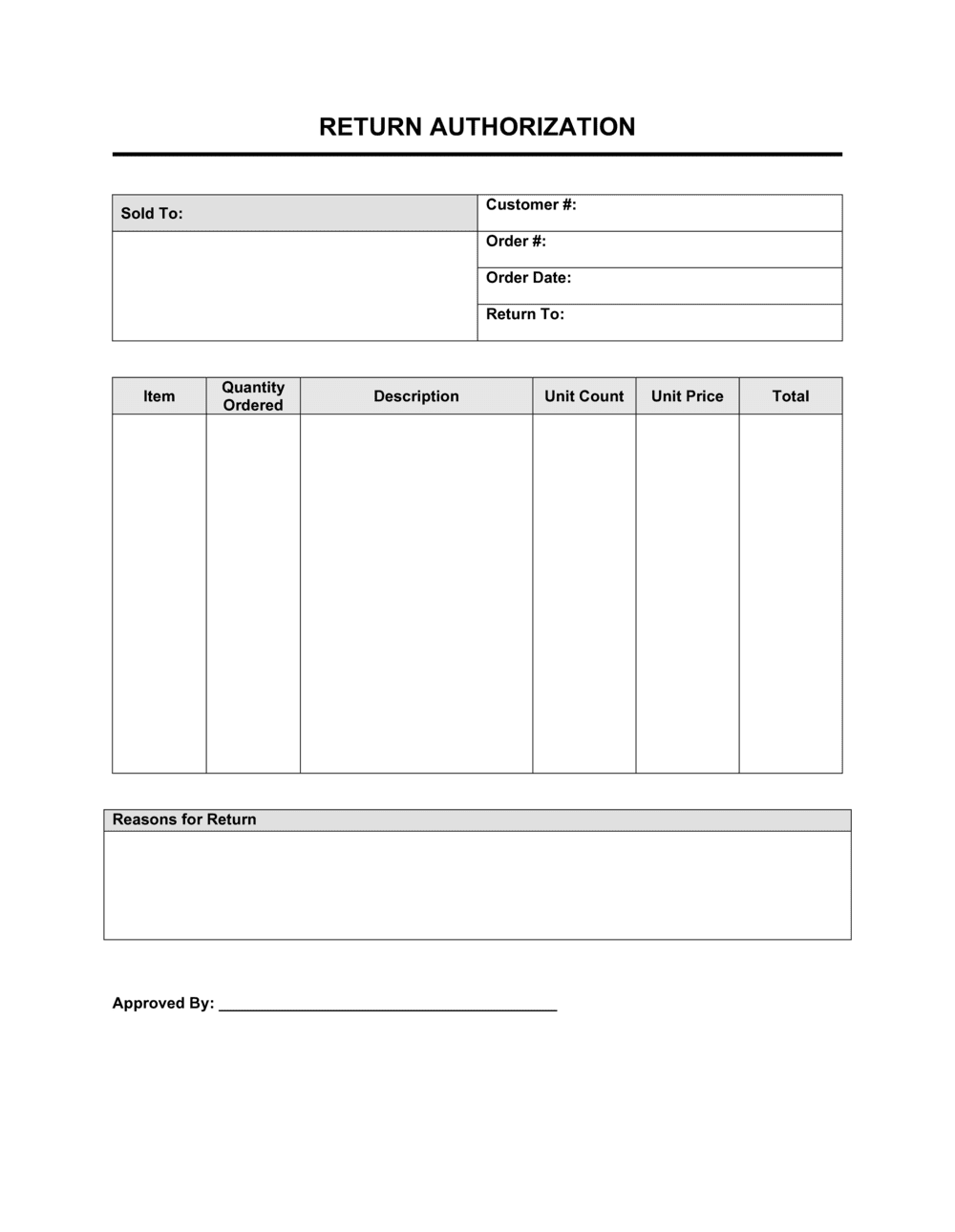

Return Authorization Form

Return Authorization Form - Choose how to process your return. To return a gift, go to return a gift. Current revision form 8821 pdf Delete or revoke prior tax information authorizations. Learn the basics of how small businesses can use return authorization to return products. Choose the order and select return or replace items. Once approved, ra numbers should be written on the outside of the return box. Web updated on 09/17/20 return authorization is the process of authorizing and tracking the return of inventory. Return authorization is the process by which a business can return an. This authorization is called power of attorney.

Learn the basics of how small businesses can use return authorization to return products. Department of the treasury internal revenue service for more information about form 4506, visit www.irs.gov/form4506. Return authorization is the process by which a business can return an. Choose the order and select return or replace items. Go to your orders to display your recent orders. Here are a few tips that will help: Taxpayer must sign and date this form on line 6. Choose how to process your return. Represent, advocate, negotiate and sign on your behalf, Complete the online form below and submit to request your ra number.

Web power of attorney you have the right to represent yourself before the irs. To return a gift, go to return a gift. Go to your orders to display your recent orders. Don’t use form 8821 to request copies of your tax returns or to authorize someone to represent you. Current revision form 8821 pdf Complete the online form below and submit to request your ra number. Department of the treasury internal revenue service for more information about form 4506, visit www.irs.gov/form4506. It is an aspect of reverse logistics. Once approved, ra numbers should be written on the outside of the return box. Return authorization is the process by which a business can return an.

Return Authorization Template by BusinessinaBox™

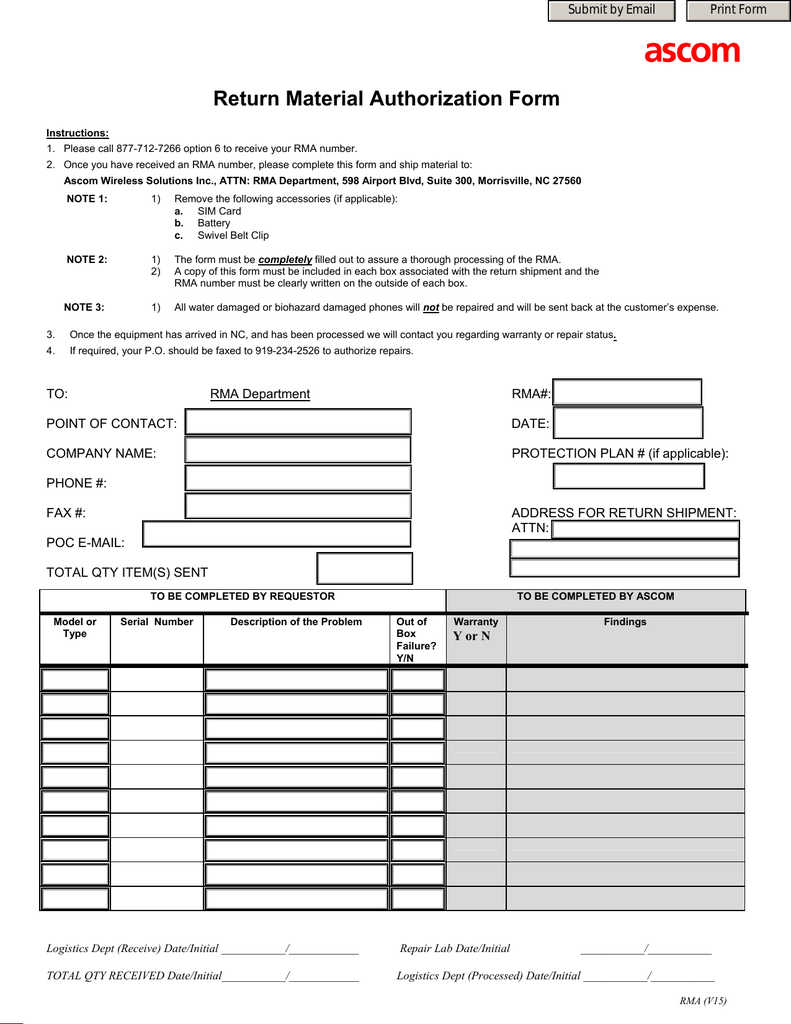

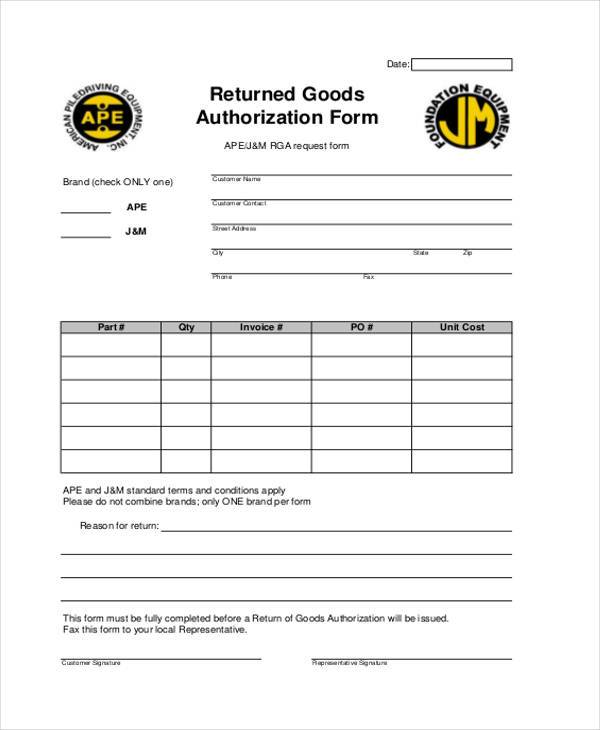

Create a totally customized rma form to capture critical return data up front Don’t use form 8821 to request copies of your tax returns or to authorize someone to represent you. The return authorization holds information about the items you expect a customer to return, such as the item number and/or vendor item number and the quantity being returned. Represent,.

Return Material Authorization Form Template Sample

Here are a few tips that will help: Web a return authorization form, also known as a return materials authorization (rma), is a record of expected customer returns. Don’t use form 8821 to request copies of your tax returns or to authorize someone to represent you. Learn the basics of how small businesses can use return authorization to return products..

Return Material Authorization Form

You may also authorize someone to represent you before the irs in connection with a federal tax matter. To return a gift, go to return a gift. Represent, advocate, negotiate and sign on your behalf, Web file form 8821 to: Customer name, last name, you can start by asking for personal information such as phone number.

Return Authorization form Template New 24 Of Return Authorization form

Learn the basics of how small businesses can use return authorization to return products. Department of the treasury internal revenue service for more information about form 4506, visit www.irs.gov/form4506. Web power of attorney you have the right to represent yourself before the irs. This authorization is called power of attorney. You may also authorize someone to represent you before the.

FREE 41+ Authorization Forms in PDF Excel MS word

Web start with forms.app's return authorization form template and customize it or create a form from scratch. Web make sure you're getting all the necessary information from your customers so you can quickly and accurately process their return merchandise authorization (rma) requests. A return authorization (ra) number must be obtained prior to returning items to sps. Choose how to process.

FREE 10+ Return Authorization Forms in PDF MS Word Excel

Return authorization is the process by which a business can return an. Here are a few tips that will help: Web updated on 09/17/20 return authorization is the process of authorizing and tracking the return of inventory. The return authorization holds information about the items you expect a customer to return, such as the item number and/or vendor item number.

FREE 10+ Return Authorization Forms in PDF MS Word Excel

This authorization is called power of attorney. A return authorization (ra) number must be obtained prior to returning items to sps. Go to your orders to display your recent orders. Web return authorization request form. Create a totally customized rma form to capture critical return data up front

Return Authorization form Template Awesome 24 Of Return Authorization

Web 4506 request for copy of tax return (novmeber 2021) do not sign this form unless all applicable lines have been completed. Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form. Web a return.

FREE 10+ Return Authorization Forms in PDF MS Word Excel

Go to your orders to display your recent orders. Select the item you want to return. Current revision form 8821 pdf With power of attorney, the authorized person can: The return authorization holds information about the items you expect a customer to return, such as the item number and/or vendor item number and the quantity being returned.

Return Material Authorization Form Template SampleTemplatess

Complete the online form below and submit to request your ra number. Web power of attorney you have the right to represent yourself before the irs. Don’t use form 8821 to request copies of your tax returns or to authorize someone to represent you. Select the item you want to return. Web make sure you're getting all the necessary information.

Go To Your Orders To Display Your Recent Orders.

Customer name, last name, you can start by asking for personal information such as phone number. Downloading our free template will help you: The return authorization holds information about the items you expect a customer to return, such as the item number and/or vendor item number and the quantity being returned. A return authorization (ra) number must be obtained prior to returning items to sps.

Choose The Order And Select Return Or Replace Items.

Taxpayer must sign and date this form on line 6. With power of attorney, the authorized person can: Web a return authorization form, also known as a return materials authorization (rma), is a record of expected customer returns. Learn the basics of how small businesses can use return authorization to return products.

Complete The Online Form Below And Submit To Request Your Ra Number.

Create a totally customized rma form to capture critical return data up front Represent, advocate, negotiate and sign on your behalf, To return a gift, go to return a gift. Here are a few tips that will help:

This Authorization Is Called Power Of Attorney.

Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form. Once approved, ra numbers should be written on the outside of the return box. Web updated on 09/17/20 return authorization is the process of authorizing and tracking the return of inventory. Don’t use form 8821 to request copies of your tax returns or to authorize someone to represent you.