Sample Form 1023 Completed

Sample Form 1023 Completed - Web before submitting form 1023, the organization must consolidate the following attachments into a single pdf file: More information about irs form 1023 and this. Web form 1023 must be filled and submitted online, this pdf copy is for reference only! Web if you are drafting a narrative to attach to your charitable organization’s narrative description of your activities under part iv of irs form 1023, application for recognition of. In order to file as a 501 (c)3 organization, you need to apply with the irs by filling out one of these forms: What's new new section 170(b)(1)(a)(xi). Retain a copy of the completed. All you need is smooth internet connection and a device to work on. Additional information about form 1023, application for. Form 1023 schedule a line 15.

What's new new section 170(b)(1)(a)(xi). Web form 1023 must be filled and submitted online, this pdf copy is for reference only! Web form 1023 checklist (revised june 2006) application for recognition of exemption under section 501(c)(3) of the internal revenue code note. Use form 1023, including the appropriate user fee, to apply. Ad get ready for tax season deadlines by completing any required tax forms today. Ad use our simple online nonprofit registration process & give your good cause a great start. Web form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Register your nonprofit & get access to grants reserved just for nonprofits. Additional information about form 1023, application for. More information about irs form 1023 and this.

Web form 1023 checklist (revised june 2006) application for recognition of exemption under section 501(c)(3) of the internal revenue code note. Provide any additional information you would like the irs to consider that would. What's new new section 170(b)(1)(a)(xi). More information about irs form 1023 and this. Web form 1023 must be filled and submitted online, this pdf copy is for reference only! Narrative description of your activities save the environment now education fund. In order to file as a 501 (c)3 organization, you need to apply with the irs by filling out one of these forms: All you need is smooth internet connection and a device to work on. Use form 1023, including the appropriate user fee, to apply. (“fund”) is organized to conduct and distribute research, studies, and analysis relating to.

Sample form 1023 Completed Glendale Community

Web if you are drafting a narrative to attach to your charitable organization’s narrative description of your activities under part iv of irs form 1023, application for recognition of. Provide any additional information you would like the irs to consider that would. Ad get ready for tax season deadlines by completing any required tax forms today. If you are not.

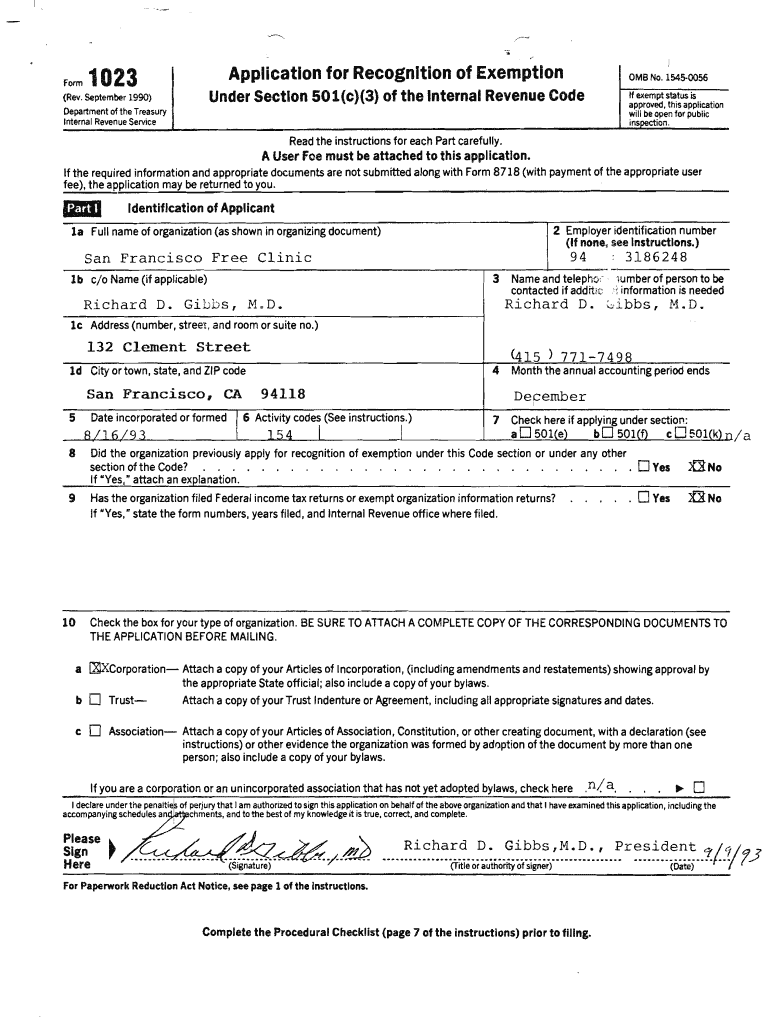

ICANN Application for Tax Exemption (U.S.) Page 1

More information about irs form 1023 and this. Retain a copy of the completed. What's new new section 170(b)(1)(a)(xi). Web if you are drafting a narrative to attach to your charitable organization’s narrative description of your activities under part iv of irs form 1023, application for recognition of. Applicants can learn more about the requirements, benefits, limitations and.

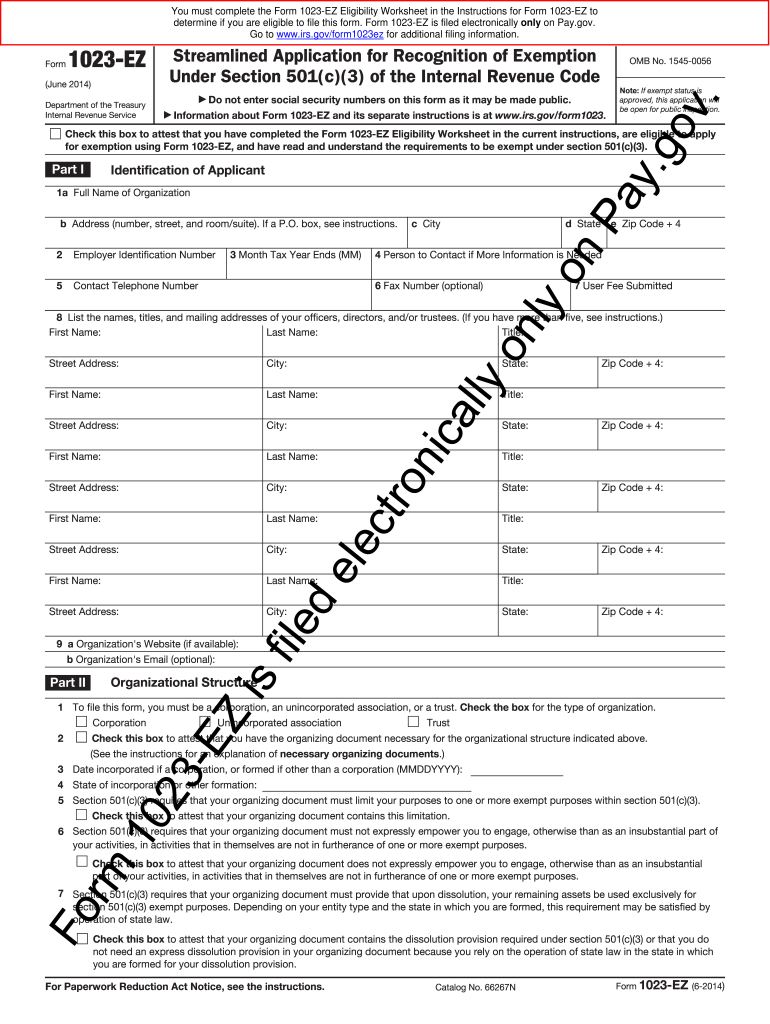

Form 1023EZ Eligibility Worksheet and Electronic Filing Instructions

Web form 1023 must be filled and submitted online, this pdf copy is for reference only! (“fund”) is organized to conduct and distribute research, studies, and analysis relating to. Web describe the course of study completed by your religious leaders. Web form 1023 checklist (revised june 2006) application for recognition of exemption under section 501(c)(3) of the internal revenue code.

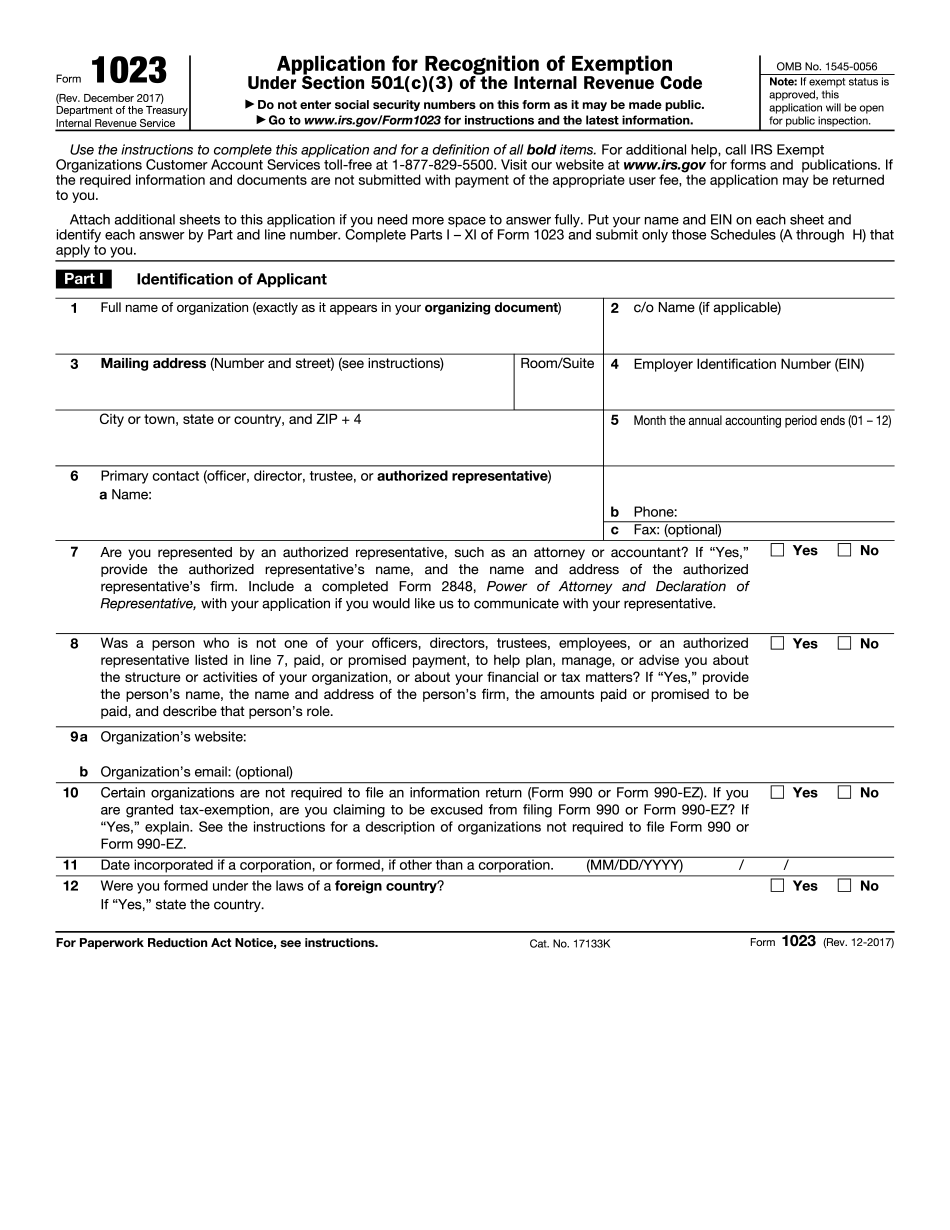

2017 2019 IRS Form 1023 Fill Out Online PDF Template

Web form 1023 checklist (revised june 2006) application for recognition of exemption under section 501(c)(3) of the internal revenue code note. Register your nonprofit & get access to grants reserved just for nonprofits. Complete, edit or print tax forms instantly. Web describe the course of study completed by your religious leaders. Retain a copy of the completed.

Form 1023 Fill out & sign online DocHub

What's new new section 170(b)(1)(a)(xi). Ad get ready for tax season deadlines by completing any required tax forms today. Use form 1023, including the appropriate user fee, to apply. Form 1023 schedule a line 15. Narrative description of your activities save the environment now education fund.

15 Printable Irs Form 1023 Ez Templates Fillable Samples In Pdf Word

Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Additional information about form 1023, application for. Retain a copy of the completed. In order to file as a 501 (c)3 organization, you need to apply with the irs by filling out one of these forms:

1023 Part Form Fill Online, Printable, Fillable, Blank pdfFiller

Organizing document (required) amendments to the. Web form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. In order to file as a 501 (c)3 organization, you need to apply with the irs by filling out one of these forms: Retain a copy of the completed. Register your nonprofit & get access.

ICANN Application for Tax Exemption (U.S.) Page 8

Complete, edit or print tax forms instantly. More information about irs form 1023 and this. Web before submitting form 1023, the organization must consolidate the following attachments into a single pdf file: Web form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Web form 1023 checklist (revised june 2006) application for.

My Own Church St. Charles Borromeo Catholic Church Meredith, NH

Retain a copy of the completed. Applicants can learn more about the requirements, benefits, limitations and. Ad get ready for tax season deadlines by completing any required tax forms today. More information about irs form 1023 and this. Complete, edit or print tax forms instantly.

Sample 1023 by Ida Mae Campbell Wellness & Resource Center Issuu

Ad use our simple online nonprofit registration process & give your good cause a great start. More information about irs form 1023 and this. Narrative description of your activities save the environment now education fund. Use form 1023, including the appropriate user fee, to apply. (a) form 1023 itself, including financial information and numerous.

Register Your Nonprofit & Get Access To Grants Reserved Just For Nonprofits.

Provide any additional information you would like the irs to consider that would. Web form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Narrative description of your activities save the environment now education fund. Web describe the course of study completed by your religious leaders.

Applicants Can Learn More About The Requirements, Benefits, Limitations And.

Web form 1023 checklist (revised june 2006) application for recognition of exemption under section 501(c)(3) of the internal revenue code note. Complete, edit or print tax forms instantly. Web form 1023 must be filled and submitted online, this pdf copy is for reference only! Ad use our simple online nonprofit registration process & give your good cause a great start.

Additional Information About Form 1023, Application For.

Retain a copy of the completed. Web sample completed 1023 ez form pdfnd security in one online tool, all without forcing extra ddd on you. In order to file as a 501 (c)3 organization, you need to apply with the irs by filling out one of these forms: Web if you are drafting a narrative to attach to your charitable organization’s narrative description of your activities under part iv of irs form 1023, application for recognition of.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

All you need is smooth internet connection and a device to work on. What's new new section 170(b)(1)(a)(xi). More information about irs form 1023 and this. Web before submitting form 1023, the organization must consolidate the following attachments into a single pdf file: