Reasonable Cause For Late Filing Form 2553

Reasonable Cause For Late Filing Form 2553 - If this late election is being made by an entity eligible to elect to. The entity must fail to qualify for s corporation status solely because it did. Making all of your payments throughout the year will help you avoid penalties. If the entity does not qualify under the. There must be reasonable cause for not filing it on time, such as the owner thought it was. Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes. Web the irs does allow relief for forms that are filed after the deadline if a business can show a reasonable cause for why the form is being filed late. Web august 20, 2022 taxpayers who owe more than $1,000 to the irs can be penalized. Web you must have reasonable cause for your failure to timely file the form 2553 by its due date. Web the corporation has reasonable cause for late election all shareholders reported their income consistent with s corporation status for the year the status should.

Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes. In most cases, we’ve found the irs to be fairly lenient when it. If this late election is being made by an entity eligible to elect to. Web what was the reasonable cause for not filing the 2553 on time? Web system issues that delayed a timely electronic filing or payment. Web if the entity qualifies and files timely in accordance with rev. Web in this video i show you how to prepare and file a late s corp election using form 2553. Web to be eligible for the new relief under rev. The entity must fail to qualify for s corporation status solely because it did. And the time from your effective date to your filing must be less than 3 years and 75.

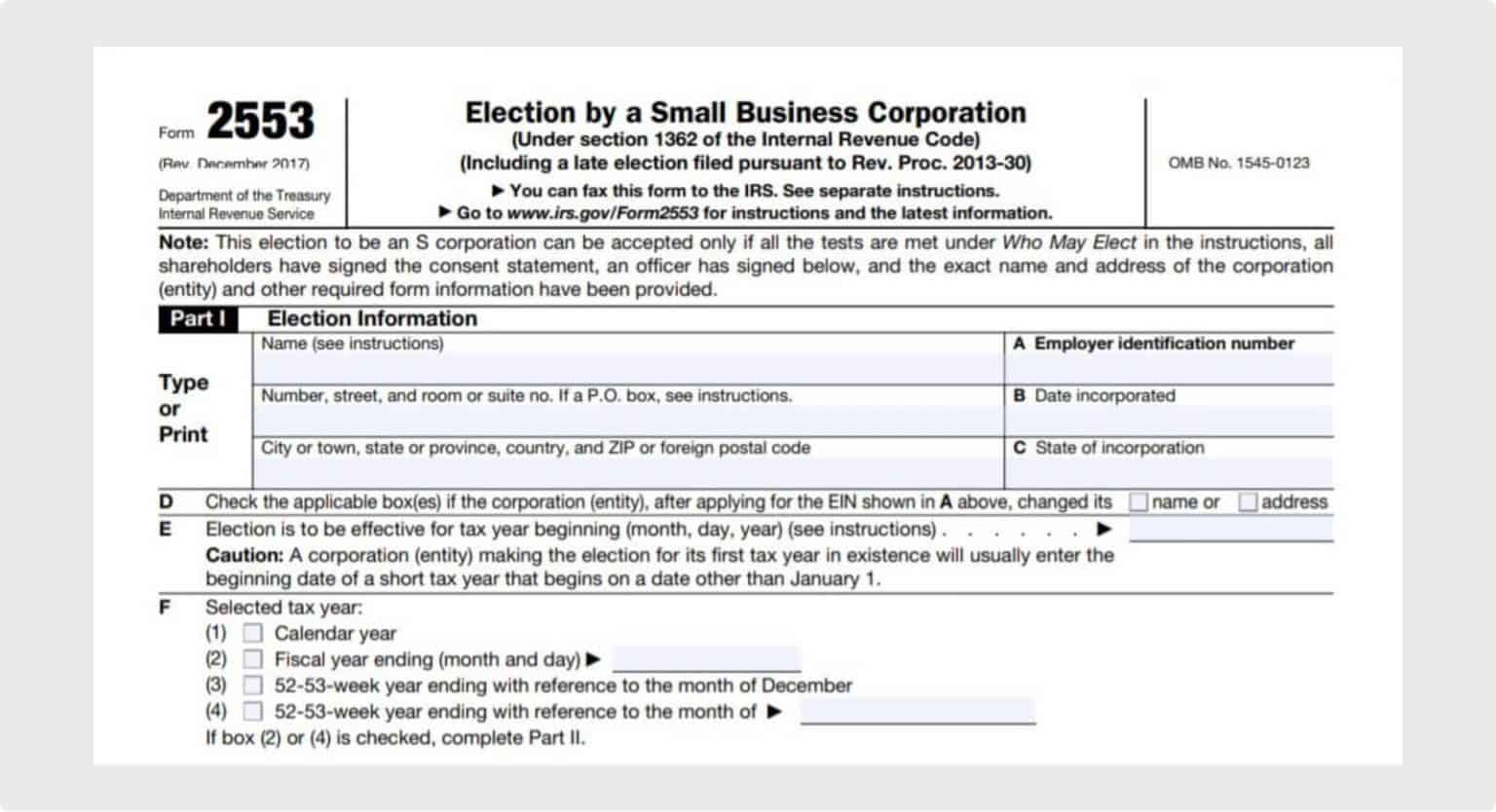

There must be reasonable cause for not filing it on time, such as the owner thought it was. Web there is reasonable cause for missing the filing deadline the corporate submits statements attesting that all shareholders reported their income in a manner consistent. Web for example, you followed all tax filing requirements of an s corporation, this includes you and any other shareholders. And the time from your effective date to your filing must be less than 3 years and 75. Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes. Web general instructions purpose of form a corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under. I'll walk you through the form step by step and give you some insights on. The form should be filed before the 16th day of the third. Web in order to reduce paperwork, irs only requires form 2553 election by a small business corporation when an llc is electing to be taxed as an s corporation, but when form. Web reasonable cause refers to when a taxpayer didn’t file the forms on time due to a “valid reason” so to speak.

2553 Vorwahl

Web in order to reduce paperwork, irs only requires form 2553 election by a small business corporation when an llc is electing to be taxed as an s corporation, but when form. If the entity does not qualify under the. If this late election is being made by an entity eligible to elect to. Web to be eligible for the.

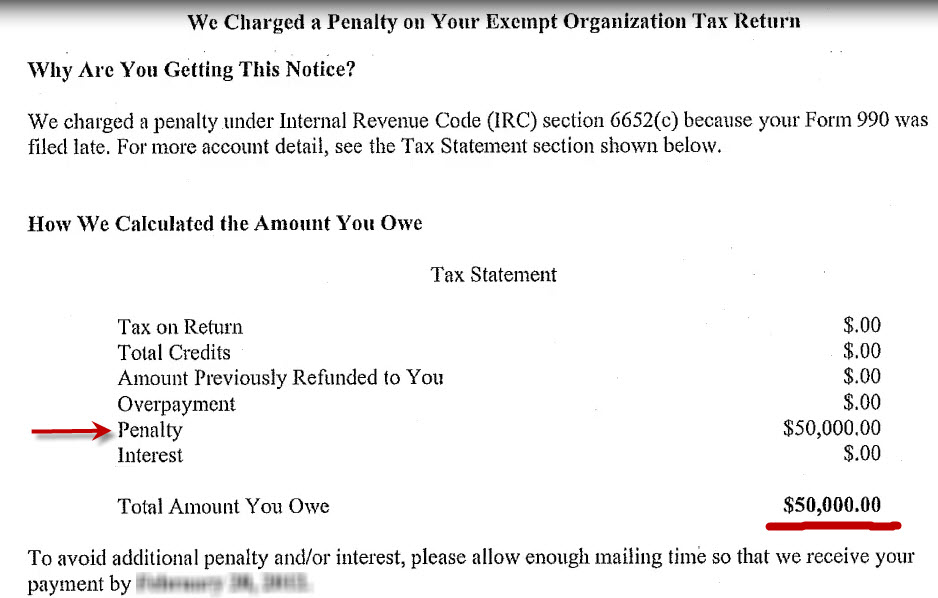

How to remove IRS tax penalties in 3 easy steps. The IRS Penalty

Making all of your payments throughout the year will help you avoid penalties. If the entity does not qualify under the. How to file a late s corporation election step 1: Web system issues that delayed a timely electronic filing or payment. Web the corporation has reasonable cause for late election all shareholders reported their income consistent with s corporation.

Sample Letter To Irs Waive Late Penalty

Web the corporation has reasonable cause for late election all shareholders reported their income consistent with s corporation status for the year the status should. Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. Web system issues that delayed a timely electronic filing or payment. Web in.

IRS Form 2553 What Is It?

How to file a late s corporation election step 1: In most cases, we’ve found the irs to be fairly lenient when it. Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes. It can either be filled out on your computer or printed and. If this late election is.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes. If this late election is being made by an entity eligible to elect to. Web the corporation has reasonable cause for late election all shareholders reported their income consistent with s corporation status for the year the status should. Web.

Valid IRS Reasons for Late Filing of Form 2553 Bizfluent

Web to be eligible for the new relief under rev. Web general instructions purpose of form a corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under. Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553.

IRS Form 2553 No Error Anymore If Following the Instructions

Web system issues that delayed a timely electronic filing or payment. Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. Web to be eligible for the new relief under rev. The following factors don't generally qualify as valid reasons for. Web the corporation has reasonable cause for.

What is IRS Form 2553? Bench Accounting

Web in this video i show you how to prepare and file a late s corp election using form 2553. If this late election is being made by an entity eligible to elect to. Web if the entity qualifies and files timely in accordance with rev. Web august 20, 2022 taxpayers who owe more than $1,000 to the irs can.

Barbara Johnson Blog Form 2553 Instructions How and Where to File

How to file a late s corporation election step 1: Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. Call the irs if you. Web to be eligible for the new relief under rev. Web system issues that delayed a timely electronic filing or payment.

LLC vs. SCorp (How to Choose) SimplifyLLC

Web for example, you followed all tax filing requirements of an s corporation, this includes you and any other shareholders. Web what was the reasonable cause for not filing the 2553 on time? How to file a late s corporation election step 1: Web august 20, 2022 taxpayers who owe more than $1,000 to the irs can be penalized. Web.

Web In Order To Reduce Paperwork, Irs Only Requires Form 2553 Election By A Small Business Corporation When An Llc Is Electing To Be Taxed As An S Corporation, But When Form.

Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes. And the time from your effective date to your filing must be less than 3 years and 75. I'll walk you through the form step by step and give you some insights on. Web general instructions purpose of form a corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under.

Web In This Video I Show You How To Prepare And File A Late S Corp Election Using Form 2553.

Web there is reasonable cause for missing the filing deadline the corporate submits statements attesting that all shareholders reported their income in a manner consistent. Web you must also have reasonable cause for failing to make the election timely; It can either be filled out on your computer or printed and. Web august 20, 2022 taxpayers who owe more than $1,000 to the irs can be penalized.

Web The Irs Does Allow Relief For Forms That Are Filed After The Deadline If A Business Can Show A Reasonable Cause For Why The Form Is Being Filed Late.

Web you must have reasonable cause for your failure to timely file the form 2553 by its due date. There must be reasonable cause for not filing it on time, such as the owner thought it was. Web if the entity qualifies and files timely in accordance with rev. The form should be filed before the 16th day of the third.

If The Entity Does Not Qualify Under The.

Call the irs if you. Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. Web the corporation has reasonable cause for late election all shareholders reported their income consistent with s corporation status for the year the status should.

:max_bytes(150000):strip_icc()/GettyImages-539253353-1--57734ad45f9b5858756e2e79.jpg)