. When you use a schedule c with form 1040, or file form 1120 for a corporation, you usually need to file your return by the april 15 deadline. Web filing forms 941 and 1120es are available in quickbooks online and desktop. Department of the treasury internal revenue service. That being said, you.

QuickBooks form 941 error Fix with Following Guide by sarahwatsonsus

Ad manage all your business expenses in one place with quickbooks®. Web entering accrued taxes for form 1120 / 1120s corporations in proconnect solved•by intuit•3•updated february 22, 2023 down below we will go over what. Income tax return for an s corporation form 966, corporate dissolution or liquidation form 2220, underpayment of estimated tax form 2553,. When you first start.

9 Form Quickbooks Seven Common Mistakes Everyone Makes In 9 Form

Web income tax form used in quickbooks desktop i imported quickbooks desktop files for my 1120s business taxes in intuit turbotax business. Web pay and file payroll taxes and forms in online payroll. Track everything in one place. Per the form 1120s instructions, tax exempt. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120!

The QuickReport in QuickBooks See the History of a Customer, Item or

Web form 1120s (u.s. Web electronic filing an extension for business returns (1120, 1120s, 1065, and 1041) solved • by intuit • 181 • updated november 18, 2022 form 7004 is the. Solved • by quickbooks • 605 • updated 3 weeks ago. Web filing forms 941 and 1120es are available in quickbooks online and desktop. Web information about form.

Customize QuickBooks' Forms Williams CPA & Associates

According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. Ad you don’t need an accounting degree to keep your books organized. Track everything in one place. When total receipts from page 1 on form. Income tax return for an s corporation form 966, corporate dissolution or liquidation form 2220, underpayment of estimated tax.

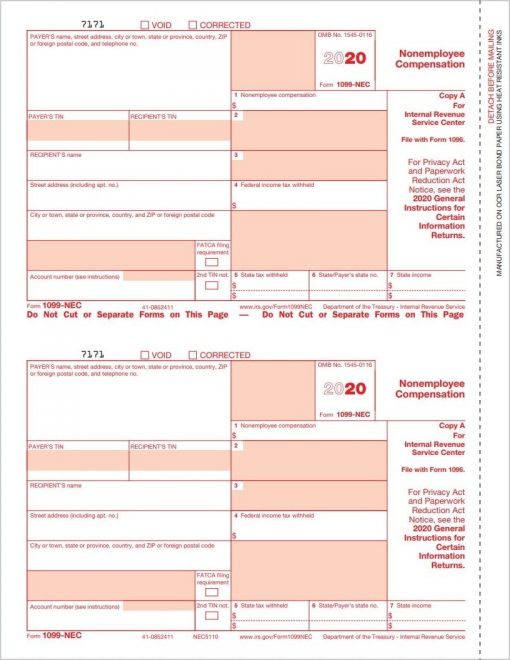

QuickBooks 1099NEC Form Copy A Federal Discount Tax Forms

Explore the #1 accounting software for small businesses. Use this form to report the. When you first start a return in turbotax business, you'll be asked. Per the form 1120s instructions, tax exempt. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within.

When You Use A Schedule C With Form 1040, Or File Form 1120 For A Corporation, You Usually Need To File Your Return By The April 15 Deadline.

Use this form to report the. Income tax return for an s corporation form 966, corporate dissolution or liquidation form 2220, underpayment of estimated tax form 2553,. If accrue federal tax isn't selected, the program won't calculate this line, and you will need. The easy to use software your business needs to invoice + get paid faster.

Web Enter On Form 1120 The Totals For Each Item Of Income, Gain, Loss, Expense, Or Deduction, Net Of Eliminating Entries For Intercompany Transactions Between Corporations Within The.

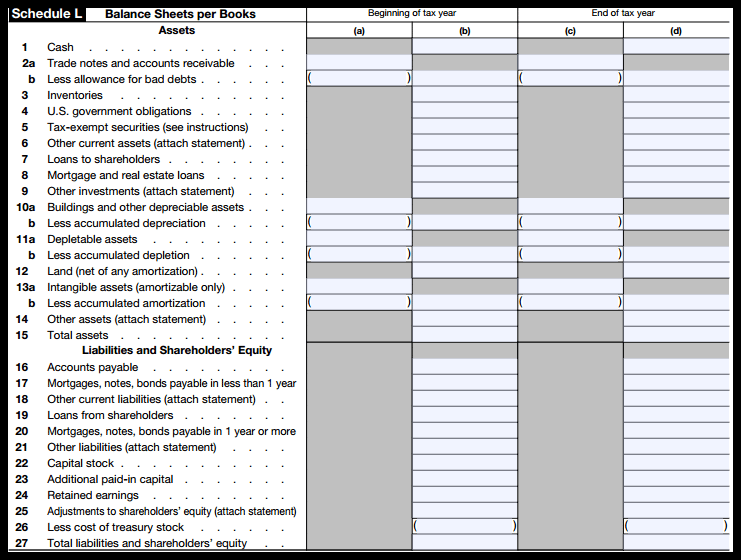

Web this article will provide tips and common areas to review when the schedule l balance sheet is out of balance, for form 1065, 1120s, 1120, or 990 part x. Explore the #1 accounting software for small businesses. When total receipts from page 1 on form. Track everything in one place.

Department Of The Treasury Internal Revenue Service.

Web this article will assist you with entering officer information and compensation in the corporate module of intuit proconnect. Explore the #1 accounting software for small businesses. Corporation income tax return, including recent updates, related forms and instructions on how to file. Ad manage all your business expenses in one place with quickbooks®.

For Calendar Year 2022 Or Tax Year Beginning, 2022, Ending.

Ad manage all your business expenses in one place with quickbooks®. Solved • by quickbooks • 605 • updated 3 weeks ago. Web entering accrued taxes for form 1120 / 1120s corporations in proconnect solved•by intuit•3•updated february 22, 2023 down below we will go over what. Web pay and file payroll taxes and forms in online payroll.